On 8 Nov 2016, the Prime Minister of India, Narendra Modi announced the Demonetization of all Rs.500 and Rs. 1,000 in a live television address at 8 PM. It also announced the issuance of new ₹500 and ₹2000 banknotes in exchange for the demonetised banknotes. The sudden nature of the announcement, the prolonged cash shortages in the weeks that followed, created significant disruption throughout the economy, threatening economic output. After 2 years we look at Was Demonetization a Success or Failure and see if we have met the objectives of Demonetization? if not how. Which countries also had demonetization and which were Successful and which were failure.

Table of Contents

Was Demonetization a Success or Failure?

Demonetization is the act of stripping a currency unit of its status as legal tender. “To break the grip of corruption and black money, we have decided that the 500 rupee and 1000 currency notes presently in use will no longer be legal tender from midnight tonight, that is 8th November 2016″, announced PM, Narendra Modi.

All were given a limited time window to deposit their existing notes with banks and replace those with new notes. This created a huge pressure on the banking system, marked by lengthening queues outside banks for about two months.

The Opposition described it as a “disaster” the BJP said, it was a “stringent action against corruption”. The former prime minister, Dr Manmohan Singh in a speech in the gathering of businessmen in Gujarat’s Ahmedabad in 2017 termed November 8 as a black day for the Indian economy and democracy. “I repeat what I said in the parliament, this was organised loot and legalised plunder,”

“Confiscation of currency was not an objective of demonetization. Getting it into the formal economy and making the holders pay tax was the broader objective,” Finance Minister Arun Jaitley said “The system required to be shaken in order to make India move from cash to digital transactions.”

- 150+ deaths

- 60 changes in 43 days

- 5000+ crore for printing new notes

- No drop in Terrorism, Stone-pelting, Naxalism

- No big black money hoarder arrested

- 99.3% money returned

Finance Minister Shri Arun Jaitley holds a press conference on Demonetisation on 8 Nov 2018

Reasons for Demonetization

Let’s go and see what the objectives were laid down in that late evening speech on 8 November 2016 of Prime Minister Narendra Modi and the gazette notification later that same day. The prime minister outlined three sets of objectives,

- Break the back of corruption and black money,

- End the circulation of fake currency

- End terrorist financing.

PM Narendra Modi address to the Nation on 8 Nov 2016 is give below.

Black Money and Demonetization

Demonetization of ₹500 and ₹1,000 notes took out 86% of the currency in the market. The government expected a quarter to a third of the HDNs in circulation not to return to the banking system, the attorney general told the Supreme Court, which was hearing a petition against demonetization.

As per the RBI annual report for 2017-18 for 2017-18, 99.2% of the ₹15,440.5 billion,i.e ₹15,310.73 billion of the HDNs in circulation on 8 November 2016 were returned. Proving Raghuram Rajan, ex-governor of the RBI, right. Raghuram Rajan had advised the government that demonetization would not achieve its objective of unearthing black money because, among other things, the tax evaders would find ways to launder their holdings.

In 2012, the Central Board of Direct Taxes recommended against demonetisation, saying in a report that “demonetisation may not be a solution for tackling black money or shadow economy, which is largely held in the form of benami properties, bullion and jewellery.” According to data from income tax probes, black money holders kept only 6% or less of their wealth as cash, suggesting that targeting this cash would not be a successful strategy.

It is clear that along with the honest who stood in line and deposited their cash in banks, the dishonest had got the better of the government. They had invented innumerable ways to deposit their illegal holdings of cash in the banks.

Fake Currency and Demonetization

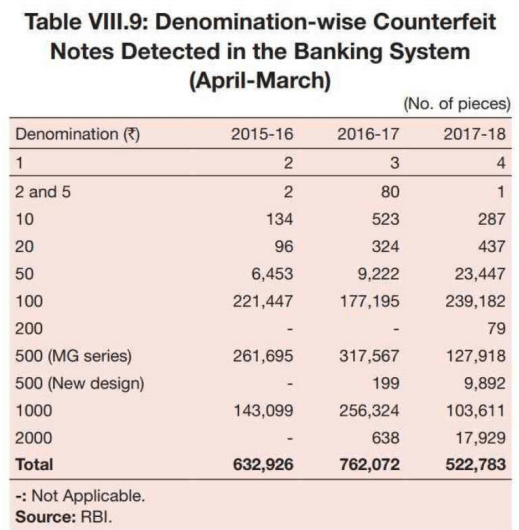

According to the RBI annual report for 2017-18

- During 2017-18, as many as 5,22,783 pieces of counterfeit notes were detected in the banking system, of which 36.1% were detected by the Reserve Bank as compared to 4.3 per cent during the previous year.

