When one sells Shares and/or Equity Mutual Funds one has Capital Gain on the sale of Equity. You cannot file the Capital Gain in ITR1. The article discusses the procedure to report Capital Gain on Sale of Shares and Equity Mutual Funds in Income Tax Return New Portal in simple terms.

Table of Contents

Tax on sale of Shares and Equity Mutual Funds

Capital Gain arises on the sale of Shares and Equity Mutual Funds(provided that such transaction is chargeable to Security Transaction Tax.)

Capital gains tax on Equity can be long-term or short-term, depending on the duration for which the individual holds the Equity.

A resident individual and resident HUF can apply for adjustment of the exemption limit against Short/Long Term Capital Gain. For example, If total taxable income excluding short-term gains is below taxable income i.e. Rs 2.5 lakh the shortfall of basic exemption can be adjusted against short-term gains. The remaining short-term gains shall be then taxed at 15% + 4% cess on it.

Shares/Equity Mutual funds sold after a holding period of less than 12 months are considered Short Term Capital Gain/Loss.

- The short-term capital gain comes under section 111A

- Is taxed at a flat tax rate of 15% +cess

- You need to show a total of short term capital gains in the ITR

- You need to show the total amount of short-term capital gain/loss. You don’t need to enter details per share/equity mutual funds.

- An individual resident cannot file ITR1 for capital gains

- In ITR You need to fill in Short Term Capital Gain in Schedule Capital Gain and check details in Schedule SI, Income chargeable to tax at special rates.

Shares/Equity Mutual funds sold after a holding for more than 12 months is considered Long Term Capital asset.

- The long-term capital gain comes under section 112A

- Is taxed 10% for gains exceeding the threshold of Rs 1 Lakhs.

- For stocks bought before 31 Jan 2018 Grandfathering comes into play, Scrip-wise details are to be reported in ITR. Script-wise details include the name of the scrip, ISIN, purchase price, sales price, and the dates of these transactions.

- For stocks bought after 31 Jan 2018, you have to give the total value of profit/loss. You don’t have to report Scrip wise details.

- An individual resident cannot file ITR1 for capital gains

- In ITR You need to

- Select Schedule Capital Gain,

- Select Long Term Capital Gain

- Fill in Schedule 112A: You can also upload the data in CSV format.

- Verify details in Schedule SI

If you buy a House using the sale proceeds of the shares or equity Mutual Funds then you can claim an exemption under Section 54F.

Expenses allowed

In the case of the sale of shares: You may be allowed to deduct these expenses:

a. Broker’s commission related to the shares sold

Note: STT or securities transaction tax is not allowed as a deductible expense

Details in Income Tax on Selling Shares: Trading, Capital Gains, ITR

Terms associated with Capital Gains

Full value consideration The amount received or to be received by the seller. Capital gains are chargeable to tax in the year of transfer, even if no consideration has been received.

Cost of acquisition The Purchase price or the value for which the capital asset was acquired by the seller.

NOTE: In certain cases where the capital asset like shares and mutual funds becomes the property of the taxpayer otherwise than by an outright purchase by the taxpayer, for example, inherited the cost of acquisition and cost of improvement incurred by the previous owner would also be included.

Cost of improvement Expenses of a capital nature incurred in making any additions or alterations to the capital asset by the seller.

Note that improvements made before April 1, 2001, are never taken into consideration.

Loss to be disallowed u/s 94(7) or 94(8)– for example, if asset bought/acquired within 3 months prior to record date and dividend/income/bonus units are received, then loss arising out of the sale of such asset to be ignored (Enter positive value only)

Section 54F of the Income Tax Act, 1961 allows tax exemption on the long term capital gains earned from selling a capital asset, other than a house property. So, if you sell a capital asset like shares, bonds, jewellery, gold, etc. and reinvest the sale proceeds towards the purchase or construction of a house property, the returns earned on the sale of the capital asset would be allowed as an exemption from tax under Section 54F.

Security Transaction Tax (STT) is a tax levied at the time of purchase and sale of securities listed on Stock Exchanges in India.

Equity Oriented Mutual Fund is the funds that invest 65% of the investible funds in the Equity Shares of the domestic companies.

