This article list some common EPF and UAN problems and their solutions such as the name and date of birth in UAN account is not correct, father’s name is missing or incorrect. This can then result in unnecessary delays and hassles when you try to withdraw the money at the time of retirement. There are other questions too like Is PAN mandatory? Will TDS be deducted? How much amount will I get on EPF withdrawal?

Table of Contents

Incorrect Date of Birth in EPF

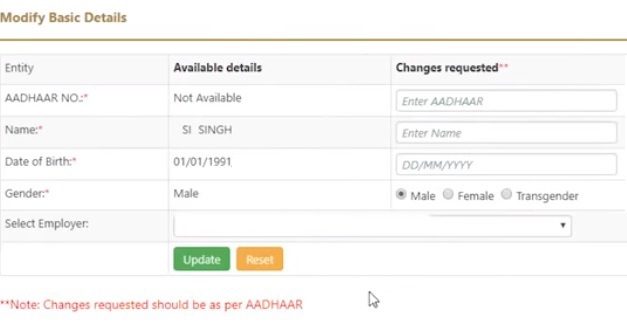

if Aadhaar is not available/verified on UAN website for an employee then employee himself can change one’s name, date of birth and Gender online by logging to UAN website. It is possible from 2019.

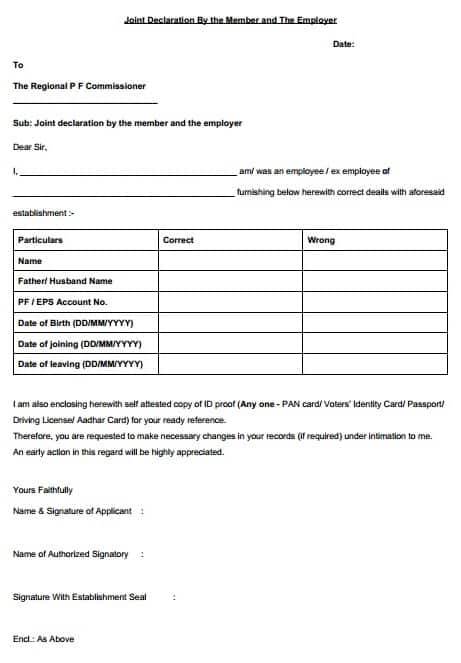

if Aadhaar is verified then the employee needs to submit EPF name change application, Joint declaration through his employer along with self-attested supporting documents. The format of the Joint declaration is shown below. You have to fill in the application. Give it to your employer with a self-attested hard copy of one of the documents given below. Employer will sign it and put the company seal. The Employer will then submit it to the EPFO office. The employee can also submit it. Details here

The Joint Declaration form should be attached with one of the documents given below. It should be self-attested.

- Voter Identity Card

- Passport

- Driving License

- Aadhaar Card

For a person who had studied below 10th standard and do not possess a passport or a birth certificate, then their update request for the same would not be entertained. Under such a situation, people can write to the Labour Ministry, Labour Minister, and PF Department. The Supreme Court has said that even if Aadhaar is not linked to the account, the benefits of a scheme cannot be stopped.

How to correct Date of Birth in EPF Online

if Aadhaar is not available/verified on UAN website for an employee then In 2019 you can change your name, date of birth and Gender online. Our article EPF Change online: Name, Date of Birth, Gender explains it in detail.

- Go to UAN website, https://unifiedportal-mem.epfindia.gov.in/memberinterface/, and Login in with your USERID & Password

- Click on Manage and then Click on Modify Basic Details as shown in the image below.

- If the difference between the date of birth in EPF and the actual date of birth is less than 1 year then details in Aadhaar are OK.

- If the difference between the date of birth in EPF and the actual date of birth is more than 1 year than the old date of birth then you need to submit online upload one of the following document: Education certificate(ex: 10th class certificate), Birth certificate, Passport,

- The change request then has to be approved by the employer

- Then request has to be approved by the EPFO office

- It takes around from 1 week to 30 days for changes to reflect on the UAN employee & employer website.

How to fill Father’s Name missing in EPF account?

