What is the ETF? What types of ETFs are available in India? How are they different from Mutual Funds? How are they different from Index Mutual Fund? Should you invest in ETF? How to buy and sell ETF on Zerodha, Upstox?

Table of Contents

What is the ETF?

ETF or Exchange Traded Fund Like a mutual fund, an ETF is also a basket of securities

but unlike mutual funds, ETFs trade daily on an exchange under a ticker with live intraday prices, similar to stocks.

So Investing in ETFs combines the diversification of mutual funds with lower investment minimums and real-time pricing like that of Stocks.

Most ETFs in the world today are passive, they track an existing index like the Nifty-50.

- Passive Investing is when it follows a systematic rules-based approach to selecting stocks/bonds that is predefined and doesn’t involve any “active” calls.

- Active Investing involves a fund manager with his team, handpicking stocks depending on market conditions and his market views & taking judgment calls when presented with new information.

ETFs that track an index suffer from something called tracking error, which is the difference between the index return and the fund return. This is also applicable to any passive mutual fund which is tracking an index.

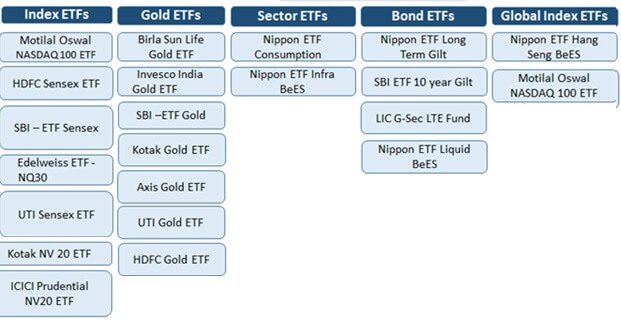

ETF landscape includes different segments of the equities market, gold, fixed income etc. But the most common disadvantage of ETFs, at least in India, is that they don’t have enough liquidity. The image below shows some of the ETFs available in India.

India and ETF Investing

The first ETF in India was created in 2001 when Benchmark Mutual Fund launched the Nifty ETF Fund to track the Nifty-50 index. Benchmark sold its business to Goldman Sachs in 2011, who in turn sold it to Reliance Mutual Fund in 2015. These funds are still in operation.

The Government had mandated Retirement and superannuation funds to invest at least 5% of yearly accretion in Equity markets. EPFO has invested Rs 86,966 crore in exchange traded funds (ETFs) till September 2019. The Employees’ Provident Fund Organisation (EPFO) is investing in ETFs based on Nifty 50, Sensex, Central Public Sector Enterprises (CPSEs) and Bharat 22 Indices. According to experts, the assets under management (AUM) of the SBI Nifty 50 and SBI ETF Sensex schemes expanded mainly due to inflows from EPFO.

The EPFO has been investing in ETFs since August 2015. Initially, the body decided to invest 5 per cent of its investible deposits into stock markets. Later, the proportion was increased to 10 per cent in 2016-17 and 15 per cent in 2017-18 and onwards.

The US is the largest market for ETFs in terms of asset size & offerings.

Video on What is ETF?

ETF vs Mutual Fund: Difference between ETF and Mutual Funds?

| Description | Exchange-Traded Funds(ETF) | Mutual Fund |

| Examples | Kotak Gold ETF invests in Gold (Gold)

SBI Sensex ETF invests in Sensex (Equity) Bharat Bond ETF invests in Bond Index (Debt) |

Kotak Gold Fund invests in Gold (Gold)

SBI Sensex Fund invests in Sensex (Equity but Index) Axis Bluechip Fund invests in Large Cap companies (Equity) ICICI Prudential Short Term Fund Invests in debt securities (Debt) Mirae Asset Equity Savings Fund invests in both Equity and Debt

|

| Definition | It is a collection of securities(stocks, bonds, gold) with an objective | It is a collection of securities(stocks, bonds, gold) with an objective |

| Tied to | It usually follows an index, the fund manager has not much choice, hence comes under Passive Investing. | May or may not follow an Index.

Mutual funds which follow index are called Index Mutual Funds and come under Passive Investing. In Non-Index Mutual fund, the mutual fund manager can choose securities based on objective but has index as a benchmark. Called as Active Investing. |

| Similar to | Like you buy and sell any stock | Like You buy and sell any Mutual Fund |

| What you need To buy and sell | You need a demat and trading account.

|

You don’t need any special account.

You can buy or sell from Distributor, AMC, Apps, Cams, MFUtility etc.

|

| When can you buy/sell? | You can buy/sell anytime during trading hours provided there is someone to sell/buy | The order put before cut off time is processed at the end of the day. |

| Whole or Fraction | You can buy only in multiples of units.

No fractional unit of ETF. For example, you have 2200 Rs and each unit of ETF is 1000. You can buy only 2 units for 2000. |

You can get fractional units.

If each unit is Rs 1000 and you have 2200, you will get 2.2 units. |

| At what price will you get/sell the unit | At the price at the time of buying/selling.

Depends on Demand and Supply |

At NAV at the end of the day. |

| Liquidity/Tradibility | As it is like stock it depends on Demand and Supply | You can buy or sell anytime.

Mutual Fund company has to accept the sell order(mostly). |

| Charge | You have to pay Brokerage Charges and expense ratio. | You need to pay an Expense Ratio |

| Exit Loads | No exit load or penalties | Many funds charge 1% in case the investment is redeemed within 1 year |

| Cash Holdings | ETFs hold no cash – as such, all money is put to work | MFs can hold cash for the investor – often this drags down performance |

| Transparency | Holdings published on a daily basis | Holdings is published once a month |

| Advanced Trades | Expert investors can use ETFs to place limit orders

even trade in derivatives based on ETFs |

Such expert trades can’t be done with mutual funds |

| Taxation | Depends on the equity percentage.

