In our earlier article Fill Excel ITR form : Personal Information,Filing Status we had discussed about how to fill Income Tax Return Form in excel for Personal Information and Filing Status. Filling income tax returns means filling information about

- Income (Income from Salary, Income from House Property, Income for Other Sources, Capital Gains),

- Tax saving Deductions under various sections like 80C, 80D etc.

- Tax Deducted (TDS) and Tax paid (Advance Tax)

In this article we will focus on filling Income Tax Return, ITR1 in Excel for Income from Salary, Income from House Property, Income for Other Sources,Deductions, TDS details and Advance and Self Assessment Tax.

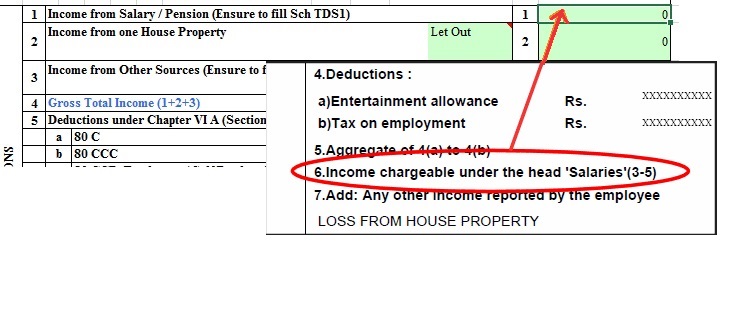

Filling Income from Salary

To fill Income Tax details for Salary, one needs Form 16, issued by the employer . Our article Understanding Form 16: Tax on income, Understanding Perquisites, Understanding Form 12BA explains it in detail. For field Income chargeable under the Head Salary/Pension , on your Form 16 fill information in point 6, as shown in image below. If there are more than one employer during the year, please furnish total salaries from all employers in this field.

Income From House Property

Any residential or commercial property that you own will be taxed, even if it is not let out, it will be considered earning rental income and you will need to pay tax on it. It comes under the head Income from House Property. Income from House Property is taxed subject to some exemptions for example on Home Loan. Our article Tax : Income From House Property gives an overview of income from House property, while Tax and Income From One Self Occupied property , Tax and Income from Let out House Property explains the specific cases. Computation of Income from House Property is shown in picture below.

In other ITRs there is section called Schedule-HP (HP for House Property) where one needs to fill in the details about percentage of co-owned property, loan, Annual Value,deductions etc. To fill it you must take care of following:

- The information relating to the percentage of share of the assessee in the co-owned property is mandatory.

- In case the property is co-owned then the assessee needs to furnish the name of the co-owner, PAN(optional) and percentage of share of the other co-owner (s) in the property.

- If property is not co-owned one can fill Is the property co-owned as NO, Your percentage of share in the property as 100.

- Annual letable value means the amount for which the house property may reasonably be expected to let from year to year, on a notional basis: Deduction for taxes paid to local authority shall be available only if the property is in the occupation of a tenant, and such taxes are borne by the assessee and not by the tenant and have actually been paid during the year.

- In case of self-occupied property Annual value is nil and interest payable on borrowed capital is limited to Rs. 1,50,000.

- If there are two or more than two house properties, the details of all properties need to be filled. The results of all the properties have to be filled in last row of this Schedule. Following points also need to

In ITR1, For Income from one House Property.

- You have only one self-occupied house

- Select Self-Occupied or Let out.

- Enter the value Income from one House Property.

- If you have reported income from House Property to your employer, it will be in Form 16. If you have taken a home loan, you have loss from property or negative income as explained in Tax and Income From One Self Occupied property. Fill in the -ve sign.

- In ITR1 there is no other section or schedule that needs to be filled.

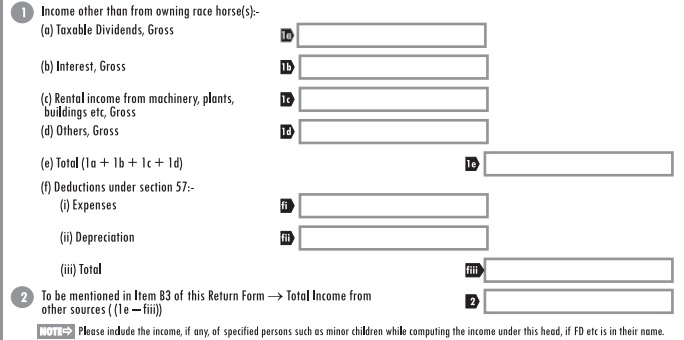

Income from Other Sources

The incomes, which are neither covered under the heads of salary, house property, business income, or capital gain, are covered in the head of income from other sources. Its time to enter your tax-saving deductions details. This head of income is a residual head because it tries to cover all other incomes which are uncovered and which are not exempt from tax. Examples of Income from Other Sources

- Dividend received from any entity other than domestic company such as cooperative bank or dividend received from a foreign company

- Any pension received by the legal heirs of an employee.

- Interest on securities if not chargeable under the head business or profession.

- Wining from lotteries, crossword puzzles, races including horse races,card games and any other sort of games or gambling or betting of any form.

- Interest on bank deposits, loans or company deposits,

- Income from machine, plant or furniture let on hire.

Computation of income From Other Sources are:

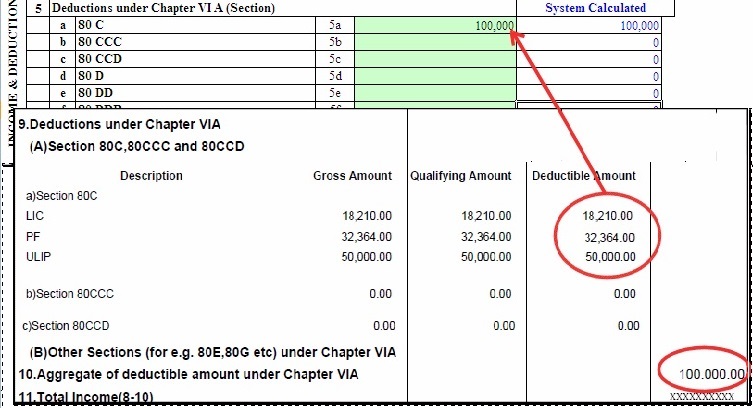

Deductions

You can save tax by investing for long term as in EPF,PPF or buying Life insurance or Health Insurance polices. These tax saving options are categorized under different sections, which if you inform to your employer are available in your Form 16. Just enter the same information in the corresponding cells. You may need to consolidate contributions under particular sections such as 80C which has a limit of 1 lakh, as shown below.If you did not declare your tax saving options, or did not submit proof within due time(usually by mid Feb) and still made some tax saving investments then you can still claim it while filing returns. Our article How to Claim Deductions Not Accounted by the Employer discusses it in detail.

