On May 28 2020, RBI discontinued the RBI 7.75% bonds. At a time when the interest rate on bank fixed deposits (FD) are coming down, one other investment option almost similar to bank FD that investors may consider is the 7.75 per cent Savings (Taxable) Bonds, 2018. The bonds have a maturity of seven years. This article explains the features of 7.75% government savings bonds and should you invest in 7.75% saving bonds scheme?

It is not available for investors to invest but it does not affect those who have already invested. They will continue to get interest/redeem the bonds as per the maturity claim.

Table of Contents

Why did Govt withdraw the 7.75% Govt Saving Bonds?

The interest rate on bank fixed deposits as well as lending rates are on the decline with the Reserve Bank of India lowering the key short-term lending (repo) rate. The repo rate is currently at a historic low of 4 per cent. So having a bond with 7.75% was not logical and sustainable.

Features of the 7.75% Government Savings Bonds

Popularly known as RBI Bonds or GOI bonds, they suit those who are looking for the highest safety of principal and a regular income.

You buy the bonds for an amount(multiple of 1000s) and have to hold it for 7 years.

You have to decide whether you want interest paid out or not during the time period.

- If you go for getting interest, Non-Cumulative, then you will get Half-yearly interest payouts (1st Aug & 1st Feb) of Rs 38.75 per Rs 1,000 (TDS might be deducted). So in 7 years, if you invest Rs 1000, you will get Rs 542.5 half-yearly. At the end of 7 years, you will get Rs 1000.

- If you go for cumulative option then interest will be paid at the end of 7 years. If you invest Rs 1,000 then at the end of seven years you will get Rs 1,703 (based on half-yearly compounding).

The features of RBI Bonds are explained below.

The Govt 7.75% savings bonds are open to investment by individuals (including Joint Holdings) and Hindu Undivided Families. NRIs are not eligible for making investments in these Bonds.

Issue Price: The Bonds are issued at par i.e. at Rs 100. The Bonds are issued for a minimum amount of Rs 1,000 (face value) and in multiples thereof. Accordingly, the issue price will be Rs 1,000 for every Rs 1,000.

Limit of investment: There is no maximum limit for investment in the Bonds.

Maturity and rate of interest: The Bonds have a maturity of 7 years carrying interest at 7.75% per annum. You can buy bonds in cumulative or non-cumulative mode. No interest would accrue after the maturity of the Bond. 8% savings bonds were for 6 years and offered 8% interest rate.

- In the cumulative option, interest is paid on maturity of bonds. The cumulative value of Rs. 1,000 at the end of seven years will be Rs 1,703.

- In the non-cumulative mode, interest is paid on a half-yearly basis. Interest on Non-cumulative (Half yearly) bonds will be paid from the date of issue up to July 31 / January 31 as the case may be and thereafter half-yearly for the period ending July 31 / January 31 on August 01 and February 01.

Tax treatment: Like bank fixed deposits, the interest income earned from 7.75% Government Savings Bonds is added to one’s income and taxed according to the respective slabs.

TDS: TDS is deducted if the interest income for a year exceeds Rs 10,000.

The tax will be deducted at source while making payment of interest on the NonCumulative Bonds from time to time and credited to Government Account.

Tax on the interest portion of the maturity value will be deducted at source at the time of payment of the maturity proceeds on the Cumulative Bonds and credited

to Government Account.

Transferability: The Bonds are not tradeable in the Secondary market and are not eligible as collateral for loans from banking institutions, non-banking financial companies or financial institutions.

Premature withdrawal: Premature encashment in respect of the Bonds shall be allowed for individual investors in the age group of 60 years and above, subject to submission of

the document relating to the date of birth of the investor in support of age to the satisfaction of the issuing bank, after minimum lock-in period. In case of joint holders or more than two holders of the Bond, the lock-in will be applicable even if any one of the holders fulfills the above conditions of eligibility.

- Lock in period for investors in the age bracket of 60 to 70 years shall be 6 years from the date of issue

- Lock in period for investors in the age bracket of 70 to 80 years shall be 5 years from the date of issue

- Lock in period for investors of the age of 80 years and above shall be 4 years from the date of issue

Redemption payment will be made on the following interest payment due date. Thus, the effective date of premature encashment for eligible investors will be 1st August and 1st February every year. However, 50% of interest due and payable for the last six months of the holding period will be recovered in such cases, both in respect of Cumulative and Non-cumulative bonds.

Nomination: A sole holder or a sole surviving holder of a Bond, being an individual, can make a nomination

