What Are Dividends? Why do companies pay a dividend? Should one invest in Dividend-paying stocks? What are the terms associated with Dividend?

Berkshire Hathaway, Warren Buffett company, generated more than $4.6 billion in dividend income in 2019.

D.Muthukrishnan on Twitter Current ITC dividends can fund our family expenses. If 12% growth in earnings and hence dividends would happen, over the next 5 years or so, dividends can take care of both family and office expenses. His family has more ITC shares than 203.8K Twitter followers.

Why Dividend are important

Table of Contents

What is a Dividend in Stocks?

When investors buy stocks, they can make money two different ways.

- By selling their shares for a price that’s higher than their original cost.

- By getting dividends, which are a portion of a company’s earnings distributed to shareholders.

When a company earns profit, it may pay a part of that profit to the shareholders While, the rest of the profit is reserved by the organization for its future growth, reinvestment, and expansion plans. A dividend is the distribution of the profits by the company to its shareholders.

Let’s assume ABC is a Company which is trading at 1200 per share. Its face value is 2 per share. Its dividend is 20 per share annually.

Dividend Percentage : (Dividend/FV) x 100 = (20/2) x 100 = 1000%

Dividend Yield : (Dividend/Share Price) x 100 = (20/1200) x 100 = 1.67%

Not every company pays dividends, but those that do typically pay them as a way to thank shareholders for their investments and to encourage further investment.

Dividends are not guaranteed and are subject to macroeconomic & company-specific risks.

There is a lot of variation in how dividends are paid out by different companies, or even by the same company over time

Investing gurus such as Warren Buffett, John Bogle & Benjamin Graham advocate buying stocks that pay dividends as a critical part of the total “investment” return of an asset.

In India company like Infosys, TCS, ITC, Coal India are popular companies that pay dividends but companies like DMart doesn’t pay dividends.

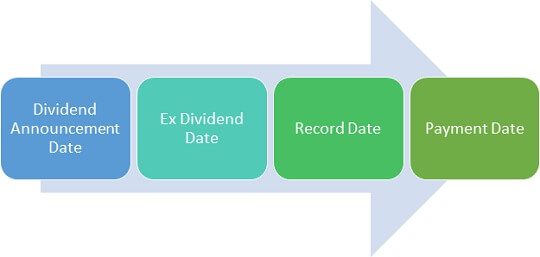

In fact Dividends, Bonus, Splits of shares are corporate events talked about by the people, media. For dividend three dates that an investor has to look out for.

- Declaration date: Company makes the announcement

- Record date: Date on which company will record all the shareholders who will be influenced by the event

- Ex-dividend date: is 2-days before the record date. The price of the stock gets reduced by the Dividend on the Ex-Dividend Date

- Payment date: For Dividend, the date when the dividend will be paid.

For tax purposes, remember From 1 Apr 2020, for an individual shareholder, the dividend is taxable as per the applicable slab rates. The government has abolished tax of 10% on dividend income in excess of Rs 10 lakh per year for resident non-corporate taxpayers (section 115BBDA of the Act).

Why do companies pay a Dividend?

If a company is doing well, then it’s share price should rise. Well, the stock market does not follow that logic.

Reliance Industries share price did not move much before Jio kicked in in 2016. Or In 2020, ITC share price seems to be going nowhere.

One of the benefits(and perils) of a company issuing dividends is that dividends affect investor sentiments about that company.

When a company pays dividends, it shares some of its profits to shareholders and that signals(mostly) stable and reliable operations. A company’s that pay the Dividend are considered as cash-rich firms and hence are looked positively by shareholders. A business would be unlikely to share a percentage of its profits if management didn’t feel confident that it would remain profitable and/or grow over the long run.

But Public sector companies (PSU) like Coal India, Power Grid, pay dividends regularly as the Govt is the owner of these companies and expects dividends to meet its expenditure. The stock price of Coal India and it’s dividend history is given later in the article.

Growing companies typically will not give dividend. They would reinvest the profits back into the company for growth and expansion.

A company that is known for giving dividends consistently over years appeals to long-term value investors and is seen as a steady, mature, and profitable company. This helps drive up the share price over time.

If the company consistently increases its dividend payouts, Investor sentiment may be even more favourable, increasing demand for the stock and day traders can potentially profit off of dividend increase announcements.

