Nifty hits all-time high, Sensex crashed 1000 points. We hear these terms often. Why should an investor of Mutual Fund or Stocks know these terms? What are Sensex and Nifty? How do they differ?

Table of Contents

Difference between Sensex and Nifty

Nifty and Sensex are used as a benchmark for Mutual Funds, index funds and index-based derivatives. Nifty and Sensex are the barometers of the Indian economy. Like average marks in class tell about performance of the class or blood reports tell about the health of the person.

- Sensex is the index of BSE and consists of 30 companies that are listed on BSE. It is designed to measure the performance of the 30 well-established and financially sound companies listed on Bombay Stock Exchange. Sensex is derived from(portmanteau ) from terms Sensitive and Index, coined Deepak Mohoni, a stock market analyst.

- Nifty comprises of 50 companies that are traded on NSE. Nifty is derived from the term National Stock Exchange and Fifty a

Sensex and NIFTY 50 are computed based on free-float methodology i.e. based on the number of shares in active circulation at any point in time. The NIFTY 50 Index represents about 66.8% of the free-float market capitalization of the stocks listed on NSE as on March 29, 2019.

During market hours, prices of the index companies, at which latest trades are executed, are used by the trading system to calculate SENSEX and Nifty every 15 seconds and disseminated in real-time

When we say, Sensex is going up. It means, stocks with high weightage in Sensex is moving up.

| Features | Sensex | Nifty |

|---|---|---|

| Full form | Sensitive Index | National Stock Exchange Fifty |

| Officially known as | S&P BSE Sensex | S&P CNX Nifty |

| Benchmark index of | Bombay Stock Exchange (BSE) | National Stock exchange (NSE) |

| No. of companies | 30 | 50 |

| No of sectors | 24 | 13 |

| Started on | 1st January 1986 | Nov 1994 |

| Base Value and Year | 100 for 1979 | 1000 on 1995 |

| Owned by | BSE | NSE Indices Limited |

Stock exchange and Index

Nifty and Sensex are the barometers of the Indian economy

A stock exchange is a place where people buy and sell shares or stocks, bonds, NCDs, etc.

- India has many Stock Exchanges some regional like Calcutta Stock Exchange(CSE) or International India International Exchange (India INX) given below.

- Bombay Stock Exchange (BSE) and National Stock Exchange (NSE ) are two major stock exchanges in India.

- Companies raise money or capital by IPO (Initial Public Offering) and after IPO gets over, these companies get listed on the stock exchanges such as BSE, NSE.

- Buying shares from the Stock exchange provides an opportunity for the public to buy these shares

- As on date, more than 5,000+ companies are listed in BSE and NSE.

- BSE is the oldest and first stock exchange of Asia and was formerly known by the name of –The Native Share & Stock Brokers Association. Bombay stock exchange was founded by Premchand Roychand, famously known as the Cotton King, the Bullion King or the Big Bull in 1875

- Stock exchange : What is it, Who owns, controls covers stock exchanges in detail.

The stock exchanges comprise of several thousand companies. To understand the market’s performance a certain set of companies representing various sectors are chosen and a group is made. This group is called an index.

- Sensex is the index of BSE and consists of 30 companies that are listed on BSE. It is designed to measure the performance of the 30 well-established and financially sound companies listed on Bombay Stock Exchange. Sensex is derived from(portmanteau ) from terms Sensitive and Index, coined Deepak Mohoni, a stock market analyst.

- Nifty comprises of 50 companies that are traded on NSE. Nifty is derived from the term National Stock Exchange and Fifty a

- These are not the only indices of BSE or NSE. BSE has indices such as S&P BSE SENSEX 50, S&P BSE MidCap, list of which is given below

