A home loan helps you buy a house but it is also a loan which many people want to get pay off as soon as possible. So many people have the question If I have an outstanding home loan, and I receive a bonus or lump sum payment, should I use it to prepay home loan? Should I prepay my home loan if I get extra money? Should I invest or pre-pay my home loan? What’s better to pre-close first in India: a car loan or a home loan? However, prepayment on a home loan, may not always be the best financial decision that one can make. There are multiple factors which one must consider before deciding to pre-close their home loan. This article talks about what you should consider before prepaying the home loan. And if you close your home loan what documents you should get back.

Table of Contents

Prepayment of Home Loan

Prepayment is when you repay your home loan (partly or fully) ahead of time. It reduces the outstanding principal which in turn reduces the loan tenor or EMIs. Before prepaying your home loan consider

- Your feelings or psyche towards the loan. Are you comfortable with the loan? Does it seem like the sword of Damocles hanging over your head?

- The amount of your goals, emergencies, etc.

- How will you use the loan – repay the other loans or invest?

- Tax benefits

- consider the stage of your home loan tenure

- consider prepayment charges, if any

Suppose you take home loan of Rs 50 lakh at 8.5% for 20 years to purchase a house worth Rs 62 Lakhs.

- If you continue your loan till the end, then the total interest paid by you will amount close to Rs 54 lakhs.

- But if the tenure of the same loan is for 10 years, the total interest will be approximately Rs 24 lakhs.

So by reducing the tenure by 10 years, the interest payments reduce by 30 lakhs!

Before Prepaying the Home Loan

Prepayment charges on Home Loan

In Jun 2012, RBI or the Reserve Bank of India asked banks to stop levying foreclosure charges and pre-payment penalties on floating rate home loans. This is applicable for home loan balance transfer process too. Before this banks charged 2-5% of the unpaid principal for full/partial prepayment. For the fixed rate loan, even today lender can charge penalty.

Your comfort level on Home Loan

Holding a debt is an unwanted and distressing thought for many individuals. Even if they are comfortable paying the EMIs, they certainly aren’t at peace mentally. If you feel as if the sword of Damocles is hanging over your head, then just pay. In such case, you should repay your loan provided you have built an emergency fund, and you have no other high interest loans like a Credit card or Personal Loans.

Building an emergency fund

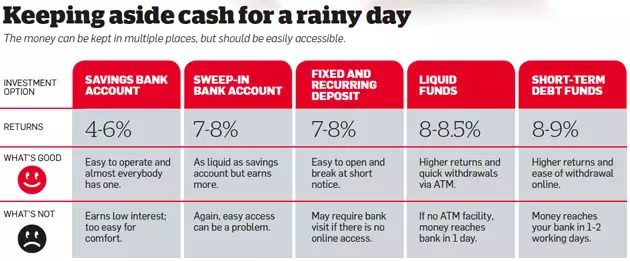

In today’s uncertain job market, a lay-off can lead to several months of unemployment. A serious illness or disability due to illness or accident can also hamper one’s ability to earn for a prolonged period. When life throws nasty financial surprises your way, have a Plan B ready. An adequate emergency fund can help you tide over the crisis.

Many use credit cards to tide over the emergency till you are able to arrange funds. But credit cards should not be seen as a replacement for setting up an emergency fund.

Emergency Funds are to help you deal with the unexpected. An emergency fund is typically around 3-6 months of living expenses. This thumb rule varies according to individual circumstances. If you have health insurance, you won’t need a contingency fund during a medical emergency. If it is cashless, you may not have to shell out even a rupee if you don’t have an emergency fund then before prepaying the home loan it should take priority.

Other Loans vs Home Loan prepayment

The home loan interest rate is generally lower than the rate of interest charged on other loans such as car loan, personal loan or credit card loan. Therefore, if you want to reduce debt, it is better to prepay high interest-bearing loans as against housing loans which carry a lower rate of interest.

