As discussed in our article Basics of Employee Provident Fund: EPF, EPS, EDLIS 12% contribution from your side goes to EPF, but the 12% contribution which your employer makes, out of that 8.33% actually goes in EPS (subject to maximum of Rs 541 and after Oct 2014 Rs 1250) and the rest goes into EPF. But there is more to Employee Pension Scheme such as how much pension can one get(maximum after 35 years of service is Rs 3250), EPS portion does not earn any interest, after 10 years you cannot withdraw instead you get scheme certificate, withdrawal amount depends on number of years of service. We shall answer these questions in this article. This post is dedicated to our reader Afsheeen who made us look more into EPS.

Table of Contents

What is Employees’ Pension Scheme (EPS)

Employees’ Pension Scheme (EPS) of 1995 offers pension on disablement, widow pension, and pension for nominees. EPS program replaced the Family Pension Scheme (FPS) of 1971. When an employee joins an establishment covered under the Employees Provident Funds & Miscellaneous Provision Act, 1952 (s)he becomes a member of Employees Provident Fund Scheme (EPF), Employees’ Pension Scheme (EPS) 1995, Employees Deposit Linked Insurance Scheme (EDLIS ) , 1976 . The EPS act in pdf format can be read at EPFO’s EPS webpage or Employees’ Pension Scheme, 1995 (pdf) and FAQ on EPS at EPF webpage. It’s main features are:

- It is financed by diverting 8.33% of employer’s monthly contribution from the EPF. Monthly contribution to EPS is restricted to 8.33% of 6500 or Rs 541 p.m and after Oct 2014 Rs 1250 8.33% of 15,000. Government’s contribution of 1.16% of the worker’s monthly wages if salary less than Rs 6,500.

- Unlike the EPF contribution EPS part (8.33% out of 12% contribution from your employer or Rs 541 and after Oct 2014 Rs 1250 what ever is minimum) does NOT get any interest.

- The fraction of service for six months or more shall be treated as one year and the service less than six months shall be ignored. So 9 years and 6 months will be rounded upto 10 years.

- Lifelong pension is available to the member and upon his death members of the family are entitled for the pension.

- A employee can start receiving the pension under EPS only after rendering a minimum service of 10 years and attaining the age of 58/50 years.

- No pension is payable before the age of 50 years.

- Early pension can be claimed after 50 years but before the age of 58 years. But it is subject to discounting factor @ 4% (w.e.f. 26.09.2008) for every year falling short of 58 years. In case of death / disablement, the above restrictions doesn’t apply.

- The maximum Pension per month is subject to maximum of Rs 3,250 per month.

- Maximum service for the calculation of service is 35 years.

- No pensioner can receive more than one EPF Pension.

Earlier there was a provision under EPS allowing commuting of one third of monthly pension by paying 100 times the original monthly pension. However, the amended scheme from 26 Sep’ 2008 doesn’t allow it anymore.

Table below gives the rates of contribution of EPF, EPS, EDLI, Admin charges in India.

| Scheme Name | Employee contribution | Employer contribution |

| Employee provident fund | 12% | 3.67% |

| Employees’ Pension scheme | 0 | 8.33% |

| Employees Deposit linked insurance | 0 | 0.5% |

| EPF Administrative charges | 0 | 1.1% |

| EDLIS Administrative charges | 0 | 0.01% |

The purpose of the scheme is to provide a pension in the following situations:

| Name | Conditions | Features |

| Superannuation | Age 58 years or More and atleast 10 years of service | The member can continue in service while receiving this pension.On attaining 58 Years of age, a EPF member cease to be a member of EPS automatically |

| Before superannuation or Retiring Pension/Early Pension | Age between 50 and 58 years and atleast ten years of service | The member should not be in service |

| Death of the member | Death while in service: Atleast 1 months serviceDeath while not in service: (Now not in service)Age less than 58 years and Holding valid Scheme certificate or proof of service | In case of died member having family, pension is payable to (1) the spouse and (2) two children below 25 years of age. When a child reaches 25 years of age, the third child below 25 yrs of age will be given pension and so on.– If the child is disabled, he may get pension till his death.– In any case, only 2 children will receive pension at a time.In case of member not having family, pension is payable to single nominated person.– If not nominated and having dependend parent, pension is payable first to Father and then on father’s death to Mother. |

| Permanent Total Disablement Pension | Permanent disability | Permanently and totally unfit for the employment which the member was doing at the time of such disablement |

Note: As per Updated document of EPS( EPS 1995 (pdf)) on 2008 eligible period of service has be changed to 10 years from 20 years. Hence Short service Pension which was Member has to render eligible service of 10 years and more but less than 20 years is no longer valid.

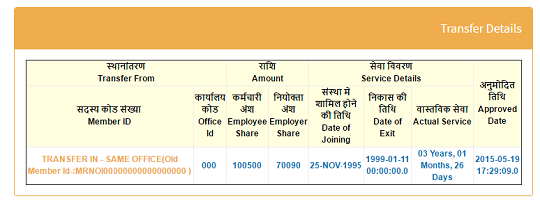

What Happens to EPS on Transfer of EPF account?

Transfer of EPS on Transfer of EPF from one company to another. If EPF gets transferred the EPS also gets transferred though UAN passbook shows amount as 0. One of us had transferred the EPF from earlier company to new company. While EPF withdrawal was done there was no information about EPS withdrawal. We asked UAN helpdesk about EPS transfer and the response we got the same day after submitting our request was as follows

WHILE TRANSFERRING PF FROM ONE ESTABLISHMENT TO ANOTHER, THE SERVICE DETAILS INFORMATION (VIZ LENGTH OF SERVICE, NON-CONTRIBUTORY PERIOD, LAST WAGES DRAWN ETC) ARE FURNISHED TO THE RECEIVING PF OFFICE IN ANNEXURE-K WHICH WILL BE USED TO CALCULATE PENSION BENEFITS. AMOUNT IN PENSION FUND IS NOT REQ”.

UAN passbook will show the transferred amount of EPF but duration of job,Actual Servie, will be noted in passbook as shown in image below.

Calculation of Pension from EPS

Minimum Pension you will get Rs 1,000. Our article How much EPS Pension will you get with EPS Pension Calculator explains it in detail with examples.

For a member who joined EPF before 15.11.1995 have 3 components in Pension calculation:

(a)Past Service Benefit (b)Pensionable Service Benefit (c)Proportionate Reduction

- Past Service : means the period of service rendered by an existing member from the date of joining Employees’ Family Pension of 1971 till the 15th November, 1995.

- Pensionable service means period of service rendered from 16 Nov 1995.

- Proportionate reduction: if the past service is less than 24 years and past service benefit + Pensionable service pension is less than Rs.500.

For those who joined after 15.11.1995 only Pensionable Service Benefit is applicable

Pension depends on your contribution to Pension Fund and your service. You may be drawing very high salary, but your contribution to Pension Fund will be only Rs. 541 and and after Oct 2014 Rs 1250 max. This is because, as per EPF scheme, employer has to remit 8.33% of actual salary or of Rs. 6500 or 15,000 whichever is minimum. If your contribution in terms of amount or number of years is less, your pension will be less. . Your company can contribute more with permission. EPF Goa has details on how to get more pension.

Note: If no wage is earned for a certain period, that period is to be deducted from the service (as there will be no contribution to Pension Fund). Maximum pension is calculated as follows

Mr R.Kapoor started his job on 15th Nov 1995. He works for 35 years. His average salary=20,000/- per month but for pension service maximum salary considered is Rs 6,500. So Mr. Kapoor’s pension from 16.11.2025 will be

Rs (6500 X 35)/70 = Rs 3250/month.

You may calculate your possible approx. pension amount by using Approximate Pension Calculator.

Withdrawal of EPS

If the total service of the employee is less than 9.5 years, (s)he is not entitled to pension so he can apply for Withdrawal benefit ie Pension Fund Money back. Once, the service period crosses 10 years, the money withdrawal option ceases you can only get a Scheme Certificate which (s)he can use to get a pension from the age of 50 years.

EPS Withdrawal for less than 6 months

if you work less than 6 months then you cannot withdraw your Pension amount. You can transfer the same to your new company.

EPS and Scheme Certificate

If the total service of an employee is more than 9.5 years and the age of the employee is less than 50 years of age, (s)he can only claim a scheme certificate. (S)He can add services at different companies to calculate the total service. (S)he can get a pension from the age of 50 years. If (s)he has a scheme certificate for all services, he may apply directly at EPF which covers the area where the bank (SBI, Canara, Syndicate,) is situated. He needs to fill Form 10-D, get the form attested by that bank manager with photo and other required documents which is mentioned in the Form-10D itself.

Withdrawal of EPS

If the total service of an employee is less than 9.5 years and the age of the employee is less than 50 years of age then only one can withdraw the EPS amount in cash. But unlike EPF which when you withdraw you always get 100% of your EPF part, for EPS withdrawal amount depends on Average salary and total service, NOT related to actual Balance in the Pension Fund. The withdrawal amount is governed by what is called Table ‘D’.

| Years of service | Proportion of wages at exit |

| 1 | 1.02 |

| 2 | 2.05 |

| 3 | 3.10 |

| 4 | 4.18 |

| 5 | 5.28 |

| 6 | 6.40 |

| 7 | 7.54 |

| 8 | 8.70 |

| 9 | 9.88 |

Note that the table D is upto 9 yrs only, because if 10 yrs are crossed, then you are liable for pension.