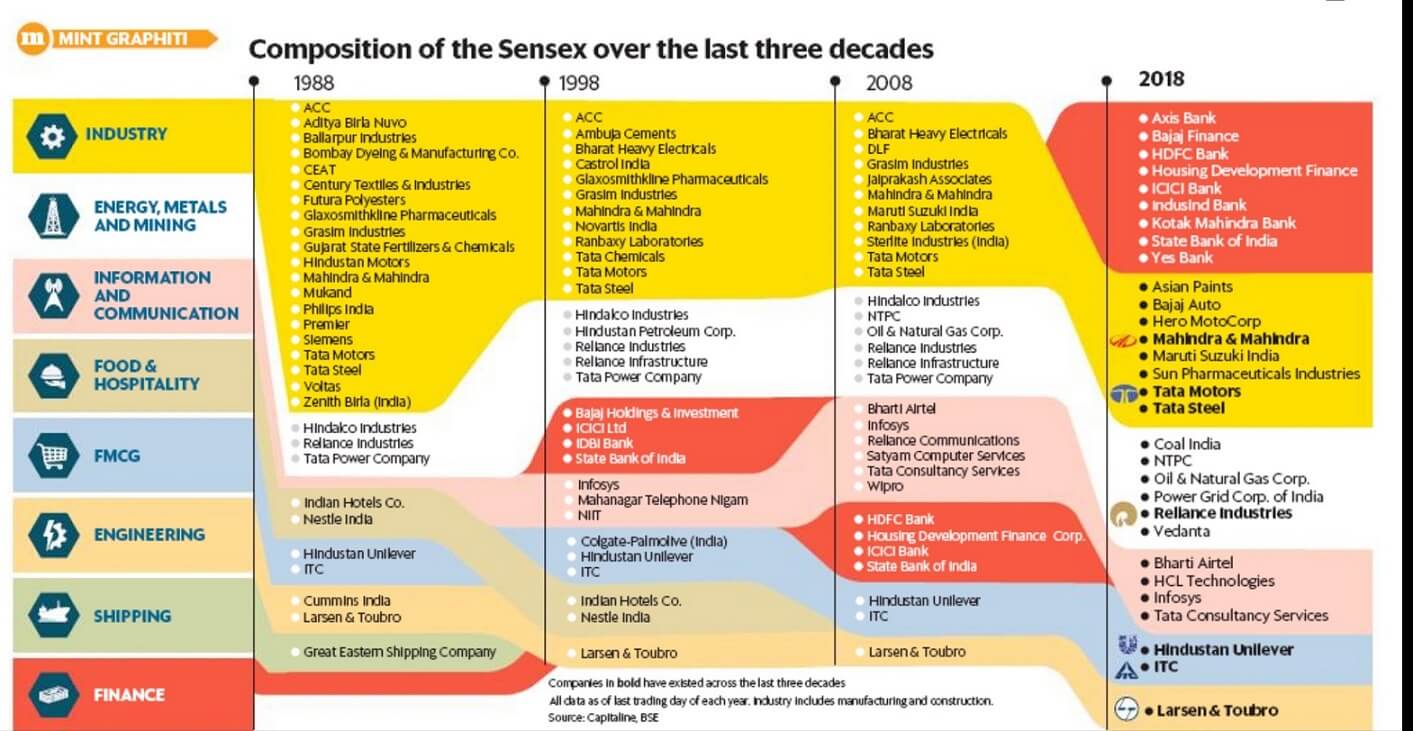

- Indices are rebalanced every 6 months. The first constituents of Sensex are given later in article

- Nifty will be rebalanced on Mar. 27, 2020, Sept. 25, 2020

- For example, from December 23, 2019, Sensex changed

- Tata Motors, Tata Motors DVR (Tata Motors with differential voting right ), along with Yes Bank, and Vedanta were dropped from the BSE’s benchmark Sensex.

- UltraTech Cement, Titan Co Ltd and Nestle India were added to the index.

How Sensex and Nifty are used as a benchmark for Mutual Funds

The standard against which the performance of a stock or mutual fund is measured is referred to as a benchmark. In India, as per the regulatory guidelines implemented by the Securities and Exchange Board of India (SEBI), the declaration of a benchmark index is mandatory

Every mutual fund scheme is benchmarked against a relevant index. You should always compare the scheme’s performance with its benchmark. The fund may be down, but if it managed to beat its benchmark, the fund manager has justified his fees.

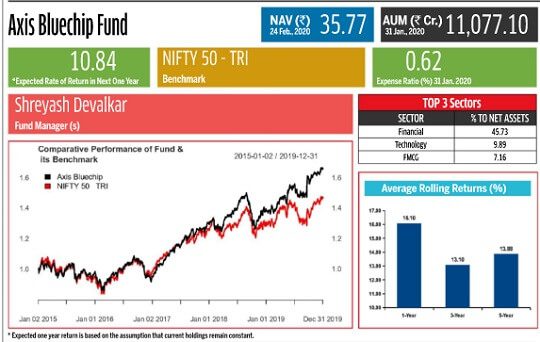

For example, Axis BlueChip Fund benchmark is Nifty 50.

