Indians buy gold. But the trend of rise in prices of gold in last few years have taken it out from the reach of common people. So different jewellers have come up with gold saving scheme(s). These schemes make buyers buy gold with their monthly saving by paying in installments. Hence there is no burden to pay a huge amount at one go. The jewellers also offer bonus at the end of the scheme. In this article we shall look at these gold saving schemes offered by different jewellers, pros and cons of the schemes.

Table of Contents

Gold Saving Schemes

Gold saving schemes offered by jewellers are of two types of:

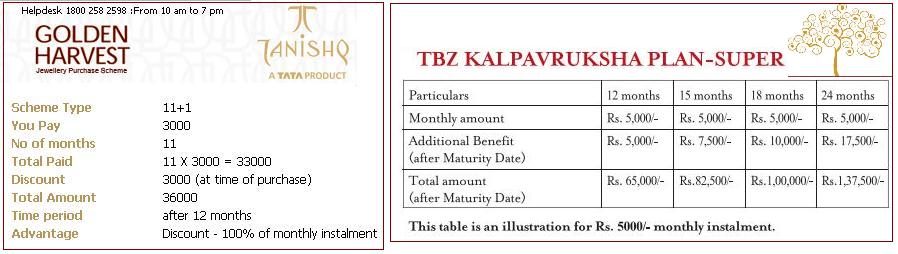

Money Installment: To pay a flat amount every month for a fixed period. At the end of the period the customer gets to convert the money into equivalent value of jewellery. Jewellers offer a bonus amount to the customer at the end of the fixed period. The bonus amount is generally equivalent to one/two month’s installment and is paid at the end of the scheme. There could also be the promise of ‘zero’ wastage and lower making charges on the jewellery you purchase out of these savings. Some of the schemes which are on offer are TANISHQ Golden Harvest Scheme, Gitanjali:Tamanna – Monthly Saving Scheme, Tribhovandas Bhimji Zaveri (TBZ): Kalpavruksha Plan Super, P C Jeweller: Jewels for Less, Prince Swarna Vaibhav. Example of such a saving scheme is shown in picture below:

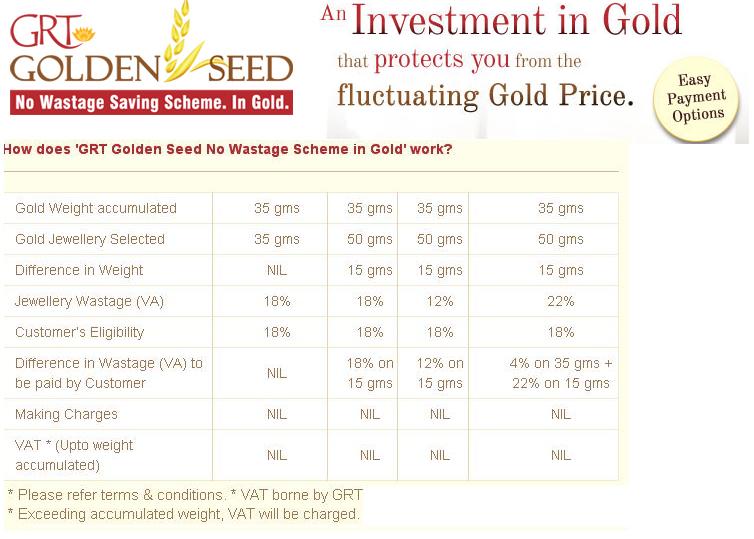

Money Installment in Gold:In this also one pays a flat amount every month for the fixed period but the monthly installment is invested immediately in gold at the prevailing price.At the end of the instalment period you can convert gold collected into your favourite piece of jewellery. This lets you directly buy grams of gold every month at existing rates instead of buying them at the end of maturity. This helps you to protect your investment from the fluctuating gold prices. But these schemes do not normally carry the ‘bonus’ advantage and their may or may not be benefits such as zero making charges. Ex:GRT Golden Seed Scheme. Example of such a saving scheme is shown in picture below:

Let’s look at the example of these kind of schemes in detail

TANISHQ Golden Harvest Scheme

The Golden Harvest Scheme(GHS) is by Tanishq which has show-rooms throughout India(pan-India presence). As per their website over 10 lac people rely on GHS scheme of Tanishq. Some highlights of the scheme from webpage TANISHQ Golden Harvest Scheme are as follows:

Kind of jewellery: You can buy anything from a wide range of pure 22K jewellery to diamond 18 K jewellery and colored stones. Only Gold coins and Silver Coins cannot be purchased under the Golden Harvest scheme. No, cash refunds are not allowed in the Golden Harvest scheme.

Time period and Bonus: Under this scheme, you need to invest a fixed amount every month with Tanishq for 11 months. The 12th month installment is paid by Tanishq, hence you can buy for more than what you pay. Earlier there was 18 months scheme but it seems to be dis-continued now.

Location: You can buy from any of the Tanishq showrooms across India. Hence you can enroll anywhere, and if you move, your account can move with you. You can also enroll online.

Clubbing with other ongoing schemes: You can club your Golden Harvest discount at the end of the scheme, with any ongoing scheme that Tanishq has at that time. Thus get that extra benefit!

How to enroll: You can enroll for GHS either in any of the Tanishq showrooms or online. If you’ve registered online, you have to pay the installments online. Currently, the showroom customers have to pay the installments at the showroom itself.

How to enroll online: To enroll for GHS online, you need to register yourself by filling the registration form. Once that is done, you can fill in a small enrollment form with the details of GHS scheme you want to opt for, and pay the first installment online. You can pay every month using your debit/ credit card

Changes in scheme: Once the first instalment is paid, you cannot change the scheme. You can also not change the installment value if you’ve chosen the 11+1 scheme.

Scheme Status: Whenever you want to see your scheme status, you can log in using your username and password and go to the‘My accounts’ page. You may click ‘view details’ to see the details of your account.

Missing the installment: It is advised that the installments be paid within 3 days of the due date. If you delay or miss paying installments, the discount shall be reduced proportionately to the effect of the number of days the payment is delayed by.

Liquidity: You can buy jewellery worth the amount accumulated till date, but you lose out on the discount in case you buy before the maturity date. You need to send a request in case you want to do so.

Nominee: In the event of the death of the account holder, the account is transferable only to the person who is nominated by the account holder in the enrolment form at the time of opening the account (nominee details).

Redemption: You need to carry your valid photo ID (viz.Ration Card/ Passport/ Driving License/ PAN Card/ Voter ID ) to the Tanishq Showroom you selected for redemption after the maturity date of the scheme. It is also recommended that you carry a print-out of your account details page. You are advised to redeem your account latest by 3 months post the maturity date.

Gitanjali:Tamanna – Monthly Saving Scheme

Gitanjali Jewels offers a bouquet of world’s leading Jewellery brands that include Nakshatra, Gili, D’damas, Asmi, Diya, Maya Gold, Parineeta, Collection G, Gold expressions. Their “One Shop Stop” Jewellery outlets spans across all over India . They have a scheme called TAMANNA – Monthly Saving Scheme, wherein you pay in installments and “Get Benefited at the End”. Some highlights of the scheme Gitanjali:Tamanna – Monthly Saving Scheme are as follows:

Amount: Minimum amount to be invested is Rs 1000 only. More investment could be done but in the multiples of 1000 only.

Time Period and Bonus: You pay 12 monthly installments and get 2 months installment absolutely FREE on Diamond Jewellery and 1 month on Gold Jewellery.

Kind of jewellery: You can purchase the following brands: Asmi, D’damas, Nakshatra, Gili, Maya Gold, Collection G, Gold Expressions, Diya under this scheme. This scheme is not valid on purchase of Gold coins & Solitaires. You stand a chance to win Surprise Gifts every month through a lucky draw.