So if Ms. Priya Sharma’s monthly salary is Rs 40,000 per month but for purpose of pension only Rs 1250(earlier 541) p.m or Rs (15,000 earlier 6,500) annually is considered. If she withdraws after 3 years her annual pension will be

= Proportion corresponding to 3 years of service from Table D * 6500

= 3.10 * 6500 / 3.10 * 1250

How to Claim Pension from EPS

For pension, withdrawal benefit, scheme certificate etc. application should be through ex-employer. For pension, Form 10D(pdf format) is to be used. For withdrawal benefit & scheme certificate fill Form 10 C(pdf format) which is also available with the HR department

If you have scheme certificate for all of your service, you may apply directly at EPF which covers the area where your bank (SBI,Canara,Syndicate,….) is situated after attesting the filled up Form-10D by that bank manager with photo and other required documents which is mentioned in the Form-10D itself.

FAQ

Frequently Asked Questions we came across.

Q: I worked in a company for exactly 1 year(12 months) My Basic salary was 1,20,600 and deduction for PF from my salary was 1206 P/M. As I know equal deduction should be include by the employer. However I was told at the time of joining that the deduction of employer will also be deduct from your salary and It will be not displayed in your salary slip.

The PF amount I received against the EPF A/C is 21518+6630=28148 i.e however less then the actual amount credited as a pf contribution including both employee and employer that should be 28948.

Ans : Total amount in EPF will be your contribution (A), Employer’s contribution (B) and interest. In your case basic salary of Rs.1206/per month, PF and EPS contribution will as follows:

- A) Your 12 months PF contribution will be – Rs. 14472 (i.e. 1206 X 12)

- B) Employer’s 12 months PF contribution will be – Rs. 7980 (i.e. 665 X 12)

- C) Employer’s 12 months EPS contribution will be – Rs. 6492 (i.e. 541 X 12) or 15,000 (i.e 1250 *12) after Oct 2014

In my opinion your credited EPS amount of Rs.6630 is correct, if your service is exact 1 year (i.e. 6500 X 1.02) Source: citehr query on EPF and EPS withdrawal

Q: Employee is a member of Employees’ Pension Scheme. He/She has left employment at 48 yrs. of age and 8 yrs. of service. When shall he/she receive his/her pension?

Ans: He/She can take either withdrawal benefit or can take scheme certificate so that the 8 years service can be added to any future service that he / she may put in, in any other covered establishment. By virtue of being a holder of a scheme certificate, if the member dies before 58 years widow / widower and children shall be entitled for pension.

References: MoneyQuest’s EPF-EPS Facts you should know about, JagoInvestor 10 hidden rules of EPF/EPS,Approximate Pension Calculator

Related Article:

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

- Withdrawal or Transfer of Employee Provident Fund

- EPF Refund and Bank Account Problems

- What are EPF,Pension and Insurance Changes from 1 Sep 2014

- UAN or Universal Account Number and Registration of UAN

Note: The article is for educational and informational use and do not construe this as professional financial advice. Check out our Disclaimer.

Hope this article helped in understanding Employee Pension Scheme or EPS. Maximum pension after 35 years of service can only be Rs 7500(3,250) per month! If you have a scheme certificate that you can share please let us know. What are your thoughts on EPS, EPF?

pls sggest if an employee is not a member of EPS schme and join other company and same UAN continue they why it is not possible for 2nd employer to submit eps contibution of that employee as he was not under eps scheme before. What is the procesdure inthis case please suggest

Hi Sir Please give your Suggestion on how to proceed regarding my problem.Thanks in Adavance

I joined my first company

When I joined my first company ,my basic salary was less than 15k,so automatically I was part of EPS ,so 8.33 percent automatically goes to it.But after two years my basic pay went past 15k but company was still deducting eps instead of diverting the entire money to EPF also I was also not aware of it at that point so didn’t question them.Now recently i switched to a new organization and here also they are deducting 1250 towards EPS .I stated my basic is above 15000 so I want my EPS to be diverted to EPF but there was no proper response from them and they stated you are already part of EPS so they are deducted .Since my new company payroll is managed by third party ,i am not getting proper response and the employees also not aware of the EPS clause.I want my entire contribution to go to EPF as I feel EPS is not worth it as it doesnt provide interest on the deposit and only available after 60 years.

1)Whom do i need to contact for the above mentioned query?

Sad to hear.

I am not sure whether once EPS is deducted can one opt out of EPS.

I have asked Labour Lad Advisor, the EPF experts.

Will update you with the answer.

Once EPS starts you cannot opt out of it.

Oh okk But sir somewhere in the above i came across some procedures to come out of EPS and diverting my entire contribution to EPF,so is it not possible?

That is before you start contributing to EPS in your first job.

Hi Sir,

I have 24 years of service and have had EPS contributions till 2015 ( I took a VRS ). From the time I retired, I have been getting a monthly payment of Pension. But, when I checked the EPFO passbook, the pension amount has not reduced ( there is nothing in the withdrawals column ). I have turned 58 now. Am I eligible for a lumpsum withdrawal or is the monthly payment that I’m getting a part of the overall EPS amount?

sir,

when i applied for scheme certificate of eps, my application was rejected on the ground that i have to submit break particulars between date of joining and date of leaving. when i asked epfo personal he said there is particular column in 10c of service break and write no breaks and it will be approved. can i edit 10c form or where i can find in online form

Why do you want a Scheme Certificate? It was useful earlier when there was no UAN.

Details about Scheme Certificate are covered in our article http://bemoneyaware.com/eps-scheme-certificate/

If you have UAN you are good. Your EPF & EPS History is there for you and EPFO to see.

If you still want Scheme certificate

The pdf copy of Form 10C is https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form10C.pdf

The details of non-contributory service of the member are on page 3.

This actually has to be submitted by the employer.

You can search the editable form on Google and upload it while

Dear Sir.

One of my employer has not deducted EPS contribution even though i am eligible as i joined employment in 2011 and they put entire contribution in the PF account.

Now i am trying to transfer one of the EPF balance to my new company and EPF Authority said EPS not deducted in past company and rejected this transfer. Service duration is 10 years so i cannot withdraw EPS.

How can this be solved

Sad to hear about your case.

so you are Transferring EPF balance

Is EPS getting deducted in the current job?

You file the complaint at EPFO asking about the problem as explained here

http://bemoneyaware.com/epf-grievance-complaint-online/

Yes. it is about transferring PF.

I will raise a grievance but do you know this problem of lack of Pension deduction in previous be solved now that service is 10 years or more.

Hi Sir

I have 4 PF accounts in my UAN (worked in 4 different company), And I have transferred all 3 PF accounts to present PF account. (EPS is not reflecting)

In last organization I left job in 5 months (Father got expired), Now I have applied for both form-19 & form10c,

But form 10C got rejected due to service less than six months, but EPS contribution including all 4 company is about to 4 years.

Please help me what should I do now?

Thanks in Advance

Hi i have left my previous organisation in 2015. I have withdrawn the EPF during that time and missed to withdraw EPS amount.

Can i withdraw my previous EPS now. Currently i am working for another company and my EPF and EPS are getting credited to different UAN.

Thanks,

Venkatesh

You should be able to withdraw your pension.

Can you access your old UAN online?

Thanks sir for your reply. Yes i can access my old UAN.

I have worked April 2010 to June 2015. My total EPS amount is April 2010 to Sep 2014 it is (52 *554 =28808) and from Sep 2014 to June 2015 (10 * 1250 = 12500) and total is 41308. Can you please tell me what would be the amount i am expecting if i apply for withdrawal. I don’t know how to calculate using the propagation rule

Sir,

I have service in various private companies from Jul 1998 to Dec 2014[with a 4 months gap in 2nd half of 2012]. I have worked in 6 companies[2 in Chennai, 3 in Bangalore[till 2012] and 1 in Trivandrum]. I worked in Trivandrum company during 2013-14[2 years].

I am 51 years and wanted to start availing pension. My entire PF was withdrawn in 2015. It seems my service history is not properly updated in pension records. The Trivandrum company details are updated. So I raised a grievance with EPFIGMS site. They responded saying I need to get Annexure K from RO Office, Bangalore and then contact Trivandrum EPF/EPS.

I tried to raise a grievance to download Annexure K but it looks like it is going to Trivandrum EPFO site – whereas it should be directed to RO office, Bangalore. How to do it? Please help me out.

Regards,

While raising grievance use your PF account number/Member id of company you are interested in

Hi,

One of my colleague will retire on 30th Sept 2019 after rendering 30 years service. He was member of EPS’95 from day one of EPS scheme and now after retirement, he is planning to settle with his son in Germany. What are the options available to him regarding pension or withdrawal of corps in the given case.

