Do you need to pay tax on dividends you received from Stock or Mutual Fund? What about the TDS on the Dividend? You may have got a dividend from the stock of a company or from a mutual fund in India. Dividend received on or after 1 April 2020 is taxable in the hands of the investor/shareholder. This article covers how are dividend received from stocks, mutual funds taxed. How is it different from earlier years? Also covers dividend distribution tax (DDT) and how its abolition impacts tax.

You can read our Income Tax Money Workbook, Filing ITR is not rocket science but it is more than uploading just Form 16 on the website. Whether you file ITR yourself or your CA, tax lawyer, or website files ITR you should know some concepts of Income Tax you should be aware of. We have come up with a workbook on Income Tax that explains the various concepts related to Income Tax, We go through the filing of ITR1 for sample data.

Anshuli received a dividend of Rs 1500 for her shares. She will have to pay tax as per her tax slabs.

For example, Anshuli has 50 shares of ABC, and the company has declared a dividend of Rs. 10 per share. She will receive a total dividend of Rs. 50X10=500. Next year, if she still holds 500 shares as on record date company pays a dividend of Rs. 15 per share, you will get Rs. 750.

On 5 June 2020, Aryan received a dividend of Rs 6,000 from the company listed on NSE. As his dividend income is more than Rs 5,000, the company will deduct a TDS @7.5% on the dividend which is Rs 450. So Aryan received the amount of Rs 5,550(6000-450). The dividend income is taxed at the slab rates applicable for FY 2020-21 (AY 2021-22).

if Aryan borrowed money to invest in equity shares and paid interest of Rs 2,700 during FY 2020-21, then he can claim Rs 540(20% of Interest) as a deduction.

Join our Telegram Group BeMoneyAware and Checkout our Instagram Channel Bemoneyaware

Table of Contents

Do I Need to Pay Tax on Dividend Income?

A dividend for stocks is a distribution of a portion of a company’s earnings to shareholders, according to the number and class of shares held by them is called the dividend. The amount and timing of the dividend are decided by the board of directors, who also determine whether it is paid out of current earnings or the past earnings kept as reserve. Company or Mutual Fund House is not obliged to declare the Dividend.

A Company can declare dividends at any time in the Financial Year. Based on when the company declares Dividends, dividends are classified as Interim and Final Dividend. The final dividend is taxable in the year in which it is declared, distributed, or paid, whichever is earlier and interim dividend is taxable in the year when such dividend is received by the shareholders. For more details about Interim and Final Dividend you can click here.

Dividend received on or after 1 April 2020 is taxable in the hands of the investor/shareholder. Dividend received from an Indian company was exempt till 10 lakh until 31 March 2020 (FY 2019-20) as the company was paying dividend distribution tax (DDT).

The dividend is taxable, comes under Income from Other sources, and is taxed at the income tax slab rates for FY 2020-21 (AY 2021-22). Income from Other sources includes income such as the interest of Saving Bank Account, Fixed Deposit, Recurring Deposit, Senior Citizen Saving Scheme(SCSS), etc and it needs to be shown in the Income Tax return. Our article Income From Other Sources explains it in detail.

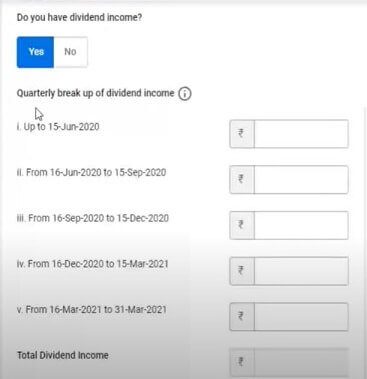

As Its Income from Other Sources, it can be filled in any ITR, as shown in the image for the new Utility. It has to be shown for every quarter(because of Advance Tax).

For a resident Indian, there is a 10% TDS on dividends if it is more than Rs 5,000 from a company or mutual fund under section Section 194. But as a COVID-19 relief measure, the government had reduced the TDS rate to 7.5% for distribution from 14 May 2020 until 31 March 2021. Though TDS is deducted the Dividend is still taxed as per your Income Slab Rates. So you need to claim the TDS, if deducted, in your ITR.

