Divorce are devastating emotionally, that the financial implications of the separation often never crosses the mind. Due to the emotional trauma, one’s thinking gets clouded, preventing one from acting in a logical manner. Women, especially those who are not financially savvy or involved in the family’s money decisions, are the most vulnerable. In a divorce, what was once called “ours” gets divided into “his” and “hers.” Things become more complicated if the couple has children. What is Divorce? Types of Divorce, What are the Rights of Women on Divorce? What about Loans, Bank Accounts, Investments on Divorce? How much Alimony does one get? How does the law decide Who gets Custody of Children?

Marriages are said to be made in heaven, but divorce is most certainly a very earthly affair.

Table of Contents

Types of Divorce and Process

A divorce is a legal action between married people to end their marriage before the death of either spouse. It is referred to as dissolution of marriage. There are three important factors which need to be sorted out at the time of divorce are:

- Settlement of property, assets, liabilities

- Alimony

- Custody of child

Types of Divorce in India

The Indian Divorce procedure can be broadly classified into two different categories.

- Divorce by Mutual Consent: When both spouses agree to dissolve a disturbed marriage they can pursue the Indian divorce procedure with Mutual Consent. One needs to file a joint divorce petition. Court will give a period of six to eighteen months to the parties, called the cooling-off phase, to reconcile. If they cannot reconcile then they have to discuss the terms of the settlement. And also have to file second motion and Court passes a Decree of Divorce.

- Contested Divorce: A contested divorce is one where the husband or the wife wants a divorce, but the other doesn’t. Or both want a divorce, but cannot agree on issues such as alimony, custody of children. In a contested divorce one has to prove the court reasons, called grounds, for wanting to separate. Reasons can be like adultery, desertion, cruelty, impotency and chronic diseases like leprosy, venereal disease etc. Such grounds can be challenged by the other party. This makes contested divorce proceedings long, stressful and relatively expensive. It often happens that a couple starts the divorce proceedings by way of a contested divorce, but over the course of the trial, agree to divorce by mutual consent. In India, the grounds of divorce are decided based on the religion of the couple.

Divorce through mutual consent takes a minimum six months to settle, whereas if it takes the court route it may take anything between 2-5 years depending on the case.

The legal process in India is quite painful, long and expensive. A couple can save on legal expenses if they mutually arrive at a financial settlement. They can also take the help of their neutral friends and family members.

If the divorce is happening by mutual consent, the problems of splitting in the assets in a manner fair to both parties can be resolved. However, if it isn’t by mutual consent, the husband, who is usually the breadwinner in India society, can resort to concealing assets and income, so that the wife doesn’t get her rightful share. Men usually do this by stashing cash in lockers, showing low income and high expenses and unloading a property to family and friends with the understanding they will get it back after the divorce settlement is final.

In India marriage and dissolution of marriage come under personal matters and the laws are on the basis of customs and rights of different religions as shown below

- The Hindus, Buddhists, Sikhs, and Jains are governed by the Hindu Marriage Act, 1955.

- Muslims by the Dissolution of Muslim Marriages Act, 1939.

- The Parsis are governed by the Parsi Marriage and Divorce Act, 1936.

- The Christians are governed by the Indian Divorce Act, 1869.

- The Special Marriage Act, 1956 is known to govern all inter-community and civil marriages.

Women Rights and Divorce

Investments in her name: A married woman has exclusive right over her individual assets and property. She is the sole owner and manager of her assets whether earned, inherited or gifted to her unless she gifts it in part or wholly to anyone.

On separation, the wife has the right to Stridhan or StreeDhan and all jointly-held investments where she has made some monetary contributions. Stridhan refers to the woman’s personal wealth and encompasses all movable and immovable properties, gifts, and everything else received by her from her parents, relatives and even from her in-laws at the time of her marriage. It can include things like cash, gift-items, jewellery, car, furniture and more. She also has a right on all gifts received after her marriage, for instance, those given to her on festivals and other functions. If the husband refuses to part with items that come under Streedhan, she can back them up with relevant bills and receipts whenever needed. For this, it’s important she makes a list of all her assets and gets it signed by two witnesses so that there is no room for it to be challenged later.

Our article StreeDhan : What is it? Why should one know about StreeDhan? talks about streedhan in detail

Property: Wife share in property would be 50% in all her husband’s residential properties. In other properties, her share will be decided as per the court decision. Rajya Sabha passed a bill, regarding the wife’s share in the husband’s inherited property after divorce. After separation, the wife has no claim on the husband’s ancestral property or inherited wealth which may include a house/vehicle, valuable collectables, household items and so on.

Divorce: Loans, Bank Accounts, Investments

Divorce and Loans

In today’s times, joint debt, such as car and housing loans, and credit card dues is part of household finances. So, a divorce settlement will not only be about dividing assets but also loans taken together.

