The interest on any contribution above Rs. 2.5 lakh by an employee to a recognized provident fund is taxable effective from 1st April 2021. This means that a person contributing up to Rs 20,833 a month to PF i.e has a basic salary of up to Rs 1.73 lakh a month will not have to pay the tax. But above that amount will have to pay tax on his contribution above 2.5 lakh. What are the new rules on tax on EPF interest, Your EPF account will now show taxable and non-taxable balance, How to calculate tax on EPF Interest with Calculator

Table of Contents

New Rules for Tax on EPF Interest

New Rules for EPF Interest which is Taxable applicable from 1 Apr 2021.

- Any balance in EPF till 31 March 2021 or interest earned on them in the future is exempt from tax.

- The tax-free contribution limit of 2.5 lakhs a year includes the Statutory contribution of 12% of the basic + any VPF contributions. It does not include the Employer contribution.

- A limit of 5 lakh will be applicable to cases where employers do not make contributions to the provident fund

- Any interest credited to the provident fund account above 2.5 lakhs is taxable. Such interest will be taxable under the head Income from Other sources and not under the head salaries.

- TDS @ 10% u/s 194A will be deducted from the interest amount by EPFO. Should show up in Form 26AS and AIS(??)

- Still not clear If PPF is included along with EPF

Challenges of an EPF account holder with a contribution above 2.5 lakh

- EPF passbook shows taxable and nontaxable part. The image above the EPF passbook. Read Details here.

- Will the TDS deducted on Taxable EPF interest show up in Form 26AS and TIS and AIS?

- The interest is credited to the PF account only after the close of the tax year (often after the due date of filing the tax return).

- In the case of employer-managed PF Trusts, the responsibility of maintaining separate accounts for taxable and non-taxable contributions and the requirement for tax withholding, where applicable, would fall upon the Trust.

How to download EPF passbook?

You can access your EPFO passbook online through the EPFO website or mobile app. To do this, you will need your Universal Account Number (UAN) and password.

To access your passbook, have to be registered with the EPFO website. To register yourself, you will have to activate your Universal Account Number

- Step 1: Visit website: https://passbook.epfindia.gov.in/MemberPassBook/Login.jsp

- Step 2: Enter your UAN, password and captcha code. Click on ‘log in’.

- Step 3: On successful login, select the member ID to view your passbook.

The passbook shown is in PDF format which can be easily downloaded.

Note: You cannot view passbook for exempted establishments, i.e., if your employer manages the EPF trust on their own, settled members and inoperative members.

In case you have forgotten the password of your account, you can reset the password by visiting the EPFO Member e-sewa website (https://unifiedportal-mem.epfindia.gov.in/memberinterface/)

Basics of EPF Interest

- The EPF interest rate of India is decided by the central government with the consultation of the Central Board of trustees every financial year. In FY 2021-22 EPF interest rate is 8.1%

- No interest is calculated on Pension Contribution since benefits are based on the service length and average wages at the time of exit, whether the benefit is through Pension or Withdrawal Benefit.

- EPF is for the FY but interest is supposed to be credited in April but since last few years it credited sometime around Oct. (Maybe now the Govt with have to give interest before one file ITR)

- If while doing final settlement the interest for the current year is not notified, interest is credited on the basis of the rate declared for the immediately preceding year. However on the declaration of interest whether at a less or higher rate no revision of the settled amount is done.

- The employee contribution up to Rs 1.5 lakh can be claimed as a deduction under Section 80 (C) of the I-T Act.

- EPF interest is compounded yearly but in a year it uses the Average Monthly Balance method. Interest is calculated on a monthly basis for the period of investment during the year at the rate of interest specified by the government. This interest is added to the investment in the EPF of the account holder. Interest is separately calculated for the Employee Share and Employer Share of Provident Fund.

- If your account remains inactive (no contribution is made) for three years, the money will earn interest but interest would be taxable.

How To Calculate Tax on EPF Interest

According to the new rules, from FY 2021-22, any interest credited to the employee’s provident fund account is tax-free only for contributions up to 2.50 lakh every year and any interest on the employee’s contribution over 2.50 lakh is taxed. In case the employer does not contribute to the provident fund of the employee, then the limit applicable will be ₹5 lakh of the employee’s contribution.