For non-resident shareholders, TDS is deducted at the rate of 20%, subject to beneficial tax treaty rate, if available.

If the total tax liability(for which Tax is not deducted), including Dividends, exceeds Rs 10,000 in the relevant year. You will have to pay Advance tax installments

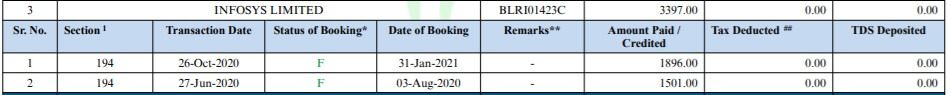

The company will provide a certificate for a tax deduction in Form 16A for tax deducted at source.

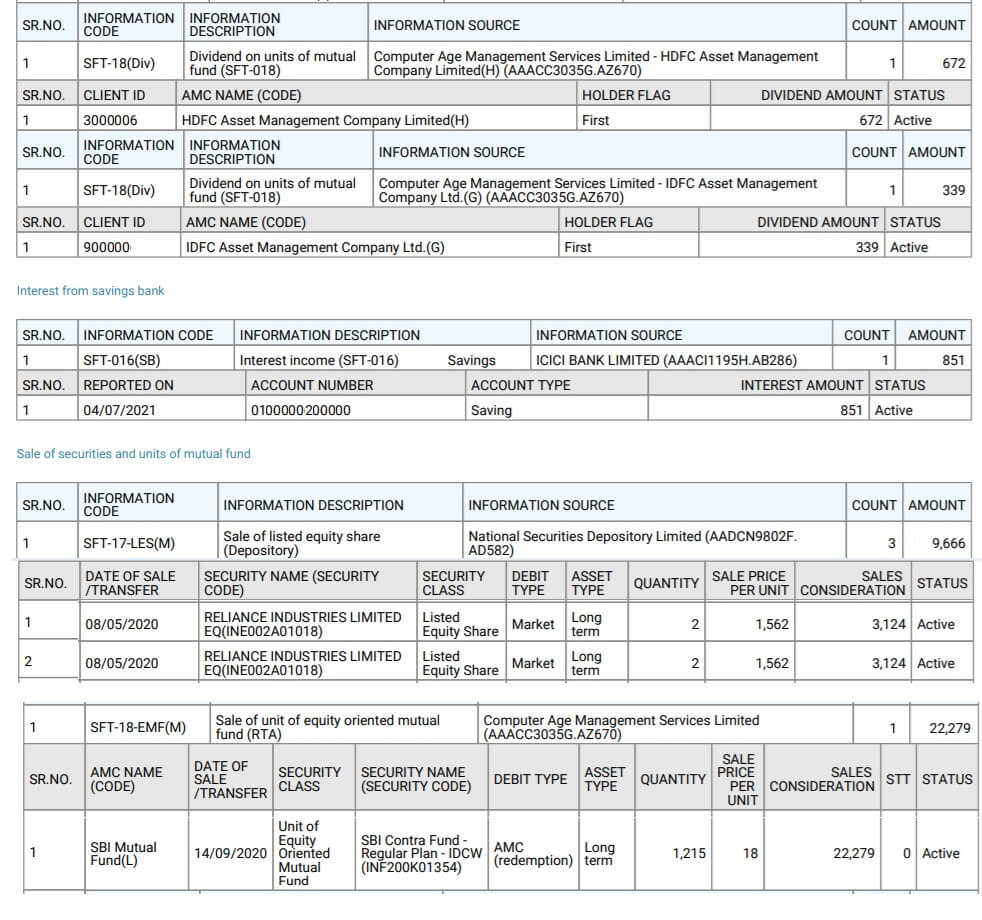

The dividend will appear in your AIS(Annual Information Report) & TIS /Form 26AS whether TDS is deducted or not as shown in the image given below. You can get your AIS form from the income tax website with your login credentials (with valid PAN) at TRACES or e-filing website of the Income-tax department of India at the links https://www.tdscpc.gov.in/app/

Submission of Form 15G/15H: A resident individual receiving dividends whose estimated annual income is below the exemption limit can submit form 15G (15H for senior citizens) to the company or mutual fund paying the dividend. The company or mutual fund will inform the shareholder about the dividend declaration on their registered mail id and would require submission of form 15G or form 15H to claim dividend income without TDS. Our article What is Form 15G? What is Form 15H? explains it in detail.