He can not withdraw eps money. He has to submit form 10d at epfo office where his company is. for pension.

My last organization is a private trust & I’ve already withdrawn whole pf amount through them.when it comes to EPS withdrawal they are insisting me to apply online.when I tried online it’s not allowing me, showing error message to communicate with my employer. again I get back to employer ,they r saying EPFO not accepting offline withdrawal as well.pls help. How can I withdraw now.

Dear Sir,

I am Senior citizen still working and drawing salary. I am also getting EPS amount from my Previous service.

My Question is under ITR-1 of 2019, showing EPS income under head other income as I was doing earlier also is O.K. or not.

The question is raised as this year ITR-1 asking breakup of income. Please advise.

If EPS income to be shown under salary, my Form16 issued for present job will not show EPS income and will be mismatch.

Await your advice please.

Thanks

Ashok Kumar

I have a service break of 8 months last year, average of last 60 month will count this 8 month as zero or it will be completely excluded?

No problem with a job break.

Service history depends on the number of months & years worked.

Your Pension amount/Pension Withdrawal amount depends on how many years you have contributed to EPS.

Dear sir,

As per my pass book EPS pension amount is Rs.21,868/- but I received Rs.13,471/- and i worked for just one organization (2 Year 3 months 30 days). I want to know the reason for this deduction and calculation of this deducted amount. Please help in this.

Thanks

my husband was an employee of a psu his date of joining is 02.10.1989 & date of birth is 05.08.1959. he died on 01.01.2007. kindly tell me i am eligible for eps,1995 or not.

Dear bemoneyaware,

I worked for a company from 2007 to 2011. When I quit this company in 2011, all the contributions made to EPF and EPS were withdrawn by me, also the EPF account was closed.

I did not work for any company from 2011 to 2017, so I was not a member of EPF during that period.

Then I started working again for a company in June 2017. Although my basic monthly salary was more than 15000/-, my employer started contributing INR 1250 towards EPS from their share of 12.5% EPF contribution.

As per EPFO rules: In case an employee, who is “not existing EPF member” joins on or after 01-09-2014 with wages above Rs 15000/- in that case the pension contribution part will be added to employer share of EPF.

So please advise if my current employer is correct in diverting INR 1250 towards EPS or I should be exempt since I was not an existing EPF account holder when I joined this new company after a gap of about 6 years. They created a new EPF and UAN numbers for me, with no reference to old account which was closed after withdrawal in 2011/12.

Thank you.

Difficult question Kumar.

Technically you have been a member of EPF.

Employers are not aware of the rule.

The problem will come during the withdrawal, many new employees getting more than 15,000 for whom employer deducted EPS inspire of salary limit have had their EPF claim rejected.

as explained in the article here.

Subject: Scope of getting higher pension from EPS by enhanced contribution in EPS Fund from EPF account by serving a ‘Joint Request’ by employee and employer to EPFO

1. Section 6A of The Employees’ Provident Funds Act mandates that Central Government may frame Employees’ Pension Scheme and establish a Pension Fund from the employer’s contribution not exceeding eight and one-third per cent of the basic wages, dearness allowance and retaining allowance of the concerned employees as may be specified in the Pension Scheme.

2. Though there is no direction in the Act to fix a ceiling for maximum pensionable salary, yet under Para 11(3) of the Pension Scheme maximum pensionable salary was limited to Rs.5000/- w.e.f. 16.11.1995.

3. The ceiling was subsequently enhanced to Rs.6500/- per month w.e.f. 08.10.2001.

4. Thereafter a proviso was added to Para 11(3) of the Pension Scheme w.e.f. 16.03.1996 permitting an option for contribution on salary exceeding ceiling. The proviso is as given under:

“Provided that if at the option of the employer and employee, contribution paid on salary exceeding rupees six thousand and five hundred/Rs. 6,500 per month from the date of commencement of this Scheme or from the date salary exceeds rupees six thousand and five hundred/Rs.6,500 whichever is later, and 8.33 per cent share of the employers thereof is remitted into the Pension Fund, pensionable salary shall be based on such higher salary.”

5. Para 26(6) was added to Employees’ Provident Fund Scheme empowering an officer not below the rank of an Assistant Provident Fund Commissioner to allow such higher contribution on joint request.

6. It is specified in Para 26(6) of Employees’ Provident Fund Scheme that “Notwithstanding anything contained in this paragraph, an officer not below the rank of an Assistant Provident Fund Commissioner may, on the joint request in writing of any employee of a factory or other establishment to which this Scheme applies and his employer, enroll such employee as a member or allow him to contribute more than fifteen thousand rupees of his pay per month if he is already a member of the Fund and thereupon such employee shall be entitled to the benefits and shall be subject to the conditions of the Fund, provided that the employer gives an undertaking in writing that he shall pay the administrative charges payable and shall comply with all statutory provisions in respect of such employee.”

7. Para 10 of the Order of the Supreme Court of India dated 04.10.2016 on SLP(C) Nos. 33032-33033 of 2015, mandates that “if both the employer and employee opt for deposit against the actual salary and not the ceiling amount, exercise of option under paragraph 26 of the Provident Scheme is inevitable.”

8. As per Para 11 of the said SC Verdict, all that the Provident Commissioner is required to do is an “adjustment of accounts” which in turn benefit employee. The Provident Fund Commissioner can seek return of all amounts that employee may have taken or withdrawn from Provident Fund Account.

9. Ignoring the verdict of the Supreme Court of India dated 04.10.2016 on SLP(C) Nos. 33032-33033 of 2015, the Central Government has amended Para 11(3) and Para 11(4) of the Pension Scheme by G.S.R. 609(E), dated 22.08.2014 (w.e.f. 01.09.2014) as given below:

4. In the principal Scheme, in paragraph 11,

…

(c ) in sub-paragraph (3),-

(i) for the words, letters and figures “rupees six thousand and five hundred/Rs, 6500″, the words “fifteen thousand rupees” shall be substituted;

(ii) the proviso shall be omitted.

(d) after sub-paragraph (3), the following sub-paragraph shall be inserted, namely:-

“(4) The existing members as on the 1st day of September, 2014, who at the option of the employer and employee, had been contributing on salary exceeding six thousand and five hundred rupees per month, may on a fresh option to be exercised jointly by the employer and employee continue to contribute on salary exceeding fifteen thousand rupees per month:

Provided that the aforesaid members have to contribute at the rate of 1.16 per cent on salary exceeding fifteen thousand rupees as an additional contribution from and out of the contributions payable by the employees for each month under the provisions of the Act or the rules made thereunder:

Provided further that the fresh option shall be exercised by the member within a period of six months from the 1st day of September, 2014:

Provided also that the period specified in the second proviso may, on sufficient cause being shown by the member, be extended by the Regional Provident Fund Commissioner for a further period not exceeding six months:

Provided also that if no option is exercised by the member within such period (including the extended period), it shall be deemed that the member has not opted for contribution over wage ceiling and the contributions to the Pension Fund made over the wage ceiling in respect of the member shall be diverted to the Provident Fund account of the member along with interest as declared under the Employees‟ Provident Fund Scheme from time to time,

10. G.S.R. 609(E), dated 22.08.2014 (w.e.f. 01.09.2014) also specifies in Para 11(3) of the Pension Scheme that maximum pensionable salary shall be limited to Rs. 15000/- (fifteen thousand rupees) per month and Para 26(6) of Provident Funds Scheme has been amended accordingly.

11. G.S.R. 609(E), dated 22.08.2014 was challenged through writ at Kerala High Court.

12. Kerala High Court in its verdict dated 12.10.2018 on WP(C).No.13120 of 2015 set aside the Employee’s Pension (Amendment) Scheme, 2014 [brought into force by notification No. GSR. 609(E) dated 22.8.2014] which had curtailed the facility of enhanced contribution on EPS. The verdict clearly said that:

(a)The stipulation introduced by the amendment that the employees should make an additional contribution of 1.16% does not find support in any statutory provision [Para- 11 of the verdict].

(b) Since insistence on a cut -off date has already been found to be bad and set aside by this Court, there is no justification for introducing the same again [Para- 13 of the verdict].

The writ petitions are all allowed as follows:

i) The Employee’s Pension (Amendment) Scheme, 2014 brought into force by Notification No. GSR. 609(E) dated 22.8.2014 evidenced by Ext.P8 in W.P.(C) No. 13120 of 2015 is set aside; All consequential orders and proceedings issued by the Provident Fund authorities/respondents on the basis of the impugned amendments shall also stand set aside.

ii) The various proceedings issued by the Employees Provident Fund Organization declining to grant opportunities to the petitioners to exercise a joint option along with other employees to remit contributions to the Employees Pension Scheme on the basis of the actual salaries drawn by them are set aside.

iii) The employees shall be entitled to exercise the option stipulated by paragraph 26 of the EPF Scheme without being restricted in doing so by the insistence on a date.

iv) There will be no order as to costs.

Therefore, it appears that, on the basis of Kerala High Court verdict, employee and employer of WBSETCL have the opportunity to submit ‘Joint Request’ for higher contribution on EPS which is mere an adjustment of accounts as money will go from EPF to EPS and employer does not have any extra burden on such higher contribution.

