How to File ITR for AY 2022-23 or FY 2021-2022? This year again you need to choose Old or New Tax Regime while filing ITR (Income Tax Return). There is no Excel or Java offline Utility for filing ITR but a new offline utility based on JSON for all ITRS is available for filing. Other than that there are not many changes in ITR forms this year. This article covers all the information on filing ITR forAY 2021-2022 about old and new Tax Regime, Income Tax Slabs for AY 2021-2022, Form 101E on How to Select New Tax Regime, about the new ITR Offline utility.

Our Income Tax course will teach you everything you need to know about income tax in simple terms that are easy to understand. Learn Income Tax Course

We have come up with a workbook With Examples and Worksheets that explains what is Income, Income Tax slabs, Types of Income, how and when to pay self-assessment tax, how to pay the tax due, how to File ITR More details of the workbook here

Table of Contents

Overview of Filing ITR for FY 2022-22

- The employer is required to issue Form 16 to employees before 15th June

- Excel and Java offline Utility for filing ITR has been discontinued

- A new offline utility based on JSON is to be used.

- The Income Tax Website has been updated. You can access the new e-filing website at www.incometax.gov.in. Details in our article here.

- Choose Old and New Tax Regime and One has to inform the Income Tax Department of his choice of Old or New Tax Regime while filing ITR.

- Those with business Income have to file Form 10-IE electronically and give an Acknowledgment number before filing

ITR Offline utility

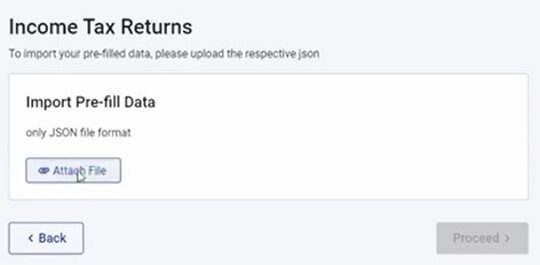

Instead of Excel and Java utilities, the Income Tax Department will issue an offline utility for taxpayers based on technology “JSON” (JavaScript Object Notation), a lightweight data storage format. The offline utility is available for use on computers running Windows 7 or later editions till 12 May 2021

Taxpayers need to use the offline utility to retrieve pre-filled data from the income tax e-filing site and upload it into the new utility, which allows taxpayers to edit and save returns, pre-filled data, and profile data as well.

The utility is a user-friendly functionality for filing returns and will provide greater convenience to taxpayers. It also provides help in the form of FAQs, guidance notes, circulars and provisions of the law so as to enable hassle-free return filing as shown in the image below.

According to the newly notified forms, an individual whose tax has been deferred due to ESOPs allotted by an eligible startup is not permitted to file ITR 1 or 4

- It is enabled to import and pre-fill the data from e-filing portal. You can fill the balance data. You can also edit the profile data other than PAN data in the utility, however, it is suggested to edit the same in your Profile at e-filing website and regenerate prefill data.

- Facility to upload ITR at the e-filing portal is not enabled. You can fill and save it either within the utility or export output json file to your system.

- Once filing is enabled, you can upload the same at e-filing portal

Below add-ons will be enabled in subsequent releases:

- Pre-fill data related to tax payments.

- Upload of ITR

- Questionnaire-based functionality to help you identify which ITR is applicable to you.

- Payment of taxes through this utility

- Facility to verify and upload ITR through the utility itself.

To File ITR for AY 2022-2023, Choose Old and New Tax Regime

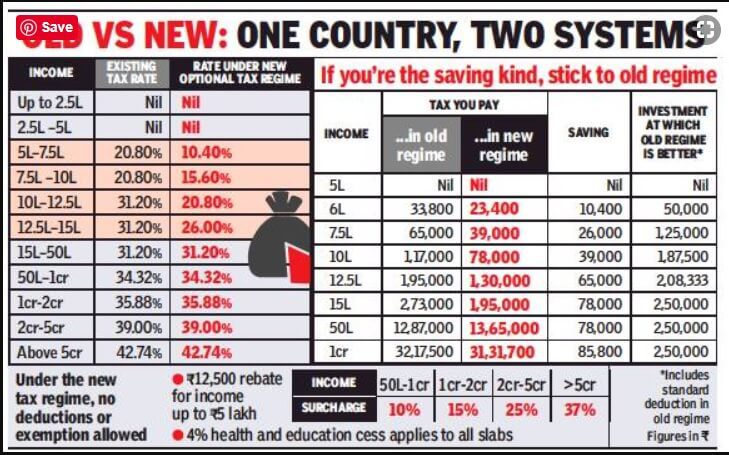

From the financial year (FY) 2020-21, individual taxpayers can choose between two tax regimes – the existing or old tax regime and the new, concessional one. The income tax slabs have been restructured in Union Budget 2020-21. Now taxpayer has a choice to Take Deductions and stick with the old tax slabs and not take deductions and opt for new tax slabs.

