I had transferred my EPF account from my old organization to the new company. While EPF transfer was reflected in the UAN passbook there was no information about EPS transfer. I checked my UAN passbook of both the old account and new account Pension contribution was 0. What happened to my EPS during the transfer? Did I not fill some form? Did I lose the amount? were some of the thoughts that plagued me. After searching and digging I found that EPS depends on the length of service detail and that is all EPS needs to decide the Pension. The Service history information is captured in View->Service Details section of the UAN. You can get Annexure K from EPFO by raising EPF grievance for record purposes. This article details the transfer of your old EPF account to a new employer, What is Annexure K of EPF? Scheme Certificate and EPF Transfer, and EPS Pension.

Table of Contents

When you transfer your old EPF account to a new employer

An employee should transfer his provident fund Using EPFO’s online facility from the previous employer to a new employer. You can do it offline and online. Online you can transfer from the EPFO UAN Portal using Online Services->Transfer Request. To use the facility one must have their KYC approved in the UAN and Employer should have a digital signature. The Employee has to get his claim attested by the current or the previous employer.

Our article How to Transfer EPF Online on changing jobs explains the process in detail.

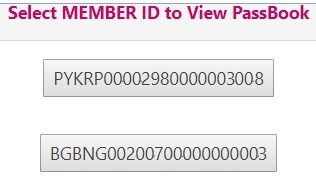

I had transferred my EPF account from my old organization to the new company. While EPF transfer was reflected in UAN passbook there was no information about EPS transfer. In my UAN passbook of both the old account and new account, Pension contribution was 0. The 2 passbooks of EPF site for unexempted trusts are shown below. You might have more depending on how many EPF accounts you had. Exempted Trusts passbook is not available on the net.

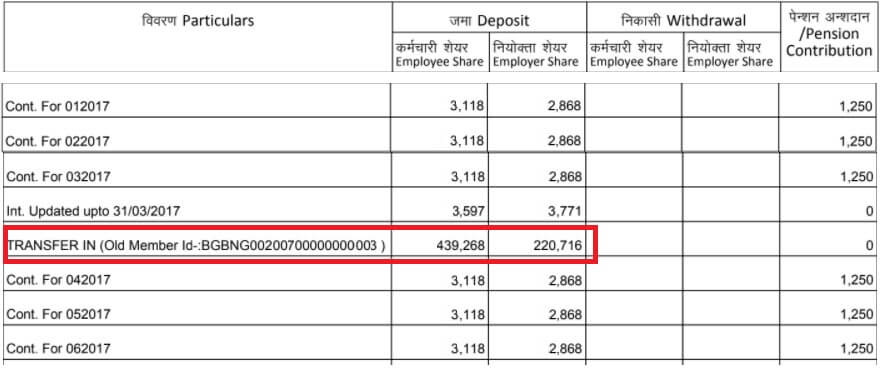

The image below shows the Transfer In to the new passbook. Note Pension contribution column is 0.

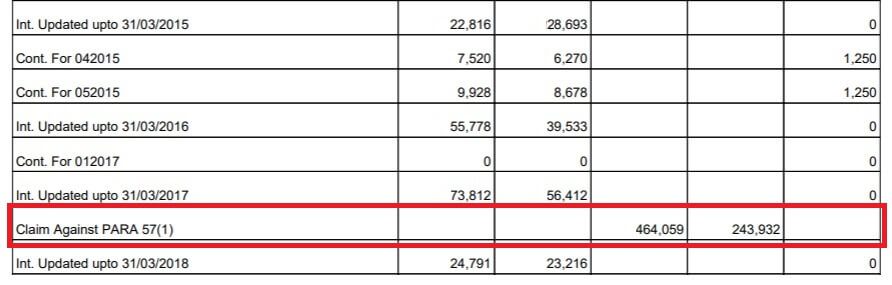

Old passbook which shows the transfer out.

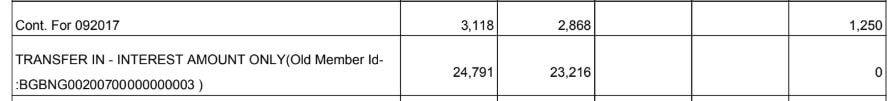

If you look carefully, the transfer In and transfer out amounts do not match. Transfer In was 439,268 and 2,20,716 and Transfer-Out was 464,059 and 2,43,932. Difference was 464,059- 439,268 = 24,791 and 2,43,932-2,20,716=23,216 which is due to interest earned on the EPF amount for Year 2018 as shown in the image below.

Actually, there were two entries for Transfer In. One was for the EPF employee and employer, 439,269 and 220716. Another later in Sep 2017 interest for the EPF with the old employer was also transferred.

EPS Transfer: What happened to my EPS during the transfer?

What happened to my EPS during the transfer? Did I not fill some form? Did I lose the amount? were some of the thoughts that plagued me. I followed up with my finance time and they had no idea. I checked with my colleagues and did not get any concrete answer. I googled, I asked but not much of help. I asked UAN helpdesk(which was functional then but is non-functional since Nov 2017) and got the following response

“WHILE TRANSFERRING PF FROM ONE ESTABLISHMENT TO ANOTHER, THE SERVICE DETAILS INFORMATION (VIZ LENGTH OF SERVICE, NON-CONTRIBUTORY PERIOD, LAST WAGES DRAWN ETC) ARE FURNISHED TO THE RECEIVING PF OFFICE IN ANNEXURE-K WHICH WILL BE USED TO CALCULATE PENSION BENEFITS. AMOUNT IN PENSION FUND IS NOT REQ”.

Our article UAN helpdesk explains how to get common UAN problems solved such as What is UAN status? How to get Date of Birth Corrected?

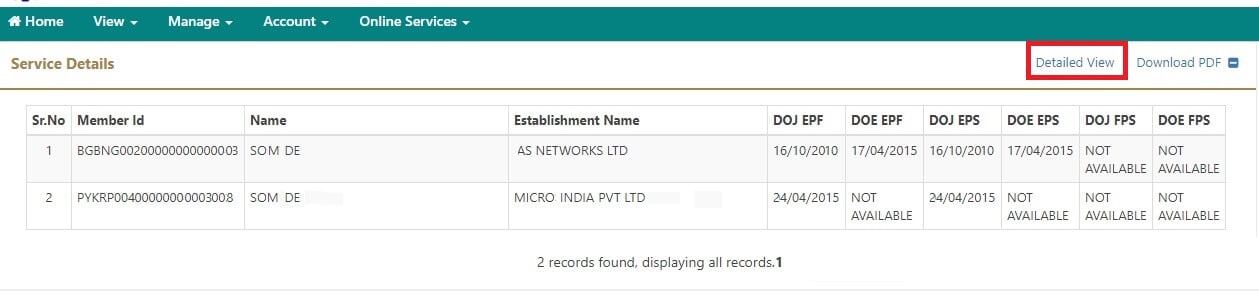

The Service history information is captured in View->Service Details section of the UAN, as shown in the image below

What is Annexure K of EPF? How is it related to EPS transfer?

Annexure-K of EPF is a document which contains details of EPF account. It is internal document sent between regional EPF offices during transfer of the accounts. It is especially useful during the transfer of EPF from exempted private trusts. The private PF trusts maintain their workers’ PF money and account themselves. They are called exempted establishments because they don’t have to file PF returns.