Index and ETF

In India, the ETFs are in focus due to the underperformance of active funds

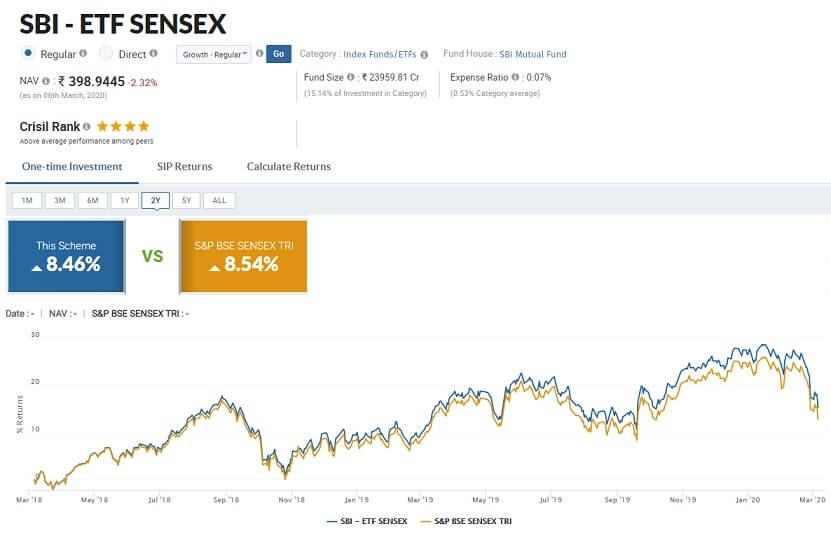

An ETF is a basket of stocks that reflects the composition of an Index, like S&P Nifty or BSE Sensex. The ETFs trading value is based on the net asset value of the underlying stocks that it represents. Think of ETF as an Index Mutual Fund that you can buy and sell in real-time at a price that changes throughout the day.

The image below shows SBI ETF Sensex which tracks Sensex. There are different ETFs which follow different indices.

Video on What is Sensex and Nifty?

This 7 minute Video discusses What is Nifty and Sensex, Index, Bse, Nse, how to calculate Sensex

How are the companies Selected for Sensex and Nifty?

Both NSE and the BSE use the free float market capitalisation method to calculate their benchmark indices Nifty and Sensex respectively and assigning weight to stocks in the index. So a company with a higher free float has a higher weightage on the indices. A free float index reflects market trends better as it takes into consideration only those shares which are available for trading. It also makes the index more broad-based as it helps to reduce the concentration of top few companies.

Sensex is calculated using the Free-float Market Capitalization methodology since September 1, 2003.

The market capitalization of a company is determined by multiplying the price of a stock by the number of shares issued by the company. For example, if a company has 1 lakh shares and the stock price is Rs 20, then the market capitalization of the company is Rs 20 lakh.

Free float is a variation of market capitalization method. It uses the company’s floating shares i.e shares which are readily available for trading, which is the total number of shares minus promoters shareholding. For example, if a company has issued 10 lakh shares of face value Rs 10, but of these, four lakh shares are owned by the promoter, then the free float market capitalisation is Rs 60 lakh. For instance, Coal India has a total market capitalisation of Rs 1.8 lakh crore but the free float market capitalisation is about Rs 35,600 crore because of the government’s high holding.

Stocks that have small free float are likely to see higher price volatility as it takes fewer trades to move the share price. On the other hand, in the case of a larger free float, volatility is lower. In stocks with a large free float, the number of people buying and selling the shares is higher and so, a small amount of trading does not affect the price significantly.

So a company with a higher free float has a higher weightage on the indices. A free float index reflects market trends better as it takes into consideration only those shares which are available for trading. It also makes the index more broad-based as it helps to reduce the concentration of the top few companies.

The market capitalization is further multiplied by the free-float factor to determine the free-float market capitalization.

As per this methodology, Index level at any point of time depicts the free-float market value of 30 constituent stocks relative to a base period.