This change is under Sections 10(11) and 10(12) of the Finance Act 2021. And Sections 10(11) and 10(12) define the exemption on the amount added to the provident fund. Still not clear if PPF is included along with EPF.

If an employee has contributed Rs 4 Lakhs to the EPF account then the interest earned on Rs 1.50 Lacs (4 – 2.5 is taxable).

But only if life was so simple.

One has to separate EPF account balance into taxable and non-taxable portions as explained in the table below. Notification is given below

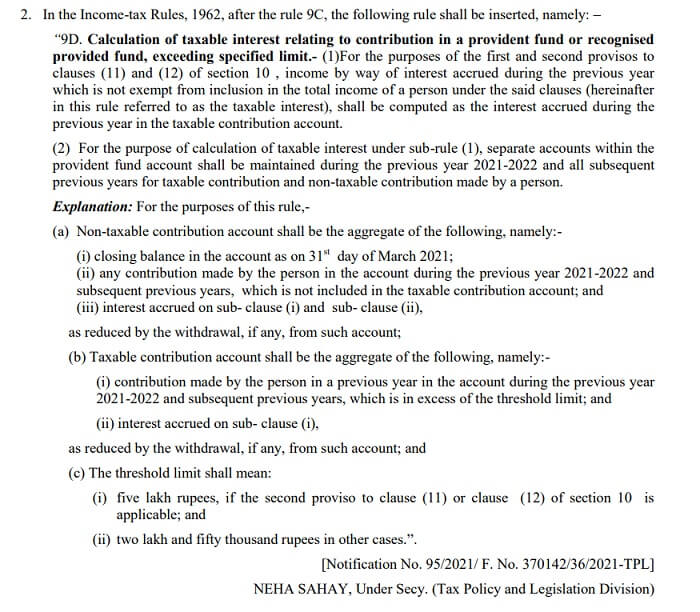

Notification No. 95/2021-Income Tax Dated 31st August 2021, given below. It explains the Calculation of taxable interest relating to contribution in a provident fund or recognized provided fund, exceeding the specified limit under RULE 9D.

Example of How to calculate Tax on EPF Interest

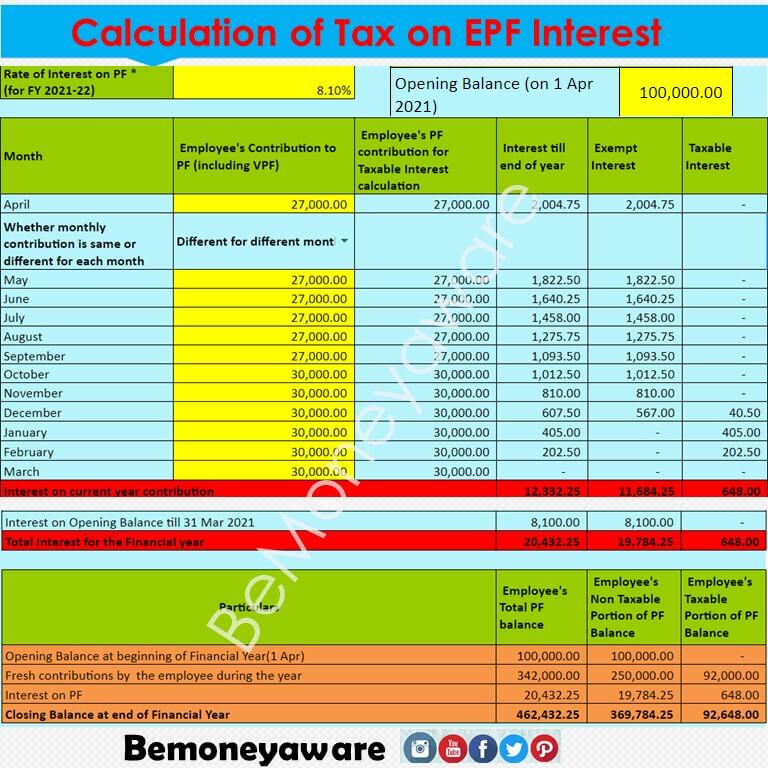

We can understand the above with the help of the following example:

Shailesh had an opening EPF balance of 1,00,000 on 1 Apr 2021. In FY 2021-22 Shailesh contributed Rs 27,000 till Sep 2021 and then his contribution increased to 30,000 per month due to an increase in his salary. In this case, his annual contribution is Rs 3,42,000 (i.e greater than Rs 2.50 Lacs) and hence he needs to pay interest on PF contribution of Rs 92,000 (Rs 3,42,000 – Rs 2,50,000 ).