Business trusts are like mutual funds that raise resources from many investors to be directly invested in realty or infrastructure projects.

Schedule 115AD (1)(iii) involves entering the same details as for Schedule 111A but is applicable to non-residents.

Account Statement of your Shares and Mutual Funds

The account statement from your Demat account is a summary of all the transactions in the Demat account. The statement provides the relevant details like sale consideration, date of acquisition, cost of acquisition, Period of holding, ISIN Code, etc. These details are required to be reported in Capital Gain Schedules of Income Tax Return.

Account Statement can be downloaded from the broker with whom you maintain a Demat account. Most of the brokers provide the Capital Gain Statements along with Transaction Details.

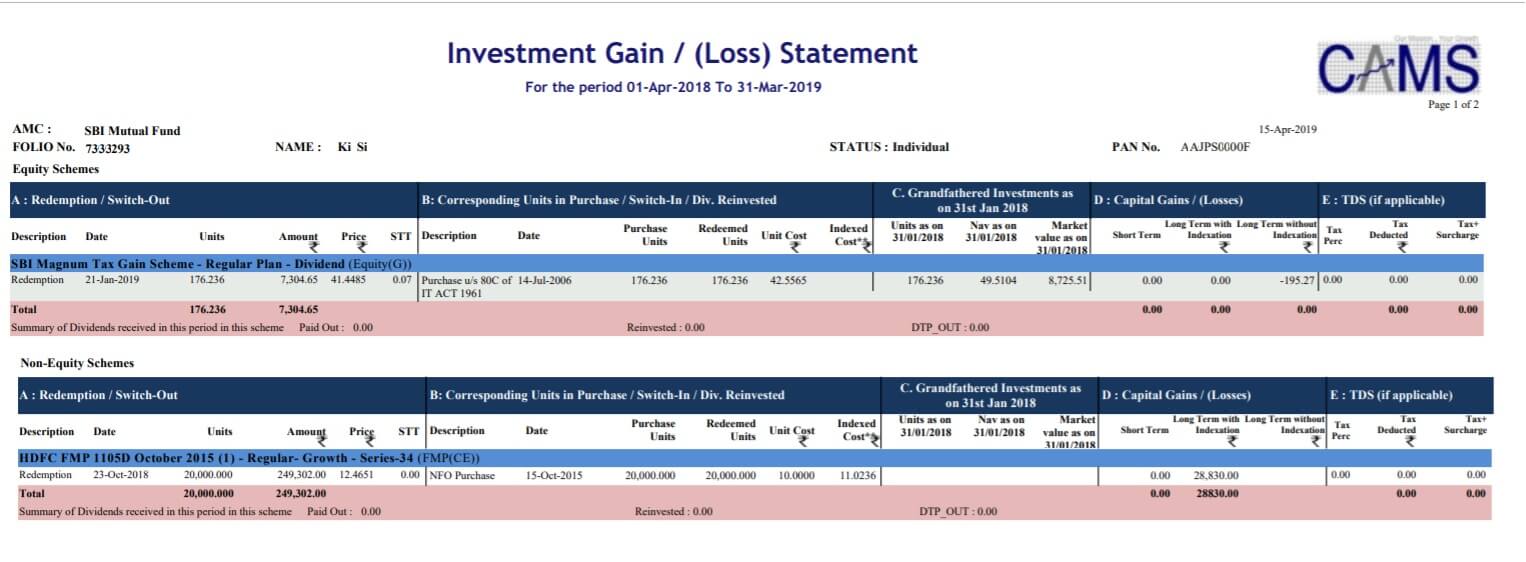

The capital gain statement from Mutual Funds Registrar & Transfer Agent CAMS and Karvy have details about short and long-term capital gains and of individual transactions.