Deduction of interest expense: Introduced from 1 Apr 2020. If one borrows money to invest in equity then one can claim a deduction of interest expense incurred against the dividend. The deduction should not exceed 20% of the dividend income received. However, you are not entitled to claim a deduction for any other expenditure incurred for earning the dividend income.

Dividend of Stocks

Investing gurus such as Warren Buffett, John Bogle & Benjamin Graham advocate buying stocks that pay dividends as a critical part of the total “investment” return of an asset.

In India company like Infosys, TCS, ITC, Coal India are popular companies that pay dividends but companies like DMart don’t pay dividends.

Our article Dividends of Stocks: Pros & Cons, Compounding discusses What Are Dividends? Why do companies pay a dividend? Should one invest in Dividend-paying stocks? What are the terms associated with Dividend?

Berkshire Hathaway, Warren Buffett company, generated more than $4.6 billion in dividend income in 2019.

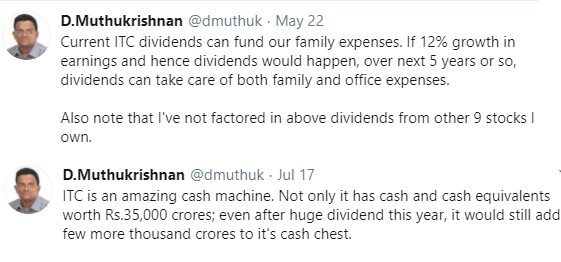

D.Muthukrishnan on Twitter Current ITC dividends can fund our family expenses. If 12% growth in earnings and hence dividends would happen, over the next 5 years or so, dividends can take care of both family and office expenses. His family has more ITC shares than he has Twitter followers.

Dividend of Mutual Funds

Investing in mutual funds involves choosing between a dividend or growth option.

But Dividend in mutual funds is different from the dividend received from stocks. Dividends are paid by redeeming equivalent units of the scheme. Mutual Funds distribute the accumulated profit made by the scheme.

From April 2021, the Securities and Exchange Board of India (Sebi) has changed the terminology from dividend to IDCW (income distribution cum withdrawal). On selecting the IDCW option, investors have two choices: payout or reinvestment.

The IDCW option in mutual funds is different from the dividend in stocks.

- In the payout mode, the accumulated income is paid out to the investors, like how the dividend is given to investors for their stock holding.

- In the reinvestment option, the income is reinvested into the scheme by the purchase of additional units with the distributed amount. The purchased units are added back to the existing holding of the investor

Suppose you invest Rs 10 in an equity fund. The NAV of the fund increases to Rs 15 and the fund manager declares a dividend of Rs 2. After the payment of the dividend, the NAV of the fund falls to Rs 13.

You can check and get Unclaimed Mutual Fund Dividend

Dividend Income in Form 26AS

The dividend will soon appear in your Form 26AS whether TDS deducted or not as shown in the image given below. You can see Form 26AS with your login credentials (with valid PAN) at TRACES or e-filing website of the Income-tax department of India at the links https://www.tdscpc.gov.in/app/

Earlier Rules on Dividend Income

From 1 Apr 2020, the following are withdrawn

- Dividend distribution tax (DDT) on companies and mutual funds. In India, a company that has declared, distributed, or paid any amount as a dividend, was required to pay a dividend distribution tax at 15% plus applicable surcharge and cess taking the effective rate to 20.6%. DDT was introduced in 1997 at a 7.5% flat rate in an effort towards efficient tax collection, but the rate has increased over a period of time which has attracted criticism for unnecessarily burdening companies. Interestingly, DDT was scrapped in 2002 only to be re-introduced in the next year on grounds of ease of tax administration. People also argued that it amounts to double taxation, after paying a corporate tax at 25%, the effective tax rate, including DDT, for Indian firms worked out to be 48.5%.

