Form 16 is a certificate issued by employers, giving details of employees’ TDS (tax deducted at source) usually by mid-June and is used in filing I-T returns. When it comes to ITR filing, Form 16 is perhaps, the most basic and important document for salaried taxpayers. The Income Tax department has revised Form 16 by adding various details. Effective 12 May 2019, the revised Form 16 comes into effect. This article explains the Form 16 Revised Format with images of changes. Why the changes were made.

CBDT has also extended the due date for issue of Form 16 for the financial year 2018-19 from 15th of June, 2019 to 10th of July, 2019

Table of Contents

Why are the changes in revised Form 16?

ITR Forms for AY 2019-20 asks for the detailed breakup. Now break up of the Income, Deductions, Exempt allowances/receipts is to be provided by the Employer in Form 16 and employee in ITR. Hence the changes have been made in Part -B of Form 16.

It will be easy for the taxpayers to fill the ITR as proper information is available in Form 16. It will be easy for the income tax department to match and will put the checks for the possible evasion of tax. Our article ITR for FY 2018-19 or AY 2019-20: Changes, How to file explains it in detail.

CBDT has also revised the format of Form 24Q,(Annexure II) which is used by employers when they deposit the TDS deducted by them on salary paid to employees.

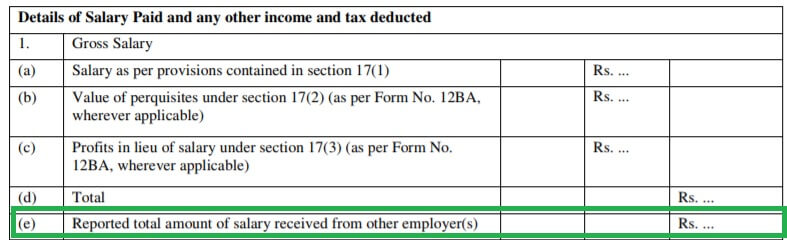

1. Reporting Salary earned from the previous employer in Form 16 Revised Format

New: Reporting the total amount of salary received from another employer(s) in Form 16.

Earlier: Specific there was nothing in Form 16 about Salary from the previous employer. However, for tax calculation employers had to include salary income from the previous employer if a new employee reported it to them. Employees submit Form 12B to disclose salary earned from the previous employer to their new employer.

Impact: This does not have a direct impact on employees who changed jobs. Those who have had more than one employer usually have a Form 16 from each employer and they will still get separate Form 16s. In case you make a disclosure to the new employer in Form12B, the new employer must include it separately in Form 16 issued by him to you, as per the new format. This was the case earlier too. Effectively, no change in your ITR filing.