How to enroll: You can enroll in the scheme in any of their stores, which can be found by using the Gitanjali:StoreLocater The scheme is not transferable from one city to another city. If you have to shift from one city to another & you want a transfer then: you can transfer the scheme to your nominee & the nominee can continue with the scheme If there is no nominee to continue the scheme then you will have to buy the jewellery worth the installments paid till date but you wont get the bonus installment as the scheme is seized half the way by you.

Scheme Status: At the start of the scheme, a pass book will be given to every member which is to be updated periodically. Member of the scheme should ensure that all the entries of the payment are correctly entered into the passbook.

Payment of Installment: Payments should be made within the 10th day of every month by cash/DD/account pay cheque (Local cheque only) in favour of : Gitanjali Jewellery Retail Private Limited. Yes you can give Post Dated Cheque but you should take care that these cheque doesn’t get bounced. If it bounces then you would be charged with the amount of the fine paid for bounced cheque.

Missing the installment: If a member misses any installment on due date or for some months then the maturity date will also get postponed to the same period.

GRT Jewellers: Gold Jewellery Saving Scheme

GRT Jewellers are famous jewellers from Chennai since 1964. They have two schemes Gold Tree Gold Jewellery Saving Scheme and Golden Seed.Gold Tree Gold Jewellery Saving Scheme is like other scheme in which one pays installment every month and buys jewellery at the end of the period.

Amount: Deposits should be for a minimum of Rs. 500 and multiples thereof upto Rs. 10,000.

Kind of Jewellery: Gold Jewels /Silver articles.

Time period and Bonus:It is active over a 15-month period. GRT offers one instalment of deposit and a cash incentive/gift article based on deposit amount as shown in figure below. GRT also bears the VAT of the jewellery one purchases under the scheme. There are no making charge for plain gold jewellery up to saving scheme maturity value (except special design and Nages items).

GRT Jewellers: Golden Seed

GRT Golden Seed is a jewellery saving scheme in which for every monthly instalment, gold is credited to one’s account at the prevailing rate. That is, one directly buys grams of gold every month at existing rates instead of buying them at the end of maturity. This helps one to protect your investment from the fluctuating gold prices. This scheme is similar to the regular scheme in terms of monthly installment except that in the end one gets to buy gold. Highlights of the scheme are as follows:

Monthly Installment: Minimum Rs. 1000/- and in multiples of Rs. 1000/- only.

Time Period: 15 Months.

Kind of Jewellery: Plain gold jewellery with No Wastage (up to 18%) and No Making Charges. One can buy Diamond / Platinum / Ruby / Emerald / Ethnic / Silver Jewellery / Article paying full wastage & making charges as applicable. One can also buy 22 Ct. Gold Coins or 24 Ct. without paying wastage for amount =(Accumulated weight x 22 Ct. gold rate on the date of purchase)

Payment of Installment: Payment can be made by Cash / DD / Money Order / Electronic Clearing System (ECS) / Post Dated Cheques (PDC) / At Par Cheques / Local Cheques / any ICICI Bank Branch (Cash or at par cheques). Monthly instalments should be paid on or before the 10th of every month.

Missing installment: The scheme remains valid, redemption period gets delayed accordingly.

Discontinue:If you discontinue before 12 months, you can buy jewellery for the instalment amount accrued. But you lost the benefits of gold weight accumulation, no wastage (VA) and no making charges. If you discontinue after 12 months you will be eligible for weight based accumulation for the months you have paid and the benefits of no wastage (VA) and no making charges

Tribhovandas Bhimji Zaveri :Kalpavruksha Plan Super

Tribhovandas Bhimji Zaveri is a jeweller in Mumbai’s Zaveri Bazaar since 1864.Now they have branches in many places in Andhara Pradesh, Gujarat, Kerala, Madhya Pradesh, Maharashtra. They offer Kalpavruksha Plan Super highlights of which are given below:

Monthly Installment: Minimum Rs. 1000/- and in multiples of Rs. 500/- only.