Joint Request format:

To

The Regional Provident Fund Commissioner

Employees’ Provident Fund Organization,

Sub: Joint Request by the employer and the employee for contribution to Employees’ Pension Scheme 1995 on salary exceeding ceiling limit per month

Sir,

In terms of Para 26(6) of Employees’ Provident Fund Scheme 1952, I,………………………………………, do hereby exercising Joint Request by the employer and the employee to contribute on actual salary exceeding ceiling limit (Rs.5000/-, Rs. 6500/- or Rs. 15000/- as applicable) from the date of commencement of Employees’ Pension Scheme 1995

Yours faithfully,

Date:

Signature:

Name:

UAN:

Verification

Certified that Mr./Mrs./Ms. ………………………………………………. UAN ………………………………………… is a member of EPS who has been contributing at 8.33% of ceiling salary [8.33% of Rs. 5000/- from 16.11.1995, 8.33% of Rs.6500/- from 08.10.2001 and 8.33% of Rs. 15000/- from 01.09.2014] and is exercising Joint Request by the employer and the employee to contribute on actual salary (Basic Pay+ Grade Pay+ D.A.) exceeding ceiling limit (Rs.5000/-, Rs. 6500/- or Rs. 15000/- as applicable) from the date of commencement of Employees’ Pension Scheme 1995.

Date:

Signature of the employer

I applied for form 10c to withdraw my pension,

My total service was 5 yrs.

As per passbook, total pension was 64246/-, but the amount credited was only 49603/-

How 14643/- got deducted and i lost this much amount?

For EPF, they deducted 10% tax which is fine, but i am not able to see how EPS was deducted with so much amount?

The amount deducted from EPS does not make sense.

If you have 5 years of service then no TDS should be deducted.

Please raise an EPF complaint explained in our article How to register EPF complaint at EPF Grievance website online

Thanks for the valuable information.

I applied for online pf claim but after 10 days the status showed that claim is rejected with the reason that Pension share is not deducted/Certificate enclosed is improper.

What does that mean?

I have no clue about the above-mentioned reason for rejection.

Hi,

Thanks for the great article!

My question might seem repetitive, sorry for that, but if I transfer EPF online thro the UAN portal, your post mentions that EPS also gets transferred, but I have read in some other articles that an employee needs to take the scheme certificate from EPFO and submit with new employer. Is it still necessary to take scheme certificate at all if the transfer of PF is made online?

My work history;

Company 1: June 2014 to March 2017

Company 2: April 2017 to Feb 2018

Company 3: Feb 2018 – Present

Since I had a short stint at company 2, I didn’t get a chance to transfer my PF (partly my ignorance). Now I have 3 PF accounts linked to my UAN and I am looking to transfer to the latest account from the UAN portal. Would I need to get the scheme certificates for Company 1 & 2, then submit these to Company 3? Please advise

Thanks for your time!

If you work more than 9 years and 6 months in an organization and contribute you get Scheme Certificate.

As you have worked around 3 years in Company1 and 1 year Company2 you are not eligible for Scheme Certificate.

Our article What is EPS Scheme Certificate? discusses it in detail.

contribution to EPS does not earn interest. Your Pension from EPS depends on number of years you worked.

So EPFO finds out your number of years from the Member Ids linked to your UAN.

Log in to UAN Portal at Member Home and click on View->Service History

Our article How to check Member Ids or PF accounts linked to UAN discusses it in detail.

Please transfer your 2 PF account using the process explained in Online EPF Withdrawal: How to do Full or Partial EPF.

And verify it with your passbooks.

i have worked for 8 yrs in a company and i resigned. i m withdrawing my pf. my eps amount is abt 68000rs. and epf amount is 217000rs. what eps amount would credited into my account?

You would get your EPF (employee and employer contribution) + 8.70 of EPS contribution.

As you have contributed for more than 5 years this is tax free!

Hi,

Lets say I have withdrawn my pension amount before 9.5 years of service. So after that how the Employer contribution will be ? will it be same again as 8.3% (Rs.1250) to pension and 3.7 % to PF?

Regards,

Ashok.

You can withdraw your EPS if you leave your job.

Once you join a new job the EPF and EPS contribution starts again.

Hi,

As per a recent Supreme Court Order, provision has been enabled to deduct 8.33% of entire salary (Basic+DA) & not limited upto Rs. 15000 thereby enabling employees to getmuch higher pension. Request if this matter can be deliberated.

Thanks.

i have taken vrs on 31.10.2011 actual date of retirement was 30. june 2013. after amendment in eps how i will get pension

Hi,

How to check EPS balance in govt EPFO site? I have worked in LnT which is private company , and it is having its own trust, then i joined HCL , it is also having its own trust.

I have transferred my PF money from LnT to HCl, does it mean EPS also transferred or it is with govt office.

and i have two UAN number ,one is from previous employer and one is for current employer. how to tackle this.

Hi, I have started accumulating my PF amount from my previous employer (PF office maintains) from April 2005 and when I switched job in Jan 2007, I’ve transferred my PF amount to current employer (has own PF trust), PF amount was transferred in 2007 but did not see any on EPS. And also my EPF and EPS date of joining is showing on UAN protal with my current organization joining date i.e. 2007 but not of my previous employer date i.e. 2005. When I checked with my current employer, they say as below.

“Please confirm you have initiated Pension transfer process along with PF transfer. Once pension transfer is done the PF start date will be updated”

Can you please confirm what needs to be done from my side for EPS?

Hi

I’m a person who falls on less than 10-year work experience category , UAN portal shows both of my employers. when I approached my old employer seeking my eps amount status they gave annexure-k and told your eps service is transferred.

My question:

the old eps amount is not included in my current passbook

is ann-K is sufficient to withdraw my amount later?

please tell me am extremely confused.

what is the correct process of transferring eps amount from one PF office to another?

From 20/06/2013 all of suddenly, From my employer contribution around 3231 Rs is credit toward EPS, which is much more than a cap Rs541, so What shall I do now.

That is surprising. Because max amount in EPS cannot be more than 1251 a month.

Can you share the passbook at bemoneyaware@gmail.com

I think Employees should have option of choosing the pension schemes of goverment organizations like LIC.

I have completed 10y of service, contributing Rs 541 per month towards EPS, except in the last month of my service, when it was 1250. I opted for Early pension at the age of 51y, but by the time the processing was completed, I turned 52y 6m. Going by the example you give, my pensionable salary will be Rs 6500, which gives monthly pension of Rs 929. However, since minimum pension is supposed to be Rs 1000, we should take it as 1000. Then there is 4% reduction in pension for each reduced year of service from 58y – which means 4*6=24%. Hence the pension I should get is Rs 760. Are my calculations right?

Dear team

My total work period as per joining date and date of exit is 9 year 6 month ,but last six month of my service i was on leave hence my actual contribution to EPS is 9 years only .can i withdraw EPS as my period is only 9 year of contribution

Or i will not be allowed to withdraw bcoz my work period is 9 year 6 month as per joininh and releiving data

I’m 63yrs, I retired in 2011, and I’m receiving pension while in service my name was mentioned as ANTHONY FILONE ZACARIAS COLASO in all records i.e EPF/FPF/ESI/LIC including my bank account. now I’m in the process of changing my name as ZACARIAS FILONE COLACO & MY NOMINEE’S NAME AS BUBUNA CINTIA ELIZA COSTA FERNANDES asper our birth certficates, I have already managed to change the name on my PAN/AADHAR/EPIC cards,PASSPORT & SOME BANK ACCOUNTS, Please inform me the procedure to change my name as ZACARIAS FILONE COLASO & my nominee’s name

My dad retired in 1994 at the age of 63 yrs. He was contributing to EPF from 1955-1994 with a break of one and a half years.He has taken his withdrawal benefit. Can he join the pension scheme now by refunding the withdrawal benefit together with interest (for past service pension)?

He tried to get the pension several times with the EPS office and was rejected by the office every time saying that “he turned 60 years old on 1991 and hence is not eligible for pension under EPF scheme 1971”

Hi,

I was an employee of an MNC from January 2007 to October 2016 (9 years 9 months). I was deputed for discontinuous service in US under the same employer for 4 years 1 month (March 2012 to July 2012 and December 2012 to October 2016). During my service in US there were no contributions made to Provident Fund. I resigned from the MNC in October 2016 to another company in US and am not planning to move to India soon. Can I get EPS portion withdrawn citing employment/settlement abroad and not opt for scheme certificate even though I was a member of EPFO for almost 10 years. What should be the supporting documentation that I need to furnish to get the EPS withdrawn without scheme certificate?

Myself was employed in one organization from 08th January 2009 to 31st May 2011 which was my first job. Then i joined my second organization on 10th June 2011 where i am working till now. After joining the second organization, i applied to transfer the PF from first organization to second organization via Form-13 and it got transferred. I also applied to withdraw the pension amount deposited under EPS-95 scheme from previous employer via Form-10C but have not got the amount. So i am not confirm whether the pension scheme is already transferred with the PF transfer via Form-13. That time of 2011,UAN concept was not there.

