We all want a place of our own, a place where we can relax in peace with our family.Buying a house is a big investment and an even bigger cumbersome process. But everyone is under pressure to buy a house. This article has a list of articles related to buying, owning and selling House. Before buying a house, On home loan MCLR Base Rate etc. On Home Loans, On Taxes that one has to pay while living in the house, Taxes one has to pay on selling the house

Table of Contents

Before buying a house

- Buying the house: Right time to buy,what should one consider before buying

- Process of Buying a house and Getting Home Loan

- Is Real Estate the best Investment Option?

- Should you even consider a self-occupied property as investment?

- Real Estate Bill: Will it help Buyers and Developers?

Things to consider before Buying the house

- Don’t buy if you aren’t absolutely sure that you want to be there long term

- House costs money more than just buying the house

- Renting the house if you don’t use it

- Tax Benefits and Home Loan : Owning a home offers tax advantages by way of interest payment, principal repayment as well as capital gains.

- House for now or for future

- House always appreciates

- House is Illiquid

It’s impossible to say renting or buying is a better decision because each one of these factors (and more) depends on your unique situation. You have to consider where you live, what kind of house you’re looking for, how much you pay in rent, how much you’ll pay in the future…the list goes on and on. The image below shows the result of Buy Vs Rent calculator from MagicBricks.com. You can Buy vs Rent Calculator by clicking here.

| Factors favoring Buying House | Factors favoring Renting a House |

| Stability: While renting, you are always bothered about rental increases or when your landlord may decide to sell the house. If you stay in your own house, you don’t have to worry about such issues.

|

Flexibility While buying a house gives stability, renting offers flexibility. These days many people move to different cities/countries every 2-3 years to explore better job prospects. If your time horizon is short-term and if you are unsure of the city you want to settle in, renting is a better option.

|

| Making Improvements When you own a house, you can fix up your bathrooms the way you want, build a modular kitchen and paint your walls orange or yellow if you like. While if you stay in a rented house, you have to comply with all conditions imposed by the landlord. | No Commitment :When you rent a house, you can move out of the house by giving just a month’s notice whereas if you have to move out of your owned house either by renting out the house or by selling the house, it requires much more effort, time and money. |

| Forced Savings: When you decide to buy a home, first you force yourself to save for the high downpayment and then you indirectly save when you pay off the home loan. | Low Transaction Costs: Buying and selling a house has high transaction costs that include Registration charges, Stamp duty charges and Brokerage Fees. To recover these costs you have to stay a minimum number of years in your owned house. In case of renting, transaction costs are limited to rental brokerage which becomes negligible if you stay for 2-3 years in the same house.

|

| Capital Appreciation:Real Estate price will keep on increasing | Low Monthly Outgo Monthly outgo in renting is much lower compared to buying where you have to also pay for the Home Loan EMI. In an uncertain economy when jobs are at risk, it is better to stay on rent. |

Renting a House

House Rent Allowance or HRA is given by the employer to the employee to meet the expenses of rent of the accommodation which the employee has taken for his residential purpose. To claim HRA you need to submit PAN number of your house owner, Lease agreement and receipts to your landlord.

- HRA Exemption,Calculation,Tax and Income Tax Return

- How to Claim HRA : Rental Agreement and Rental Receipt

- Claim HRA while living with parents

- How to show HRA not accounted by the employer in ITR

- HRA increased from 24,000 to 60,000 under section 80GG

- Rental Income and NRI: When House of NRI is on Rent : NRI can let out the property

- Credit the rent received to his NRO/NRE account.

- The rent income is liable to income-tax as “income from house property”. He is entitled to a deduction of taxes levied by the local authority paid during the year and a further deduction of 30% thereafter.

- The tenant has to deduct TDS at the rate of 30.9%.

- The balance amount of rent is liable to tax as per the applicable slab rates after considering the threshold exemption.

- If more TDS has been deducted than due tax , NRI may file your return claiming the deduction of 30% and the benefit of threshold exemption and lower slab rates.

