if the taxpayer is a resident of India, and he has paid taxes outside India, he can claim a credit of such foreign taxes paid against his tax payable in India. An individual taxpayer shall furnish Form 67 in order to claim Foreign Tax Credit. This article explains how to fill Form 67 to claim the foreign tax paid on New Income Tax Portal

It is also essential to file Form 67 on or before the due date of filing the income tax return u/s 139(1) i.e. the original return of income

- Foreign tax credit(FTC) has to be claimed in the year in which the taxpayer’s income has to be assessed to tax in India i.e in the Assessment Year

- FTC is lower of, tax payable on such income under the Indian tax laws and the foreign tax paid;

- Foreign Tax Credit will be determined in Indian Rupees by the currency conversion at the telegraphic transfer buying rate on the last day of the month, immediately preceding the month in which such tax has been paid or deducted.

- An assessee can claim Foreign Tax Credit by providing proof that tax was deducted. That is by furnishing the Certificate or statement specifying the nature of income and the tax amount either paid by the taxpayer or deducted from their income

Table of Contents

Procedure to File Form 67

The Central Board of Direct Taxes (CBDT), through a notification dated 19 September 2017 no. 9/2017 provides the procedure for filing Form 67:

- The taxpayer must be prepare and submit Form 67 either before or on the due date of filing the tax return

- This form is available on the e-filing portal of the income tax department

- Electronic Verification Code (EVC) or Digital Signature Certificate (DSC) is mandatory to submit Form 67

The residence state is the home country of the taxpayer, while the source state is a foreign country where the taxpayer is employed or receives income from.

You will get TTBR for the relevant FY at SBI’s forex division or access http://mksco.in/forexrate/

You can also get Rates of USD, YEN, Euro, at the RBI(Reserve Bank of India) webpage here.

How to fill Form 67

You can fill and submit Form 67 only in online mode through the e-Filing portal.

Step 1: Log in to the e-Filing portal using your user ID and password.

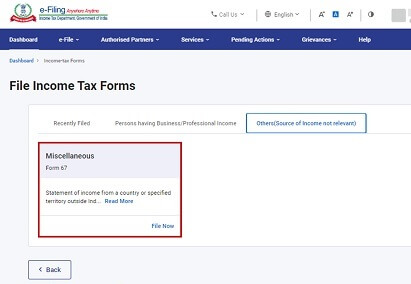

On the File Income Tax Forms page, select Form 67. Alternatively, enter Form 67 in the search box to find the form.

On the Form 67 page, select the Assessment Year (A.Y.) and click Continue.

On the Instructions page, click Let’s Get Started.

Fill Form 67

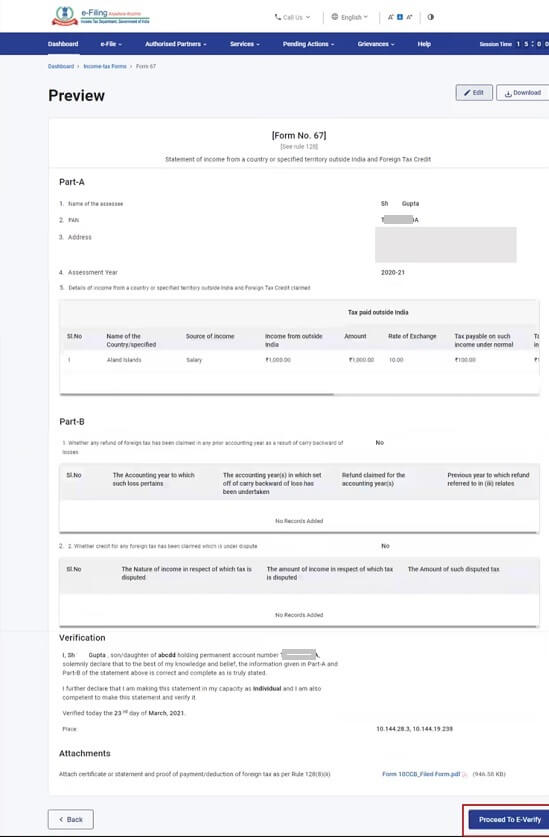

On the Preview page, verify the details and click Proceed to e-Verify.

Click Yes to submit.

After successful e-Verification, a success message is displayed along with a Transaction ID and Acknowledgement Number. Please keep a note of the Transaction ID and Acknowledgement for future reference. You will also receive a confirmation message on the email ID registered on the e-Filing portal.

Form 67 has 4 sections:

- 1. Part A

- 2. Part B

- 3. Verification

- 4. Attachments

How to fill Part A of Form 67

Part A of the form entails basic information such as your Name, PAN or Aadhaar, Address and Assessment Year.

Add the receipt details of the income from a country or specified territory outside India and Foreign Tax Credit claimed.

How to fill Part B of Form 67

Part B of the form is where you will be required to provide details of refund of foreign tax as result of carry backward of losses and disputed foreign tax.

4.3. Verification

The Verification section contains a self-declaration form containing fields as per Rule 128 of the Income Tax Rules, 1962.

4.4. Attachments

The last section of Form 67 is Attachments where you need to attach a copy of the certificate or statement and proof of payment/deduction of foreign tax.

Related Stocks:

- Dividends of Stocks: Pros & Cons, Compounding

- Do I Need to Pay Tax on Dividend Income? How to report Dividend Income in ITR?

- Indians Invest in US Stock Market: Why, DOW, NASDAQ, How to invest

- RSU of MNC, perquisite, tax , Capital gains, ITR

- How are Dividends of International or Foreign Stocks taxed?

Disclaimer

All content on this site is for educational and informational use only. Please do not construe this as professional financial advice. You should consult a qualified financial person(tax advisor/financial advisor) prior to making any actual investment or trading decisions. We accept no liability for any interpretation of articles or comments on this blog being used for actual investments/taxation purposes!

Join our Telegram Group BeMoneyAware and Checkout our Instagram Channel Bemoneyaware