“I am working in ABC company since 2008. On Checking my PF on website SMS shows EE amt : 47631 & ER amt: 14571.( account updated 31/03/2014). If today I leave job how much would I get from PF” or “I checked my EPF account, EE & ER should be same but it is showing me different amount? ” Why is it so? This article gives an overview of Employee Provident Fund (EPF), how to check EPF balance, decodes the EPF SMS one gets on checking, What is EE, What is ER?

Basics of EPF

Employee Provident Fund (EPF) is an integral part of earning for all working professional in India. Most of the employees(government and private) save a small fraction of their salary through EPF, which is automatically debited from their salary and credited to their EPF accounts by their employer. The Employees’ Provident Fund (EPF) managed by the Employees’ Provident Fund Organisation (EPFO) ensures that an individual puts away enough for retirement every month. With 12% of his basic salary and a matching contribution by his employer, a subscriber to the EPF should be able to accumulate a decent amount by the time he retires. For example If someone started working at the age of 25 in April 2000 at a basic salary of Rs 20,000 a month and got a raise of 10% every year, he would roughly have accumulated Rs 32 lakh in his PF account by now. If the trend continues, he would have saved about Rs 2.46 crore by the time he is 55 years old and more than Rs 3.5 crore of tax-free money on retirement at 58. Let’s go over the basic facts of EPF .

- EPF actually consists of Provident Fund(which we shall PF) and Pension scheme(EPS).

- Normally, both the employer and employee contribute 12% each of the basic salary of the employee plus DA (if any) to EPF. (Employee can contribute more towards EPF voluntarily which is called VPF)

- The entire 12% of employees contribution is added towards PF.

- 8.33% out of the total 12% of the employers contribution is diverted to the EPS or pension scheme and the balance 3.67% is invested in PF. However, if the basic pay of an employee exceeds Rs. 6,500 per month, the contribution towards pension scheme is restricted to 8.33% of Rs. 6,500 (i.e. Rs. 541 per month) and the balance of employers contribution goes into EPF. EPFO has now raised the eligibility ceiling for EPS to Rs 15,000 a month.

- The employer contribution is exempt from tax and employee’s contribution is taxable but eligible for deduction under section 80C of Income tax Act.

- The EPF interest rate is decided by the central government with the consultation of Central Board of Trustees. It is announced on annual basis.

- The accounting period of PF is from March to February every year.

- At the beginning of the each fiscal, there would be an opening balance, the amount accumulated till then. Thus, for next fiscal the new opening balance would be: Old opening balance + monthly contribution throughout the year + interest (old opening balance + contribution).

- Interest rate on PF part of EPF is credited annually at the end of financial year on 31 Mar of financial year .

- EPS being a pension scheme, interest is not applicable. Hence, no interest is earned on the amount accumulated in EPS.

Our article Basics of Employee Provident Fund: EPF, EPS, EDLIS and Understanding Employee Pension Scheme or EPS explains these in detail. EPF Calculator can be used to find how much would you have on retirementby contributing to EPF.

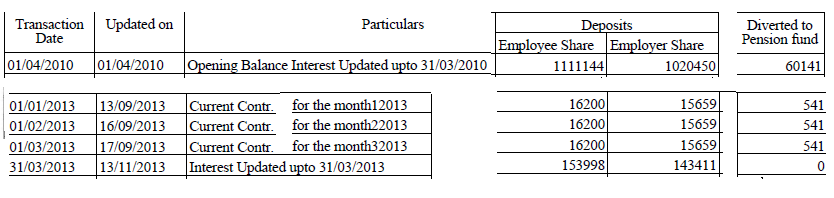

As Employer’s contribution goes towards EPS, Employer’s share in EPF will be less than EE or Employee Contribution in EPF. It’s only 541 Rs a month you may think. But the monthly contribution of Rs 541 can grow into a huge amount over the long-term. Even at a modest interest rate of 8%, this tiny amount can burgeon into Rs 12.41 lakh in 35 years. So that’s what you are missing out because of EPS. Sample of EPF passbook which shows monthly contribution of Employee, Employer and how it is split into Pension fund and Provident Fund,how interest is added to Employee Contribution and Employer Contribution but not to EPS. Image below shows, parts from EPF passbook. You can see the transaction date, the date on which contribution was made in your EPF account, when the EPF account was update, details or Particulars like Contribution was for which month (12013 means 1st month of 2013 or Jan 2013), how much was employee’s contribution, how much was Employer’s contribution in EPF and Employer’s contribution in EPS . Employer’s share in EPF + Pension Fund is usually equal to Employee’s share.

How to check EPF balance?

EPFO has been using technology to turn into a more professional and nimble organisation. It has made several other investor-friendly changes in the past. Now you can check your EPF balance through SMS, see your passbook. It has introduced online facility for transferring the balance to a new account. Going forward, all members will have a Universal Account Number(UAN) which will be portable across employers and cities. UANs have already been allotted to 4.17 crore active contributors to the EPF

You can check your EPF balance through various ways. Our article How to get information about EPF balance : Annual Statement, SMS, E-Passbook explains the various methods of getting EPF balance in detail.

EPF balance by SMS : From July 2011 one can check the EPF Account balance online.

- Go to http://www.epfindia.com/site_en/KYEPFB.php

- Select EPFO Office

- Enter PF Account Number which is in the format : EPFO Office Code/Establishment Code(Max. 7 Digits)/Extension(Max. 3 digits)/Account Number (Max 7 digit) (PF Account Number may not have Extension code, in that case leave it blank).

- Enter your Mobile and Name, Accept Terms and condition and Submit.

- You will get SMS alert from EPFO : EE amount : Rs XXXXX and ER amount Rs:XXXXX as on <Today’s Date>(Account updated upto Date).

EPF Balance SMS :What is EE , What is ER

When you get information from EPFO the information is in terms of EE , ER and EPS. The SMS is kind of coded so let’s try to decode it. The SMS says:

EPF Balance in A/C No. BGBNG0451230000134 is EE Amt: Rs. 67009, ER Amt: Rs. 47000 as on 27-08-14 (Accounts updated upto 31-03-2014)-EPFO.

So what is EE and ER? Decoding the EPF balance SMS from EPFO:

- A/C No: This is your EPF account number. You EPF account number have your area code, company or establishment code and your account number.

- EE Amt: Employee Contribution i.e. your total contribution in the EPF account. The sum total of PF amount deducted monthly from your salary.

- ER Amt: Employer Contribution i.e your company contribution. The sum total of PF amount monthly contributed into your EPF account by your employer.

- As on [Date]: The date till which your monthly contribution has been updated in your EPF account. In the example above, contributions in EPF upto 27-08-14 are shown

- Accounts updated upto [Date]: This tells you till when the accounts were updated. Usually accounts are updated at the end of financial year when the interest till this date has been added into your EPF account. From the example above, it tells that interest till 31st March 2014 has been added into your EPF account. It does not show current balance of PF Account as on the day you asked for information.

You can see that EE(Employee Contribution) is more than ER(Employer Contribution). Because Employer’s contribution is split into two halves, the Pension fund(EPS) and Provident Fund(PF). SMS does not show the information about Pension fund but EPF passbook does.

When the PF amount is withdrawn before five years of continuous service, it is be taxable in the hands of the individual as if the fund was not recognised from the start of the contributions.Provident Fund would be treated as an Unrecognised Fund from the beginning.

Related Articles:

All About EPF,EPS,EDLIS, Employee Provident Fund

All About UAN or Universal Account Number of EPF

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

- Understanding Employee Pension Scheme or EPS

- Voluntary Provident Fund, Difference between EPF and PPF

- Tax on EPF withdrawal

- Transfer EPF account online : OTCP

According to the PF Act, all companies with an employee base of more than 20 are needed to register with the EPFO. The employer and the employee both have to contribute 12% of the basic salary to the PF account.

Dear Sir

i have worked almost 19 1/2 years in single company

and i have left the company on april 2017.

i have applied FOR PF WITHDRAWAL

I have received the 1st time PF Amount Rs,116171/- on 27/10/2018

and 2nd received Amount was Rs,399328/-

After 25 days i have checked my E-Pass Book it was showing Balanc

300260/-

and on date i have checked Miss Call Service EPFO 01122901406 AND 7738299899

BOUGHT the Sms showing Balance amount as per above

But When i have call my Employer and EPFO RO they are telling no balance showing their but i have balance in my e-pass book and till it was showing

I have given called to no which was given in Grievance to EPFO RO

i have told above mater reg balance showing they have told me to apply online and i have applied online

but why in their system not showing balance kindly advise sir

and can i now how much time it will take to credit amount in my account.