My present company as well as the past company has own trusty and so i am unable to view passbook via UAN login.But while logging on to company’s own portal of PF , i am noticing that the amount of PF from first organization is transferred , but no information or data of my past service is visible in present company’s own PF portal. I am presently 31 years old. Suppose i will serve my present company up to 58 years of age. But after so many years when i will attain age of 58, how i will prove my service tenure to first company which was from 08th January 2009 to 31st May 2011 as mentioned above. And if in case suppose before attaining the age of 58, i serve 3 to 4 more companies. And after changing one company to another, every time i apply for PF transfer via present system of UAN. Then whether the pension scheme will also be transferred? And when i will attain age 58, how i will prove my services to all the previous employers?

Hi,

I want to transfer EPF from my previous employer to new but I want to withdraw EPS from the previous employer.

Is it possible?

Please suggest at the earliest.

कर्मचारी भविष्य निधि संगठन में ई पी एस के तहत प्राप्त होने वाले पेंशन से निजी क्षेत्र के कर्मचारियों को फायदा कम नुकसान ज्यादा हो रही है !

कर्मचारी भविष्य निधि संगठन के तहत पेंशन फंड में नियोक्ता द्वारा कर्मचारी के मूलवेतन का 8.33% राशि योगदान की जाती है । जिसमें सरकार नाममात्र का 1.16% राशि योगदान करती है । पेंशन फंड में जमा राशि पर ब्याज प्रदान नही की जाती है । कर्मचारी का न्यूनतम 10 वर्ष सेवा पूर्ण होने पर 50/58 वर्ष बाद पेंशन प्रदान की जाती है । किन्तु यह पेंशन कर्मचारी की पेंशन फंड मे जमा राशि के तुलना में बहुत ही कम दी जा रही है । जिसे हम नीचे दिये गए उदाहरण के द्वारा समझ सकतें हैं ।

माना की रमेश 23 वर्ष की उम्र में 4000 रुपये मूल वेतन के सांथ किसी कम्पनी में नौकरी शुरू कि । यदि मूलवेतन में प्रतिवर्ष 300 रूपये वृद्धि होती है तो रमेश की 58 वर्ष की आयु तक 35 वर्ष की सेवा पूर्ण हो जायेगी तथा मूलवेतन 14200 रुपये हो जायेगी ।

पेंशन सूत्र अनुसार रमेश को 58 वर्ष की आयु के बाद उसकी 35 वर्ष की सेवा एवं 14200 रुपये मूलवेतन के आधार पर – 35*14200/70=7100 रुपये प्रतिमाह पेंशन प्राप्त होगी ।

उपरोक्त्त उदाहरण के ठीक विपरीत यदि रमेश प्रतिमाह पेंशन फंड में जमा होने वाली राशि के बराबर PPF या किसी अन्य सेविंग स्कीम में निवेश करेगी तो 58 वर्ष की आयु तक ब्याज सहित लगभग 12 लाख 55 हजार रुपये जमा हो जायेगी। उस 12 लाख 55 हजार रुपये को यदि पोस्ट ऑफीस की मंथली इन्कम स्कीम में निवेश करेगी तो 8000 रुपये प्रतिमाह ब्याज प्राप्त होगी तथा उसके मूलधन 12 लाख 55 हजार रुपये खाता में सुरक्षित रहेगी।

जबकि सरकार पेंशन फंड में जमा राशि पर प्रतिमाह 7100 रुपये ही पेंशन के रूप में प्रदान करेगी तथा पेंशनर एवं उसकी पत्नी के मृत्यु के बाद यदि उसके बच्चों की उम्र 25 वर्ष से कम है तोे बच्चों को पेंशन मिलेगी हालाँकि कर्मचारी की 58 वर्ष उम्र होते तक बच्चों की उम्र भी 25 वर्ष से ऊपर होगी अतः पेंशन पूर्णतः बंद हो जायेगी। कर्मचारी के जिंदगी भर की मेहनत की कमाई से जमा पेंशन फंड की राशि नॉमिनी को नही लौटाई जाती है यह पूर्णतः सरकार की हो जायेगी ।

उपरोक्त उदाहरण के अतिरिक्त 10 वर्ष से कम सर्विस का एक अन्य उदाहरण प्रस्तुत है…..

माना की श्याम ने 23 वर्ष की उम्र में 4000 रूपये मूलवेतन से नौकरी शुरु की और 9 वर्ष 5 माह में 7000 रुपये मूलवेतन पर नौकरी छोड़ दी तो वह पेंशन का हकदार नही होगा क्योंकि उसकी सेवा 9 वर्ष मानी जायेगी ।

श्याम को EPS नियमानुसार 9 वर्ष की सेवा पर 9.33% * अंतिम 12 माह की औसत मूलवेतन (9.33*6825) = 63677 रूपये पेंशन फंड की राशि वापस कर दी जायेगी ।

यदि श्याम 9 वर्ष 5 माह के स्थान पर 9 वर्ष 6 माह की सेवा के बाद नौकरी छोड़ देती है । तो उसकी पेंशन योग्य सेवा 10 वर्ष मानी जायेगी और वह पेंशन का हकदार हो जायेगा । तथा 50 वर्ष की आयु के बाद उसकी 10 वर्ष की सेवा एवं अंतिम 12 माह की औसत मूलवेतन के आधार पर कुल {10*6850/70} =979 रुपये प्रतिमाह पेंशन बनेगी । हाँलाकि सरकार ने न्यूनतम मासिक पेंशन 1000 रूपये कर रखी है अतः श्याम को 50 वर्ष की आयु पूर्ण होने पर 1000 रुपये प्रतिमाह मासिक पेंशन प्राप्त होगी ।

इसी उदाहरण के ठीक विपरीत यदि श्याम 9 वर्ष 6 माह की नौकरी न कर 9 वर्ष 5 माह बाद नौकरी छोड़ कर पेंशन फंड से मिली एकमुश्त राशि 63677 रुपये को 17 वर्ष के लिए (वर्तमान ब्याज दर 7.25% पर ) फिक्स डिपॉजिट कर देती है तो श्याम को 50 वर्ष की आयु पूर्ण होते ही F.D.की मैच्यूरीटी राशि 2 लाख 9 हजार रूपये प्राप्त होगी ।

इस राशि को पोस्ट ऑफीस की मंथली इन्कम स्कीम में निवेश करती है तो प्रतिमाह 1340 रूपये ब्याज प्राप्त होगी ।साथ ही 2 लाख 9 हजार रूपये उसके खाते में सुरक्षित रहेगी ।

जबकि सरकार श्याम को 10 वर्ष की सेवा पर 50 वर्ष की उम्र के बाद मात्र 1000 रूपये ही प्रतिमाह पेंशन प्रदान करेगी । न तो इसमें प्रतिवर्ष महँगाई राहत के रुप में किसी प्रकार की वृध्दि होगी और न ही कर्मचारी की मृत्यु के बाद पेंशन फंड में जमा राशि उसके नॉमिनी को वापस लौटायेगी ।

EPFO की इस EPS स्कीम से कर्मचारी को फायदा कम नुकसान ज्यादा हो रही है । EPS स्कीम सिर्फ उन्हीं कर्मचारीयों के परिवारों के लिए फायदेमंद है! जिसकी आकस्मिक मृत्यु अल्प सेवा के दौरान हो गई हो या जो 40 वर्ष की उम्र के बाद EPF की सदस्य बनें हैं जिनकी पेंशन फंड में कम योगदान है ।

अतः सरकार को निम्न बिंदुओं पर जवाब देना चाहिये ..

1. निजी क्षेत्र के कर्मचारियों की मेहनत की कमाई से जमा पेंशन फंड की राशि पर इतनी कम पेंशन क्यों दी जाती है । जबकि दी जाने वाले पेंशन राशि से अधिक सरकार पेंशन फंड में जमा राशि पर ब्याज प्राप्त कर रही है।

2. कोई कर्मचारी लम्बी अवधि तक EPF का सदस्य है तथा 58 वर्ष में पेंशन प्राप्त करती है। यदि कुछ दिनों बाद पति-पत्नी दोनों की मृत्यु हो जाती है और उनके बच्चों की आयु भी 25 वर्ष से ऊपर है तो उनकी पेंशन पूरी तरह बंद हो जायेगी । तब कर्मचारी के पूरी जिंदगी की कमाई से जमा पेंशन फंड की राशि को सरकार उसकी नॉमिनी को क्यों नही वापस करती है ।

जबकि NPS में पूरी राशि कर्मचारी के नॉमिनी को लौटा दी जाती है ।

2. पेंशन फंड में जमा राशि पर EPF की तरह ब्याज क्यों नहीं प्रदान कि जाती है तथा ब्याज सहित कुल जमा राशि के अनुसार प्रतिमाह पेंशन क्यों नही दी जाती है ।

3. पेंशन की राशि में प्रतिवर्ष महँगाई राहत के रूप में वृद्धि क्यों नही की जाती है ।

4.पेंशन सूत्र में परिवर्तन क्यों नही क्या जाता है

Sir,

I am with you. Government is making fool of employees in this EPS scheme. When I felt that this scheme is of no use to me. Why I can not close this? As per my calculation I can save 1.76 crore with the same contribution while I will get only 7500 per month after 58 years of age.

