Regular and Direct Mutual Fund plans are options to buy the same mutual fund scheme, run by the same fund managers who invest in the same stocks and bonds. The major difference between direct plan and a regular plan is that in the case of a regular plan your mutual fund(also known as AMC) pays a commission to your broker whereas in case of a direct plan, no such commission is paid. The article explains the differences between the Direct and Regular Plans of Mutual Funds, the difference in returns, how to know whether you have invested directly?

On average, you will earn 0.50%-1% more per annum by investing in a mutual fund scheme through its direct plan rather than its regular plan. This would lead to higher returns especially for a longer period based on the amount(As explained in the article below For a SIP of Rs 5000 a month for 15 years with 15% difference would be of around 4 lakh). No commission reduces the expense ratio of your mutual fund scheme, increases the NAV and hence increases the returns over the long term.

Choice of mutual fund to invest in is critical. If you understand the Mutual Funds, you can pick your own mutual funds or you get recommendations from registered Finance Service advisor then the direct plan is better.

Table of Contents

Differences between Direct and Regular Mutual Funds

The table below shows differences between Direct and Regular Mutual Funds

| Description | Regular Plan | Direct Plan |

| What | Investing through distributors | Investing directly |

| Expense Ratio | High | Low |

| NAV | Low | High |

| Returns | Low | High |

| Investment Advice | Available | Not Available |

| Market Research | Done by distributor/agent | Done by self |

| Portfolio Tracking | Done by distributor/agent | Done by Self |

Example of Direct and Regular Mutual Fund: Expense Ration, NAV and Returns

Example of Equity and Debt Direct and Regular Mutual Fund in terms of NAV, Expense Ratio, Returns is given below. Note that Expense ratio is high in regular plan(without keywords like Direct/Retail) and Returns are higher in Direct plans

| Name of Mutual Fund Scheme | Year | Expense Ratio | NAV (8/Nov/19) |

1 month | 3 month | 1 year | 3 years | 5 years |

| Equity | ||||||||

| Axis Bluechip | Jan-2010 | 1.99 | 31.57 | 4.36 | 8.82 | 23.42 | 16.65 | 10.85 |

| Axis Bluechip -Direct Plan |

Jan-2013

|

0.81 | 34.20 | 4.46 | 9.13 | 24.94 | 18.16 | 12.18 |

| Debt Funds | ||||||||

| Franklin India Short Term Income Plan – Retail Plan | Jan 2002 | 1.48 | 4093.6766 | 0.41 | 0.89 | 7.35 | 7.69 | 8.7 |

| Franklin India Short Term Income Plan – Direct Plan |

Jan-2013

|

.74 | 4317.9281 | 0.48 | 1.09 | 8.18 | 8.47 | 9.00 |

How much can one save due to Difference in Returns of Direct and Regular Plan

On an average, you will earn 0.50%-1% more per annum by investing in a mutual fund scheme through its direct plan rather than its regular plan. This would lead to higher returns especially for longer period based on the amount

For example, if one started investing in an equity fund through a SIP(systematic investment plan) of Rs 5,000 a month for 15 years.

- In a regular plan, with expense ratio of 2.5%, the investment would grow to Rs 26.5 lakh.

- In a direct plan, with expense ratio of only 1%, would grow to higher amount of Rs 30.6 lakh,

- A gain of Rs 4.1 lakh compared to a regular plan.

Average Expense Ratio of Regular and Direct Mutual Fund plans

The average expense ratio of the direct and regular plans of mutual funds across different fund categories is shown in the table below

| Fund Category | Regular Plan | Direct Plan | Difference |

| Equity | 2.02% | 1.22% | 0.80% |

| Debt | 0.90% | 0.42% | 0.48% |

| Hybrid | 1.96% | 0.98% | 0.98% |

Source: Value Research, Data as on March 31, 2019.

Advantages of investing in a Regular Mutual plan

Advantages of Investing through a broker are given below. If your broker does not do this or asks you to regularly invest and exit from Mutual Fund schemes then maybe you need to change your broker.

- Investment recommendations: There are more than 4,000 Mutual Fund schemes of different types. Performance of mutual funds varies and the choice of which fund to invest in is critical. The plan (regular or direct) is a secondary consideration. The choice of a good fund vs a poor fund could lead to a difference of as much as 4-5 % in return over time.

- Periodic review, rebalancing: By reviewing your portfolio and helping you rebalance, your advisor would further improve the performance of your holdings and get you more return. This could easily be worth another 1-2% over time.

- Additional services like facilitating your investment, tracking your portfolio, and account changes: This is not simply a question of saving time and effort. Most people simply won’t do it and neglect their portfolios resulting in poor returns and, sometimes, even lost money because they don’t have a record of their investments.

How To Know If You Are Invested In Regular Plans Or Direct Ones?

The account statement/fund holding statement will clearly state whether your mutual fund plan is regular or direct. Check the Distributor Code in the Mutual Fund Statement. If the Statement shows Direct then you have invested directly. Otherwise it would have name and details of the broker who is earning commission through your Mutual Fund investment.

- Typically, if you have invested in a mutual fund scheme through your bank, then it would be a regular plan.

- If you have invested through the website of the mutual fund, or any of the above mentioned mutual fund sites,the plan would be direct.

- If you are receiving a ‘free of cost’ service from your investment agent or if he/she tells you he/she is paid by the mutual fund company then in all likelihood you have invested in a regular mutual fund plan.