Time Period and Bonus: 12 months /15 Months / 18 months / 24 months.

Kind of Jewellery: 22kt gold, diamond or platinum jewellry

Payment of Installment: Payment can be made by Cash / DD / Money Order / Electronic Clearing System (ECS) / Post Dated Cheques (PDC) . Monthly instalments should be paid on or before the 15th of every month.

Missing installment: The scheme remains valid, redemption period gets delayed accordingly.

Discontinue:If one discontinues before end of scheme period, one can buy jewellery for the instalment amount accrued. But one loses the benefits. If one discontinues before payment of third installment one has to pay Rs 500 towards administrative charges.

P C Jeweller: Jewels for Less

PC Jewellers has many showrooms in north Indian states such as Delhi, Punjab, Uttrakhand(Dehra Doon, Haridwar), Madya Pradesh(Indore, Bhopal), Haryana(Rohtak, Faridabad, Gurgaon,PanchKula) Rajasthan (Jodhpur,Ajmer ,Beawar, Bhilwara ,Pali), Uttar Pradesh (Noida ,Ghaziabad ,Lucknow , Kanpur), Chattisgarh(Raipur, Bilaspur). They offer Jewels for Less scheme, highlights of which are given below:

Monthly Installment: As little as Rs 1,000 and as much as you want, can be saved in monthly installments, The amount has to be in multiples of 1 000, like 2000, 3000, etc.

Time Period and Bonus: Minimum 12 months maximum 36 months. You get 2 months installment as bonus. So if you invest Rs 2,000 for 12 months you can buy jewellery worth 24,000 (2 X 12,000) + 4,000( 2 X 2000) = 28,000 Rs.

Kind of Jewellery: You can buy any jewellery from our gold and,diamond collections. You can buy jewellery for a higher amount also. For example, if your amount on maturity is 14,000/- you can buy worth 25,0001 by paying 1 1,000/- more and get the jewellery of your choice. However, the scheme doesn’t apply to pure gold and silver coins. Buying will be at the prevailing gold rate with the usual making charges and that of raw gold.

Payment of Installment: Payment can be made by Cash / DD / Money Order / Electronic Clearing System (ECS) / Post Dated Cheques (PDC) . Monthly instalments should be paid on or before the 7th of every month.

Missing installment: The scheme remains valid, redemption period gets delayed accordingly.

Discontinue:If one discontinues before end of scheme period, one can buy jewellery for the instalment amount accrued. But one loses the benefits. No cash will be refunded.

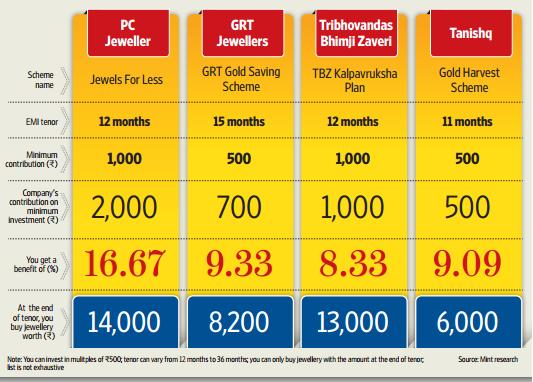

Comparison of different schemes

A comparison of different schemes done by Livemint:Are gold jewellery saving schemes worth it? is shown in picture below:

Jeweller’s Interest

For jewelers, this scheme is a win-win situation as he gets the chance to sell his product, and at the same time he earns interest on the customer’s installment. Quoting from Livemint:Are gold jewellery saving schemes worth it? R.K. Sharma, executive director, PC Jeweller, says “This scheme is a business building programme. By getting customers involved in this scheme, we ensure future sales. A majority of the times, people purchase a jewellery for a higher price than the amount invested. It is a sure shot business opportunity through which we seal our future sales.”,

Is the money safe with the jeweller? Says S. Subramaniam, chief financial officer, Titan Industries Ltd, the parent company of the jewellery business Tanishq, “The money we get from investors through the jewellery savings scheme is deposited by us in fixed deposits in banks (most of them nationalized banks) and is absolutely safe.” But there are some jewellers who use this money for operating expenses. Operating expense is an expense incurred in order to carry out a company’s normal business activities. Choose your jeweller cautiously. (Ref:Livemint:Are gold jewellery saving schemes worth it?)

