So finally, you have decided to invest in the stock market. Congratulations. Now You are looking for your first stock to invest in. In this article, we shall help you not only invest in a first stock but also how to select stocks and make a stock portfolio.

Table of Contents

You can Earn or Lose Money in the Stock Market

Why should you invest in the stock market? Investing in the stock market gives you an opportunity to earn potentially higher returns on your investment and beat inflation.

Even before thinking of buying any stock, the first step is to see how money has been most successfully made or lost in the past.

As per Motilal Oswal Wealth Creation Study of 2021 biggest Wealth Creators of 2016-2021 are as shown in the image below

And the total Wealth Destroyed during 2016-21 is INR 11 trillion, 15% of the total Wealth Created by top 100 companies

Make a Diversified Portfolio, Asset Allocation

“The most fundamental decision of investing is the allocation of your assets:

How much should you own in stocks?

How much should you own in bonds?

How much should you own in cash reserves?”

Jack Bogle, the founder of Vanguard

But like eating just proteins is not good for health, one needs a balanced meal, same happens for investing. You need to have a good balance of all types of investment options like EPF, PPF, Gold, etc.

We are not taught finance in school or at home. So, you need to understand the stock market. We recommend you get an insight into the investing world by learning investment terminologies, various investment instruments, and financial intermediaries. One of the good places to start is the Free course on the Stock market for beginners

To make your portfolio you need to have done the following. Remember no one strategy fits all. It is as personal as you are.

● Know your risk tolerance

● Understand various investment options

● The amount you want to invest

● Time for which you want to invest

● Decide the frequency of Investment: Is the investment lump sum or do you want to set up SIP, STP, SWP

● Understand the tax on various investment options.

● Track the portfolio, and Rebalance it at least twice a year.

Before you start investing

You must have an emergency fund of at least 2 months

You must have insurance to cover your liabilities.

Basic Rules for Investing in Stock Market

Legendary investor Warren Buffett’s optimal business-picking formula is as follows

Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business whose earnings are virtually certain to be materially higher five, ten, and twenty years from now. Over time, you will find only a few companies that meet these standards—so when you see one that qualifies, you should buy a meaningful amount of stock. You must also resist the temptation to stray from your guidelines: If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.

Let’s break it down into simple rules.

● You will not treat the Stock market as a Casino. You are not investing in stocks to become rich quickly.

● You will invest only that amount which you don’t need for at least 3 years.

● You will not take a loan and invest no matter how confident you are about a stock

● You will also track/invest in an ETF/Index fund based on Sensex/Nifty 50. So that you can compare how your stock selection is w.r.t to benchmark. See, if you should invest in stocks directly or take the mutual fund route

● You will devote time learning about stocks,

● You will not blindly follow tips

● You will not start with futures, options, or trading. Start slow. Focus on investing till you are comfortable. You are here to play a 5-day test cricket match, survival is most important which means learning, practicing.

Basic rules of choosing stocks by a beginner

Stocks aren’t lottery tickets. Behind every stock is a business, a company. If the company does well, over time the stocks do well, and vice versa. You must look at the company, you need to research

● You will not invest in penny stocks

● You will start with Large Cap and then move to Mid Cap, Small Cap

● You will not invest more than 20% of your portfolio in a single sector

● You will not invest more than 10-20% of your portfolio in a single stock

● You will Select Fundamentally strong companies, preferably market leaders

● You will also try to buy at a price that gives you a margin of safety

● You will write the reasons for buying in your investment journal.

● You will not buy all in one go, you will invest slowly

● You will Keep at least 20-30% cash with you always

● You will not buy on tips. But will analyze the stock, a checklist is given below

● You will not buy and forget. You will monitor the stock and check its performance

● Not all stocks will give you great returns. Accept that some stocks you choose will not do well. It has happened with Warren Buffett, has happened with Rakesh Jhunjunwala, it will happen with you.

● You must define when a company is getting close to maturity, and that’s when you exit. Or the story deteriorates. If the story’s intact, you hold on.

There are three aspects that you should consider when investing in any stock which is

Right Stock

Right Price

Right Time

How to choose stocks?

So how do you choose the stocks? By using the knowledge that you know (and building on it). Legendary investors Warren Buffett and Charlie Munger call it Circle of Competence. A circle of competence is an area of the world where you have useful knowledge that gives you an edge. In simple words, it means choosing businesses which you understand well. In his 1996 Shareholder Letter Warren Buffett says

What an investor needs is the ability to correctly evaluate selected businesses. Note that word “selected”: You don’t have to be an expert on every company or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.

Charlie Munger takes this concept outside of business altogether and into the realm of life in general. Charlie’s simple prescription tries to answer Where should we devote our limited time in life, to achieve the most success?

You have to figure out what your own aptitudes are. If you play games where other people have the aptitudes and you don’t, you’re going to lose. And that’s as close to certain as any prediction that you can make. You must figure out where you’ve got an edge. And you’ve got to play within your own circle of competence.