How to invest in Mutual Funds Directly

There are many Apps/Website available in which you can invest directly into Mutual Funds, other than investing through Mutual Fund websites. Our article How to invest directly in HDFC Mutual Funds shows how to invest directly in Mutual Funds from the mutual fund websites. You need to create an account in all the Mutual Fund websites,

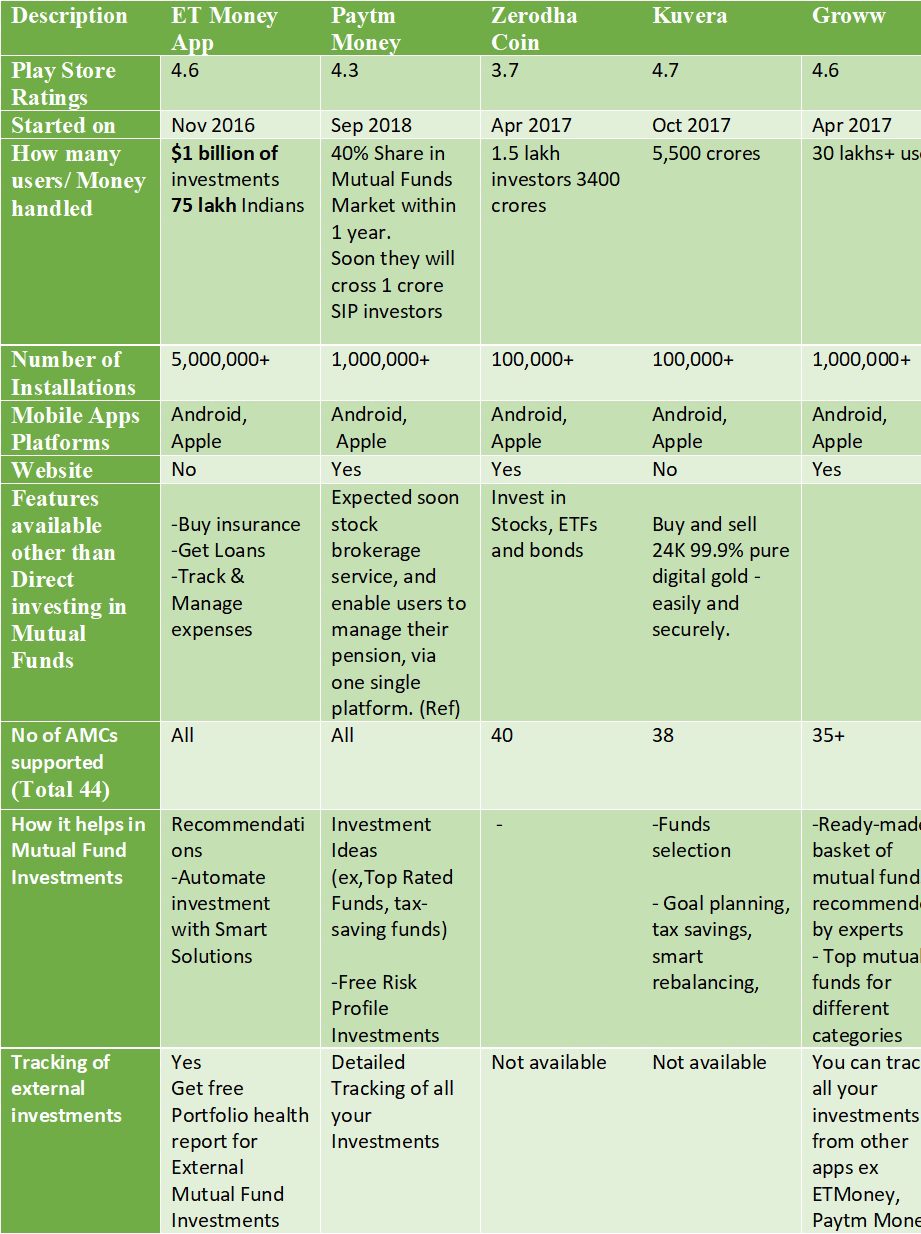

Some of them are given below(in no specific order). Our article, Compare Direct Mutual Funds Investing Platforms, compares some of these platforms in detail, a snapshot of it is shown in the image below

1. Kuvera

2. Goalwise

3. CAMS & Karvy Website/Mobile App

4. Mutual Fund Utility: What is MF Utility Buy and Sell through MF Utility

5. PaisaBazaar

6. Zerodha Coin

7. PayTM Money

8. ETMoney :

9. Groww

10. Clearfunds

Related Articles:

All About Mutual Funds : Basics, Choosing, Paperwork, Direct Investing

- Direct Investing in Mutual Funds

- Compare Direct Mutual Funds Investing Platforms,

- PayTM Money

- Switching of Mutual Funds

- Redeeming Mutual Funds : Check Exit Load,Taxes

- Investing in Equities: Stocks vs Mutual Funds

Do you invest in direct plans of Mutual Funds? If Yes, Which platform do you use to invest?

Direct Mutual Funds present the best way to invest. Regular plans may have been popular when there was no internet penetration and everything had to be done via paper, but now, with internet there’s no sense paying extra for these things when all of them can be done online.

Excellent read, Positive site, I have read a few of the articles on your website now, and I really like your style. I really appreciate your work.If you require aboutcompany registration online bangalore | pvt ltd company registration fees bangalore please click on it.

Nice article, I wasn’t aware of many tips mentioned in this article. Appreciate the amount of hard work that you put in to creating this amazing article. Thanks for the info!

This is a superb post so easy and so clearly define. and yes i am really enjoyed to read this post. You can also get more relevant tender related information on our website https://www.mumbaitender.co.in/

Direct mutual funds are a better way to invest in mutual funds because it offers higher returns in comparison with regular funds. But investors should only go for mutual funds if they have enough knowledge to invest by themselves. One should be aware of market conditions, funds before investing in them.