- The tax of 10% on the dividend of more than Rs 10 lakh (Section 115BBDA) for resident individuals, HUF and firms.

Tax on Dividend on Resident shareholders

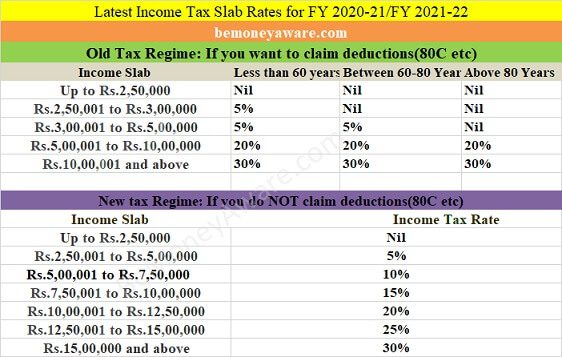

The dividend is taxable, comes under Income from Other sources, and is taxed at the income tax slab rates for FY 2020-21 (AY 2021-22) shown in the image below

Income from Other sources includes income such as the interest of Saving Bank Account, Fixed Deposit, Recurring Deposit, Senior Citizen Saving Scheme(SCSS), etc and it needs to be shown in the Income Tax return. Our article Income From Other Sources explains it in detail.

Resident individual taxpayers, Trusts, etc., in the highest income slab with income above ₹5 crores, will now have to pay more tax for dividend income as the effective tax rate is 42.7% ( rate of 30% (plus surcharge at 37% and cess at 4%). Earlier, the effective tax rate on their dividend income was 34.8% [i.e. DDT at 20.6% plus income tax at 14.2% (ie. tax at 10% plus surcharge at 37% and education cess at 4%) under section 115BBDA].

Resident individual taxpayers in the lower slabs such as 10% will now be subject to tax at the effective tax rate of 10.4% (10% plus education cess at 4%) will pay less tax.

Indian firms and LLPs will have to pay more tax outflow under the new dividend taxation regime. Now they have to pay tax at 34.90% (tax rate of 30% plus surcharge at 12% and education cess at 4%) while earlier they had an effective rate of 32.20% [DDT at 20.6% plus tax at 11.60% (10% plus surcharge at 12% and education cess at 4%) under section 115BBDA]

How to show Dividend in ITR

The dividend is taxable, comes under Income from Other sources, and is taxed at the income tax slab rates for FY 2020-21 (AY 2021-22) shown in the image below

Income from Other sources includes income such as the interest of Saving Bank Account, Fixed Deposit, Recurring Deposit, Senior Citizen Saving Scheme(SCSS), etc and it needs to be shown in the Income Tax return. Our article Income From Other Sources explains it in detail.

As Its Income from Other Sources, it can be filled in any ITR, as shown in the image for the new Utility. It has to be shown for every quarter(because of Advance Tax).

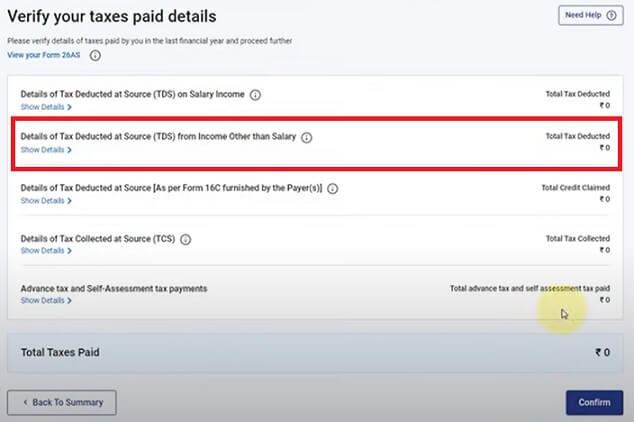

If TDS is deducted you have claim it in ITR

Dividend Received from Foreign Company

There is no change in How Dividend received from foreign Company is taxed. Foreign company is one listed outside in India like in NASDAQ in USA

A dividend received from a foreign company is taxable. It is also charged to tax under the head Income from other sources at the rates applicable to the taxpayer. For instance, if the taxpayer comes in the 30% tax slab rate, then such dividend will also be taxable at 30% along with cess.