Dividend payouts also help calm nerves especially when the stock price is not doing well and hedge against inevitable downturns in the stock market. Although dividend payouts are unlikely to offset big swings in the market, they can help jittery investors keep cool.

So if a company does not pay a dividend then it does not mean that the company is bad. It is because the company is utilizing the amount of the profit for its growth thereby allowing themselves to grow and letting their shareholders earn from appreciation in stock price. Ex DMart does not pay a dividend.

Remember that

Dividends are not guaranteed and are subject to macroeconomic & company-specific risks. A company is not bound to pay the Dividend as Dividend is paid from the Cash Reserve. The company may reserve profits for its future growth and expansion plans.

Should one buy Dividend-Paying Stocks?

As Dmuthuk said on Twitter Current ITC dividends can fund our family expenses. If 12% growth in earnings and hence dividends would happen, over the next 5 years or so, dividends can take care of both family and office expenses.

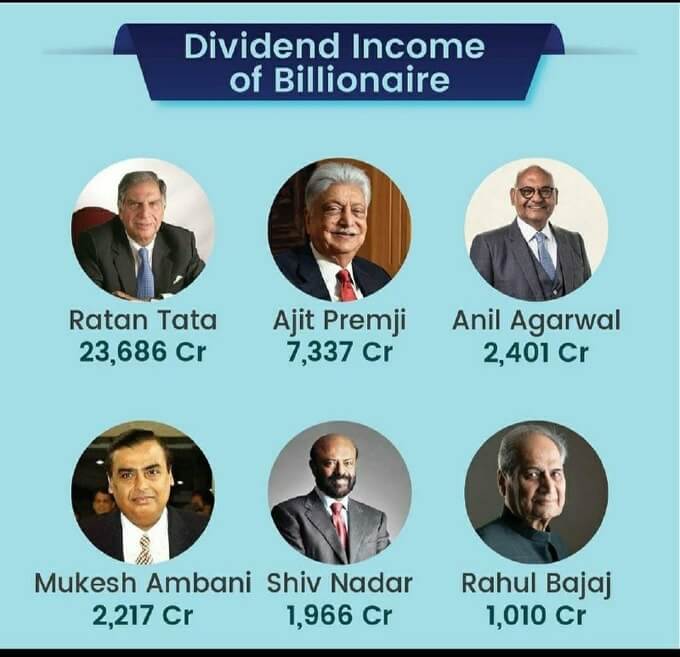

Mukesh Ambani gets an annual salary of Rs 15 crore. He hasn’t taken a salary hike in a decade, but his income from Reliance Industries Ltd. has almost doubled in the same period as he earns a lot from the dividend. More at Mukesh Ambani: Richest Man of India

There are different ways of investing, some of which are given:

- Buy and Hold Investing: buy Good stocks and hold them for a long time

- Trend Investing: Investing in Trending stocks or sectors to catch those big waves,

- Dividend Investing: Invest in companies which give good investments.

Many new investors get teased into purchasing a stock just on the basis of a potentially juicy dividend. And there is no specific rule of thumb in relation to how much is too much in terms of a dividend payout.

Share price keeps fluctuating based on Market Conditions, Emotions, Sentiments, News, Analyst Reports, Demand, Supply etc. So returns keep fluctuating. So at any point in time, we have some notional(on paper) Profit or Loss.

But, if we are invested in a Consistent Dividend paying company, the Quarterly/Annual dividend is Real Money for us. It comes to our Account. Over a period of time, it can be used for our expenses or can be Reinvested.

Dividends are derived from a company’s profits, so we can assume that dividends are a sign of good financial health.

From an investment perspective, if one buys good companies which have a history of good dividends, it adds stability to a portfolio.

Stock prices are volatile, buying stocks which pay dividends helps cushion the declines in the stock prices.

The best stock would be where stock price appreciates and we also get a steady stream of income from dividends. And we all are searching for such companies.

So instead of investing in a bank fixed deposits which give low returns, one can invest in an equity share that pays a good dividend and hope for appreciation.

But the downside to investing in dividend-paying stocks is that companies that pay dividends are not usually high-growth leaders.

Many feel that when a company declares a dividend it is telling the shareholders: “We do not need your money BECAUSE we do not know how to manage the money as well as you do”. So by declaring dividends, splits or bonuses, companies are destroying the value of the shareholders.