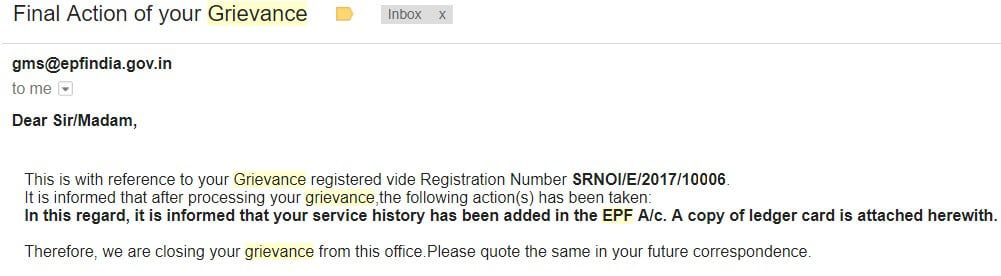

Anyone can get the Annexure-K by raising the grievance.

- Visit http://epfigms.gov.in/

- Click on the Register Grievance to register EPF complaints. To lodge the complaint you must have your EPF UAN number. This has been made mandatory from 1 January 2016.

- Our article How to register EPF complaint at EPF Grievance website online explains the process in detail.

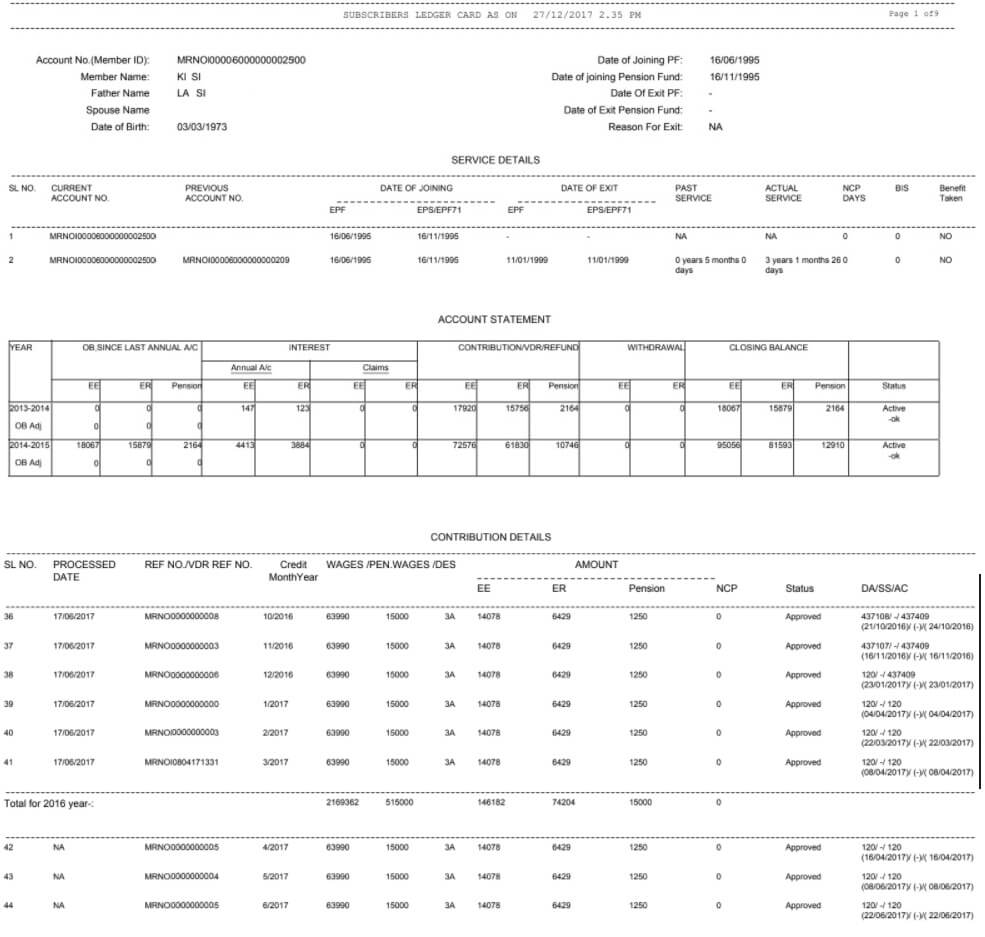

Sample Annexure-K is shown below.

Scheme Certificate and EPF Transfer

I have worked for 10 years. When I transferred by EPF I did not get my scheme certificate?

If you have worked in an organization for more than 10 years and you want to withdraw from EPS you will not get your money but would get an EPS Scheme certificate, which you can use at age of 58/60 years to EPFO to get your pension. When you transfer your EPF you do not get scheme certificate.

EPS Scheme certificate is a certificate issued by the Employees Provident Fund Organisation(EPFO), Ministry of Labour, Government of India. stating therein the details of service of the PF member. The EPS Scheme Certificate shows the service & family details of a member who is eligible to get provident fund pension in case of death of the member. Scheme Certificate is also an authentic record of service.

Our article What is EPS Scheme Certificate? explains it in detail.

EPS Pension

Employees’ Pension Scheme (EPS) of 1995 offers pension on retirement, disablement, pension to widow and pension for nominees. Pension depends on your contribution to Pension Fund and your years of contribution to EPS.

- A lifelong pension is available to the member and upon his death members of the family are entitled to the pension.

- You may be drawing a very high salary, but your contribution to Pension Fund will be only Rs. 541 and after Oct 2014 Rs 1250 max. This is because, as per EPF scheme, the employer has to remit 8.33% of actual salary or of Rs. 6500(before Oct 2014) or 15,000 whichever is minimum. If your contribution in terms of amount or number of years is less, your pension will be less.

- Unlike the EPF contribution EPS contribution does NOT get any interest.

- An employee can start receiving the pension under EPS only after rendering a minimum service of 10 years and attaining the age of 58/50 years.

- Early pension can be claimed after 50 years but before the age of 58 years. But it is subject to discounting factor @ 4% (w.e.f. 26.09.2008) for every year falling short of 58 years. In case of death/disablement, the above restrictions don’t apply.

- For those who joined after 15 Nov 1995, the formula for calculation of Pension is,

- EPS Pension = Average Salary x Number of Years Service /70

- If you withdraw your EPS from an earlier job, through Form 10C, then earlier years of service will not be counted.

Our article How much EPS Pension will you get with EPS Pension Calculator explains the EPS Pension

Conclusion of what happens to EPS on the transfer of EPF

For those who joined after 15 Nov 1995, the formula for calculation of Pension is, EPS Pension = Average Salary x Number of Years Service /70

You may be drawing a very high salary, but your contribution to Pension Fund will be only Rs. 541 and after Oct 2014 Rs 1250 max. This is because, as per EPF scheme, the employer has to remit 8.33% of actual salary or of Rs. 6500(before Oct 2014) or 15,000 whichever is minimum.

Unlike the EPF contribution, the EPS contribution does NOT get any interest.

When you transfer your EPF, EPS amount will not be reflected in your passbook. But you will get your pension based on the number of years you have contributed, which one can find out from View->Service History of UAN website.

YouTube video on EPF Transfer

If you still want a document to see the amount in EPF, in EPS during your work life, you get request for Annexure K from EPFO using grievance.

