“I did not get the License to start a payment bank and hence I started Happy Loans through ArthImpact”, said Manish Khera. Manish Khera is a trendsetter in the domain areas of financial inclusion, payments & banking. Who is Manish Khera? What are Happy Loans? How do Happy Loans from Arth Impact are using technology to bring changes in the micro finance? Manish Khera answered such questions during a virtual meet with bloggers.

Manish has worked in ICICI Bank, built one of the country’s biggest banking correspondence network through his company, FINO Paytech. In 2013, he started Yatra Tatra Sarvatra (YTS) for providing digital financial solutions to banks to serve the mass market. The company was later acquired by Airtel in 2015 and we know it today as AirTel Payments. Manish has worked for Financial Inclusion in areas where banks didn’t see a viable business case to invest. And this ability to get into untapped areas has won him several laurels including recognition as a Young Global Leader by the World Economic Forum. We could feel his passion for using technology to serve the millions when we had a chance to have a virtual meeting with him with a few other bloggers.

Manish explained to us about Happy Loans and ArthImpact. ArthImpact is India’s smartest end-to-end digital lending platform which provides Happy loans from Rs 2000 up to Rs 1 lakh to households and small businesses in India with an income bracket of Rs 1 lakh to 5 lakh per annum. A customer doesn’t need to visit any bank to submit his KYC or make repayment, everything is available with just a few clicks. Manish said that using technology, ArthImpact can deploy a loan in a turnaround time of 30 seconds, if the customer has an Aadhaar number and a bank account. And even the repayment is easy. If the customer has a POS terminal a percentage of it is used for repayment. Seems like magic.

The past few years have witnessed several lending start-ups, including a few in the section of personal loans and others in microfinance. According to Manish, the lending market is vast, The differentiators will be customer experience and use of technology to make the process easy. The Question and Answer session we the bloggers had with him is given below.

Why Happy Loans?

Our primary research revealed a dire need for easy cash management among customers in the rupees 1 lakh to 5 lakh per annum income bracket. This includes shopkeepers, traders, and semi-skilled workers in urban and semi-urban areas. Such people find it difficult to get loans from banks. The paper work is scary and the process takes times. Until now, only informal channels, namely money lenders have offered these segments what they need because of ease of application, instantly available funds, and flexibility – which is why informal loans are the biggest form of household borrowing pan-India, according to the 2016 ICE 360° survey.

Through various merchant aggregators like POS machine providers, remittance enablers Happy Loans are available to the customer with minimal documentation and in quick time.

Do you do a credit check for customers?

If they have a credit history we do consider it. But In most cases, such people don’t have a credit history. So we have to use alternate ways. For example, if the customer has a POS machine we can know his volume of business, the pattern of these volumes and break up with respect to the underlying customer transactions. Some of our partners are ItzCash, mswipe, EKO, Vaya etc.

What role does technology play in Happy Loans?

Manish excitedly told us that Technology plays an important role in financial inclusion. For example, FINO, using biometric-enabled smart card solutions to provide financial, non-financial products and services to the unbanked rural & urban masses and enrolled million of customers for basic banking and insurance services. Technology makes it easy to collate information about customers from the details provided and from what’s available in the ecosystem. Processing this information ensures that right customers get the benefit of friendly rates and bad customers are left out in the selection stage itself.

Technology also involves moving money out and bringing it back. Following demonetisation as the ecosystem has become far more conducive and accepting of the digital banking framework.

What about the defaults on the loans?

We operate on the fundamental premise that people are good borrowers. I am very optimistic about repayment because credit would add value to such customers and the alternate mode was very high cost and often unavailable. They would, therefore, prefer to avail of their services and be diligent in repayment. Manish proudly said that since they have started there has been no default.

So do you lend just to women?

We just don’t lend to women borrowers , a popular axiom in microfinance model. We are gender neutral.

Where did you get the money to start ArthImpact?

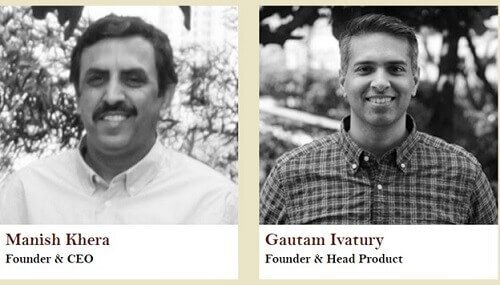

ArthImpact was founded by Gautam Ivatury and myself, Gautam Ivatury has started, advised and funded mobile ventures and Fortune 500 players globally as head of the CGAP / World Bank digital finance program (backed by the Gates Foundation), as cofounder of Signal Point Partners (an advisory firm and incubator), and via board and investor roles at other fintech startups.

They are currently bootstrapped. Started in January 2017, Manish states that the founders have invested Rs 10 crore of their own money as preliminary capital into the firm.

What are the plans for Happy Loans?

This year which is our first year we wish to disburse 100 crores of loan. And then target is to achieve 500 crores.

Bemoneyaware take on Happy Loan

Small business have problems getting loans for their businesses. And banks are not interested in the small amounts. Many end up taking loans from family members or money lenders. Getting loan and payment of loan means taking time off from the business. There is a need for such types of loans. And using technology in the loan process.

Manish Khera has worked for Financial Inclusion in areas where banks didn’t see a viable business case to invest, Fino PayTech, YTS which was later acquired by Airtel. During the meet we could feel his passion to help those who need a small amount of loans and using technology to disburse and collect payment.

ArthImpact wants to make a revolutionary offering for more than 600 millon people who do not have access to mainstream credit facility in India by offering small loans for their regular life. Manish combines the spirit of entrepreneurship with a passion for technology and commitment to serve millions. We wish him all the best in his new endeavor.