A large portion of consumers is still waking up to CIBIL score and its impact on their creditworthiness in the eyes of financial institutions. RBI (Reserve Bank of India) has mandated that all banks are required to check the individuals CIBIL score before a decision on loan application is made. Needless to say, the score enquiry is to determine if one is eligible for a loan. For a bank lending you money, they are trying to determine if you have the ability and discipline to pay back the loan.

So, if you need a loan in the future, you really don’t have a choice but to maintain a good CIBIL score. But what is CIBIL exactly and what is a good CIBIL score? Let’s dive in.

About CIBIL:

CIBIL (Credit Information Bureau (India) Limited) is a credit information company (CIC) and is a premier source of credit scoring for individuals and commercial entities in India. A credit score from CIBIL is known as CIBIL Transunion Credit Score and ranges from 300-900. The higher the credit score, the better is the borrower’s creditworthiness. A higher score also generally translates to loan approvals and in some cases, lower interest rates. Banks and financial institutions associated with CIBIL submit individual transactions with their bank credit cards and loans every month. Your CIBIL score is updated on a monthly basis. Please note that a CIBIL score is affected neither by the savings you might have nor your income.

Table of Contents

How is CIBIL score calculated?

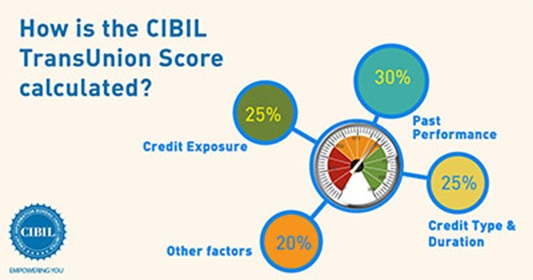

There are various factors influencing the score including payment history and longevity of the credit cards. Here’s a breakdown as released by CIBIL itself.

As you can see, 30% is dependent on your credit behavior in the past. This means if you have outstanding balances on your credit cards or loans, your score is bound to tank.The next 50% of the score is affected by the three W’s: What type of credit, How much and How long.

The first W talked about your credit type. A secured loan like home loan/auto loan holds more credibility than an unsecured loan like personal loan. A secured loan is nothing but a loan against a guarantee.

The second W talks about what is the credit exposure you have. This takes in to account your credit card limits as well. For example, you may have 3 credit cards with Rs 1Lac as the limit for each. It means you have a credit exposure of Rs 3Lacs.

The third W indicates how long have you been using them. The older a credit card is, the better for your score provided you have been making your payments on time and preferably in full. Yet, it is not the full picture. A good credit score is dependent on not just how consistent and on time you are with your payment but also, how much of the credit do you use in your daily life. Needless to add, the more credit you use up, the less attractive your score becomes.

But I do not need a loan now. Do I still need a CIBIL Score?

Absolutely. You may not need a loan today, but future is unpredictable. You might need one 5 years down the line. Unfortunately, you cannot build a credit score overnight. It takes at least 12-18 months to build a good score.

So, Tell Me How To Build A Good CIBIL Score!

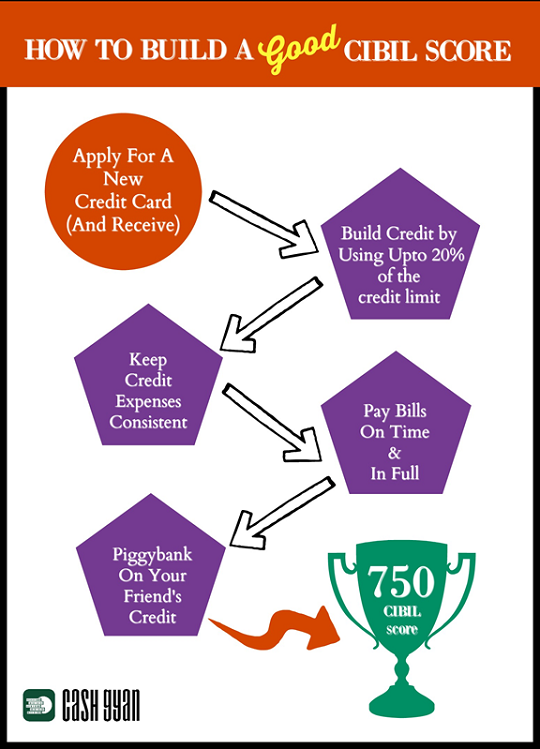

Here’s your cheat sheet to building a good CIBIL score. This is especially useful if you are just starting out or if you have the NH score (applicants with no credit history to report). If you follow these 5 practices below, you can guarantee a good credit score.

