Investing in Mutual Funds is suggested as a way to build wealth. But before your invest in Mutual Funds you need to follow few steps. To start investing in a fund scheme you need a PAN, bank account and be KYC (know your client) compliant. Then you have to decide Where and how to buy funds? This article gives an overview of what you need to do to start investing in Mutual Funds.

Table of Contents

Steps to start investing in Mutual Funds

- Know your Customer or KYC: KYC is applicable for first-time investor and needs to be done only Once. Single KYC is valid for all fund houses. It can be done

- Offline by visiting the office of the KRA or

- Online or eKYC with Video In Person Verification(IPV) call

- Aadhar based eKYC SEBI currently permits investment of Rs 50,000 per Financial Year per Mutual Fund for Aadhaar based eKYC using OTP verification.

- Choose the way you will invest in Mutual Funds. There are options of buying mutual funds offline and online. You can invest in mutual funds via agents or directly from mutual fund companies.

- Offline : Mutual Fund Agents, distributor or Banks

- Online

- Through share broking websites like ICICIDirect, HDFC Securities

- Through online MF Agents like FundsIndia

- Direct Investment

- online website of respective mutual funds

- online MFU utility

- Respective mutual fund local office

- Investor Service Center Karvy/CAMS office

- Choose the Mutual Fund Scheme you want to invest in

- Choose the Investing Option: Growth/Dividend Payout/Dividend Reinvestment: When investing in mutual funds, there are three options that are available in which you could invest: growth, dividend and dividend reinvestment. One is normally expected to select one of the three options when filling an investment form, however, in case if you do not fill any of the option, the fund house selects the default option for the scheme as mentioned in its Scheme Information Document (SID), which is most often the growth option.

- Lump Sum or SIP : You can invest either in lump sum or via SIP (Systematic investment) route. For SIP route you can provide SIP mandate form to the fund house or distributor. This will enable automatic SIP transaction and investment in selected mutual fund scheme.

- After investing and Folio Number: After investing the mutual fund company allocates you a folio number and would issue you an Account Statement.

How to get KYC for investing in Mutual Funds?

KYC or Know your Customer: is the known and regular process in the Banks/Mutual Funds whereby the identity of an investor is verified based on written details submitted by him on a form, supplemented by an In-Person Verification (IPV) process.

- KYC is a one-time process. Once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc), you need not undergo the same process again when you approach another intermediary such as Mutual Funds.

- KYC is mandatory. KYC norms are mandatory for ALL applicants/investors (including existing investors and joint holders) while investing with any SEBI registered Mutual Fund, irrespective of the amount of investment.

- Non-compliance with KYC can lead to rejection of Purchases / Additional Purchases / SIP Registrations / SIP Renewals

- The provisions of The Prevention of Money Laundering Act, 2002 (PMLA) and KRA Regulations (2011), has made it mandatory for all Market Participants to comply with the ‘Know Your Client’ (KYC) norms.

- All Investors will have to submit their PAN card copy (which serves as Proof of Identity (PoI)) and Proof of Address (PoA) only once with any of the intermediary it deals with.

- Currently, KYC is done free of cost.

KYC and CKYC

CKYC means Central KYC. The Central KYC (cKYC) has been brought in to make the life easier for investors. So completing KYC process with any bank, Mutual Fund, or an insurance company will be enough and you won’t have to do this process again anywhere. Before the Central KYC (cKYC) there were separate KYC formats for different financial institutes like Mutual Funds, banks etc. The introduction of Central KYC (cKYC) aims to eliminate this dissimilarity across the investment platform. The new KYC forms are CKYC forms. Information that is currently sought on the current KYC form and the new CKYC form, is not same? CKYC requires additional information (for ex. mother’s name, FATCA information etc) . Central KYC or cKYC, One KYC for your Banks, Mutual Funds, Insurance

The following video talks about KYC and different ways of doing KYC.

How to do KYC for Mutual Funds Offline?

Offline KYC can be completed at any MF office or KRA office (CVL KRA, NDML KRA, DOTEX KRA, CAMS KRA, Karvy KRA). KRA is a KYC registration Agency which maintains KYC records of the investors centrally, on behalf of capital market intermediaries registered with SEBI, eliminating the need to repeat KYC. One needs to submit the following for their Offline KYC process:

- Copy of PAN

- Proof of address

- Photograph

- Completed and signed KYC form

- In-person verification at the MF / KRA office

How to do Aadhar Based eKYC for Mutual Funds?

Aadhaar was used as Proof of Identity, Proof of Address and date of Birth. Now you can use it for electronic Know your Customer (eKYC) or electronic Signature(e Sign). If you have an Aadhaar number, you can opt for e-KYC or eSign. Once you enter your Aadhaar number, you will get a one-time password (OTP) on your mobile number. Once you enter this, you are said to be KYC-compliant and you are good to invest.

- This facility is currently available only for individual investors with single mode of holding.

- Sebi currently permits investment of Rs 50,000 each financial year per mutual fund for Aadhaar based e-KYC using OTP verification.

- Once the investment value crosses Rs 50,000 in a financial year, the investor will have to undergo in-person verification.