Sir,

Cannot comment without seeing all the details.

You can send all the information, images of passbook, messages etc to bemoneyaware@gmail.com

MY EE AMOUNT 25499 & ER AMT 7803 ACOUNT UPDATE 31/03/2015 JOIN JOB 4/7/2011 AND LEAVE 31/03/2016 HOW MUCH AMOUNT I WILL GET PLS REPLY

Hi sir,

i have tried to transfer my pf account to my present Pf account through online submission claim portal. once i entered my previous PF account number and then which appears like “Your previous establishment APHYD0028034000 is unexempted under both PF and Pension Schemes and accounts are handled by RO HYDERABAD”.

I am not able to fill the form as it showing the above text in red color. could you please suggest me, what shall i do now.

Hello sir,

I have resigned from a company after working for 2 years and 6 months in December 2014,till now i am unemployed (October 2016).I checked my PF A/C and it is showing as EE Amt: 24130, ER Amt: 7572 as on 23-06-2015. Please kindly tell me if i withdraw my PF now,what amount will i be getting??And is there any extra amount which is to be added in this like EPS or anything else.Please suggest,i will be very thankful to you .

सर मेरा नाम हे GOPAL CHINDHU NIMBHORE PF NO DL /24754/173358

हे मेरा 962 rs कटीग होता था तो मुझे 20 महीने

का कितना pf मिलेगा

why im getting this text sms (i applied pf widrawal on 15 days back)

we are commited for strict enforcement of labour laws and inspection. (Pro-worker initiative_-Bandaru Dattatraya, Labour and Emploment Minister India

Hi Kirti,

I have applied for two PF account 1. Which i have resigned in 2015 and other in 2016.

No. 1 Pf Account shows.

EE Share – 18156

ER Share – 5561

PF contribution – 11872

from which I have received only Rs. 19082 in last to last week.

No. 2 Pf Account shows.

EE Share – 14141

ER Share – 4323

PF contribution – 9556

from which I have received only Rs. 8704 in last week.

Will I get the balance amount ? if yes than how much did I going to receive and when?

It will be very helpful to me if you can share your reply..

Regards,

Shaila

I worked in an Indian company from April 2011 to October 2013 and made contribution to EPF while I was employed in that company. Since 2013 I have been working outside India. I plan to withdraw my PF balance in October 2016. My taxable income in India would be below the exempt limits. How would TDS be caculated in such case.

Hi,

I was working for a company from 2008 to 2011 during which my account was older type e.g. UP/12345/012345. When I left the company, I didnt my PF account to new company and I have switched companies twice by now. Now in my current company, I have newer PF Account number, for which I do have a UAN number. But I am not able to get any details regarding older EPF account. Can you please tell me how can I link/tranfer my older account to my UAN. Thanks.

Hi, I am worked for a MNC for 6 years and recently applied for EPF closure. I got a lumpsum credited to my account. However, a week back received an sms as “Rs. 3118 for 05/2016 has been credited in your EPF account”, but, still the amount is not yet credited to my account. For the previous amount credited i have received a similar sms and got amount credited, but this time, the amount is not credited. Checked EPF balance it is showing old balances. Could you please let me know on any insights you have?

Hello ,

I left the company three months back and and applied for PF about one month back. Today i got a message stating that a amount is credited in EPFO account with UAN number. What is the meaning of amount credited in account.

Means money has been transferred to bank account associated with your UAN number.

so, after getting the sms within what time it will be credited to my bank account. Or i need to fill any other form or some formalty ,

kindly suggest how to get it asap in my bank account from my assosiciated pf account.

No you don’t have to do any other formality. Now it is upto EPFO to transfer money.

What SMS have you got? Could you share that at here or our email id (bemoneyaware@gmail.com) so that it is helpful for other readers

Hi team i have applied for my pf on 1st aug can u tell me till when it will arrive into my a/c.

Thank you and look forward hearing from you.

Assuming you have applied for withdrawal of EPF, it should be cleared from 7-30 days.

Means my last day in the company was 01 st aug. So does that mean that the form would be submitted on the same day??

I have applied for my pf.. I worked in a company for 1.8 years, I want to know if I would get the EPS amount with the PF amount..

If I receive a message saying the balance is EE Amt: Rs 341213 and ER Amt: Rs 192517. I am confused what is the total amount, does the last two digits are to be considered as decimals ?

Sir

I HAVE WORK ONLY 6 MONTHS NOW I WANT TO WITHDRAWAL MY AMOUNT, SO WHICH FORMS I REQUIRED TO FILL AND SUBMITED.. PLZ TELL ME SIR.

R/SIR

PLZ TELL ME THE REQUIRED DOCIMENTS FOR WITHDRAWAL OF 6 MONTH AMOUNT

Sir

I HAVE WORK ONLY 6 MONTHS NOW I WANT TO WITHDRAWAL MY AMOUNT, SO WHICH FORMS I REQUIRED TO FILL AND DIBMITED.. PLZ TELL ME SIR.

Hi sir,

i have few questions,

1) i have worked for 2.9 yrs in software company from 2010 to 2013. In my salary slip my name was mention as Challa Trinadh Pavan kumar, but in the PAN Card it is mentioned as Trinadh pavan kumar only(surname was missed). Now i am going to apply for the EPF. my question is do i need to write the name as PAN Card or Salary slip in the Form 19 as well as Form 15 G. Kindly suggest me in this regard.

2) i hope its been soo late to apply EPF. i have checked with EPFO to get my amount by entereing PAN Card mentioned name itself. which was not accepting my surname. Weel EE is 18831rs and ER is 6275rs. will i get ER amount 6275 rs along with EE amount and interest?

Hope to hear soon, proactive reply would be highly appreciated

You should give the name as the EPF because that’s what EPF department has.

Its not late to apply for EPF withdrawal as its your money. You will get EE,ER,EPS.

What’s in a name Shakespeare said. But if you don’t have one name in all your financial documents then its pain. Please use a consistent name all across.

sir I have got sms its showing EPF balance in A/c NO. KD/MAL/0094725/000/0144537 is EE 7003, ER amt :Rs, 2152 as on 27-06-2015 but i have worked 3years on a coporate sector from 06-03-2013 and my last leaving day was on 31-03-2016 so as my UAN has been activated last msg i have got my epfo balance was 14547, so how much total amount will i get after applying my pf plzz… informed me

The SMS does not show latest balance. In your case it is shoing as on 27-06-2015.

If you have UAN passbook then that would show the updated amount.

You would get Your share of EPF, employer share of EPF and EPS if you withdraw.

As you have worked for less than 5 years, TDS will be deducted is amount is more than 50,000. To avoid TDS you need to submit Form 15G.

Hi, I already registered on UAN members portal but when I was try to download my e-passbook. Error shown that members pass book not available. So please help me and tell me how can I know my epf details because online epf balance also not show my account balance due to data not update till the my joining date.

Which browser are you using?

In Chrome when we have tried, we also get same message.

Often after 2-3 times we are able to download the passbook.

Let us know if you are successful.

Hi sir.

I’m reigned my job 3 years ago now I’m looking to withdraw my epf. Now it is possible? pls guide me

I’m resigned my job 3 years ago now I’m looking to withdraw my epf. Now it is possible ?

Yes it is possible to withdraw your EPF after 3 years. It’s your money.

The process remains the same.

ou can withdraw EPF both the employee and employer contribution by submitting Form 19.

Withdrawal from Employee Pension Scheme, EPS, depends on if you have more than 10 years of contribution to EPF. If you have more than 10 years of contribution to EPS you will get a Scheme Certificate. You can apply for Withdrawal Benefit or Scheme Certificate through Form 10C for retaining the Pension Fund Membership.

Our article Forms to avoid TDS,15G, 15H, and EPF Withdrawal Forms Form 19, Form 20,Form 10C,Form 10D,Form 51F talks about it in detail.

You might also have to submit Form 15G if TDS is not deducted

Mera ee 16819 er 5149 h lakin mera ye amont mene transfer kiya h apne purane pf khate se nye me or ye dono 5 saal se kam time ke khate h to agar mai withdrawn kru to kitba paisa milega mujhe sabh kuch kaat ke

If my gross income is below tax slab (i.e say 200000 p.a) and I contributed PF for 15 months. After I quit job and withdraw my PF will there be any tax deduction even if the gross salary is below tax income slab.

