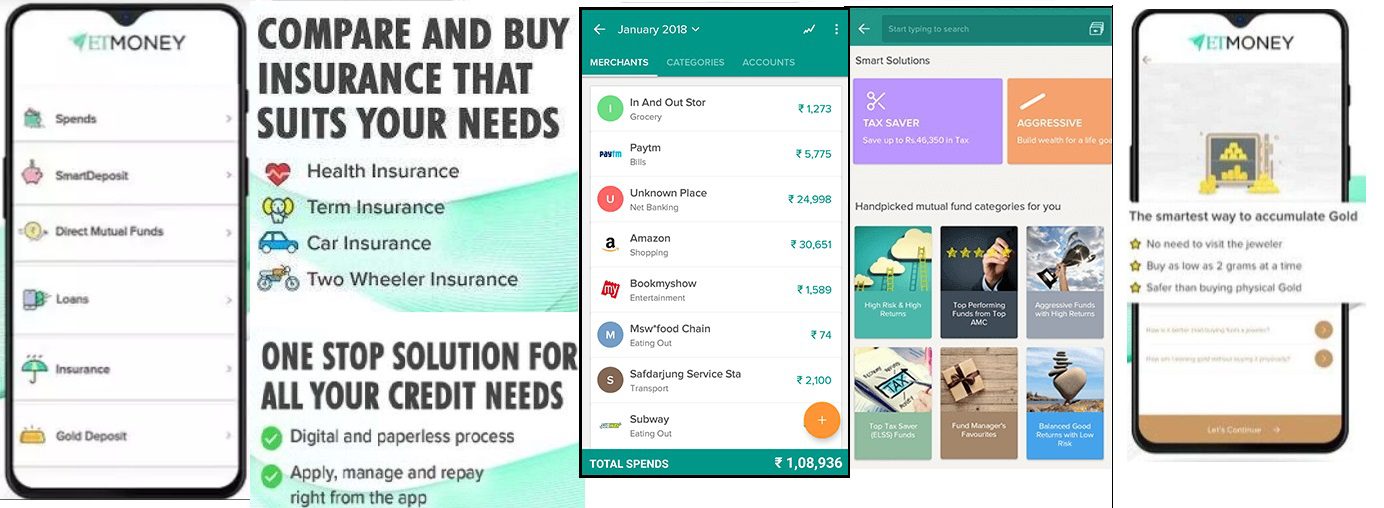

ETMoney App promises to be a one-stop solution for all your financial needs-Direct Investing in Mutual Funds, Loans, Spend Tracker, Insurance, Buying Gold and More. Everything on ET Money is paperless. Lets look at ET Money App in Detail, what are its features and how does it help one in Finances.

Table of Contents

Features of ET Money App

ET Money App is available on both Android and iOS. ET Money App has 4.6 rating on Google PlayStore with more than 5,000,000+ installs. It has done $1 billion of investments 75 lakh Indians since Nov 2016.

It is a Times Internet-backed company. Times Internet is the digital arm of the Times of India Group, the largest media conglomerate in India which offer products like Newspaper Times of India(TOI), Economic Times(ET), Navbharat Times(NBT), Cricbuzz, Gaana, MX Player, Dineout, Indiatimes, MensXP, iDiva, Gradeup etc.

Everything on ET Money is paperless and done on SmartPhone.

The ETMoney app is safe for example when you do direct Investing through ETMoney App, your money goes to Mutual Fund companies.

Features of what makes ETMoney unique are:

- Direct Investing in Mutual Funds: ETMoney allows direct i.e zero-commission investing in Mutual Funds. It helps in Mutual Fund investments by giving Investment Ideas

- ETMoney’s Spends Tracker and Monthly Saver automatically aggregates all your spends at one place by tracking your expenses through your SMSs and categorising them so that you have a track of where your money is going.

- Personal Loan, RBL Credit Card and Credit Line: If you have salary above Rs 25,000 a month and a good credit score then you can avail personal loan or Loan pass on ET Money App in collabration with RBL bank. If you go for Loan pass you get a RBL Credit card.

- ETMoney Smart Deposit: ETMoney allows investment in Nippon India Liquid Fund which offer better returns than Saving bank account.

- Insurance: ETMoney offers Term Plan, Health Insurance, Car Insurance, Bike Insurance from more than 20 insurers(like HDFC Ergo, HDFC Life, Bharti AXA, Kotak, Apollo Munich,Tata) where you can compare and buy the best plans.