- The old tax regime allows the taxpayer to continue with existing tax exemptions such as House Rent Allowance, Leave Travel Allowance, Home Loan Interest, 80C(EPF, PPF, ELSS), except for section 80CCD (2), i.e., employer’s contribution to NPS.

- While those opting for the new regime will have to forego most of the tax exemptions and deductions that are available under the old regime.

The image below shows the amount of deductions, at which old and new tax slabs are the same. if you are claiming deductions less than that amount go for the new regime and if you are claiming deductions more than that stick with the old regime. Unless you have a business income you can make this change at any time.

- The standard deduction of Rs 50,000 is available for salaried individuals and pensioners for FY 2020-21( For FY 2018-19 standard deduction was Rs 40,000.)

- If your total taxable income(after all deductions) is less than 5 lakhs, resident individuals and senior citizens will get a rebate of up to Rs 12,500 under section 87A.

- A deduction for interest payments up to Rs 1,50,000 is available under Section 80EEB for the purchase of the electric vehicle

How To choose old or new Tax System

- Calculate all the deductions you take this includes: Standard Deduction of Rs 50,000 for salaried & pensioners, HRA, 80C, Home Loan Interest except for section 80CCD (2), i.e., employer’s contribution to NPS.

- Calculate tax using the old system.

- Calculate tax using the new system

- Find the difference

- Check the paperwork required to claim, if it is worth it.

Form 10-1E & How to Select New Tax Regime

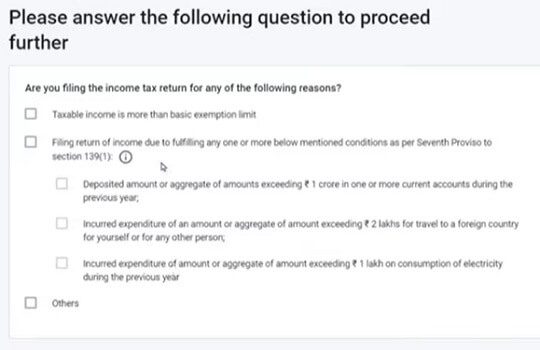

As per CBDT order in Oct 2020, the taxpayer has to fill Form 10-IE electronically, telling his choice of Old or Next Tax Regime before filing the Income Tax Return (ITR) of the relevant Financial Year (FY)

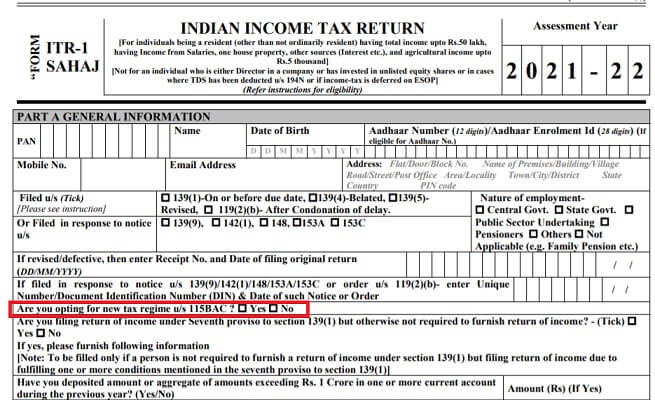

ITR1, ITR2 physical forms released shows a checkbox of which tax regime is chosen.