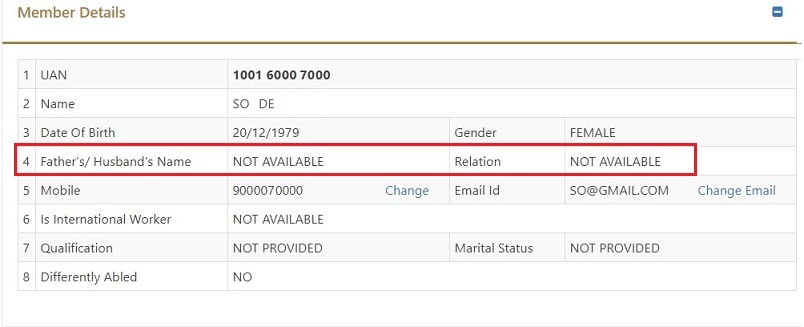

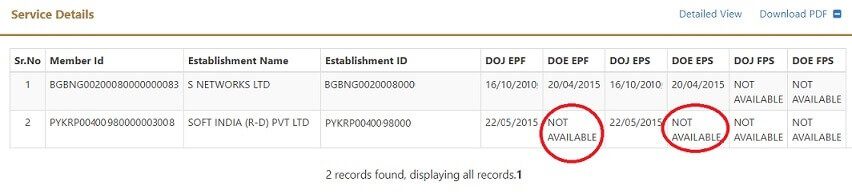

If Father’s name is missing, as shown in the image below, then ask your employer. The employer can add Father’s name for an employee through the employer’s UAN site as explained in the article How to get UAN Missing details updated by Employer

The employer will login to employer UAN website using his company’s login and password. The Employer website is unifiedportal-emp.epfindia.gov.in/epfo/ while employee UAN website is unifiedportal-mem.epfindia.gov.in/memberinterface/

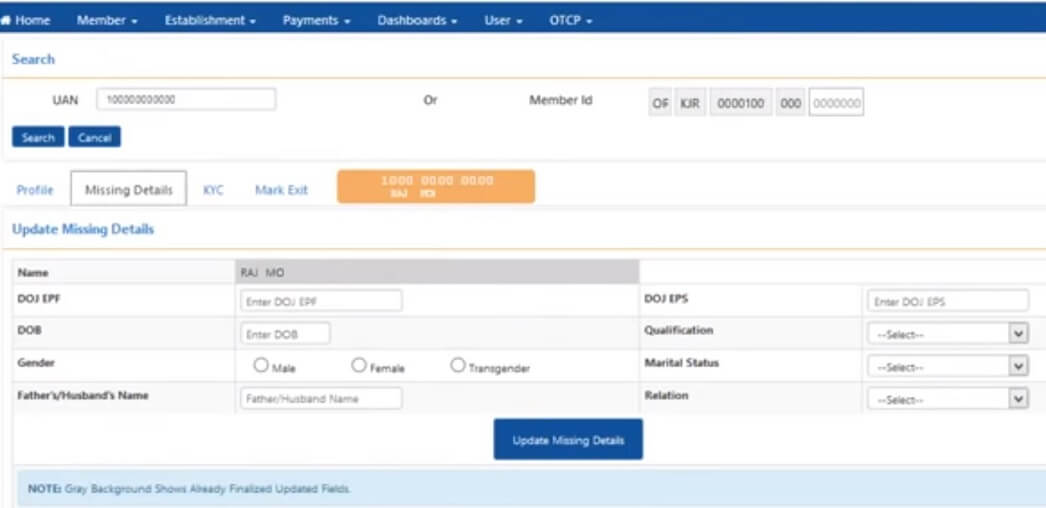

He will then search for the employee using UAN or PF account number.

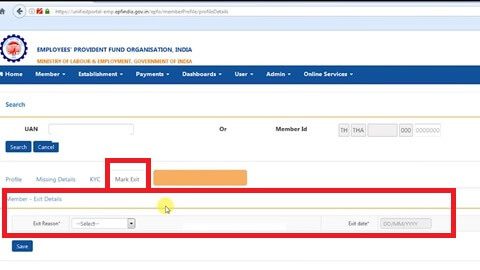

Information about an employee is available in Four different tabs, Profile, Missing Details,KYC, Mark Exit. Employer will go to Missing Details Tab as shown in the image below.

After entering the missing details. he will click on Update Missing details.

How to correct Father’s Name in the UAN account?

If the father’s name is incorrect then correction of the father’s name cannot be done online. To fix the issue, a joint declaration form (Employee + Employer) is required to be filled. The format of the Joint declaration is shown below. You have to fill in the application. Give it to your employer with a self-attested hard copy of one of the documents given below. Employer will sign it and put the company seal. The Employer will then submit it to the EPFO office. The employee can also submit it.