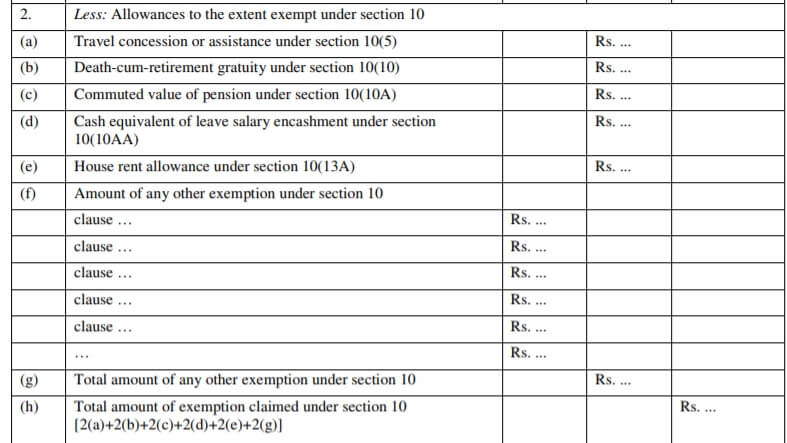

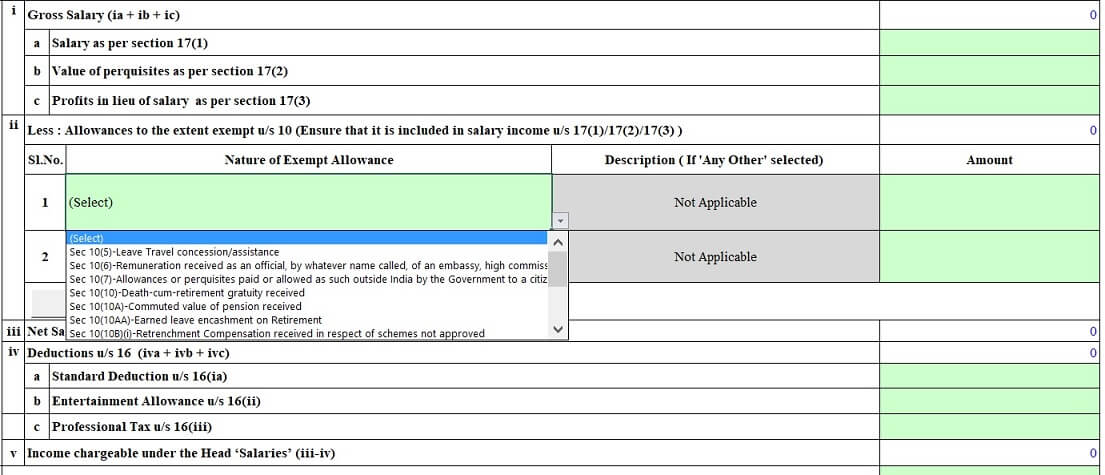

2. Break-up of allowances that are exempt from tax in Form 16 Revised Format

Addition: Amount and details of all allowances where exemption is claimed must be reported separately. This is in line with the changes made in the tax return forms (ITRs).

Earlier: Employers were using separate formats, some provided the break-up of exempt allowances, while some did not.

Now Form 16 will carry each and every detail and amount of exemption on allowances claimed by an employee. Therefore, this increases disclosed items of salaried taxpayers. Employers will report individual amounts of allowances claimed as exempt in Form 16. Exemption on HRA, exemption on LTA, exemption on gratuity, exemption on leave encashment will now appear as separate line items in Form 16.

ITR asks for Exempt allowances as shown in the image below.

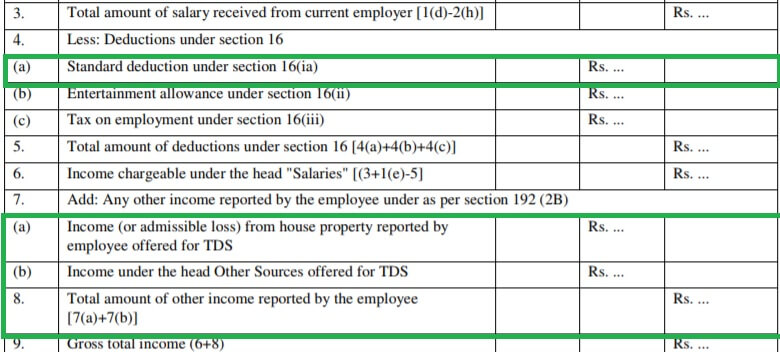

3. Standard deduction in Form 16 Revised Format

New: Standard deduction has been added in Form 16.

Standard Deduction is a new deduction of Rs 40,000 that has been introduced effective FY 2018-19 for Salaried and Pensioners. The standard deduction is essentially a flat amount subtracted from the salary income before calculation of taxable income. Medical reimbursement and transport allowance have been removed, but LTA, HRA are still on.

While filing ITR, the maximum amount of standard deduction that can be claimed by a salaried individual/pensioner is Rs 40,000 for the financial year 2018-19, (It was increased to 50,000 Rs for FY 2019-20 announced in the budget 2019 which is applicable from 1 Apr 2019).

Earlier: Standard deduction was not available

4. Disclosing additional income earned to employer

Modification: Only Income (or loss) from house property or income from other sources can be shown in Form 16.

Earlier: Earlier employees could disclose any type of income earned by them to their employer and request for TDS deduction via the employer to meet their tax dues

Impact: However, with the new Form 16, it can be said that now only income (or loss) from house property and income from other sources can be disclosed to the employer for deduction of TDS. Any other income earned, i.e. tax on capital gains or business and profession must be deposited by the taxpayer directly.