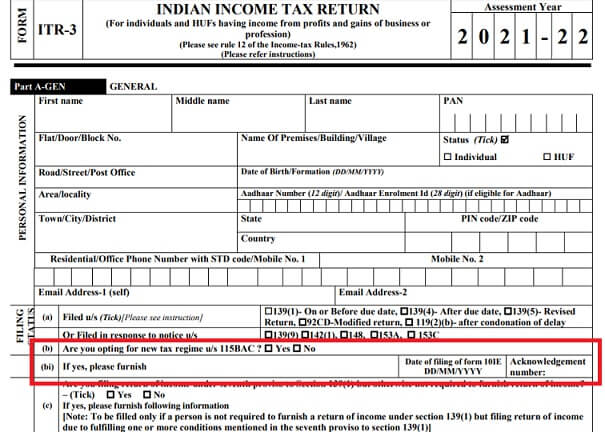

But ITR 3, ITR 4 also asks for the Acknowledgement date for filing Form 10-IE as shown in the images below. It has to be filled by those who have business Income. (if we get any more information on it we will keep you updated)

As we know Individuals having business income are not eligible to choose between the new and old tax regime every year. Once they have opted for the new tax regime, they only have a one-time option of switching back to the old tax regime in their lifetime. Once they switch back, they cannot opt for a new tax regime again.

An individual having no business income has the option to choose between the old and new tax regimes every year. This means that a salaried individual will have to file this form for every year for which he wants to choose the new tax regime.

Essentially, people with business income may have to fill Form 10IE twice – once to use the new tax regime and the second time to switch back to the old regime.

Video on How to file ITR for FY 2020-21

This video explains How to file Income Tax Return AY 2021-22 Offline JSON Utility Demo. Microsoft Excel and Java offline utility have been discontinued.

Income Tax Slabs for AY 2022-23 or FY 2021-22

Under the existing tax regime, the basic tax exemption limit for an individual depends on their age and residential status. According to their age, resident individual taxpayers are divided into three categories:

1. Resident individuals below the age of 60 years

2. Resident senior citizens aged 60 years or above but below 80 years

3. Resident super senior citizens who are 80 years or above

The tables below give the old and new Tax Regime. The left-hand side of the table given below shows the old tax regime which comes with deductions and tax exemptions. The right-hand side of the table shows rates in the new tax regime without any tax exemptions and deductions.

If senior citizens or super senior citizens are opting for a new tax regime then the benefit of higher exemption limit will not be available, i.e., limit of higher exemption of Rs 3 lakh in case of senior citizens and Rs 5 lakh in case of super senior citizens will not be available under the new optional regime. Therefore, under the new tax regime, basic exemption limit will remain Rs 2.5 lakh for all taxpayers.

Do keep in mind that only individuals having no business income in a financial year are eligible to choose between both the tax regimes every year. Thus, such an individual can choose the old tax regime in one year and the new tax regime in the next year. However, those having business income, once they have opted for the new tax regime, cannot choose between both the tax regimes every financial year. They have only once in a lifetime opportunity to switch back to the old tax regime.

Income tax slabs for resident individual below 60 years of age, non-resident individuals (NRI) irrespective of age and HUFs

| Old tax regime (With deductions and exemptions) | Total income | New tax regime (without deductions and exemptions) |

| Nil | Up to Rs 2.5 lakh | NIL |

| 5% | From Rs 2,50,001 to Rs 5 lakh | 5% |

| 20% | From Rs 5,00,001 to Rs 7.5 lakh | 10% |

| 20% | From Rs 7,50,001 to Rs 10 lakh | 15% |

| 30% | From Rs 10,00,001 to Rs 12.5 lakh | 20% |

| 30% | From Rs 12,50,001 to Rs 15 lakh | 25% |

| 30% | From Rs 15,00,001 | 30% |

Income tax slabs for resident individual age above 60 years but below 80 years (senior citizen)

| Old tax regime (With deductions and exemptions) | Total income | New tax regime (without deductions and exemptions) |

| Nil | Up to Rs 2.5 lakh | NIL |

| Nil | From Rs 2,50,001 to Rs 3 lakh | 5% |

| 5% | From Rs 3,00,001 to Rs 5 lakh | 5% |

| 20% | From Rs 5,00,001 to Rs 7.5 lakh | 10% |

| 20% | From Rs 7,50,001 to Rs 10 lakh | 15% |

| 30% | From Rs 10,00,001 to Rs 12.5 lakh | 20% |

| 30% | From Rs 12,50,001 to Rs 15 lakh | 25% |

| 30% | From Rs 15,00,001 | 30% |

Income tax slabs for resident individual age above 80 years (Super senior citizen)