The Joint Declaration form should be attached with one of the documents given below. It should be self-attested. Please check that in the document Father’s name is mentioned. Note Husband’s name

- PAN Card

- Voter Identity Card

- Passport

- Driving License

- Aadhaar Card

The sample form of the correction in EPF details is shown in the image below from our article How to Correct EPF Details like Name,Father Name,Date of Joining

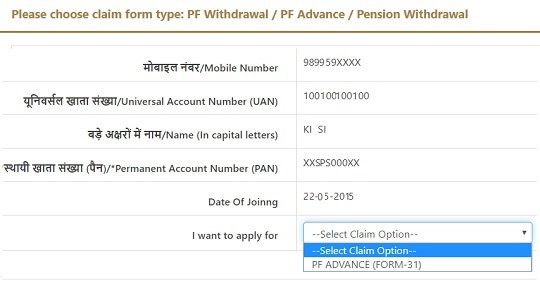

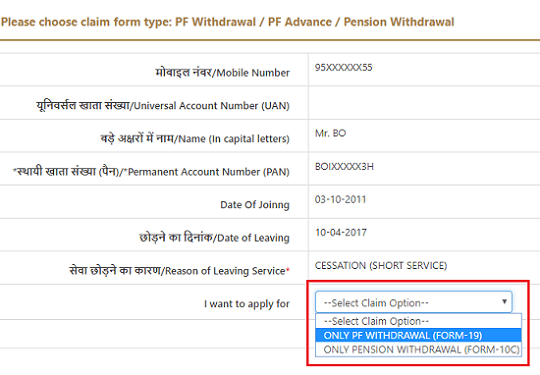

Why can I only see the PF Advance (Form 31) and not PF Withdrawal forms 10C and 19?

Form 10C (for Pension) and 19 (for PF) are for withdrawing from EPF after leaving the job i.e final settlement of the PF. The final settlement is only possible when your employer has marked your date of exit. Please request your employer to mark the date of exit, after which you can withdraw.

If your employer has not marked your date of Exit then the PF department would think that you are still employed at the organization. In this case, you will only see one form i.e. Form 31 which is advance refund, as shown in the image below. Therefore, it is necessary that one should ask the employer to mark the date of exit.

How to update Date of Exit in EPF on UAN website?

Date of exit can only be updated by the employer. This was not possible at the employee end.

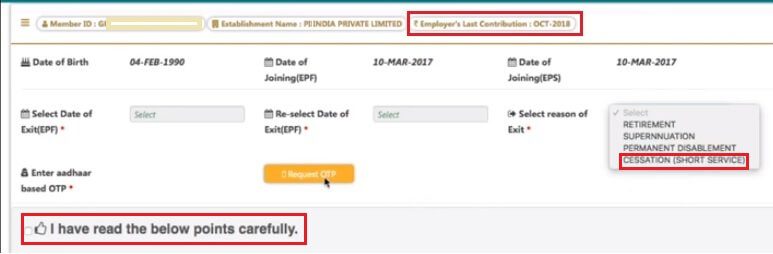

From Jan 2020, EPF has introduced a new feature in UAN website for employees, Now an EPF member can update his date of exit(DOE) in the UAN website without the help of an employer after 2 months of leaving the job. The date of exit gets updated instantly. No employer approval, No EPFO approval is required. Our article How can an employee Update Date of Exit in EPF in UAN himself Without Employer explains in detail, an overview is given below.

- Step 1: Login in your UAN member portal, and go to menu Manage and select Mark Exit

- Step 2: Select your Employment i.e Your latest Member ID.

- Step 3: Enter your date of exit in two places. You are not required to mark the exact date of exit.

- You can mark date within 15 days after the date of leaving of job.

- Check the last contribution month in the page(shown by the red box in image) or download your passbook and find latest Provident Fund contribution month. Enter last date of that month.

- Step 4: Select the reason for the exit, You have to select any of the Reasons given below. In most cases, one would select Cessation (Short Service)

- Step 5: Click on Request OTP option. OTP will be sent to your registered mobile number

- Please select the checkbox for Terms and Conditions. Please understand the terms and conditions given below. If satisfied finally click on the updated date of exit.

How employer marks date of exit?

To mark the exit date, an employer has to login to the EPFO employer portal and mark the date of exit, the reason for leaving the organization.

What to do if the Employer not updating Date of Exit or KYC?

If the employer is not updating the date of exit or updating the KYC. You should try to request the employer first. If possible, try to have written/email proofs.

If even after multiple requests to an employer he doesn’t update then

- you can raise a complaint online on EPF grievance website or

- write a complaint o the regional EPFO commissioner with details about the Company Name, Established ID, etc through email or by visiting the EPFO office. The EPFO will investigate the matter against your establishment. You can get Regional office details from the EPF website, an example of which is shown below, as discussed in the article How to find your employer’s EPFO office and EPFO office Phone Numbers

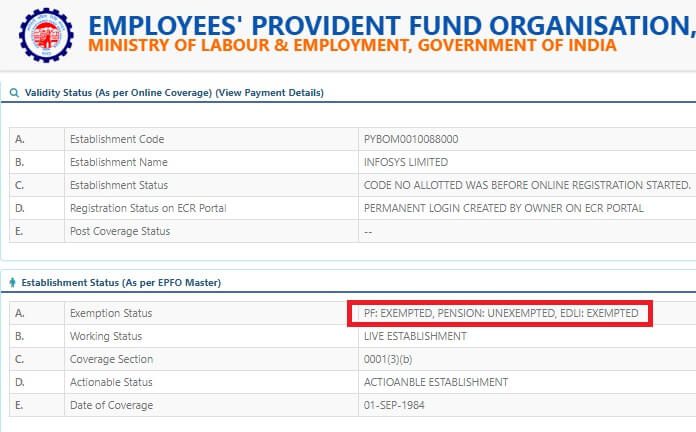

EPF Withdrawal Error: Your establishment is exempted from EPF, contact your trust