Home Loan

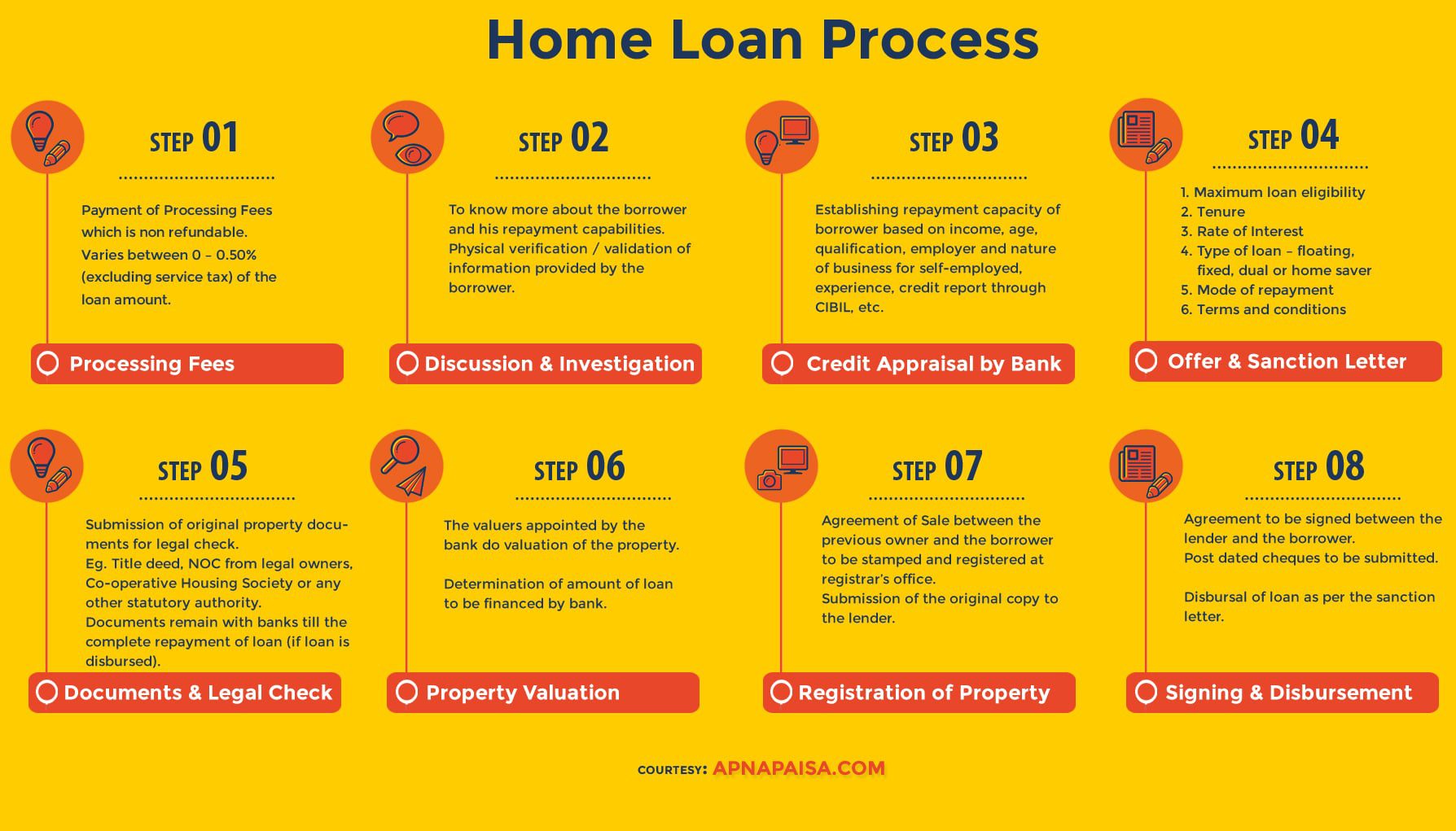

Taking a home loan is a mammoth task, especially with all the paperwork and cumbersome legal formalities involved

- Process of Buying a house and Getting Home Loan

- The buyer has to deduct TDS on property by filling Form 26QB at 1% of the total sale consideration if the amount exceeds Rs 50 lakhs. If payments are in installments, TDS must be deducted on each installment.

- Occupancy Certificate and Campa Cola flats: The list of legal documents that need to be considered before buying or looking to buy property.