| Old tax regime (With deductions and exemptions) | Total income | New tax regime (without deductions and exemptions) |

| Nil | Up to Rs 2.5 lakh | NIL |

| Nil | From Rs 2,50,001 to Rs 5 lakh | 5% |

| 20% | From Rs 5,00,001 to Rs 7.5 lakh | 10% |

| 20% | From Rs 7,50,001 to Rs 10 lakh | 15% |

| 30% | From Rs 10,00,001 to Rs 12.5 lakh | 20% |

| 30% | From Rs 12,50,001 to Rs 15 lakh | 25% |

| 30% | From Rs 15,00,001 | 30% |

Applicable for all individual taxpayers:

- Rebate of up to Rs 12,500 is available under section 87A under both tax regimes. Thus, no income tax is payable for total taxable income up to Rs 5 lakh in both regimes.

- Rebate under section 87A is not available for NRIs and Hindu Undivided Families (HUF)

- Cess at the rate of 4% is applicable on the income tax amount.

- Surcharge at different rates on the income tax is applicable before the levy of cess if the total income exceeds Rs 50 lakh in a financial year.

As mentioned above, even the surcharge is levied on the income tax amount if the total income crosses a certain level. Given below is the table showing surcharges that will be levied.

| Taxable Income | Surcharge (%) |

| Income above Rs 50 lakh but below Rs 1 crore | 10 |

| Income above Rs 1 crore but below Rs 2 crore | 15 |

| Income above Rs 2 crore but below 5 crore | 25 |

| Income above Rs 5 crore | 37 |

ITR Forms

| ITR Form | Applicable to | Salary | House Property | Business Income | Capital Gains | Other Sources | Exempt Income | Lottery Income | Foreign Assets/Foreign Income | Carry Forward Loss |

|---|---|---|---|---|---|---|---|---|---|---|

| ITR 1 / Sahaj | Individual, HUF (Residents) | Yes | Yes(One House Property) | No | No | Yes | Yes (Agricultural Income less than Rs 5,000) | No | No | No |

| ITR 2 | Individual, HUF | Yes | Yes | No | Yes | Yes | Yes | Yes | Yes | Yes |

| ITR 3 | Individual or HUF, partner in a Firm | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| ITR 4 | Individual, HUF, Firm | Yes | Yes(One House Property) | Presumptive Business Income | No | Yes | Yes (Agricultural Income less than Rs 5,000) | No | No | No |

| ITR 5 | Partnership Firm/ LLP | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| ITR 6 | Company | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| ITR 7 | Trust | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Be Aware of Income Tax

Our Income Tax course will teach you everything you need to know about income tax in simple terms that are easy to understand. There are no high-level jargons within the course. You’ll be able to learn through our lectures and quizzes. This course is suitable for salaried, professionals, and business owners who want to learn about Income Tax. Learn Income Tax Course

Understand Income Tax: What is Income Tax, TDS, Form 16, Challan 280 covers all articles related to Income Tax slabs, Types of Income, the tax on different types of Income when it is taxed, dates and year related to Income Tax, tax cut i.e TDS, how to see TDS, how and when to pay advance tax, how to pay the tax due.

How to file ITR Income Tax Return, Process, Income Tax Notices lists all the articles for understanding Income Tax Return or ITR, filling Income Tax Returns

We have come up with a workbook With Examples and Worksheets that explains what is Income, Income Tax slabs, Types of Income, the tax on different types of Income, dates related to Income Tax, tax cut i.e TDS, how to see TDS, how and when to pay self-assessment tax, how to pay the tax due, how to File ITR More details of the workbook here

You can also enroll in our training here  Disclaimer: This information is for educational purposes only. We have tried to provide the information to the best of our ability. But please consult your CA, tax consultant. Bemoneyaware.com is not responsible for any liability on information provided on the site.

Disclaimer: This information is for educational purposes only. We have tried to provide the information to the best of our ability. But please consult your CA, tax consultant. Bemoneyaware.com is not responsible for any liability on information provided on the site.

Related Articles:

Sir,

I understand that the Annuity earned each year from PMVVY is taxable. What about the taxability of the Maturity Value? Is it entirely exempt u/s 10(10D) or Only the Purchase Price is exempt and the Final Year Annuity is taxable?