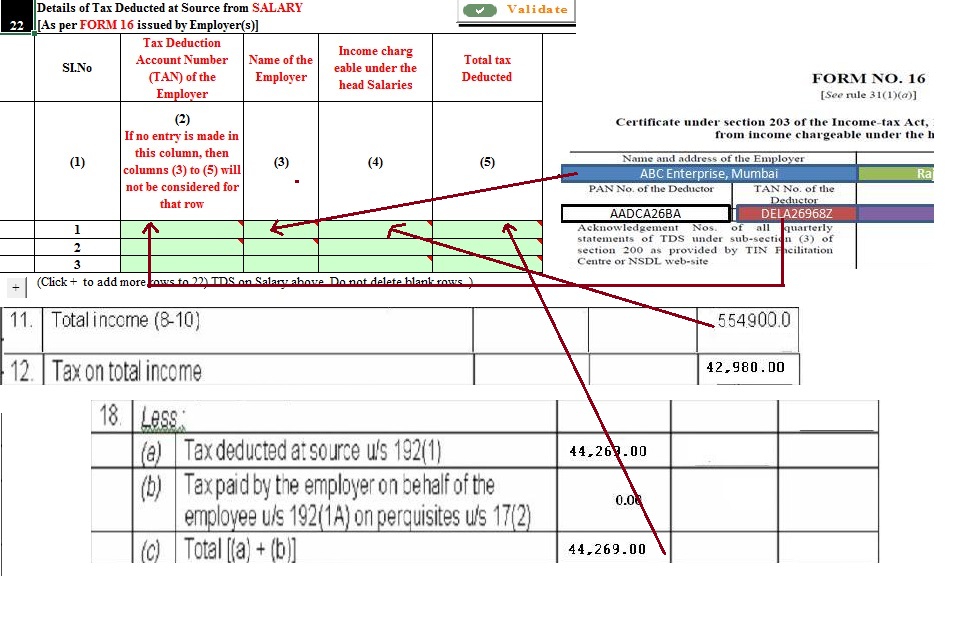

TDS or Tax Deducted at Source

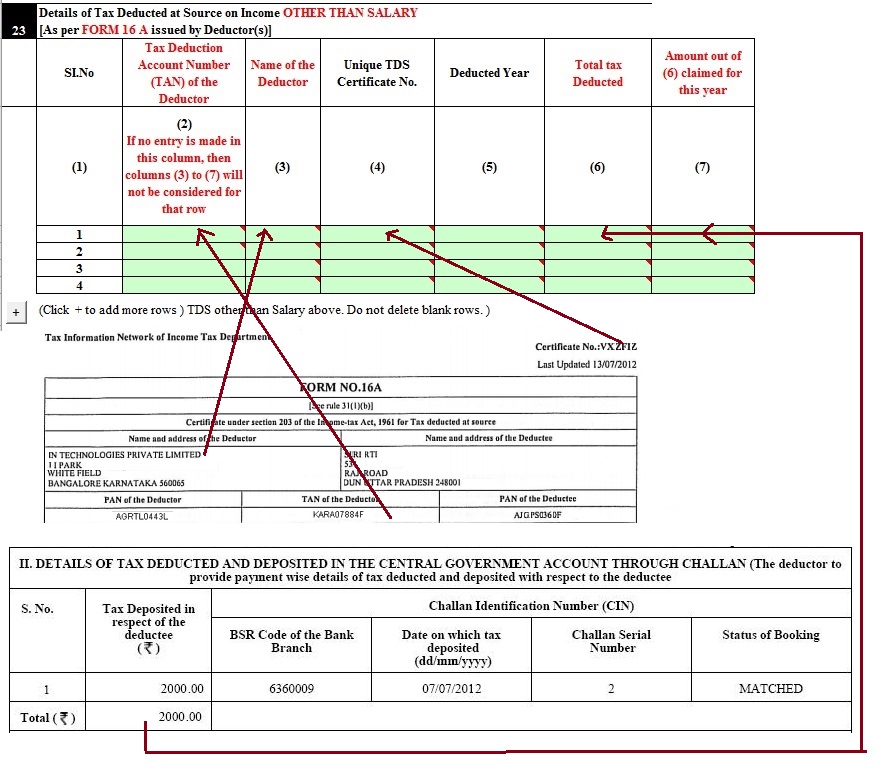

Click on the TDS Tab by clicking on bottom of excel ITR or Clicking Next on Income Details Tab. All the tax deductions at source made in the current financial year should be reported in the TDS tab. Details of each TDS certificate are to be filled separately in the rows.

- You need to fill in information about TDS (Tax Deducted at Source) from Salary as per Form 16 given by the employer, and/or on

- Income from Other sources on Form16A issued by the deductor such as bank if bank has TDS details on interest in Fixed Deposit.

Note: Please enter the details of TDS at appropriate row. TDS on Salary should go to row 22 in ITR1, while TDS on Income from other sources should go to Row 23 in ITR1. In other ITRs also PLEASE keep them separate.

Please verify that TDS you are reporting from Form 16 and Form 16A matches with the TDS in Form 26AS. Income Tax Department facilitates a PAN holder to view his Tax Credit Statement , called as Form 26AS, online. Our article Viewing Form 26AS on TRACES shows how to view Form 26AS.

Filling in ITR, TDS as reported in Form 16 for Salary

Filling in ITR, TDS as reported by deductor in Form 16A

- Unique TDS Certificate Number : This is a six digit number which appears on the right hand top corner of those TDS certificates which have been generated by the deductor through the Tax Information Network (TIN) Central System.

- Deducted Year -mention the financial year in this column.

- Total Tax deducted Enter details from Form 16A. Round off to nearest Rupee.

- Amount out of (6) claimed for this year. Usually this will be the same as tax deducted. This value cannot exceed tax deducted. Round off to nearest Rupee.

