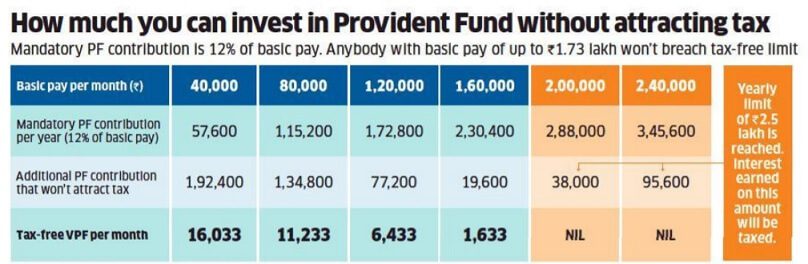

From 1st April 2021 the interest on any contribution above Rs.2.5 lakh and Rs 5 lakh based on conditions by an employee to a recognized provident fund is taxable. This means that a person contributing up to Rs 20,833 a month to PF i.e has a basic salary of up to Rs 1.73 lakh a month will not have to pay the tax. But whether the interest will only be taxed in the year of contribution, not after it is still not clear. This only applies to EPF and not PPF. This article explores how does Tax on EPF above 2.5 lakhs affects EPF? What are the alternatives to EPF and does it make sense to contribute to EPF beyond 2.5 lakhs. The image below shows how much you can invest in Provident Fund, EPF, and VPF, without attracting tax.

EPF rule tweaked. Now, an employee can earn tax-free interest on contributions of up to Rs 2.5 lakh. A limit of 5 lakh will be applicable to cases where employers do not make contributions to the provident fund. Finance Minister Nirmala Sitharaman introduced an amendment to raise this threshold limit to Rs 5 lakh during the debate on Finance Bill 2021, which was passed by the Lok Sabha on 23 Mar 2021.

Table of Contents

Tax on EPF, VPF Contribution above 2.5, 5 lakhs

The interest on any contribution above Rs. 2.5 lakh by an employee to a recognized provident fund is taxable effective from 1st April 2021. This means that a person contributing up to Rs 20,833 a month to PF i.e has a basic salary of up to Rs 1.73 lakh a month will not have to pay the tax.

A limit of 5 lakh will be applicable to cases where employers do not make contributions to the provident fund. Finance Minister Nirmala Sitharaman introduced an amendment to raise this threshold limit to Rs 5 lakh during the debate on Finance Bill 2021, which was passed by the Lok Sabha on 23 Mar 2021.

The number of people who actually contribute more than Rs 2.5 lakh is less than 1 percent of the total number of contributors in the EPF,” reported DNA quoting Expenditure Secretary T V Somanathan. Therefore, the common man does get affected by this move.

But will the interest be only be taxed in the year of contribution, not after it, is not clear?

From the finance bill 2021 (page 34)

But provisions of these clauses shall not apply to the interest income accrued during the previous year in the account of the person to the extent it relates to the amount or the aggregate of amounts of the contribution made by the person exceeding two lakh and fifty thousand rupees in a previous year in that fund, on or after 1 st April 2021, computed in such manner as may be prescribed

For all contributions made by employees (not employer) in EPF or VPF, which exceed Rs. 2.5 lakhs in a year, any interest earned on this excess amount will be subject to regular taxation. any balances in EPF that you will have till 31 March 2021 or interest earned on them in the future are exempt from tax.

The contribution limit of 2.5 lakhs a year is combined on the Statutory contribution of 12% of the basic + any VPF contributions. It does not include the Employer contribution.

VPF

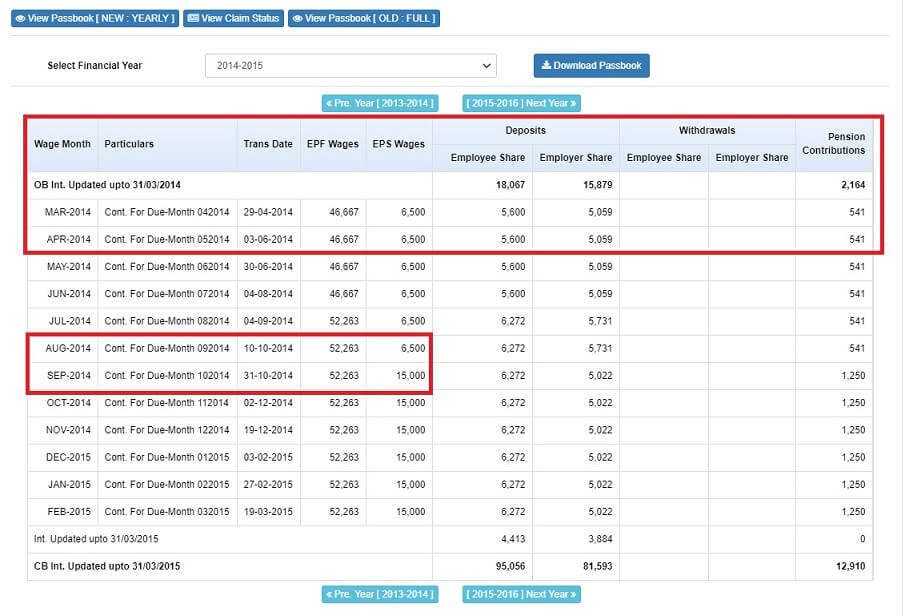

In EPF, an employee has to contribute 12% of his basic pay towards his provident fund account. An equal amount is contributed to by his employer. An employee may voluntarily choose to contribute more than 12% he can do so up to 100% of basic and D.A. This is called Voluntary Provident Fund or VPF. But the employer will contribute an amount matching only the 12%. In the EPF passbook, VPF contribution does not appear differently. More details about VPF in our article Voluntary Provident Fund, Difference between VPF, EPF and PPF

