A unit linked insurance plan that has no premium allocation & policy administration charges and provides additional allocation on every premium paid and increases every 5 years. Unyakeenable right? Edelweiss Tokio has launched a new plan called Edelweiss Tokio Life Wealth Plus. This article discusses Edelweiss Tokio Life Wealth Plus plan in detail.

Table of Contents

Overview of Edelweiss Tokio Life Wealth Plus Plan

Edelweiss Tokio Life Wealth Plus is a Unit Linked Plan that takes care of the financial security of your family and also helps you to accumulate wealth. Edelweiss Tokio won the Outlook Money Awards 2016 for Best Life Insurer. Features of Edelweiss Tokio Life Wealth Plus Plan are:

- Zero allocation and administration charges: 100% of your premium is invested into the funds as per your chosen investment strategy. No premium allocation and policy administration charges are levied throughout the policy term.

- Additional allocations: Every year, additional allocations are added to the fund on every premium paid by you during the premium paying term. These allocations start at 1% and increase every 5 years to 3%, 5% and 7% thereby accelerating your wealth accumulation.

- Investment Strategy: You have an option to choose one of the following investment strategies based on your profile and risk appetite:

- Lifestage and duration based strategy – Edelweiss will manage your asset allocation based on your age and remaining years to your policy maturity.

- Self-Managed Strategy wherein your money will be allocated to your choice of fund(s)

- Rising star benefit: If you Opt for Rising Star Benefit then your child’s future financial needs are taken care of even in your absence

- Liquidity or Partial Withdrawal: You have option to partially withdraw your money in case of emergencies from the 6th policy year

- Unlimited Opt-in and Opt-out option between Investment Strategies

- Unlimited free switches between funds

- Tax benefits: You may be eligible for tax benefits as per applicable tax laws.

- 80C/80CCC: Deduction is allowed for only so much of the premium payable as does not exceed 10% of the actual capital sum assured. The maximum amount of deduction that an assessee can claim under Sections 80C, 80CCC will be limited to Rs. 150,000

- Top-up Premium: You can invest your surplus money as Top-up Premium over and above the Premium subject to conditions.

Aren’t ULIPs Bad?

Unit-linked insurance plan (ULIP) is a combination of protection and saving. It combines insurance with investment. It provides life insurance and also channels one’s savings into market-linked assets for meeting long-term goals. A part of the premiums one pays goes towards

- What is called the ‘mortality charge’ that gives you a life cover? It is calculated by the insurer after factoring in your age, health risk and mortality table used by the insurer.

- The rest of the premium goes into a fund in the equity or debt market. The amount you would get on maturity is then fully determined by how this fund does, and what charges are applied by the insurance company to manage this fund. Hence it is called as Linked.

Before 2008 ULIPs had a heavy charge structure in the form of premium allocation charges. These charges sometimes went as high as 80% of the first year premium, so the customer’s effective investment got eroded.

However, IRDAI intervened, and now the ULIP charge structure has come down drastically. The new guidelines increased the lock-in period from 3 years to 5 years and made it mandatory to regularly pay the premium until the end of the chosen term.

If you are looking at investing in ULIP, you should make sure that the goal for which the ULIP is to be used is at least ten years away. In fact, the Unit Linked Insurance Products do not offer any liquidity during the first five years. You will not be able to surrender or withdraw from the Unit Linked Plan completely or partially until the end of the fifth year.

Your Investment Options with Edelweiss Wealth Plus

You have an option to invest your premium in any one of the two Investment Strategies

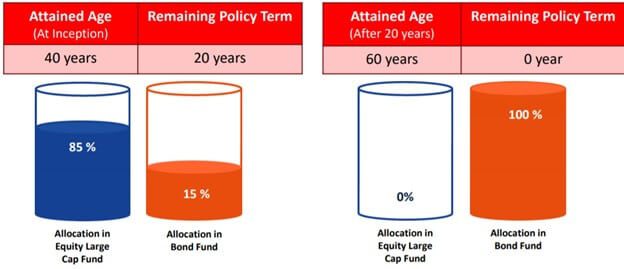

- Life Stage and Duration Based: As the age of the life insured increases and the remaining policy term reduces, this strategy ensures money is moved automatically from riskier fund to a safer fund progressively. Under this strategy, the fund value is distributed between 2 funds: Equity Large Cap Fund and Bond Fund

- Self-Managed: Under this strategy, policyholder can invest the premium in any of the available funds and in the proportion of his/her choice based on the risk appetite. One can switch the invested amount amongst the available funds using the switching option.