If you try to do EPF withdrawal and get the error that Your establishment is exempted from EPF, contact your trust. This error signifies that your PF account is managed by your own company as a trust and not the EPFO office. Our article EPF Private Trust, the Exempted EPF Fund talks about it in detail.

Currently, there are more than 1,500 companies that operate their own PF trusts. Some of the big companies that operate their own PF trust include Nestle India Ltd, HDFC Ltd, Glaxo (I) Ltd, Godrej Industries Ltd, Infosys, TCS and Steel Authority of India Ltd (SAIL) etc.

If your EPF is an exempted trust then The employees of companies with EPF trust cannot see their passbook on EPF website as the employer or Private Trust does not deposit money to EPFO. The Company provides them with this information through payslips, company own website.

For example

- Wipro employees can view their PF contribution by logging into an internal site called My Wipro -> MyFinancial->Reports->PF. One can contact PF team at pf@wipro.com along with his employee ID and exit details to withdraw.

- TCS employees have the Ultimax website, where an employee can fill his personal details, bank details, time sheets etc. In the Ultimatix portal go to my documents column. You can check your PF balance there.

To Withdraw from the Exempted trust have to contact your company HR and submit appropriate forms.

However, Pension or EPS is with the EPFO Department. You can submit the filled form to the employer or do it online from UAN website.

To find whether your company is exempted trust or not you can follow the steps mentioned below, from our article How to find your employer’s EPFO office and EPFO office Phone Numbers

- Go to http://www.epfindia.gov.in/

- Click on Our Services->Employers

- Click on Establishment Search

- You can enter the Establishment code/ name of the office

- Enter Captcha

- Click on Search

- Select your company

- Click View Details on the company. You will see Validity Status and Establishment Status.

- In the Establishment Status. if Exemption Status is unexempted then the details are with Regional EPFO office. If the status is exempted then the EPFO is maintained by a private trust.

Which Form to Fill to withdraw from EPF?

- Form 19 is filled for withdrawal from EPF.

- Form 10C is filled for pension withdrawal

- Form 31 is filled for partial EPF withdrawal or EPF Advance.

How to Withdraw EPF online

To withdraw PF online you need to fill in both Form 19 and Form 10C.

You can claim your PF online only if you meet the following conditions :

- You must be allotted a UAN number and it should be activated

- Your mobile number must be registered with the UAN

- Your bank details must be seeded into the UAN

- Your PAN and Aadhaar should be seeded into the EPFO database

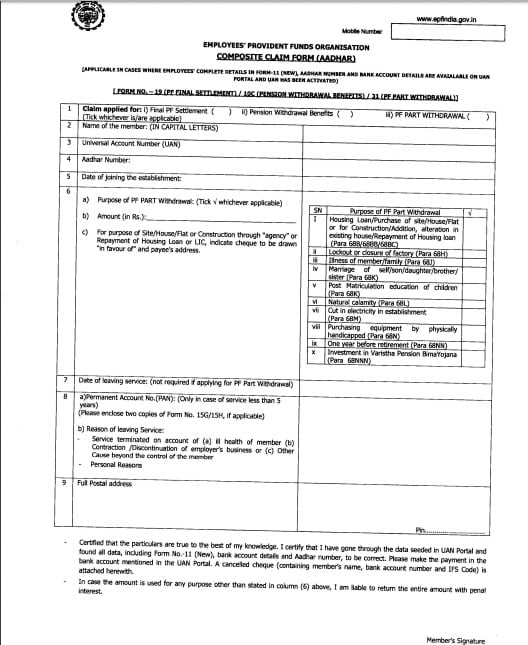

How to Withdraw EPF offline

However, only the Composite Claim Form has to be filled for withdrawing funds offline.