How to do eKYC for Mutual Funds

Go to the website of the Mutual Fund you are interested in buying. Fill the form online. Submit or Upload the documents online. Arrange for Video call for In-Person Verification at your convenient time. This video from Birla Mutual Fund shows how to to eKYC . Other companies KYC process is similar.

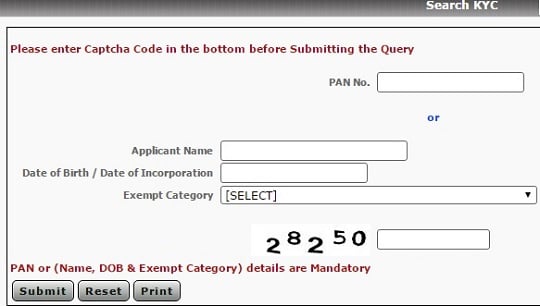

How to check your KYC status?

One can check the status on KYC compliance with their PAN number with any of the KYC Registration agency. This holds true for Existing investors and those who have submitted their applications

- https://www.cvlkra.com/

- https://kra.ndml.in/

- https://www.nsekra.com/

- https://camskra.com/

- https://www.karvykra.com/

How to Invest in Mutual Funds?

When you invest in Mutual Funds you have to choose how will you invest

- Direct or Regular Plan.

- Online or Offline

- How often will you invest: One time or lump sum or frequently.

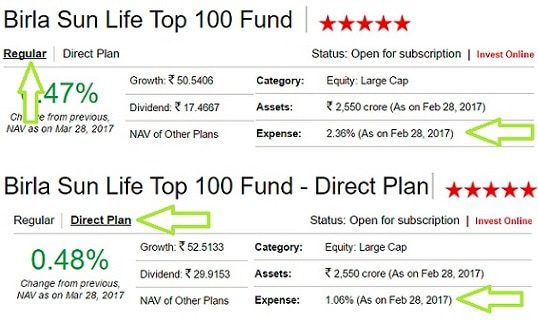

Direct Plan vs Regular Plan of Mutual Funds

A Direct plan is what you buy directly from the mutual fund company, whereas a Regular plan is what you buy through an advisor, broker or distributor (intermediary). Mutual fund distributors make annual commissions from your investments perpertually from the Mutual Fund Company or AMC.

- In a regular plan, the mutual fund company pays commission to the intermediary. This is then recovered as an expense from the plan. The Direct Plan has a lower expense ratio as compared to existing plans in the same schemes since there is no commission to be paid to the distributor under this plan. So the expense ratio is higher for a regular plan.

- Different expenses of Direct and Existing Plans result in different NAVs for both plans.

- Though Direct and Existing Mutual Funds are different plans in terms of NAV and expense ratio they are similar in all other aspects. The Portfolio, Taxation etc.

- The return you make on a direct plan is higher by approximately 0.5% for equity funds and approximately 0.2% for debt funds.

- On an SIP of ₹5000 / month over 25 years with 15% return, upfront commission of 1% and trail commission of 1% Your investment in Regular mutual fund will grow to ₹1.36 Cr. while in Direct mutual fund will grow to ₹1.64 Cr.

The image below shows the difference of Direct and Regular Mutual Fund from valueresearchonline.com. Our article Direct Investing in Mutual Funds explains investing in Direct Mutual Funds

Direct Investing in Mutual Funds is suited for whom?

If you can pick and track your own mutual funds, then the direct plan is better. If you invest through an intermediary and that person or entity knows what they are doing and are not being influenced by other factors like the commission they earn, you will get good service and potentially earn more on your investments vs what you could have done on your own. In that case, the advisor has earned their fee and investing in a regular plan would be better for you.

Direct Investing Ideal for:

- Investors who know which funds to buy.

- Ready to experiment and bear the risk.

- Investors who have time to track and rebalance portfolio

How to Buy Mutual Funds Directly?

- At most Mutual Fund Company websites such as icicipruamc.com, hdfcfund.com, reliancemutual.com, utimf.com, sbimf.com, franklintempletonindia.com. You need to register separately for each fund house website. Many fund houses ask signed form to be submitted to their office. You won’t get any independent fund recommendations

- At CAMS or Karvy: No recommendations here either. But you do get the benefit of one-time registration.

- At MF Utility: You will need to mail in a form to set up a common account number for all mutual funds. No recommendations as MF Utility is a common facility set up by the Mutual Fund Companies.

- At online advisers ex Clearfunds, Invezta Oroweath:

- You only need to register once to buy funds from every single Mutual Fund Company.

- They handle your KYC if you are a fresh investor.

- They recommend funds, and give you all the data and information you need (such as Morningstar ratings and factsheets) to help you pick the best mutual funds.

- They let you pick and choose your own dates to set up an SIP and let you change the SIP amount at no additional fee.

- They give all the tax reports you could possibly need at year end.

Investing offline through Distributor

Through Agents or Brokers-This is the traditional way of investing in India since a long time. In this option the agent comes to your doorstep and do all necessary formalities like collecting necessary documents, taking signatures and submitting the forms to the chosen mutual fund companies. In this type of mode, you need to worry about all the processing part.

