Mistakes are bad, many give us the opportunity to learn. But it is best to avoid them. Money mistakes lead to financial disasters. In this article, we will discuss some of the frequently done money mistakes along with how to avoid them.

“A smart person learns from his mistakes, but a truly wise person learns from the mistakes of others.

Table of Contents

Financial Mistakes on Spending

Spending money to show people how much money you have is the fastest way to have less money – Morgan Housel

Spending like a King

You got a bonus. How would you spend it? Did you buy the new gadget or bought designer clothes or bags?

People often tend to spend more than what they earn on luxury items and lavish lifestyles. A fancy car, a fancy watch, a fancy vacation, a fancy house. People want fancy stuff and willing to spend. For example, many youngsters buy high-value smartphones on EMI which is much more than the monthly income. Or purchase clothes every week even though it is not needed just because there is a Big Billion Sales or there is a discount or to impress people.

Spending a bomb on weekend parties: We are seeing new culture in India especially in cities, 5 days work and 2 days party. Pubs are jam-packed on weekends and people spend a bomb on drinks. By the end of the month, they are left with no money.

Travel: Many go for an exotic vacation just because someone put a post on Instagram. Instagram and Facebook are introduced as Social Media Platforms but they are actually destroying the entire social fabric. Friends are jealous and try to show off.

Lifestyle inflation: Upgrading your car because you have got a good bonus, Moving from 2bhk to 3bhk because you have got a good hike, are some of the examples of lifestyle inflation

Sale Sale Sale: From Amazon’s “Great Indian Sale” to Flipkart’s “The Big Billion Days”, everyone is buying things. Many buy things just because it is on discount. And now these sales come every few months.

Not tracking cash flow

Very few people keep a track of their expenses. Most of them just don’t know where the money is gone.

No emergency budget

Not having any extra money in the case of emergency results in embarrassing situations of borrowing money from friends and relatives. Some people even break their investments and make a big mistake

Spending all the hard-earned money on children higher education or business setup

For years, it has been the parent’s responsibility to save money for their child’s education. And child’s education is getting costlier.

There has to be a shift in parents’ mindset that It’s fine to take an education loan, especially for post graduation!

Spending all the hard-earned money on children marriage

Saving for a child’s education along with marriage is a common goal for most parents

Marriages are made in heaven! But to solemnize them on earth we have The big fat Indian wedding! And Indian parent consider it their duty to finance the wedding.

And then we had Social media bombarding us with glitzy celebrity wedding pictures remember Anushka Sharma’s, Deepika Padukone’s, or Priyanka Chopra’s marriage.

Marriages became an event where the focus was on razzmatazz, DJs, destination weddings, expensive decorations, many types of food and functions which last long hours rather than the function(s) itself.

The question in Indian marriages is how much to spend on it.

For those who have it it’s ok to flaunt it, Mukesh Ambani spent a very small percentage of his Networth on his kid’s marriages.

But there are families who have to fund the marriages by taking loans.

Expenditure on Indian weddings was large(before Covid). According to a 2018 report published by Evoma, a Bengaluru-based wedding planning company, Indian families spend about 20% of their wealth on their daughter’s wedding.

People save their entire life just to spend all the money on random relatives and friends who bother about the food and arrangements.

What is the topic of discussion at weddings? Decorations are just ok. At Sharmaji’s son’s wedding, they created a village mela and had food options like Mexican. Mr Verma has gifted a car to his daughter. Mr Mehta has gifted 500-gram gold to his daughter.

Don’t bring up your children to believe that you’ll take care of everything and they can do whatever they wish to. The same applies to wedding expenses as well

Solution of Spending

The financial equation that people follow is Income – Expenses = Savings.

This means after deducting expenses from the income, they would get the savings. For example, a person deducts his expenses from his salary and gets a very small proportion of savings.

According to Warren Buffet, the financial equation should be Income – Savings = Expenses.

This means that after a person gets his/her salary, he should first deduct the savings from it and whatever is left after that should be used to manage the expenses. If the priority is given to the Savings from the initial stage itself, the better is going to be the results at the time of retirement.

Spending more than what you earn pushes you into debt. You end up buying things that you don’t need to impress people who don’t care about you. And if you buy on credit card and pay the minimum you are caught in a debt trap that impacts your credit score.

A lot of people confuse not spending with being cheap. We are not asking you to not spend but spend on things that make you happy, not a friend or relative on Instagram. Don’t compromise with quality and research enough to buy the product or service at a reasonable price.

Eventually, you are not left with any savings, and at a later stage when you retire there would be nothing left with you.

Saving a proportion from what you earn and controlling your expenditure will count more than ever at a later stage.

Credit Card Mistakes

With great power comes great responsibility – Spiderman

Having a credit card is a double-edged sword.

