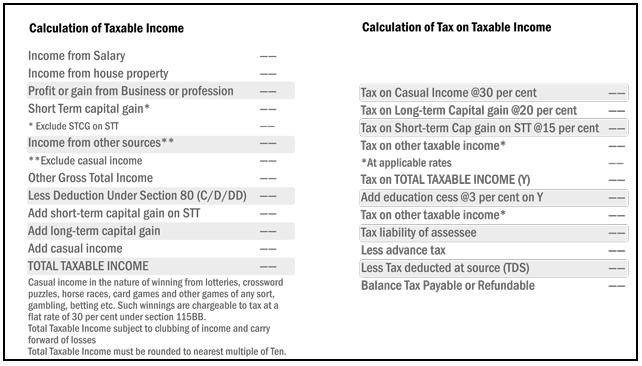

The income earned between 1 Apr 2020 to 31 Mar 2021, called FY 2020-21, will be assessed for tax in the AY 2021-22. The last date for filing returns for individuals is 31 Dec 2021. This article lists all the articles for understanding Income Tax Return or ITR, filling Income Tax Returns. The following image shows how to calculate Income Tax

Table of Contents

What is the Income Tax?

If you have income there is a tax. To understand Income Tax we need to understand what is Income, Income Tax slabs, Types of Income, the tax on different types of Income when it is taxed, dates and year related to Income Tax, tax cut i.e TDS, how to see TDS, how and when to pay advance tax, how to pay tax due. Our article Understand Income Tax: What is Income Tax, TDS, Form 16, Challan 280, lists all the articles for understanding basics of Income Tax.

Last Date to File ITR

The income earned between 1 Apr 2020 to 31 Mar 2021, called FY 2020-21, will be assessed for tax in the AY 2021-22. Details in our article How to File ITR for FY 2020-2021 or AY 2021-2022

How to File ITR

Income tax filing and processing comprises of following stages. Our article explains rules applicable on How to File ITR for FY 2020-2021 or AY 2021-2022

-

- Compute income (5 types: Income from Salary, Income from owning a house, Income from selling capital (Mutual Funds Stocks, Property/House, Gold), Income from Business/Profession, Income from other sources(Interest on Saving bank account, Interest on FD)

- Check Exempt Income if any (PPF interest, EPF withdrawal after 5 years, Life Insurance payment)

- Deduct valid deductions (under Chapter VI-A) 80C,80D etc.

- Claim TDS already deducted(Check Form 26AS)

- Determine tax payable. Your net tax due should be 0.

- Pay the Self Assessment tax using Challan 280 if any and update ITR.

- Submit ITR.

- E-verify ITR / Sending ITR-V

- Wait for ITR to be Processed: Either ITR will be Processed / or you would get Notice

Video on How to File ITR

The 8 min video from Income Tax Department provides guidance to taxpayers on How to e-file ITR-1 (Sahaj) for AY 2020-21

Before Filing ITR

Why should one file ITR? Is it mandatory to file ITR? : It is our constitutional obligation to file tax returns

What is Financial Year and Assessment Year,Difference, ITR,Fiscal Year of World

- Income Tax for Beginner

- Income Tax for FY 2018-19 or AY 2019-20

- Income Tax for FY 2019-20 or AY 2020-21

- ITR for FY 2018-19 or AY 2019-20: Changes, How to file

- Documents Required to file ITR, For All types of Income

- Mistakes while Filing ITR and CheckList before submitting ITR

- What to Verify in Form 26AS?

- Missed Filing ITR of Earlier Years: Check Tax Liability,File Condonation of Delay,

- Which ITR Form to Fill?

- Filing Income Tax Returns after deadline

Income Tax Slabs for FY 2019-20 (AY 2020-21)

| Tax | MEN and WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 250000 | 300000 | 500000 |

| 5% tax | 250001 to 500000 | 300001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Surcharge | 10% of tax where total income exceeds Rs. 50 lakh

15% of tax where total income exceeds Rs. 1 crore |

||

| Education Cess | Health & Education cess: 4% of tax plus surcharge | ||

| Tax Rebate | Rs 12,500 for income up to 5 lakh u/s 87A | ||

Filling Income Tax Return

You can file your income tax returns using the following Options.