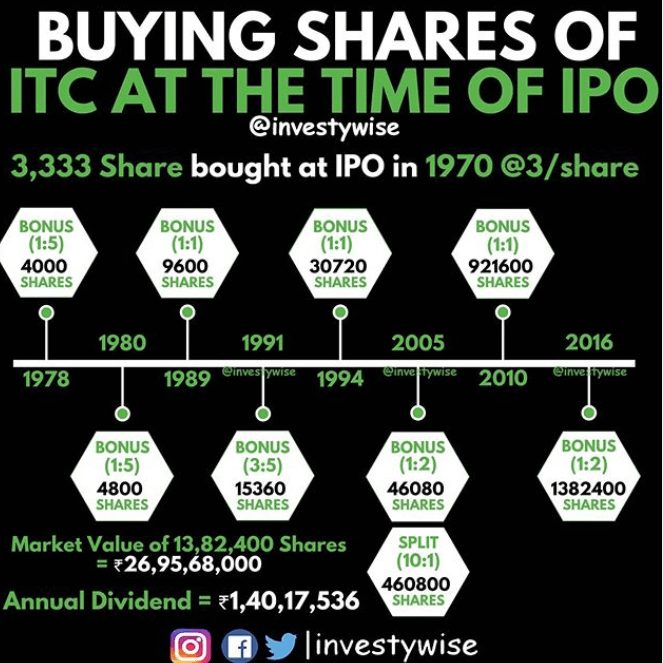

Splits and bonuses are mostly cosmetic events. Splits, reduce the share price. Typically a company replaces every old share with two new ones, each at a fraction of the former price. Same holds for bonus shares. But over a period of time, Splits, Bonus & Dividends have a huge role to play in wealth creation as one can see from the ITC stock split, bonus and dividend. If one had bought 3,333 shares of ITC in IPO in 1970, the number of shares would have increased & so would have the dividends.

How Splits, Bonus and Dividend affect create wealth

Things to look for in Dividend Paying Stocks

- The business is growing, earnings are growing. Else, dividends won’t grow. Checkout the stock price and dividend yield of Coal India.

- Dividend Payout history. Is it regular? Consistent? Growing? Flat?

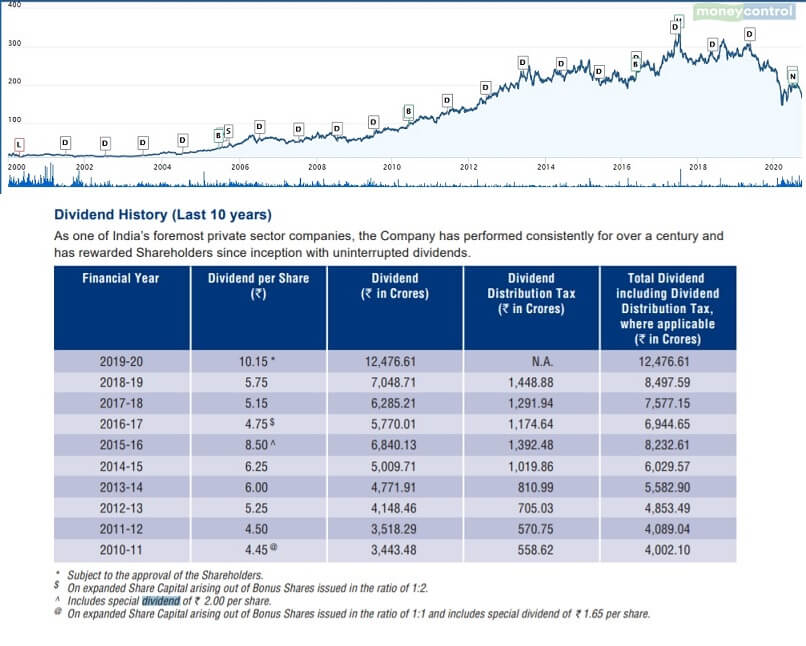

- Dividend-Paying Policy in Annual Report and see if they have adhered to it religiously. The image below shows the ITC stock price and Dividend history

- Avoid cyclical companies while looking for consistent dividends (where dividends also will be cyclical)

Coal India Good dividend but negative returns

Don’t blindly follow the Dividend Yield. If a company’s stock price continues to decline, its yield goes up Dividend Yield is calculated as the ratio of a company’s annual dividend to the market price of the share in percentage. For example, a company gives a dividend of Rs. 20 with a market price of the share is Rs. 200 then the Dividend Yield comes out to be 10%.