Also if you can help me show the calculation by way of an example would be more helpful. say I contribute Rs 700 for 15 months towards PF, so does my employer (PF +EPS), so what would I receive after I withdraw.

Hi,

I have worked in a company for 2 yrs 10 months,now I want to withdraw my pf since i left my company on 29th jan, they are asking to fill form 15G, I am confused with column 16 ‘estimated income for which declaration is made ‘ and column 17 .

I have already looked into my form 16 but confused with the exact data i need to put in these columns.

it’d be very kind if you can help me with this .

Please check our article How to Fill Form 15G? How to Fill Form 15H? for more details.

You can check out our sample filled form 15G

Hello,

I was working from july 2013 to March 2015(approx 19months), my EPF account shows EE amount- 10161rs/- and ER amount- 3131rs/- as on 29-06-2015(accounts upto 31-03-2015).What will be the amount if i withdraw now, i do not have any other deposition into EPF account where i presently work.

What will be my total withdrawn amount after tax deduction if any.

Sir,

I worked for 3 years from 2011 to 2014 and haven’t worked since then.

My EPF balance is approx 33 in EE and 22 in ER.

I have almost filled the forms for PF withdraw and will be sending them to my ex-employer.

My questions

1- I know I will get 33k plus 22k plus interest whatever I have earned on withdrawal but will I automatically get the EPS amount also( as you have told EPS amount is not sent in the sms)

2 – IS there a way to know the EPS amount

3- I will be joining a new company in june this year with income >10 lakh, so If I withdraw my pf at that time, will they deduct 30% tax from it? if yes, is tehre a way to reduce it?

Congratulations on your new job Vicky.

Question is why do you want to withdraw your earlier EPF. As you are joining a new company in June 2015, you can transfer your old EPF account and use compounding to your advantage.

As you have contributed to EPF for less than 5 years, your withdrawal will be taxable. To avoid TDS you must fill form 15G.

If you want to withdraw then please do it ASAP because theoretically you need to be unemployed for 2 months after resignation to apply for EPF withdrawal.

If you withdraw you will get only 33K + interest which is Employees contribution. From 10 Feb 2016 one cannot withdraw Employer contribution.

EPS amount is fixed 541 before Oct 2014 and 1250 after. You can withdraw EPS if you have contributed for less than 10 years .

Hi,

I worked for 8 years in a S/W company and left the job in Dec-14. Since then, I am into business and not employed anywhere. My EPF A/C will be 10 years old by Oct-16. I came to know that if I keep the A/C for 10 years, I am eligible for pension on the EE(or EPS) amount. Is there an age limit to receive monthly pension? Or can I start getting it right after the completion of 10 years? As I mentioned, I am not working anywhere and can say, I am retired.

Hi Kirti,

Need your advice…I have few questions>

1) I have worked for 3.5 yrs in one company then changed the organization and here I am working for 2 years……there was no break in between…can I withdraw my PF for the first company…will it be taxable ….talking about the PF of the first company where I have worked 3.5 years……

2) If I transfer the PF from the first company (3.5 yrs one)…the EE+ER+ EPS every component will be transferred automatically….specially the EPS (Pension) component.

3) Lastly, I have the UAN no for the second organization (Present)…the 2 yr one…….I am unable to log in via UAN its showing the Name and User iD (Don’t remember the exact error)does not match….when I am clicking on the option of activating the UAN no…its showing already activated…….

SAME PHONE Number CAN USE from old UAN ID to New UAN Id, please tell me

my employer is not ready to submit my pf form in pf office, as i need to withdrawal my remaining pf amount but my past employer is not cooperating with me, so shall raise any complaint in court against my employer? am i eligible for complaining against my previous employer? i want to sue them in court please suggest.

Hi

I was worked for more than 5 years and resigned in the year 2010. Since then I didn’t withdrawn EPF amount. No transactions happened so far.

I didn’t have UAN for this.

Now I am working for another organization since 2011 till date. I do have UAN activated for this new organization.

I didn’t transferred EPF amount of previous account to the new EPF account of new organization.

Are there any ways to withdraw the previous EPF account amount without previous employer involvement?

Please suggest.

i m joining on 1-january -2015 & still working in company but in passbook there is 11 entries seen ( Contribution 2-2015 to 12-2015)

it is wrong or right because working 12 Month so it should to 12 entries in passbook .

pls help

You joined in Jan but first salary was credited in Feb. So you would not have any entry for Jan.

Now you should see entry for Jan 2016

i did a job last year in a small enterprise. employer provide pf facility but they could not provide me hard copy of payslip. i had worked 1 year. now i didn’t know my pf number and UAN. they created my UAN. i want to know what i do for get my pf balance.

I have been working in current organization for 13+ yrs and my PF balance that i received as a text message as total contribution is 10,20,986. I want to withdraw for Home Loan.

How much funds can i withdraw? Can i go for 100% withdrawal?

How much is held back in EPS?

How much time will it take to withdraw?

Thanks

As explained in our article EPF Partial Withdrawal or Advance One can use EPF Partial Withdrawal For construction/ purchase of house/ flat. It takes around a month to withdraw from EPF is application is submitted through employer

Under Para 68-B of the Scheme

Whose House: self . Property should be in the name of self or spouse or jointly. It should not be a joint property owned by other than the spouse

Eligibility : Should complete 5 Years of service .

How often can one withdraw for same purpose : Only Once for either the construction or purchase of house or repayment of housing loan

Maximum Admissible Amount : 36 times of Wages

Proof/ documents required : Declaration in the Proforma obtained along with application signed by Member

One has to submit Form 31,called as EPF Withdrawal or EPF Advance Form , through the Employer along with documents. A fixed minimum balance in the account will be kept before arriving at the amount of advance admissible subject to the above conditions. In EPF’s Form 31, you need to provide your personal, PF account, salary and bank account details. Once the claim is processed, you will receive direct credit to your bank account. Do note that only after your Employer verifies your partial withdrawal application the EPF office will process it.

I want to check by 10 old PF details(2006), i have tried using KNOW YOUR PF NUMBER but when ever i do it says invalid member.

I dont have UAN number for this PF number

Please advice how to check my amount

Can you get in touch with your old employer?

You can only raise complaint as explained in our article Track Inoperative EPF account : Use EPFO online helpdesk

Its not possible to contact old employer, so is their any other alternative way to get my pf amount?

If you have a UAN number with KYC details verified then yes. Our article New EPF Forms for those with UAN for submission without Employer’s attestation explains it in detail.

You can transfer the account to your current account verifying with present employer.

Hi, I worked in a company for 8 years and left the job in Dec-2014. I am working a a freelancer and hence there is no contribution to my PF account and don’t think will do in the next 2-3 years. I learnt that with drawl process is complex if it was more than 3 years after I left the Job. I logged in with my UAN to initiate online withdrawl but couldn’t find any option to do so.

Should I keep it as it is or is it good to withdraw the money now?

Thanks

Online withdrawal is still not possible Rajesh.

After 3 years from your last contribution in EPF your EPF account will not earn any interest. SO till Dec 2017 your EPF is earning interest.

With UAN you have proof about exact contribution please download the UAN passbook.

Regarding withdrawal there is no problem after 3 years also.

As you have contributed for more than 5 years your EPF withdrawal is tax free.

Question is what will you do with your withdrawal money? If you know of somewhere you can invest and get more than 8% then go ahead.

You can wait for some more time, EPF withdrawal will soon hopefully be online.

One thing more : If you join another company and give your PAN you will theoretically not be allowed to withdraw as the guideline is one should be unemployed for 2 months. This is not followed till now but we never know when EPFO will enforce it.

Its difficult to decide , we have listed both the pros and cons. Do let us know what you decide

I have been working for the past 5 years in thesame company. Can I withdraw the PF partially . please advice

Yes you can partially withdraw from you EPF while in service for repaying the housing loan, Marriage, Treatment,subject to prescribed conditions. Our article,EPF Partial Withdrawal or Advance, talks about how one can partially withdraw from EPF, for what purpose, how much can one withdraw and how many years of service one needs to have completed.

i have applied for my PF withdrawal my current balance is EE-61547 & ER-35029 as on 25-06-2015,but i received a NEFT of INR 24,788.00 from EPFO which is less than above amount total,i have applied for withdraw before 5 years.

please tell why it came less or some payment still pending.

As when i have seen in claim status its showing separately 10c and 19 has been filled are they settled separartely????

looking for response.

Yes there are two different Forms

Form 10C for EPS or Pension withdrawal

Form 19 for EPF withdrawal.

You have just got EPS withdrawal. You should get another payment for EPF withdrawal.