Composite Claim Form is a combination of Form 19, Form 10C and Form 31. You can download the new forms from here (pdf): Aadhar based Composite Claim Form, Non-Aadhaar based Composite Claim Form. EPF New Composite Claim Forms by EPFO both Aadhar based and Non Aadhar based for partial and full withdrawal from the EPF. EPF Composite Form Aadhaar based is shown below

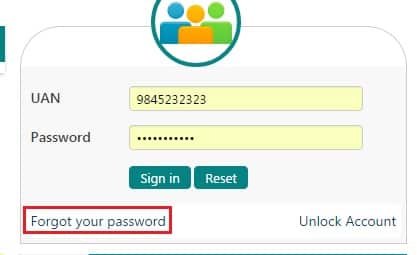

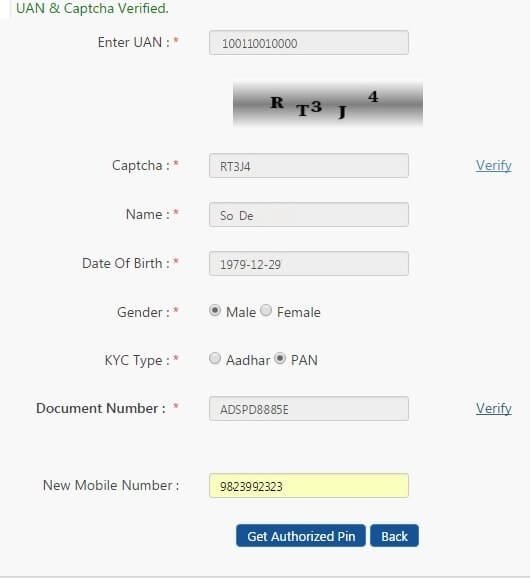

Lost Mobile Number and Forgotten Password

UAN gives the facility of changing the mobile number if you have forgotten the password and your mobile number has changed. Our article Change Mobile Number in UAN if forgotten Password and Mobile Number Changed talks about it in detail. This works only if the details you enter Your Name, Date of Birth and Gender matches the UAN database. Else you will get an error message. In that case, contact your employer for the details of your UAN.

- Go to UAN website of EPF at UAN New Website

- Click on Forgot Password.

- Enter your UAN number and Captcha. Click on Verify.

- The mobile number mapped to your UAN will be shown. If you want to change the mobile Number you can click on No.

- You will see the screen asking for your Name, Date of Birth, Gender, KYC Type, and Document Number. Enter your details. Click on Verify near the Document number.

- After details are verified. You can enter your new Mobile number and get OTP in it.

- Then enter your Password twice.

- You will see Password changed successfully message. You can click on Login to log with your new password.

Is PAN mandatory for EPF?

If the PF amount is less than 50,000 then PAN is not mandatory. But if PF amount is more than 50,000 Rs especially if you have worked for less than 5 years. Else TDS will be deducted. TDS will be deducted at the rate of 10% if PAN is provided and 34.608 % if PAN is not provided. Please note the following as explained in our article EPF Withdrawal before 5 years,TDS,Form 15G,Tax and ITR

if you withdraw your PF balance before the expiry of five years of contribution, then it is taxable in the year in which you withdrew.

- Your employer’s contributions along with the accumulated interest amount will be taxed as “profits in lieu of salary” under the head Salary. However, relief under Section 89 will be available.

- Interest accumulated on your (employee) contributions will be taxed under the head “Income from other sources”.

- The tax deductions claimed on your contributions to EPF will be revoked or rolled back, and shall be liable to tax.

Tax, TDS and EPF

Table on taxability on withdrawal of EPF

The following table will help you easily understand the taxability on withdrawal of EPF:

| Sl No | Scenario | Taxability |

| 1 | Amount withdrawn is < Rs 50,000 before completion of 5 continuous years of service | No TDS. However, If the individual falls under the taxable bracket, he has to offer such EPF withdrawal in his return of income |

| 2 | Amount withdrawn is > Rs 50,000 before completion of 5 years of continuous service | TDS @ 10% if PAN is furnished; No TDS in case Form 15G/15H is furnished |

| 3 | Withdrawal of EPF after 5 years of continuous service | No TDS. Further, the individual need not offer the same in the return of income as such withdrawal is exempt from tax |

| 4 | Transfer of PF from one account to another upon a change of job | No TDS. Further, the individual need not offer the same in return of income as it is not taxable. |

| 5 | Before completion of 5 continuous years of service\ if employment is terminated due to employee’s ill health The business of the employer is discontinued or the reasons for withdrawal are beyond the employee’s control | No TDS. Further, the individual need not offer the same in the return of income as such withdrawal is exempt from tax