We should aware all employees and should get our money back.

After a long search found a article which was my thoughts and analysis. This is pure loot , pension of 7500pm is nothing after 35 yrs. Maids earn more. Why cant i discontine from EPS and make contribution to EPF fully? Lets start a war with PMO and Modi ji…he will listen…pls sir..

Please do so Sir.

If you have joined EPF before 2014 then you cannot discontinue from EPS

Veeri good ideas tek andolan

After a long search found a article which was my thoughts and analysis. This is pure loot , pension of 7500pm is nothing after 35 yrs. Maids earn more. Why cant i discontine from EPS and make contribution to EPF fully? Lets start a war with PMO and Modi ji…he will listen…pls sir..

I have worked in a company for 8.5 years post 1995.Prior to 1995, I have worked for 5 years in another company. Am I eligible for pension?

Well I really liked studying it. This post offered by you is very effective for proper planning.

Hello All,

The current organisation I am working in contributes for the EPF scheme. But the next company I am joining is exempted from it and is not contributing to the EPF.

I have worked less that 5 years. What can I do now?

Having read this I thought it was extremely enlightening.

I appreciate you taking the time and energy to put this content together.

I once again find myself personally spending a lot of time both reading and leaving comments.

But so what, it was still worthwhile!

Hi

I worked for a company from 2004 to 2009 and resigned in 2009 completing nearly 5 years.I withdrew my PF and did not do anything about my Pension fund. Then i took a break for a year and joined another company in 2010 and at present completing nearly 7 years. If i resign from my present job, will the old job be considered for completion of 10 years and eligible for Pension after 50 years. What should i do ?

My UAN is not entitled to my old job as i withdrew my PF. How can i add that expeirence for the EPS Scheme

Dear Anamica,

you are not eligible for the EPS scheme. because you have to be same organization the complete your 10 years.

Typically when you withdraw from EPF you fill

Form 19 to withdraw EPF both the employee and employer contribution.

Form 10C to withdraw from EPS.

So are you sure you did not fill Form 10C?

If you did not fill Form 10C then your money is with EPS. You can raise grievance to find out details of that account.

My Father expired in 2004, he was working in private company for almost 22 years, on his behalf my mother receives pension but the pension amount which she is receiving has not increase from 2004 till now. My question is does the pension increases, if yes how it increases is it based on pay commission. If she eligible for increase how to claim it.

Very detailed and neatly arranged information.

Thank you!

hi, My Dkm site asking me for EPS A/C No. where i can get EPS A/c no.??

i was working in a company from 12-09-11 and leave 1-4-15 i have claimed our epf and received till 30-7-2014.

and now i am working in a company from 1-1-16 and my current company pf ac no TAN/MAS/1388454/000/68 AND MY OLD COMPANY PF AC NO TN/MAS/0030427/000/2043.

NOW I WANT ALL THE PF AMOUNT PENSION AMOUNT IN A SINGLE ACCOUNT.

WHAT AND HOW TO DO?

PLEASE HELP ME

While applying for EPF withdrawal what forms did you fill? Did you not get the EPS amount ?

My dad retired in 1994 at the age of 63 yrs. He was contributing to EPF from 1955-1994 with a break of one and a half years.He has taken his withdrawal benefit. Can he join the pension scheme now by refunding the withdrawal benefit together with interest (for past service pension)?

He tried to get the pension several times with the EPS office and was rejected by the office every time saying that “he turned 60 years old on 1991 and hence is not eligible for pension under EPF scheme 1971”

My father retired at the age of 63 years old from a private company. He turned 60 years old on 16/1/1991. He was contributing to EPF from 1955-1994 with a break of one and a half years ( from July 1979- Jan 1981). Is he eligible for past service pension?

If he has been contributing to EPS for more than 10 years and hasn’t withdrawn he is eligible for pension since he was 58 years. Our article How to Fill EPS Pension Form 10D to claim EPS Pension explains how to claim EPS Pension

hi can any one guide me on eps , i have changed 2 company first company epf has transferred in new one company through form 13 ( uan website ) . just wanted to know eps is also transfered or not how can i know ?.if not how can i claim ?

it is not showing any eps amount transfer in new company . in both company i worked above 2 years .

Dear Sirs,

I have opted for early pension at the age of 50 and received the commutation amount by sacrificing 1/3 portion of the pension. Since at the age of 51 I have been receiving pension Rs.650/- per month. But minimum pension of Rs.1,000/- not applied in my case and still i am getting Rs.650/- per month. Is there any lapse in my case. Please expedite.

Hi,

I have worked at my previous company for 5 month 28 days(8-1-2007 to 6-7-2007) and in my current company I have epf a/c for last one and half years. Now I have transferred the amount from previous to new a/c. so can I eligible to apply for scheme certificate.

I HAVE JOINED SERVICE IN THE AGE OF 50 MY EMPLOYER COVERED ME UNDER EPF SHOULD I GET PENSION AFTER AGE OF 58 OR NOT

Hello

My name is Shailendra and I had worked in last company where i have 1 UAN No. after that i have joined another company and they give me another UAN no. so I can transfer my previous amount to new account.

Where to apply for EPS Pension as i have just retired from my service

Which forms should I fill and where to submit

I have Transfered My PF to new company Employee and Employer contribution is transferd but Pension contribution does not. Do i need to submit Annexes E. to my old PF office. please guide me.

Thank you

Transfer of EPS on Transfer of EPF from one company to another. If EPF gets transferred the EPS also gets transferred though UAN passbook shows amount as 0. UAN passbook will show the transferred amount of EPF but duration of job,Actual Served, will be noted in passbook as shown in image below.

Regret not received any reply to my post of dt.9/7/16

Hi

I worked for a company for 2 years then joined new company .I applied for EPF and EPS Transfer .

What I see in my UAN Account is only EPF transfer amount .How to check if my EPS is transferred or not to my new EPF and EPS account which was provided by my employer.

if EPS is not transferred ,what is the Process

Thanks

Satish

hi,

My basic pay is 45000 per month, and i have worked for exactly 16 months,

Now i have applied for PF Withdraw, how much amount I will get now, and How much will be left out in EPS scheme, is it (EPS amount) can be transferred after EPF withdrawal..??

Read your article for EPF and EPS.it is very helpful.Thanks a lot for it.

I have one question

Suppose A person works around +8 years in a company then he transfer his pf to new pf account for new company and pension amount also.

After some time his pf is transferred in new account but approx Rs 58000 pension amount (which was shown as pension amount on his previous account) is not transferred

Can you provide the rules / reason for the same.

How do you know that the EPS was not transferred?

The UAN passbook does not show transferred EPS amount.

As mentioned in the article WHILE TRANSFERRING PF FROM ONE ESTABLISHMENT TO ANOTHER, THE SERVICE DETAILS INFORMATION (VIZ LENGTH OF SERVICE, NON-CONTRIBUTORY PERIOD, LAST WAGES DRAWN ETC) ARE FURNISHED TO THE RECEIVING PF OFFICE IN ANNEXURE-K WHICH WILL BE USED TO CALCULATE PENSION BENEFITS. AMOUNT IN PENSION FUND IS NOT REQ”.

Dear sir , i have transfer money of epf from one account ot another. My contribution + employer contribution money transfered but pensio amount not transfer please suggest for this issue.

i HAVE WORKED FROM 1992 TO 2007 IN ONE COMPANY AND GOT MY PENSION CERTIFICATE IN LIEW OF PENSION AGAIN I STARTED WORKING FROM 2007 TO TILL DATE WITH 4 COMPANIES IN BETWEEN TWO BREAKS OF SERVICE FOR APPROXIMATLY ONE YEAR EACH. STILL I AM WORKING AND MY PREVIOUS SCHEME CERTIFICATE IS NOT LINKED TO PRESENT EMPLOYER. HOW I WILL GET PENSION AND HOW MUCH PENSION I WILL GET. MY PRESENT SALARY IS MORE THAN 15,000 AND EARLIER SALARY WAS MORE THAN 6500.

Dear sir,

I am epf member from 2007 onwards, this is my 3rd company , i withrawed epf from first company , there is 2 months gap between 1st and 2nd company, now i am working in 3rd company, I would like to withdraw my epf from 2nd company, may i get EPS benefitS by calculating continues service from 2007 onwards after my retirement

how to link my UAN for the 3 companies epf account

Hello Sir,

Read your article for EPF and EPS.it is very helpful.Thanks a lot for it.

I have one question

Suppose A person works around 6 years in a company then he withdraws his pf and pension amount also.Now after some time he joins another company.Does will he face any issue when joining the new company because he already withdrew the pension amount.The new company will have pf and pension policy.Thank

In Form 10d, in Family column, is it essential to mention names of deceased family members and provide their original death certificates?