Do keep us updated.

i joined in 2012 .i leaved my job with in 6 month after getting another job .till now i have not withdraw pf amount its about 4 years ..pleas tel me is there any problem how do i withdraw my pf

No there should not be any problem. People have withdrawn, transferred EPF after 10 years also.

You can withdraw manually by submitting forms to your old employer of if you have UAN number new forms without employer. Our article Forms to avoid TDS,15G, 15H, and EPF Withdrawal Forms Form 19, Form 20,Form 10C,Form 10D,Form 51F talks about Forms in detail

As your contribution is less than 5 years if you withdraw from EPF you will have to pay tax on it. Have you joined another company and are you contributing to EPF? We recommned you to transfer the money from old EPF.

Employee Share +

Employer Share +

Pension Fund = all amount submitte in my account…??? M I write or wrong….plz help or sms me plz on my number any one 09881035947

Plz help as soon as possible plz any one

Employee Share +Employer Share + Pension Fund = all amount submitte in my account…??? M I write or wrong….plz help or sms me plz on my number any one help me mob 09881035947 sms plz I am waiting for replay…

Still waiting…

sir my ee is 59119 and er is 18088 . iwant to withdraw my pf how much approx i will get. please tell

You would get in EPF 59119+18088 + interest earned this year.

If you have worked for less than 10 years you can withdraw your EPS which usually was 541 till Sep 2014 and 1250 afterwards.

If you withdraw before 5 years then your EPF will be taxable and if 80C claimed in earlier years it would be revered.

Sir My Epf Ac No is UK/DDN/0036338/000/0000971 Balance is EE Amt :Rs 2108 and ER Amt:646 as on 30-06-15(Account updated upto 31-03-2015) i worked only for 3 months in company then i left. so may i get my Epf Amount ? If yes then how can i get and how much?

Sir,

My EE amount Rs.12488 and ER Rs.3827 as on 17-4-2015(accounts updated upto 31-03 2015.

i joined company in May 2012 an left in july 2013. But in September 2015, i joined another comapany.So i have a gap of 2 years . will it affect my PF amount in terms of EPS, Interest an EE.?

The effect on

-Employee share and Employer share would be due to compounding. Explained below

-EPS amount does not earn interest it only depends on the number of years.

How compounding gets affected in EPF

One gets interest on opening balance and monthly contribution. So for next year the new opening balance would be: old opening balance + contribution throughout the year + interest on the (old opening balance + contribution). You left in Jul 2013 so the account became dormant but it would still interest till 2016.

So from Jul 2013 there has been no contribution hence the amount used for calculating interest would be less than what it would have been if contribution would have been throughout the year.

EPF Balance in A/C No. MR/NOI/0054051/000/0004040 is EE Amt:Rs 889, ER Amt:Rs. 272 as on 17-08-15 (Accounts updated upto 31-03-2015)-EPFO

plz sir mera Pf kitna aayega if I withdrawn now, maine 13 aug 2014 to 10 feb 2015 tak work kiya hoon,

plzzzzzz reply

reply me any one, i will give a .50 paise cost chocklate

Hi,

Thanks for providing such detailed information. Appreciated!

I got one mail from my employer. Please suggest me what should I do next.

Here is the mail..

“Please be informed that we are unable to attach your previous employment details with Syntel’s PF No due to the below error:

Previous DOB against the entered UAN does not match the DOB entered against the Present Member ID ”

Any help is appreciated…

Thanks in advance.

From FAQ on UAN website

Q.32 Whether the present employer is allowed to link the previous member id based on the information furnished by the member through form 11 even if there is difference in date of birth or even if the details with previous employer is in-complete or there is mismatch?.

The validation of date of birth has been kept to ensure that the linking with UAN takes place for the correct member only. Any dilution in this validation might lead to linking of wrong member ids.

Q.33 Whether the member can correct his date of birth or to furnish the missing information of previous employment particulars through the present employer.

No, the correction in date of birth in the previous employment can be made through the previous employer only.

Maira er amount.4882 hai ee amount 1495 total amount kitbi ayaegi mujhe plz reply

Aapko milega Employee contribution (EE) 4882 amd Employer amount (ER) 1495 + EPS + Interest on EE and ER from Apr to month you withdraw.

Please note that if you withdraw before 5 years EPF is taxable

I have received the SMS from EPFO that my EE is 42904 and ER is 13568.

Kindly help me that apart from Rs 45k+ same amount we will rec or extra…bcz 4.3yr service I thing 90k+ will rec me amount is it right or wrong…????

Why do you think you will receive 90k+?

If you have UAN, activated you can see the contribution and full amount.

You are entitled to recieve EE which is employee that is your contribution, ER Employer’s contribution. Interest earned on EE+ER from 1 Apr 2015 to date you withdraw, as interest for earlier years is accounted for in EE +ER.

You can with EPS which will 650 * Num of months you contributed till Sep 2014 + 1250 * num of months from Oct 2014 to date you withdraw.

As you will be withdrawing before 5 years of service you would have to pay tax on withdrawal amount.

Plz suggest or help m for receiving amount how much Me in account??? plz sms 9881035947

Dear Sir/Madam, I am part of IT company since sep-2006. I have got two queries on my PF Accumulations.

Query 1 : Opening Balance has not been shown in the PF tracker and the same was not considered for interest calculation. It was not the case till 2012 to 2013 financial period. From 2013-2014 & 2014-2015 annunal statements showing only Employee contribution and Employer contribution. Is it correct?

Query 2: Huge difference in the TOTAL PF Balance between our employer database and EPFO Database.

I have availed the SMS balance equiry facility launched by EPFO office. Got an sms which contains the balance information. It shows very less PF than my employer database. To whom should i contact for this issue? how can i know the exact total PF balance available? Kindly clarify.

Do you have UAN activated? If yes please checkout your UAN Passbook.

1. When you say PF tracker what do you mean?

UAN passbook shows monthly entry from Apr 2010 and lump sum entry for earlier years.

2. SMS shows account information till particular date Accounts updated upto [Date]: This tells you that the interest till this date has been added into your EPF account.

First check with your employer and then EPF office.

Hi,

Please suggest as my monthly deduction from salary was 912 per month..worked in the previous organisation for 6 months approx..and the EE amount what I checked in EPF balance :4233 Rs.

Am surprised..how is it possible that deducted amount was high and what am getting is not even equal to that?

Can anyone suggest.

dear its 2*ee+er……that i know….if you know other formula then please share…+919467781012…i have EE =24500 & ER =7500 THEN PLEASE REPLY IF U HAVE ANY IDEA…I WANT TO WITHDRAW MY PF

You should get EE(Employee share) + ER(Employer share) + EPF+Interest on EE and ER share from 1 Apr to date of withdrawal, (for other years interest is added in the EPF portion in Apr)

How did you arrive at 2*ee+er.

Hi,

Very Nice and helpful information here. My husband had a PF account very long time back in company that is now closed down some years back. Now we are unable to even track down the status of the PF as the site says there is no record in the Master records. Is there any way around this? My husband was in the company for almost 5 years. But had problems transferring the PF account to the new company. Any help and suggestions are appreciated. Thank you

Maam sorry to hear about your case.

If you have the PF number and payslip which shows contribution to PF account you can try the RTI router to get the EPF information.

If one is unclear about what your EPF status is or if one’s EPF transfer work has even started? Why did one’s EPF money still not credited in bank account etc etc… You can ask all these questions and you should be getting the answers within 30 days. The three steps to file RTI are:

Buying a Postal Order of Rs 10 from Post Office

Drafting your RTI letter

Sending the RTI letter by Registered Post or Speed Post

The article Jagoinvestor article on RTI for EPF Withdrawl and Transfer issue has details on each of the step, with sample letter ,filing RTI online, filing two RTI applications for Transfer of EPF. Note Before filing the RTI , a good idea would be to file a EPF grievance redressal form online

If you could keep us updated we would appreciate it as it would help other readers too.

Thanks for the prompt reply. Will try your suggestion. Will definitely keep you posted.

Regards,

Hi,

I worked from Aug 2011 to Oct 2015 in one organization.

My PF details upto March 31, 2015 is EE: Rs 55199 and ER: Rs 26431.

1)Does ER share mentioned include (EPF(3.67%) and EPS(8.33%) or only PF(3.67%))?

2)If i transfer my PF to new company, will EPS also be transferred to new company EPS fund or only the employer EPF will be transferred from previous company to the new company employer EPF fund?

3)Is there any place where we can check the monthly PF submissions by our employer ?