Even in the case of a foreign dividend, the investor can claim deduction only for the interest expense restricted to 20% of the gross dividend income.

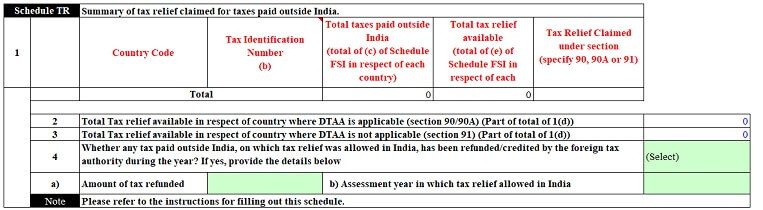

Double Taxation means that the taxpayer shouldn’t have to pay tax on the same income twice. For example, if a US MNC like Microsoft, gives dividends then it might deduct tax on it. Now one should not pay tax again on the same income to the extent of what is deducted. The taxpayer can claim double taxation relief(DTAA) for the tax already deducted. The relief claimed can be either as per the provisions of the double taxation avoidance agreement(DTAA) entered into by the Government of India, with the country to which the foreign company belongs, or he can claim relief as per Section 91 (in case no such agreement exists).

If any tax is deducted in the US then the US IRS department will send a Form similar to Form 16 to your address.

If any tax is deducted, you can claim it in your ITR as shown below from ITR2(old form).

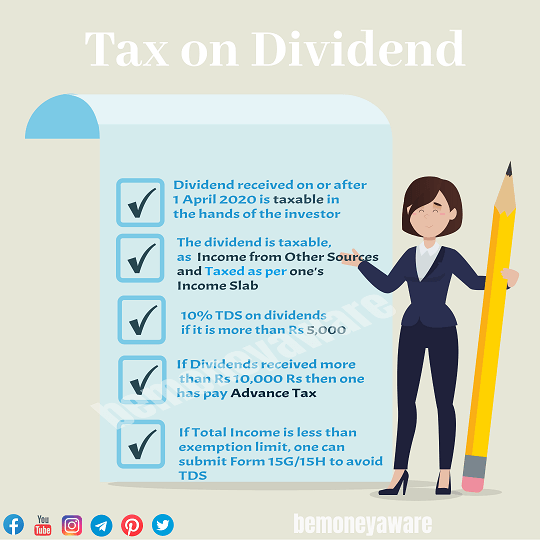

Summary of Tax on Dividend from Stocks and Mutual Funds

The image below sums up the Tax on Dividends from Stocks and Mutual Fund. For more such information you can visit our Instagram channel

Disclaimer

All content on this site is for educational and informational use only. Please do not construe this as professional financial advice. You should consult a qualified financial person(tax advisor/financial advisor) prior to making any actual investment or trading decisions. We accept no liability for any interpretation of articles or comments on this blog being used for actual investments/taxation purposes!

Related Articles:

- Dividends of Stocks: Pros & Cons, Compounding

- Dividends Options of Mutual Funds:Tax, Switch

- Income From Other Sources

- Unclaimed Mutual Fund Dividend

- RSU of MNC, perquisite, tax , Capital gains, ITR, eTrade

Join our Telegram Group BeMoneyAware and Checkout our Instagram Channel Bemoneyaware

Do you get Dividend from Stocks or Mutual Funds? Do you think Tax on Dividends is justified? Which stock gives you Dividend?

The lowest tax slab for resident individuals is 5%, not 10%.

You are right. Thanks for the input.

Those in 5% tax slab get a Tax rebate of Rs 12,500 available under section 87A

We have changed the wordings in our article.