When the price of a share falls and keeps falling the ‘yield’ looks very attractive. Indiainfoline is now available at a yield of 6.5%p.a. This is very attractive IF AND ONLY IF you believe that the dividends will be sustained for a substantially long period of time. Funnily, if the market does believe this, the share would not be at such a low price!!

It is important to beware of companies with high dividend yields. . Make sure that the company is good and that you are sure that the company is doing well.

If the company does not have a consistent dividend-paying track record, run.

ITC Dividend history and stock price

Dividend Reinvestment and Compounding

Dividends can be reinvested back into more shares of a dividend-paying stock.

Using the payout to purchase more shares of dividend-paying stock leads to a larger payout and more shares owned, thereby compounding your wealth.

Once you received your dividends, wait for the right price & then reinvest. Need not necessarily reinvest immediately after you received the money.

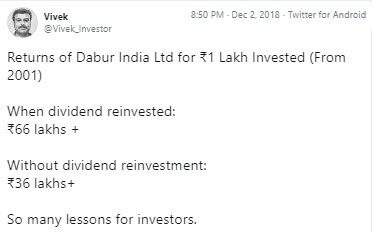

As Vivek_Investor says

How Dividend Reinvestment helps in creating wealth

How many times can a company pay Dividend in a year?

A company can give the Dividend to its shareholders in 3 forms i.e. Interim Dividend, Final Dividend, and Special Dividend.

- Interim Dividend can be given anytime during a financial year.

- Final Dividend is paid once at the end of the financial year.

- Special Dividend is the non-recurring dividend that is tied to special events like the profits earned by selling an asset, etc. The amount is usually larger in comparison to the normal dividend.

Terms associated with Dividend of Stocks

What is Dividend Percent?

Dividend Percent can be understood as the percentage of the face value of a stock. For example, let’s say if the price of the stock is Rs. 100 and its face value is Rs 10 then 200% of the Dividend declared equals to Rs. 20.

Note: Dividend per cent must not be calculated on the stock price rather it is based on the face value of a stock.

What is Dividend Yield?

Dividend Yield is calculated as the ratio of a company’s dividend to the market price of the share. The result is then multiplied by 100 to express it as a percentage.

For example, a company gives a dividend of Rs. 20 with a market price of the share is Rs. 200 then the Dividend Yield comes out to be 10%.

Dividend Yield i is dynamic since the market price of a share keeps on changing regularly. If the stock price crashes then the dividend yield would come down as the dividend given by the company would also come down.

Note: The Dividend in the numerator is calculated by adding all the dividends that a company gives in a year like interim dividend and the final dividend.

What is Dividend Payout Ratio?

The Dividend Payout Ratio (DPR) is the fraction of net income a firm pays to its stockholders in dividends. Dividend payout ratio measures the percentage of net income that is distributed to shareholders in the form of dividends. The payout ratio is a way to measure the sustainability of a company’s dividend payment stream.

Payout ratio = dividends per share (DPS) / earnings per share (EPS)

Let’s say a company has earnings per share of Rs 100 and gives dividend of Rs 10. Its payout ratio would be 10%.

Difference between Dividend Yield & Dividend Payout

Dividend yield refers to the rate of return earned by the shareholders on their investment.

Whereas the dividend payout ratio represents that portion of the earnings which the company distributes as a dividend.

High yielding stocks pay out a large chunk of their earnings as a dividend. This is also why they are referred to as income-stocks.

Image below shows Dividend Yield & Payout of HUL

Dividend Yield vs Dividend Payout

What is the Dividend Record Date?

Dividend Record Date is the date of the record i.e. company will pay a dividend to the shareholders who have the shares of the company in their Demat account on this date

For example, a company’s Record Date is 30 August 2020 then one must purchase its share by 28 August 2020, shares are in your account in T+2 days i..e. 30 August 2020.

What is the Ex-Dividend Date?