1. ER includes 3.67% of employer contribution only.

2. EPF is transferred. Regarding EPS it will shown 0. When we raised the question using UAN Helpdesk we were told

WHILE TRANSFERRING PF FROM ONE ESTABLISHMENT TO ANOTHER, THE SERVICE DETAILS INFORMATION (VIZ LENGTH OF SERVICE, NON-CONTRIBUTORY PERIOD, LAST WAGES DRAWN ETC) ARE FURNISHED TO THE RECEIVING PF OFFICE IN ANNEXURE-K WHICH WILL BE USED TO CALCULATE PENSION BENEFITS. AMOUNT IN PENSION FUND IS NOT REQ”.

3. If you activate your UAN you would see monthly contributions by employer and also get SMS

Hi everyone, I have been through all the comments and advices. But I am still little confused in EPS!

If around 8% of employer contribution going to EPS then how would I get back that accumulated EPS amount? It is a part of our CTC and it is deducted from our CTC!

I am a private employee working in an MNC.

When one attains the age of 58 one can apply for pension from EPFO. You would get atleast pension of Rs 1000 per month.

Hi,

I verified my PF balance,I am seeing that my ER amount is less than EE amount.

Is it because interest is accumulated on just my contribution or will it be applicable for my employer contribution too.

As Employer’s contribution goes towards EPS, Employer’s share in EPF will be less than EE or Employee Contribution in EPF.

The entire 12% of employees contribution is added towards PF.

8.33% out of the total 12% of the employers contribution is diverted to the EPS or pension scheme and the balance 3.67% is invested in PF.

EPF part of both Employee and Employer earn interest.

EPS part of Employer contribution does not

Hi,

I have worked in an organization from march 2016 to oct 2010 and in second organization from oct 2010 to june 2015.I have withdral my pf amt from by both companies but I am not sure whether i have widrawal my eps amt from my first company or not.

Can i check anyhow whether i have withdrawl my eps oe not?

Please help.

Do you know which forms did you submit?

Kindly let me know that what is the exact purpose of ‘Form 15-G’ and would it help for saving the tax ?

If I am not wrong, we should submit Form 19, Form 10C, Form 15G(for avoiding the Tax deduction), copy of PAN card and duly signed cancel cheque/copy of bank pass book for withdrawing the PF.

Please correct if it is wrong.

Short explanation: If you are withdrawing before 5 years and you don’t want TDS to be deducted then you need to fill Form 15G.

And yes you have to submit form 19, Form 10C, Form 15G,copy of PAN and cancelled cheque of bank for withdrawing PF.

Long explanation:

Form 15G or 15H is submitted to request income provider for not deducting tax or TDS for prescribed income.

These forms can be used only for payments in the nature of Interest of Securities, Dividend, Interest other than Interest on Securities (Bank/Company Deposits) , NSS & Interest on Units. For other types of payments, these forms cannot be used.These days for PF withdrawal one is required to fill Form 15G if one does not want tax to be deducted.

One can submit these forms to bank, post office, company etc

These forms have to be filed ans submitted to the payer which can be bank, post office, company . The payer or the institution takes them on record, the entire interest is to be paid to the depositor or lender without TDS

While Form 15G is for Indian residents below 60 years of age, HUFs and trusts, Form 15H is for those above 60.

Our article What is Form 15G? What is Form 15H? covers it in detail.

You can withdraw from EPF and EPS if you are unemployed for 2 months. You can also wait for two months to get a new job and then you can get your PF Account transferred to the new Account. However, in case of not getting the job , apply for the settlement before 36 months from leaving the last job as no interest will be paid after 36 months and the account will become inoperative.

You can withdraw EPF both the employee and employer contribution by submitting Form 19.

Regarding EPS contribution the form that one can fill are given in table below

Your Age EPS Contribution Form Instructions

Less than 50 years Less than 10 Years 10C Withdrawal/Scheme Certificate

Our article Forms to avoid TDS,15G, 15H, and EPF Withdrawal Forms Form 19, Form 20,Form 10C,Form 10D,Form 51F discusses it in detail

Thank you so much.

You are welcome

I worked at an MNC for 2 years and 3 months. My EPF has accumulated for this period – the last contribution being made this month (November 2015). However, I’ve quit and joined a law firm where no PF is paid. What is the best way to handle the PF at this point? I do not want to withdraw it because of the high rate of deduction. I can not transfer it as I’ve joined a law firm where there is no PF contribution. Upon reading your article I understand that there is no point leaving the PF balance as it is as no further contribution to the account makes it a dormant account. So, what is the best way to take this forward?

Do let me know.

Thanks

No interest will be paid after 36 months and the account will become inoperative. So if you are not planning to change job within 3 years you can let your EPF account continue.

Do you mean that no interest will be paid after 36 months from the last date of contribution? If yes, that means interest will stop accruing from 3 years post December 2015 (i.e. December 2018 onwards)?

In that case, if I withdraw it in December 2018, the 5 year mark would have passed and I will not be liable to pay the TDS on it, correct?

Also, to further clarify, I am currently working in a new job.

Looking forward to your response.

Thanks.

Interest will be paid till 3 years after the last contribution. So your EPF account would continue to earn interest though no new contribution is made till Dec 2018.

5 years are 5 years of contribution to EPF. So even after 3 years number of years of contribution would be same as in Dec 2015.

We would recommend you to hold onto to EPF account and if you join new company in next 3 years you can transfer your EPF account.

Theoretically you cannot withdraw if you are working but practically EPFO is not so strict about the condition.

Hi Sir,

I worked in a company for 6 months and 12 days in Bangalore and then I got job in Hyderabad. So, I transferred my Bangalore company PF amount to the hyderbad company PF account. I got a message like my Bangalore company pf amount credited to the present company account. When I checked in the passbook through online it is showing only my employee share and employer share amount from the previous company credited to the present company pf account. Whereas, pension amt it is showing as 0. Can you please help me with this?

Good observation. It seems that EPS is also transferred.

One of us had transferred the EPF from earlier company to new company. While EPF withdrawal was done there was no information about EPS withdrawal.When we used UAN Helpdesk We asked about EPS transfer and the response we got the same day after submitting our request was as follows

Dear Member, Your UAN Helpdesk Reference ID 15088888 has been closed with closing Remarks

“WHILE TRANSFERRING PF FROM ONE ESTABLISHMENT TO ANOTHER, THE SERVICE DETAILS INFORMATION (VIZ LENGTH OF SERVICE, NON-CONTRIBUTORY PERIOD, LAST WAGES DRAWN ETC) ARE FURNISHED TO THE RECEIVING PF OFFICE IN ANNEXURE-K WHICH WILL BE USED TO CALCULATE PENSION BENEFITS. AMOUNT IN PENSION FUND IS NOT REQ”.

Hi Sir,

Thanks for your prompt response. So, are you coming to say my previous pension amt won’t be displayed in the present company PF account?

Yes Sir the previous pension amount won’t be displayed in UAN passbook but EPF has recorded the period for which you have worked in earlier company

Thanks a lot for your valuable answer

I have received the SMS from EPFO that my EE is 32304 and ER is 7568.

Kindly help me that apart from Rs. 39872 will I get my EPS + interest of EPF.

I had worked 2.5 years in the Company.

Also let me know that what is the minimum period for withdrawing the PF?

Some facts that we would like to draw your attention to

The amount you get on withdrawal is EE(Employee Share) + ER(Employer Share) which also includes interest till end of financial year + Interest of EPF from Apr of current financial year on period till you withdraw EPS.

EPF money is for retirement so if you plan to rejoin the work force then it’s better to transfer the EPF account and use power of compounding

Thank you so much.

Sorry to bother you again, kindly let me know that what is the exact purpose of ‘Form 15-G’ and would it help for saving the tax ?

If I am not wrong, we should submit Form 19, Form 10C, Form 15G(for avoiding the Tax deduction), copy of PAN card and duly signed cancel cheque/copy of bank pass book for withdrawing the PF.

Please correct if it is wrong.

Hi Sir,

I want to clarify one thing. Before one month i submitted my EPF form in my office after that they rejected my form and they mentioned as EE and ER should submit along with proof for any correction in member name and father name.So what is the procedure for solve this issues.

Hi my self shivam would like to know information about epf

My EE amt is 57322 and ER amnt is 18654

Working with organisations since 6 year.can u plz a plan how much pf I will get

If you are unemployed for 2 months then you can withdraw your EPF + EPS

You will get EE(Employee share) + ER (Employer share) + Interest of the current financial year till the time you withdraw.