Will the EPF passbook be updated to show different contributions portfolios, 1. Employer’s contribution, 2. Employee’s contribution below 2.5L each year, 3. Employee’s contribution above 2.5 lakh each year. The current passbook(as of Feb 2021), from our article, How to view EPF Passbook, is shown in the image below

Is Investing more than Rs 2.5 Lakh in EPF is still a good strategy?

Should one contribute to EPF above 2.5 lakhs?

The number of people who actually contribute more than Rs 2.5 lakh is less than 1 percent of the total number of contributors in the EPF, So the common man does not get affected by this move of the Finance Minister.

This marks the second time the NDA government has sought to tax employees’ provident fund savings. A 2016 Budget announcement to tax 60% of EPF account balances at the time of withdrawal, was later rolled back.

The image below shows how much you can invest in Provident Fund, EPF, and VPF, without attracting tax.

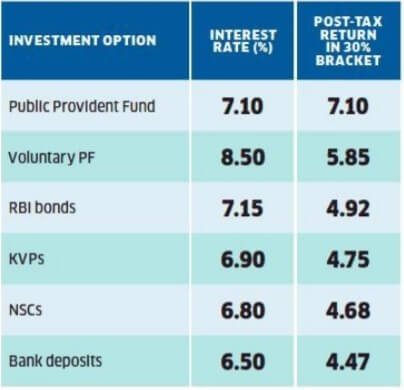

- If you are under the 30% tax slab, then your post-tax returns will be 5.95%

- If you are under a 20% tax slab, then your post-tax returns will be 6.8%

- Finally, if your tax slab is 10%, then your post-tax returns will be 7.65%

The image below shows how much returns can one get from EPF on different contribution amount

Alternatives to EPF, VPF

Assuming you are under the highest tax bracket of 30%, who will give you the 5.95% tax-free returns in the current scenario?? Bank FDs, Debt Funds, Tax-Free Bonds, RBI Floating Rate Bonds, or NCDs.

There may be few instruments like PPF which may be offering higher tax-free returns than the EPF post-tax returns on the amount which is taxable as per the new tax rule.

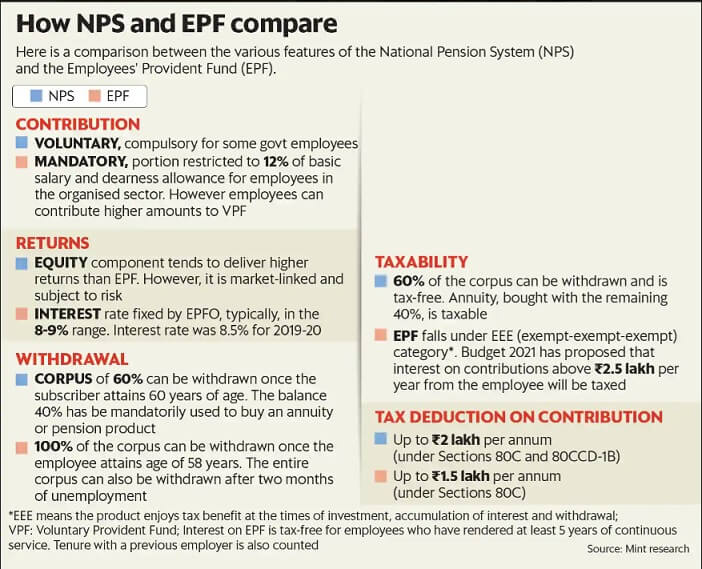

Can NPS be an alternative to EPF?

NPS is a market-linked pension system.

- Contributions to NPS are tax-deductible up to ₹1.5 lakh under Section 80C and up to ₹50,000 under Section 80CCD(1B).

- Returns on NPS are market-linked. Returns on NPS fluctuate according to the returns on equities, corporate bonds, and government bonds. Over the past five years, equity schemes in NPS have given returns of 15-16%, corporate bond funds 9-10% and government bond funds 10-11%.

- NPS matures at age 60 when 60% of the corpus can be withdrawn free of tax, and the remaining 40% must be used to buy an annuity (regular pension) product which is taxable.

Related Articles:

The high-interest rate continues to make EPF an attractive option even though the interest earned on contributions above ₹2.5 lakh is taxable.

As per the scenario after the budget, a salaried individual must first invest ₹2.5 lakh in EPF and VPF. Then, he/she can contribute ₹1.5 lakh to Public Provident Fund (PPF). If there is a surplus still, VPF will still be better than products like corporate fixed deposits post-tax. One can also invest in NPS considering the additional deduction available

Will the contributions that exceeds Rs 50K every year be maintained in a separate bucket and gets accumulated and interest earned on this get taxed every year?

Or will the tax on interest income be applicable only for the contribution made for that AY and the future interest (later years) will not be taxed?

Regards

Good questions.

Things are still not clear.

Will update the article as we get more information