BSE calculates the free-float factor to two decimal places as illustrated below: E.g: For ABC Ltd, Free Float Factor is (100-48.44)/100 = 0.51

| Category | No. of Shares | % |

| Total Equity Shares | 2,50,00,000 | 100% |

| Promoter and Promoter Group | 1,20,00,000 | 48.00 |

| Promoter Depository Receipts (DR) | 10,000 | 0.04 |

| Public Shareholders Locked in | 75,000 | 0.30 |

| Strategic holding | 25,000 | 0.10 |

| Total | 48.44 |

What are the Stocks in the Sensex and their weights?

| Company Name | Sector | Weightage | |

| 1 | HDFC Bank Ltd. | Banks | 12.37% |

| 2 | Reliance Industries Ltd. | Petroleum Products | 10.43% |

| 3 | Housing Development Fin. Corp. Ltd.£ | Finance | 9.27% |

| 4 | ICICI Bank Ltd. | Banks | 7.89% |

| 5 | Infosys Limited | Software | 6.78% |

| 6 | Tata Consultancy Services Ltd. | Software | 5.22% |

| 7 | Kotak Mahindra Bank Limited | Banks | 4.74% |

| 8 | ITC Ltd. | Consumer Non Durables | 4.18% |

| 9 | Axis Bank Ltd. | Banks | 3.95% |

| 10 | Hindustan Unilever Ltd. | Consumer Non Durables | 3.85% |

| 11 | Larsen and Toubro Ltd. | Construction Project | 3.57% |

| 12 | State Bank of India | Banks | 2.82% |

| 13 | Bajaj Finance Ltd. | Finance | 2.73% |

| 14 | Bharti Airtel Ltd. | Telecom – Services | 2.62% |

| 15 | Maruti Suzuki India Limited | Auto | 2.07% |

| 16 | Asian Paints Limited | Consumer Non Durables | 2.01% |

| 17 | Indusind Bank Ltd. | Banks | 1.65% |

| 18 | HCL Technologies Ltd. | Software | 1.44% |

| 19 | Nestle India Ltd. | Consumer Non Durables | 1.39% |

| 20 | Titan Company Ltd. | Consumer Durables | 1.3% |

| 21 | UltraTech Cement Limited | Cement | 1.18% |

| 22 | Tech Mahindra Ltd. | Software | 1.14% |

| 23 | NTPC Limited | Power | 1.12% |

| 24 | Mahindra & Mahindra Ltd. | Auto | 1.08% |

| 25 | Power Grid Corporation of India Ltd | Power | 1.06% |

| 26 | Sun Pharmaceutical Industries Ltd. | Pharmaceuticals | 1% |

| 27 | Bajaj Auto Limited | Auto | 0.93% |

| 28 | Oil & Natural Gas Corporation Ltd. | Oil | 0.72% |

| 29 | Tata Steel Ltd. | Ferrous Metals | 0.71% |

| 30 | Hero MotoCorp Ltd. | Auto | 0.66% |

What are the Stocks in the Nifty and their weights?

As on 8 Mar 2020, stocks in the Nifty and their weights are given below. Changes would happen on 25 Mar 2020.