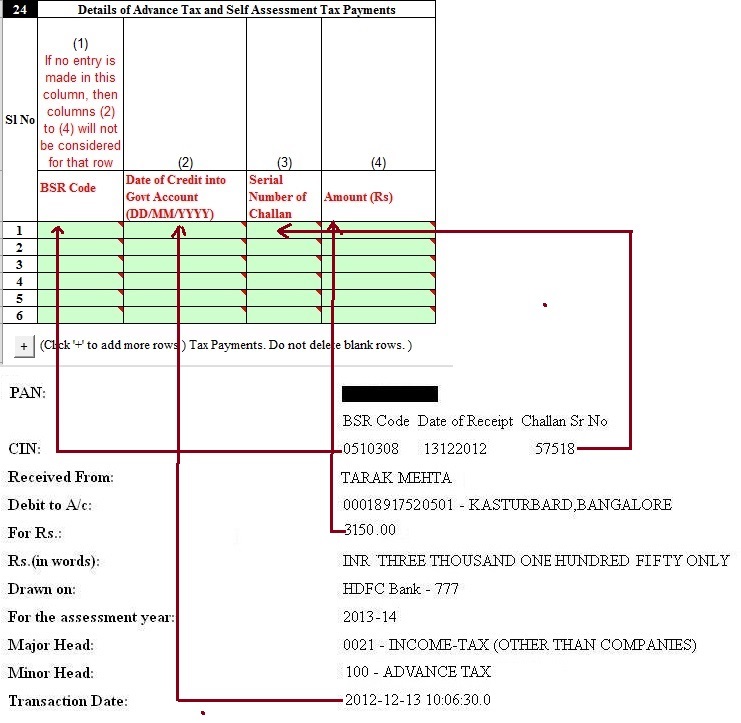

Details of Advance Tax and Self Assessment Tax

Advance Tax: For salaried persons tax deduction at source (TDS), takes care of the tax payments for salary. But there can be other kind of income like interest on saving bank account, fixed deposits deposits, bonds, rental income or capital gains. If tax on income is more than 10,000 Rs in a financial year, Income Tax Department expects you to estimate your income and pay Advance Tax. Advance tax has to be paid in instalments in September, December and March. If If advance tax is due to you and you don’t pay then You need to pay interest(under section 234A, 234B, 234C) while filing returns. Details of Advance Tax are covered in our article Advance Tax:Details-What, How, Why

Self Assessment Tax: While filing income tax returns, an assessee does a computation of income and taxes to be filed in the returns. At times,due to incorrect calculation or laziness or ignorance, the tax paid either as Advance tax or in TDS is less than actual tax payable. The difference between tax payable and tax paid is called the Self assessment tax. This needs to be paid before Income Tax Returns are filed.

Our article Paying Income Tax : Challan 280 explains how to pay Advance Tax, Self Assessment tax in detail.

Note: When you fill in the form for the first Time, you will not know if Self Assessment Tax has to be paid or not. So fill in the Advance Tax details,if paid. Compute the income as explained later in the article. If after computation you find that tax is payable, this would be Self Assessment Tax. Pay it and then enter the details about it in this section.

Related Articles:

- Fill Excel ITR form : Personal Information,Filing Status

- Income Tax for Beginner, Income Tax For Beginner – Part II

- E-Filing of Income Tax Return

- Understanding Form 16: Tax on income,

In this article we have covered filling Income Tax Return, ITR1 in Excel for Income from Salary, Income from House Property, Income for Other Sources,Deductions, TDS details and Advance and Self Assessment Tax. In our next article we will cover Computation of Income Tax, Self Assessment Tax, Generation of XML in detail.

I am a buyer of a flat and got possession in 2017.

Do I need to fill the TDS paid to government in ITR 1. ? I see entried of tds in form 26as..

And user which section in ITR do I fill ,if I have to.

I have filed ITR but didnt pay tax while tax payable laibility is exist..what to do

If you don’t pay all tax due your return may be called defective.

If after calculating the income, taking care of deductions and deducting the tax already paid (TDS) one realises that one has paid less tax than due then one has to pay the balance tax. This tax is called Self Assessment Tax. One has to calculate the self assessment tax, pay the Self Assessment tax using Challan 280,update the ITR and then submit it. Our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR explains it in detail and also has a video.

Please revise the return after filling the details about Self Assessment Tax.

I have paid the Self Assessment tax and got the Chalan Identification Number. Now while e filing in which section we need to enter this chalan Number and amount which I paid to make the my tax as ZERO. Without making my tax as ZERO I can not submit ITR1. Please advise

Yes, you are right.

Please go through our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

It has a YouTube video too

sir,

My employer not accounted HRA & Education Allowance in Form 16, while filling the ITR 1 can i Deduct the same amount directly from under the head (ITR 1) B1 income from Salary/ Pension ? I am confused please help me

Yes you can claim HRA while filing ITR.

Our article How to show HRA not accounted by the employer in ITR discusses it in detail.

These days CPC cross checks with Form 26AS so you might get a notice.

But you can reject their demand.

sir,i i have interest income of say 19014 rs bank has already deducted TDS 1903 at source then why during e-filing of tax return the site is again deducting tax 2000 rs from me?

I don,t understand? please clarify….

thanks & regards

Interest that is earned on fixed deposits is taxable in the hands of the depositor as per the income slab so a person who earns income between 2 lakh to 5 lakh pays only 10% tax on it while person who earns above 10 lakh pays 30% tax (And education cess and surcharge at the rate of 3%). If TDS is deducted and you are in 20% tax slab then you need to pay a remaining tax of 10%.

Say you have earned an income of 19,535 (without TDS deduction) with TDS deducted as Rs 1953.5 ( 10% of 19,535) then 19535 should be shown in income from other sources and 1953.5 should be claimed in TDS.

In a partnership firm, factory land is on hire and pay TDS thereon to one partner(HUF)U/s 194IA. Now from 01.04.2017 a residential flat of one partner give to one of the employee and rent paid by partnership firm. TDS Liable for the same? Under which saction and rate?

Should belated returns be filed under section “on or tbefor due date 139(1)” or under after “due date 139(4)”?

As the due date for filing return was 5 Aug 2016 and you have missed that. You can file Belated return under section 139(4).

Our article Filing Income Tax Return after Due Date: Belated return explains it in detail.