|

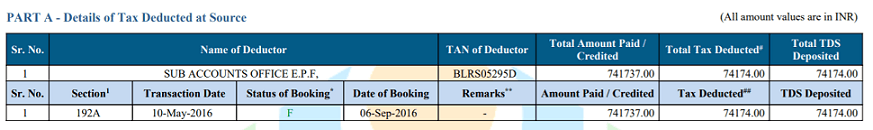

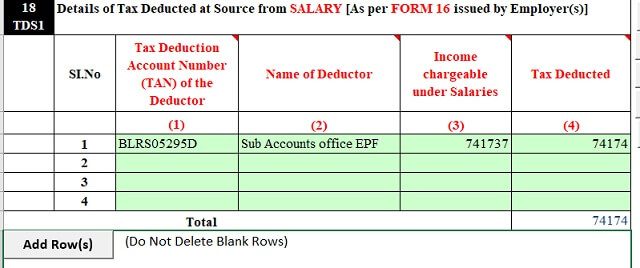

TDS on EFP Withdrawal before 5 years

If you have worked for more than 5 years EPF withdrawal is Tax-Free and no TDS should be deducted. But many times TDS is deducted. EPF expects Form 15G/15H but there is no way to send it online. Some people have emailed the Filled Form 15G/15H to the Regional EPFO office and some have submitted it through EPF grievance site. Sample Filled Form 15H for EPF Withdrawal can be found here. Regional EPFO email id can be found as explained here.

If the TDS deducted you need to show it in the ITR as TDS deduction.

If EPF Withdrawal is more than 5 years show the full amount without TDS as exempted income

Can I withdraw from old PF account, while currently working

In case you are working currently, officially you cannot withdraw from your old PF account. You must not be working for atleast a month, Date of exit has been updated by employer as explained in Online EPF Withdrawal: How to do Full or Partial EPF

You should transfer your old PF amount to your new PF account. We highly recommend you to transfer your old EPF account for the following reasons: Our article How to Transfer EPF Online on changing jobs explains it in detail.

- PF is for your retirement. Let compounding increase your PF amount.

- Your Service Period includes both old and new service period.

- This helps to decide if the contribution to EPF is less than 5 years or not. EPF withdrawal after 5 years is tax-free.

- Helps in Pension calculation as Pension depends on the number of years you have worked.

- Your PF accounts get merged. So when you finally want to withdraw, you need to submit only one EPF withdrawal requests, for all the EPF accounts, to your last employer. Else you cannot withdraw from old EPF account online. You would to do it offline and need to visit the EPFO office

Should I transfer my EPF account from old employer to new

One has to transfer old PF account to the new account. Only then will you be able to withdraw from both the accounts online. Linking of PF account with UAN is not sufficient. EPFO plans to merge the PF accounts automatically when one changes job but it has been in pipeline from some time so till then do an employee has to do manually. Explained in detail in Why should one transfer old EPF account to new employer?

- If you leave 2nd organization and withdraw then you will be able to withdraw from only the current i.e second organziation. To withdraw from the first employer you would have to approach the first employer and do it offline. This becomes time-consuming.

- Old EPF account will be considered as inactive. It will earn interest but you will have to pay tax on it. It will also show in Form 26AS.

PF interest not credited

PF interest should be credited by Apr but from last year PF interest is not being credited in Apr. Last year PF interest credited started in Sep 2018.

How many days to get money after EPF claim?

When an employee applies for EPF claim online then it takes 3-30 working days to get the PF amount into the bank account. When an employee applies for the claim in offline mode then it takes 20-30 working days. It depends on the Regional EPFO, how fast they handle claims and how busy is the Regional EPFO office or how good are the employees?

You can track your EPF Withdrawal Claim through UAN website or EPF website.

- Login to UAN site with your UAN and password. Go to Online Services -> Track Claim Status

- By clicking on the link on EPF Website https://passbook.epfindia.gov.in/MemClaimStatusUAN/and entering your UAN and Captcha.

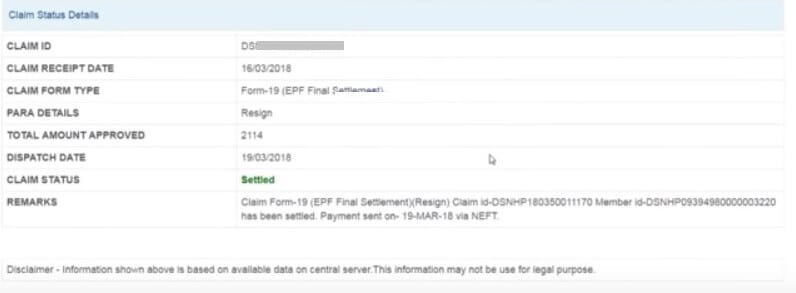

Once EPF settles the account the EPF site shows the message about the account being settled with the date of NEFT amount but often amount gets credited after 2-3 days. For example, Claim receipt is for 16 Mar 2018, Dispatch Date is 19 Mar. But the amount is credited 2-3 days after the NEFT date mentioned in the Status on EPF site.

Our article After EPF Withdrawal : Claim Status, How Many Days To Get PF Amount explains it in detail.

When you don’t get your EPF Withdrawal money though it shows Settled

If the claim is settled and many days have passed please verify that bank account number is correct, IFSC code is correct. After logging on to UAN Website (https://unifiedportal-mem.epfindia.gov.in/memberinterface/) you can click Manage->KYC to see your details.