The ex-dividend date is 2-days before the record date. The price of the stock gets reduced by the Dividend on the Ex-Dividend Date. So one must have stock in their Demat account before the Ex-Dividend Date to be eligible to receive the Dividend.

If one purchases a stock on the Ex-Dividend date or after that date then they would not be eligible to receive the dividend payout since the price of the stock has already been reduced on the given date.

In the case of a seller, if a seller sells his stock on the ex-dividend date then still they would be eligible to receive the dividend.

For example, if the Ex-Dividend Date is 28 August 2020 and the Dividend Record Date is 30 August 2020 then one must be able to get the stock by 27 August 2020.

What is the Dividend Payout Date?

Dividend Payout Date is the date when a dividend is scheduled to be paid to the eligible investors. The Dividend Payout Date is around 20-30 days after the Ex-Dividend Date.

Dates associated with Dividend

Case Study of Berkshire Hathaway and Dividends

One of the keys to Warren Buffett’s success is that he holds companies for long periods of time and he focuses on high-quality dividend stocks.

From Here’s How Much Dividend Income Warren Buffett Will Receive in 2020

At the end of 2019, Berkshire Hathaway’s owned 52 securities (50 stocks and two exchange-traded funds/trusts). Of these 52 securities, 36 of them pay a dividend. Buffett’s investment portfolio collected $4,720,296,790 (that’s more than $4.7 billion) in dividend income in 2020.

Wells Fargo and Coca-Cola have been held by Berkshire Hathaway for at least three decades. For example, Warren Buffett’s Berkshire Hathaway bought more than $1 billion of Coca-Cola shares in 1988. And Coco-Cola is still part of his portfolio,

In total, Buffett has 10 companies that are providing Berkshire Hathaway with more than $100 million in dividend income this year:

-

- Apple: $755,079,143 in estimated 2020 dividend income.

- Bank of America : $666,006,192.

- Wells Fargo: $659,354,353.

- Coca-Cola : $656,000,000.

- Kraft Heinz: $521,015,709.

- American Express : $260,770,404.

- US Bancorp : $222,532,158.

- JPMorgan Chase: $214,253,755.

- Delta Air Lines: $114,165,834.

- General Motors: $114,000,000.

If there’s one key takeaway from examining Warren Buffett’s portfolio, it’s to not overlook the power of dividend stocks.

Where to find dividend information of a stock?

You can find the details regarding the dividend of stocks on any of the major financial websites in India. Here are a few reliable financial websites to get these pieces of information in India:

- Money Control: https://www.moneycontrol.com/stocks/marketstats/bsetopdiv/

- Screener: https://www.screener.in/explore/

- Investing.com: https://in.investing.com/

Which are the Top Dividend Stocks in India?

Sadly there is no one list. The list given below is from the Livemint. It lists top 10 companies have been consistently paying dividends over the last five years.

Stock, Dividend Payout Ratio(%), Dividend Yield(%)

- ITC 81.51, 5.20

- Hindustan Zinc 102.44, 7.02

- Power Grid Corporation of India 43.43, 5.41

- Indian Oil Corporation 48.87, 10.46

- Bharti Infratel 58.87, 5.13

- Petronet LNG 69.36, 5.08

- Pfizer 296.54, 6.80

- Sun TV Network 71.13, 5.16

- Procter & Gamble Health 87.09, 8.71

- SKF India 222.40, 7.78

Data as on August 28; Source: Value Research

As a personal opinion, we would suggest the stocks that represent growth along with the Dividend. For example, TCS has an attractive dividend yield of 3.44%. Infosys has a dividend yield of 1.9%. Bajaj Auto Ltd. offers a dividend yield of 4.16%.

Videos on Investing in Dividend Stocks

P V Subramanyam has done many videos on Dividend Investing. One such video is given below.

Related Articles:

All About Stocks, Equities,Stock Market, Investing in Stock Market

- Difference Between NSE and BSE, Listing of company on Stock Exchange

- Indians Invest in US Stock Market: Why, DOW, NASDAQ, How to invest

Dividends are Real Money. Dividends have an effect on investor sentiment and actual share value. Long-term investors often look at dividends as a primary component of the fair price of a company’s shares, while short-term investors can incorporate dividend payouts into their trading strategies. In the Longer Run, Dividends can work magic.

Trackbacks/Pingbacks