Sir

I worked 2yrs from 2013 to 2015 in one company later I joined new company, I transferred my PF to new a/c, after 4yrs of service I left job and encashed my EPF after 2yr gap joined new job can I add my old EPS service to new job and EPS share will be added to new a/c?

Regret not received any reply to my post of dt.19/7/16 on the money lying in EPS a/c.

Hi Sir,

I worked more than 6 years after that i claimed my pf account. i received the full amount for Employee share and employer share,but i can not received full amount the pension contribution amount, only received 50% only. please clarify the pension amount.

Thanks,

Regards

Jaya Ganesh

I am a widow and have retired from private company last year after 30 years of service and getting a mere pension of Rs.1721/-. My son has turned 26 years of age. My question is since my son is not eligible for pension from EPS after my death, whether he can withdraw the EPS amount after my death. Please reply.

As per EPS rules Monthly children pension shall be payable until the child attains the age of 25 years

Hello Sir,

Read your article for EPF and EPS.it is very helpful.Thanks a lot for it.

I have one question

Suppose A person works around 6 years in a company then he withdraws his pf and pension amount also.Now after some time he joins another company.Does will he face any issue when joining the new company because he already withdrew the pension amount.The new company will have pf and pension policy.Thanks

No there should not be any problem. Everything was done legally.

For claiming EPS, will family members be taken as what I fill in the form or will other close relatives not mentioned in the form also have a share in claim? Must I mention close relatives who are deceased?

Hello I have recently quit my job from PSU Bank after 3 years of service. I want to know will I be able to withdraw the employers contribution in pf and my NPS

hi

for calculation of epf, is there any provision that DA should be formed part of retirement benefits?

Sir,

Any updates on my querry dated July 9, 2016

Sir,

Following are yearwise contributgion to my Employee Pension fund account since 1995:

1995-96 433.00

1996-97 3,754.00

1997-98 4,041.00

1998-99 4,393.00

1999-00 4,773.00

2000-01 5,004.00

2001-02 5,856.00

2002-03 6,468.00

From 2003-04 it is full contribution of 6492/- per annum and from Sept 2014 monthly 1250/-. Please let me know, what is the pension amount I will be getting, when I get retired on July 31, 2027? May date of joining the service is Dec. 1, 1193. Please guide me.

Regret not received any reply to my post of dt.9/7/16

Hi,

I would like to cancel my EPS. i need to withdraw the money now.what is the procedure for this. Please if anyone knows about this let me know.

Sorry you cannot cancel EPS and just have EPF. if you are without job you can withdraw from EPF and EPS

I have 10 years of service in one company and now I am going to be without a job for some time (I am 31 years of age). As such, I want to withdraw EPF+EPS… should I fill both Form 10C and Form 10D? Is that possible under the new rules? Thanks!

There are no changes in the EPF rules. Changes suggested in Feb 2016 were rolled back.

You can withdraw your EPF and EPS by submitting Form 10C and 10D to employer.

As you have worked more than 10 years you will get Scheme Certificate for EPS.

Thanks for your quick response!

So that would mean that I can withdraw the EPF amount with tax deductions, but I cannot withdraw my EPS and will have to settle for Scheme Certificate? Is there any way to bypass this certificate and opt for cash (for the EPS part) instead? It sounds horribly unfair! 🙁

Thanks for your time!

As you have crossed 10 years there is no way to bypass Scheme certificate in EPS.

Know its unfair..but can’t help it

If I contributed 1250 rupess for EPS in 35 years of service. The total accumulated amount will be 35*12*1250= 5,25,000

But after age of 58, I’m getting maximum 7,500 per month. The amount is very less.

If I deposit the same amount in POST office savings scheme ( Recurring deposit) the returns will be more.

My question for how years we have contribute to EPS. IS it for 10 years or until last day of service ?

Dear Sir,

My Q are:

1.Same is above?

2.Is it possible to partial withdrawn of EPS after 10 years of service?

Regards:

Santosh kumar

Sorry you cannot withdraw from EPS after 10 years of Service as you get Scheme certificate.

sir, I have completed 22.5 years of service in the cci and I got pension certificate at the age of 44 years and after 3 years again joined in birla concern till date working under new pension scheme my date of birth is 8.06.1959, I am going retire on 30.06.2017. Total service is 12.5 years before 1995 after service is 19 years then how much pension I will get. Please give me information.

pension calculation formula I have joined in sevice on 27.01.1983, taken VRS on 17.06.2003 and again I joined in service 7.01.2007 till date I am in service. on 30.06.2017 I will get retirement. Then how much I will get pension tell me.

Hi how to transfer widow pension scheme 1000 directly to the bank account?what is the procedure to do that?

Is it the widow getting pension from EPS?

if a EPF&EPS member dies his widow will be getting epf & pension as per pf rule

* he / she need to fill from 20 & 10d for the claim with proper documents need to submitted to the pf office

* nominee form or family members form or declaration form need to fill

* original death certificate or xerox attested by employer

* bank account in nationalised bank

My dad ‘ s joinoing date is 1/4/1998 & retiring date is 1/2/2016……basic salary 7384 & DA 256….how much pension he will receive??

My earlier company had superannuation scheme and the trust was under LIC. When resigned from the company, a portion of the accrued amount was considered for pension and am getting Rs. 4568/- P.M.

Since I joined another firm has tendered my resignation 4 months back.Now that I am planning to claim withdrawal as per Form 10 C, point 12, are you availing pension under EPS? What should I mention?

Also I have more than 10 years continuous service and aged 53. So will I be eligible for withdrawal of the ER contribution in full? Please advise. Thanks in advance. PS K

My earlier company had superannuation scheme and the trust was under LIC. When resigned from the company, a portion of the accrued amount was considered for pension and am getting Rs. 4568/- P.M.

Since I joined another firm has tendered my resignation 4 months back.Now that I am planning to claim withdrawal as per Form 10 C, point 12, are you availing pension under EPS? What should I mention?

Also I have more than 10 years continuous service and aged 53. So will I be eligible for withdrawal of the ER contribution in full? Please advise.

Was superannuation scheme over and above EPF?

If Yes, then you are not availing pension from EPS. Please mention No in Form 10C.

Yes Sir you will get full ER contribution, as the change by Govt for not getting Employer contribution has been removed.

As you have 10 years of service, you cannot withdraw from EPS. You will get a scheme certificate.

At age of 58 you will submit it to your EPFO to claim EPS Pension.

You can use our How much EPS Pension will you get with EPS Pension Calculator to find how much EPS pension you will get

I have service years of 19 years + 6 months + 17 days. Pension has been calculated by taking only 19 years service years.

As per my understanding it should be taken as 20 years + 2 bonus

Please clarify which is correct?

Regards,

Manohar

Sir / Madam,

I am retired Feb 2016 very recently from a Recent private organization(Company B) where I had a service of 8 years and so, i applied for withdrawal of both EPF and Pension amount and received the same.

But when I cross checked I had a “scheme certificate” from an earlier company (Company A) where I worked. I want to apply for pension using Form 10 D and below are my questions. Please clarify:

1: Do I have to submit my form 10 D through Recent private organization(Company B) or earlier company (Company A) ?

2: In the Pension calculation will my service of 8 Years in the recently worked company be calculated (FYI I withdrew all the PF and Pension Amount) ?

3: Also how to track my pension application ?

Hi,

I withdrew the entire EPF and EPS after working 3 yrs in a company in 2015 after 4 months of hiatus. The amount was credited into my acct in Feb 2016. As I already had some taxable income, the EPF was taxed at 10% of the total EPF. For filling returns for 2016 the accountant is saying the entire EPF amount should be considered as taxable income. Request you to please let me know,

1. whether EPF should be considered as taxable income and should it be included in calculating the total income and the tax accordingly calculated ( The withdrawal was done in Feb 2016 when the current rule was not in vogue) ?

2. If we have to claim exception on the total EPF amount withdrawan, under which section should it be done?

3. Should EPS also be included in calculating the total income?

4. If EPS is exempted from income tax, then under which section should one show the amt received from EPS while filing the returns?

5. Are the amts received from pension annuities taxable? If not, under which section the annuities amt should be shown for exemption?

Thanks & Rgds

Kris

When the PF amount is withdrawn before five years of continuous service, it is be taxable in the hands of the individual as if the fund was not recognised from the start of the contributions.Provident Fund would be treated as an Unrecognised Fund from the beginning.

The employer’s contribution and interest, thereon, would be fully taxable as as profits in lieu of salary or ‘salary income’ in the hands of the individual.

The employee’s contribution would be taxable to the extent of deduction claimed under Section 80C, if any, under the Income-tax Act,1961 and

The interest earned on employee’s total contributions would be taxable as ‘income from other sources’ in the hands of the employee.

See the example in detail in Tax on EPF withdrawa

Hi Kris,

I have the same issue. I worked for 3 years and withdrew entire corpus which was credited in Dec, 2015. On EPF amount, 10% was deducted. There was no tax deduction on EPS. I am pretty sure you would have to pay tax on EPF corpus in the way mentioned in the article link given by bemoneyaware below.

The EPS part is still a riddle. Let me know if you get information on EPS taxation and head under which it should be mentioned in case it is exempted.