If a couple has taken a joint loan, both of them are equally liable for the repayment of the loan. The divorce will not alter their financial liability

If you have an add on credit card for the spouse, you can stop it so that he/she cannot use it. Else you will have to pay for it.

If there is a default on the joint loan it will negatively impact the credit history of both partners. If one has been a guarantor for a loan taken by the other person, and the principal borrower defaults, the guarantor’s credit history will be negatively impacted. This would hurt the chances of getting a loan in future.

One option is to preclose the loan. A lender is not interested in who gets the ownership of the thing bought on loan; all it wants are the regular payments for the loan or loan be closed. So, one can always sell the thing and liquidate other assets to repay the debt.

The divorce settlement should clearly spell out who repays which loan and takes care of which expense. It is crucial to get the change effected in the bank records as well.

Divorce and Home Loan

Please note that If the property is purchased by one person and the title is held by the other, the legal owner is the person in whose name the property is. However, if the other person can prove to the court that he or she funded the purchase, he/she can claim it,

A lender is not interested in who gets the ownership of the property; all it wants are the regular payments for the loan or repayment of the loan.

There are many ways to settle joint home loan and the outstanding amount:

- Sell the property and clear the loan. The remaining amount could be divided mutually. But be careful of the sale value. It should not be a distress sale.

- One party can take over the property ownership, by settling the contribution of the other party. The property can then be refinanced, based on his/her borrowing capability.

- Clear one party’s name from the lending institution’s loan account. The institution shall assess the possibility of doing so and the loan amount outstanding, by examining the other party’s repayment capacity. The loan was granted on the basis of the combined credibility. So, the lender might want to review the repaying capacity of the other borrower before removing one’s name from the loan.

Our article Joint home loan with Spouse: Pros and Cons explains the advantages and disadvantages of a joint loan in detail.

Divorce and Saving Bank Accounts

The savings accounts, the bank locker, the demat account, everything that’s joint has to be closed.

If there is a joint savings account, the balance will be shared equally, irrespective of who deposited the money. The cunning spouse can transfer all the money from their joint bank account to a separate savings account, even before the divorce/or during the settlement. Since one is a joint account holder, they have the rights to operate the account and withdraw from it.

You need to close joint bank accounts

Bank fixed deposits can be redeemed before maturity, but this may invite a penalty.

Divorce and Investments

A simple way to divide savings in the form of shares, mutual funds and fixed deposits is to liquidate them and share the proceeds. However, premature liquidation may mean you may lose out on the returns.

You cannot change the name of the account holders or convert a joint demat account into single-holder account. The only option is to open individual accounts and transfer the shares into them. You will have to pay fees for these transactions if the destination account is not identical (held by the same persons).

For Mutual Funds taken in the joint name you cannot remove the name from Mutual Funds.

Divorce, Nomination and Will

Change nominee details Change the nomination details of your investments, including Provident Fund, PPF, bank account, demat account and mutual funds. Change the nominee in your insurance policies.

Alter your will: If you have written a will, you may want to change the beneficiary(s)

Divorce and Custody of Children

If children are involved the question is Who will the child stay with, when the other parent can meet the child i.e what will be the terms of access, how will the child’s living and educational costs be met?

Custody of a child only implies as to who the child will physically reside with. Both parents continue to be natural guardians. The custodial parent will be the primary caretaker responsible for the emotional, medical and educational needs of the child and the non-custodial parent who does not.

The non-negotiable principle on which custody is decided is the ‘best interest and welfare of the child’. Who will best serve the child’s emotional, educational, social and medical needs is the only criteria. The earning capacity of the parent does not determine custody but the capacity to provide a safe and secure environment does. A non-earning mother will not be disqualified but the earning father will be asked to provide child support.

Access to the non-custodial parent could be weekly, fortnightly, daily or monthly. It could be just day access or overnight access with gradual increase including weekend and/or vacation, access on special days, etc. It could also be free access with no fixed schedule, but as per the parents and the child’s convenience, could include the non-custodial parent’s right to school events, etc.

For Maintainance of Child, parents can agree to a one-time lump-sum amount or a staggered payment either at different stages of the child’s educational life or a monthly amount with incremental increase. The amount should be sufficient for the day-to-day expenses of the child to maintain or improve the standard of living.

The court is parens patriae, the ultimate guardian of the child and her/his property and so minor’s property/income is amply protected by law and terms of custody, access and child support can be altered in changed circumstances and/or in the interest of the child.

The Guardians and Wards Act, 1890 is the universal law pertaining to issues involving child custody and guardianship in India, regardless of the child’s religion. However, under secular principles, India also sanctions laws pertaining to different religions.

