‘The Secret’ by Rhonda Byrne is a best-selling self-help book that suggests you can make your dreams come true through the power of visualisation. When you visualise your desires, you can achieve them. This is certainly an interesting concept; putting the book’s philosophy into action could work even better when good thoughts are put into action. That’s why in this article, let’s discuss how you can actively achieve your goals and dreams through investments in SIPs. A question that an investor is facing these days is Should I stop my SIP? This is the right time to go back to basics and understand why SIP should be part of one’s investment philosophy.

Table of Contents

Should you stop your SIP?

Regular investing, and not market timing, is the key to long-term wealth creation. One should do SIPs in equity with a long-term time frame of at least 5 years. During this cycle, the equity markets will go through a number of ups and down, which will help investors in rupee cost averaging. For example, in 2017, we saw one-year SIPs of midcap funds delivering as high as 30-40 per cent return, while right now some SIPs are showing negative returns. In the long term, equity market returns follow nominal GDP growth rates.

“It is simple: if your goals are not yet achieved, your savings have to continue.”

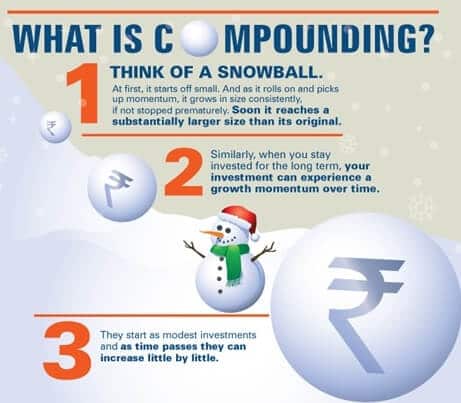

The market will test your resolve at times. Terminating SIPs not only breaks the power of compounding, but it also leads to a shortfall in the corpus. Ignore the market noise and continue your SIPs month after month. This unwavering discipline will help you build an impressive corpus, letting you achieve key goals in life.

What is SIP?

A Systematic Investment Plan or SIP is an investment vehicle that allows you to invest in mutual funds simply and systematically. Once you choose a mutual fund, you need to invest a fixed amount on a regular basis. Based on your convenience, this can be on a monthly, quarterly or annually basis.

SIP to achieve your dreams

Listing your future goals and dreams is a crucial part of financial planning. For example, you may want to start your own business in the next ten years, put a down-payment on a house, take your family on a world tour or even plan an early retirement. Guess what, you can achieve all these goals by investing in SIPs.

SIPs allow you to fulfil your dreams without any tensions or worries. All you need to do is invest the required amount in the mutual fund on a regular basis. And when you invest for the long-term, you can earn substantial returns on your investments. This is possible through the power of compounding.

Power of compounding

Compounding means that the returns you earn, in turn, earn returns for you. Here is an example: imagine you invest Rs. 5,000 per month in a mutual fund through SIP. The fund offers you an annual return of 13%. After a period of 10 years, you would have invested a total amount of Rs. 6 lakh and the value of your investment would be Rs. 12.3 lakh. But if you invest for a period of 15 years, the amount invested would be Rs. 9 lakh (just an increase by Rs. 3 lakh), but the total value of your investment would be Rs. 28 lakh. This is the power of compounding. It works better when you stay invested for the long run.

Rupee cost averaging

One of the best aspects about SIP is that you don’t need to be a professional at investments. There is no need to continuously analyse the market performance or time it to earn profits. Anyone can invest through SIPs and achieve good returns. When you invest through SIP, you can keep the worry of market volatility at bay. You just need to invest regularly.

Here, when you invest a fixed amount at regular intervals, you can buy additional fund units when the price is low and a lesser number of units when the price rises. This is the concept of Rupee Cost Averaging (RCA). In the long term, the impact of short-term fluctuations on your investments is lessened, and you can earn better returns.

Conclusion

These days, it is very to invest in mutual funds through SIPs. In fact, you can do it right from your own home. Select a fund to invest and create a standing instruction with your bank to transfer a fixed amount of money from your account into the fund each month. This way, you can steadily accumulate the wealth to achieve your dreams and goals. And for best results, start investing in a fund of your choice right away! Sticking to disciplined investing even as the market changes tunes lays a solid foundation for a secure financial future. We hope this will encourage you to continue on your investing journey. Have you read the book Secrets?