Hi,

when i tried to file zero returns for the year 2014-2015 i am unable to submit it .after following the procedure u said.i am getting msg as ‘the end date for filing this ITR is over’

how can i submit it.i selected as return under section 139(4)..but system is not allowing me to submit.can u help me on what i need to do

hii

i purchased a flat in 2013 which was under construction and i had a housing loan for it. the construction was over and i got registered on my name on 30-03-2015 . my employer said i couldn’t file the tax return unless i furnish the holding tax receipt and the details of my loan is not available on my form-16. i have the holding tax receipt now. so how to file the income tax this time. i don’t see a section 24 in itr1. i have the interest certificates with me. how to proceed further?? please help

I also have similar Issue. I am filing Tax Return with ITR-1 using Excel spreadsheet provided on IT Dept’s website. There is no section 24 in that spreadsheet. One of my friend told me to enter loan interest paid in the last financial year as negative amount for head ‘2. Income from Housing Property’ (row no. 42) on the first ‘Income Details’ tab. Can you please confirm, if that is correct procedure? Thank you.

In ITR1, For Income from one House Property information to be filled is different.

In ITR1 there is no separate section or schedule that needs to be filled.

You can use this form is you have only one house(other than many other conditions in Which ITR Form to use)

Select Self-Occupied or Let out.

Enter the value Income from one House Property : If you have taken a home loan and you have loss from property or negative income due to interest on home loan, as explained in Tax and Income From One Self Occupied property, claiming interest by

For self occupied property : Fill in the -ve sign upto a limit of Rs 2,00,000 per individual

For let out property,rules remain the same. So Income from house property will be Annual Value (rent received) – taxes paid to local authority- 30% deduction on Annual Value – Full interest paid

More details at Income from House Property and Income Tax Return

In ITR1 form, 20TDS2, TDS other than salary, Deducted year coloum not showing current year ie.2016 where as in mar’16, Union bank deposit TDS against my PAN. So, how can I claim in coloum “Amount out of (5) claim in this year”

Sir are you talking of Form 16 or Form 26AS? If union bank has deducted TDS it should appear in your Form 26AS and you should collect Form 16A from bank. What to Verify in Form 26AS? discusses it in detail.

Mine is a case of Form 16A. It mentions x amount deducted in Jan, Feb and Mar 2016. The Certificate No is available on Form 16A, but there is no option in the dropdown lit while filing ITR to select Year 2016.

Plz advise.

Hi keerti

Can I feel itr1 form on my mobile ?

How ?

Which document is needed?

ITRs are excel and java utilities. Some apps are available on Google App store but feedback isn’t good.

Essays like this are so important to brenaoding people’s horizons.

I haven’t claimed my HRA for the months Jan-Mar. How do I file it while filling ITR1? Thanks in advance.

Typically HRA exemption is taken care by employer for full year. How did you end up not claiming HRA for Jan-Mar.

Remember HRA is applicable only if you are employee

TDS of AY 2012-13 has been deducted by my employer and they handed over me the form 16, but in 26AS such information is not reflected till now. Based on Form 16 I have filed ITR1 on time. Now AY 2013-14 once again they deducted TDS and handed over me the Form 16 but the related information in not reflected on 26AS AY2013-14.

So my question is should I go with efiling ITR1 on the basis of Form 16 which I got from my organisation or not.

Regards

See if you have Form 16 then details in it should match Form 26AS. If it is not updated till now why is it so, ask your Finance department.

Income Tax office will calculate tax based on Form 26AS so you have to take a call

Do you want to go with Form 26AS tax

or

Do you want to follow up with your company.

I suggest you fill it on basis of your Form 16 and follow it up with your Finance department

Thank You very much for Your valuable Suggestion Sir.

TDS of AY 2012-13 has been deducted by my employer and they handed over me the form 16, but in 26AS such information is not reflected till now. Based on Form 16 I have filed ITR1 on time. Now AY 2013-14 once again they deducted TDS and handed over me the Form 16 but the related information in not reflected on 26AS AY2013-14.

So my question is should I go with efiling ITR1 on the basis of Form 16 which I got from my organisation or not.

Regards

See if you have Form 16 then details in it should match Form 26AS. If it is not updated till now why is it so, ask your Finance department.

Income Tax office will calculate tax based on Form 26AS so you have to take a call

Do you want to go with Form 26AS tax

or

Do you want to follow up with your company.

I suggest you fill it on basis of your Form 16 and follow it up with your Finance department

Thank You very much for Your valuable Suggestion Sir.

while filing ITR1 of finanacial yr 11-12-I found Tds submitted by Deductor is 90Rs less than actual tax deducted from my salary(which is shown in form 16 given to me).now what should I do?

Income Tax office will calculate tax based on Form 26AS so you have to take a call

do you want to forgo Rs 90 (its a small amount )or ask your finance dept. about the discrepancy (In any case you should ask why it so)

while filing ITR1 of finanacial yr 11-12-I found Tds submitted by Deductor is 90Rs less than actual tax deducted from my salary(which is shown in form 16 given to me).now what should I do?

Income Tax office will calculate tax based on Form 26AS so you have to take a call

do you want to forgo Rs 90 (its a small amount )or ask your finance dept. about the discrepancy (In any case you should ask why it so)

while filing ITR1 for finanacial year 11-12 .TDS information given by deductor(DDO) is 90rs less than tax deducted from my salary(TDS) which is there in form 16 given to me(by DDO) .what should I do now?

while filing ITR1 for finanacial year 11-12 .TDS information given by deductor(DDO) is 90rs less than tax deducted from my salary(TDS) which is there in form 16 given to me(by DDO) .what should I do now?

TDS has deducted more than what is to be paid as tax. what should i mention in column 7 i.e. claim out of(6). tds has been deducted in 2012.

Anil I assume you are talking of Column 7 for Salary detailsof ITR2.

You have to fill amount as mentioned in Form 26 for TDS there is a separate section,Schedule TDS1

Details of Tax Deducted at Source from SALARY

[As per FORM 16 issued by Employer(s)] Calculation of Tax will do that automatically.

Fill in the appropriate sections for ITR2 and then calculate tax liability

Our article How To Fill Salary Details in ITR2, ITR1 explains filling of Salary Details.

and Income from House Property and Income Tax Return

TDS has deducted more than what is to be paid as tax. what should i mention in column 7 i.e. claim out of(6). tds has been deducted in 2012.

Anil I assume you are talking of Column 7 for Salary detailsof ITR2.

