The price of gold has been rising rapidly in America, India, and elsewhere. The price of gold is sitting near 6-year highs in US dollar terms. But against many fiat currencies, gold has already hit all-time record highs in 2019.

Table of Contents

Gold is Also Soaring Against Other Currencies

When looking at global economics or geopolitics, it can be tempting to see the world through a narrow lens. But that’s not how things work.

In today’s worldwide economy, everything is interconnected to a certain degree. What’s happening in one country can affect another country or even the entire global economic and financial system. As an example, look to the crisis of 2008 – a handful of big, multinational banks headquartered in the USA almost crashed the entire world economy singlehandedly. This can happen due to a chain-reaction series of events.

With the price of gold, we are witnessing a sort of chain reaction with regard to the declining value of national currencies. Central banks around the world have been engaged in a decade-long money printing spree. The result has been to increase the existing money supply, thereby diluting the value of fiat currencies.

This so-called “monetary stimulus” or “quantitative easing,” as it’s referred to, has begun leading investors into safe-haven assets like gold. The resulting herd mentality has begun a virtual worldwide stampede into precious metals.

Negative Interest Rates Raise Gold’s Appeal

Lastly, it’s important to take note of the fact that over $16 trillion worth of sovereign debt has begun paying a negative rate of interest so far in 2019, and the number is rising fast (the figure could easily be higher by the time you read this).

Why is this important? Because traditionally, bonds have been the go-to safe-haven asset. But now many of them have become a guaranteed way to lose money. In fact, some experts estimate that 85% of the world’s positive-yielding debt now comes from USA treasury notes! In other words, only a small fraction of sovereign debt outside of America even has a positive yield anymore.

Needless to say, this increases the appeal of gold, which has a multi-millennia track record of retaining its monetary value. And while gold doesn’t yield anything, that’s a lot better than a guaranteed loss.

US: Individual Retirement Accounts and Gold

For the reasons cited above and more, investors in US have begun turning to alternative investment options like a physical gold IRA. What is a physical gold IRA and how does it work? In India we have Soverign Bonds.

Simply put, an IRA that holds physical gold is just what it sounds like – a retirement account that is 100% collateralized with physical gold bullion. The bullion is most commonly held in secure storage vaults. The vaults could be in your home country or overseas. Some investors prefer to hold their gold overseas to protect them from any potential confiscation of gold by government entities, as happened in the USA during the 1930s.

A gold IRA works pretty much like any other individual retirement account. The only difference is the money you deposit takes the form of physical gold coins or bars, so you usually have to deposit the equivalent of at least one-tenth ounce of gold. That’s commonly the smallest denomination of gold coins. Gold IRAs only allow certain types of coins and bars from specific reputable minting companies and national governments to be deposited into their vaults. This minimizes the chance of having counterfeit metals enter their vaults.

The great thing is that instead of having digital representations of value (such as with stocks, bonds, or fiat currency), your account balance reflects an actual physical commodity that has stood the test of time. Regardless of what happens in the financial world (which has become increasingly chaotic over the last year), you will know your savings are being held in a secure vault. But there is some potential downside.

All this security comes at a cost. Someone has to pay the people who own and maintain the vaults. That payment comes in the form of small monthly fees taken from your account, in addition to a small fee paid to bullion dealers (this fee is referred to as a “premium” over spot price) every time your IRA manager has to go and buy physical gold. But the really big fees come into play as soon as you want to sell your gold for fiat currency.

A gold IRA is best for people who don’t plan on withdrawing their funds anytime soon. The costs of getting your gold out of the vault (some services allow for delivery of your gold) or otherwise selling it for fiat can get expensive. If you think you may need access to your funds in the near-term, consider a tax-advantaged account such as a Roth IRA.

India Sovereign Bonds

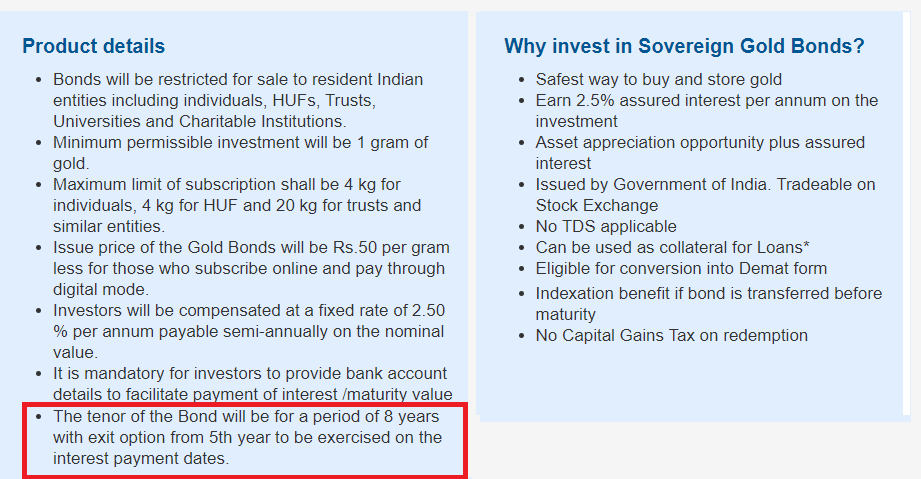

Sovereign Gold Bonds(SGBs) are government securities in grams of gold, issued by Reserve Bank on behalf of Government of India. It is an alternative to consumers in place of physical gold . You can apply for Sovereign Gold Bonds through your Bank Demat, like ICICI Direct, Zerodha etc. Features of Sovereign Gold Bonds are given below. Our article Sovereign Gold Bonds :Should You Invest gives an overview of it.

Precious metals markets are doing very well this year. Capitalize on the trend by investing however you can, either with an IRA or other means.