The detailed calculation, shown below, involves the following steps

- Calculation on EPF interest for each month for the current financial year (Tax will be exempt till the amount of total contribution is less than or equal to 2.5 lakhs)

- Calculation of EPF interest on the opening balance on 1 Apr 2021(Which is tax-exempt)

How to Show EPF Interest in ITR

According to the new rules, any interest credited to the employee’s provident fund account is tax-free only for contributions up to 2.50 lakh every year and any interest on the employee’s contribution over 2.50 lakh is taxed. In case the employer does not contribute to the provident fund of the employee, then the limit applicable will be ₹5 lakhs.

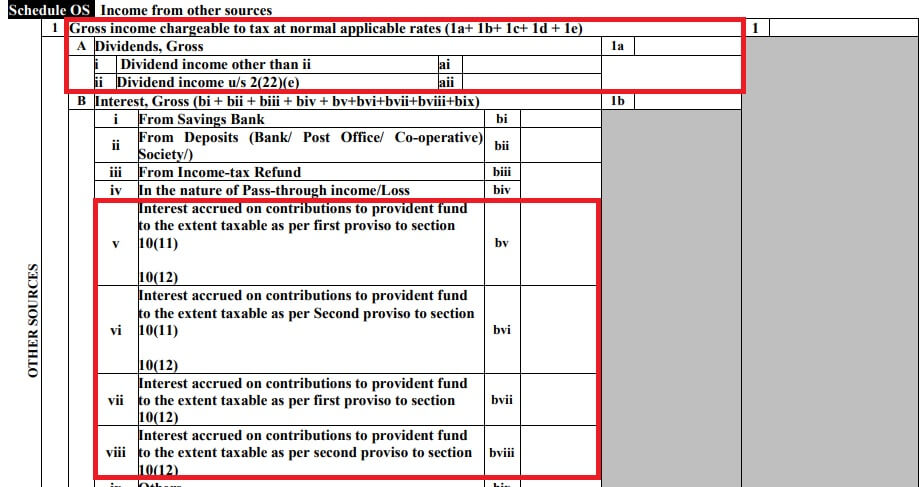

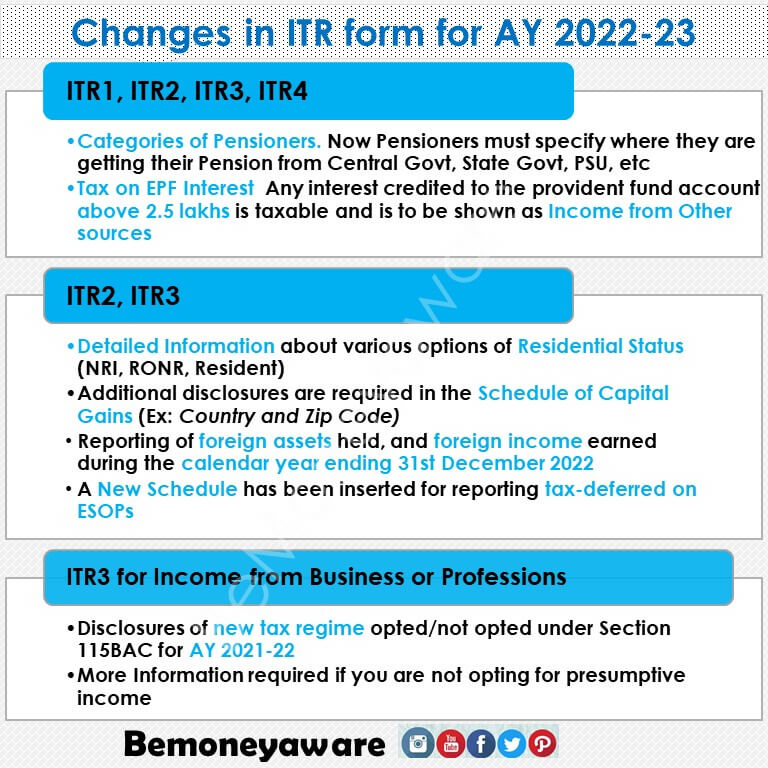

In AY 2022-23, the Schedule Income from Other sources has details about EPF Interest as shown in the image below

If TDS is deducted it should appear in Form 16AS.