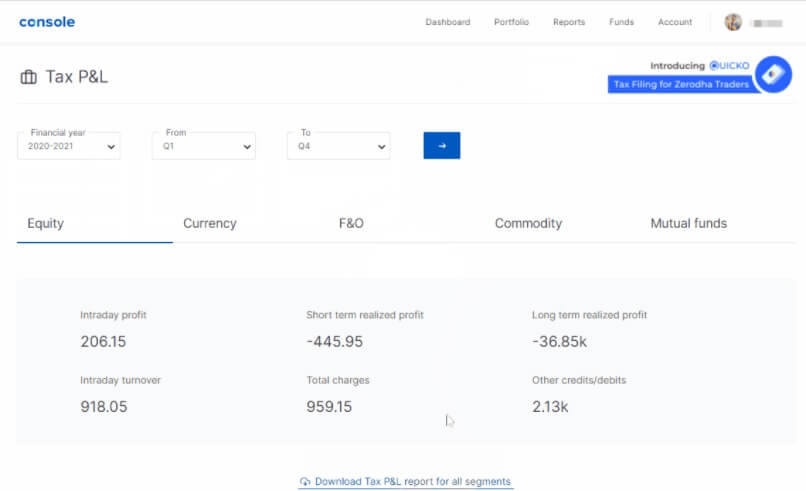

Example of Capital Gain Statement of Zerodha

Log in to Console > 2. Reports > 3. Tax P&L > 4. Select the Financial year and the quarter range. > 5. Click on the arrow button > 6. Click on Download Tax P&L report for all segments.

Once you download the Tradewise Tax P&L report, you can find this information in the ‘TRADE WISE EXITENTRY 2019-03-31’ sheet. The entry and exit dates along with the holding period are available.

If you pay brokerage then you can get the brokerage details.

Example of Capital Gain Statement from CAMS

Our article How to get Capital Gain Statements for Mutual Funds CAMS, Karvy etc explains it in detail

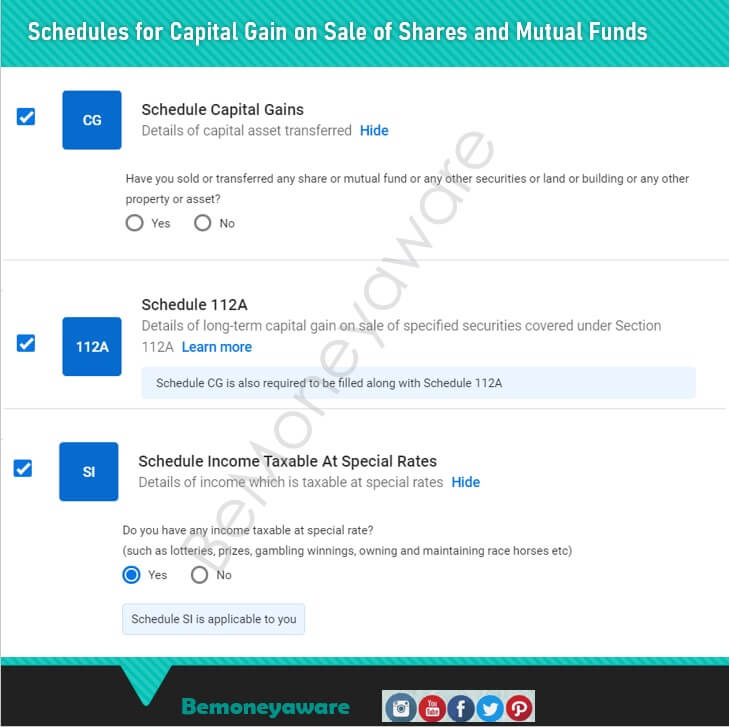

Schedules of Capital Gains in ITR

Click on Income Schedule and select the following schedules:

- Schedule Capital Gain,

- Schedule 112A for Long Term Capital Gains

- Schedule Special Income: It will show a summary of taxable Capital gain, special tax rate, and tax.

Click on Schedule Capital Gain.