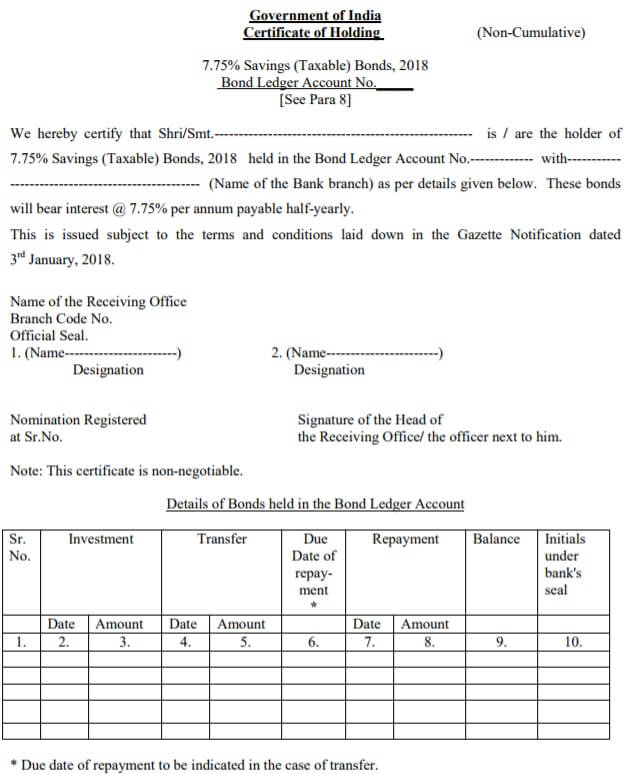

How the bonds will be issued: The Bonds will be issued in demat form (Bond Ledger Account) only. The image below shows the Certificate of Holding for Non-Cumulative option.

Subscription: Applications for the Bonds in the form of Bond Ledger Account will be received in the designated branches of agency banks and SHCIL. Once you apply, you will receive a Certification of Holding with the Bond Ledger Account number.

The 7.75% Savings (Taxable) Bonds scheme replaced the 8% Savings Bonds Scheme, also known as RBI Bonds Scheme.

Should you invest in the 7.75% Government Savings Bonds

As on 1 Apr 2020, Bank FDs’ rate of interest has gone low and the rates of small savings schemes, barring SCSS, also stand below what these bonds are offering. Looking at this scenario, these bonds are still an attractive investment option.

Interest Rates of Post office Small Savings Schemes discusses the interest rate of Post office small saving schemes.

While the new bond scheme may be a good option for risk-averse investors, it is not beneficial for someone looking to invest for a mid or short term.

- The 7.75% interest is taxable and post-tax returns for 30% tax bracket would be just 5.36%

- There is a lock-in period. You cannot exit or sell the bond until maturity.

- Senior citizens can get 7.6% in senior citizens saving scheme. Our article Senior Citizen Savings Scheme, SCSS explains it in detail.

Instead one may consider Debt Mutual funds or ELSS for investment as the scheme is known to provide much better returns for a similar period.

- One can invest in debt or arbitrage mutual funds. the returns are similar to bank fixed deposit but are more tax efficient.

- According to the CRISIL Mutual Fund Ranking, the top ELSS funds delivered returns between 11.4% and 19.5% for a 3-year tenure, which when compared to the savings bond scheme that previously stood at 8% is much higher.

- Moreover, the lock-in period for ELSS schemes is just 3 years compared to the Savings Bonds Scheme which has a fixed tenure of 7 years.

Where can you buy 7.75% Government Savings Bonds

You can buy 7.75% Government of India Savings Bonds from designated branches of SBI and Associate banks, Nationalised banks, Private Sector banks (like HDFC bank, ICICI Bank) and Stock Holding Corporation of India Ltd. It is also available through Demat services like those of ICICIDirect etc.

Subscription to the Bonds will be in the form of Cash/ Drafts/ Cheques or any electronic mode acceptable to the receiving office. (ii) Cheques or drafts should be drawn in favour of the bank (Receiving Office), specified below and payable at the place where the applications are tendered.

- ICICI Bank Ltd.

- HDFC Bank Ltd.

- Axis Bank Ltd.

- State Bank Of India

- Allahabad Bank

- Bank of Baroda

- Bank Of India

- Bank Of Maharashtra

- Canara Bank

- Central Bank Of India

- Dena Bank

- Indian Bank

- Indian Overseas Bank

- Punjab National Bank

- Syndicate Bank

- UCO Bank

- Union Bank of India

- United Bank Of India

- Corporation Bank

- Oriental Bank Of Commerce

- Vijaya Bank

- IDBI Bank

- Stock Holding Corporation of India Ltd.

The Bonds will be issued in demat form (Bond Ledger Account) only. The image below shows the Certificate of Holding for the Non-Cumulative option.

How to apply for 7.75% Saving Bonds through ICICIdirect?

For investing in Saving Bonds you will need to first allocate funds for the purpose of investing. You will need to click on the modify allocation page and allocate funds for investing in “Mutual Funds, IPO and Others”.

Once sufficient funds have been allocated you can apply for these bonds by clicking on the button for GoI bonds. Thereafter click on the place order button and apply for Bonds by filling in the required details.

Related Articles:

- Best Fixed Deposit Interest Rates, FD rates

- All About Fixed Deposit,FD

- Interest Rates of Post office Small Savings Schemes in FY 2017-18

- Senior Citizen and Retirement, Income Tax, Form 15H,Will

- Senior Citizen Savings Scheme, SCSS

The 7.75% interest in Government of India Savings Bonds, 2018 are attractive in the low-interest rate scenario. But there are better options to invest as stated above.

For Government of India Bond 7.75 half yearly cumulative Rs 1700 after Rs 1000 investment. Very good safe investment if some one wants to investment in crores. For details call 9462659179 as we give incentive on same. As compare to latest bank FDR rates and risk factor it is highest safe avenue.