Under secular law as well as Hindu law, rules are given below. For other laws, you can read our article Divorce and custody of child.

- The mother usually gets custody of the minor child, under the age of five.

- The choice of a child above the age of nine is considered. A mother who is proven to neglect or ill-treat the child is not given custody.

- Usually Fathers get custody of older boys and mothers of older girls.It is not a strict rule and is primarily decided based on the child’s interests.

Types of Child Custody

- Sole Custody: One parent has been proven to be an abusive and unfit parent and the other parent is granted custody.

- Joint Physical Custody: Both parents will have legal custody, but one will have the physical custody (child resides with him or her) and will be the child’s primary caretaker.A new concept that has evolved while negotiating divorce settlements.

- Third-Party Custody: Neither of the biological parents is given custody of the child. Instead, child custody is granted to a third person by the court.

A Supreme Court bench headed by Justice Vikramjit Sen had ruled that an unwed mother does not have to take consent from the biological father of the child, or reveal his identity for sole guardianship of the child.

The Delhi High Court has ruled that using the mother’s name is sufficient for a child to apply for a passport when the child is being brought up by a single mother without any involvement from the father.

Alimony and Divorce

About Alimony

As per the Hindu Marriage Act, the husband is expected to take care of the woman’s reasonable needs through alimony or maintenance after divorce. Alimony can either taken as lump-sum or it can be a monthly payment to support the wife and children if any.

The court decides the maintenance amount, depending on the husband’s income and property, the woman’s income and property, and the couple’s individual financial needs. In India, women can only expect one-fifth of the husband’s pre-tax (roughly a third of his post-tax) income as alimony. Hindu and Parsi laws allow even husbands to seek monetary support.

Lawyers say when the client is a woman, they should opt for a lump sum payment from the husband. This ensures the safety and security of alimony. In many cases, husbands might stop paying after some time, citing different reasons.

When a client is a man, request the court for monthly maintenance. This is because in case the wife remarries or gets into a relationship with someone, the ex-spouse can approach the court to discontinue the alimony.

If the wife/husband wants the alimony increased, one needs to file for revision of payment and provide adequate documents for the claim.

Examples of Alimony paid

We have read stories of American men shelling out huge alimonies, but now Indian men are also shelling big amounts as alimony. Hrithik Roshan’s wife Sussanne apparently demanded around Rs 400 crore as alimony after filing for divorce and the actor reportedly agreed to pay Rs 380 crore in the settlement. Though these reports were rubbished by Hrithik and his lawyers. It seemed they arrived at out-of-court settlements regarding alimony, residence and permanent maintenance.

Karisma Kapoor has demanded Rs 7 crore in alimony from her Delhi based businessman, Sunjay Kapur. The couple, who got married in 2003, filed for divorce in 2014. Sunjay had to transfer his posh bungalow in Mumbai in Karisma’s name and also had to purchase bonds worth 14 Crores for their children. Each of his kids will receive an interest of Rs 10 lakhs as monthly expenses from the bonds.

Sanjay Dutt apparently paid Rs 8 crore to Rhea Pillai as alimony money.

Divorce and Tax

Tax Implications of Alimony

The Income Tax Act does not contain specific provisions relating to Alimony. Income tax provisions along with relevant case laws must be studied for taxation of alimony. As a general principle, a capital receipt is non-taxable while a revenue receipt is taxable.

- The amount of lump sum received as permanent alimony on account of divorce is not taxable. It is considered to be a capital receipt and, therefore, the provisions of Income-tax Act 1961 (The Act) are not applicable. So, the amount of permanent alimony is not treated as income and thus not taxable..

- Monthly alimony payments will be treated as income in the hands of the recipient

- For the person paying the alimony, there is no provision under the tax laws enabling him to claim a deduction towards such payment from his income.

Divorce and Asset transfer

While you are married if you are given an asset by your spouse it is tax-free under Section 56(2)(vii) of the Income Tax Act. But after divorce the asset will be treated as a gift and hence, will be taxable to you. Any income earned from an asset after a divorce is taxable for you,

- For assets with a market value above Rs. 50,000, other than immovable property (jewellery, securities etc.), you will have to bear the taxes at the time of the asset’s transfer.

- If the asset’s worth, when it was received, is lower than the market value – which exceeds Rs. 50,000 – the difference will be taxable.

- Immovable assets like shares etc. whose stamp duty value is higher than Rs. 50,000, will be taxed.

Tax and Other assets

There is no specific provision in the Act for tax implications on sale of assets acquired at the time of divorce. As a general rule, any asset when sold is subject to capital gains tax. After divorce, any subsequent income from the sale of assets(Gold, property, Mutual Funds) would be taxable in the hands of the recipient spouse. The holding period of the previous owner is also taken into account when calculating the gain and its taxation. The cost of acquisition is deemed to be the cost at which the previous owner bought it

However, if the ex-spouse only pays for certain expenses like rent of the home, child support (education fees) etc., instead of monthly alimony, one will not have to pay tax on these amounts.