1) Apply for new cards, if you don’t have any: Do not exceed more than 3 credit cards. Add up the credit card limit of all the credit cards you have. That’s the credit exposure you have. It pays to have them in your pocket just so you continue to have high creditworthiness. But sometimes, it also makes sense to close some of these. Having too many credit cards does not reflect well on you as a trustworthy borrower. It puts a bad light on you as a credit-hungry individual. However, before closing the extra ones, keep an eye out for the oldest of credit cards. An old credit card establishes your credit history and if you have made timely payments, it’s an asset not to lose.

2) Use up to 20% of your credit card exposure limit: While the official limit on credit card use for a good score is 30% of the credit limit, it is best to limit it to 20%. A lot of us are raised believing credit cards are evil but not any more. In fact, using credit cards is essential to build a credit history. We, however, have also seen that credit cards drain our money. Discipline plays a big role in not going overboard. A simple way of keeping credit card use under check is using it to pay for only predictable and fixed expenses. For example, a utility bill is a predictable (if not fixed) monthly expense. Set auto-payments from your credit card to pay for it. Ensure that these payments do not amount more than 20% of your credit limit.

3) Keep the credit card expenses consistent: Often neglected, the trick to maintain a good score is not only to use your credit card but also use it consistently and for a consistent amount. This reflects that the individual is in control and is making planned expenses.

4) Pay your bills on time: Payment history takes the pie. Ensure every bill is paid on time and if possible, always in full amount. Banks have noted that 86% of all individuals paying minimum amount on their credit bills have a chance to default on their payments. Don’t fall in the trap of paying minimum amounts. The interest you pay on credit card bills is exorbitant. While it is not explicitly noted, minimum payments affect your score adversely. In simple words, do NOT use credit cards for more money than you can pay back within the same month. The timing of the payment also matters. Making payments at least 5 days prior to the last day of payment is important as well.

5) Piggybank on your relative/friend’s credit: Follow this with caution. Since even being a guarantor to someone else’s credit reflects in your score report AND them paying on time reflects well on you too, the idea is to sign up a guarantor for someone you trust to do well with money. The flip side is if your friend fails in making payments on time, it hits your score as well. Therefore, be a guarantor only and only if you are sure of the creditworthiness of your friend.

All in all, instill financial discipline to surge ahead with your credit score. Credit scores will become increasingly important in our lives. It is already used to evaluate candidates for some jobs like compliance and regulation. The importance of Credit Scores will only increase as time passes by. So, know your score today and act smart by working on maintaining a good score!

Video on being Smart Saver

If you need more inspiration, watch this video on YouTube on how to be a smart saver produced jointly by Bemoneyaware.con and cashgyan.com.

Related Articles:

- Understanding CIBIL CIR report

- CIBIL CIR : Account and Negative Factors.

- Understanding Loans

- Life of Debt – Responsibly

- FAQ on CIBIL CIR Report and Score

ABOUT THE AUTHOR: Shilpa Mudiganti is the founder and editor of Cashgyan.com, a website aimed at making the no-pension generation financially worry-free. She likes to read and write about money management and loves a good chat. If you would like to start a conversation with her, leave a hint at Shilpa@cashgyan.com.

Thanks for the Useful Info, Learn more at http://www.loankuber.com/content/cibil-score/impact-of-foreclosure-on-cibil/

Very informative every individual need to maintain good credit score. To know please visit check credit score https://www.letzbank.com/

Very informative every individual need to maintain good credit score. To know please visit check credit score https://www.letzbank.com/

So if I dont have a credit card, does it affect my CIBIL score ??

Hi Rehan,

Sorry for the delay. Yes, it does. You need a credit card to build score.

So if I dont have a credit card, does it affect my CIBIL score ??

Hi Rehan,

Sorry for the delay. Yes, it does. You need a credit card to build score.