Life Stage and Duration Based Strategy

Under this strategy, fund value is distributed between the below 2 funds:

Equity Large Cap Fund and Bond Fund. As the age of the life insured increases and the remaining policy term reduces, this strategy ensures money is moved automatically from riskier fund to safer fund progressively.

Let’s say a 40-year-old person opts for a 20-year policy Term.

- At inception, the allocation in Equity Large Cap Fund will be 85% which is Min of (85, (100-40)*20/10).

- After 10 years, the age will now be 50 years and remaining policy term will now be 10 years. At this stage, the allocation in Equity Large Cap Fund will be 50% Min of (85, (100-50)*10/10).

- After 20 years, the age will now be 60 years and remaining policy term will now be 0 years. At this stage, the allocation in Equity Large Cap Fund will be 0%.

Self–Managed

Under this strategy, the policyholder can invest the premium in any of the available funds and in the proportion of his/her choice based on the risk appetite. One can switch the invested amount amongst the available funds using the switching option. Funds that are available and their performance as on 30 Sep 2017 is given below:

| Fund | Benchmark | H1 FY18 | Morning Star ITD Ranking | Morning Star ULIP Rating |

| Equity Large Cap Fund | 9.8% | 15.9% | 6/142 | 4 |

| Equity Top 250 Fund | 12.1% | 20.5% | 6/141 | 5 |

| Mid-Cap Fund | 17.8% | 21.9% | Not rated, yet to complete a year | |

| Managed Fund | 9.8% | 12.1% | 1/68 | 5 |

| Bond Fund | 8.9% | 9.4% | 1/16 | 5 |

Additional allocation in Edelweiss Tokio Life Wealth Plus Plan

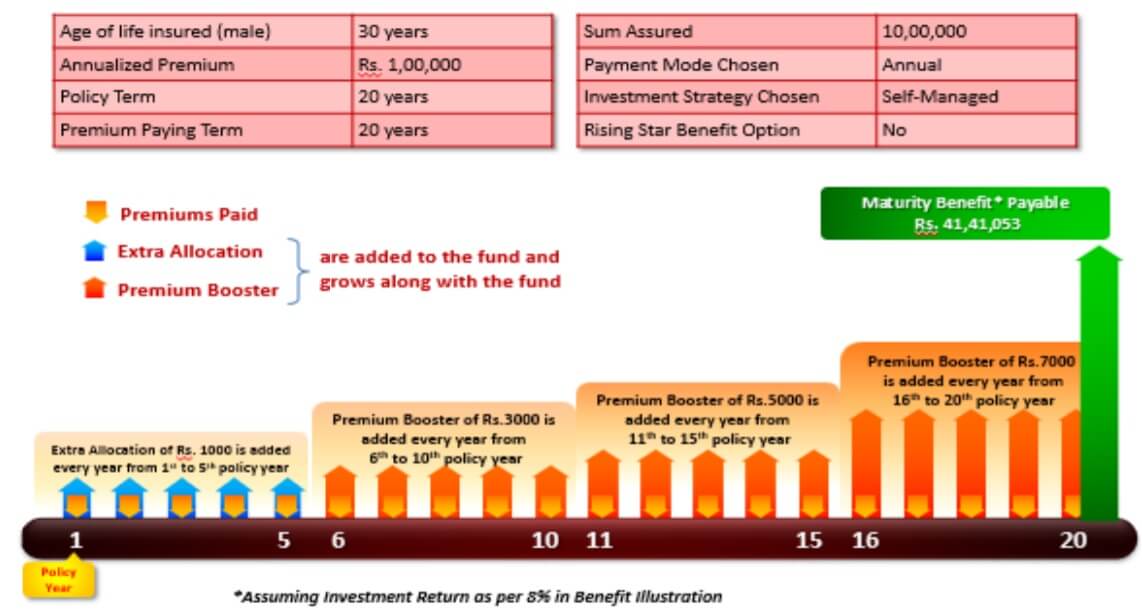

Wealth Plus ensures that 100% of premium paid by you is allocated to the fund(s) as per your choice and Investment Strategy. In addition to this, the plan provides additional allocation every year starting from the 1st Policy Year till the end of the premium paying term.

- Extra Allocations – added with every premium in the first 5 policy years – 1%

- Premium Booster – added at the end of each year starting from the 6th policy year till the end of the premium paying term. The Premium Booster added each year to the fund are 3% for year 5 – 10, 5% for year 11 – 15, 7% for year 16 – 20.

For example, if you choose to pay an Annualised Premium as Rs. 50,000 for a Premium Paying Term and Policy Term of 20 years. Additional Allocations added in each policy year would be Rs. 40,000, if each of the due premiums are paid before the end of the grace period.

| Extra Allocation | Premium Booster |

| For policy year 1 to 5 = 50,000 X 1% = Rs 500 every year | For policy year 6 to 10

=50,000 X 3% = Rs 1,500 every year For policy year 11 to 15 =50,000 X 5% = Rs 2,500 every year For policy year 16 to 20 =50,000 X 7% = Rs 3,500 every year

|

Rising Star Benefit in Edelweiss Tokio Life Wealth Plus Plan