Also apply for EPS and get the EPS amount also.

As you have completed more than 5 years it all will tax free. Show it as exempt income in ITR.

But please remember EPF is for retirement, your future and withdraw from EPF only if you need money.

I have applied for the EPF and EPS both as my job tenure was 10 months. My employee deducted a PF amount of 2800/- pm from my salary! Now they are showing me EE amt. as 27940 and ER amt as 2548 as on 22/04/15 (Accounts updated upto 31/03/15). I like to know how much money I’ll get once the EPF payment is to done? please tell me!

SIR WHAT IS FORM 10C ?

Hello

I’m working with a company since one year and recently I have recd. a msg from epfo its showing that is ….

epf balance in a/c no.ds/NHP/0034299……..IS EE AMT 4516,ER 1858 AS ON 23 JUNE 15 ACCOUNTS UPDATED UPTO 31 MARCH

nOW i WANT TO KNOW WHY ITS SHOWING MORE LESS BCOZ M WORKING WITH THIS COMPNY SINCE LAST ONE YEAR PLZ HELP

You should be having UAN number. Please activate the account and check exact contributions as Employee and Employer contribution. Our article UAN or Universal Account Number and Registration of UAN explains it in detail.

i have working in a factory last 10 years i left my job after ten years and i have check my p.f. balance my amount is displayed EE amount 72610 and ER amont 42713 plz suggested me how i get total balacne in my account

Sir if you want to withdraw your EPF then you have to fill form.

If your age is below 50 years then

Age is Below 50 Years and you Have Completed 10 Years of Eligible Service.

You can apply (in certain cases after a waiting period of 2 months) for

Final Settlement of PF through FORM 19

AND

Scheme Certificate from Pension Fund through FORM 10C

Note:

1. You can also wait for some time to get a new job and then you can get your PF Account transferred to the new Account.

However, in case of not getting the job, apply for the settlement before 36 months from leaving the last job as no interest will be paid after 36 months and the account will become inoperative.

2. Withdrawal Benefit is not permitted since you have > 10 Years of eligible service. Only Scheme Certificate will be issued.

madam

I have worked for company for 10 months.I have checked e pf my ee 11254 and er amount is 3745 .how much I get.

EE+ER+Interest on the amount from Apr 2015 till when you work

In addition You can also withdraw EPS amount.

So My Total amount PF is ER +EE right?????

EE+ER+interest on it till you work + EPS (if withdrawal is before 10 years of service)

Hi..

I have worked in my first company for 4.1 years and now moving to US(same compay.intra company transfer).i want to withraw my PF balance.

If i withraw this amt, it will be taxed? Or is there way i can save my tax amt?

Sir Congratulations.

EPF withdrawal before 5 years is taxed. If you submit form 15G then TDS will not be deducted. But tax liability remains.

Our article EPF Withdrawal before 5 years,TDS,Form 15G,Tax and ITR explains it in detail

Or pension fund ka kuch nahi ayega????

Pension fund ka amount bina interest ke aayega.

But you can withdraw only if you are un-employed for last 2 months.

And since you have withdrawn before 5 years of service you will have to pay tax on it.

Or interest nahi ayega

Bilkol aayega.

Typically The interest amount is calculated monthly but the total interest amount is credited once a year only.

Interest Amount is calculated on the average monthly balance. EPF subscribers are eligible to get interest amount on their contributions and employer’s PF deposits.

When one leaves job in middle of the year then one will get interest for average monthly balance till one was working

And I work in company 2.5 year

I leave job before 2.5 year and my pf account show me ee amount 13000 and er amount 4000 what amount i received plz sugges

EPF + EPS ie 13000+ 4000

Sir/Madam,

I resigned my job on 30th APRIL’15.

My PF form has been submitted on Sep 3rd 2015.

So for the period of May, June, July, August will the interest be calculated and credited? If not please clarify.

Thanks

Raju S

Hi,

I worked for a company in mumbai from 2009 to 2011. I want to withdraw my amount from the PF account but the company is closed and have no employees now, can you please help me in taking out my PF amount for that company. I am very helpless right now and not getting any solution for this

BR//

Rahul

Sorry to hear about your situation.

Was the PF a trust run by your organization or the EPFO.

Do you have the PF number?

Are you still working? Do you have UAN number?

sir

I was working in suwidha center and have resigned after working 2 years.My epf amount was EE Amt: 19123, ER Amt: 5859 as on 24-06-2015. Please tell me is there any extra amount is to be added in this.

How much i will get the amount ?

You have EPS amount , the pension one.

You can apply (in certain cases after a waiting period of 2 months) for

Final Settlement of PF through FORM 19

AND

Withdrawal Benefit/ Scheme Certificate from Pension Fund through FORM 10C

Hi Every one,

Could you please explain to that,

every month comapany deduct for PF amount is 3485.

But i checked in EPF portal with UAN number.

Employee share=1600

Employer share=450

Pension fund=1050

Please any wrong in this, I have compared with PF deduction in salary slip and EPF portal, am confusing, Could please clarify any one. Thank you

Hello Sir,

I have worked in my previous company for 2 years and 8 months(April2012-Jan2015).

My EPF account balance showed as

EE-32,189 ER-9,858 Pension-20,041 Total-62,088

But while i’m claiming, received only 56,212.28 in my bank account. Please explain me on this..

Thanks

Samson

They must have deducted TDS @ 10%

I like it your epf sms ee er withdrawing epf transfer. You can book online ers 2015 conferences at UK for any purpose.

EPF Balance in A/C No.

PU/PUN/0303853/000/0001933 is EE Amt: Rs 12091, ER Amt: Rs 3699 as on 25-5-15

(Account upto 31-3-2015)-EPFO

How much i will get the amount ?

I left my company in july 2014. i work 18 months over there.

Every month pf deducted is Rs 604.

So how much i will get now ???

How can i get details about 10c form.it is not cleared in google.

Hi ,

l was working in private organization two years ago. I worked there for 5 month. my epf deduction is rs.1400 per month but when i resigned from job. I don’t get any pf amount in my account. tell me how can I get the epf amount. or procedure to get it.

I already applied to claim. I have to know the total amt i will get. It will be 56680(EE+ER as shown in msg) or more..?

You will get amount till Oct 2014 which should be more than EE+ER 56,880(amount in message) + interest (from Nov 2014 till the claim .)

Note that EPF and EPS withdrawal are not related.

You can also withdraw EPS , which does not come in SMS, by filling the withdrawal form 10C.

Dear sir,

I completed my service in a pvt company from august 2009 to oct 2014. After checking my pf balance i got msg that my balance are EE amt 43380 & ER amt 13300 as on 11/3/2015. And also gives account updated up to 31/3/2014. I am totally confused. Please tell me how much amout i will get in my account.

Thanks

Nasaruddeen

Sir the SMS message might show not show updated details. You will get amount till Oct 2014. As you have completed 5 years EPF withdrawal would be tax free but we recommend you to consider if you need to withdraw as epf is for retirement

Dear sir,

I completed my service in a pvt company from august 2009 to oct 2014. After checking my pf balance i got msg that my balance are EE amt 43380 & ER amt 13300 as on 11/3/2015. And also gives account updated up to 31/3/2014. I am totally confused. Please tell me how much amout i will get in my account.

Regards

Hi Kriti, Pl. be informed that, as on 19/06/14 my EPF balance is Rs.74,436/- as below:

Employee Share : 37679

Employer Share : 23232

Pension Fund : 13525

But,today i got SMS saying,Rs.17,582/- deposited and Rs.27429.58 subject to clearing. It means total would be only Rs.45011/-. But, according to EPF Statement, my balance is more.

Just now i checked my balance again in EPF portal and got SMS like EE:500038/- & ER: 29617/- ==> Rs.79655/-

Hence, i am totally confused. kindly let me know that, would i get total amount or not? and do the needful please.

Thanks!

I assume you have UAN.

Please register for UAN and download the pass book. It would show you exact amount put in every month. Our article FAQ on UAN number and Change of Job talks about UAN in detail

Sir,

Pl. be informed that, i am unable to download UAN passbook at this moment as server is not responding.

But,

1) according to my EPF Passbook, balance is Rs.74,436/- as below.

Employee Share : 37679

Employer Share : 23232

Pension Fund : 13525

2) according to EPF Portal SMS : Rs.79655/- (EE:50,038/- & ER: 29617-)

Hence, my doubt is WILL I BE CREDITED OF TOTAL EPF BALANCE (CASE 1 OR CASE 2). Less or more to amounts showing.

