Interest credited to an Employee Provident Fund (EPF) account after an individual ceases to be in employment is taxable in his hands in the year of credit. In Nov 2017, the Bengaluru bench of the Income-Tax Appellate Tribunal (ITAT) also upheld this income tax provision while adjudicating the matter of a retired individual. This article talks about what happens to EPF account when you leave the job? When does EPF account become inoperative? is Interest on EPF taxable? Discusses the case of ITAT and Tax on Interest of EPF of the retired employee. What is Income Tax Appellate Tribunal or ITAT? What is Exempt Income and specifically Exempt Income under Section 10(12) which is Payment Received from Recognised Provident Fund?

Table of Contents

Inoperative EPF account, What happens to EPF on leaving the job

A PF account becomes an inoperative account and does not earn further interest when an employee retires from service after attaining the age of 55 years or migrates abroad permanently or dies and does not apply for withdrawal within 36 months. Until such time, interest will continue to accrue on the PF balances. However, no interest will accrue once the account becomes inoperative.

These are per the rules notified in 2016. Earlier, in case there was no contribution made for 36 months, then that account was classified as an ‘inoperative’ account.

However, while the accumulated balance up to the date of retirement or end of employment is not taxed, any interest earned on the PF account post resigning, retirement, or end of employment is taxable.

However, during the period when contributions don’t get credited to the PF account, the interest rate earned does not remain tax-free. According to a Bengaluru bench of the Income-Tax Appellate Tribunal (ITAT) ruling, the interest credited to an Employees’ Provident Fund (EPF) account after an individual ceases to be in employment is taxable in his hands in the year of credit.

What happens If you do not withdraw EPF after 7 years

Once the EPF account becomes inoperative, the unclaimed funds are moved into the Senior Citizens Welfare Fund. This is true even for the trusts of establishments exempted under Section 17 of the EPF & MP Act, 1952.

As per the rules, the unclaimed amounts should be identified on an annual basis by September 30 of each financial year and transferred into the Senior Citizens’ Welfare Fund on or before the 1st day of March every year.

Once the unclaimed balance gets transferred to the Senior Citizens’ Welfare Fund, it remains there for 25 years. The rules, however, allow the members claiming to be entitled to the unclaimed amount transferred to the Fund to apply within 25 years from the date of credit of the unclaimed amount into the Senior Citizens’ Welfare Fund. “Thereafter unclaimed amount shall escheat to the Central Government unless a court orders otherwise

In view of the large time span of 25 years, all exempted establishments should keep accounts and full employee wise details of each member whose amount is transferred to Senior Citizens’ Welfare Fund including PF account number, Pension Account Number, name and father’s/spouse’s name of the employee, amount transferred, date of birth, date of joining, last known address of employee along with bank account number, Aaadhar card number, nominee details, list of family members etc. (wherever available).

EPF Interest is taxable in unemployed

Post-employment, due to termination, resignation or retirement, many continue to maintain their EPF accounts and earn interest on the same.

When an employee resigns from his job or his services are terminated, his EPF account continues to be operative and earns an interest until he applies for withdrawal of the accumulated balance or takes up another job and transfers the balance.

The interest which had accrued to one’s EPF account is taxable is one is unemployed.

Questions that one may have are and we are trying to find the answers are:

- What if I haven’t declared the interest earned by EPF in my Income Tax Return? If my ITR was processed should I refile my ITR?

- Going forward should I declare interest in my EPF income while filing ITR? Under which section?

- Do I have to declare the interest when I withdraw?

- Does it apply if I contribute to EPF Trust?

- Should I withdraw my EPF balance?

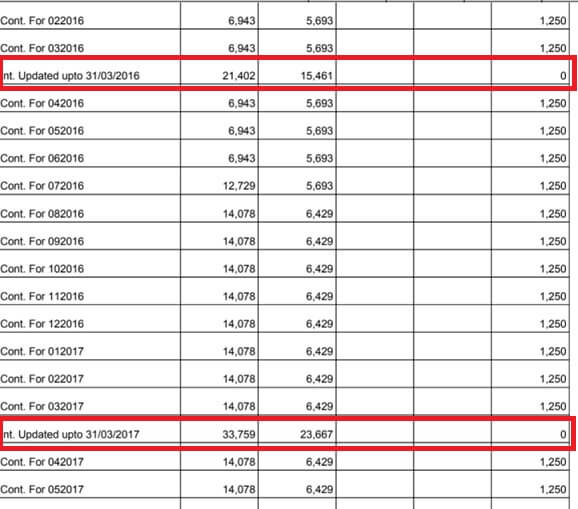

The EPFO ‘declares’ the annual interest paid out to subscribers each year. The EPF interest rate is decided by the central government with the consultation of Central Board of trustees. Compound interest as declared by Central Govt. is paid on the amount standing to the credit of an employee as on 31 Mar every year. You can see it in your passbook from 2010, an excerpt of which is shown in the image below.In the last four years, the returns have been around 8.7 percent a year. This interest is decided based on the surplus of its income over expenses. Details in our article How EPFO earns to pay Interest, How EPFO Manages Money, EPFO investment in Stock Market

ITAT and Tax on Interest of EPF of the retired employee

The man had retired from a prominent Bengaluru-headquartered software company after 26 years of service, on 1 April 2002, and the total amount in his EPF account then was ₹37.93 lakh. Nine years later, on 11 April 2011, he withdrew the grown sum of ₹82 lakh from his EPF account. This amount included interest of ₹44.07 lakh that had accrued post his retirement till the date of withdrawal.

The retired employee did not offer this interest amount to tax, as he viewed it would be exempt under Section 10 (12) of the I-T Act. During assessment proceedings for financial year 2011-12, the income tax officer sought to levy tax on this amount and the litigation finally reached ITAT’s doors.