Related Articles:

All About EPF,EPS,EDLIS, Employee Provident Fund

- How to Transfer EPF to NPS

- Basics of Employee Provident Fund

- EPF Form 11 on Joining a New Job

- Understanding EPS or Employee Pension Scheme

- EPF Private Trust

We think that EPF passbook and/or website should be improved to reflect that EPS is also transferred. What do you think? What are your suggestions to improve the EPF passbook and UAN?

Hello Sir,

I have following situation:

Previous Company A – UAN1

Current Company B – UAN2

EPF has been transferred successfully.

But, the service history of Company A is not reflecting in UAN2.

How to bring service history of Company A in UAN1 to UAN2.

Thanks,

are you able to find a solution, I have same problem

Hi Sir,

I worked L&T Infotech for 4 years and left organization in 2015, I withdrawn my PF amount(not EPS). after that i joined in CTS and worked for 1 year and left organization.

I didn’t withdrawn any PF/EPS amount from CTS. From 2016 i am not working any organization.

Now when i am trying to withdraw PF amount through online(EPFO site), my claim got rejected with comments “member is advised to contact epfo, thane and transfer eps service of L&T to CTS account and then apply for settlement.

Please let me know how can transfer my L&T EPS amount to CTS? is it possible through online. I tried contact with L&T PF department but no help.

Thanks in advance…

You need to transfer your EPF/EPS account to CTC and then apply

For details You can read our article http://bemoneyaware.com/why-transfer-old-epf-account-new-account/

I worked for NCR Cop. for little over 9 years, EPF was managed by company trust and have now moved to another organization FIS here also most likely PF is managed by company trust don’t know for sure as I have recently joined. Currently I’m in process to transfer my PF what action must I take on my EPS. Can I request to withdraw same without any impact on my PF what are pros and cons of this action.

My intention is to withdraw only EPS don’t want to withdraw my PF at all.

Not possible to just withdraw EPS. Usually, EPFO rejects the application.

I worked with Hirepro from Mar 2018 to May 2019 and in the same month i.e., May 2019 I joined with Quesscorp worked until March 2020. I kept transfer request of PF amount transfer from Hirepro to Quesscorp in which only employee and employer amount has been transferred. Since, my LWD was on March 2020. I raised claim forms of 19 and 10C for which I successfully received my employee and employer contribution amount and pension amount only from Hitachi. The pension from Hirepro did not get transferred to Quesscorp PF account and it was not reflected in my claim as well. Now pension amount of Hirepro is still reflecting in the portal and passbook.

Request to help with the process of claiming pension amount from Hirepro’s PF account

Hi Admin,

I worked in 2 organizations for about 5 and 8 months in each. I have transferred the pf balance from the earlier to the second company and withdrew the balance. The reason for quitting is updated as cessation due to short service and all the withdrawal was done online under form 31,19 & 10C. Please help me understand if I can withdraw my old company pension or would that also have got transferred to the second company and if yes how do I proceed please.

For less than 6 months one cannot withdraw Pension

Dear Sir,

I Have Applied 10c EPS Transfer But They people are rejected due to Annexure K Document in the previous organisation

how to submit that annexure k document in that portal only upload cancellation cheque option only

how to withdrawn my EPS

Please Suggest Me i have urgent requirement

Regards

Murali

Did you work in a company with exempted trust?

Assuming for just 3 years, EpS contribution is not more than 45-46K. I had asked for annexure K while i see epf is successfully transferred. The Annexure K which I got is something revised and is not seen as the above posted annexure K details where EPS details were written. How to see now EPS, as this annexure K i got while lodging with the earlier PF no for the UAN.

However for the new PF number , where i also raised the grievance but could not get Annexure K.

Hi Admin,

I have query regarding EPS. I worked with 2 organisations and I have withdrawn the PF of these organisations. Though I raised Request for pension withdrawal it was rejected everytime.

I want to withdraw my pension from these two previous organisations. How to proceed?

Thank you

What does Reason for rejection says

How did you withdraw? Online/offline

How long did you work in these organizations?

When you withdrew the EPF did you withdraw the EPS i.e pension part too?

Same problem sir, please help.

Please tell me, how i can withdraw my pansion

The whole process is designed to HARRAS the common working man. This is such a shameful business being done under the hood. We must file RTI and court case to bring TRANSPARENCY to how our hard-earned money is being mishandled.

Thanks for your informative blog. Is it possible to explain how the interest period during the transfer from A to B is calculated as there seems to be some gap on how A calculates it and how B calculates it.

I have transferred my PF from company A to B. Amount is transferred in Jan by EPFO, along with interest for 9 months, i.e. Apr to Dec. In company B (which is an exempt company), I got interest only in Feb & Mar, which seems logical as the amount is transferred in Jan. Overall for last financial year, I got interest for only 11 months. Now the question is, should EPFO be paying me for 10 months, i.e. Apr to Jan? What is the right procedure in this case?

I did not find any information in this regard. Appreciate if you could clarify my query.

Dear Sir,

I have two UAN, and PF from earlier UAN has been transferred to New UAN.

But, the employment details cant be seen in new UAN view – >Service History section,

So , while calculating EPS later, it will impact right ? as my old UAN Service history is not updated to New one.

How to solve this issue ??

Thanks for your time 🙂

Did you rejoin the same organization or a sister organization?

For many, including me, who rejoined the same organization UAN site is not showing old company details.

It is a bug, we raised it in our UAN petition at Change.org

Please raise a complaint as EPF grievance and ask for Annexure K.

Details about how to raise EPF complaint here

About Annexure K here http://bemoneyaware.com/eps-transfer-epf/#What_is_Annexure_K_of_EPF_How_is_it_related_to_EPS_transfer

Our Change.org petition is here

Hi,

Is it good to withdraw EPS money or keep it for pension. Is it good to withdraw money and do a FD which can give interest amount like pension. Which amount is more in practice.

I have another doubt. I worked in a company for 8 years and withdraw my money. I did not know how EPS calculation is done so do not know I was missing 8 years service. Now I am in another company from 7 years. Is there any way I can return money back to EPFO and add my previous 8 years service. Please help.

It depends

Maximum Pension one can get is Rs 7,500 per month.

Minimum Pension one can get is Rs 1,000 per month

Our article How much EPS Pension will you get with EPS Pension Calculator explains it in detail.

If you have withdrawn your Pension amount then earlier service years cannot be added.

What did you claim: Only EPF or both EPF and Pension?

I have transferred the PF amount from my previous organization to current organization but the pension fund amount is still in the previous organization account. How can i withdraw that amount . My service of previous organization is of 1 years and now 4 months in current organization. Please advise me the procedure to withdraw it.

Hello Sir,

My Online PF claim has been rejected twice. 1st time it was rejected due to incorrect Bank IFSC code. After correcting the IFSC in UAN portal, I reapplied for Online claim again. Today the status on Unified portal says Rejected, but in Member passbook, it shows under process. How do i know the reason for rejection for the 2nd time?is there any mistake that I am doing while submitting online claim?

Wait for a few days before the status appears.

But you can file an enquiry to find out why the EPF was rejected. Process of filing enquiry is explained in our article How to register EPF complaint at EPF Grievance website online

I have transferred the PF amount from my previous organization to current oraganization but the pension fund amount is still in the previous organization account. How can i withdraw that amount . My service of previous oraganization is of 1 years and now 4 months in current organization. Please advise me the procedure to withdraw it.