Will it be shown in AIS(Annual Information Summary) is to be seen.

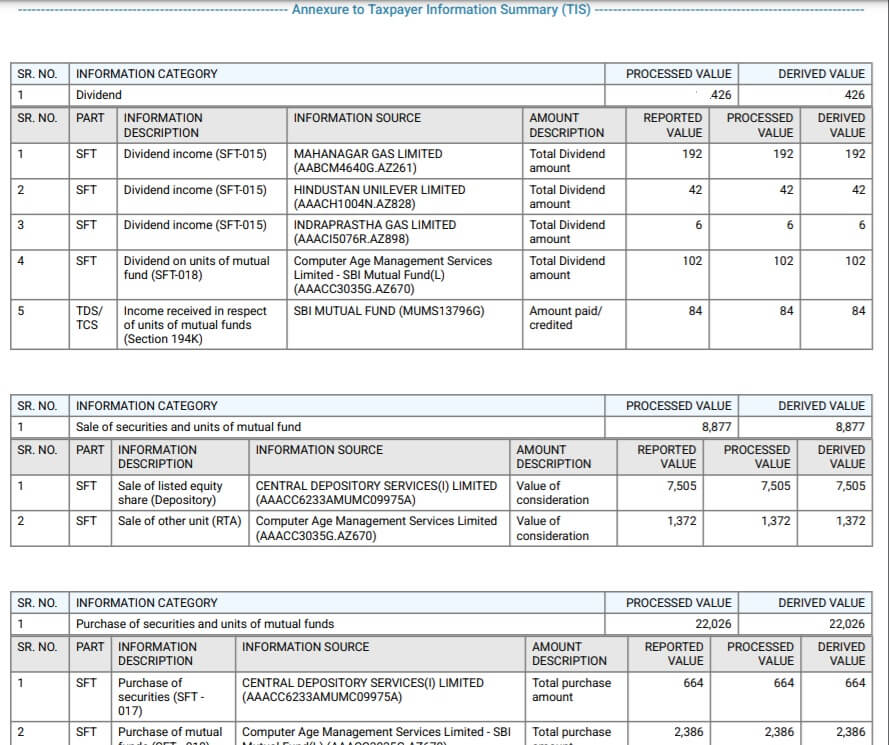

TIS and AIS

Income Tax Department has rolled out the new Annual Information Statement or AIS which provides one’s comprehensive view of information such as interest, dividend, stocks transactions, mutual fund transactions, foreign remittance information, etc. A simplified Taxpayer Information Summary (TIS) has also been generated which shows the total value for the taxpayer for ease of filing return. Details of TIS and AIS here

Form 26AS on the TRACES portal will also continue in parallel till the new AIS is completely operational.

