When you own stocks you can earn through Dividends and capital gain/loss when you sell your shares. When you own stocks listed outside the Indian stock exchanges whether directly or through the ESPP, RSU, ESOP plans of your employer, taxation is different from the way stocks listed on Indian stock exchanges are handled. In this article, we shall cover what to do when you own International stocks and you have dividends? How are they taxed and shown in the ITR?

Table of Contents

Taxation of International Stocks

Investing in foreign stocks is treated as investment in unlisted shares as they are not listed on the Indian stock exchange.

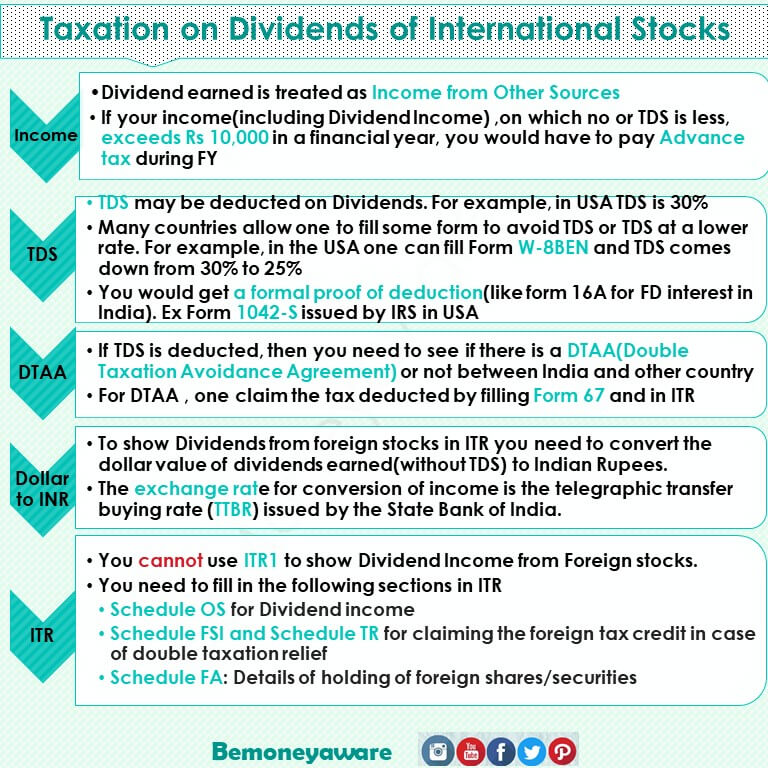

Taxation on Dividends of Foreign or International Stocks

- Dividend earned is treated as Income from Other Sources (as in the Indian Stocks).

- If your income on which the Indian govt has not deducted or has deducted less tax, for example, dividend income(Indian or Foreign), Interest on Fixed Deposit, exceeds Rs 10,000 in a financial year, you would have to pay Advance tax (this is true for the Indian Stocks too)

- TDS may be deducted on Dividends for example for stocks listed in the USA, TDS on dividends is deducted at 25% (it is called Tax withholding in the USA)

