Life is precious. So, when a medical emergency hits you or any of your family members, the last thing that you want to worry about is money. After all, no life should extinguish before its time for the lack of funds, least of all, your loved ones.

But what do you do, when you, or say your child suddenly falls severely ill and needs to be hospitalized? While on one hand your heart breaks seeing your little one suffer, on the other hand, you have bigger worries of being cash-strapped.

How do you foot the bills? Will you compromise of her treatment and not admit her in a good and reputed hospital? Or will you go around begging money from friends or relatives to fund your child’s hospitalization cost?

You don’t have to do any of these things because these days you can always opt for a quick personal loan in form of a medical loan to battle medical emergencies. Does that give you some relief?

Medical Loans

Medical loans are unsecured loans that are readily available at an interest of 12 to 25%. In simple words a medical loan is a personal loan for a medical emergency, so the rules and norms are pretty similar to how you avail a personal loan.

A medical loan helps you to avail the best medical facilities without you having to worry about funds. Sometimes, illnesses are long-term, and one may need a continuous cash flow. During such times as well, a medical loan can be of great help. You might have parked some savings in form of fixed deposits or mutual funds for future expenses such as your child’s higher education or their marriage or for your retirement. Why should you then break these schemes mid-way? Instead, if you take a personal loan for a medical emergency, you will not even have to eat into your savings to fund your medical expenses.

Availing a medical loan from trusted institutions such as Tata Capital is simple and hassle-free. To apply for a medical loan, you have to be between 23 to 58 years of age with a minimum monthly salary of Rs 20,000. You have to be employed for at least two years in the current organization. Your rate of interest will depend upon your age, the ongoing market rate, your total amount of the loan and the tenure you are opting for.

Even though the documentation required for a medical loan is very basic, considering the fact that medical emergencies mostly come unannounced, it is better to keep your documents in place so that if need be, you can immediately apply for a personal loan for medical emergency. Let’s first take a look at the documents that a salaried individual will require to apply for a medical loan:

-

-

- Application form with the latest photograph: You can download the application form online from the websites of leading financial institutions such as Tata Capital that is known to disburse medical loans in the least possible time. Fill up the form carefully without any overwriting or spelling mistakes. Make sure the details that you provide a match with the details in your documents.

- Identity proof: Identity proof can be your PAN card, passport, voter ID card or your driving license.

- Address proof: Address proof can be your passport, voter ID card or your driving license.

- Residence ownership proof: You have to give a copy of your residence ownership, could be your electricity bill or a rental agreement or your property papers, if you own the house.

- Bank statement: You need to submit bank statements of the last six months. These days with online banking facilities available, it is no big deal to procure bank statements. You just need to log on to the bank’s website, and request for the last six months’ statement, which would be readily available. If you are not Internet savvy, you can even visit your bank branch and request them to give you a copy of your last six months’ bank statement.

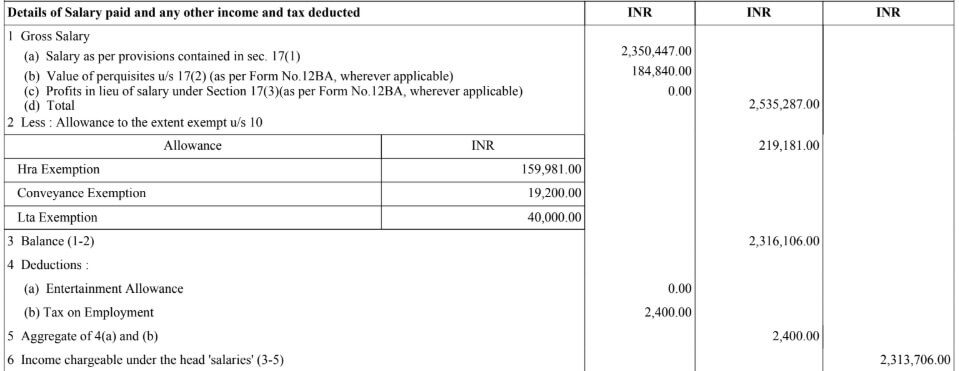

- Income proof with latest Form 16: Assuming you pay your taxes and file your tax returns on time, you will obviously be having a Form 16. You will have to submit the same to avail a medical loan.

- Existing loan: Be frank enough to disclose if you have any other ongoing loans such as a home loan or a car loan or any other personal loan running. Your past repayment history matters when lenders give you loans. Do not hide anything because when the bank or financial institution will do their due diligence they will anyway get to know about your existing loans.

-

Apart from salaried professionals, self-employed individuals, or those with a business of their own can also apply for a medical loan. The basic document requirements are more or less the same. The only other thing that they need to produce, considering they can’t show salary slips, is the business existence proof under the Shop Establishment Act. As far as tax returns are concerned, they will have to produce Income Tax returns for the last two years, Balance sheet, Audit report, etc.

If you have all these documents in place, your medical loan is just a click away. So, keep your documents ready and handy, and be prepared for all kinds of contingencies in life.

Hi I applied for ml before 8 week of due date but on 36 week I lost my baby i will 26 ml or 12 week old confirm me