- Contact a Distributor or an Agent of mutual funds.

- Fill the application form.

- Give all required Documents to him. He will complete all formalities like collecting all documents & taking signature wherever required.

- Give cheque.

- The agent or distributor would submit the application form with the cheque and all relevant documents to the mutual fund company.

Investing Online from Mutual Funds Website or Investing Portals

If you are Compliant with KYC

- Visit the website and register for online transaction services. Provide necessary information i.e. Name, Email, Phone Number, DOB, Address, PAN number, etc.

- The F-Pin will be generated and will be sent to you in email id and on registered mobile.

- Using this F-Pin you can create your User ID and Password.

- Login using the credentials just created and start investing.

Comparison of different ways of Investing in Mutual Funds

Table below compares different ways of investing in Mutual Funds.

| Mutual Fund House Website | hdfcfund.com,

reliancemutual.com, utimf.com, sbimf.com, franklintempletonindia.com Website/App |

Once you register with the fund house further investment becomes very easy. You need to register separately for each fund house website.

You can buy direct plan of mutual fund. Many fund houses ask for signed form to be submitted to their office. |

| Through CAMS or Karvy

|

These Registrar & Transfer Agents act as a single-window system for investors help.These are like middle men or intermediary firms between you and mutual fund companies for record keeping and processing (Registrar & Transfer Agent) and they will be appointed by mutual fund companies

Website/App |

Presently they offer online investments only for selected mutual fund companies.

You can to view your all portfolio at one place, you can request consolidated account statement from them (irrespective of who the service provider) by submitting your request. You can invest directly by entering broker code as DIRECT |

| MF Utility | MF Utility (MFU) is a shared services initiative by the Association of Mutual Funds in India (Amfi).

Website |

direct plans of multiple mutual fund schemes across many fund houses using a single transaction. |

| Bank’s Website | hdfc Bank,

Icici bank Website/App |

|

| Independent Mutual Fund Portals | Fundsindia.com, scripbox.com and fundsupermart.co.in

Website/App |

|

| Online Brokers | ICICIdirect,

HDFC securities, Kotak Securities, ShareKhan, Indiainfoline etc. Website/App |

|

| Offline Agents or Brokers | This is the traditional way of investing in India In this option the agent comes to your doorstep and do all necessary formalities like collecting necessary documents, taking signatures and submitting the forms to the chosen mutual fund companies.

You can’t invest in the direct plans of mutual fund schemes through these platforms. |

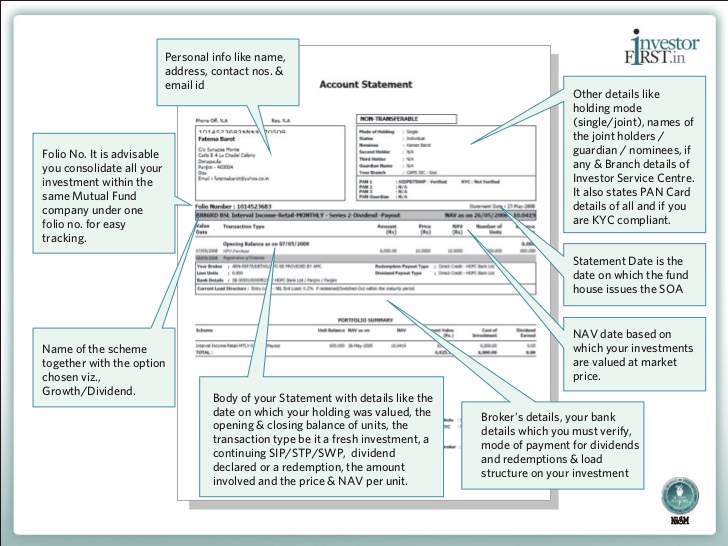

After Investing in Mutual Fund Folio Number and Account Statement

A folio number is a number given to a mutual fund investor by an asset management company when one invests in the fund.

- Like a bank account number, the folio number can be used as a way to uniquely identify fund investors and keep records of items such as how much money each investor has placed with the fund, their transaction history and contact details.

- The Folio number is unique for each fund house. So, when you invest for the first time in XYZ fund you would get a folio number that’s different from the folio number given to you when you invested in ABC fund.

- Most fund houses offer one folio number and several account numbers in the same folio for all investments made under the same unit-holder combination. This makes tracking all your investments with same fund house easier.

Mutual Fund company sends Mutual Fund Account Statement which has all details about one’s investment. A sample MF Account statement is shown in the image below.

Related Articles:

- All About Mutual Funds : Basics, Choosing, Paperwork, Direct Investing

- Investing in Equities: Stocks vs Mutual Funds

- Alternatives to Fixed Deposits: PPF,FMP,Debt MF,RD,CD

- How to Choose Mutual Fund : Ratings, Fund House,Size

- Tax and Mutual Funds

- How to Nominate:Bank Account, Mutual Funds

- Claiming Deceased’s Mutual Fund Units

How to change mobile number in mutual fund KYC ?