- Do it yourself, file through Income Tax Department website https://incometaxindiaefiling.gov.in/

- Filing through a professional (Chartered Accountant/Tax Return Preparer (TRP)/Certified Financial Planner)

- Using an online e filing Service provider like Cleartax.in, MyITreturn.com, Taxspanner.com,Taxsmile.com

- E-Filing of Income Tax Return,

- How to file Income Tax Return Online: Incometaxefiling,CA,efiling Websites

- Comparison of Income Tax Filing Websites:IncomeTaxEfiling,ClearTax,etc

Filing on Income Tax Website

- Registering on Income Tax efiling Website

- How to Reset Password if you Forget password of Income Tax E Filing Website

- Prefilled ITR: Quick eFile ITR1 or Quick e-File ITR4 Online

- E-filing : Excel File of Income Tax Return,

- How to Link Aadhaar with PAN for filing ITR

- Prefilled XML to Fill ITR2, ITR3 in Excel or Java Utility

- Income Tax Refund, PreValidate Bank Account, Link PAN, How

Filling ITR1 Form & ITR2

- Which ITR Form to Fill?

- Filling ITR 1-Form

- How to fill ITR1 for Income from Salary,House Property,TDS

- Filling Individual ITR Form: Fields A1 to A22

- Filling ITR-1 : Bank Details, Exempt Income, TDS Details

- Fill Excel ITR form : Personal Information,Filing Status

- Fill Excel ITR1 Form : Income, TDS, Advance Tax

- Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax

- How To Fill Salary Details in ITR2, ITR1

- How to Fill ITR when you have multiple Form 16

- Tax Exempt Allowances in Salary Schedule S in ITR2

- How to Claim Deductions Not Accounted by the Employer

- Are ESPP,ESOP in MNC to be filed in ITR as Foreign Assets?

ITR: Income from Other Sources, Exempt Income

- Income From Other Sources :Saving Bank Account, Fixed Deposit,RD and ITR

- Interest on Saving Bank Account : Tax, 80TTA

- Exempt Income and Income Tax Return

- Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund

- How to Show Interest from NSC in Income Tax Return (ITR)

- Fixed Deposit in Name of Wife: Clubbing,Tax,TDS, ITR,Refund

House Property and Income Tax Return

- Tax : Income From House Property

- Income from House Property and Income Tax Return

- Tax and Income From One Self Occupied property

- Tax and Income from Let out House Property

- Pre-Construction Home Loan Interest and ITR

- Joint Home Loan and Tax

- Terms associated with Home Loan

Capital Gains and Income Tax Return

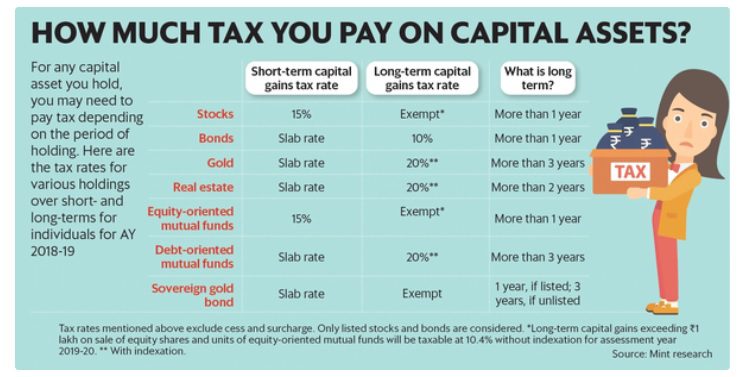

Any profit or gain that arises from the sale of a ‘capital asset’ such as House, Gold, Mutual Funds, Stocks is a capital gain. This gain or profit is charged to tax in the year in which the capital asset is sold.

Capital gains are not applicable when an asset is inherited because there is no sale, only a transfer.However, if this asset is sold by the person who inherits it, capital gains tax will be applicable but purchase date would be of original buyer not date of Transfer. The Income Tax Act has specifically exempted assets received as gifts by way of an inheritance or will.

Capital Gain Tax rules differ based on asset and holding period. Capital gains are classified as short and long term capital gains .

- Capital Gain Calculator from FY 2017-18 with CII from 2001-2002

- How to show Long Term Capital Gains on sale of House in ITR

- Long term Capital Gains of Debt Mutual Funds: Tax and ITR

- Short Term Capital Gains of Debt Mutual Funds,Tax, ITR

- Budget 2018: Long Term Capital Gain on Stocks & Equity Mutual Funds

Basics:

- On Selling a House,

- Capital Loss on Sale of House

- Cost Inflation Index,Indexation and Long Term Capital Gains

Challan 280, Self Assessment Tax and Advance Tax

Before filing the ITR one has to make sure that one owes no tax . If after calculating the income, taking care of deductions and deducting the tax already paid (TDS) one realises that one has paid less tax than due then one has to pay the balance tax. This tax is called Self Assessment Tax. One has to calculate the self assessment tax, pay the Self Assessment tax using Challan 280,update the ITR and then submit it.