You have to fill amount as mentioned in Form 26 for TDS there is a separate section,Schedule TDS1

Details of Tax Deducted at Source from SALARY

[As per FORM 16 issued by Employer(s)] Calculation of Tax will do that automatically.

Fill in the appropriate sections for ITR2 and then calculate tax liability

Our article How To Fill Salary Details in ITR2, ITR1 explains filling of Salary Details.

and Income from House Property and Income Tax Return

Very Good Information and queries.I have filed online ITR 1 for AY 2013-14.and sent ITR V by post.But I was not aware that where and How to place Home loan interest paid.Please tell me how to rectify it?

Very Good Information and queries.I have filed online ITR 1 for AY 2013-14.and sent ITR V by post.But I was not aware that where and How to place Home loan interest paid.Please tell me how to rectify it?

i have filled my return with 16A, i have filled it for the year 2011-12, 2012-13. i am doubt about 2011-12. I mean shall I get my return submitted for the year 2011-12

Didn’t understand the question.

For income earned between 1 Apr 2012 to 31 Mar 2013 One needs to file returns for Assessment Year (AY) 2013-14 by 5th Aug,

i have filled my return with 16A, i have filled it for the year 2011-12, 2012-13. i am doubt about 2011-12. I mean shall I get my return submitted for the year 2011-12

Didn’t understand the question.

For income earned between 1 Apr 2012 to 31 Mar 2013 One needs to file returns for Assessment Year (AY) 2013-14 by 5th Aug,

Hi Kirti,

Apart from Salary, I dont have any sources of income. So, I should not fill 23 & 24 in TDS sheet right.

I assume you are talking of ITR1.

Row 23 is Details of Tax Deducted at Source on Income OTHER THAN SALARY [As per FORM 16 A issued by Deductor(s)] which usually happens if you have a Fixed Deposit and interest on FD is more than 10,000 for the year so bank deducts TDS.

If you don’t have any such income Leave Row 23 empty

Row 24: Details of Advance Tax and Self Assessment Tax Payments

If you have not paid any advance tax then you don’t need to fill.

If all your tax liability has been taken care of and you don’t have to pay any extra tax before filing return then your Self Assessment Tax would also be 0 and row 24 empty.

Use Calculate Tax and verify that Row 8 Total tax payable is 0 or less

Ramya please show interest from Saving bank account (it is your income) . Upto 10,000 is exempt. Check our article Interest on Saving Bank Account : Tax, 80TTA for details.

Hi Kirti,

Apart from Salary, I dont have any sources of income. So, I should not fill 23 & 24 in TDS sheet right.

I assume you are talking of ITR1.

Row 23 is Details of Tax Deducted at Source on Income OTHER THAN SALARY [As per FORM 16 A issued by Deductor(s)] which usually happens if you have a Fixed Deposit and interest on FD is more than 10,000 for the year so bank deducts TDS.

If you don’t have any such income Leave Row 23 empty

Row 24: Details of Advance Tax and Self Assessment Tax Payments

If you have not paid any advance tax then you don’t need to fill.

If all your tax liability has been taken care of and you don’t have to pay any extra tax before filing return then your Self Assessment Tax would also be 0 and row 24 empty.

Use Calculate Tax and verify that Row 8 Total tax payable is 0 or less

Ramya please show interest from Saving bank account (it is your income) . Upto 10,000 is exempt. Check our article Interest on Saving Bank Account : Tax, 80TTA for details.

Thanks.. very nice walk through..

Thanks

Thanks.. very nice walk through..

Thanks

which row of deductions in income tax return form is for interest paid for housing loan

Deduction for interest paid for house loan comes under Income from House Property.

ITR1 is to be used if only one house property, ITR2 for multiple House properties.

Our article Tax : Income From House Property, Tax and Income from Let out House Property cover it in detail

which row of deductions in income tax return form is for interest paid for housing loan

Deduction for interest paid for house loan comes under Income from House Property.

ITR1 is to be used if only one house property, ITR2 for multiple House properties.

Our article Tax : Income From House Property, Tax and Income from Let out House Property cover it in detail

I do not have any income from “salary” but have Receipts of Annuities from LIC policies and Interest from Deposits.

Normally when tax payable is calculated from Salary, the tax calculator tools take care of the basic exemption slab.

In my case, do I show my Interest Income after reducing the basic exemption slab, say Rs. 7,50,000 less Rs. 2,50,000 = 5,00,000 under Schedule OS 1(b) – Interest, Gross?

Also, I need to record LTCG loss on sale of shares? Where do i record this on ITR2?

Annuities from LIC policies and Interest from Deposits are taxable as per your income slab. Interest from FDs will go as Income from Other sources.

Annuity received from LIC are taxable under the head salary. Did your LIC branch not give a certificate or Form 16?

Don’t do the deduction your self. Enter the amount of annuity received and interest on Fixed Deposits, your 80C deductions and then calculator will take care of deductions

For LTCG loss on sale of shares

Long term capital Gain from Shares(STT Paid) is exempted from tax so Long term capital Loss from Sale of shares ,Being exempted income u/s 10(38),can not be adjusted against any other Long Term Capital gain As Loss from exempt source cannot be carried forward.

In such cases, neither the assessee is required to show the same in the return nor is the ITO under any obligation to compute or assess it

I do not have any income from “salary” but have Receipts of Annuities from LIC policies and Interest from Deposits.

Normally when tax payable is calculated from Salary, the tax calculator tools take care of the basic exemption slab.

In my case, do I show my Interest Income after reducing the basic exemption slab, say Rs. 7,50,000 less Rs. 2,50,000 = 5,00,000 under Schedule OS 1(b) – Interest, Gross?

Also, I need to record LTCG loss on sale of shares? Where do i record this on ITR2?

Annuities from LIC policies and Interest from Deposits are taxable as per your income slab. Interest from FDs will go as Income from Other sources.

Annuity received from LIC are taxable under the head salary. Did your LIC branch not give a certificate or Form 16?

Don’t do the deduction your self. Enter the amount of annuity received and interest on Fixed Deposits, your 80C deductions and then calculator will take care of deductions

For LTCG loss on sale of shares

Long term capital Gain from Shares(STT Paid) is exempted from tax so Long term capital Loss from Sale of shares ,Being exempted income u/s 10(38),can not be adjusted against any other Long Term Capital gain As Loss from exempt source cannot be carried forward.

In such cases, neither the assessee is required to show the same in the return nor is the ITO under any obligation to compute or assess it

Sirs

Very informative article on how to fill ITR 1.

