ESG investing or Sustainable investing refers to investing in companies that meet high environmental, social, and governance standards. For example, companies that deal with Alcohol, tobacco, gambling, or adult entertainment are not considered meeting ESG parameters. ESG investing is becoming more than a public relations tactic. In 2020, $27.7 billion was invested in ETFs in U.S. markets. In India also, ESG investing is picking up as shown by the amount invested and NFOs of Mutual Funds in 2020. What is ESG Investing? What is the investment philosophy they follow? Is it a good investment?

Table of Contents

What is ESG Investing?

Usually, investors focus on returns. But now, investors want to associate with businesses that are more responsible for sustainability. So along with the income statement and balance sheet analysis(fundamental analysis), investors are considering ESG factors also as given below

- Environment: greenhouse gas emissions, water usage, pollution mitigation

- Social: workforce policies, labour standards, data privacy, product safety

- Governance: independence of the board, auditing, business ethics, anti-corruption policies

For example, ITC is a great company but foreign investors have exited this stock because it sells cigarettes and hence doesn’t score well on the ESG parameters

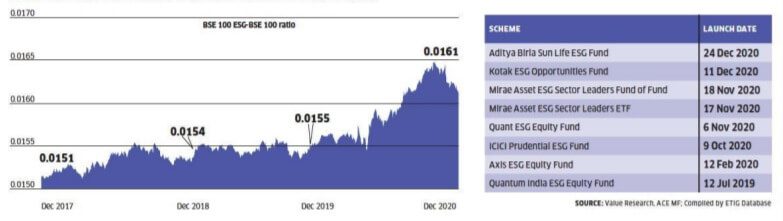

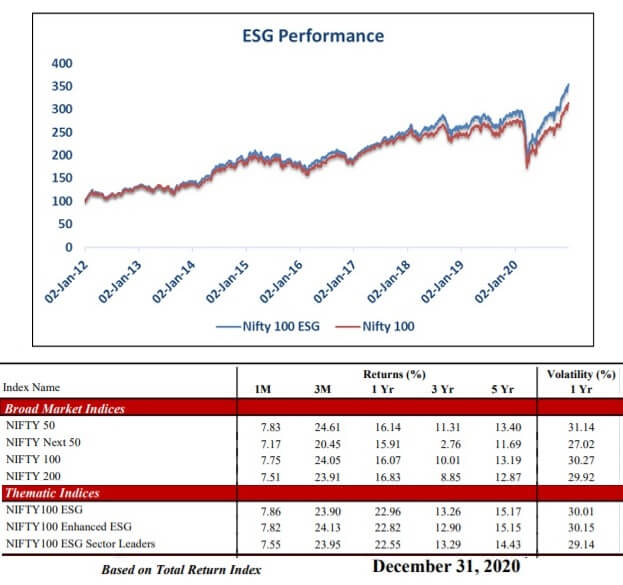

There are ESG Indices such as NIFTY100 ESG, NIFTY100 Enhanced ESG Index, Nifty100 ESG Sector Leaders. The image below shows the performance of Nifty 100 with Nifty ESG funds

Mutual funds based on ESG are also being introduced such as Quantum India ESG Equity Fund, Axis ESG Equity Fund (February 2020), ICICI Pru ESG Fund (October 2020).

Internationally, the Dow Jones Sustainability Index (DJSI) was introduced in 1999. Created jointly by S&P Dow Jones Indices and SAM, the DJSI selects the most sustainable companies from across 61 industries.