Based on a reading of Section 10(12) and also the definition of “accumulated balance”, the ITAT held: “The exemption is limited to the accumulated balance due and payable to an employee up to the date of his retirement or end of his employment.”

ITAT pointed out that the term “accumulated balance due to an employee” is defined as the balance standing to his credit, or such portion of it as may be claimed by the concerned employee under the regulations of the fund “on the day he ceases to be an employee”.

Thus, the ITAT agreed that the interest earned postretirement was taxable in the hands of the retired employee. However, it added that the aggregate interest of ₹44.07 lakh should be taxable in the hands of the retired employee, in the respective financial years in which the interest income actually arose.

This ITAT ruling applies to retired employees as well as those who have quit employment for various reasons, say, to be an entrepreneur or a homemaker, and have continued to retain a balance in their EPF accounts.

What is Income Tax Appellate Tribunal or ITAT?

Usually, disputes arise when there is a mismatch between the tax liability assessed by the taxpayer and what the tax department thinks it should be. Changes or amendments in tax laws with retrospective effect may also result in tax disputes. If the assessee disagrees with the tax department’s evaluation, she can raise the issue with the authority concerned. Till the time the tax demand is paid or it is withdrawn by the taxman, the case is considered to be disputed.

Income tax liability is determined at the level of Assessing Officer first.

- A tax payer aggrieved by various actions of Assessing Officer can appeal before Commissioner of Income Tax (Appeals).

- Further appeal can be preferred before the Income Tax Appellate Tribunal or ITAT.

- On substantial question of law, further appeal can be filed before the High Court

- And then to the Supreme Court.

The ITAT, set up on 25 January 1941, is the first independent forum where tax disputes under the Direct Taxes Acts are examined and where excesses of the state, if any, are remedied. The orders passed by the ITAT are final, an appeal lies to the High Court only if a substantial question of law arises for determination. In 2016, the comptroller and auditor general of India reports that 32,834 disputes were pending at the Itat level, with Rs1,35,984 crore of disputed amount. A rough back-of-the-envelope working based on these numbers reveal that the government pays back to the taxpayer about Rs5,000 crore in interest per annum for the cases at the ITAT.

Income Exempt under Section 10(12): Payment Received from Recognised Provident Fund

Any income that an individual earns or acquires during a financial year which is non-taxable is called Exempt Income. As per the Income Tax Act, there are specific kinds of income that are exempt from tax as long as these types of income fulfil the guidelines and provisions outlined in the Act. Example of Exempt income are the interest received through PPF, long term capital gains earned through shares and stocks, interest from agricultural means etc. This income has to to be declared by the taxpayer when filing his or her income tax returns. Our article Exempt Income and Income Tax Return discusses it in detail.

Most income that is exempted from tax is listed under Section 10 of the Income Tax Act which contains a list of income that is deemed or considered to be free from taxation.

Under Section 10(12) – Any payment received via a recognised or authorised Fund is tax-free in following cases only

- The employee has rendered 5 years’ continuous service.

- Though he has not rendered 5 years’ continuous service and the service has come to an end because of reasons beyond his control.

The Finance Act, 1974 has added a clarification to this exemption. If the accumulated balance standing in the name of the employee is transferred from one recognised provident fund to another similar type of fund, such balance will not be added to the total income of the assessee. The period of five years will be counted by adding the period for which the fund remained with the previous employer to the period for which the fund remains with the present employer from whom he is getting refund.

In case an employee leaves service of his own accord before the expiry of 5 years, the amount on which tax has not been paid earlier is taxable under the head salary. As such taxable amount will be

- (a) Employer’s contribution to RPF-upto 12% of employee’s salary; and

- (b) Interest credited on RPF balance-upto 9.5% p.a.

Related Articles:

All About UAN or Universal Account Number of EPF

All About EPF,EPS,EDLIS, Employee Provident Fund

- EPF Withdrawal before 5 years,TDS,Form 15G,Tax and ITR

- Online EPF Withdrawal: How to do Full or Partial EPF Withdrawal Online

- Exempt Income and Income Tax Return

- Exempt Incomes and Allowances for Income Tax Filing

- How EPFO earns to pay Interest,

- How EPFO Manages Money, EPFO investment in Stock Market

Leaving the balance with the old employer may not help much if withdrawing it at a later date is the plan as the interest earned during non-employment period gets taxed in the year of withdrawals. And, if you have retired at the age of 55, do not let it become inoperative and withdraw the final balance as early as possible. PF accounts cannot turn inoperative till age 55, yet transferring the PF balance from previous organisations to the current employer is always a better approach to aim for a sizeable corpus for your retirement.

Please let me know how to report interest earned on EPF after I quit the job.

Should I report the interest every year or I should report interest for all years only when I withdraw EPF?

Also please explain what section in ITR to report such interest with example (image/video), reporting year-wise or reporting at withdrawal.

Thanks

I haven’t transferred my old epf account to current organization epf account. Where should I declare the interest earned on the old epf account in ITR?

One does not need to declare the interest earned on the EPF account.

(Only on PPF account as it is under exempt income)

But you must transfer the old EPF account to new employe.r Only then will you be able to withdraw from both accounts online. Linking of PF account with UAN is not sufficient. For more details check out our article Why should one transfer old EPF account to new employer?

What about interest earned in case of government provident funds which are exempt u/s 10(11) and are registered under 1925 Act?

Could you please let me know the answer to the question raise – What if I haven’t declared the interest earned by EPF in my Income Tax Return? If my ITR was processed should I refile my ITR?

EPF Interest is not declared in the ITR unless it is withdrawn

Don’t revise the return if its already processed.

Don’t fix the thing which is not broken.