The word credit comes from Latin, meaning “trust”. When you sell something to another person but give them time to pay, you trust them to pay you back. This article looks at the History of Credit Cards,How did idea of first credit card started? Which was the first credit card? How credit cards have evolved? When were the first credit card introduced in India?

Table of Contents

History of Credit

Credit was first used by the ancient civilisations of Assyria, Babylon and Egypt around 3000 years ago. It spread to Europe as trade routes developed – putting people from these Arab lands in contact with Europeans – and really took off during the Middle Ages.

In the 12th century, large trading fairs were commonplace in Europe and people travelled from far and wide to buy and sell things. Traders went from one fair to the next, so credit was extremely important to them. They use credit to buy things in one place and then get the money to pay for them in another by selling the goods at a profit. In Italy, trade agents were soon to be found at each large fair. Their job was to record the details of this constant round process of buying, selling and repayment.

During this period, the idea of paying in installments gained widespread acceptance. In 1730, a merchant called Christopher Thornton, who lived in Southwark, London, published an advertisement to attract customers. It read ‘rooms may be furnished with chests of drawers or looking glasses at any price, paying for them weekly, as we shall agree’

From the 18th century to the early 20th century, tallymen sold clothing in return for weekly payments. They were called tallymen because they kept a tally of what people bought on a wooden stick. One side of the stick had notches representing debt and the other side recorded payments. Before organized consumer credit, there were five major lending sources: pawnbrokers, illegal small-loan lenders, retailers, friends and family, and mortgage lenders.

History of Credit Cards

The earliest plastic cards are a long way from the sophisticated and widely-accepted cards that we are now accustomed to but, nonetheless, laid the foundations for the convenience and ease-of-use that we now enjoy. In the 1920s the buy now and pay later system was introduced in the U.S. It could only be used in the stores issued it. Also in the 1920s, according to Encyclopedia Britannica credit cards originated in the U.S. when individual firms (such as oil companies and hotel chains) issued them to customers for use within their firm. Western Union had begun issuing charge cards to its frequent customers in 1921. Below are the front and reverse of Western Union Card.

Reverse of Western Union Card

Front of Western Union Card

John Biggins of the Flatbush National Bank of Brooklyn invented the “Charge-It” program between bank customers and local merchants. The Charge-Plate was an early predecessor to the credit card and used during the 1930s and late 1940s. It was a 2 1/2″ x 1 1/4″ rectangle of sheet metal, similar to a military dog tag, that was embossed with the customer’s name, city and state (no address). It was laid in the imprinter first, then a charge slip on top of it, onto which an inked ribbon was pressed

It is almost similar with today credit card function but purchases could only be made locally, and Charge-It cardholders had to have an account at Biggins’ bank. Merchants deposited sales slips into the bank and the bank billed the customer who used the card. In 1951, the first bank credit card appeared in New York’s Franklin National Bank for loan customers. It also could be used only by the bank’s account holders.

First credit card

The first credit card idea was began in 1949 when a man named Frank McNamara had a business dinner in New York’s Major’s Cabin Grill. When the bill arrived, Frank realized he was forgotten to bring his wallet. He managed to pay the bill, but he decided there should be an alternative to cash. The small, cardboard card was invented then, named as Diners Club Card and used mainly for travel and entertainment purposes. It claims the title of the first credit card in widespread use. Image below shows the first credit-card .

First credit card

Story in detail is given in image below

How did idea of first credit card started?

The Diners Club, which was created partially through a merger with Dine and Sign, produced the first “general purpose” charge card, and required the entire bill to be paid with each statement. By 1960′s, Diners Club card was replaced with plastic.

American Express was formed in 1850 and in 1958 the company emerged into the credit card industry with its own product, a purple charge card for travel and entertainment expenses. Bank of America issued the BankAmericard (now Visa) bank credit card later in 1958. In 1959, American Express introduced the first card made of plastic (previous cards were made of cardboard or celluloid).(Image Credit: Creditcollectibles.com.)

In 1966 a number of banks formed the Interbank Card Association (ICA). The name Master Charge was licensed from the First National Bank of Louisville, Kentucky in 1967. With the help of New York’s Marine Midland Bank, now HSBC Bank USA, these banks joined with the ICA to create “Master Charge: The Interbank Card”. Check out 40 years of master card. OurMaster and Visa card talk about these card in detail.

