Who doesn’t want their families to stay safe and healthy? However, emergencies never come with a prior notice. God forbid, in case of a misfortunate event like an accident or illness, have you ensured that your family would still remain protected? In this age of rising medical costs is there a way to keep the health cost minimum? One of the solutions is to buy a Family Floater Policy. This article explains what is the Family Floater Health Insurance policy ?. How does it differ from Individual Health Insurance Policy? When should one buy a Family Floater Health Insurance Policy?

Table of Contents

What is a Health Insurance Policy? What is the Sum Insured?

Health insurance or Medical Insurance covers surgical and medical expenses of an insured individual. It reimburses the expenses incurred due to illness up to a predefined limit called as Sum Insured. A Sum Insured represents the Maximum Liability of the Insurance Company during the policy period.

For example, if Shyam has Rs 2 lakh health cover i.e. Sum insured is Rs 2 lakh and that individual is hospitalized twice in a year. In his first visit, his hospital bill was Rs 70,000.

In the second visit his stay in a hospital, his bill was Rs 1.5 lakh.

So his total hospital bill for the year was Rs 2.2 lakh.

The health insurance company will pay only Rs 2 lakhs. (This is the sum insured provided by the health insurance policy.) The remaining 20,000 Shyam has to pay from his own pocket.

Sum insured or Sum Assured are similar words, non-life insurance policies like health insurance, motor insurance use sum insured while life insurance plans offer sum assured.

What is the Family Floater Policy?

In case of an individual health policy, the policy is issued in the name of one person only. If that individual falls sick, it is only his health insurance policy that can be used.

In a family floater policy, all family members are covered under a single policy. In a Family Floater Mediclaim Policy, the amount insured is shared amongst the family members i.e. the sum insured floats.

For example, if there is a family with two kids, take a family floater policy with a sum assured of Rs. 5 lakhs, all four members of the family share the Rs. 5 lakh sum assured. That means, irrespective of who in the family gets hospitalized the insurer’s maximum liability towards the entire family for a particular year is Rs 5 lakh.

If any one member of the family is hospitalized and uses Rs 2 lakh of the cover, then the balance i.e. only Rs 3 lakh is available for the other three members of the family for the rest of the year.

Chances of all family members getting hospitalized in the same year are slim. So you get a large cover shared amongst all family members for one of you to claim. With family floater, you don’t need to maintain and keep track of several health insurance policies, and the price for buying is lower than buying individual covers. It is health insurance for family. After all, a family that takes insurance together stays together. 🙂

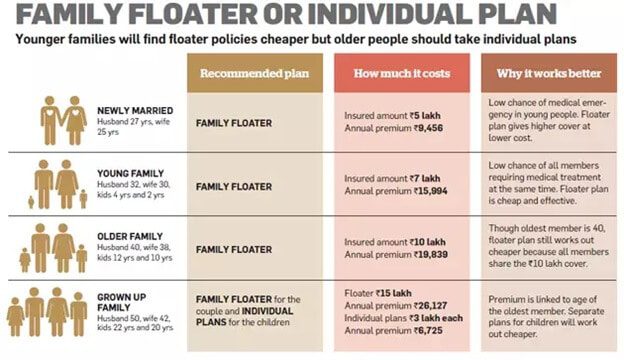

But remember that the premium of the policy is decided on the basis of the age of the eldest family member.

Tax Benefits of Health Insurance Policy

Tax benefits are also available with family floater health insurance plans under Section 80D of the Income Tax Act, 1961.

The maximum deduction of Rs 25,000 a year can be availed under Section 80D on the premium paid for the policy for self, spouse, children if no one has attained the age of 60 years.

The maximum deduction of Rs 50,000 a year can be availed under Section 80D on the premium paid for the policy for parent who is a senior citizen of age 60 or more. Before FY 2018-19 the limit was Rs 30,000.

Note: You cannot claim any tax deduction on premiums paid for your sister, brothers, or in-laws.

Individual or Family Floater Policy

Your family’s needs should determine the type of policy to buy. The number of family members, age of the oldest family member, both aspects are crucial to identify a policy. If one of your family members is older than 50 or has lifestyle disease or health issues, or issues, it would be sensible to look for an individual cover for such a family member. Because not only will the premium be high but because of frequent claims by the family member, other members might be left without a cover. So the question is do you want to save some amount and jeopardize the option of having an independent cover for each member of the family.

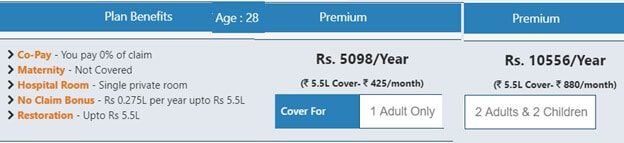

The following images show when it makes sense to go for family floater plan and when to go for the individual plan.

Who all can be covered by the family health insurance?

Many health insurance policies allow spouse and kids in a family health insurance policy.

In some family health insurance policies, the plan extends the cover to parents, in-laws, and siblings.

Things to Consider Before Buying a Health Plan

- Right Sum Insured

- Network hospital

- Check whether the insurer offers co-payment. It is when the policyholder pays a certain part of the total claim Know the deductible: Deductible is the amount that one requires paying from his/her pocket in case of a claim. The remaining amount will be paid by the insurer.

- Know room limit: Also called the capping amount, room limit is the amount up to which the insurance policy will pay for your hospital room in case of hospitalization.

- The waiting period to be served for pre-existing ailments and for a specific illness as shown in the image below

- Claim settlement ratio

- Maximum renewal age period

- No Claim Bonus

Don’t buy any product to save taxes, especially health insurance. Buy a health insurance to protect yourself and your family from rising medical costs. We hope and pray that all of us stay healthy but if there is a medical illness then the health insurance can take care of the financial aspect. The choice between a Family floater and an Individual Policy depends on how effective is a Family floater compared to Individual policies for all the family members.

A family floater is one of the best health insurance plans for family health care. A family floater primarily insures the policyholder, spouse, and children (2-3) but there are Insurance companies that provide family cover for extended families as well. This way you may include your parents in the policy as well. Thanks for sharing a great article on family insurance. Keep posting.

I closed my minor son’s account in sbi vasundhara Ghaziabad and they issued me a account payee demand draft in my son’s name. He doesn’t have any account anywhere else and I don’t intend opening one either. How do I cash that draft? The bank is unwilling to help. Please help me.