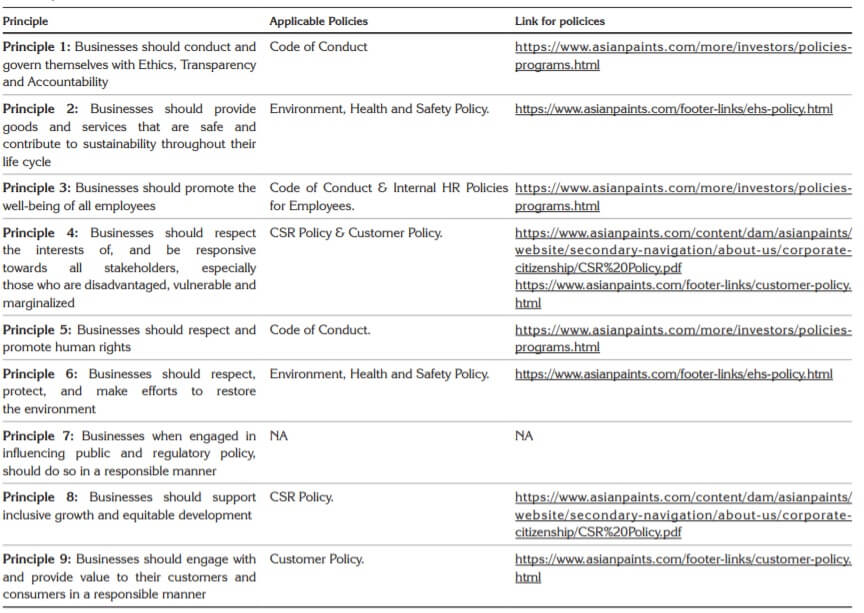

In India, SEBI mandates the top 1,000 listed companies, to prepare a business responsibility report (BRR) every year. The BRR has extensive disclosures about the level of adoption of responsible business practices. What BRR covers and Sample report is given later in the article.

Examples of Companies that rank high in ESG parameters

UltraTech Cement: As cement is a carbon-intensive industry, UltraTech has integrated low carbon strategy into its business roadmap to address SDG 13 (climate change goal) based on COP21 of the United Nations Framework Convention on Climate Change. Initiatives like cooler upgradation, calciner modification, voltage variable frequency drive installation. So Ultr Tech has been ranked among the top 10 companies, internationally, on Dow Jones Sustainability Indices (DJSI) in the ‘Construction Material’ Industry sector.

Maruti Suzuki awards scholarships to meritorious students from underprivileged and economically weaker communities. Maruti Suzuki has partnered with a number of states to adopt several Industrial Training Institutes (ITIs) and also set up the first Japan-India Institute for Manufacturing (JIM) in Gujarat.

HUL started the Suvidha Centre, which is located in Mumbai’s most challenging slums, to cater to issues of lack of personal hygiene, non-availability of safe drinking water and poor sanitation. So HUL was awarded the top corporate leadership ranking in the 2019 Sustainability Leaders Survey, for the ninth year running (2011-2019).

More such Indian companies at Top performing ESG companies in India & how are their stocks faring

ESG Investing in India

Moving to ESG is not recent in India. Regularity bodies like RBI, SEBI have been pushing companies to commit to ESG standards, sustainable development and non-financial reporting.

In 2007, the RBI(Reserve Bank of India) issued a letter to all scheduled commercial banks, advising them on their role on Corporate Social Responsibility, sustainable development and non-financial reporting.

In 2008, CRISIL Standard & Poor, KLD Research & Analytics launched the S&P ESG India Index, first investable index of companies whose business strategies and performance demonstrate a high level of commitment towards meeting ESG standards.

In 2012, the Securities and Exchange Board of India (SEBI) issued a circular that made it mandatory for the largest 100 listed companies to publish an annual business responsibility report. The requirement was extended to the 500 companies in SEBI’s Listing Obligations and Disclosure Requirements Regulations 2015. Bombay Stock Exchange (BSE) launched Greenex and Carbonex.

In 2014, a landmark CSR law was passed to mandate companies of a particular scale and profitability to spend 2 percent of average profits of preceding years.

In 2015, RBI included social infrastructure and renewable energy within the Priority Sector Lending requirements for banks.

Nifty ESG Indices

There are 3 NSE ESG indices.

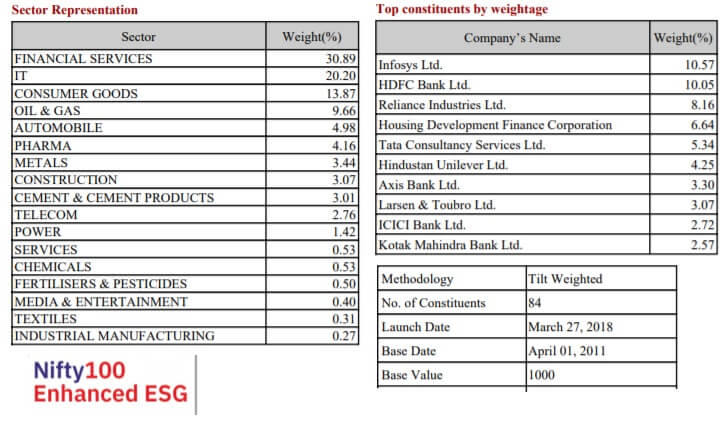

NIFTY100 ESG Index is designed to reflect the performance of companies within the NIFTY 100 index, based on Environmental, Social, and Governance (ESG) scores. The weight of each constituent in the index is tilted based on ESG score assigned to the company i.e. the constituent weight is derived from its free float market capitalization and ESG score.