| r.No. | Company Name | Sector | Weightage |

|---|---|---|---|

| 1 | HDFC Bank Ltd. | Banks | 10.99% |

| 2 | Reliance Industries Ltd. | Petroleum Products | 9.27% |

| 3 | Housing Development Fin. Corp. Ltd.£ | Finance | 8.1% |

| 4 | ICICI Bank Ltd. | Banks | 6.94% |

| 5 | Infosys Limited | Software | 5.78% |

| 6 | Kotak Mahindra Bank Limited | Banks | 4.68% |

| 7 | Tata Consultancy Services Ltd. | Software | 4.54% |

| 8 | ITC Ltd. | Consumer Non Durables | 3.72% |

| 9 | Axis Bank Ltd. | Banks | 3.35% |

| 10 | Hindustan Unilever Ltd. | Consumer Non Durables | 3.35% |

| 11 | Larsen and Toubro Ltd. | Construction Project | 3.17% |

| 12 | Bharti Airtel Ltd. | Telecom – Services | 2.53% |

| 13 | State Bank of India | Banks | 2.51% |

| 14 | Bajaj Finance Ltd. | Finance | 2.49% |

| 15 | Maruti Suzuki India Limited | Auto | 1.8% |

| 16 | Asian Paints Limited | Consumer Non Durables | 1.75% |

| 17 | Indusind Bank Ltd. | Banks | 1.44% |

| 18 | HCL Technologies Ltd. | Software | 1.25% |

| 19 | Nestle India Ltd. | Consumer Non Durables | 1.21% |

| 20 | Bajaj Finserv Ltd | Finance | 1.18% |

| 21 | Titan Company Ltd. | Consumer Durables | 1.13% |

| 22 | NTPC Limited | Power | 1.02% |

| 23 | UltraTech Cement Limited | Cement | 1.02% |

| 24 | Tech Mahindra Ltd. | Software | 0.99% |

| 25 | Mahindra & Mahindra Ltd. | Auto | 0.94% |

| 26 | Power Grid Corporation of India Ltd | Power | 0.92% |

| 27 | Sun Pharmaceutical Industries Ltd. | Pharmaceuticals | 0.87% |

| 28 | Bajaj Auto Limited | Auto | 0.81% |

| 29 | Dr Reddys Laboratories Ltd. | Pharmaceuticals | 0.77% |

| 30 | Britannia Industries Ltd. | Consumer Non Durables | 0.76% |

| 31 | Bharat Petroleum Corporation Ltd. | Petroleum Products | 0.74% |

| 32 | Wipro Ltd. | Software | 0.71% |

| 33 | Coal India Ltd. | Minerals/Mining | 0.69% |

| 34 | Oil & Natural Gas Corporation Ltd. | Oil | 0.67% |

| 35 | Tata Steel Ltd. | Ferrous Metals | 0.62% |

| 36 | UPL Ltd. | Pesticides | 0.62% |

| 37 | Grasim Industries Ltd. | Cement | 0.59% |

| 38 | Indian Oil Corporation Ltd. | Petroleum Products | 0.58% |

| 39 | Adani Ports & Special Economic Zone | Transportation | 0.57% |

| 40 | Hero MotoCorp Ltd. | Auto | 0.57% |

| 41 | JSW Steel Ltd | Ferrous Metals | 0.52% |

| 42 | Eicher Motors Ltd. | Auto | 0.5% |

| 43 | Tata Motors Ltd. | Auto | 0.5% |

| 44 | Hindalco Industries Ltd | Non – Ferrous Metals | 0.49% |

| 45 | Vedanta Ltd. | Non – Ferrous Metals | 0.45% |

| 46 | Cipla Ltd. | Pharmaceuticals | 0.44% |

| 47 | GAIL (India) Ltd. | Gas | 0.42% |

| 48 | Bharti Infratel Ltd. | Telecom – Equipment & Accessories | 0.39% |

| 49 | Zee Entertainment Enterprises Ltd | Media & Entertainment | 0.39% |

| 50 | Yes Bank Ltd. | Banks | 0.17% |

Other stock exchanges in India

India has many Stock Exchanges some regional like Calcutta Stock Exchange or CSE or International India International Exchange (India INX).

- CSE is a regional stock exchange (RSE) located at the Lyons Range, Kolkata and is the second oldest stock exchange in South East Asia incorporated in 1908.

- India International Exchange (India INX) is the first international stock exchange operating 22 hours a day and six days a week where international investors and Non-Resident Indians (NRIs) can trade from anywhere across the globe at their preferred timings.

- But many stock exchanges were closed like Ahmedabad Stock Exchange in 2018.

| Sr. No. | Name of the Recognized Stock Exchange | Address | Recognition Valid Upto | Segments Permitted |

|---|---|---|---|---|

| 1 | BSE Ltd. | P J Tower, Dalal Street, Mumbai 400023

Website : http://www.bseindia.com |

PERMANENT | a. Equity b. Equity Derivatives c. Currency Derivatives (including Interest Rate Derivatives) d. Commodity Derivatives e. Debt |

| 2 | Calcutta Stock Exchange Ltd. | Website : http://www.cse-india.com/ | PERMANENT | |

| 3 | India International Exchange (India INX) | 101, First Floor, Hiranandani Signature Tower, GIFT City IFSC, Gujarat 382355

Website : http://www.indiainx.com/ |

Dec 28, 2020 | a. Equity Derivatives (Equity Index Derivatives & Single Stock Derivatives) b. Commodity Derivatives c. Currency Derivatives d. Debt |

| 4 | Indian Commodity Exchange Limited | Reliable Tech Park, 403-A, B-Wing, 4th Floor, Thane-Belapur Road, Airoli (E), Navi Mumbai 400708