Hi,

My online PF transfer claim is rejected by field office with following reason;

1) Wages more than Rs 15000/-not eligible for pension membership but ESTT remitted pension contribution

2) Certificate A/B/C/D/E/F is not enclosed / signed

My previous employer PF account was with EPFO and current employer PF is maintained by trust, due to this it got rejected? Please help

If I worked totally more than 10 years in multiple companies but not completed more than 10 years in Sigle company. I mean 5 years in company A and 6 years in Company B like wise if have worked till the age of 58. But not completed 10 years in any single company. Would I be eligible to get pension and who do I can claim and what could be the pension I get. Can you please give me the calculation.

Hi Sir,

Could you tell me under which category we should raise grievance for Annexure K for Trust to Trust transfer.

Thanks,

Sangeetha

You can choose Non transfer of PF accumulations

Hi,

I filed for EPS withdrawal as my number of employment years is less than 10. My 10C claim got rejected with remark as REJ BCZ EPS SVC DETAILS NOT RCVD FROM GN GGN 5572

I dont know what to do next. I tried to contact my previous employers but no help. I know pension is maintained by EPFO so I am guessing employers cannot help much.

Please help me out. I am unemployed now and need to withdraw my pension as soon as I can.

Please let me know if more details are needed. Looking forward to your response.

Thanks

How can I withdraw my pf and pension amount by online?

Is there any single form to fill or both form 19 and 10C need to fill separately?

How do i get the interest which credited after my previous pf balance was transferred to new pf account?

Hi All,

This is regarding my Pension transfer to current company.

I had worked in Tech Mahindra for 1 years 4 months and next in Capgemini for 1 years and 6 months.

Currently i am working in Cognizant and completed 2 years of service.

I had transferred my Tech Mahindra and Capgemini PF and it is now added to Cognizant PF. But i could see that Pension contribution done on Tech Mahindra and Capgemini is still not added to Cognizant.

I clicked Annexture K, it showed the message “No exempted to unexempted provident fund transfer claims associated with the UAN”

Please let me know when will the Pension amount can be seen or reflected to my current company Statement or will be this shown after completing 10 years of service in all togethers like (Tech Mahindra, Capgemini and Cognizant)

Hi Senthil,

I am facing the same issue. Let me know if you could find the solution to above.

I am facing similar issue post changing my job. EPF and EPS both have been transferred successfully. However, only PF amount is seen on passbook. The pension amount is still not reflected. I have raised several grievances but there is no response from PF office yet. Sad we have struggle so much for our own hard-earned money.

You will get your EPS money when either you do full settlement or on retirement.

It would be simpler if they show it in passbook but we know common sense is not that common

Hi,

I had worked in my previous company (trust) for 8 years. I have transferred my PF amount to current company (non-trust) and it is reflecting correctly. But the Pension amount is ‘0’. How can I transfer my pension amount from previous company?

Pension is always with EPFO. So you don’t need to transfer.

Login to the UAN site and download Annexure K so that you have proof of your EPF contributions.

As you have explained, the EPS amount will get calculated after I resign from my company with a service of more than 10 years; what will happen if I resign before 10 years?

I worked in a company for 1 year and I changed my company. I got my EPF transferred, while the pension amount went hidden, Now if I resign from the new company before I complete a total service of 10 Years, Will I get the EPS total amount along with the previous company balance also or will I only get the EPS amount that my present company gave me?

How many years did you work in the new company?

If total number of years in both the companies is less than 9 years and 6 months then you would be able to withdraw your EPS.

This would include EPF from earlier company too!

I have transferred the PF amount from my previous organization to current oraganization but the pension fund amount is still in the previous organization account. How can i withdraw that amount . My service of previous oraganization is of 7 years and now 4mnths in current organization. Please advise me the procedure to withdraw it.

hi sir

i worked in 2 companies 4 year and 1.6 year respectively. when i left the job from my first company & joined new company i did my pf transfer. after quitting the 2nd company, i filled my composite claim form after 2 months. i get the pf amount of both companies and eps amount of last company.

As service is less than 10 year how can i withdraw my EPS amount of 1st company which is 21000 Rs. and still jobless.

please help.

Hi,

When my new company(Sun Pharma where I had worked for 4 yrs 6 months) took over (purchased) the older company (Ranbaxy where I had worked for 4 yrs 4 months), the transfer of EPF from Ranbaxy to Sunpharma has been done. I have been provided with two Member ID . And my Service History shows details of both the Member ID.Recently ,I had resigned from my company and after 2 months I had applied for the EPF and EPS transfer and my Bank account was credited with the same EPF amount as shown in my Passbook. But the amount credited for EPS is only for my second Member ID (Sunpharma). I also tried registering grievances at EPF Grievance Website and got the response as “It is informed that your grievance is being treated as non-actionable due to the following reason(s):

Your grievance has been forwarded to section concerned for early action. “.

Now my doubt is….

a) where has my EPS amount of my first company gone?

b) Why haven’t my full EPS amount credited to my account even if my Service History is showing the details of both the Member ID?

Please help and Thanks in advance.

Dear sir plz reply,

I register a transfer request where i worked for 1 year to new employer where i left after 4 months. So my question is that..can my previous amount of eps is eligible to withdrawl or it will be lost. inbetween i also doa mistake to withdraw form 9 and 10c applied my 10 c rejected and 9 form amout credited to my bank. Still my previous amount not transfer ..when it transfered to my pf what should i have to do for full withdrawl of my previous pf money.

Hi Sir,

With regard to the 10 year period of contribution to EPF/EPS to be eligible to withdraw EPS, can you confirm if this 10 year period should be continuously with one organization OR can it also be sum of years with multiple organizations like Comp A – 3.5 years + Comp B – 5.5 years + Comp C – 1 year?

Yes, you are right.

The number of years are the number of year of contribution to EPS which can be in 1 company or multiple companies.

Thanks much for confirming it Sir.

Hi,

When my new company(CApegemini) took over (purchased) the older IT company (Igate), the transfer of EPF from Igate to CG was not done. I presumed that the company would get this Bulk transferred for the benefit of Emps. However it was not the case and now I have to request my OLD PPF office to transfer from their location (Mumbai office) to the new EPF office (Pune).

When I tried through the Online portal, however against a grievance only my new EPF no can be seen and not the OLD. so in this case, how do I make this request. Please note: Now I have resigned from CG too and not working anywhere. Please Guide.

Hi,

I am facing Multiple UAN issue where in i have worked with 3 Companies

1.) Wipro Ltd (PF account is exempted account maintained by Trust)

2.) HCL (PF account is un exempted maintained by EPF)

3.) Broadridge (PF account is un exempted maintained by EPF)

Unfortunately my second Company HCL has generated a new UAN other than the first one which i have with WIPRO. However i have raised a online transfer claim in JAN-2017 from WIPRO to HCL which has settled i can see the amount in the HCL PF account passbook but my Tenure is not reflecting in the current UAN which i have with HCL & Broadridge. In service history it is only showing HCL & Broadridge i have several Grievance from EPFO site providing them Annexure K to upload and add my WIPRO Service tenure to my current UAN but EPFO Grievance is always closed with out any action stating DOJ & DOE is already updated. Can any one please advise how to get my 1st Company Service tenure added to my current UAN Number…

Thanks for your support in advance…:)

same problem sir,

pls reply

I am also having same problem

Hi,

I worked for Wipro from Aug 2nd 2004 to Nov 14th 2008. PF was maintained by its own trust. Thereafter I moved to Cognizant and worked there from Dec 3rd 2008 to Aug 14th 2015. Cognizant was maintaining PF accounts with RPFO , Chennai. Thereafter I moved to TCS and worked there from Aug 19 2008 to Feb 22nd 2019. PF in TCS was maintained by its own trust. I recently transferred PF ffrom Cognizant to TCS. Will my pension also be transferred or there is nothing like pension transfer and only the pension is paid as per the number of years of service rendered ? I checked my years of service in EPFO online portal under View – > Service History and it only shows my employment with Cognizant. It doesnt show the employment with Wipro or TCS. Will I get my scheme certificate correctly showing my years with all 3 companies ?