I shall be thankful if you please also write an article on How to fill ITR 4 as well particularly for stock trading in futures and options for small traders.

Actually I use to invest in stocks for short term as well as long term. Last year on a suggestion of my broker I did some Stocks/Index trading in Future and options (roughly for 4 months). But as stock trading was not my cup of tea, I stopped doing it but now facing difficulty in filling ITR. It has become a problem for me.

I have been advised to file ITR 4, but filling ITR 4 is a very difficult job. So the request.

Thanks

Umesh yes filing Income Tax Return is difficult because we do not have much information about it. It’s like writing an essay for board exam in a language which you do not know.

Crux of filing income tax return is

Finding type of income (Salary, Income from House Property, Business or Profession, Capital gain and Other sources)

Finding deductions,exemption ie tax implications of income

Coming to your question about futures and options

As per the provision of the Income Tax Act, 1961, income from futures & options (F&O) is treated as normal business income. Thus, profit or loss from such business (F&O) will be taxable as income under the head profits and gains of business or profession whether or not the assesse is carrying on any other business or profession.

Tax will be charged on such income at the normal rates applicable to an individual.

if the total sales, turnover or gross receipt from business for the previous year relevant to assessment year exceeds Rs. 1 crore from the FY 2012-13 then its mandatory to get books of accounts audited.

If there is a loss in F&O, here provisions of section 44AD will apply and accordingly audit of books of accounts will also be required. The provision of this section mandates disclosure of at least 8 % of net profit on the gross turnover.

For details you can refer Taxmantra Tax Return Filing in case of Futures & Options Trades, FUTURES AND OPTIONS – TAXABILITY AND TURNOVER – INDIVIDUAL TAXATION or TAXATION ASPECTS OF FUTURES & OPTIONS (pdf)

I would request you to contact a Chartered Account for filing your Income Tax Return (better to be safe than sorry)

Thanks Kirti for your reply

The reply is as informative as your articles are. The links you mentioned were really helpful.

It seems that I have to contact a CA for filling my return as although the total turnover will be around 3-4 lakhs but because of a loss of around 25-27 K I have to get my accounts compulsory audited by a CA. Another expanse, do not know how much it will cost me but I think will not be less than 2-3 K.

Thanks Umesh glad to be of help. Put down that cost to your learning experience. We all have paid fee some time or the other.

To cheer you up we recommend you going through our article Taxing Times: In a lighter vein which has jokes and quotes on tax!

Sirs

Very informative article on how to fill ITR 1.

I shall be thankful if you please also write an article on How to fill ITR 4 as well particularly for stock trading in futures and options for small traders.

Actually I use to invest in stocks for short term as well as long term. Last year on a suggestion of my broker I did some Stocks/Index trading in Future and options (roughly for 4 months). But as stock trading was not my cup of tea, I stopped doing it but now facing difficulty in filling ITR. It has become a problem for me.

I have been advised to file ITR 4, but filling ITR 4 is a very difficult job. So the request.

Thanks

Umesh yes filing Income Tax Return is difficult because we do not have much information about it. It’s like writing an essay for board exam in a language which you do not know.

Crux of filing income tax return is

Finding type of income (Salary, Income from House Property, Business or Profession, Capital gain and Other sources)

Finding deductions,exemption ie tax implications of income

Coming to your question about futures and options

As per the provision of the Income Tax Act, 1961, income from futures & options (F&O) is treated as normal business income. Thus, profit or loss from such business (F&O) will be taxable as income under the head profits and gains of business or profession whether or not the assesse is carrying on any other business or profession.

Tax will be charged on such income at the normal rates applicable to an individual.

if the total sales, turnover or gross receipt from business for the previous year relevant to assessment year exceeds Rs. 1 crore from the FY 2012-13 then its mandatory to get books of accounts audited.

If there is a loss in F&O, here provisions of section 44AD will apply and accordingly audit of books of accounts will also be required. The provision of this section mandates disclosure of at least 8 % of net profit on the gross turnover.

For details you can refer Taxmantra Tax Return Filing in case of Futures & Options Trades, FUTURES AND OPTIONS – TAXABILITY AND TURNOVER – INDIVIDUAL TAXATION or TAXATION ASPECTS OF FUTURES & OPTIONS (pdf)

I would request you to contact a Chartered Account for filing your Income Tax Return (better to be safe than sorry)

Thanks Kirti for your reply

The reply is as informative as your articles are. The links you mentioned were really helpful.

It seems that I have to contact a CA for filling my return as although the total turnover will be around 3-4 lakhs but because of a loss of around 25-27 K I have to get my accounts compulsory audited by a CA. Another expanse, do not know how much it will cost me but I think will not be less than 2-3 K.

Thanks Umesh glad to be of help. Put down that cost to your learning experience. We all have paid fee some time or the other.

To cheer you up we recommend you going through our article Taxing Times: In a lighter vein which has jokes and quotes on tax!

I have a query. Now its time to fill for AY 2013-2014. I have missed submitting my proofs of LIC in office. So in my Form 16 under section 80C I see only the amount for EPF. However my EPF + LIC contribution adds upto 1 Lakh. So my question is while submitting the ITR – 1 online, under 80C should I put 100000 and claim a refund accordingly. Is this correct approach? Please suggest.

Above all, I must say very beautiful article…Good Job! 🙂

Yes Justin you are right you can claim your investment in LIC , if done before 31 Mar 2013. You can put EPF + LIC contribution as actuals and when you compute tax it would show more tax paid hence you can claim it as refund.

Our article How to Claim Deductions Not Accounted by the Employer discusses it in detail.

Thanks for a beautiful comment, spread the word around 🙂 .

Yup sure…and your suggestion definitely helps. Was worried whether I am doing it the right way. 🙂

It’s good to have doubts ..it means you are thinking my teacher used to say. This blog is series of doubts I had. I have been in similar position so could empathise

Thats very true! Also I was skimming thru other articles of your. Indepth analysis on financials. Highly appreciated! Seems very interesting! Thanks once again for helping me out. I will go through other articles and will give my views. 🙂

Thanks Justin. Will wait for your comments to make us better.

Hi Kirti,

One small doubt. While I am planning to submit ITR – 1 online, how will I submit the proofs which I have missed submitting to employee. Do I have to send it with ITR-V. Seems one has to just keep it and need not submit it anywhere. Please suggest.