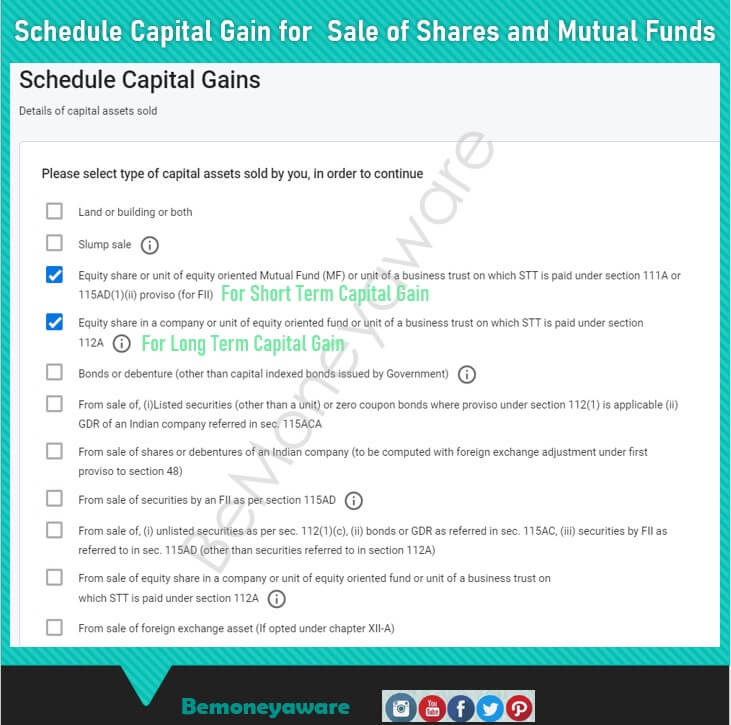

Select Type of Capital Assets

For Short Term Capital Gain :Select Equity Share or Unit of Equity oriented Mutual Fund or business Trust in which STT has been paid under section 111A

For Long Term Capital Gain: Select Equity in a Share or Unit of Equity oriented Mutual Fund or business Trust in which STT has been paid under section 112A

If you have both select Both.

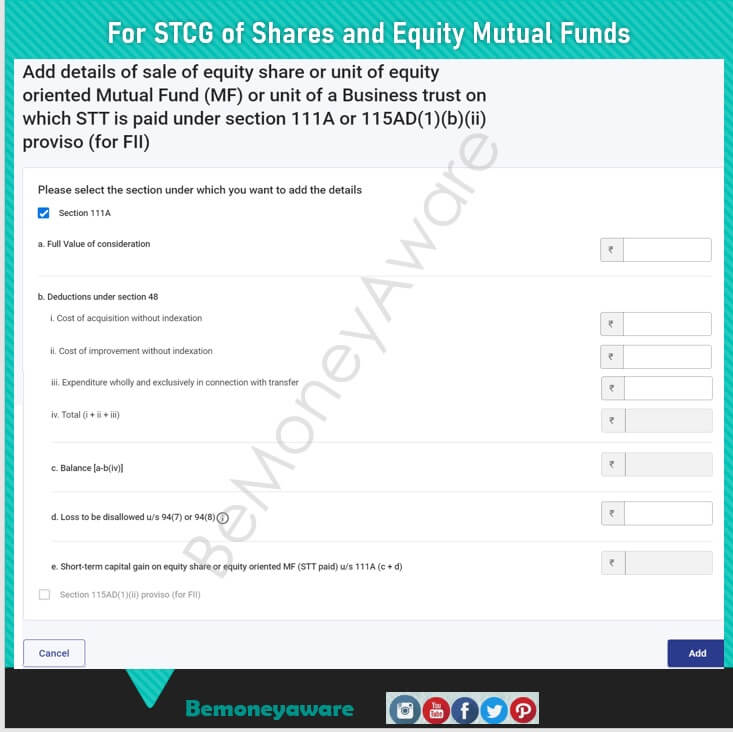

How to show Short Term Capital Gain from the sale of Shares and Equity Mutual Funds in ITR

Enter Total amount received from the sale of shares and Equity Mutual Funds in ITR in the short-term(less than 12 months) & cost of purchase. This has to be for all the shares and all the Mutual Funds that you have bought and sold across different brokers and Mutual Fund houses.