Thanks!

Bhaskar

Yeah server does hang at times.

Verify the dates mentioned in EPF balance,in UAN as well as SMS. It mentions data till what date.

We personally think one in EPF SMS is latest.

Hi, Irrespective of values, would i able to get the total outstanding amount which shows in UAN Passbook ? If yes, then what is the duration between remittance to remittance. As i have been credited on yesterday like wise when will i get balance amount?

Sir, Pl. be informed that, i have downloaded the UAN PASSBOOK. It has been updated till date as below.

=======================================================

TOTAL DEPOSITS | DEPOSIT | WITHDRAWAL | PF CONTRIBUTION

| | (PARA 69(2)|

===============|=========|============|================

EMPLOYEE SHARE | 51497 | 51497 | 18088

EMPLOYER SHARE | 30481 | 30481 |

=======================================================

Now, please guide me that how much amount i will get from above. I remember that i have applied to withdraw PF CONTRIBUTION amount too. But, it is not showing in withdrawal column.

Your immediate response in this regards will be highly appreciated and shall be thankful to you.

With Regards!

Bhaskar

How much PF amount to credit on my account, please provide the details.

THis is my PF details, which received earlier from PF site

EE amount: RS 24111 and ER amount RS: 7382, account as updated on up to 31-03-2015.

Finaly how much i can get it from PF office.

On withdrawing you would get EE (Employee contribution) + ER(Employer contribution) for EPF.

Regarding EPS if you have worked for less than 10 years you can withdraw it.

Hi

Is the EPS amount mandatory?

can we not evade it?

Do we get the EPS amount also at the time of PF withdrawal?

i was working for 8 years and now quit and no plans to join any other company.

In this case will i get my EPS amount also?

Pl clarify.

Yes it is mandatory for those working before Oct 2014.

No diversion to EPS shall be made for all new PF members on or after September 1, 2014 having (pay) more than Rs 15,000 at the time of joining

Hi

How can i check if my pf has been transferred from my previous company to new company. Please reply… Thanks…

Hi, my PF amount has been transferred from company X (previous company) to Company Y(current). But, now if I download my passbook,Pension contribution amount for the company X is shown as 0.But it should be 17500 as per calculation. Why the pension contribution is not shown for the transferred amount. In the Company X I have worked for 22 months. Kindly clarify, whether the previous company pension contribution amount also be added in PF Amount or not. If not how to get that money?

Sir, I quit my job in April, 2015 and have not taken up a job anywhere else. When I checked my PF details on-line, the details provided were as follows- EE amount Rs 20057/- and the ER amount Rs 6142/-.There was no mention of EPS amount. I have worked for 3 years.How do I calculate the receivable amount? Will I be given the EPS amount?( I don’t remember filling in any details for the pension plan in the PF claim form). Could you please tell me how much amount I will get? Your help will be greatly appreciated.

Dear Sir

we see all pf calculation

but i confuse

that ER amount we get but EPS amount we get not

ER is 3.67%

Its not that you do not get Mukesh , its just that it goes into the Employee pension scheme (EPS) Rs 1250 per month since Oct 2014 and when you turn 58 you will get pension.

Dear Sir,

After reading through, I still have a doubt. I have changed 3 companies – started with company A for 2 years, transferred PF to company B and worked there for 4 years, then transferred PF to company C and worked there for 2.5 years. So totally, I have worked for 8.5 years. So if I withdraw now, will I be taxed as I have not been with the last organization for 5 years or will the withdrawal not be taxed as I have not withdrawn the pf for 8.5 years?

Awaiting your reply. Thanks

– Rajendra

This is urgent for me to take a financial decision. Can you please reply to me above question. Your response is highly appreciated

EPF counts as total contribution to EPF. So for you it’s more than 5 years.

But if you are working you cannot withdraw- you can take borrow from EPF.

We don’t want to sound preachy but EPF is for retirement so withdraw only if you really need money

Hi,

I joined my job in 18-12-14.My current CTC is 139740 and my basic is 9173 and every month am getting 8600 net to hand . so rest when I checked my PF account my EE amt is:2192 and ER amt is :670 as on 10-06-15(accounts updated upto 31-03-15)means what please explain me clarity.

EE means employee contribution from 18 dec to 31 mar 2015 is 2192.

ER means employer contribution from 18 dec to 31 mar 2015 is 670

Dear Sir,

I have transferred amount from previous pf account to current pf account but when check EPF balance got through the SMS is not matching.Just showing current accumulated amount.

can you help me where could find the balances of my previous PF amount.

Thanks

Vijay

EPF balance is not updated every day. That is why SMS says Accounts updated upto .

Your earlier company or your earlier PF slip would be helpful to find balance of previous PF

June 22.

EE-6250

ER-2015

so if i withdraw now, the ER will be 6250 or will it be the same 2015.the employer must contribute the same as the employee.as per the SMS it is mentioned that the last update is on march 2015 so if i withdraw on aug?

You will get Employee contribution (EE) and Employer Contribution(ER).

Yes Employer contributes same but most of it goes towards EPS (8.33%) and Insurance

You the amount would be more in Aug than in Mar if you are still working.

If you have UAN number you should activate it and see the EPF passbook. Our article UAN or Universal Account Number and Registration of UAN explains it in detail

You can only withdraw if your are not working for 2 months after leaving the job

If you have contributed less than 5 years entire amount would be taxable. TDS of 10% will be deducted

Hello sir,

I was working in a company and have resigned after working 2 years and 9 months.My epf amount was EE Amt: 18938, ER Amt: 7607 as on 04-06-2015. Please tell me is there any extra amount is to be added in this like EPS or anything else.And if i withdraw my ammount then how much amount i will get.Please suggest .

You will get Employee contribution (EE) and Employer Contribution(ER).

As you have contributed less than 5 years entire amount would be taxable. TDS of 10% will be deducted

For EPS you would get a scheme certificate

Our suggestion is don’t withdraw but transfer it to the new organization when you change your job.

Sir presently i am not working in any organization,i am preparing for the government job.So would it be beneficial for me to withdraw the money or i keep it as it is.Kindly suggest.

I had worked in same company for 14 years and 7 months, as per SMS my EE amt is 225161 and ER amt is 99780, which amount will I get as of amount of pf.

Both EE(Employee’s contribution) & ER (Employer Contribution).

Hi

I was checking my UAN Passbook and I am not able to understand one thing.

My EE and ER contribution for the month are correct but I was expecting

my total EE = (total EE of last month + this months contribution) and

total ER = (total ER of last month + this month ER contribution)

But the actual amount it is showing is different (its more than the above calculation).

As far as I understand interest is only added annually so why do I see this discrepancy?

Thanks in advance

Best Regards,

Sandeep Jana

I have opted for withdrawl and submitted necessary documents to my employer. where do icheck the status? please guide me.

We assume you have submitted form 19 to your employer

Or Have you done online through Transfer EPF account online : OTCP ?

Visit webpage Claim Status on epfindia.com. Select the EPFO Office where your account was maintained and furnish your PF Account number. Document Know Your Claim Status (pdf format) lists the steps in detail with images at each step. Please be aware of the tax implications of withdrawal.

You can check the claim status at Claim status of EPF

After applying PF, in how many months we will receive the amount…?

45 DAYS

Hi,

My name is Pavan.I am working in ABC company from Jan 2010 till date(31/05/2015).Once I resign from this Company, whether I will get the full amount if I withdraw it?

I am refering here about the PF

If your EPF contribution are same as you joining and leaving date then you have completed 5 years so withdrawal will not have any tax.

Are you joining any other company? Do you have UAN number?

If you have UAN number then EPFO will be able to track whether you are eligible for withdrawal or not.

On withdrawal you will get EE + ER + EPS.

hi sir my pf amount last transfer 5980 but my pf amount is above 18000/-

when comeing next amount plz reply

Sir we were unable to understand the question. Can you explain it? Is 5980 Employee contribution?

what is the exact premium for Atal pension yojana for age of 26 year

Sir,

For 26 years of age Premium based on monthly pension amount is given below

Monthly Pension Premium

1000 82

2000 164

3000 246

4000 327

5000 409

This is explained in detail in article Atal Pension Yojna

Hi Kriti,

i was working from Sep 2014,company’s contribution is also deducted from my end. And when i checked my balance it is showing EE Amt:Rs6165,ER Amt:Rs1885 as on 17-04-15.

can you tell me the company’s contribution(which is also deducting from my end) per month.