Early Master Card

How Credit Cards have evolved

Today, it takes seconds to use a card to pay for a purchase. Often, you don’t even need to sign, and you can count on multi-layer security to keep your information safe. From The Evolution of Credit Cards

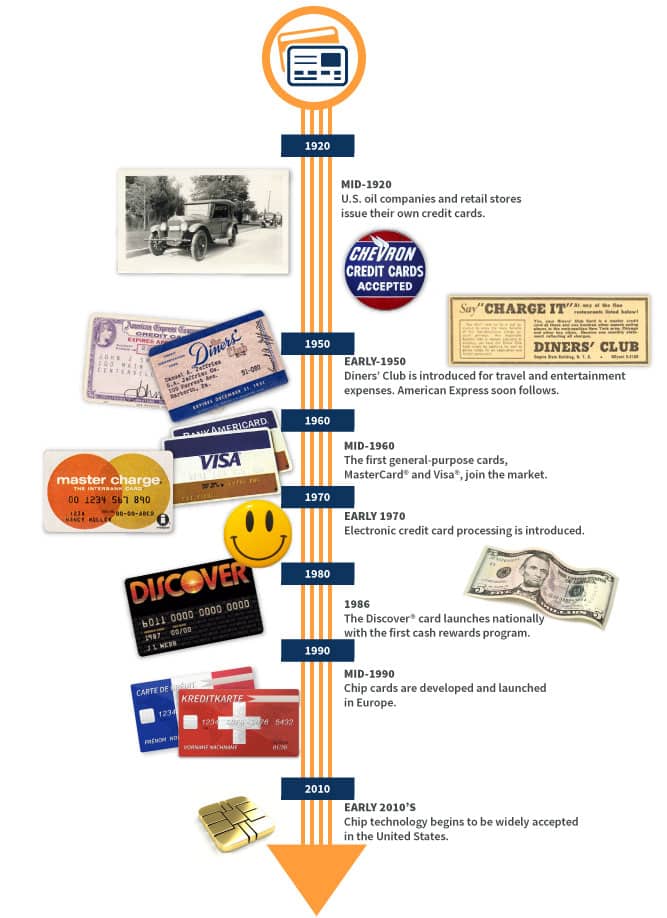

Early 1900s to 1940s. Oil companies and retail stores issued their own credit cards to be used only at that retailer. Cards were made of paper, cardboard, and later, metal.

1950s. Diners Club was introduced in 1950 for travel and entertainment expenses. It’s believed to be the first widely used credit card. American Express® issued its own plastic travel and entertainment card later in the decade. Both cards required cardholders to pay off the balance each month.

Mid 1960s. The first general-purpose credit cards, later known as MasterCard® and Visa®, joined the market.

1973. Electronic credit card processing was introduced. This allowed merchants to access information from banks to ensure that the user had enough credit for the purchase, which gave consumers far more flexibility in using their credit and more places to use a credit card as payment.

1986. The Discover® card launches nationally with a television commercial during Super Bowl XX. The card focused on delivering consumer-friendly features and services, such as the very first cash rewards program and no annual fee.

Mid 1990s. The EMV* (Europay, MasterCard, Visa) chip was developed and launched in Europe, providing more security. Now the technology has caught on in the World

Today. Credit card holders can use their cards at merchants across the country and around the world. They have the flexibility to pay off their balances each month or make monthly payments to fit their budgets. Consumers can even link their credit cards to their smartphones. Many cards provide rewards for purchases.

Card issuers continue to work tirelessly to increase security and protect cardholders’ personal information. EMV chip card technology is increasingly being adopted by card issuers and merchants in the United States. Chip cards feature both the chip and traditional magnetic stripe, so they’re usable even when the merchant doesn’t yet support chip technology. When the card issuer and merchant both support chip technology, the chip card can be inserted into the terminal to complete the transaction.

Credit Card in India

The credit card market in India started out in 1981 when Visa issued the card. Andhra Bank was the pioneer of credit cards in India.

Trackbacks/Pingbacks