Thanks,

Prathiba

Did you give the same UAN of Cognizant to TCS?

Is your transfer from Cognizant to TCS complete?

Check if TCS passbook shows old amount.

Raise EPF grievance as explained here and ask for Annexure K for your service in Cognizant.

Pratibha please initiate transfer your EPF from Wipro to TCS.

Hi,

I worked in a PF exempt establishment from Aug 2nd 2004 to Nov 14th 2008(Wipro). Then I moved to Cognizant from Dec 3rd 2008 to August 14 2015. At cognizant PF was maintained with RPFO, chennai. Then I moved to TCS from Aug 19 2015 to Feb 22nd 2019. TCS had its own PF trust. When I logged into EPFO portal and checked the Service History from View menu it shows only the employment details of Cognizant and doesnt show the employment in Wipro and TCS. I want to get a scheme certificate for my accumulated pension since i have not yet reached 50/58 years of age. But your article says that pension/scheme certificate will be paid as per the number of years of service rendered. So will my scheme certificate include the number of years that I have worked with Wipro and TCS ? Kindly clarify.

Thanks,

Prathiba

Hi,

My question is specific to EPS –

I got your point that if we serve for continuous 10 years, we will get the scheme certificate but if some one switches company (EPS maintained by trust) at early stage after 5-6 years.

What should he do ? what are the options available ?

Thanks.

Best to transfer the EPF.

Hi Sir,

I worked in exempted trust (A)for 3.5 years and moved to non exempted trust (B), where I worked for 3.5 years. Both of them have same UAN and transferred my PF from A to B successfully. I left the company B 3 months bank and currently not working. I can see both member IDs in service history and DOJ and DOE is also updated. When I try to do 100% withdraw (form 19 ) it says you have less than 5 years of experience and since PAN is not verified you will be charged 34.5% tax.

Could you please help me what should be done to avoid the tax and why my previous company experience is not counted.

Raise EPF grievance asking to explain.

You can raise a complaint as explained in the article How to register EPF complaint at EPF Grievance website online

How are sure that PF was transferred?

I can see the credited amount from previous account to recent pf account in passbook.Is there any other things that I need to check?

Did you transfer from exempted trust/unexempted trust to exempted trust/unexempted trust?

The passbook of both accounts should be as shown in the article How to Transfer EPF Online on changing jobs

You can do the following:

a) Download Annexure K after logging in to the UAN member site and clicking on Online Services->Download Annexure K

Annexure-K of EPF is a document which contains details of EPF account as shown in the article mentioned earlier.

Annexure K is not available in UAN portal, it says “No exempted to unexempted provident fund transfer claims associated with the UAN”. I was working in TCS earlier and transferred it to IBM. In service History also I can see both member IDs of TCS and IBM pension IDs.

You can also raise EPF grievance at the EPF grievance website as explained in our article How to register EPF complaint at EPF Grievance website online

I am not able raise grievance. When submit the grievance it’s giving error like something went wrong but not showing what went wrong.

Which browser and which Operating system are you trying on?

Are you trying on mobile?

I am trying in windows 10 OS and in all browsers IE,Chrome,Mozilla.

Should I not use windows 10?

I have worked on three companies (A,B and C)

Can I transfer PF from “A” to “C” directly as I left ‘B’ in one week and no contributions were made.

Yes, you should transfer from A to C directly.

Please start the process as soon as possible.

Is it mandatory to submit the form 13 to employer when we do online transfer.

Does he submit it to PF office ?

Yes, currently it is.

EPFO is planning for Autotransfer for quite some time but till then this is the only way.

I have transferred my pf from my old company to new but my eps has not been transferred?wat will happen to my eps amount?can I withdraw it or nothing can be done?

As mentioned in the article EPS does not get transferred.

Your pension depends on your service history.

How can I transfer my pension contribution to new company?

Hi

I have worked for the organization for 3 years and then left it in 2016. I have made transfer request 20 days before from my previous employer to new one and the amount is transferred. However pension amount is showing 0 transfer in my both passbook. Also unlike your screenshot, both the amount shown in the passbooks are same as there is no difference.

I would like to know should I wait for some more time to get this pension amount transfer to the new company too or how can I check weather they have transfer the pension amount too? How long does it take to transfer pension fund once the request of transfer amount made?

Please let me know as I would like to go ahead and do the withdrawal request

Thanks!

I’ve transferred my EPF from previous (PF trust) to current company. Even I have annexure K for that (previous tenure with company was 5 years) EPF transferred amount (from previous company) reflects in my current passbook but not the EPS amount.

Please let me know, from where I can confirm that EPS amount also has been transferred. And from from where I can check the exact EPS amount which has been transferred.

I i have worked in company A for 1year and 8 months and joined company B after w months. I have request company A to add Date of exit but the company A added date of exit after i joined the company B. How will i withdraw the PF contribution and EPS contribution while working of Company A? Sir, plz reply for my coment.

What if i have resgined company B within 4 months. Can i withdraw my company A EPS contribution?

Even I have the same question.

Please naswer

Did you trying withdrawing online?

Does it report an error? What is the error?

I had worked from 13.10.2014 to 11.06.2016 in previous company at tat time my father name was updated wrongly online in EPFO portal,but now in 19.02.2018 i joined new company and linked the UAN number 100432492093 and in my office UAN is linked but husband name is updated in UAN online portal , applyed for online transfer claim in 17.03.2019 but reply was rejected {transfer (unexempted to unexempted in other region or to exempted establishments)}

transfer claim rejected —Transfer (unexempted to unexempted in other region or to exempted establishments) , what does this mean???? how can i withdraw or transfer my pervious company PF

I have already transfered my old epf to new epf account old company duration 6 years new company duration 4 years can I elegiable for pension

Yes as your total contribution in Pension scheme EPS is more than 9 years and 6 months you are eligible for Pension.

Please check your service history and see if both the jobs are showing up

Hi,

i joined company B from company A. Now I have initiated PF transfer from company A to company B. But I resigned from Company B. As company B has 60 days notice period and PF transfer takes atleast 90 days. So What will happen to my PF?

Wait.

Don’t initiate the EPF transfer request from Company B to Company C till transfer from A to B is over.

in my old company, i started EPF and EPS from day 1. So my EPF start day is same as my joining date. However my EPS start date says “NOT AVAILABLE”. How to get this reflecting the correct information. ?

I have 3 PF accounts(Company A, Company B and Company C). Unfortunately I have not transferred my previous

PF accounts (A and B) to C. I quit job in company C and claimed PF amount and it is settled.

Now I have transferred my previous (Company A and Company B) PF accounts to Company C. I am seeing status as “Accepted by field office”. I have checked my latest PF account and previous PF amounts are transferred. But claim option is not display. Please anyone help me on this.

You would have to take offline route.