- The number of fake Rs 50 notes detected shot up 154.3% to 23,447 pieces, as against 9,222 notes detected in 2016-17 and 6,453 in 2015-16.

- Detection of counterfeit Rs 100 notes increased 35% to 2,39,182 pieces during the said period, compared with 1,77,195 notes in 2016-17 and 2,21,447 in 2015-16.

- Counterfeit notes in denominations of Rs 500 and Rs 1,000 detected in SBNs (specified banknotes) decreased by 59.7% and 59.6% respectively, as the same comprised only the residual part of SBN deposits processed during 2017-18,” the report said. This residual currency refers to the high-value notes scrapped by demonetisation in November 2016.

Number of Fake notes detected

India is NOT a Cashless Economy

Indian economy was completely based on cash. A foremost objective of the Prime Minister was to achieve a cashless Indian economy through demonetization. The government in this way succeeded in encouraging people to use digital means for making transactions.

India has not entirely adopted the method of digitalization. Indians still prefer holding cash in hand. Not many regions especially the rural areas, have been comfortable in using digital portals. But it would not be wrong to say that, demonetisation, in fact, did boost the country’s digital platform.

- Currency in Circulation: RBI data indicated that currency in circulation rose to Rs.19.6 lakh crore as on October 26, 2018, a 9.5% growth from two years ago. And the currency in circulation was Rs. 17.9 lakh crore on November 4, 2016, the week before the note ban came into force.

- Cash Withdrawals: RBI’s Data also mentioned that cash withdrawals from ATMs grew 8% to Rs 2.75 lakh crore in August 2018 from Rs 2.54 lakh crore in October 2016.

- Rapid pace ATM Expansion: Parallel with the increasing cash withdrawal, in the last 2 years, ATMs expansion has increased with about 1,000 ATMs being added every month.

Cost of Printing Notes

The total expenditure incurred on security printing during the FY18 stood at Rs 4,912 crore as against Rs 7,965 crore in 2016-17. The amount was higher in FY17 due to demonetisation.

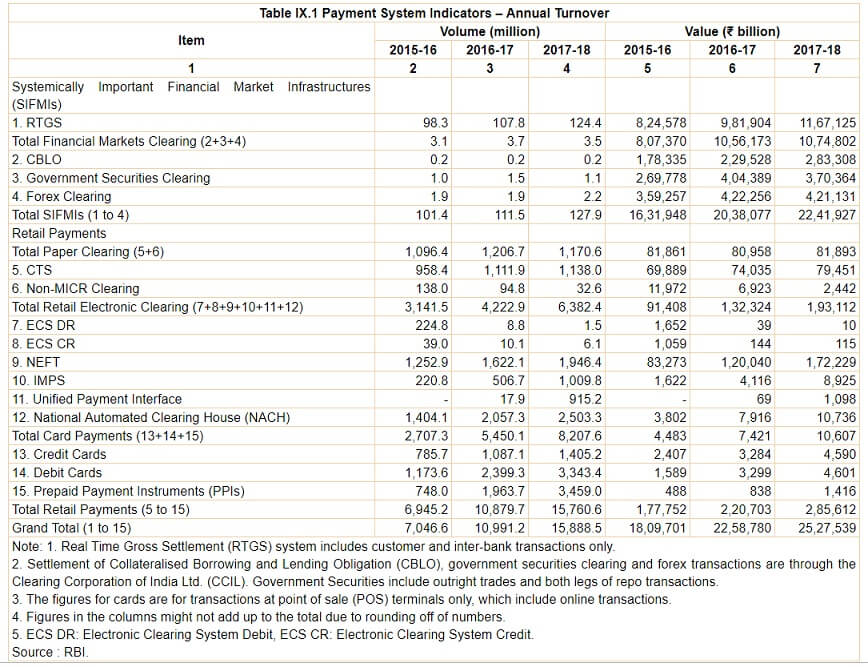

Payments in India

In 2017-18, non-cash transactions rose 45 per cent in volume and 29 per cent in value. The volume rate of growth, while lower than that in 2016-17, is higher than the average 25 per cent seen in the two fiscals prior to demonetisation. The trend is similar for value growth too.