Thanks,

Justin Samuel.

You are right Justin, you don’t have to submit any proofs. But keep them with you for 6 years atleast just in case if your’s is one of the case selected for scrutiny or you get the notice from Income Tax Dept.Probability of being called is not related to whether you have submitted the proof or not. Just make sure that your tax details (TDS, Advance tax etc) matches Form 26AS.

I have a query. Now its time to fill for AY 2013-2014. I have missed submitting my proofs of LIC in office. So in my Form 16 under section 80C I see only the amount for EPF. However my EPF + LIC contribution adds upto 1 Lakh. So my question is while submitting the ITR – 1 online, under 80C should I put 100000 and claim a refund accordingly. Is this correct approach? Please suggest.

Above all, I must say very beautiful article…Good Job! 🙂

Yes Justin you are right you can claim your investment in LIC , if done before 31 Mar 2013. You can put EPF + LIC contribution as actuals and when you compute tax it would show more tax paid hence you can claim it as refund.

Our article How to Claim Deductions Not Accounted by the Employer discusses it in detail.

Thanks for a beautiful comment, spread the word around 🙂 .

Yup sure…and your suggestion definitely helps. Was worried whether I am doing it the right way. 🙂

It’s good to have doubts ..it means you are thinking my teacher used to say. This blog is series of doubts I had. I have been in similar position so could empathise

Thats very true! Also I was skimming thru other articles of your. Indepth analysis on financials. Highly appreciated! Seems very interesting! Thanks once again for helping me out. I will go through other articles and will give my views. 🙂

Thanks Justin. Will wait for your comments to make us better.

Hi Kirti,

One small doubt. While I am planning to submit ITR – 1 online, how will I submit the proofs which I have missed submitting to employee. Do I have to send it with ITR-V. Seems one has to just keep it and need not submit it anywhere. Please suggest.

Thanks,

Justin Samuel.

You are right Justin, you don’t have to submit any proofs. But keep them with you for 6 years atleast just in case if your’s is one of the case selected for scrutiny or you get the notice from Income Tax Dept.Probability of being called is not related to whether you have submitted the proof or not. Just make sure that your tax details (TDS, Advance tax etc) matches Form 26AS.

I have a query. Now its time to fill for AY 2013-2014. I have missed submitting my proofs of LIC in office. So in my Form 16 under section 80C I see only the amount for EPF. However my EPF + LIC contribution adds upto 1 Lakh. So my question is while submitting the ITR – 1 online, under 80C (Income Details – 5a) should I put 100000 and claim a refund accordingly. Is this correct approach? Please suggest.

Above all, I must say very beautiful article…Good Job! 🙂

I have a query. Now its time to fill for AY 2013-2014. I have missed submitting my proofs of LIC in office. So in my Form 16 under section 80C I see only the amount for EPF. However my EPF + LIC contribution adds upto 1 Lakh. So my question is while submitting the ITR – 1 online, under 80C (Income Details – 5a) should I put 100000 and claim a refund accordingly. Is this correct approach? Please suggest.

Above all, I must say very beautiful article…Good Job! 🙂

Hello Kirti,

I’ve filed the IT returns and got the ITR-V form. I’ve some query in ITR-V under the section “COMPUTATION OF INCOME AND TAX THEREON”

Row 6 is saying “Total tax and interest payable” is 22760. but in row 7,

“Taxes Paid” the TDS is showing as 45524. and refund is showing as 22760 in row 9.

Could you please clarify the query on COMPUTATION OF INCOME AND TAX THEREON section?

Thank you

Kishore Bitra

ITRV is based on information filled in the ITR

Total tax and interest payable is tax you need to pay on your income

Taxes paid is tax that has already been collected from you in form of TDS

If Total tax payable is more than taxes paid you get refund which has happened in your case

Based on your details, tax on your income is 22760 but you have already paid 45524 as tax to govt. So govt needs to refund you 22760 back,

Hope doubt is cleared?

Hi Kirti,

In TDS page, I filled details in row 22 and 23 also. I think I’ve to fill only row 22 because it is asking for “Details of Tax Deducted at Source from SALARY

[As per FORM 16 issued by Employer(s)]”

But I filled the same details in row 23 (“Details of Tax Deducted at Source on Income OTHER THAN SALARY [As per FORM 16 A issued by Deductor(s)]“)…I don’t have income other than salary.

which are mentioned above in row 22.

That is why the reason I’m getting TDS as

b TDS (Total from item 22 + item 23) 15b 45,524

I think I don’t have to fill row 23, Am I correct?

I’ve already generated XML and filed the return. Please let me know what is the process to modify now.

Thank you

Kishore

Don’t worry you can rectify it. (These mistakes happen)

If an individual has already filed the income tax return and subsequently discover any omission or wrong statement therein, he can re-file the return with necessary modification. This re-filing of the income tax return is referred to as Revised Return

The receipt no. & the acknowledgement no. of return filed earlier is must for the refiling of the return.

Return filed under section : section 139(5)

Whether original or revised return? Revised

fill acknowledgement number or date of filing of the original return

Press Save and continue and go ahead make changes and enter correct details

Generate new XML and upload it. You will get a new ITR-V in your inbox.

Once you receive the ITR-V form, you are supposed to send across both original and revised return ITR-V forms to IT department Bangalore within 120 days.

Thank you Kirti. I’ve generated new XML file and uploaded.If possible could you please edit the above article mentioning the difference between row 22 and 23 in TDS? and let people know who needs to fill 23, may be this will helpful for the novice people like me.

And finally I appreciate your hard work in answering the queries at midnight too 🙂 .

Thank you

Kishore Bitra

Thanks and updated the article too!

Hello Kirti,

I’ve filed the IT returns and got the ITR-V form. I’ve some query in ITR-V under the section “COMPUTATION OF INCOME AND TAX THEREON”

Row 6 is saying “Total tax and interest payable” is 22760. but in row 7,

“Taxes Paid” the TDS is showing as 45524. and refund is showing as 22760 in row 9.

Could you please clarify the query on COMPUTATION OF INCOME AND TAX THEREON section?

Thank you

Kishore Bitra

ITRV is based on information filled in the ITR

Total tax and interest payable is tax you need to pay on your income

Taxes paid is tax that has already been collected from you in form of TDS

If Total tax payable is more than taxes paid you get refund which has happened in your case

Based on your details, tax on your income is 22760 but you have already paid 45524 as tax to govt. So govt needs to refund you 22760 back,

Hope doubt is cleared?