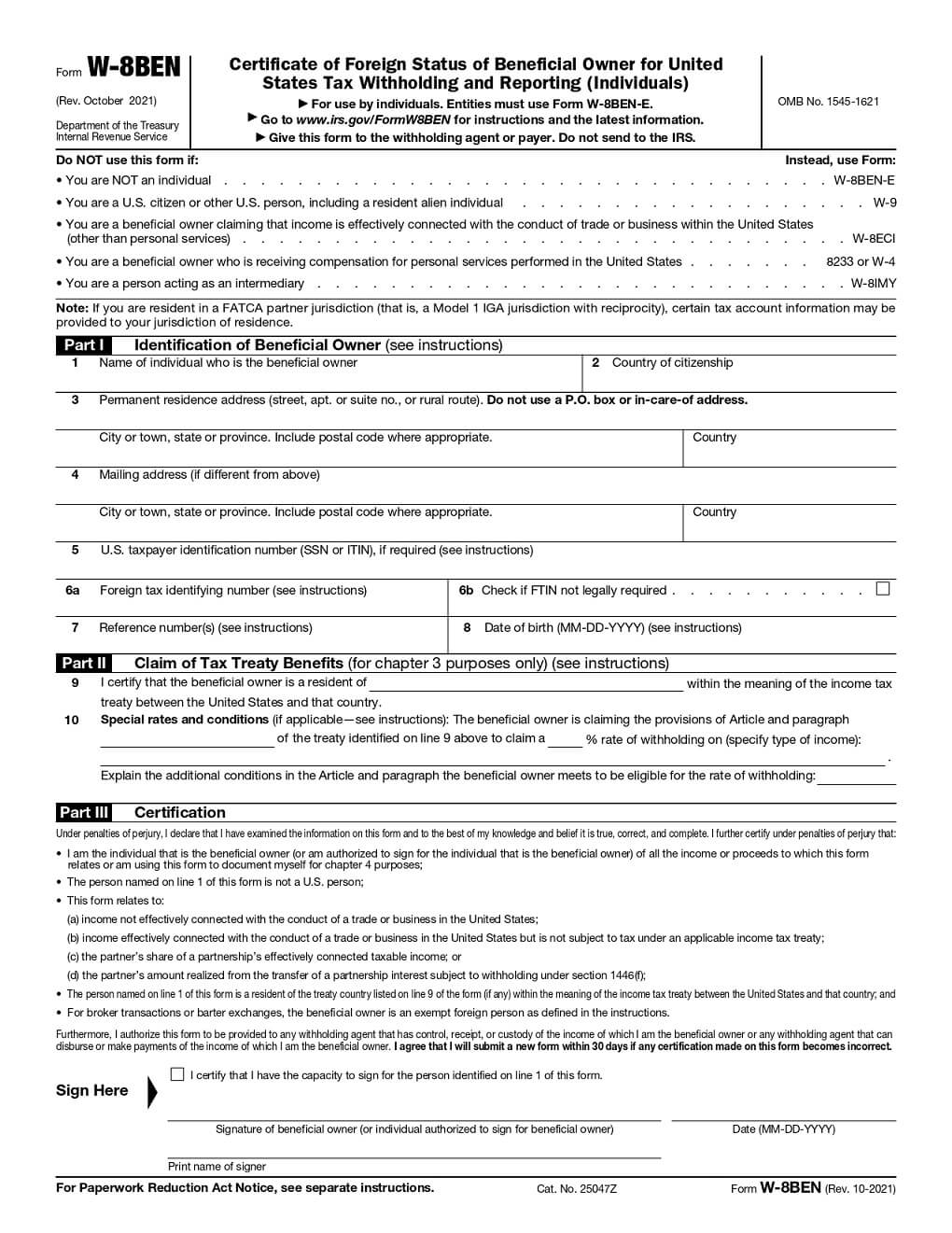

- Many countries allow one to fill some form to avoid TDS or TDS at a lower rate in a foreign country example in the USA one can fill Form W-8BEN. Any dividends on US stocks get taxed at a flat 30% for foreigners. Many countries, however, have income tax treaties with the US(called DTAA), and residents of these countries enjoy a lower tax rate on dividend income. Indian residents, for example, pay a flat 25% withholding tax on dividends in the US. W-8 BEN form confirms the individual’s eligibility for this reduced rate.