Amongst the electronic modes of payments,

- The Real Time Gross Settlement (RTGS) system handled 124 million transactions valued at ₹1,167 trillion in 2017-18, up from 108 million transactions valued at ₹982 trillion in the previous year. At the end of March 2018, the RTGS facility was available through 1,37,924 branches of 194 banks.

- The NEFT system handled 1.9 billion transactions valued at around ₹172 trillion in 2017-18, up from 1.6 billion transactions valued at ₹120 trillion in the previous year, registering a growth of 20 per cent in terms of volume and 43.5 per cent in terms of value. At the end of March 2018, the NEFT facility was available through 1,40,339 branches of 192 banks, in addition to a large number of business correspondent (BC) outlets.

- Credit cards and debit cards: During 2017-18, the number of transactions carried out through credit cards and debit cards was 1.4 billion and 3.3 billion, respectively.

- Prepaid payment instruments (PPIs) recorded a volume of about 3.5 billion transactions, valued at ₹1,416 billion.

- Mobile banking services witnessed a growth of 92 per cent and 13 per cent in volume and value terms, respectively, while the number of registered customers rose by 54 per cent to 251 million at end-March 2018 from 163 million at end-March 2017.

How India pays as per RBI annual report

Increase in Return Filing and Tax Collection

Direct tax collections have indeed gone up. Some of it is to be expected as the money launderers make a one-off payment of income tax. Some of it is also because to register under GST you also needed to be filing returns and with a PAN.

- The number of e-returns of Individual taxpayers filed till 5th Aug 2017 (due date of filing) increased to 2.79 crores from 2.22 crore returns filed during the corresponding period of last year, registering an increase of about 57 lakh returns (25.3%).

- The total number of all returns (electronic + paper) filed during the entire Financial Year 2016-17 was 5.43 crore which is 17.3% more than the returns filed during FY 2015-16.

- For FY 2016-17, 1.26 crore new taxpayers (return filers + non-filers making tax payments) were added to the tax base (till 30.06.2017).

- Collection of Advance Tax under Personal Income Tax (i.e. other than Corporate Tax) as on 05.08.2017 showed a growth of about 41.79% over the corresponding period in F.Y. 2016-2017.

- Collection of Self Assessment Tax under Personal Income Tax showed a growth of 34.25% over the corresponding period in F.Y. 2016-2017.

- There was a 38% increase in admission of undisclosed income (from Rs. 11226 crores to Rs. 15496 crore)

- The Pradhan Mantri Garib Kalyan Yojana (PMGKY) offered another opportunity to unaccounted cash holders to come clean and deposit their cash by paying 50 per cent of it as tax, penalty and surcharge, and parking an additional 25 per cent for four years without interest. This scheme too has not produced results as anticipated, only Rs.2,300 crore was collected against the I-T department’s target of Rs.1 lakh crore.

Demonetization in India and World

India is not the only country to come up with demonetisation, there are countries who experimented with it in the past. Where countries like Australia, United Kingdom, and Pakistan were successful in demonetisation there are countries who failed miserably. Here’s a look at five countries that had tried demonetisation but failed at the end.

Demonetization Before in India

The Indian government had demonetised bank notes to combat tax evasion via “black money” held outside the formal economic system

- In 1946: In 1946, the British Raj government removed notes of 500, 1000, and 10,000 from circulation.

- In 1978: The Janata Party coalition government demonetised banknotes of 1000, 5000 and 10,000 rupees, again in the hopes of curbing counterfeit money and black money.

Successful Demonetization in Countries

- Pakistan in 2016: In December 2016, in order to improve the security and durability of the bank notes, State Bank of Pakistan (SBP) issued new designs’ bank notes. The move was applicable to 10, 50, 100 and 1,000 rupee notes’ older design. The country issued a tender 18 months back and gave citizens enough time to exchange their old notes for the new design notes.