- ETMoney Gold Deposit Through ETMONEY’s GoldDeposit, you get the flexibility to buy gold digitally through Nippon’s (earlier Reliance) Gold Savings Fund

Comparison of ETMoney with other platforms for direct investing in Mutual Funds such as PayTm Money App, Zerodha is discussed in detail in Compare Direct Mutual Funds Investing Platforms, a snapshot of which is given later in the article.

CEO of ETMoney is Mukesh P Kalra @kalramukesh . Mukesh cofounded Moneysights but had to shut it down in 2012. Times Internet bought Moneysights in 2014 for an undisclosed amount, integrated it with ET Portfolio, and rebranded it as ET Money.

Link to Google Play store for ET Money App. Please read it for reviews

Note: It has customer service 9205231523 if you want any clarifications/help. You can also do online chat or email.

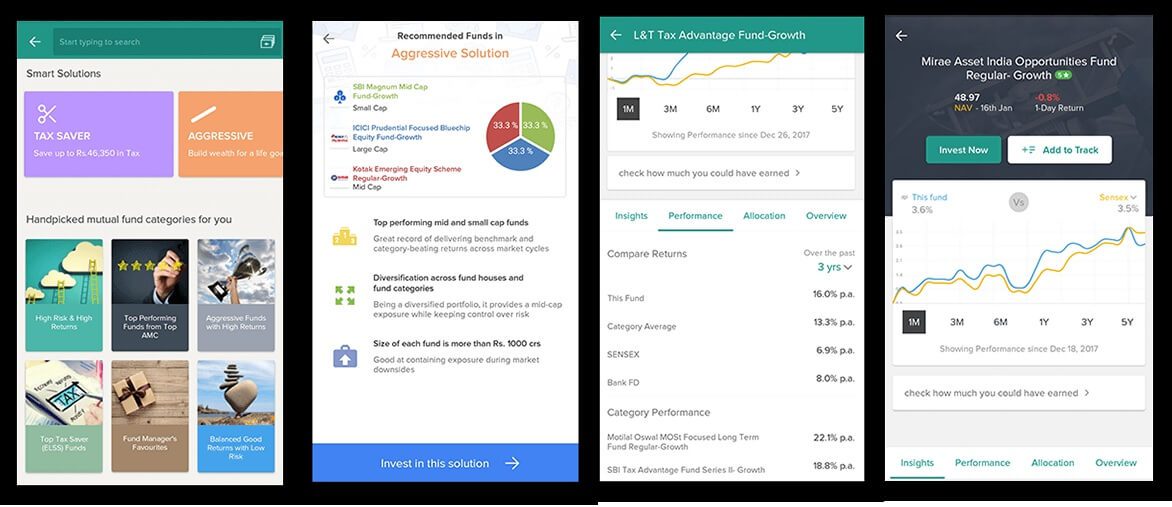

ETMoney Direct Investing in Mutual Funds

ETMoney allows direct i.e zero-commission investing in Mutual Funds. So users can invest in any mutual fund scheme with ET Money’s paperless & instant KYC procedure without paying a penny in commission or brokerage. This results in investors earning up to 1% higher returns using the ETMoney app on the same investment as compared to commission-driven plans they buy from agents. Just by saving on this commission, one can earn up to Rs. 25 lakh extra in 25 years.

It also helps in Mutual Fund investments by giving Investment Ideas like Top Tax Saver (ELSS) Funds, Best Index Funds, Mutual Fund for Beginners, Invest like Warren Buffet i.e Value Investing, Best SIP funds, detailed analysis of Mutual Funds.

You can invest in SIP or Lump Sump. You get detailed information about the Mutual Fund, how the returns have been, how does it compare to index, other similar funds(category)

It also allows Tracking of Investments both made through ETMoney app and not made through ETMoney.

Video on Direct Investing in Mutual Funds through ET Money App

ET Spends & Monthly Saver

ETMoney’s free Spends Tracker and Monthly Saver automatically aggregates all your spends at one place by tracking your expenses through your SMSs and categorising them so that you have a track of where your money is going. You also get a weekly/monthly spends summary about your expenses to keep you on top. There is also a feature of setting up automatic bill reminders so you have to never pay a late fee ever again.