For example One may have taken a car loan as well as a home loan and wondering which one they should prepay first. The thumb rule is, ‘Close the most expensive loan first’. Now how do you judge which loan is more expensive? It can be tempting to prepay the loan with highest EMI first but that isn’t the only factor to consider. Interest Rate, Tax Benefits and prepayment penalties are some of the things that you need to weigh in both the loans and then calculate which prepayment gives you the most savings. Home loans have high EMIs but they give strong tax benefits on both principal amount and interest. Compared to this, car loans a have no tax benefits. The interest rate on home loans is also lower than car loans. Therefore, it’s a much better idea to prepay the car loan before the home loan in spite of the prepayment penalty charged on the car loan.

Investment for higher returns

You should consider the post-tax return. For those in the 30% tax slab, and with outstanding home loan balance less than Rs 20 lakh, the effective cost of a loan is only 6.65% So you can invest in options which will generate higher returns.

For example, PPF, Sukanya Samruddhi Yojana and listed tax-free bonds, offer higher annualised return than 6.65

If your time horizon is longer and you can take risk, then you can consider investing in equities, either through mutual funds or directly which can generate better returns

For example, Shyam gets a bonus of Rs 3 lakh. Should he invest this amount or make Home Loan Prepayment?

- If he plans to invest this money in options like Bank FD, Post Office Savings Scheme or PPF. In all these options, the maximum return which one will be able to generate is upto 8.5%. With an investment of 3 lakh and a return of 8.5%, maximum returns would be approx Rs 25,500 p.a.

- If he opts for Home Loan Prepayment then he will save Rs 30,450 p.a. towards Home Loan interest.

Between 2 prepayment of Home Loan is a wiser option.

But if he is confident of generating annual returns of more than 10.15% (Home Loan ROI) then it will be wiser decision to invest the bonus amount.

You can always follow the middle path – invest some, prepay some.

Tax Benefits on Home Loan

Home loan customers are confused whether to utilize the tax benefits of home loan or save on interest. Tax benefits of home loan are shown in the table below. But by prepaying the home loan For Self-occupied property borrower has to forego Tax benefit on HRA allowance.

| Deductions | Section | Maximum Deduction | Conditions |

| Principal | 80c | 1.5 Lakhs | house property should not be sold within 5 years of possession |

| Interest | 24B | 2 Lakhs | loan must be taken for purchase or construction of the new house. It is not to be used for buying plot or land.The construction should be completed within 5 years from the end of financial year in which loan was taken.

If joint holders share the EMIs, both can claim Rs 2 lakh each in interest deduction |

| Interest | 80E | 50,000 | Value of property should not be more than Rs 50 lakhs Loan amount should not be more than Rs 35 lakhs |

| Stamp Duty | 80C | 1.5 Lakhs | It can be claimed only in the year in which it is paid |

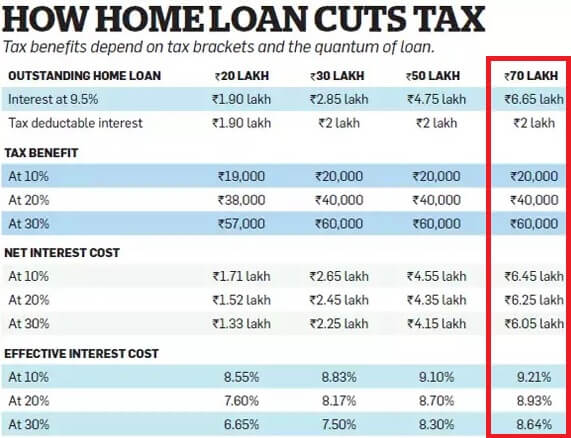

if the annual interest amount is more than 2 lakh rupees, then by prepaying the loan you save on future interest payment. For example, the annual interest on a Rs 70 lakh outstanding loan, at 9.5%, comes out to be Rs 6.65 lakh. After considering 2 lakh rupees deduction under Section 24C, the interest amount will fall to Rs 4.65 lakh, so effective cost of interest will reduce from 9.5% to 8.64%, for those in the 30% tax bracket. The image below shows the tax benefits based on tax brackets and amount of loan(ref: Times of India)

