The best time to begin planning your tax-saving investments is at the start of the financial year. It gives you more time to understand the different tax savers and prudently plan how to get the most from them.

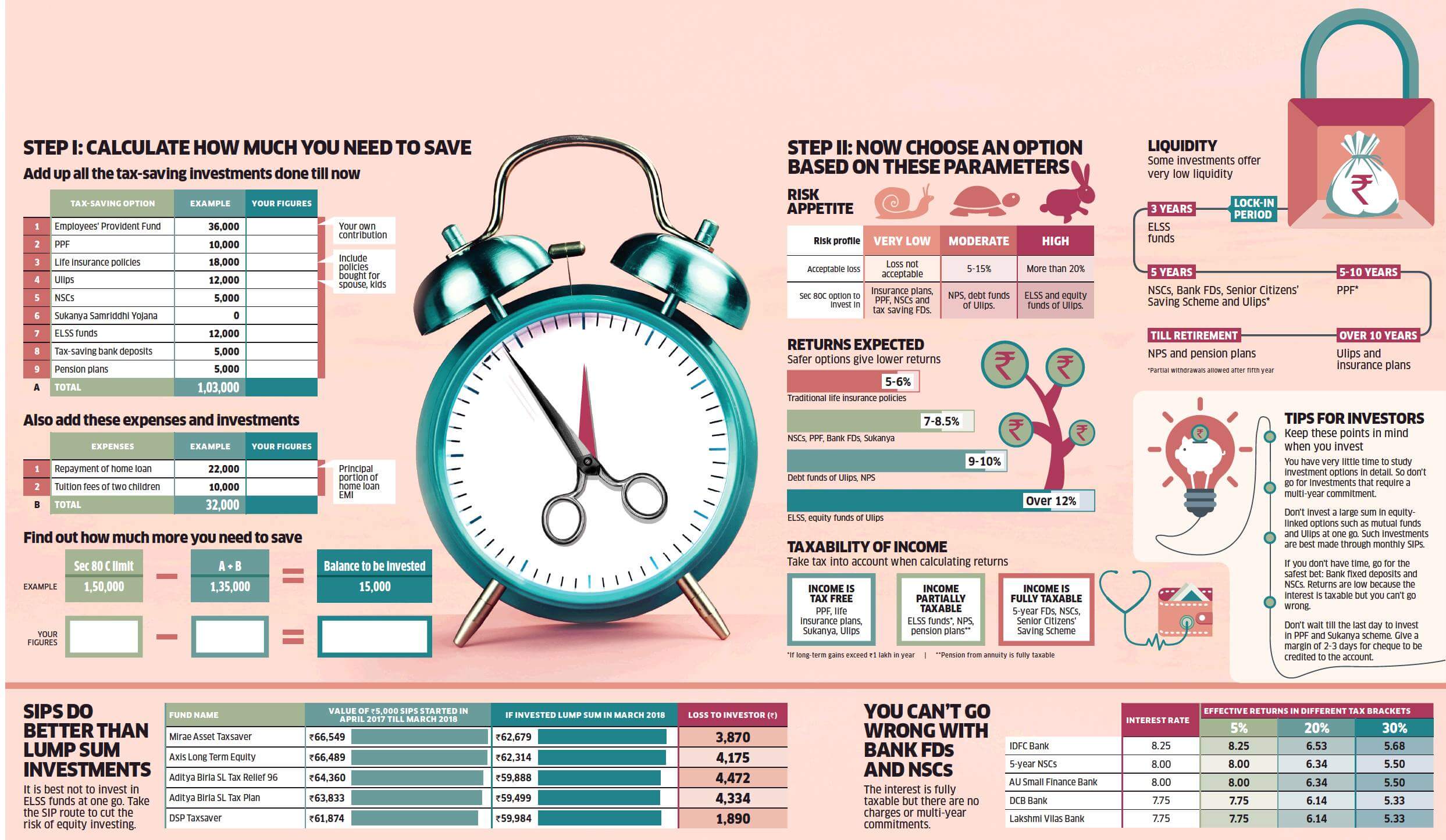

Here are some investment options that can help you achieve your goal of wealth creation while saving tax simultaneously. Infographic from ET Wealth (11 Mar, 2019) shows the various options, How much tax you can save?

Equity-linked savings schemes (ELSS)

ELSS are tax saver mutual funds that give you an opportunity to grow your money. Being linked to the equity markets, ELSS funds carry some risk but at the same time offer high returns. They qualify for a tax deduction under Section 80C of the Income Tax Act, 1961, up to a limit of Rs. 1.5 lakh. There is a lock-in period of three years when you invest in ELSS. However, you can continue with ELSS investments even after the lock-in period to save for long-term goals.

Public Provident Fund (PPF)

PPF is a 15-year scheme that you can extend indefinitely in a block of five years. The principal and interest earned are backed by the Government while returns are tax-free. Currently, PPF offers an interest rate of 8% per annum. You can deposit miminum of Rs. 500, and a maximum of Rs. 1.5 lakh in a financial year. PPF is best suited for investors who need stable and steady returns.

Employees’ Provident Fund (EPF)

EPF is a popular tax saver; it helps salaried individuals accumulate a tax-free corpus and saves tax. An employee contributes 12% of their basic salary per month towards their EPF account. The employer contributes an equal percentage, but only 3.67% goes into the EPF. The employees’ contributions qualify for a tax deduction under Section 80C up to a limit of Rs. 1.5 lakh. The interest as declared by the government each year is tax-free.

Unit-linked Insurance Plan (ULIP)

This hybrid product serves two purposes. It invests your money into various market-linked assets and also provides life insurance. There are five to nine fund options for most ULIPs with varying asset allocation between debt and equity. The lock-in period for ULIPs is five years, and the duration can go up to 15 to 20 years. After the expiry of the lock-in period or the maturity, the fund value is tax-free.

Traditional insurance plans

Traditional insurance plans include whole life plans, endowment and money-back plans. These plans come with a fixed term and a fixed sum assured. The premiums for these insurance plans depend on factors such as age at the time of taking the policy, the period of coverage, etc. Premiums are required to be paid every year until the plan matures. You can claim a deduction on the premiums under Section 80C. Additionally, the maturity value and death benefit are tax-free.

Sukanya Samriddhi Yojana (SSY)

Launched as part of the ‘Beti Bachao Beti Padhao’ campaign, the SSY is a small-deposit scheme for the girl child. It provides income tax benefit and currently fetches an interest rate of 8.1%. You can deposit a minimum of Rs. 1000 to open this account and a maximum up to Rs. 1.5 lakh in a financial year. You can open an SSY account any time after the birth of a girl till she becomes 10. Furthermore, the account can remain operative until her marriage, after she turns 18 or 21 years.

InfoGraphic on Tax Saving Options

Conclusion

The above-mentioned are a few tax saving investments that can help you create long-term wealth. Each of these tax saving schemes offers different features and benefits. So, it is essential to make the right choice.