You get the benefits of buying when you don’t have enough cash with you, get reward points, buy one get one movie ticket, lounge access.

But if you just pay the minimum you would be caught in the credit card trap! Here compounding works against you.

A credit card must not be used to make purchases of items that one cannot afford.

Careful usage of credit cards lets you save on the interest earned over the amount that you would have spent for your purchases.

Dipping into Retirement EPF account

Every time people change jobs, they withdraw their EPF balance. Withdrawing your EPF is financial hara-kiri. The money goes into unnecessary expenses and the retirement corpus is back to zero. It’s a decision you will regret when you are a few years away from retirement.

The Employees Provident Fund (EPF) can make you a crorepati. A person with a basic salary of Rs 25,000 a month at the age of 25 can accumulate Rs 1.65 crore in the EPF over a period of 35 years. This assumes that his income will rise by 10% every year and the EPF will earn 8.7% returns. Yet, many people are unable to reach the Rs 1 crore milestone in their EPF accounts.

Money mistakes about Insurance

Not having protection, the insurance

Having insurance is important. It keeps you protected from any unforeseen situation that may arise in the future. Not having insurance can wipe up all your savings in a single go. In the most disastrous form, it may even leave you behind in huge debt.

For example, a person did not have health insurance. When he was admitted to a private hospital he was left with a huge bill of expenses. Now, the person has to pay that bill from the amount that he had saved since when he started. This leads to a huge financial burden.

Buying an insurance product is important.

- Term insurance plan ensures that your family and loved ones would be taken care of even when you are not there with them in the future.

- Health insurance would ensure that you would clear the huge medical bills in case of sickness.

Mixing Investment with Insurance

One should not mix insurance with investment. Yet, many buy traditional insurance policies like endowment plans, money back plans that give the “triple benefits” of life insurance, long-term savings and tax benefits. These policies give returns of 5-6% and also force the policyholder into a commitment for many years.

If you have taken the wrong policy then you have 2 options

- You can surrender a policy if you have paid premiums for a minimum number of years. You will suffer a loss when you do this.

- You can also convert an insurance policy into a paid-up plan after three years. The policy will continue with a reduced sum assured but you won’t have to pay the premiums any further. The paid-up value is given to the policyholder on maturity. The policy turns into a paid-up plan if premiums are not paid for two consecutive years. It is better than paying premiums for the full term and earning 5-6% returns.

Money Mistakes about Investing

Not Starting investing early

Compounding is the eighth wonder of the world,

He who understands it earns it… he who doesn’t… pays it.

Investing small amounts at an early age would have a compounding effect and this would increase your retirement income later.

Alicia started investing Rs 2,000 every month from the age of 25.

Boman, who started investing Rs 5000 per month when he reached the age of 35.

At Age of 45

After 20 years, Alicia’s investment of ₹ 4.80 lakhs will grow to ₹ 19.98 lakhs * @ 12 % p.a

After 10 years, Boman’s investment of ₹ 6.00 lakhs will grow to ₹ 11.62 lakhs * @ 12 % p.a

Alicia’s returns are more despite Boman investing more than Alicia.

This is one of the most important hurdles faced by youngsters. The youngsters in the initial stages of their career have a lower income and they feel they will start investing once their income grows.

This is the time value of money. The earlier you would invest, the better the results would be. While the later you would invest, the lesser would be the results.

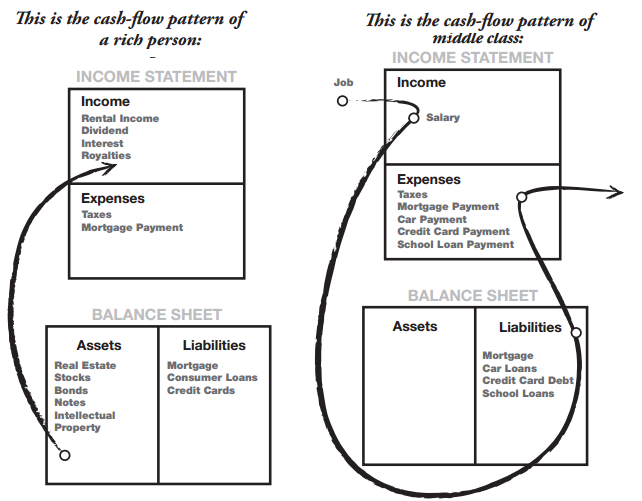

Not understanding the difference between Asset and Liability

Car is a necessity but people spend a lot of money and even take the loan to buy a luxury car over and above their budget.

Having a car is not an asset because it consumes fuel and has a maintenance cost. Its price will only depreciate in the future.

Our article Cost of owning a Car explores it in detail.

