FinTech is the combination of technology in finance. Applying for a loan, buying insurance, and investing online is no different from shopping and booking appointment online. A sharp upturn in sales of mobile phones and the internet is the driving force behind the digitization of financial transactions.

“Necessity is the mother of invention”. Yes, and today’s necessity is the digitization of financial transactions. It is paradoxical that in spite of one of the fastest growing economies of the world; still, our country has 190 million unbanked adults. (Source: Business Standard). The rejection rate for the mortgage or home loan is around 70% (source: YourStory) and most of the loan aspirants have to go through a physical collection of documents and manual intervention which scale up the cost.

As the country is going through a complete digital transformation, FinTech companies are playing a vital role by promoting the financial inclusion of people from all walks of life, such as individuals, small and micro industries. They have designed a common portal where individuals can compare and access various financial services provided by multiple banks, insurance companies and AMCs. Indeed, online portals are beyond a plain comparison; they also provide customers with proper guidance from beginning to end.

Table of Contents

Video on What is FinTech?

This 3+ minute video by CNBC explains what is FinTech. FinTech a multi-billion dollar industry that’s changing everything from how we make purchases to how we get loans.

FinTech in India

The financial technology ecosystem has emerged as one of the hottest sectors in India’s internet play. With funding pouring in, even global players like Google and WhatsApp are looking to get a piece of this pie. According to NASSCOM, the Indian fintech market is expected to grow at a CAGR of 22 per cent for the next five years.

- Driven by mobile wallets, and more recent innovations including the Unified Payment Interface (UPI) platform, Indian consumers have embraced the use of mobile payments for day-to-day transactions.

- Consumers are visiting insurance aggregator and bank aggregator sites for comparison shopping.

- Consumers are visting Peer-to-peer (P2P) platforms for high-interest investments

- Online stockbroking and investment sites are becoming increasingly popular.

- Borrowing is also being transformed — “digital lenders” are providing consumers with a simpler, less–paper borrowing experience while leveraging alternate data as a credit surrogate to provide credit to non-traditional borrowers.

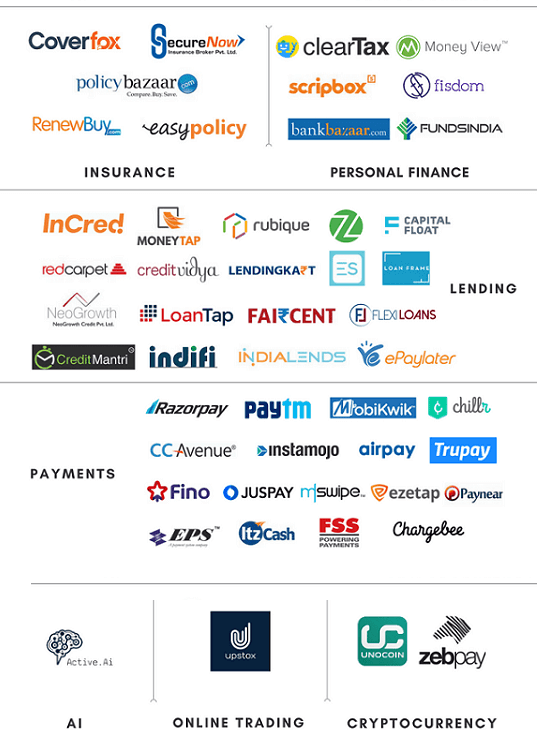

Some of Top FinTech companies in India are given below

The Drivers: Increasing Digital Penetration

| % Urban Consumers | 2016 | 2018 | 2020 |

| Digital Footprint: Access to the internet | 23% | 45% | 75-80% |

| Digital Influence: Used Internet During the Purchase Process | 9% | 30% | 50-55% |

| Digital Buyers: Purchased anything Online | 3% | 23% | 35-40% |

Source: BCG 2017 Digital India Report

The two major benefits of online fintech company are

- End to end digitalized process

- Real Time Analysis

A common portal for loans provides complete details about all banks’ loan schemes. You can thus apply to many banks using a single form. The customer can then compare the offers and avail one as per their requirement.

Stakeholders of FinTech Success in India

There are many stakeholders that have brought about a revolution in this industry in the Indian economy. Three major stakeholders are:

Banking Sector

The banking sector is promoting the fintech industry by adopting its innovations. Banks are collaborating with start-up fintech organization through blockchain technology. Blockchain is a path-breaking system that is used to store large ledgers of data virtually and has the potential to replace the traditional style of updating KYC, lending funds and making payments.

Start-up enterprises

Start-up companies are paving the way for financial inclusion of masses and creating initiatives towards digitizing India. In recent years, especially after demonetization, they have encouraged and helped citizens to go cashless. Currently, there are more than 200 fintech start-ups across segments in India that could make financial services cost-effective and more efficient.

Government Bodies

The Government of India has taken initiative like Startup India and established Rs. 10,000 crore FFS (Funds of funds for startups) to meet the financial needs of innovative startups (Source: The Times of India)

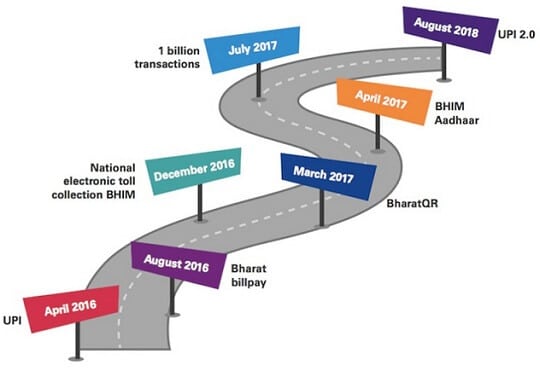

Apart from Startup India, the Indian Government has set up a UPI (Unified Payment Interface) system. UPI is a real-time payment system that helps in instantly transferring the money between two bank accounts through the mobile platform. UPI enables multiple bank accounts to get into a single mobile application and is helping in unifying the citizens towards ‘cashless India’ scheme.

Fintech has a huge market potential. Currently, it is only 3% of the organized retail lending market; <0.1% that of the total market. Mutual fund penetration in India is just 1.23% (Source: AMFI, CRISIL). However, in the light of the constructive initiatives of Government and increasing digital footprints, the mutual fund investment is likely to increase correspondingly.

After e-commerce, fintech is the next booming sector. With the launch of Digilocker, Jan Dhan Yojana, expanding broadband connectivity to Gram Panchayats, EKYC services and more than 1,50,000 kms of optical fibre laid under Bharat Net – the market of fintech ecosystem is expanding. The expanding market will generate employment opportunities across varied sectors in an unprecedented way.

This post is written by Ms. Rachna Suneja, CEO of AFinoz.com, an online financial marketplace whose tie-ups cover more than 99% market in banking and MF industry in India.

Hello bemoneyaware, I read your blog and Found it interesting ang got a great knowledge about Fintech Companies and their Banking technologies and i have had a great interaction with one of the similar kinds of Fintech companies and how they have been a key factor in growing economy and hence had a great user experience out there, I would definitely like to suggest you to check it out for more knowledgeable content.

Mob. 9991771388 change add 9812034171

You are adding a lot of Value.

Thanks

Thanks for sharing such a useful information.