If Equity is more than 65% equity taxation else debt |

Depends on the equity percentage.If Equity is more than 65% equity taxation else debt |

| How to compare | Choose one which matches your risk profile, better if tied to a goal, has less expense ratio, tracking error, | Choose one which matches your risk profile, better if tied to a goal, has less tracking error, beats its benchmark |

ETF vs Index Mutual Fund: Difference between ETF and Index Mutual Funds?

Most ETFs in the world today are passive, they mostly track an existing index like the Nifty-50, Sensex.

A mutual fund is a professionally managed investment scheme that pools money from many investors and invests it in stocks, bonds, short-term money market instruments and other securities in accordance with objectives as disclosed in the offer document. Our article All About Mutual Funds explains it in detail.

Index Mutual Fund is a Mutual Funds which invests in the securities as the index it follows. For example, SBI Nifty Fund invests in stocks of companies like Reliance, HDFC Bank in the same proportion as Nifty.

| Description | Exchange Traded Funds(ETF) | Index Mutual Fund |

| Definition | It replicates an index, usually | It replicates an Index |

| It is like | It trades like a stock. Hence all features of stocks apply | You buy and sell like Mutual Funds. |

| What you need To buy and sell | You need a demat and trading account. | Don’t need any special account.

You can buy or sell from Distributor, AMC, Apps, Cams, MFUtility etc. |

| When can you buy/sell? | You can buy/sell anytime during trading hours provided there is someone to sell/buy | You will get Mutual Fund units only at the end of the day. |

| Whole or Fraction | You can buy only in multiples of units. No fractional unit of ETF. For example, you have 2200 Rs and each unit of ETF is 1000. You can buy only 2 units for 2000. | You can get fractional units. If each unit is Rs 1000 and you have 2200, you will get 2.2 units. |

| At what price will you get/sell the unit | At the price at the time of buying/selling. Depends on Demand and Supply | At NAV at the end of the day. |

| Liquidity/Tradibility | As it is like stock it depends on Demand and Supply | You can buy or sell anytime. |

| Charge | You have to pay Brokerage Charges on buying and selling and an Expense Ratio | You need to pay an Expense Ratio |

| Expense Ratio | is Less (usually) | is More |

| Taxation | Depends on the equity percentage.

If Equity is more than 65% equity taxation else debt |

Depends on the equity percentage.If Equity is more than 65% equity taxation else debt |

| How to compare | Choose one which matches your risk profile, better if tied to a goal, has less expense ratio, tracking error, | Choose one which matches your risk profile, better if tied to a goal, has less tracking error, beats its benchmark |

What is Index?

An index is an indicator or measure of something. In the case of finance, the index consists of a portfolio of securities representing a particular market or a segment of it.

One cannot invest directly in an index.

One can invest in Exchange Traded Fund(ETF) which follows an index or a Mutual Fund which benchmarks against an Index.

In India,

- We have two major Stock exchanges: BSE and NSE. Our article

- Stock indices like Sensex of BSE and Nifty-50 of NSE. Constituents of the Nifty are shown in the image below.

- But there are many indices of each exchange.

- Broad-based Indices based on the number of companies in the portfolio. Ex SENSEX, BSE-100, BSE-200, BSE-500, BSE Mid-Cap and BSE Small-Cap index, CNX 100, Nifty Midcap 50

- Sector Indices based on the number of companies in one sector ex: BSE Auto Index is the index of Auto companies in India. , BSE BANKEX, BSE Capital Goods Index, BSE Consumer, Durables Index, BSE FMCG Index, BSE Healthcare Index, BSE IT Index, BSE Metal Index, BSE Oil & Gas Index, BSE Power Index, BSE Realty Index

- Theme Indices: based on the companies following a theme like CNX Commodities, or Nifty BHARAT Bond Index – April 2023 used by Bharat Bond ETF.

Video on ETF vs Index Fund

One can invest in the stock market either through an Index fund OR an ETF, both of which serve the same purpose except there are some minor differences between the two which are explained in this video.

Video on How to buy and sell ETF on Zerodha, Upstox

This video explains how to buy sell ETF on Zerodha, how to buy sell ETF on Upstox,

Should you Invest in ETF?

If you have a demat account and you find that an ETF has fewer charges compared to equivalent Mutual Fund then you should.

Investing in ETFs has its own set of advantages like the low-cost product, can be bought and sold just like shares etc.

ETFs is one of the better ways of passive investment. Although, we are a developing economy, so, there are a lot of opportunities available for the actively managed funds to create an alpha. Nevertheless, as the market becomes more efficient, we may see the alpha generated by the active funds declining.

It is better to invest in ETFs rather than in a single company as the volatility of an ETF might be low as compared to a single company. Also, it sets you free from the process of fund selection.

Long-term investors can consider investing in ETFs as they can cash in the benefits of the low-expense ratio.

Investors can also use ETFs to diversify their portfolio further, by investing in an international equity index.

So, does it mean they would replace the mutual funds? Not at all! Though similar, both the products are structured differently and investors can use them judiciously to achieve their financial goals.

Related Articles:

- Stock Market Index: The Basics

- Investing in Equities: Stocks vs Mutual Funds

- Indians Invest in US Stock Market: Why, DOW, NASDAQ, How to invest

Do you invest in ETF? Do you invest in Index Funds?