EPF Interest Rate

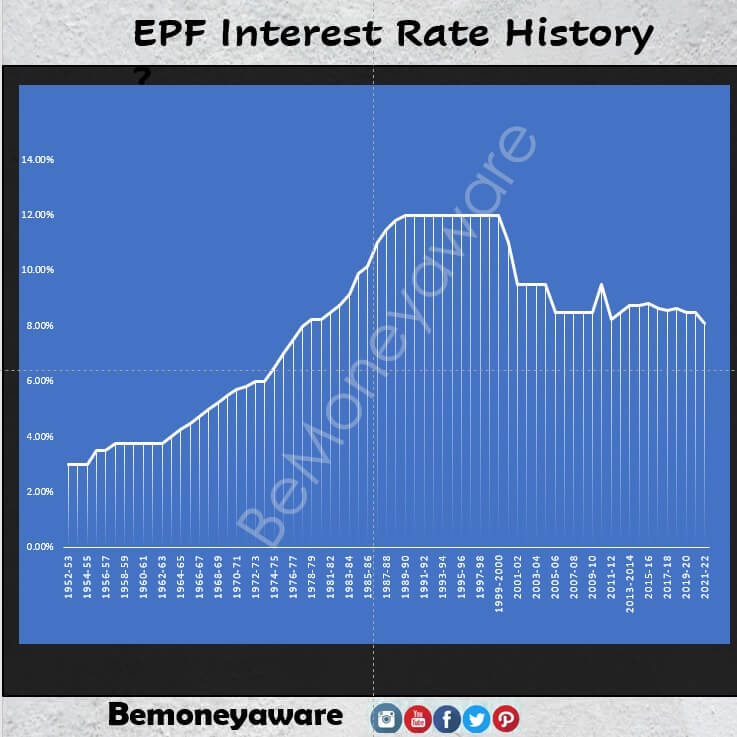

In Mar 2022, EPF Rates for FY 2021-22 were declared as 8.10%, Govt cut EPF Interest rate from 8.5%, the lowest rate since 1977-78. From FY 2017-18, interest is being credited after Sep instead of Apr. The EPF interest rate of India is decided by the central government with the consultation of the Central Board of trustees. In the past several decades, the interest rate has ranged from 8 to 9.5 % as shown in the history of EPF Interest rate

Details in our article EPF Interest Rate from 1952, How does EPFO earn to pay interest

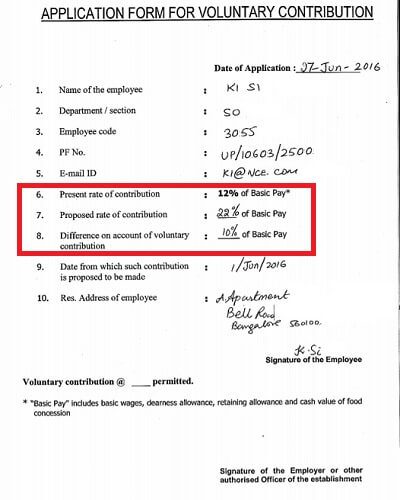

Voluntary Provident Fund(VPF)

For employees who are covered under EPF(Employee Provident Find or EPF), besides their compulsory contribution to PF, there is a provision for an additional or Voluntary contribution to EPF popularly called as Voluntary Provident Fund or VPF. The employer will not contribute more. Details in our article Voluntary Provident Fund, Difference between VPF, EPF and PPF

Check out our VPF Quiz: How well do you understand VPF

Changes in ITR for AY 2022-23

Income-tax Return (ITR) Forms for the Assessment Year 2022-23 have been notified by CBDT. The newly notified forms do not change the applicability of forms to different taxpayers but one needs to provide additional details. What are the changes in the ITR Forms for AY 2022-23? Whom does it affect and how? Details here

Income Tax Course and Workbook

Have you ever wondered what income tax is all about? What are the various forms? What’s the difference between a TDS and a TCS? Do you know how to calculate your income tax?

If you’re looking for answers, then we have just the course or workbook for you.

Details of Income Tax Course for Rs 499, 8 Modules | 66 Sessions | 3 hours 10 min

Be Aware of Income Tax Workbook: A Practical Approach (for Rs 199 only)

Calculator for Tax on EPF Interest above 2.5 lakhs

The calculator for Tax on EPF Interest above 2.5 lakhs is shown below. You can access it by clicking here

Note: It is for educational and informational use. Do Consult a qualified tax expert. We accept no liability.

Note: It is a developmental stage. If you have any suggestions please do let us, we will try to incorporate it

Related Articles:

- Changes in ITR for AY 2022-23

- How to view EPF Passbook and track Contributions, Interest, Transfer, Withdrawal

- All about VPF

- EPF Interest Rate from 1952, How does EPFO earn to pay interest

- All about TIS and AIS

- RSU of MNC, perquisite, tax , Capital gains, ITR

- How to Show Capital Gain on Shares and Equity Mutual Funds in ITR

If you found it useful please share it on Twitter, Facebook, and WhatsApp.

Hope this helped in understanding the tax on EPF interest for a contribution above 2.5 lakhs. What are the rules? How to calculate tax? How did you find the calculator? Any suggestions and recommendations.

thanks for the interest calculator

Under taxable income – you have included 92000 – I didnt understand that part? Its part of contribution that we have done (342000-250000) but it is not the interest so how can you consider 92000 as interest?

Rest your document looks good and helpful.

The interest on any contribution above Rs. 2.5 lakh by an employee to a recognized provident fund is taxable effective from 1st April 2021.

Interest on 342000-250000 i.e 92000 will be taxable from 1st Apr 2021