The index was launched on March 27, 2018, and has a base date of April 01, 2011, and a base value of 1000.

NIFTY100 Enhanced ESG Index is designed to reflect the performance of companies within the NIFTY 100 index based on the Environmental, Social, and Governance (ESG) score. Companies should have a normalized ESG score of at least 50% to form part of this index. The weight of each constituent in the index is tilted based on ESG score assigned to the company, i.e. the constituent weight is derived from its free-float market capitalization and the ESG score.

Nifty100 ESG Sector Leaders Index aims to track the performance of select companies within each sector of the Nifty 100 which have scored well on management of ESG risk and which do not have involvement in any major controversies.

SEBI categorization rules allow a fund house to launch any number of thematic and index funds (unlike diversified funds or hybrid funds). Hence the plethora of ETFs and theme-based funds have been introduced. We shall these ESG funds in detail later in the article.

Comparison of ESG Index with Nifty

The image below shows the comparison of Nifty 100 ESG fund with the Nifty

Portfolio of ESG Funds

SEBI categorization rules allow a fund house to launch any number of thematic and index funds (unlike diversified funds or hybrid funds). Hence the plethora of ETFs and theme-based funds have been introduced

ESG investing faces its own set of challenges, the primary one is a lack of quality data

There are no uniform standards for ESG yet.

For portfolio construction, fund managers rely on SEBI mandated business responsibility report put out by listed companies which contain extensive disclosures about adoption levels of responsible business practices. But fund houses have adopted their own methods to determine which companies make the ESG cut.

ESG theme is becoming not just a luxury but a necessity in the present-day scenario.

| Inception | Number of equity holdings | Top 5 holdings | |

| Axis ESG Fund | February 2020 | 52 | Bajaj Finance, Kotak Mahindra Bank, HDFC Bank, Avenue Supermarts, Tata Consultancy Services |

| ICICI Prudential ESG Fund | October 2020 | 30 | HDFC Bank,

Kotak Mahindra Bank, Housing Development Finance Corp, Infosys, Reliance Industries Ltd |

| Mirae Asset ESG Sector Leaders ETF | November 2020 | 48 | HDFC Bank, Infosys, HDFC Ltd, Reliance Industries Ltd, TCS Ltd. |

| quant ESG Equity Fund | October 2020 | 22 | |

| Quantum India ESG Equity Fund | July 2019 | 47 | Infosys, Tata Consultancy Services, HDFC Bank Ltd, Housing Development Finance Corp Ltd, Wipro. |

| Aditya Birla Sun Life ESG Fund | Dec 2020 | Fortis Healthcare, DLF, Page Industries, L&T Technology Services, Adani Ports & Special Economic Zone. |

Business responsibility report (BRR)

SEBI mandates the top 1,000 listed companies, to prepare a business responsibility report (BRR) every year. The BRR has extensive disclosures about the level of adoption of responsible business practices. The image below shows the Principles covered in BRR of Asian Paints, details of which can be found here.

Related articles:

All About Mutual Funds : Basics, Choosing, Paperwork, Direct Investing

- International Mutual Funds: What are these, Pros and Cons, Tax

- What is Small case? How is it different from Mutual Funds? Should you invest

- Understanding ELSS Funds or Equity Linked Saving Schemes

- Understanding Equity Saving Funds, Arbitrage, Taxation

ESG Investing is still in a nascent stage in India but slowly it is picking up. Many Mutual Funds have come up with ESG NFOs. There are no uniform standards for ESG yet. For portfolio construction, fund managers have adopted their own methods to determine which companies make the ESG cut. And the performance of ESG indices is comparable to the Nifty 100 index. Do you think ESG Investing will pick up in India?