You should have transferred before claiming from Company C.

same probelm withme but solved through when i applied offline . this is the only solution.

regards

calim through company non aadhar form. and post a grievance in the epfigms portal. same happend with me but fund now transferred.

sandeep kumar

I have switched 3 jobs in my 5 year career.

I don’t understand this, If my EPF is transferred from previous to new company then I don’t need to worry about scheme certificate to get my EPS transferred too? Is that correct? If yes then why will I need to separately fill form 10c for transfer of EPS to get scheme certificate and then submit it to new company and form 13 for transfer of EPF?

Hi,

My company-A had PF with trust (exempted establishment).I have transferred my EPF account from company- A to company-B, but i did not raise any transfer request for EPS(as i was not aware that, in case of trust we should get transferred both EPF and EPS).Now when i applied for EPF tarnsfer from company-B to company-c online through EPF portal, the request got rejected.When i raised a grievance, i got a reply “PF amount has been received from company-A account and updated,but EPS detail not received hence claim was rejected for want of EPS detail.” .

Can you please guide me on how to initiate the transfer request of EPS from company-A? What is the process to do the same?Should i raise a request to transfer the EPS from company-A to company-C?

Thanks in Advance.

I am also in exactly same scenario as yours. I have raised a grievance with EPFO along with Annexure-K from company A. Waiting for their reply.

You did the right thing.

Transfer of EPF means the transfer of EPS too.

But EPFO website sucks.

There is no way to just transfer EPS which is needed if one works in the organization with exempted trust

I also saw the descripancy in EPFO website regd service history not reflecting my old service of more than 10 years. My PF amount was correctly transferred and so after following up with EPFO, they did send me Annexure-K which shows correct service record details. Do I still need to go ahead and get EPS scheme certificate?

in your screenshots, the transfer in and transfer out amounts are not the same. Is the total difference of 48007 (464059 – 439268 + 243932 – 220716) the EPS contribution?

Good observation.

The difference is due to the interest amount.

We will update the article soon.

Can you please update an article of “in your screenshots, the transfer in and transfer out amounts are not the same. Is the total difference of 48007 (464059 – 439268 + 243932 – 220716) the EPS contribution?”

Good observation.

The difference is due to the interest amount earned on EPF with old employer till it was transferred which was added later Sep 2017.

The article has been updated

In your screenshots, the transfer out and transfer in amounts are not the same. Is the total difference of 48007 the EPS contribution?

Thank you for the detail information provided. Much appreciated.

I have couple of queries regarding EPS amount:

1. I have worked 9.5 years with an organization and transferred the EPF however EPS is not shown in the passbook , which you have explained the reason. However I need to just withdraw EPS. Can we do that..?

2. Do we loose EPS amount if we changes job with in 2 years of time. ?

Your response is highly appreciated. Thanks!

You cannot just withdraw EPS amount.

You can apply for pension after you turn 50 years.

One loses pension amount(not the EPF) if one changes job before 6 months

I had left my first job within 6 months from date of joining and withdrew the PF amount but now I want to claim EPS amount.Also I am now working in an organisation which is maintaining it’s own PF trust .Can I claim my EPS amount of last employer in which I worked less than 6 months

Sir, I have worked for contractual Jobs of 3 months each in more than 4 companies. I have withdrawn EPF amount already, but as you mentioned if the service is not more than 6 months in one company, have I lost the EPS amount and can only apply for pension after I turn 50? This is cheating on the part of EPFO.

Hi I have transferred my old pf to the new organisation and the duration of service with the old organisation was more than one year. Now I have left the current organisation after working for 4.5 months? Both the organisation was same as I Rejoined

Can I withdraw both the pf as well as the pension amount????

IS the EPF Grievance web site works? I have been trying from past 2 hours to lodge complaints but its keep rotating the image and does not revert with complaint number.

Hi Sir

I had transferred MY PF amount from old organisation to new organisation,But my pension contribution is not transferred.. what is the procedure to get the pension contribution.

Thanks,Siva

Hello:

I need some clarification on EPF as well as the EPS amount.

I have two UAN.

First UAN is for Company A

Second UAN for Company B & C

While working in Company B i putten a request for transfer PF account from Company A to Company B.

In which PF amount is transferred but EPS amount not transferred to new UAN. Same is still showing in First UAN.

– I did check my PF Account and found the EPS (pension) was not transferred.

Also when i am trying to do One Member – One EPF Account.

Wants to transfer One UAN to Second UAN (the current one in which company B & C service details are updated) getting an error.

Please find the description of error “Details of previous account are different than present account. Hence claim request cannot be processed.”

When trying to transfer First UAN of Company A to Second UAN (Current One)

EPS does not get transferred.

EPS is used to calculate your Pension amount which depends on the service history.

Does your View->Service History show all the EPF accounts?

Does your EPF passbook show the transfer of EPF from account A to account B?

Hello,

I have a very important question to ask her, which was not clarified in this post here:

It is understood that one can claim EPS amount after rendering minimum 10 years to an organization.

My question is, what is an employee keeps switching an organization every 3 or 4 years to get a better hike? Because, this is what is today’s condition in the IT field.

Now, when the PF amount is transferred to new organization from 5 different organization, and employee has just started working with new organization for few months, it will show service details for only the time period he worked for current organization and not his entire working period with other organizations.

Keeping this condition in mind, is an employee still eligible for EPS? If yes, what is the procedure to claim the same. If not, what is the reason?

Please help to put some light on this topic.

Hello ,

My EPS amount is not transfer to new EPF account. how it would caluclate EPS service.

I have joined 29-10-2009 in Prevoius EPF/EPS member and New EPF menber joined date: 01-09-2017.

Can i eligible to withdraw EPS amount till Apr 2019(9.6 years)

Great Man.

Thanks a lot.

I was thinking I am a victim and started following the same procedure you did. Writing mail to EPFO and old employer wondering where my Pension contribution went.

The mail reply I get from EPFO is:

‘With reference to pension only service particular will be transferred as per EPF & MP act 1952. There will be no physical transfer of funds’

Totally clueless before reading your article.

Thanks

Hi Sir,

I initiated a pf transfer from previous employer to current employer , since my current employer is separate pf trust they are asking me Annexure k form.

I was trying to submit a grievance request in the website http://epfigms.gov.in/ but it never gets submitted nor it gives me any error.

How do i get Annexure K form so as to complete my pf transfer.

sir i had transfered my UAN from old organisation to new organisation my pension contribution is not transfered what is the procedure to get the pension contribution

Hi,

I have a query related to my epf and eps fund. Actually Left my job and want to withdraw full amt of epf and eps amt. I have my UAN activate but it have 2 pf account no. My service of past pf account is more than 1 year and current pf service is less than. I left both jobs. Pf amt is still not transfer. Both DOJ and DOE for both account is mention in uan. Please suggest me how i can withdraw my full amt of pf and eps of both account at single time.

Hi,

I worked in

Company A for 6 yrs

Company B for 2 yrs

and relieved from work completely now. I am planning to withdraw my PF amount.

Will 10% Income Tax be deducted from my PF amount as I did not complete 5 yrs in Company B or Will I be eligible for NO TAX withdrawal as the sum of total service equals to 8 yrs?

Please Clarify.

Thanks in Advance.

Got same question from Ram too. Are Ragu and Ram same person?

Did you transfer your EPF from company A to company B.

If yes then your total years of contribution to EPF is more than 5 years and you can withdraw from EPF with withdrawal being tax free.

