This article talks about what financial tasks one should complete before 31 Mar 2022. If you don’t do these tasks then you may lose income tax benefits that you could have availed and also end up making some of your investments in an inactive state.

Table of Contents

Financial Tasks Deadlines

In India, Financial Year is from 1 Apr to 31 Mar of the next year. So FY 2021-22 which is AY 2022-23 is from 1 Apr 2021 to 31 Mar 2022.

The financial year 2021-22 is coming to a close. Make sure you do complete these important income tax and investment-related tasks before 31.3.2022.

- Tax-harvesting is using the tax-free window of Rs 1 lakh to lower your overall LTCG(Long term capital gain tax) in equity. You redeem, and then re-invest, a portion of your equity investments that are over one year old. Details here,

- Link your Aadhaar with Permanent Account Number (PAN). In case it is not done before March 31, 2022, then your PAN card will become inoperative, and you may not be able to perform financial transactions that require PAN.

- File Belated Returns: The last date to file a belated return for the FY 2020-21 or AY 2021-22 is 31 March 2022, with a penalty. Details on How to file Belated returns are here.

- Finish your Tax savings: If you chose Old tax Regime

-

- Make tax-saving investments

-

- Continue Accounts PPF, NPS, Sukanya Samriddhi Account

- If you have a PPF account Make minimum contributions of Rs 500 to PPF to avoid penalty. Details about PPF here.

- If you have a Sukanya Samriddhi Account make a minimum contribution of Rs 250. Details about Sukanya Samriddhi Account here.

- Make minimum contributions of Rs 1000 to NPS Tier 1 to avoid account getting frozen

- Additional deduction on home loan under 80EEA

- The benefits of additional deduction of Rs. 1.5 Lakh for the homebuyer’s interest paid on home loan (over and above Rs. 2 Lakh under section 24 of Income Tax Act) is available up to 31st March 2022 under Section 80EEA of the Income Tax Act. If you are eligible for the home loan under Section 80 EEA, make sure you avail yourself before the scheme ends.

- Pay TDS on rent over Rs. 50,000

- Pradhan Mantri Vaya Vandana YojanaThe PMVVY is available only with LIC India and for the financial year 2021-22, the PMVVY scheme provides an assured pension of 7.40% per cent payable monthly.

Submit Claim To Employer:

-

- Claim LTA, Medical Bills. You cannot claim this while filing Income Tax Return ITR

- Claim HRA This you can claim also while filing Income Tax Return (ITR) but it is recommended that you claim before.

The income tax slabs have been restructured in Union Budget 2020-21. Now taxpayer has a choice to Take Deductions and stick with the old tax slabs and not take deductions and opt for new tax slabs.

- Old or New Tax Regime to choose with Calculator for Income Tax helps in deciding which one should you choose?

Last date for Filing Income Tax Returns

FILE ITR FOR FY 2019-20(AY 2020-21) till 31 Mar 2021 with the penalty. Then you will not be allowed to file your ITR for this year unless you get Income Tax notice.

The last date for filing returns for an individual is usually 31 Jul of the assessment year but many times it gets extended. The last date for filing returns for FY 2019-20 or AY 2020-21 was 10 Jan 2021.

If one missed the last date for filing returns, one can still file returns till 31st Mar of the Assessment year. So one can still file for returns for FY 2019-20(AY 2020-21) till 31st Mar 2021. Our article Filing Income Tax Return after Due Date: Belated return discusses it in detail.

Save Taxes

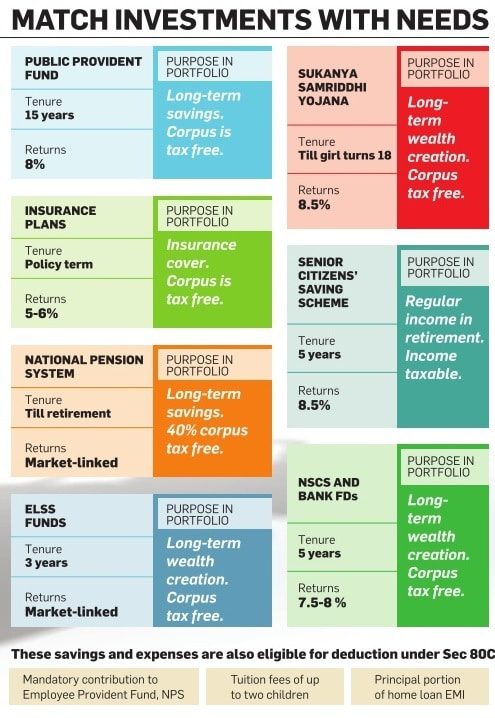

All tax-saving investments and expenses for 2019-20 have to be made before March 31. No tax deductions will be available for 2019-20 on investments made after the financial year ends. Match your tax-saving investments to your needs as shown in the image below. For details on the individual tax savings read following links

Keep PPF and NPS Tier 1 account alive

- CONTRIBUTE TO PPF : The minimum annual contribution to your PPF account is Rs 500. After which you will face a penalty of Rs 50 for each year you fail to make the minimum contribution. Our articles discuss about Contributing and activating PPF in detail.