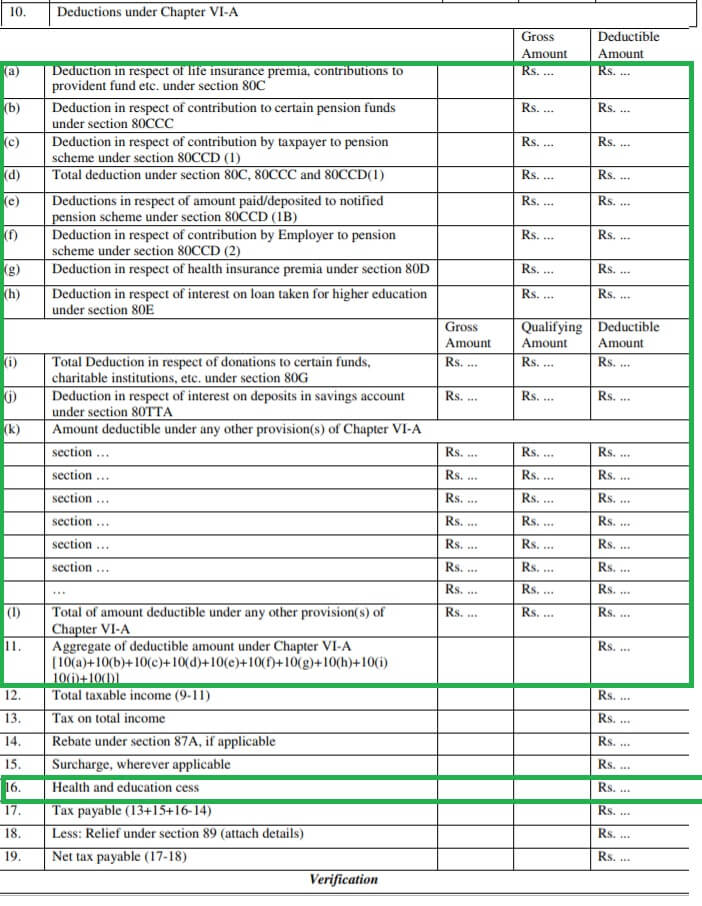

5. Deductions to be specifically reported in Form 16 Revised Format

Modification: Elaborate section wise break-up of various Chapter- VI-A deductions ranging from 80C, 80CCD, 80E, 80G

Earlier: the disclosure of various deductions was mentioned in a consolidated manner.

Impact: The new forms also ask for more elaborate section wise break-up of various Chapter- VI-A deductions. Though many corporates/employers were already providing this break in the Form 16s issued by them it was difficult for the tax department to verify as to whether the employees/taxpayers are reporting these exemption/deductions in their tax return in-line with the form 16 issued by the employer. As these details were not uniform across Form16, TDS return – Form 24Q and Individual Tax Return forms it was difficult for the tax department to track the tax evaders who were resorting to false claim (exemptions/deductions) to reduce the tax liability.

A similar break up is also asked in the Annexure II of Form 24Q i.e. TDS Return and applicable ITR Form.

6. Education Cess has been replaced by Health and Education Cess

Health and education cess will be 4% instead of the earlier 3%.

Indian government levies taxes on its citizens to raise money for numerous purposes and for meeting the economy’s expenditure. This tax is paid by every Indian citizen knowingly in the form of direct taxes or unknowingly in the form of indirect taxes. Income tax is an example of a direct tax. While GST is an example of indirect tax.

Cess is a tax that is levied by the government to raise funds for a pre-decided purpose. Collections from the Education Cess and the Secondary and Higher Education Cess, for instance, are supposed to be used for funding primary and higher and secondary education respectively. Likewise, money collected from the Krishi Kalyan Cess is to be used for funding agri development initiatives. Our article Tax: What are Cess and Surcharge? What is the difference explains it in detail.

Related Articles:

Mistakes while Filing ITR and CheckList before submitting ITR

ITR for FY 2018-19 or AY 2019-20: Changes, How to file

- Budget:2018 Long Term Capital Gain on Stocks & Equity Mutual Funds with Calculator

- Tax: What are Cess and Surcharge?

- E-Filing of Income Tax Return, E-filing : Excel File of Income Tax Return,

The website is good I didn’t found any contact page so writing here, at your website the ads are not placed properly.

I am professional AdSense earning booster and give guarantee to increase your revenue around $1000 per month by fix the adsense ads and by using other ad network.

willing to improve ur earnings

contact from here: https://www.duggu.org/services/

I registered a complaint against epfo meerut vide MRMRT/E/2019/00965 dt.29.5.2019. There were two issues one issue solved but another issue which is on account of wrong calculation of pension is still to be resolved but complaint has been closed by epfo meerut.

Kindly take up & revert back.

Please raise the grievance again