Else you would have to make 2 EPF withdrawal requests -one for company A and one for company B.

and would have to meet Regioanl EPFO office about company A.

Do you have UAN?

can you see company A in your service history?

Claim-Form-19 (EPF Final Settlement)(Resign) Claim id-BGBNG********* Member id-BGBNG********** Payment sent via NEFT has been returned on- 05-SEP-18.

What is reason and what need to do next.

Please check your Bank account details.

If your bank account number or IFSC code is incorrect NEFT transfers fails.

Don’t worry you would get your money

You would now need to submit Reauthorization Form.

Our article When you don’t get your EPF Withdrawal money due to Incorrect bank details etc talks about it in detail.

Hi,

I worked in

Company A for 6 yrs

Company B for 2 yrs

and relieved from work completely now. I am planning to withdraw my PF amount.

Will 10% Income Tax be deducted from my PF amount as I did not complete 5 yrs in Company B or Will I be eligible for NO TAX withdrawal as the sum of total service equals to 8 yrs?

Please Clarify.

Thanks in Advance.

Did you transfer your EPF from company A to company B.

If yes then your total years of contribution to EPF is more than 5 years and you can withdraw from EPF with withdrawal being tax free.

Else you would have to make 2 EPF withdrawal requests -one for company A and one for company B.

and would have to meet Regioanl EPFO office about company A.

Do you have UAN?

can you see company A in your service history?

Hi,

I tried to withdraw my PF but it is showing i have less than 5 yeaes of service so amount is taxable. But i have 6years of experience and my service details also has the same. But in withdrawal form it is showing as short service, the service period of my last company. I filed a grivience and got the following reply.

it is informed that the member EPS service details from previous pf office not received till date by this office , hence member may be advised to contact your previous pf office for details regarding the same.

What should I do regarding the same

Anu did you

-work in 2 organizations with total service more than 6 years

-is your current period of working in new organization is less than 5 years

-When did you leave old organization?

-Did you transfer your old PF to new employer?

Sir my previous employer fransfered my EPF contributions into my current account on the bases of Form 13 offline. but my service history not reflecting in unified member portal

That’s surprising.

Are you using the same UAN number?

Can you mail all required details to our email id bemoneyaware@gmail.com

I Worked in Company A from 2010 to 2012(2years), Company B from 2012 to 2017(4years). i had transferred my EPF from company A to B while i was in B. Now i joined company C(2017 to present), then transferred EPF from B to C. Transfer is good but View->Service History shows only 2 records. One of B from 2012 to 2017(4yrs), Other of 2017 to present. is it okay ? Will EPFO consider my A’s experience ?

You should see all your service details.

Please raise EPF grievance and ask why are details of company A missing.

Also ask for Annexure K which we have discussed in the above article.

Our article How to register EPF complaint at EPF Grievance website online discusses it online

I worked at company A (exempted trust) for 2 years and B for 1 year. Got A’s epf transferred which shpws 0 eps transferred. Now Im fully withdrawing my EPF and EPS.

How can i withdraw the EPS which was contributed in A?

As you have transferred your EPF, withdrawal from B will include EPF and EPS of both A and B.

Thanks for the detailed article.

I have a question regarding EPS transfer. My request to transfer EPF/EPS from company A (PF Trust) to company B got completed. I can see the PF amount got credited in Company B passbook. But my service history page on UAN site doesn’t show Company A’s service record. Company A is saying that claim to transfer EPS from Bandra EPFO to Thane EPFO is settled. How can I check total “pensionable” service period to make sure previous employer’s contribution to EPS is transferred?

Thanks in Advance for any help.

I worked in my previous company for 6 years and after that i joined new company and its more than 4 years now in new compnay. So my total experience is more than 10 years.

My PF amount from previous employer got transferred automatically in 2016 to PF account of the new company. How can i withdraw/or get Scheme Certificate of the Pension Contribution amount from previous employer. Please reply.

When the EPF gets transferred your EPS is taken care of too.

EPS depends on the length of service detail and Your View->Service details is what EPFO needs to decide your Pension.

My EPS (Pension Contribution) from previous employer is not transferred when i see the passbook. How can i transfer or withdraw now.

EPS is not transferred.

Your pension depends on the number of years you worked.

same issue here,how can i withdraw that amount(pension contribution).thanks in advance.

sir,

i have worked in company A for 4.5 years and switched over to company B and requested PF transfer online from company A to Company B via online after transfer is successful only EPF amount got transferred to Company B account and EPS of Company A remains in The old account itself. is there any procedure to transfer Company A EPS to reflect at Company B EPS account? plz guide

EPS information is with Regional EPFO.

But for some stupid reason, the EPS amount is shown 0.

As explained in the article Regional EPFO says your pension depends on numbers of years you contributed to EPF, which is available in View->Service History.

So as of now you cannot do anything.

Hi Team

My previous employer which was an exempted oraganization (Trust) has transferred my PF to RPFC of new employer and issued Annexure K to me. I have submitted Annexure K to my current employer and the PF dept over here in new organization is saying that it will now take 60+ days to transfer PF from RPFC to my new PF account. Is it correct really?

Whole process was offline as last organization was exempted one.

Anything Can I do to transfer it to my new PF account in less time. Any link where I can upload Annexure K and get it transferred directly.

Also do I have to manually track my new PF account passbook to check if my PF has been transferred which is updated only once in a month as per process from EPFO.

Note: New employer has account with EPFO and not trust.

Hi,

I worked with company A for 2 Years Company B for 6 Months and Company C for 3 Months i have transferred the B’s PF To C’ PF account no.

Q1.- I want to withdraw my PF From C Now , will i get the Total Ammoun(B’s EPF+EPS + C’ EPF+EPS)

Q2.- My A Company is closed now i have no contact details of anyone from the A Company. How to withdraw the PF From A’s Company. shall i transfer it To C’s account?

Are you still working for company C?

Any transfer has to be approved by present/past employer.

You can withdraw the two separately

For company c as you have worked less than 6 months, you might not be eligible for EPS.

For withdrawing from company A you visit the regional epfo office.

Hello Sir,

I have successfully merged two EPF account. As per your blog when I check “The Service history information” it shows only one entry of current employer, it does not show entry of my previous EPF account. Can you throw some light on this problem please. What should I do?

Due to this i am not been able to take advance EPF for purchasing flat as it is only showing my current company where i have completed just 1 year and for taking advance for purchasing flat requires minimum 5 years. I had completed 6 years of service in previous company and 1 year with current company.

Thanks,

Shanthi

Yes, that is the bug in EPFO site.

We have raised that in our Change.org petition which you can see here.

You can raise EPFO grievance. Our article How to register EPF complaint at EPF Grievance website online explains the process in detail.

Hi,

I have successfully merged two EPF account. As per your blog when I check “The Service history information” it shows only one entry of current employer, it does not show entry of my previous EPF account. Can you throw some light on this problem please. What should I do?

Thanks,

Dharam Padia

Can you send your PF passbook snapshots which show transfer and view Service history to bemoneyaware@gmail.com

Hi @bemoneyaware,

A quick question: are Scheme Certificate and Annexure-K the same thing, if one hasn’t completed 10 years of service?

If not, how to get scheme certificate? (You have clearly mentioned how to get Annexure-K though).

No Piyush, they are not the same thing.

Annexure K shows your EPF contributions throughout your working history.