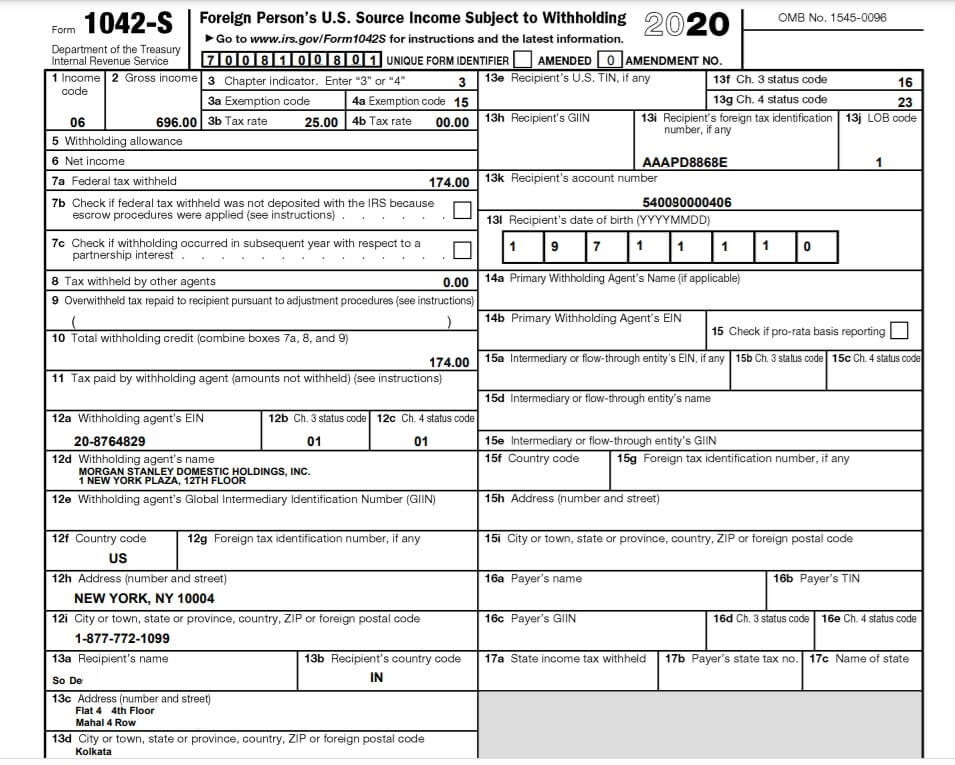

- You would get a formal proof of deduction(like form 16A for FD interest in India) for example USA issues Form 1042-S which shows the amount earned and tax deducted.

- If TDS is deducted then you need to see if there is a DTAA(Double Taxation Avoidance Agreement). If yes, then you will be eligible to claim benefits under the DTAA.

- Then you can claim the tax deducted by filling Form 67 and in ITR(other than ITR1 as you cannot file ITR1 if you have foreign assets) and pay the remaining tax as per your income slab or ask for a refund if extra tax has been deducted.

- To show Dividends from foreign stocks in ITR you need to convert the dollar value of dividends received to Indian Rupees. This amount should be the original amount without the tax deduction. For example, Bharat received 100$ dividend but 25$ was deducted as tax so he got only75$ in his account. But he has to show the original amount without TDS(tax withheld)

- Under the Indian income-tax law, the exchange rate for conversion of income earned in foreign currency into Indian rupees is the telegraphic transfer buying rate (TTBR) issued by the State Bank of India.

- You will get TTBR for the relevant FY at SBI’s forex division.

- You can also get Rates of USD, YEN, Euro, at the RBI(Reserve Bank of India) webpage here.

- Site http://mksco.in/forexrate/ has TTBR rates since 2020.

- You cannot use ITR1 to show Dividend Income from Foreign stocks. So if you are salaried then you have to use ITR2, ITR3.

- You need to fill in the following sections in ITR for showing Dividend Income

- Schedule OS for Dividend income

- Schedule FSI and Schedule TR for claiming the foreign tax credit in case of double taxation relief

- Schedule FA: Details of holding of foreign shares/securities

Let’s take the example of Bharat owns stocks of Microsoft(he can either buy it directly or as an employee, he could have got through ESPP/RSU).

He receives a dividend of $100 on which 25% of $100 ie 25 is deducted. The net payout of the dividend is $75 which gets credited to his account.

Bharat should add dividend income of $100 to his Income from Other Sources in his income tax return. The dividend income is taxed as per the applicable tax slabs.

He can claim a credit of $25 that is the tax withheld by the US company. If he is 20% tax slab then as more tax is deducted he can claim for refund of this extra TDS but if he is 30% tax he has to pay an extra tax of 5%(+ surcharge and cess)

Taxation on Capital Gains of International Stocks

When you sell the shares then capital gains/loss come into play.