CBDT vide press release dated 26 September 2020 clarified that script-wise reporting is not required for the sale of the short term listed shares

For example, you bought

- 200 shares of company A on 20 May 2020 for Rs 100 and sold it on 11 Dec 2020 for Rs 120. You have a short term capital gain of 200*(120-100) = 4000

- 100 shares of company B on 17 Aug 2020 for Rs 100 and sold it on 12 Feb 2020 for Rs 80. You have a short term capital loss of 100*(80-100) = -2000

- 150 shares of company C on 12 Sep 2020 for Rs 100 and sold it on 31 Mar 2021 for Rs 111. You have a short term capital gain of 150*(111-100) = 150* 11 = 1650

- 100 units of Equity Mutual Fund D on 12 Aug 2020 for Rs 100 and sold it on 20 Dec 2020 for Rs 122. You have a short term capital gain of 100*(122-100) = 100* 22 = 2200

So your net Short Term Capital Gain = 4000 – 2000 + 1650 + 2200 = 5850. This is what you have to report in the ITR

Full Value of Consideration, you need to enter the total of sale values: 200*120 + 100*80 + 150*111+ 100*122 = 60850

Cost of acquisition without Indexation, you need to enter the total of purchase values: 200*100 + 100*100+ 150*100+ 100*100= 55000

Broker’s commission related to the shares sold 100(from your Demat statement) is say Rs 100

How to show Long Term Capital Gain from the sale of Shares and Equity Mutual Funds in ITR

The Equity Share and Equity related instruments like Mutual Fund Units having more than one year of holding come under Long Term Capital Gains.

Long Term Capital Gain on sale of Equity Share and Equity related instruments like Mutual Fund Units, liable for Security Transaction Tax(STT) covered under Section 112A of Income Tax Act.

The rate of long-term capital gains tax on these listed securities is 10% for gains exceeding the threshold of Rs 1 Lakhs

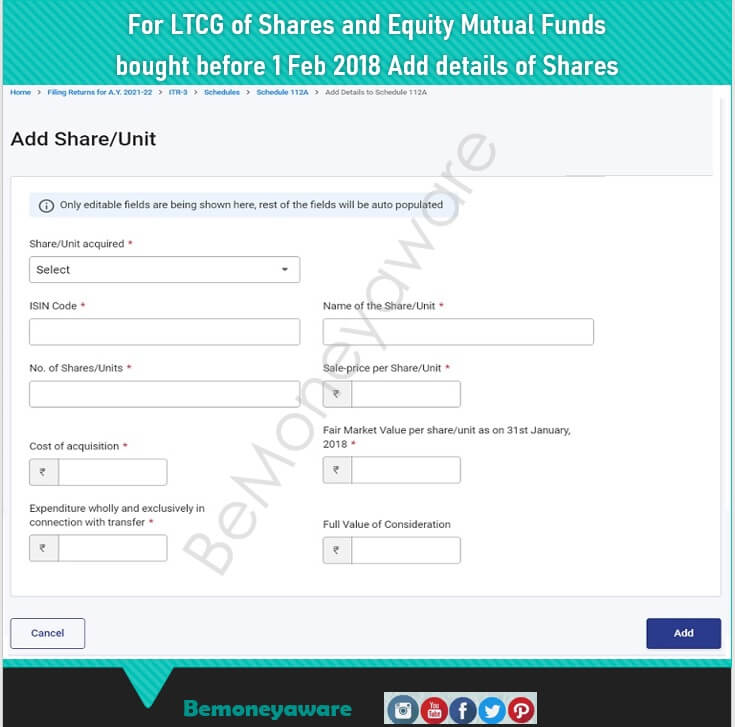

For stocks bought before 1 Feb 2018

Scrip-wise details are required to be reported in ITR for LTCG eligible for Grandfathering clause. Script-wise details include the name of the scrip, ISIN, purchase price, sales price, and the dates of these transactions.

Once you enter script-wise detail in 112A Schedule and click on Add, the cost of Acquisition and Capital gain will be auto calculated by the portal and will be displayed as indicated below

To verify/check the Stock Price or NAV of equity Mutual Fund on 31 Jan 2018 check the articles.