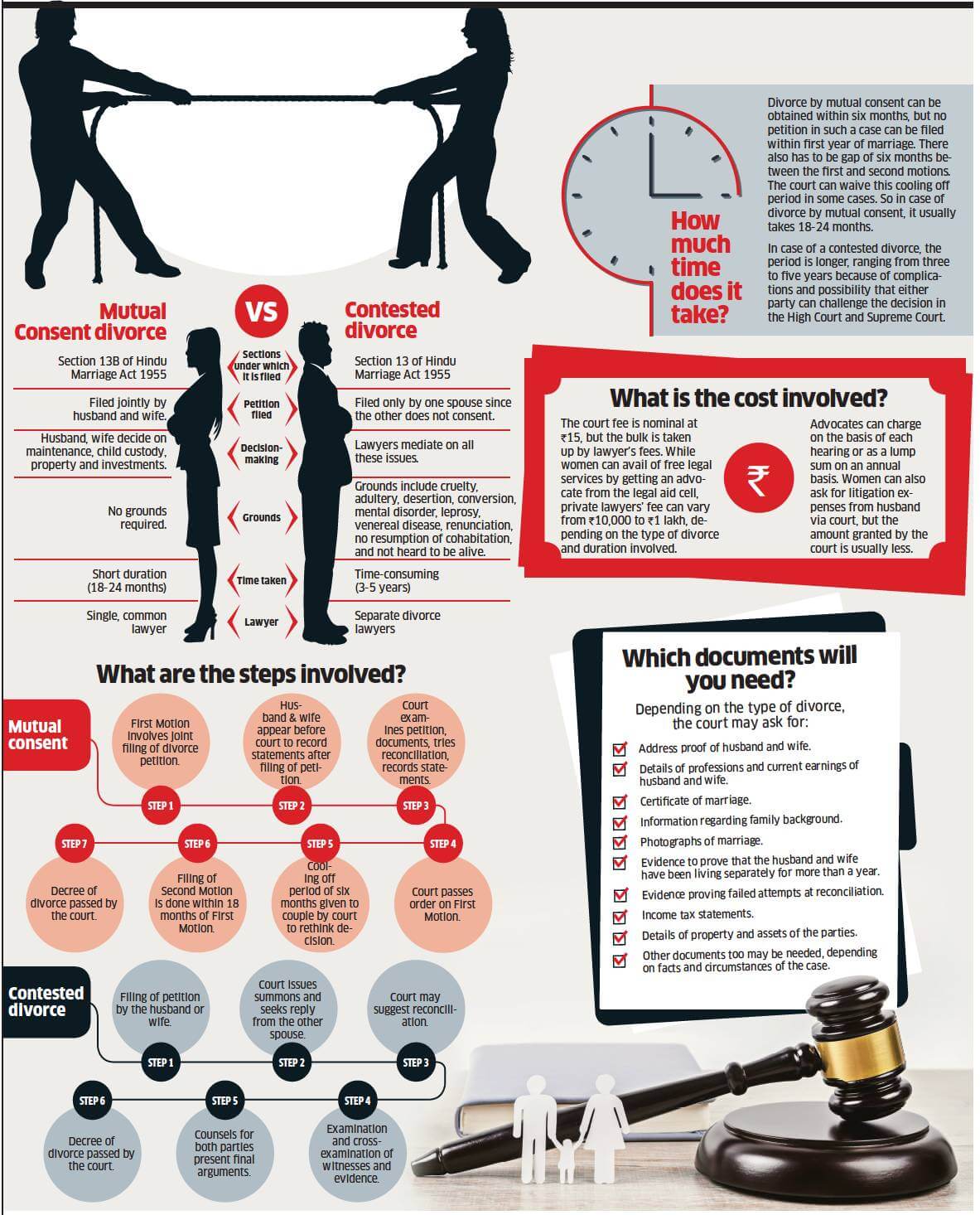

Overview of Divorce in Picture

This image from ET Wealth 20 Jan 2020 gives an overview of Divorce contested and with Mutual consent.

Related Articles:

- StreeDhan : What is it? Why should one know about StreeDhan?

- Inheritance rights of Women in India: Hindu, Muslim, Christians

- Maternity Leave :Duration, Wages,Maternity Benefit Act

- PINK is not What Women Want! Advertisers, Producers,Please listen

- Oh you are only a housewife!

- Women and Financial Planning

Divorce can be emotionally devastating, but you can prevent it from becoming a financial catastrophe

Really liked your blog it will be very helpful the content was good

good work..keep it up