Video on ETMoney Expense Tracker

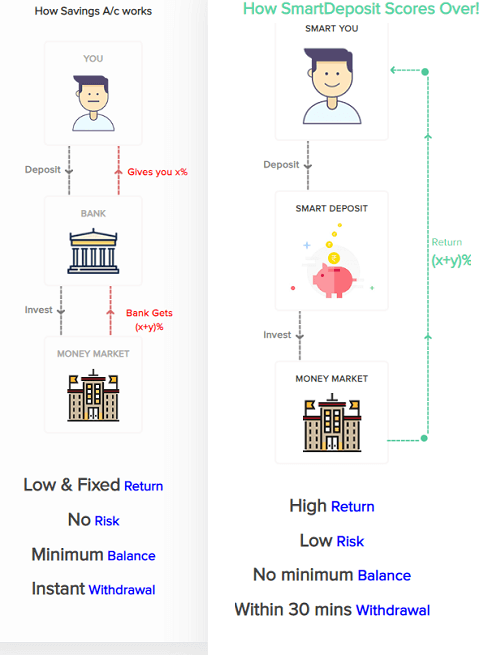

ETMoney SmartDeposit: Get returns better than saving bank account

ETMoney allows investment in Nippon India Liquid Fund which offer better returns than Saving bank account. Saving bank offer around 3.5-4% interest rate. But liquid fund offers a higher return of around 6%.

Liquid funds has a very small lock-in period of 7 days(exit load between 0.007% to 0.0045% if redeemed within 7 days), 24X7 withdrawal, instant redemption. This is what ETMoney calls UPAR KI KAMAAI which is easy to earn Convenience Of Savings Account, With FD Like Returns

A liquid fund is a debt mutual fund that invests in financial instruments such as government bonds, CPs, treasury bills, etc. Liquid mutual funds have a maturity period of 91 days.

Nippon India Liquid Fund is a popular Liquid fund, details of which you can find on valueresearchonline.com here.

ET Insure: Insurance on ETMoney App

ET Insure offers the best insurance policies from more than 20 insurers(like HDFC Ergo, HDFC Life, Bharti AXA, Kotak, Apollo Munich,Tata) where you can compare and buy the best plans that have the features you’re looking for within seconds. It offers Term Plan, Health Insurance, Car Insurance, Bike Insurance.

ETMoney Gold Deposit

Through ETMONEY’s GoldDeposit, you get the flexibility to buy gold digitally through Nippon’s (earlier Reliance) Gold Savings Fund. Once invested, the user can also track the value of their gold in grams with realtime update of gold prices. so don’t have to visit the jeweller to purchase the metal as they . With just 5 clicks on your phone, you can buy 24 Karat 99.5% pure gold from as low as 2 gms at a time in a completely secure manner. and there are no storage charges. You can sell gold online later easily at the ongoing market price.

For details about Nippon Gold Savings funds on Valuereserachonline.com can be found here.

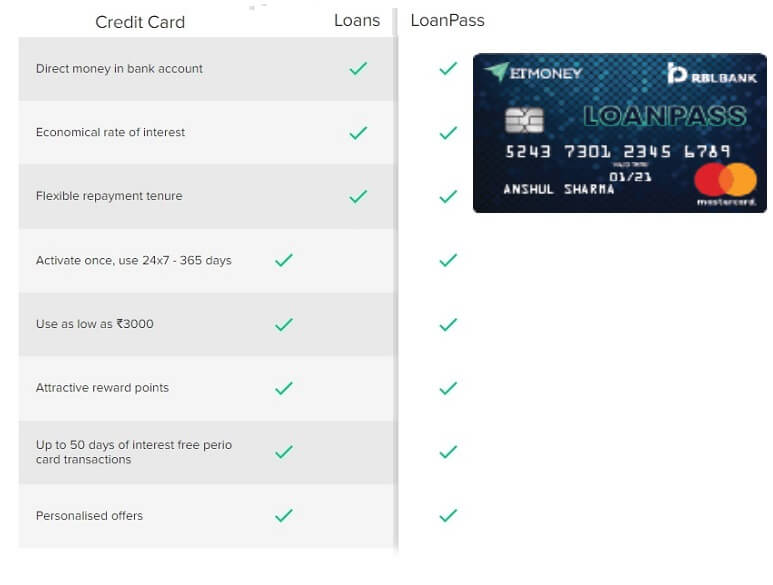

ETMoney Loan, What is Loan Pass?

Applying for loans like personal loans can be a pain considering the tiring application process and recurring bank visits. If you have salary above Rs 20,000 a month and a good credit score(above 750) then you can avail personal loan or Loan pass on ET Money App in collaboration with RBL bank.

For users with no credit score, ETMONEY has created a machine learning based proprietary scorecard to enable them to get a CreditLine.

ET Money allows its users to check their credit scores on its platform for free using credit reporting agency, Experian.

ETMONEY Personal Loan or LoanPass works in a manner similar to your credit cards and loans when it comes to Credit Score. Your score gets negatively impacted in case of missed and late payments and will improve as and when you repay your credit amount on time.

