Are you aware of the recent fitness challenge that has been going viral on social media? The Indian sports minister Rajyavardhan Singh Rathore challenged Virat Kohli, who in turn challenged Prime Minister Narendra Modi to share a fitness video. People are becoming more health conscious these days. Everyone knows the importance of good healthy food and exercise. Just like how eating vegetables is necessary for your good health, investing is necessary for your financial health. So, let’s find out how you can take care of your financial health.

Table of Contents

Importance of investing

The moment you get a job, your relatives put a sweet in your mouth and tell you to start saving. This is a good piece of advice. However, saving money in a bank account may not be enough. With inflation rate equal to (or higher) than the interest on savings accounts, you may actually lose your spending power. That’s why it is important to invest in financial instruments that offer inflation-beating returns over the long term. Stocks, mutual funds, ULIPs are some of the options you may want to pursue.

Good health helps you to live long and good investing helps you finance your expenses

Imagine the following scenario: by eating healthy and exercising regularly, you can expect to live a long life. But what if you don’t have the financial resources to manage your expenses during your later years? This can be a problem.

However, through proper financial planning, you can create sufficient savings for future. The first step is to identify your current income, expenses and savings. How much money do you need to manage your current lifestyle? And how much money will you need after you retire? This YouTube Video shows What is Personal Financial Planning and its Importance?

You can use an online retirement calculator to find out your saving requirements. Once you have a number, you can start investing towards this goal. For example, assume that you require Rs 5 crore for your retirement. Yes, this sounds like a huge amount. But guess what, it is possible to achieve this amount.

Mutual funds and SIP investments

Mutual funds are a great way to invest money and earn good returns. There are debt funds, hybrid funds, equity funds and many more different types of funds. You can invest in any of these different funds based on your investment needs and risk appetite. And when it comes to long-term investment goals like retirement planning, it is best to invest in equity funds through a Systematic Investment Plan (SIP).

Here, all you need to do is invest a fixed amount of money into a mutual fund on a regular basis. And over time, the returns you earn can be quite substantial. But the secret here is to start investing early and invest consistently.

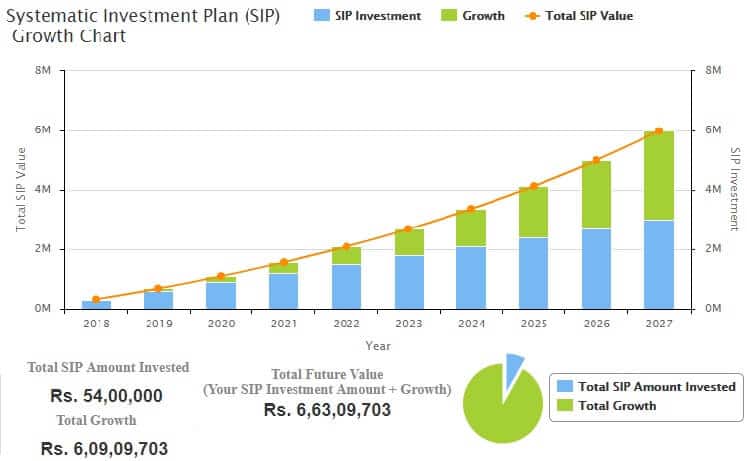

Coming to the Rs 5 crore financial goal discussed earlier, here is a solution. If you invest just Rs 15,000 each month into an equity mutual fund (offering 13% annual rate of return), you can earn a corpus of Rs 6.6 crores at the end of 30 years.

PM Modi Fitness Challenge

The Indian sports minister Rajyavardhan Singh Rathore challenged Virat Kohli, who in turn challenged Prime Minister Narendra Modi to share a fitness video.

Conclusion

Health is wealth. By being healthy, you can work for a longer period of time and take care of your family better. Similarly, by investing regularly for a long time period, you can achieve all your financial goals and be prepared for the future.