Website : http://www.icexindia.com/ |

PERMANENT | a. Commodity Derivatives |

| 5 | Metropolitan Stock Exchange of India Ltd. | Vibgyor Towers, 4th Floor, Plot No C 62, G – Block, Opp. Trident Hotel, Bandra Kurla Complex, Bandra (E), Mumbai 400098

Website : http://www.msei.in/index.aspx |

Sep 15, 2020 | a. Equity b. Equity Derivatives c. Currency Derivatives (including Interest Rate Futures) d. Debt |

| 6 | Multi Commodity Exchange of India Ltd. | Exchange Square, CST No.225, Suren Road, Andheri (E), Mumbai 400093

Website : https://www.mcxindia.com/ |

PERMANENT | a. Commodity Derivatives |

| 7 | National Commodity & Derivatives Exchange Ltd. | Akruti Corporate Park,1st Floor, Near G.E.Garden, L.B.S. Marg, Kanjurmarg (West), Mumbai 400078

Website : http://www.ncdex.com/ |

PERMANENT | a. Commodity Derivatives |

| 8 | National Stock Exchange of India Ltd. | Exchange Plaza, C-1, Block G, Bandra Kurla Complex, Bandra (East) Mumbai 400051

Website : https://www.nseindia.com |

PERMANENT | a. Equity b. Equity Derivatives c. Currency Derivatives (including Interest Rate Derivatives) d. Commodity Derivatives e. Debt |

| 9 | NSE IFSC Ltd. | Unit No. 1201, Brigade International Financial Centre, 12th Floor, Block-14, Road 1-C, Zone‑1, GIFT-SEZ, Gandhinagar, Gujarat 382355

Website : https://www.nseifsc.com/ |

May 28, 2020 | a. Equity Derivatives (Equity Index Derivatives & Single Stock Derivatives) b. Currency Derivatives c. Commodity Derivatives d. Debt Securities (Masala Bonds) |

Note:

1. The Hyderabad Securities and Enterprises Ltd (erstwhile Hyderabad Stock Exchange), Coimbatore Stock Exchange Ltd, Saurashtra Kutch Stock Exchange Ltd ,Mangalore Stock Exchange, Inter-Connected Stock Exchange of India Ltd, Cochin Stock Exchange Ltd, Bangalore Stock Exchange Ltd , Ludhiana Stock exchange Ltd, Gauhati Stock Exchange Ltd, Bhubaneswar Stock Exchange Ltd, Jaipur Stock Exchange Ltd, OTC Exchange of India , Pune Stock Exchange Ltd, Madras Stock Exchange Ltd, U.P.Stock Exchange Ltd, Madhya Pradesh Stock Exchange Ltd, Vadodara Stock Exchange Ltd, Delhi Stock Exchange Ltd and Ahmedabad Stock Exchange Ltd have been granted exit by SEBI vide orders dated January 25, 2013, April 3, 2013, April 5, 2013, March 3, 2014, December 08, 2014, December 23, 2014, December 26, 2014, December 30, 2014, January 27, 2015, February 09, 2015, March 23, 2015, March 31, 2015 ,April 13, 2015, May 14, 2015, June 09, 2015, November 09, 2015, January 23, 2017 and April 02, 2018 respectively.

2. India International Exchange Ltd and NSE IFSC Ltd have Single Segment across all asset/product classes.

3. The details have been last updated on January 17, 2020.

First constituents of Sensex

* Asian Cables, Ballarpur Industries, Bombay Burmah, Ceat, Century Textiles,

* Crompton Greaves, Glaxo Smithkline, Grasim, GSFC, Hindalco,

* Hindustan Motors, HLL, Indian Hotels, Indian Organics,

* Indian Rayon, ITC, Kirloskar Cummins, L&T, M&M, Mukand,

* Nestle, Reliance Industries, Scindia Shipping, Siemens,

* Tata Motors, Tata Power, Tata Steel, Zenith

Other Indices of BSE

|

Other indices of NSE

These indices are broad-market indices, consisting of the large, liquid stocks listed on the Exchange. They serve as a benchmark for measuring the performance of the stocks or portfolios such as mutual fund investments.