Limitations of the Gold Saving Schemes

- Mostly you can use the accumulated amount only to buy gold jewellery—not gold bars or coins. If the main purpose of a buyer is to invest, then buying jewellery is not a wise choice. As the jewellery is not made of 24 carat gold, and it also carries some making charges, so the return value of jewellery would be much less when compared to gold coin, biscuit or bars.

- You are not refunded in cash, so in case you need some accumulated money for an emergency at the end of the tenor, you won’t be able to use this money for the contingency. Here, the best you can do is sell the piece of jewellery you buy with the accumulated amount and forego the making charges part.

- To avail of the bonus amount, you should have completed payment of all the installments. If you stop in between you forgo the bonus.

- Gold Jewellery is purchased at the prevailing market rate. If at the time of booking jewelry, the gold rate is Rs 2800/gram but after the completion of installments, the rate increased to Rs 3000/grams, then buyer has to pay Rs 2000 extra for every 10 grams due to change in price of gold. If you opt for the gold saving scheme, where you buy a certain gram of gold every month, you circumvent the above risk but then not all jewellers offer the scheme.

[poll id=”21″]

Related articles:

For people who are looking to buy jewellery for marriage or other purposes, the gold saving schemes works well as it makes way for systematic investment. Choose your jeweller cautiously. Have you invested in any gold saving scheme? How was your experience? Do you think gold saving schemes are useful?

Gold is a classic asset that everyone loves to own. Be it in any form, gold sustains demand and makes it a profitable investment. But, it is not easy to buy gold online at its purest.

can NRI”s invest in the scheme as we cannot be available when it matures. Can benefeciary pick up the gold

Depends on the jeweller . Some jeweller allow NRIs to remit using an internet banking facility. Or you could give a standing instruction to your bank to transfer a fixed amount periodically. The third option is that you could give a cheque from your local NRI account through your relatives in India.

Hi. I want to invest 10k / month for an year. Purely for my sister’s marriage. Which jwellery shop and which scheme will be suitable for me.

Price of gold is going down.

You can check with the jeweller where you want to buy jewellery for the scheme.

My picks are: 1. If the requirement is ornament go for Jewellers scheme 2. If the requirement is pure investment go for ETFs

Only benefit buyer would get from those schemes is pay in installments rather than lump sum. But from buyer’s perspective, he will loose more out of these

Very practical advice Srikanth

i wish to open gold saving scheme

Choose the jeweller of your choice, your tenure and then start. If you have many choices then you can think of whether to go for gold jewellery or gold as in GRT Jewellers: Golden Seed.

Very informative article pin pointing the nitty gritty details of gold schemes.Loving the site and the contents. Too good for layman like me.

Thanks a lot for encouraging words Vineeth. Glad you liked it. We have been in your position so can understand what you feel.

Your articles on Gold Saving scheme is simply superb. This is very much useful for those planning to invest in gold for there future. Hope you write articles on Mutual funds which offer investment in Gold.

Thanks Gopi. Yes we are planning to write article on Gold ETFs soon. Watch out the space!

Its surprising to see a detailed article on Gold Savings Scheme. I appreciate the initiative of putting all information together in this. Excellent article.

Can you also publish some article on Gold ETFs? This will also interest people who want other avenues to invest in gold.

Thanks a lot Sekhar. We have plans to write article on Gold ETFs soon. Just wait for the space.