Thanks,

Raghu

The process is painful but here is it.

Note: EPS part is fixed part is from employer contribution and does not earn interest.

Download the PF passbook from the UAN member portal. The EPF passbook shows the details similar to the image.

Now Add up the employee contribution excluding interest part.

Also Add up the employer’s contribution excluding interest.

Add up the pension contribution.

Pick the interest on employee contribution for a year. Deduct the interest of the previous financial year from the respective financial year.

Similarly also take out the interest on the employer’s contribution.

Now open the income tax efiling portal. Choose the respective financial year to revise the income tax return.

Increase your taxable income by the employer’s EPF contribution and earned interest of the year.

Fill the interest on employer’s contribution into the other income column.

Deduct the employee contribution from the total 80C investment amount. Now your 80C investment will go down.

Repeat the above 9 steps for every financial year. Check the taxable amount before return submission.

Pay the income tax and get the challan no. Fill the total tax paid amount and submit the revised return of every financial year.

Hi Bemoneyaware,

Sorry, if the question was ambiguous. Your article is very clear to me regarding EPF. That is not my question. My query is:

(i) Is the withdrawal of EPS (after 3 years of service) amount taxable? The EPFO has not taxed it while crediting, they have only taxed the EPF amount while crediting to my bank account? Do I need to pay tax on EPS amount received?

(ii) If EPS withdrawal amount is indeed exempt from income tax, under what head will it come if I am showing it as exempt income u/s 10.

The question is not about EPF but EPS. There are lot of internet articles for EPF withdrawal tax but not even one that clearly explains EPS amount withdrawal. Also, I am doubtful that we can file revised returns for older than one year.

Thank you in advance.

Thanks,

Vaibhav

Hii,

I worked with a Company for about 5 years and 3 months i have received my PF amount however i have not received my EPS amount. Already filled form 10 is there any way, i can check the status of withdrawal as its been more than 4 months i left my last organization, but EPS is still not credited to my account.

Hi,

I worked for an Indian company for 8 years 8 months(Sep2006-May2014) and after that I have moved to abroad.I have realised that after leaving the job my employer has only credited the EPF back to my account and not the EPS.

Can anyone suggest if I am still sligible to claim EPS money and who should i contact? My current total experience is 9 years 9 months but I am not in India since last 2 years so am i eligible for EPS withdrawal or I cannot get it now as my total experience is in 10 years bracket?

My employer is only providing me with an EPS certificate for 2 years of work. I joined in July 2014 and leaving in June 2016. Can I claim my EPS amount by depositing this certificate in Bank?

EPS Certificate after 2 years of work? Usually you get EPS Scheme certificate if you have contributed for more than 10 years.

You need to use if when you retire at age of 58. Submit it to Regional EPF and get Pension.

Hi, I have a query on EPS, I have Total Experience of 10 years but i worked in 6 various Companies, From HP only i remember my PF No

i.e on 2008 I served in HP for 1 year and 8 month, They Have PF trust Account at Banglore

on 2010 I join in SGK inc for 4 years , they have Chennai Zonal

on 2014 i join in Habilis for 1.6 years, they have Chennai Zonal

on 2016 I join in Marcous

Please let me know i should apply for Service scheme to move my EPS balance. earlier I had transferred my SGK PF to Habiliss linked UAN number through online transfer,but there is no reflection of my EPS balance on my online balance Passbook.

Does i have to Reapply for Service scheme to move my EPS to Current EPF UAN

Please guide me.

Regards,

John8939298807

EPS balance is not reflected in UAN passbook.UAN passbook will show the transferred amount of EPF but duration of job,Actual Servie, will be noted in passbook as shown in image updated in the article.

Check your UAN passbook.

Thanks for the reply,For Online transfer we have to give a separate form for transfer EPS, please let me know about service scheme certificate. why should we need it

Online transfer means transfer of EPS too.

Regarding scheme certificate once, the service period crosses 10 years, the money withdrawal option from EPS ceases.

you can only get Scheme Certificate which (s)he can use to get pension from the age of 50 years.

If you are looking for specific information please let us know

1. I had been worked with a Limited company ‘X’ from August, 1987 until June, 2000. And i think my PF contribution started from the year 1989. Then after 6 months i got back personal PF contribution amount.

2. I had joined and worked another company ‘Y’ July, 2002 to March, 2005. My old PF account joined with new company. After resigned from service i got back my personal contribution amount.

My question is about EPS….

1. I have submitted From 10C to withdraw my EPS amount,

As i am out of service since April, 2005,

My age right now beyond 52 years

But EPFO rejected my claim?

And there is no communication about reason?

I am confuse whether i am eligible to withdraw my EPS amount or not?

Or otherwise what is the best option for my case?

Since there is no interest towards EPS amount, i thought better to withdraw the amount if possible.

Hello Sir,

I have total service of 4 Years 6 Months and 1 day and i am planning to withdraw my EPF & EPS due to a personal need. Now based on table ‘D’, What is my proposition for withdrawal benefit of EPS?

Is it 4 years – 4.18

(Or)

5 years – 5.28

Also, does TDS will be calculated on Individual basis (EPS & EPF Amount seperately) or on the combined amount of EPS & EPF

Regards

Krishnan M

As your service is more than 4 years, 6 months it should be counted as 5 years.

TDS should only be deducted on EPF contribution as EPS does not earn interest or save tax.

Hi,

In My Member Pass book the below details are available.

विवरण/Particulars

पीएफ अंशदान/P.F. Contribution

पेंशन अंशदान/Pension Contribution#

I am having 14 years of service and my doubt is, if I resign today How Pension Contribution is treated.

For Example My Employer and Employee “P.F. Contribution” is 5,00,000 and Pension Contribution is 75000. If I resign today how the pension contribution 75000 will be treated.

You are eligible for pension only after 10 years in the service.

No pension is payable before the age of 50 years.

Maximum Pension one can get is Rs 7,500 per month.

Minimum Pension one can get is ₹ 1,000 per month.

Maximum service for the calculation of service is 35 years.

Amount of EPS pension depends on if you joined before 15.11.1995 or after.

How much EPS Pension will you get if you joined after 15.11.1995

For those who joined after 15 Nov 1995 the formula for calculation of Pension is simple. the formula of calculation of pension is,

(Average Salary X Number of Years Service)/ 70

Pensionable Salary here means amount you were contributing in EPS which is restricted to Rs 15,000 per year after 1 Sep 2014 and was Rs 6500 per year before 1 Sep 2014.

It is arrived by considering the average contributing salary preceding 60 months from the date of exit. (Earlier it was preceding 12 months)

Ex: How much pension will Rajni get if she works for 10 years from 1 Sep 2006 and retires on 1 Sep 2016

As Rajni has contributed Rs 541 per month for EPS and contributed Rs 1250 per month from 1 Sep 2014, if she retires on 1 Sep 2016 her pensionable salary for last 60 months or 5 years was Rs 15000 So her pensionable salary will be considered as

(Rs. 15000*5 )/5= Rs 15000 per year

hence her pension would be (15000X 10/70) = Rs 2143 per month

Hello!

I have gone through multiple questions answered. The answer to my question probably lies there; but for my own sanity, need help, thanks!

So, I’ve recently raised a transfer request of my PF from the previous organisation to the new one. I take it, that it’s transferring the PF amount only, and not the Pension Scheme. I worked at the last organisation for 4 years.

a) Can I withdraw the Pension Scheme amount, and not the PF amount (since I want this to be transferred).

b) If yes, how do I go about transferring the amount.

Thank you for your patience!

Typically transfer means transfer of both EPF and EPS. We haven’t seen transfer of EPF only.

You can withdraw EPF both the employee and employer contribution by submitting Form 19.

For EPS withdrawal you need to fill form 10C/10D

Process for transfer of EPF is Transfer EPF account online : OTCP

Sure, thank you! So for better understanding:

1. transfer of the PF amount, also would mean the transfer of the PS.

2. Similarly, if I were to withdraw the EPF amount, it’ll come with the EPS, and employee PF and employer PF.

3. The transfer has come through. It doesn’t show the EPS; only shows the Employee & Employer share. Hence, the question, does it or not transfer the EPS.

Thanks!

EPS does get transferred.

EPS calculation is simple. Rs 541 was deducted per month before 1 Sep 2014 and Rs 1250 per month after. No interest on EPS.

To calculate Pension they just need number of years that you worked.

You are right, it is easy to show that this EPS amount got transferred. But as we know common sense is not that common.

Your comment is awaiting moderation.

Dear sir

please guides

i have worked 5 year and 7 month

my basic was is Rs 8750 ( from last 11 month )

i have submitted form 10 c and i got 34076 in my account (which is same as eps shown in e passbook )

but as per table D calculation

8750*6.07 = 53211

please suggest what to do get difference amount

Sir for pension the maximum salary was Rs 15000 per year from 1 Sep 2014 and Rs 6500 per year before that.

If that’s in EPS passbook then you have got your share.

If you are OK then you can send snippet of your passbook to bemoneyaware@gmail.com and we will look at the caculations.

Hi,