The Policyholder/Proposer under this benefit can be a parent/grand-parent/guardian or any person who has an insurable interest in the insured child. It is an optional benefit. If Rising Star Benefit has been chosen, an additional benefit will be applicable on the life of the Policyholder in addition to the death benefit applicable on the life of the Life Insured.

In case of the unfortunate demise of the Policyholder, the following benefit is applicable to the entire policy term irrespective of the Life Insured turning major during the term.

- A lump sum amount will be paid immediately

- An amount equal to the sum of all the future Modal Premiums (if any) shall be credited to the Fund Value

- The future Extra Allocation and Premium Booster as and when due would be added to the Fund Value like a premium paying policy where the future premiums are paid on the respective due dates

- All future premiums will be waived off

- Maturity Benefit becomes payable on maturity

Unlimited Options in Edelweiss Tokio Life Wealth Plus Plan

- Unlimited free switches between fund: If you have chosen Self-Managed Strategy, you can move money between the funds depending on your financial priorities and investment outlook. This facility is called switching and is available free of cost. Minimum amount per switch is Rs. 5,000.

- Unlimited Opt-in and Opt-out option between Investment Strategies: If you have chosen the Life Stage & Duration based Strategy, you have an option to opt-in or opt-out of it at any point of time during the Policy Term. You may choose the Self-Managed Strategy by opting out of the Life Stage & Duration based Strategy at any point of time during the Policy Term.

- Unlimited Premium Redirection: If you have chosen Self-Managed Strategy, you can choose to allocate future premiums including Top-up Premiums in fund(s) different from that/those selected at policy inception or previous premium redirection request. This facility is called premium redirection and is available free of cost.

Surrendering the Policy

At any time during the Policy Term, you can choose to surrender the Policy by submitting a written request to Edelweiss.

If the surrender request is received before the completion of first 5 policy years, the fund value net of discontinuance charge shall be credited to the discontinued policy fund.

If the surrender request is received after the completion of first 5 policy years, you shall be entitled to the fund value and the policy will terminate.

Summary of Edelweiss Tokio Life Wealth Plus Plan

Yes, one should not mix insurance with investments but Edelweiss Tokio Life Insurance Wealth Plan has been devised with customer feedback and requirements in mind. It does away with Premium Allocation & Policy Administration Charges and also provides Additional allocation on every premium paid and increases every 5 years.

Have you ever purchased a ULIP? If yes, why? If not, why?