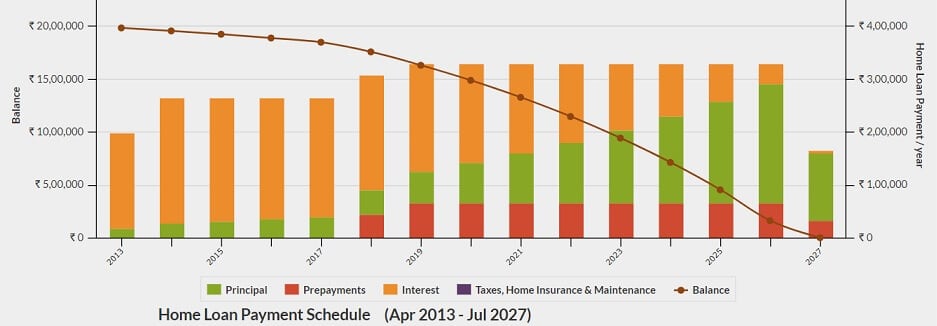

The main benefit of prepayment is the reduction in interest outflow. During the initial stage of the home loan, the interest component in the EMI is highest. Therefore, prepayment of loans in the mid-to-late stage may not give you the full benefit of saving on interest. In such cases, it is prudent to invest the surplus funds.

By prepaying your loan, your future tax benefits also go away. For instance, if by prepaying your annual interest falls below 2 lakh rupees. Then you won’t be able to use the entire 2 lakh limit In case of joint holders, there is no need to prepay if the outstanding amount is less than Rs 40 lakh.

For Example, Ram has taken a loan of Rs. 20 lakh for 20 years at 12% p.a and 5 years have passed. He is paying EMI of Rs. 22,022. If he continues with regular payments Total interest payment would be Rs. 21.29 lakhs and Total Principal Repaid Rs. 18.35 lakhs.

Let’s say He pays an additional 3 EMIs every year by increasing his payments by prepaying additional Rs. 5,500 per month, he saves Rs. 9 lakhs in interest and pays his entire loan off in 14 years total i.e. 9 years more. If he does so his payments come down to Total interest payment Rs. 12.03 lakhs and Total Principal Repaid of Rs. 18.35 lakhs.

Suppose you take home loan of Rs 50 lakh at 8.5% for 20 years to purchase a house worth Rs 62 Lakhs.

- If you continue your loan till the end, then the total interest paid by you will amount close to Rs 54 lakhs.

- But if the tenure of the same loan is for 10 years, the total interest will be approximately Rs 24 lakhs.

So by reducing the tenure by 10 years, the interest payments reduce by 30 lakhs!

You can play around with prepayment calculators to know how much will you save.

- https://www.switchme.in/calculator/prepayment and

- https://emicalculator.net/home-loan-emi-calculator/

The image on saving of interest shown in the image below if from emicalculator.net

The image with saving due to prepayment in tabular format

Properly Closing the Home Loan

When it comes to loans, fully paying loan does not mean that loan is closed. To ensure that the loan is fully closed you need to take few steps.

- You must ensure that you receive all your original property papers back and get the acknowledgment that you have received them, from the bank. You need the sale deed in resale or legal purposes in future

- Update your credit report It is your duty to confirm the update of your credit report. This update on the credit rating agency’s website takes 40 to 60 days

- The Encumbrance Certificate (EC) proves that the property is free from monetary or legal liabilities.

- Get No Objection Certificate (NOC) from the lender

- get Lien terminated. Lien is a legal right granted by the owner of the property, by law or otherwise acquired by a creditor. It serves as a guarantee for an underlying obligation, such as the repayment of the home loan.

Related Articles:

- Terms associated with Home Loan

- Costs involved in buying a house

- Can Capital Gains on Sale of House be used to pay Home Loan

- Balance Transfer of credit card: What, Why and How

As discussed above before prepaying the home loan one needs to consider various factors such as emergency funds, opportunity cost, tax benefits on home loan. What do you think one should consider before prepaying the home loan?

Thank you for sharing some tips on how to save for the home loans. The down payment is also a huge hurdle to overcome while investing in real estate. One must save for a long-term in order to fulfill the home buying dream.