Rs.1207 deduction is showing every month in my pay slip where Rs.2414 is the actual amount of deduction from my salary every month. Please help with the info…

Hi Kriti,

It may be boring to answer the same kind of questions, but please provide me the PF info for the below details.

I was working from Sep 2014, in my company they are deducting the PF both

Hello,

In my Epassbook it shows Employee Share – 11129/-

Employer Share – 3409/-

Pension Share – 7410/-

I worked for 2yrs of service. I resigned my job before 3 mnths service. Now how much amt comes during withdrawl.

Thanks In Advance.

Hari you will get Employee Share (11129) + Employer Share (3409) + Pension Share (7410)

Hi Kriti,

My current employer is maintaining PF as an exempted establishment i.e not in any PF office. I have got a UAN number and it has been linked to the Pension fund account and not to the PF account in the UAN website. My question is, I am planning to change my job and in my next organization what should be the process for transferring the accumulated PF amount from my the current organization to the new organization? i.e will I be able to apply it online as my PF account is not maintained in any PF office?

Sir

from what you say it seems that your EPF part was maintained by your company trust and Pension by EPFO.

Now you are transferring to Un-exempted accounts in both.

EPFO (pdf file) says

Apply to the PF Trust for PF transfer and to EPFO for service details transfer

Receive and credit PF from Trust in present account and transfer service details to the present account.

You can check with your current/new company and update us.

Your UAN number will not change. Submit your UAN number to new employer

Provident fund accounts with privately held PF trusts can now be transferred online to accounts maintained by the retirement fund body EPFO.

Read more at: Economic Times

Process of transferring is explained in our article Transfer EPF account online : OTCP

hi Kriti,

I had left my job on June6th 2014. Currently I am studying and unemployed. My EPF message shows EE AMt:Rs 15127 ER Amt: Rs 4858. My service period in that company is less than 2 years (17.5) months. If I with draw money now, can I get my full amount? what is the procedure now I have to follow? please suggest.

You can withdraw your EE+ER amount + EPS Amount (541* 17/18) months.

You will have to pay tax on it if your total number of contributions in EPF (including your earlier job is you have had any) is less than 5 years.

Process of transferring is explained in our article Transfer EPF account online : OTCP

Amount withdrawal will be taxable. From Jun 1 10% TDS will be deducted.

You would have to file Income tax return to ask for refund of TDS it if your total income including EPF withdrawal is less than 2.5 lakh

Very usefull info.

It is realy good information given by you.

Thanks Sir

Hi,

I have changed my job, n I’ve transferred my PF account and linked with my new account created with present employer. I followed all the procedures mentioned on EPEINDIA site and received a message from EPF that my transferal is successfully completed. Now when I check balance of current account it only show the amount of current employer and when I try to check the balance of previous account, it shows that this is account is no longer active (or something).

Can you please let me know how to get this query solved?

Your help is appreciated.

Thanks

Vinit do you have UAN number. If yes please check the EPF passbook.

It shows information in detail, opening balance, contribution every month from employee and employer, how employer contribution is being split into PF and EPS. Withdrawals if any that has been made from the EPF account.

Our article UAN number talks about UAN in detail.

Hi kirithi,

when i search my account i a getting message as non operative accounts, please let me know how to withdraw my amount.

Have you transferred your EPF account? When was the last contribution made to the account?

Hi Kriti,

If my last working day in a company is before June 1 2015(amendment effective date) say 01 May 2015 and I do premature pf withdrawl meaning before 5 years of service after the cooling period of 2 months will the tds still apply on my pf amount?

Grateful if you could answer my query ASAP.

Reagrds,

Arun

My basic salary is 8000.

My company deducted 1920(960+960) from my salary for pf.

Is it sound ok?

PLz clarify me

U explained in very understandable language

Thank u very much.

Useful information

ee bal is 15535 and er is 6089 what is net pf

Net PF is EE + ER on the given date.

EE Amt: Employee Contribution i.e. your total contribution in the EPF account. The sum total of PF amount deducted monthly from your salary.

ER Amt: Employer Contribution i.e your company contribution. The sum

In addition you have EPS which will you give you pension once you retire which is not shown in SMS but is available in EPF passbook

Hi kirti,

Thank you, so I want to re=confirm that if the SMS says EE 25000 and ER is 7000, once I resign from my job, I should get more amount from Employer as retirement amount ryte? Please clarify me the same.

Hi Kriti,

If my last working day in a company is before June 1 2015(amendment effective date) say 01 May 2015 and I do premature pf withdrawl will the tds still apply on my pf amount?

Grateful if you could answer my query ASAP.

Reagrds,

Arun

To apply for EPF withdrawal you should be un employed for 2 months.

If you have UAN it would be difficult to withdraw as govt. recommends transfer of EPF from one employer to another

Hi Kriti,

If my last working day in a company is before June 1 2015(amendment effective date) say 01 May 2015 and I do premature pf withdrawl meaning before 5 years of service after the cooling period of 2 months will the tds still apply on my pf amount?

Grateful if you could answer my query ASAP.

Reagrds,

Arun

Thank you so much for this detailed article.

I was working for 3 years and then quit working as I got married and moved out of India and claimed my pf account’s money.

On SMS it says EE 37580, ER 18262

However, I just received around 19000 rupees via my pf claim. Why is that so? And as per the article, I understand that some contribution is made to EPS. When and how can we claim that?

Thank you very much for all the information!

Urmi how did you file the claim? Online/Offline

If possible please contact your ex-employer.

You should get EE+ER. To claim EPS you have to submit Form 10C

For withdrawal benefit & scheme certificate fill Form 10 C(pdf format)

So what is EE and ER? Decoding the EPF balance SMS from EPFO:

A/C No: This is your EPF account number. You EPF account number have your area code, company or establishment code and your account number.

EE Amt: Employee Contribution i.e. your total contribution in the EPF account. The sum total of PF amount deducted monthly from your salary.

ER Amt: Employer Contribution i.e your company contribution. The sum total of PF amount monthly contributed into your EPF account by your employer.

As on [Date]: The date till which your monthly contribution has been updated in your EPF account. In the example above, contributions in EPF upto 27-08-14 are shown

Accounts updated upto [Date]: This tells you till when the accounts were updated. Usually accounts are updated at the end of financial year when the interest till this date has been added into your EPF account. From the example above, it tells that interest till 31st March 2014 has been added into your EPF account. It does not show current balance of PF Account as on the day you asked for information.

You can see that EE(Employee Contribution) is more than ER(Employer Contribution). Because Employer’s contribution is split into two halves , the Pension fund(EPS) and Provident Fund(PF). SMS does not show the information about Pension fund but EPF passbook does.

Thank you for sharing this extremely well written article. I never usually leave comments below but you made it amazingly simple for me and I felt that I needed to show my appreciation even if it has been a while since you posted this. Keep up the good work!

Thanks for encouraging words

Thanks for sharing over the topic in such a simple and clear language. It is very helpful. Thanks once again.

hi i m bheem vishwakarma working in jubiland foodwork pvt. ltd. company around 4 years . i want to know my epf balance my UAN 100112226810

If you have activated your UAN number then you can download e-pass book. Our article UAN explains it in detail

know about epf balance.

Hi I have applied for my PF withdrawal as i quit the organization and i worked with the organization for 1year.I want to know whats the amount that i will receive in my account.when i requested for balance online this was the message i received.

EE=12151

ER=3721

So is this the final amount i will receive or something more?

Looking forward for your reply…thanks in advance.

EE(Employee Contribution) is more than ER(Employer Contribution). Because Employer’s contribution is split into two halves , the Pension fund(EPS) and Provident Fund(PF). SMS does not show the information about Pension fund but EPF passbook does. So if you have UAN number I request you to get the epf passbook.

EPS part you will get only if your years of service is less than 10 years.

In short You would get EE+ER+EPS

i am working in a private ltd,

currently i am earning 31000 (approx) salary net in hand.

i joined company on 5th june 2013.

what should my pf balance as i never withdraw-ed from pf account.

kindly reply asap

regards

You can check your PF balance by sending an SMS or if you have UAN number(which we think you should have) by checking out the e-passbook.

To find EPF balance by SMS Go to http://www.epfindia.com/MembBal.html

The best way to find about EPF balance is:

On 30 Nov 2012 EPFO launched e-passbook facility. The online EPF or EPF ePassbook is an online version of the employee’s provident fund account. You can check your EPF balance online anytime. Through this facility Provident Fund details can be checked online on the website http://www.epfindia.gov.in.

Our articles How to get information about EPF balance : Annual Statement, SMS, E-Passbook covers it in detail.