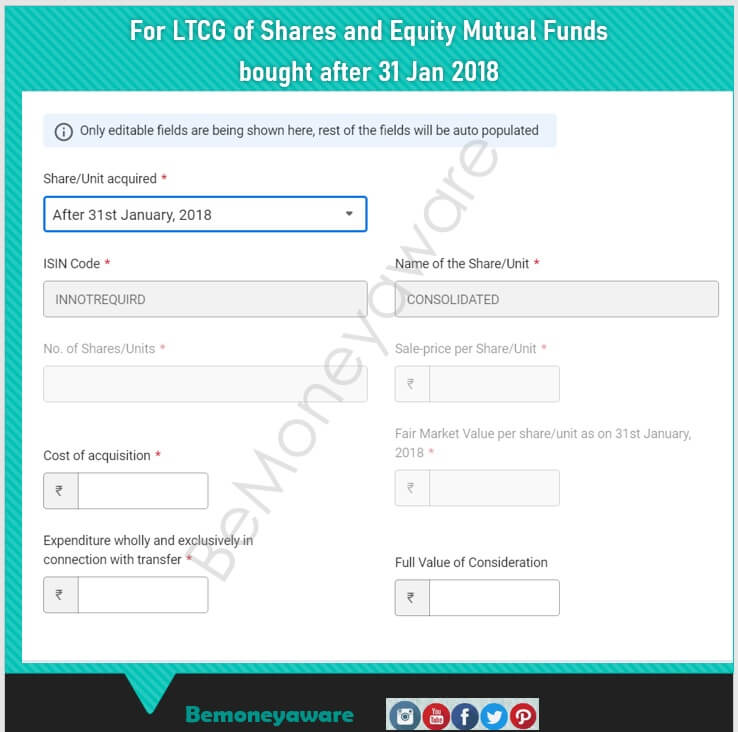

For stocks bought after 1 Feb 2018

Only total cost and sale value are required as shown in the image below. The other details a

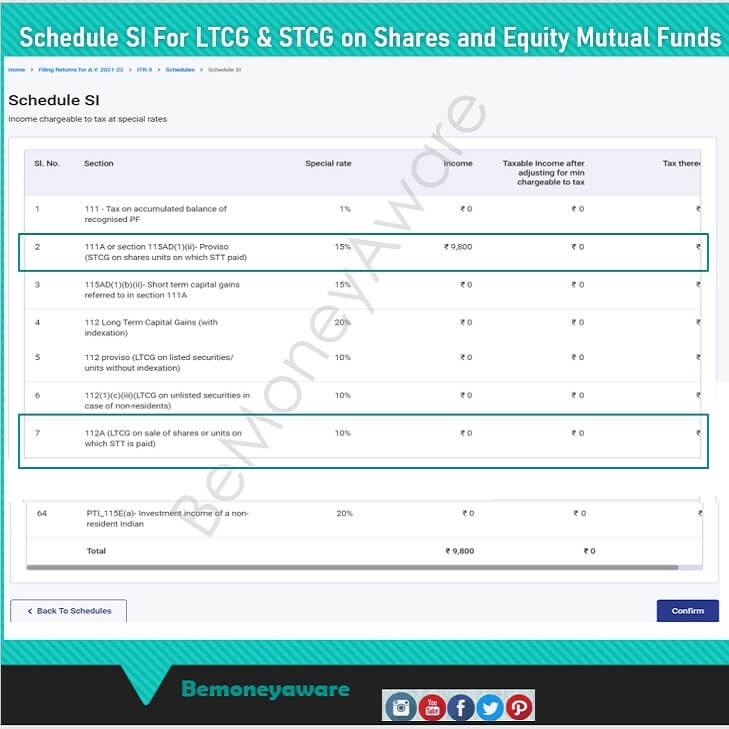

SCHEDULE SI

Verify the details match in SCHEDULE SI Income chargeable to tax at special rates. This schedule is a summary of taxable Capital gain, special tax rate, and tax thereon.

For in the image below you can schedule SI for Short term capital gains of 9800 Rs.

Related Articles

Income Tax on Selling Shares: Trading, Capital Gains, ITR

Understand Income Tax: What is Income Tax,TDS, Form 16, Challan 280

How to file ITR Income Tax Return, Process, Income Tax Notices

- Long Term Capital Gain on Stocks & Equity Mutual Funds with Calculator

- RSU of MNC, perquisite, tax , Capital gains, ITR, eTrade

- BSE Stock Price on 31 Jan 2018 for LTCG on Shares

- NAV of Equity Mutual Funds on 31 Jan 2018