So instead of starting with 5000 companies to search, use tools available online to evaluate the companies. One such tool that we like is the Finology Ticker which can help you to shortlist companies according to sectors. You can start with learning about the industry or sector you know about. You can check out Finology Ticker here. In addition, Finology Ticker has many important features such as Brand Searches, Superinvestors, 52 weeks high Stocks/52 weeks low stocks

The Emotional side of Stock investing

“In the stock market, the most important organ is the stomach. It’s not the brain.” Peter Lynch

You will remember

● Past returns are no guarantee of future returns

● After you buy the stock price may go down. Be prepared for it. Try to understand why did the stock go down. if it’s a mistake, cut your losses.

● You will make mistakes, learn from them and most importantly, you will keep learning.

● So, you have flops stocks that do not perform well. Maybe you’re right 5 or 6 times out of 10. But if your winners go up 4- or 10- or 20-fold, it makes up for the ones where you lost 50%, 75%, or 100%.

Checklist for investing in a stock

A simple Checklist for investing in a stock

- Look at the chart, long..term. Look at the consistency of return. Calendar Year returns not CAGR

- Which sector or industry is it in? Is it Govt regulated (like IRCTC, Coal India)? Is it a Cyclical stock?

- How does it stand wrt to its competitors? Is it a market leader? Is it in the top 3?

- What is the promoter holding, is it around 50%?

- What is the debt on the company? Are promoter shares pledged?

- How is the management of the company? Just do a Google search and see if you see any negative news about the company

Example of Stock Portfolio

There are several blue chips like HDFC Bank, HDFC, Kotak Bank, Infosys, Asian Paints, Nestle, and Abbott Labs that have beaten the Sensex and Nifty returns. These ‘consistent compounders’, as the celebrated equity analyst Saurabh Mukherjea appropriately calls them, have handsomely rewarded patient investors. He has discussed it in his book Coffee Can Investing

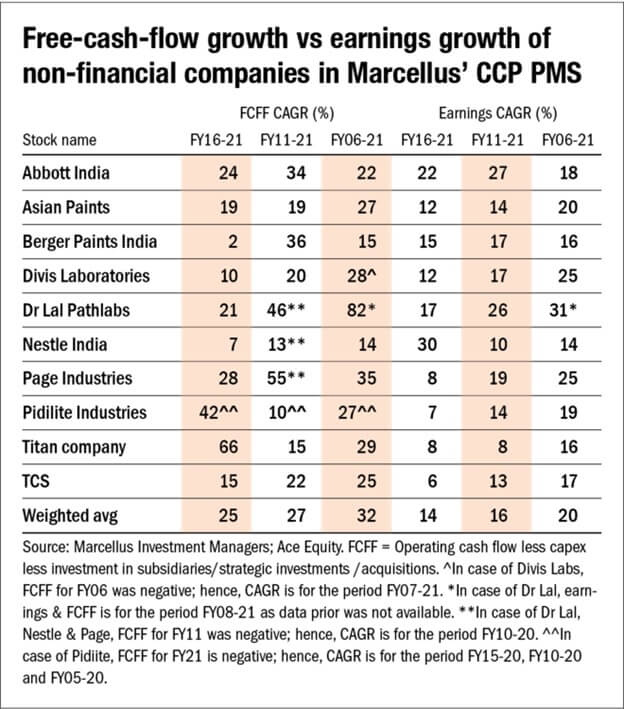

Marcellus’ Consistent Compounders PMS invests in a concentrated portfolio of heavily moated companies that can drive healthy earnings growth over long periods of time. An example of the portfolio is given below( Ref)

A beginner’s stock portfolio

A sample stock portfolio for a beginner is given below. It has mostly large-cap companies which have given consistent returns over the period. These are like Rahul Dravid, the Wall, of the Indian Cricket Team.

- Best for the total amount less than 1 lakh

- Choose 5 to 10 stocks in different sectors. (Choose between TCS or Infosys to start with but not both)

- Divide the money equally between the stocks

- Start with buying 1 share of each.

- Track the stock. To know how prices are moving and trying to understand why. For example, If Oil prices go high, Asian Paint’s price will go down.

- Buy 1 share of each company monthly

To know more on how to make a profitable portfolio learn the art of portfolio construction

Remember Wealth creation is a Marathon, not a sprint

As legendary investor Peter Lynch says

The public’s careful when they buy a house when they buy a refrigerator when they buy a car. They’ll work hours to save a hundred dollars on a roundtrip air ticket. They’ll put $5,000 or $10,000 on some zany idea they heard on the bus. That’s gambling. That’s not investing. That’s not research. That’s just total speculation

Start slow, spend time understanding the company, stock market, and yourself. You will make mistakes. Your aim is to succeed more than lose and when you are winning, make them big. Do not forget that investing is about 10% knowledge and 90% about your behavior.

You are here to play a 5-day test cricket match, survival is most important, which means learning, practicing.

Happy stock investing. What are your rules for making a portfolio? Which was the first stock you invested in.