- Challan 280: Payment of Income Tax

- Paying Income Tax Online, epayment: Challan 280

- Challan 280 : Paying Income Tax offline

- How to Correct Challan 280

- Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

- Reprint Challan 280 or Regenerate Challan 280

After Filing Income Tax Return

- E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking

- After filing Income Tax Return

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

Income Tax Return Notice

- Understanding Income Tax Notice under section 143(1)

- Income Tax Notice :Sections,What to check,How to reply

- How to Revise Income Tax Return (ITR)

- Compliance Income Tax Return Filing Notice

- Notice for Adjusting Refund Against Outstanding Tax Demand, Section 245

- Defective return notice under section 139(9)

- Income Tax Notice and Bank accounts with large value cash transaction

Videos on Income Tax

- Filing ITR : Video on Steps to File ITR, Ways to File,Documents required

- Video on Which ITR to Fill

- What is Income Tax (14 min) Understanding what is income and Income slabs

TDS, Advance Tax, Self Assessment Tax and Form 26AS

- Basics of Tax Deducted at Source or TDS

- Advance Tax:Details-What, How, Why

- Section 234A,234B,234C : Interest Penalty for not paying Expected IncomeTax on Time

- Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

- Viewing Form 26AS on TRACES

- What to Verify in Form 26AS?

- Payment of TDS on Property

Basics of Income Tax Return

- Income Tax Overview

- Income Tax for Beginner

- Understanding Income Tax Slabs,Tax Slabs History

- How to Calculate Income Tax

- If You don’t file the Income Tax Return on time

- Examples of Income Tax Calculation

For Employee Understanding Form 16,

- Understanding Form 16: Part I,

- Understanding Form 16: Chapter VI-A Deductions,

- Understanding Form 16: Tax on income

- Understanding Form 16 – Part 3

- HRA Exemption,Calculation,Tax and Income Tax Return

- How to show HRA not accounted by the employer in ITR

- Are ESPP,ESOP in MNC to be filed in ITR as Foreign Assets?

- Understanding Perquisites

- Basics of Income Tax Return

- Encashing Earned Leaves : Exemption and Tax

- What is Gratuity?

Senior Citizen and Tax

NRI and Income Tax

The income that NRI earns abroad is not taxable in India. But if an NRI earns income in India, in the form of interest from deposits, property rent, etc then it is taxable. This income, earned in India, has a basic limit of exemption.

- NRI and ITR :TDS,Tax and Income Tax Return

- Bank Accounts for NRI:NRO,NRE,FCNR, Their comparison

- NRI : Fixed Deposits, DTAA

- How to report Incomes from India while filing US tax returns

Income Tax for earlier years

Saving Taxes

Understand Income Tax: What is Income Tax, TDS, Form 16, Challan 280,

Hi,

Thanks for sharing this valuable piece of trading information through your blog post, as this can improve their trading skills and knowledge. Kudo’s to your creative content!

Hi,

Read through the blog. It was exciting and had the information that made us feel cautious in choosing the best stocks in the market.

Good Blog post

Thanks

Nice article, It is definitely very usefull for my professional workers. I gain many kinds of knowledge from your blog..If you want to know more about Tax consultants in bangalore and GST consultants in bangalore .

This was an awesome article we would love to see more such articles. I would definitely share it with my colleagues we also have a blog covering similar articles as well as articles on mutual funds to save tax here is a link to it: – https://www.fintoo.in/blog/5-factors-to-consider-for-lump-sum-mutual-fund-investment/

I read a lot of blog posts and i never heard of a topic like this. I Love this topic you made, really amazing.

Thanks. Glad you liked it

Hdfc bank Customer care no/O62O7482950//O773989O792..n

Nice article. Very informative. Thanks and keep sharing!

Thanks for sharing this information with us.

check our blog on how to deal with income tax notice in easy and time saving way.

https://aktassociates.com/blog/reply-to-income-tax-notice/

Elaborate and good one with minute details

Thanks for sharing such a piece of useful information with us. Filing ITR on time helps to manage each and everything smoothly.

thanks for sharing such an important information with us.

Thank you sharing this information very useful

TDS deducted by employer and form 16 issued but received it notice not finding in 26as what to do?

Check with your employer, why the TDS is not showing?

Income tax department considers only TDS which is reflecting in Form 26AS

Reprocess the return

Hi,

Can you help with an example on how to fill Schedule FA, section A3 in new ITR2.

Hi this is pratap Gowala I have applyed pf last 21st September and 9th October to till its swing under process

Pls check and revert

8310913767

Dear sir ITR 2 has a column ,where PAN no is to be indicated for unlisted share,i have gone through company web side ,but could not find any . you have any idea how to get same,i have also e mailed to company for e mailing me PAN no, but no reply from company

Regards

My Mobile nomber is lost please help me my date of birth not match

Please contact your employer to get date of birth details and then update the password/mobile number