Hi Kirti,

In TDS page, I filled details in row 22 and 23 also. I think I’ve to fill only row 22 because it is asking for “Details of Tax Deducted at Source from SALARY

[As per FORM 16 issued by Employer(s)]”

But I filled the same details in row 23 (“Details of Tax Deducted at Source on Income OTHER THAN SALARY [As per FORM 16 A issued by Deductor(s)]“)…I don’t have income other than salary.

which are mentioned above in row 22.

That is why the reason I’m getting TDS as

b TDS (Total from item 22 + item 23) 15b 45,524

I think I don’t have to fill row 23, Am I correct?

I’ve already generated XML and filed the return. Please let me know what is the process to modify now.

Thank you

Kishore

Don’t worry you can rectify it. (These mistakes happen)

If an individual has already filed the income tax return and subsequently discover any omission or wrong statement therein, he can re-file the return with necessary modification. This re-filing of the income tax return is referred to as Revised Return

The receipt no. & the acknowledgement no. of return filed earlier is must for the refiling of the return.

Return filed under section : section 139(5)

Whether original or revised return? Revised

fill acknowledgement number or date of filing of the original return

Press Save and continue and go ahead make changes and enter correct details

Generate new XML and upload it. You will get a new ITR-V in your inbox.

Once you receive the ITR-V form, you are supposed to send across both original and revised return ITR-V forms to IT department Bangalore within 120 days.

Thank you Kirti. I’ve generated new XML file and uploaded.If possible could you please edit the above article mentioning the difference between row 22 and 23 in TDS? and let people know who needs to fill 23, may be this will helpful for the novice people like me.

And finally I appreciate your hard work in answering the queries at midnight too 🙂 .

Thank you

Kishore Bitra

Thanks and updated the article too!

Thanks for the valuable information Kirti. I would like to clarify one thing here. I am an NRI who withdrew my provident fund and super-annuation fund in the previous financial yr. This will still come under TDS1 section right?

Guru After how many years did you withdraw from provident Fund? After 5 years of contribution in EPF withdrawal is tax free.

How much did you withdraw from super-annutation? how much did you buy annuity(pension for) and from which insurance company?

As per Section 10(13) of the Act, the benefits payable on death are exempt from tax. According to Section 10(10A)(ii) of the Act, the specified commuted value (one half if employee not eligible for gratuity and one third if employee not eligible for gratuity) on retirement or otherwise is tax-free.

For details Moneycontrol Superannuation Funds,

EconomicTimes How to reduce tax on your retirement benefits

Thanks for the valuable information Kirti. I would like to clarify one thing here. I am an NRI who withdrew my provident fund and super-annuation fund in the previous financial yr. This will still come under TDS1 section right?

Guru After how many years did you withdraw from provident Fund? After 5 years of contribution in EPF withdrawal is tax free.

How much did you withdraw from super-annutation? how much did you buy annuity(pension for) and from which insurance company?

As per Section 10(13) of the Act, the benefits payable on death are exempt from tax. According to Section 10(10A)(ii) of the Act, the specified commuted value (one half if employee not eligible for gratuity and one third if employee not eligible for gratuity) on retirement or otherwise is tax-free.

For details Moneycontrol Superannuation Funds,

EconomicTimes How to reduce tax on your retirement benefits

Good Post. This is very informative blog.Thanks for sharing a useful information about Personal Tax Planning.Keep it Up.

Thanks Divya

Good Post. This is very informative blog.Thanks for sharing a useful information about Personal Tax Planning.Keep it Up.

Thanks Divya

Well explained.Though all over process looks simple..in reality its too difficult for peoples who are not familiar with technical things (e.g xml file),computer, internet etc

Rightly said Paresh. Process looks simple but in reality it’s not that simple. When we don’t know terms like AY, income from other sources then there are bound to be mistakes. People are still comfortable paying someone(with cost reduced for filing ITR1 from 100 -500Rs) and not verifying what it filled in.

Well explained.Though all over process looks simple..in reality its too difficult for peoples who are not familiar with technical things (e.g xml file),computer, internet etc

Rightly said Paresh. Process looks simple but in reality it’s not that simple. When we don’t know terms like AY, income from other sources then there are bound to be mistakes. People are still comfortable paying someone(with cost reduced for filing ITR1 from 100 -500Rs) and not verifying what it filled in.

Hello,

I got my Form 16- (Part A)today. This file is having the details like how much I’ve been paid from employer in the form of salary (Quarter wise) and How much I’ve paid towards income tax with challan numbers. It doesn’t have information on 80C investments or 80D. I’m not sure how much I invested, is there any way I can see that? or I have to download some other Form 16 which contain those details ?

Please help me out.

THank you

Kishore B

Kishore Employer is supposed to give you Form 16 and Form 12BA. Could you check your Form 16 with series of our article on Form 16.

Understanding Form 16: Tax on income

for details

Understanding Form 16: Part I,

Understanding Form 16: Chapter VI-A Deductions

Hello,

I got my Form 16- (Part A)today. This file is having the details like how much I’ve been paid from employer in the form of salary (Quarter wise) and How much I’ve paid towards income tax with challan numbers. It doesn’t have information on 80C investments or 80D. I’m not sure how much I invested, is there any way I can see that? or I have to download some other Form 16 which contain those details ?

Please help me out.

THank you

Kishore B

Kishore Employer is supposed to give you Form 16 and Form 12BA. Could you check your Form 16 with series of our article on Form 16.

Understanding Form 16: Tax on income

for details

Understanding Form 16: Part I,

Understanding Form 16: Chapter VI-A Deductions

That’s great write with lot of info. Thanks so much for sharing.

Thanks a lot for commenting and encouraging

That’s great write with lot of info. Thanks so much for sharing.

Thanks a lot for commenting and encouraging

You are doing pretty good work…There are people including me who doesn’t know much about ITR and its is going to help a lot

Thanks Harsha, I am an ordinary person just like you. I also struggled with my ITRs(still struggling) hence the post.

You are doing pretty good work…There are people including me who doesn’t know much about ITR and its is going to help a lot

Thanks Harsha, I am an ordinary person just like you. I also struggled with my ITRs(still struggling) hence the post.

Nice Post. . .

Nice Post. . .

Very useful article. Thanks.

Very useful article. Thanks.