ET Personal Loan

On ETMoney App salaried individual of Indian nationality can get hassle-free Personal Loan from 60,000 Rs up to ₹20 Lakh at interest rate starting from 11.99% p.a. Amount and interest depends on your Credit Score.

- Individuals with monthly net salary greater than ₹20,000

- Age over 25 years and less than 58 years

- Live in one of the 700+ servicable cities

- Avail loan of any amount from ₹60,000 to ₹20,00,000

- Flexible repayment options with tenures ranging from 2 years to 5 years

- Interest starts from 11.99%

- Other charges

- Processing fees – 3% + GST for loans of value upto ₹1,00,000 & 2% + GST for loans of value greater than ₹1,00,000

- Pre-EMI interest if applicable will be added to the first EMI

- Foreclosure (Loans disbursed on/after 1st April 2019) – 4% (+GST) for loan closed before 12 months, 2% (+GST) for 12-24 months and NIL for loans closed after 24 months

- Foreclosure (Loans disbursed on/before 31st March 2019) – 4% (+GST) for loan closed before 12 months and NIL for loans closed after 12 months

- Loan Amount – ₹5,00,000

- Interest Rate – 12.0%

- Loan Term – 60 Months

- Monthly EMI – ₹11,122

- Processing Fees – 2%

You can check your eligibility within 2 minutes by submitting your basic details.

ETMoney Loan Pass

ETMoney Loan Pass is a pass to get instant loans anytime from RBL bank. It combines the benefits of instant loan and credit card into one . Loan pass is similar to withdrawing money from ATM using credit card. So you get a credit card from RBL bank for online/offline purchases. You can split your LoanPass limit between withdrawing to your bank account or spending using credit card as per your needs.

RBL Credit Card: You get RBL Credit card which has all the advantages of using a credit card. All the shopping on your credit card will be interest-free until the monthly credit card payment due date. You get benefits on using the credit card like you get 1 Reward Point on every ₹1,00 spent and 4000 Reward Points on crossing ₹1.2 lakh spent in a year.

ETMoney Loan pass offers a cashless credit line where users can get approval once and borrow from as low as Rs.3,000 to as high as 5 Lakh unlimited number of times instantly with no repeat paperwork and zero collateral using only their smartphone.

- In a single transaction, you can withdraw maximum of ₹2,00,000.

- You can have multiple withdrawals to your bank account of different amounts and for different tenures as per your financial need.

- Interest is only charged on the amount that you transfer to your bank account and not on the entire LoanPass amount.

- Interest rate charged will be personalized (ranging from 13% to 18% p.a.) based on your application details and profile(basically on your Credit Score).

- One-time repayment(with No pre-payment charges) within 20 to 50 days or EMI options ranging from 2 to 36 months. So it is Suitable for short-term money crunches as you have

- With every repayment of your monthly dues, the available balance tops us by the payment amount and can be used for next withdrawal.

- How to use ETMoney Loan

- You can withdraw any amount from ₹3000 up to your available credit limit to your bank account.

Video on ETMoney Loan Pass

What is Credit Score

Credit score is a 3 digit number ranges between 300 to 900 and is a crucial part of one’s financial health. It is a detailed record of an individual’s borrowings and repayment across loans and credit cards over the years. Banks and lenders use it to determine the risk they are taking by lending to you. A high score indicates low risk and increases your chances of getting loans and credit cards at a lower interest rate as compared to someone with a low score.

Paying Loan EMIs , credit card bills on time is generally the single most important contributor to a good credit score. Being late on any bill / EMI, is considered a possible indication of future non-payment of debt and is viewed negatively by lenders. Avoiding late payments is the best way to ensure a good credit score.

There are a total of 4 credit bureaus in India(at present). All credit bureaus in the country are licensed by the Reserve Bank of India (RBI).

- CIBIL or TransUnion CIBIL

- Equifax

- Experian

- CRIF Highmark

All credit bureaus have access to similar information about your credit profile from banks/financial institutions but they create their own scoring model to derive a credit score between 300-900. All are equal. Each of them provide Free credit report once a year.

Related Articles:

- All About Mutual Funds : Basics, Choosing, Paperwork, Direct Investing

- Compare Direct Mutual Funds Investing Platforms,

ETMoney app seems to be go-to app for all your financial needs. It is quite popular. What do you think about the ETMoney App? Which feature of ETMoney app did you like? Which feature you did not like? What more do you want from ETMoney app? Which App will become more popular ETMoney App or PayTm or ??

ET money customer care number..7679159909 Amazon India care number…7679159909 best Amazon successful India

ET money customer Amazon India care number…7679159909 best Amazon successful India