The asset is something that puts money in your pocket such as investments in Stocks, Mutual Funds, real estate etc.

Liability is something that takes money out of your pocket. Common liabilities include credit card loans, car loans, personal loans, unused subscriptions, and more.

Liability that brings money into your pocket can be a good liability but the one which takes money out of your pocket is a bad liability. Taking a loan for depreciating assets such as cars or bikes is a bad liability. Taking a loan for appreciating assets such as a house, land, business, education is a good liability.

The concept of Asset and Liability is explained beautifully in the book Rich Dad Poor Dad details of which you can check out here.

Rich Dad Poor Dad Asset and Liabilities

Not knowing where to invest

People are not even aware of what to do with the money with them.

They let the money remain in the savings account which gives a lower interest rate.

If they had invested the money in distinct financial instruments, they would have earned extended returns over the amount that he had.

People do not know why they need to save money, they don’t know their financial goals, they are not prepared for life.

Buying excessive gold only to keep it in the locker

Gold worth lakhs of rupees is kept in lockers only to be used occasionally. This is resulting in the money getting blocked and hence not getting any returns on it.

Keeping excess cash

Keeping cash is good as it may help you in times of emergency. However, keeping excess cash with you is futile. The cash is not going to make an additional income for you. For example, a housewife puts her savings in the wheat/grain boxes at the home. And, if the inflation rate is accounted then the value of your cash would decrease in the years to come. If she had put the money in her bank or any other scheme, she would have earned interest over it. With this, she would have made her savings worked for her while earning an additional amount over the money she had initially,

Risk-Averse Nature, Being cautious

Several investors are risk-averse. They do not want to take any risk and simply put the amount in financial instruments generating a lower return. For example, many put their savings in a bank FD/RD/PPF generating an average return of 5-6% just as their parents did.

If he had explored the other investment avenues like equities, mutual funds, SIPs, Post Office scheme, etc., they would have earned better interest over their savings.

Investing all the money in a single instrument, Putting all eggs in One Basket

Some people often commit the mistake of investing only in a single financial instrument. For example, a person invested all of his money into equities for a better return over his investment. However, in March 2020, when the stock market crashed, he suffered a 40% crash.

It is highly recommended to invest in different financial instruments rather than investing in a single financial avenue. This would make sure that if one financial avenue fails, others would be there to balance. Also, it is advisable to keep a small proportion of cash in your savings account that helps in case of any emergency.

Investing in Dubious schemes

Greed is a very effective driver of investments.

SpeakAsia and Stock Guru are just two examples of how investors can be lured by easy money. The fantastic returns promised by the fraudsters should have been a red flag for investors. It is virtually impossible to churn out 10-20% returns every month. Yet, investors didn’t see anything wrong in the SpeakAsia promise of easy money for doing virtually nothing or the Stock Guru promise of 20% assured returns per month.

The other basic check is to see whether the scheme is approved by the regulator. All investment schemes must have SEBI approval. Stock Guru had nothing to show in this regard. Fraudsters try to mislead investors by uploading images of PAN cards and certificates of incorporation. But these documents don’t mean that the scheme has been approved by SEBI.

Apart from getting rich quick schemes, you must ignore mails from heirs of deposed African dictators, altruistic accountants. Stick to boring investments like fxed deposits, PPF, and mutual funds if you don’t want to lose your money

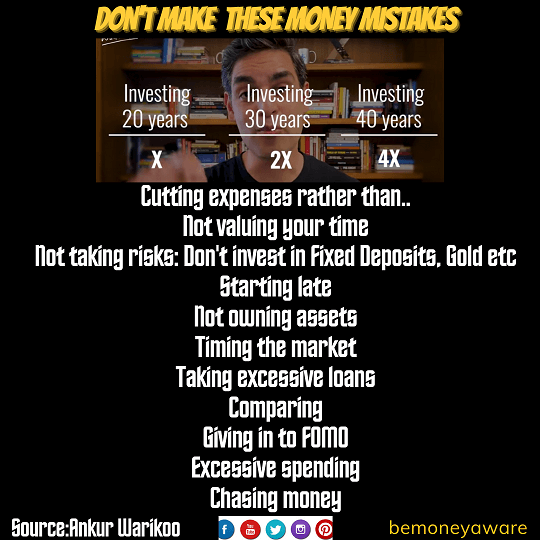

Video on Money Mistakes

Mistakes that Ankur Warikoo, made with his money, and how he finally learned the lessons about money that might collapse the timeline for you!

Ankur Warikoo is an entrepreneur, an angel investor, a mentor and an active public speaker. His most recent startup was nearbuy.com where he was the founder and CEO from 2015 until 2019.

These are some of the financial mistakes and possible solutions that one must keep in mind to ensure a better and safer future.