- Zimbabwe in 2015: In 2015, in order to stabilise its economy, racked by hyperinflation that was recorded at 2,31,000,000 per cent, the Zimbabwean government replaced the Zimbabwe dollar with the American dollar. The process took three months to make US dollar as the country’s legal tender.

- European Union in 2002: 12 EU countries introduced their single currency Euro on January 1, 2002. The European Central Bank prepared for almost three years while the participating countries distributed eight billion notes and 38 billion coins via banks, post offices, and sales outlet.

- Australia in 1996: To curb black money and improve the security features, the Australian government replaced its paper-based notes with polymer bank notes of the same denomination.

- The United Kingdom in 1971: In 1971, the United Kingdom adopted decimal currency against pounds, shillings, and pence.

Demonetization Failures in the Countries

Demonetization has a proven history of being an unsuccessful mechanism. It failed in the Soviet Union, in North Korea, in Myanmar, in Ghana and in Nigeria. Demonetisation either led to a fall in the government or an unforeseen and unwarranted turmoil in their society. In all these countries, demonetisation was done while these countries were reeling under economic crisis, on the contrary, in India, it was done while the economy was flourishing and growing.

- North Korea in 2010: In 2010, in order to tighten control of the economy and close black markets, the regime of then-dictator Kim Jong II introduced a reform that knocked off two zeroes from the face value of the old currency. The move left people with severe food shortage, an increase in the price of necessary goods and no shelter.

- The Soviet Union in 1991: In January 1991, under Mikhail Gorbachev, the government withdrew 50 and 100 ruble notes from circulation in a move to tackle the black economy and increase the currency value. The 50 and 100 ruble notes comprised of about one-third of the money in circulation. The move severely affected – the economy collapsed and citizens lost faith in the government. Historians also hinted that the move fuelled the eventual break-up of the USSR.

- Myanmar in 1987: In 1987, the military invalidated around 80 per cent of the value of money in circulation in order to curb black money. The move resulted in first student demonstrations, deepening economic unease with mass protests across the nation followed by a government crackdown and killing thousands of people.

- Nigeria in1984: In 1984, the military government under Muhammadu Buhari issued new currency notes with new colours to make old notes outdated, within a limited period. The aim of the movement was to fix the debt-ridden economy. The move failed miserably as Buhari was eventually ousted in a coup the following year.

- Ghana in 1982: In 1982, Ghana got rid of its 50 cedi notes to curb tax evasion, mop up excess liquidity and get rid of corruption. The move was highly unsuccessful as citizens started supporting the black market by investing in physical assets and turning to foreign currency, making the economy weak. Citizens in rural areas had to walk miles to exchange the demonetised money and after the deadline, there were accounts of notes abandoned as worthless.

Our Twitter poll on 5 Nov 2018 showed the following results

Was demonetization a success or a failure?

Related Articles:

- Demonetization: Ban on 500 and 1000 rupee notes,

- What are Central Banks,What is RBI? What do they do?

- History of Money : How Money has evolved from Barter to Bitcoins

- Security Features in Indian Notes, International Notes

- Monuments on The Indian Notes: Konark Temple, Himalayas,Manglayan Mission

- Coin: Anatomy, Indian coins, Motto, History, Mint Marks

Book Demonetization and the Black Economy by Arun Kumar who studied at Delhi University, Jawaharlal Nehru University (JNU) and Princeton University, USA, and taught economics at JNU for three decades till 2015.

What do you feel about Demonetization of 2016? Do you use Digital Money, if yes which form? How can we find solutions to Fake Currency, Black Money?

Good morning, I was just checking out your site and submitted this message via your contact form. The contact page on your site sends you messages like this via email which is the reason you’re reading my message right now right? This is the most important accomplishment with any kind of advertising, making people actually READ your advertisement and that’s exactly what I just accomplished with you! If you have an advertisement you would like to blast out to thousands of websites via their contact forms in the US or anywhere in the world send me a quick note now, I can even focus on your required niches and my costs are very reasonable. Shoot me an email here: harry2947har@gmail.com

Demonetization is a well organized Crime !

So true