If you have worked in an organization for more than 10 years and you want to withdraw from EPS you will not get your money but would get an EPS Scheme certificate, which you can use at age of 60 years to EPFO to get your pension. Our article What is EPS Scheme Certificate? explains Scheme certificate in detail.

Hi,

I have few questions regarding EPF and UAN. It would be great if I can get some solution to them:

1) I’m trying to link PF number of my first company to UAN , but no success. Intially the request showed as pending at the portal. Now recently it has stopped working showing error : “Something went wrong”. What should I do to get the PF number added to UAN?

2) I have changed my surname after marriage. My EPFO account has my maiden name and all documents for KYC like adhaar / PAN has my name after marriage. What should I do to do the KYC in EPFO portal. I had long back given joint application for name change request. Still name didnot update.

3) Through Form 10C will I be able to get my EPS amount in my account or will I be able to get it only after 58 years of age? I have not yet completed 10 years of service.

4) for one company Date of Exit is not mentioned. What should I do in this case. On one is responding from that company now whom I can ask to update. As a result of this I cannot transfer the PF online.

Please provide your valuable suggestions

Sad to hear about your case.

Our answers start with BMA

1) I’m trying to link PF number of my first company to UAN, but no success. Initially, the request showed as pending at the portal. Now recently it has stopped working showing error: “Something went wrong”. What should I do to get the PF number added to UAN

BMA> By linking I assume you are transferring your first PF number. Check https://passbook.epfindia.gov.in/MemClaimStatusUAN/ to see the claim status

Please raise the grievance at EPF website

2)I have changed my surname after marriage. My EPFO account has my maiden name and all documents for KYC like adhaar / PAN has my name after marriage. What should I do to do the KYC in EPFO portal. I had long back given joint application for name change request. Still, name did not update.

BMA>Please raise the grievance at EPF website

3) Through Form 10C will I be able to get my EPS amount in my account or will I be able to get it only after 58 years of age? I have not yet completed 10 years of service.

BMA>You will get your EPS amount using form 10C.

4) for one company Date of Exit is not mentioned. What should I do in this case. On one is responding from that company now whom I can ask to update. As a result of this I cannot transfer the PF online.

BMA You can raise an EPF grievance . Or try withdrawing from PF account offline.

Our article How to register EPF complaint at EPF Grievance website online explains the process in detail.

Hello: After reading the Post on “What happens to EPS when you transfer your old EPF to new employer”

– I did check my PF Account and found the EPS (pension) was not transferred, as per the Post I lodged the complaint on-line.

– I got a reply the verbatim of the response from the PF dept is as below:

Dear Sir/Madam,

This is with reference to your Grievance registered vide Registration Number SROWF/E/2018/08958.

It is informed that your grievance is being treated as non-actionable due to the following reason(s):

It is to inform that as per rules, when transfer of PF account is effected , only the PF amount will be transferred and there will not be transfer of EPS amount from one account to another .Instead , EPS will be transferred in the form of service history as EPS benefits are based only on service and not on the amount contributed to the EPS fund.

Therefore, we are closing your grievance from this office.Please quote the same in your future correspondence.”

I am lost now.

It means that your service history is good enough to know your Pension.

AMOUNT IN PENSION FUND IS NOT REQ

So your service details in View->Service Details in UAN website will be used to determine your pension.

So relax.

If you still want you can file epf grievance to ask for Annexure K, as explained in the article.

Annexure-K of EPF is a document which contains details of EPF account. It is internal document sent between regional EPF offices during transfer of the accounts

Hi,

My previous company A’s PF account is transferred to company B. In the member passbook of company B is showing only EPF amount of company A, EPS amount is not transferred. Now i want to close my PF account permanently and want to withdraw full EPF and EPS amount.

I worked in company A for 17 months and Company B for 2 Months.

Q1. Now when m trying to withdraw my EPS amount through online process, system shows only current PF account in dropdown for selection(i.e. company B’s PF account)and when m selecting the current PF account then system shows the error message as m not eligible to withdraw EPS amount as my service period for the current company is 2 months.

Kindly help me with the confusion and what m I suppose to do now?

Have you stopped working in Company B?

Is DOE updated in the UAN website, check View->Service History? Can you email the snapshot to bemoneyaware@gmail?com

Yes… Currently m not working and I’ll send u the snapshot.

Thanks for the snapshot.

The EPF site is not correct.

Please raise the issue with EPFO at their social media sites,at https://twitter.com/socialepfo or https://facebook.com/socialepfo

You please raise EPF grievance as explained in our article How to register EPF complaint at EPF Grievance website online

They should send your Annexure K which shows all your contributions.

If you don’t want to wait, then you can withdraw EPF offline by submitting the Forms to old employer or regional EPFO.

Submit EPF Withdrawal forms(with UAN or without UAN) to previous employer or EPFO.

Two types of new common withdrawal form have been introduced i.e. new CCF (Aadhar) and new CCF (non-Aadhar).

You need to use EPF Composite Claim Form (Aadhar): APPLICABLE IN CASES WHERE UAN HAS BEEN ACTIVATE AADHAR NUMBER AND BANK ACCOUNT DETAILS ARE AVAILABLE ON UAN PORTAL. The attestation of the employer is not required and this form can be submitted to EPFO directly.

Fill Form 15G to avoid TDS deduction. our article How to Fill Form 15G? How to Fill Form 15H? explains the Form in detail. A Sample filled form for Aarti Shukla, who is withdrawing on 30 Apr 2018 and who filed her ITR of AY 2017-18 (FY 2016-17) ,her EPF of Rs 1,30,00 and has 10,000 other income is here.

Attach a cancelled cheque leaf of the bank account mentioned in the Forms.

Write your Mobile Number on top of the form to get SMS alerts. You will get SMS updates

EPFO normally takes around 20 days to process your claim.

Track EPF Withdrawal

You’ll receive two different amounts in your account. One is for your EPF withdrawal and one is for Pension contribution.

Check out your tax liability. As you are withdrawing for less than 5 years the EPF is taxable.

Provident fund withdrawal before five years of completion of service will attract TDS(tax deducted at source) effective from 1 Jun 2015.

TDS on EPF will be deducted if withdrawal is more than Rs 50,000. This is applicable from June 2016.Earlier this limit was Rs 30,000.

TDS will be deducted at 10 % provided PAN is submitted. Otherwise, TDS is deducted at the rate of 34.608 % if PAN is not submitted.

If you withdraw offline you can submit form 15G/15H to avoid TDS.

Thanks for the details on this very peculiar topic. The result of your story is still a bit unclear, whether you have received EPS Credited into your account yet or not!

Just one thing to follow for further clarity- Do you mean to say that annex K is the form to withdraw the EPS component, when the service rendered in an organisation is less than 10 years. Pls advise.

No EPS amount will not be credited to your account.

No Annexure K is not the form to withdraw it is the record of your EPF service and contribution in EPF.

Thanks for your reply. I worked in my previous company for about 6.5 years. The EPS accumulation is about 70K. Obviously its not reflecting anywhere after the PF account got transferred into the new employer’s name. Can I withdraw this money somehow? Your reply would be very helpful.

Yes You can withdraw the EPF and EPS part( as you have worked less than 10 years).

Please apply for both EPF Form 19 and EPS Form 10C

Our article Online EPF Withdrawal: How to do Full or Partial EPF explains it in detail.

Thanks, If I’d like to withdraw only EPS alone, would that be possible? Kindly advise.