- Terms associated with Home Loan : Down payment or Margin, Loan to Value Ratio, What is Resale Property, What is Freehold Property? What is Leasehold property? What is Disbursement of Home Loan?

- Joint Home Loan and Tax

- Switch from Base rate to MCLR for Home Loans

- Submitting Home Loan Interest Proof to the Employer with PAN of Lender

Taxes on when you own a house

When you buy a home, you pay for loan interest, property taxes, insurance, and even maintenance and repair costs.

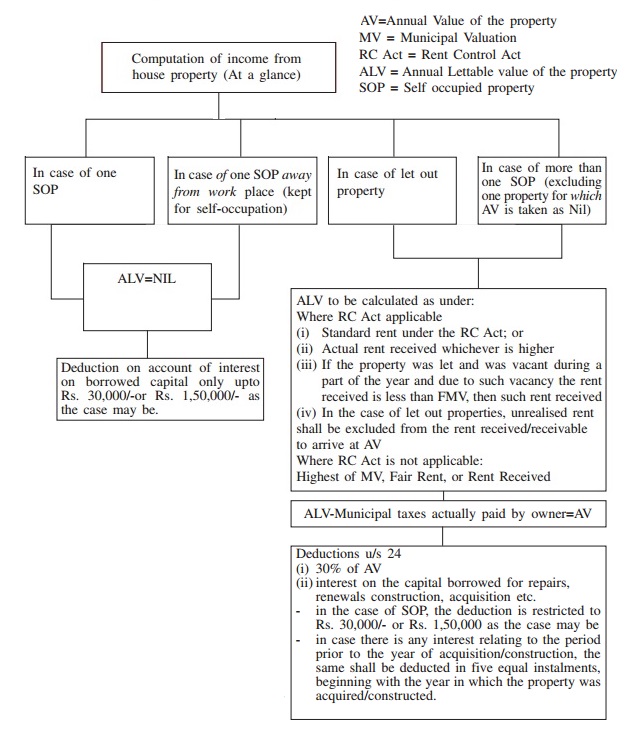

You also have to report it as Income from House Property while filing ITR

- What is Property Tax, How is it Calculated and Paid : Property Tax or House Tax in India is a tax charged by the municipal authorities for the upkeep of basic civic services and amenities in the city like roads, sewer system, parks, and other infrastructure facilities like lighting etc., as well as for maintenance of the existing infrastructure

- How to Pay Property Tax in Bangalore

- Tax and Income From One Self Occupied property

- Tax and Income from Let out House Property

Income Tax on the House when you own it

When you sell the house

Tax implications of selling a property. Like most other earnings when you sell your house, you are liable to pay tax. As Real estate is regarded as an asset, so the profit from its sale is also assessed under the head ‘Capital gains’ . This section covers Computation of capital gains, Computation of capital gains for Real Estate or Property, What is Long Term Capital Gain, how to calculate it with examples. It expands on tax benefits, When can tax benefits taken on prinicipal repayment and interest payment be reversed, how can one claim exemption on tax by investing in another property under section 54, 54F, 54EC of income tax or by putting in Capital Gain Account Scheme (CGAS). How to determine Holding Period of property?

- How to Calculate Capital gain on Sale of House?

- On Selling a house

- Capital Loss on Sale of House

- Change of base year impact on Capital gains

- Capital Gain Calculator from FY 2017-18 with CII from 2001-2002

- Capital Gains Account Scheme and Sale of property

In Budget 2017,Finance Minister Arun Jaitely has proposed to change the base year to calculate the indexation benefit from 1981 to 2001 in the budget. The change in the base year is across all asset classes but the impact would differ across assets that enjoy indexation benefit on long-term capital gains—real estate, unlisted shares, gold and bond funds

Helpful article , This is brilliant job. Thanks

Dear sir,

IF any employer pay tax on non-monetary perquisites on behalf of the empployee u/s 192(1A), can the employer deduct that tax from the salary paid by the employer to employee ? If not whether that tax paid by the employer on behalf of the employee will be a perquisites in the hands of employee which is exempt u/s 10(10CC). I would also like to know that is it optional for the employer to pay tax u/s 192(1A) ?

Suppose employer has deducted TDS on non monetary perquisites along with employees basic salary, can employee claim exemption on the amount paid as tax on non monetary perquisites?

Thanks in advance