- KEEP NPS ACTIVE : NPS Tier I account holders have to make a minimum contribution of Rs 1,000 every fiscal. Else your account can be frozen.

Pay Advance Tax

Advance tax means income tax should be paid in advance instead of lump sum payment at year end. It is also known as pay as you earn tax. These payments have to be made in instalments as per due dates provided by the income tax department. If your total tax liability is Rs 10,000 or more in a financial year you have to pay advance tax. Advance tax applies to all taxpayers, salaried, freelancers, and businessmen. Senior citizens, who are 60 years or older, and do not run a business, are exempt from paying advance tax. Our articles Advance Tax:Details-What, How, Why and Section 234A,234B,234C : Interest Penalty for not paying Expected IncomeTax on Time discusses it in detail.

Taxpayers who opt for a presumptive scheme where business income is assumed at 8% of turnover were exempt from advance tax for FY 2014-15 and FY 2015-16. However, starting FY 2016-17, such taxpayers have to pay the whole amount of their advance tax in one instalment on or before 15th March.

The presumptive scheme is covered under section 44AD and 44AE. Starting FY 2016-17 businesses with the turnover of Rs 2crores or less can opt for this scheme. This scheme has been extended to professionals such as doctors, lawyers, architects etc starting FY 2016-17 if their receipts are 50lakhs or less. Read in detail about presumptive taxation here

Due Dates for Payment of Advance Tax

For both individual and corporate taxpayers

| Due Date | Advance Tax Payable |

|---|---|

| On or before 15th June | 15% of advance tax |

| On or before 15th September | 45% of advance tax |

| On or before 15th December | 75% of advance tax |

| On or before 15th March | 100% of advance tax |

Claim LTA, HRA, Medical Bills

Claim HRA

House Rent Allowance or HRA is given by the employer to the employee to meet the expenses of rent of the accommodation which the employee has taken for his residential purpose. To claim HRA you need to submit PAN number of your house owner, Lease agreement and receipts to your landlord. Articles

- How to Claim HRA: Rental Agreement and Rental Receipt

- How to Claim Deductions Not Accounted by the Employer

- How to show HRA not accounted by the employer in ITR

Claim LTA

It is time to claim your annual reimbursements such as medical and leave travel allowance (LTA). These reimbursements are as good as tax savings. If LTA is part of salary allowance then it can be availed on travel expenses for trip within India. To claim these tax savings you submit the required bills to your employer. You cannot claim LTA while filing Income Tax Return.

Pay TDS on rent over Rs. 50,000

If the monthly rent you are paying for your residence is Rs. 50,000 or more than that, then you are required to deduct tax at source. This is TDS, and as per the income tax laws, this rate is at 5 per cent of the rent paid.

If the TDS is not deducted and paid before 31st March, you will have to pay interest and penalty as well. Our article How to pay Tds on rent above Rs 50000 using Form 26QC and Form 16C discusses it in detail.

Booking of Capital Gains and Losses

If your long-term capital gains (LTCG) from equity exceed Rs. 1 lakh in a financial year, a tax will be applicable to it. This has been introduced with effect from April 1, 2018. Also, if you are planning to sell equity and want large long-term capital gains, you can consider booking LTCG up to the tax-exempt limit of Rs 1 lakh so as to use it fully each year

Related Articles:

- Filing Income Tax Return after Due Date: Belated return

- How to Exchange Rs 500 and Rs 1000 Notes?

- If You don’t file the Income Tax Return on time

- Section 234A,234B,234C : Interest Penalty for not paying Expected IncomeTax on Time

- Advance Tax:Details-What, How, Why

Once you have made your way through the checklist, you might also want to review your portfolio. In the wake of the ongoing stock market rise, it is important to keep an eye on your investments and seek the help of an expert, if necessary.

Also, review your life and health insurance requirements

Very useful news… for this article.

Thanks for your suggestions.

These are all very useful reminders and you have put it so nicely – much more pleasant than the Chartered Accountant.

Thanks a lot for kind message

Can you please check your mail. I have an urgent query for your site.

Waiting for your quick response.

Regards,

Maxine Connolly