- For foreign shares held for more than 24 months, the capital gain is considered as Long Term and it is taxed at 20% with indexation.

- For foreign shares held for less than 24 months, the capital gain is considered as Short Term and it is taxed as per your income slab.

- For Indian stocks, if you hold the stocks for more than 1 year, then you have to pay tax at the rate of 10% for capital gains of more than 1 lakh.

Details in our article How to show Capital Gains on stocks in ITR

TDS deducted on Dividend, Form 1042-S, Form W-8BEN of USA

In many cases, a non-citizen of a country has to pay the tax on the income it earns in the country. For example, an Indian owning US stocks(either bought directly or through RSU/ESPP of MNCs) has to pay tax to that country on that income such as dividends and Capital gains.

Form W-8BEN

For the USA, One may be asked to fill in Form W-8BEN to avoid TDS deductions. The form is applicable to foreign individuals who earn money or income from U.S. sources. US MNCs with employees in India generally submit W-8BEN to US brokers to avoid any withholding related to US taxes. So, individuals must provide a completed W-8BEN form to their U.S client(brokers in case of stocks) in order to avoid paying tax to the IRS(Internal Revenue Service). Sample W8BEN form from www.irs.gov is shown below

Form 1042-S: A proof of Tax Deducted in US

If any Tax is deducted you would get Form 1042-S from USA IRS(Internal Revenue Service). Form 1042-S is the form used to report tax deducted (called tax withheld) on Income paid to foreign persons by a United States-based institution or business. Sample form 1042-S is shown below. The Gross Income is 686 USD and Tax Rate is 25% so the Federal tax withheld is 174.

For more information, see the Instructions for Form 1042-S from the IRS.

Claim Tax deducted on Dividend in Foreign country

If TDS is deducted then you need to see if there is a DTAA(Double Taxation Avoidance Agreement) between India and the country in which the company is based. If yes, you will be eligible to claim benefits under the Double Taxation Avoidance Agreement (DTAA). This will make sure you don’t have to pay tax on the same income twice.

India has a double tax avoidance treaty with more than 150 countries. For example, the USA has DTAA with India.

So if tax deducted is a foreign country then is that gone? No. you can claim it

Claim TDS deducted in a foreign country with DTAA: Form 67

You are required to submit Form 67 if you want to claim credit of foreign tax paid in a country or outside India.

Form 67 can only be submitted online on the e-Filing portal.

Form 67 should be filed before the due date of filing of Income Tax return

Our article How to file Form 67 covers it in detail.

How to show Dividend from Foreign stocks in ITR

Dividend income of stocks(both foreign and Indian) is considered as Income from other sources and is taxed as per the income slabs.

For dividends from Foreign stocks, you cannot use ITR1

You need to fill in the following sections in ITR for showing Dividend Income

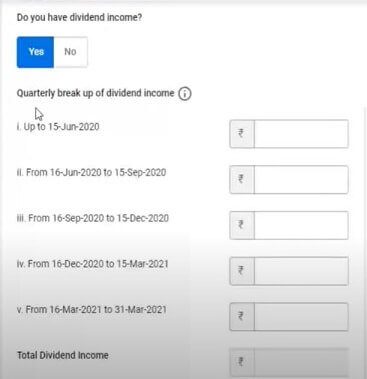

- Schedule OS for Dividend income

- Schedule FSI and Schedule TR for claiming the foreign tax credit in case of double taxation relief

- Schedule FA: Details of holding of foreign shares/securities

Show Dividend Income as Income from Other Sources

To show Dividends from foreign stocks in ITR you need to convert the value of dividends received to Indian Rupees. This amount should be the original amount without the tax deduction. For example, in our case, Bharat received 75 $ as a dividend in his account but he has to show the original amount without TDS(tax withheld)

As Dividend is considered as Income from Other Sources, as shown in the image for the new Utility. It has to be shown for every quarter(because of Advance Tax).