What if the bank account is closed/or bank details don’t match due to name mismatch or number of digits or incorrect IFSC code? Once NEFT fails then EPF amount will be credited back to the EPFO bank account within 4-6 days.

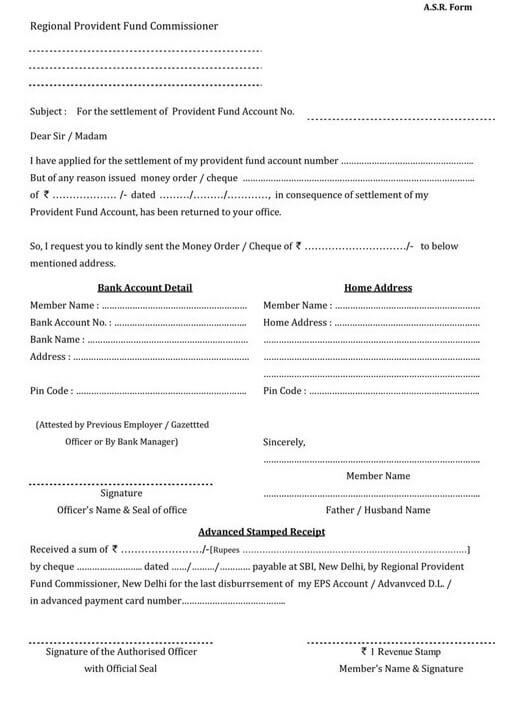

In such case does one need to reapply for the EPF withdrawal? No. The solution is to submit the reauthorization letter or ASR i.e Advanced Stamped Receipt Form to the Regional EPFO office offline with correct bank details and cancelled cheque leaf, shown in the image below. After submitting EPF re-authorization letter, it takes 10-15 days to credit your EPF amount to the correct bank account. It is explained in detail in our article When you don’t get your EPF Withdrawal money though it shows settled

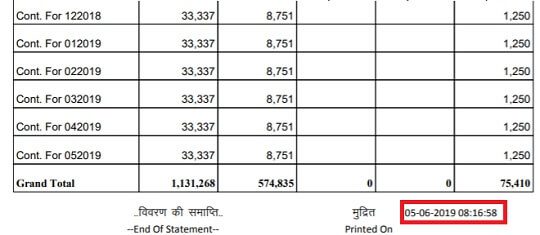

How much money will I get on EPF withdrawal?

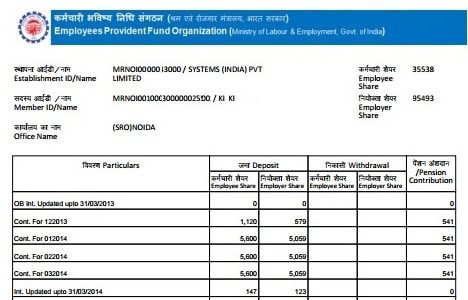

When you claim EPF Withdrawal check your passbook. Look at the Grand total column at the bottom of the passbook.

- From the EPF contribution, You would get both the Employee’s Share and the employer’s Share, mentioned in the Grand Total plus any interest due. If you have contributed for 5 years in EPF then there is no tax deduction but for less than 5 years TDS is deducted is no Form 15G/15H is submitted.

- from the Pension or EPS contribution, you will

- Not get any money if you have worked for less than 6 months

- Not get Pension amount but will get Scheme Certificate if you have worked for more than 9 years and 6 months. On reaching the age of 50 years you can claim Pension.

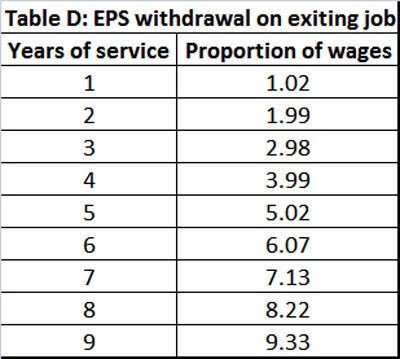

- If the total service of the employee is less than 9.5 years and the age of an employee is less than 50 years of age then only one can withdraw the EPS amount But unlike EPF which when you withdraw you always get 100% of your EPF part, for EPS withdrawal amount depends on number of years worked and maximum salary is considered as 15,000 (as maximum of Rs 1250 per month is contributed to EPS) based on Table D, shown below.