Exchange rate: TTBR

Under the India income-tax law, the exchange rate for conversion of income earned in foreign currency into Indian rupees is the telegraphic transfer buying rate (TTBR) issued by State Bank of India

You will get TTBR for the relevant FY at SBI’s forex division or access http://mksco.in/forexrate/

You can also get Rates of USD, YEN, Euro, at the RBI(Reserve Bank of India) webpage here.

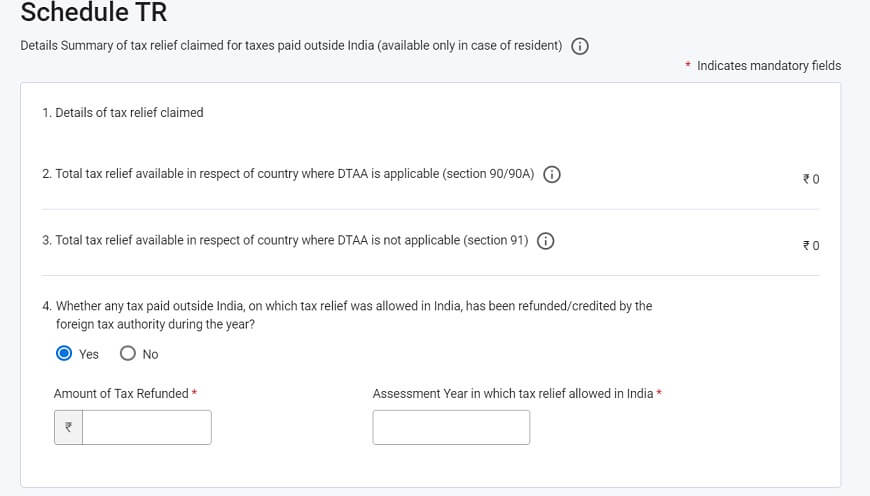

Claim Tax deducted in Schedule FSI and Schedule TR

Schedule FSI and Schedule TR for claiming the foreign tax credit in case of double taxation relief

The income tax act allows Indian residents to claim a credit of foreign taxes paid by a taxpayer against their total tax liability in India.

- Section 90 is for claiming the foreign tax credit in a case where India enters into a DTAA (double taxation avoidance agreement) with another country. Provided the agreements mention claiming of such FTC

- Section 90A When there is DTAA with the Specified Associations, then Tax Relief can be claimed u/s 90A and shall be calculated in the same manner as Section 90.

- Section 91 is for with claiming of FTC where India has not entered into a DTAA (double tax avoidance agreement) with the country where the income arises for a taxpayer

Schedule FSI to claim Tax Deducted

Schedule TR for claiming the foreign tax credit in case of double taxation relief

Fill in the same details as in Schedule FSI

Overview of Foreign Stocks

Related Stocks:

- Dividends of Stocks: Pros & Cons, Compounding

- Do I Need to Pay Tax on Dividend Income? How to report Dividend Income in ITR?

- Indians Invest in US Stock Market: Why, DOW, NASDAQ, How to invest

- RSU of MNC, perquisite, tax , Capital gains, ITR

Disclaimer

All content on this site is for educational and informational use only. Please do not construe this as professional financial advice. You should consult a qualified financial person(tax advisor/financial advisor) prior to making any actual investment or trading decisions. We accept no liability for any interpretation of articles or comments on this blog being used for actual investments/taxation purposes!

Join our Telegram Group BeMoneyAware and Checkout our Instagram Channel Bemoneyaware

Do you get Dividend from International Stocks? How do you show in the ITR?

Hi, Is his dividend income mentioned in section 2 of schedule OS? Income chargeable at special rates?

Thank you for the great explanatio. You provided an example of Microsoft Dividend and generally, Microsoft provides quarterly Dividends in Month of March, June, Sept, Dec. And since US FY is Jan to Dec, Form 1042-S will have details from Jan to Dec for Income and Tax withheld. But when it comes to filling ITR, our FY is April to March. So how do we show the Dividend details and associated proof because if I am filling ITR for FY20-21, I will have 1042-S form of 2020 and will not have details of March 2021 (falling in India FY).