- So if Ms Priya Sharma’s monthly salary is Rs 40,000 per month but for purpose of pension, only 15,000 is considered. If she withdraws after 3 years her pension withdrawal amount will be= Proportion corresponding to 3 years of service from Table D *15,000= 2.98 * 15,000 = 44,700

Whom to complain about EPFO

- You can raise it with EPFO on their social media platform. We would suggest that you do so after raising the grievance. Social media accounts of EPFO are

- You can complain through the PF Grievance Portal. Our article How to register EPF complaint at EPF Grievance website online explains it in detail

- If this does not work then you can write to the Regional PF Commissioner and keep a copy with yourself. You can find Email id of Regional PF Commissioner as explained here.

- If this too does not work, you can file Right to Information (RTI),

- Or go to Consumer Court for the redressal.

Related Articles:

- EPF Change online: Name, Date of Birth, Gender

- How to get UAN Missing details updated by Employer

- How to Correct EPF Details like Name,Father Name,Date of Joining

- EPF Private Trust, the Exempted EPF Fund

- How to find your employer’s EPFO office and EPFO office Phone Numbers

- Change Mobile Number in UAN if forgotten Password and Mobile Number Changed

- How to Transfer EPF Online on changing jobs

These are some of the frequently incurred PF problems. In case you are facing any other problem, please let us know through the comment section below.

why i am getting this error when i am trying to merge two account under same UAN number for claim: invalid employer , please enter valid data.

why this error coming and how to rectify it

Can you send screenshots of your service history etc to bemoneyaware@gmail.com

This much information is not sufficent

hi

i dont UAN number and not linked adhar card last company shutdown so how can i now my UAN number how to withdraw PF account i workd 2years compa how to take

What details do you have? Provident Fund number?

My father name problem

Sir mera uan no 100872518895 hai date of exit sudhar nahi hua hai 30-11-2016 Karna hai join decaletion from Jama kiya hu 27-02-20 ko sir Se mera request hai. mera sudhar karne ka kirpa kare

Please raise EPF complaint as explained in the article

http://bemoneyaware.com/epf-grievance-complaint-online/

Hello .. i recently gone through your all articles its really so informative. Thanks for advance.

I have 2 queries please help to resolve

1. Whenever i am going on online services @EPF portal its showing message that your bank acoount detail is also linked with (1001××××××) another UAN, definitely this is not mine because its my 1st job and i am having only 1 UAN than how can linked another UAN with my bank details. now please advice how to cope up with this problem.

2 in my 10th marksheet my father name is mentioned without sirname and same is mentioned in EPF record, later on my all documents like aadhar and Pan, fathet name is mentioned with sirname. I wana know i have to add sirname in EPF data and if yes then how can i do.

Regards

GS

1. This is something new that has been showing up with latest update in UAN website.

Can you Attach another bank account to this UAN. For this, you need to add another bank account in UAN website in KYC and get it approved by the employer.

Talk to your employer and tell him your problem. Some incorrect data entry has been done.

2. Is your Aadhaar verified then you can’t edit the details. To fix the issue, a joint declaration form (Employee + Employer) is required to be filled. The format of the Joint declaration is shown in our article How to correct Father’s Name in the UAN account?

Call me on 9868082898 for File Form No-19(PF withdrawal), 10C(Pension withdrawal Benefits), Form No-31(PF Advance) or any EPF or EPS related problem

Hi,

While trying to update exit date for organization which I left in sep-2016 in epf account it is showing no last contribution contact your employer. What to do?

Check the passbook, what is the last month that is mentioned in it.

My date of exit didn’t upadate whn i updating its showing ..no contribution made by employer . actually i want to withdrawal my full amount. earlier i withdrew advance amount but i want to withdrawal remaining amount.so why should i do.

employer entered interchanged name as per aadhar, not approving now.

what should do?

You can try to talk to the employer

You can raise a complaint in EPFO through their grievance site as explained http://bemoneyaware.com/epf-grievance-complaint-online/

I have all the details uploaded correctly. Father name is also correct but claim got rejected with the note- father name differs in claim form and kyc please check” please advise what should I do??

Check the details in UAN.

If things are correct, raise a complaint as explained in http://bemoneyaware.com/epf-grievance-complaint-online/

Mobile number dose not match with the avablel data. I want know my uan number and status. Please reply me.

Check with your employer as to what mobile number have they linked with your UAN

Hi,

I am unable to add find my previous Employment details in my UAN dashboard. Also let me how to Withdraw Money from my Inoperative Pf account of previous Employment. Thanks.

100574106103 Father name mismatch New name update

(MUNIRATHINAM)

My.uan.no.100910145059.PF NO.TNAMB00661290000000124.my porblam.Name of date of bihrt.of.mobail.no my corrcte name.sunil.date of birth.10/01/1990 .mobilel no.9416752416

Call me 9868082898 for file claim PF form 19 and 10C/Advance 31

101443410728

My.uan.no.101105923082.my porbalam.Name of date of bihrt.of.mobail.no my corrcte name.Lalu prsada.date of birth.23/07/1993 .modail no.9713553970