While filling Challan 280 for self assessment tax, advance tax one may make mistake such as mention wrong Assessment year or Incorrect PAN or TAN etc. It is necessary to correct such mistakes otherwise tax would not be credited to you in correct year and you might get notice from Income tax department for tax due. This article talks about How should one rectify mistakes made while filling Challan 280?

Table of Contents

If you have paid Challan 280 Online

Our article Challan 280: Payment of Income Tax discusses the basics of Payment of Income Tax. If you have paid Challan 280 online then only your Assessing Officer can correct the details. You can correct the details in the challan 280 by

- Submitting a letter to your Income Tax Assessing Officer in the specified format.

- You can send it through post, but it’s better if possible visit personally and submit the letter.

- Also get acknowledgment on another copy of the same letter

Assessing Officer

An Assessing Officer is a person who has jurisdiction(means: official power to make tax decisions and judgments for that assessee) to make assessment of an assessee, who is liable to tax under the Act. The designation may vary according to the volume of income/nature of trade as assigned by the Central Board of Direct Taxes(CBDT Board), the department which deals with income tax. He may be an Income-tax Officer, Assistant Commissioner, Deputy Commissioner, Joint Commissioner or an Additional Commissioner. To know more about Assessing Officer one can read incometaxindia.gov.in:Central Board of Direct Taxes

To know your Assessing Officer , (which is an optional field to fill in our ITR forms also) Go to incometaxindiaefiling.gov.in/e-Filing/Services/KnowYourJurisdictionLink.html and enter your PAN number. Our article How to find Jurisdictional Assessing Officer : Income Tax explains it in detail.

Format of Letter

You need to submit a letter to your Income Tax AO for correction in challan data along with the photocopy of the challan.Required Format for Correction of Section can be as follows

Date :……….

To,

The ITO

Ward ………….

……………..

……………..

Sub: Request for Correction and/or rectification of Assessment Year in challan.

Sir,

This is to inform you that while making payment of Self Assessment Tax of Rs……………..for the AY 2012-13 i wrongly mentioned the AY 2011-12 in ITNS 280.

I, therefore, request you to kindly make the necessary correction in your records. I am also enclosing a photocopy of the said challan.

I sincerely regret for my inadvertent mistake.

Thanking you,

Yours faithfully

……………….

If you have paid Challan 280 in Physical form or Offline at Bank

If you have paid Challan 280 in physical form by going to bank, bank can information if requested is submitted within a time frame or period based on information that needs to be updated. After lapse of time frame, request can be made to the Assessing Officer. The fields that can be corrected by the Taxpayer through Bank are given below:

|

Sl. No. |

Type of Correction on Challan |

Period for correction request (in days) |

|

1 |

PAN/TAN |

Within 7 days from challan deposit date |

|

2 |

Assessment Year |

Within 7 days from challan deposit date |

|

3 |

Total Amount |

Within 7 days from challan deposit date |

|

4 |

Major Head |

Within 3 months from challan deposit date |

|

5 |

Minor Head |

Within 3 months from challan deposit date |

|

6 |

Nature of Payment |

Within 3 months from challan deposit date |

Procedure for requesting correction

- A separate request letter is to be submitted for each challan

- The tax-payer has to submit the request form for correction (in duplicate) to the concerned bank branch.

- The tax-payer has to attach copy of original challan counterfoil.

- In case of correction desired for challans in Form 280, 282, 283, the copy of PAN card is required to be attached.

- In case of correction desired for payments made by a tax-payer (other than an individual), the original authorization with seal of the non-individual taxpayer is required to be attached with the request form.

- The time window for correction by the bank is 7 days from the date of receipt of correction request from the tax-payer.

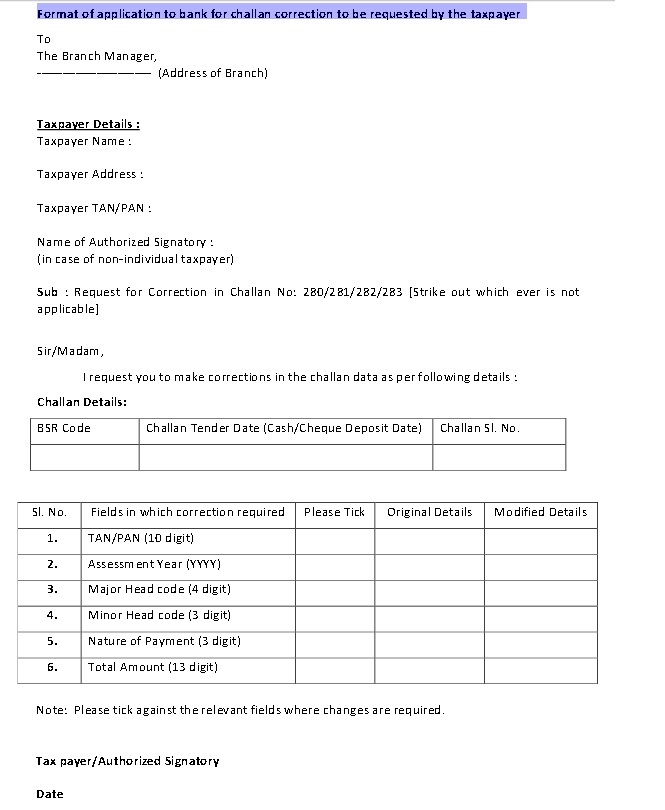

Format of letter to be submitted to bank is shown in image below (Click on Image to enlarge), you can check from ChallanCorrectionMechanism(pdf)

Overview of Tax Information Network of Income Tax Department

Income Tax Department has set up a Tax Information Network (TIN) as a repository of important tax related information. National Securities Depository Limited (NSDL) hosts TIN. TIN receives on behalf of the tax administration, all returns of tax deduction at source (TDS) & other information for digitization into a central database. TIN receives online information on collection of taxes from the banks through “Online Tax Accounting System” (OLTAS), which also flows into the central database.

TIN matches TDS returns from the deductors with the collection details from the banks (through OLTAS). On the basis of this matched data a PAN wise electronic ledger account is prepared with the details of tax credits. This PAN ledger (called Form 26 AS) is made available to the taxpayers so that they can verify whether the deductors have deposited the tax in a timely fashion. The taxpayers also have the facility of accessing the TIN system to ascertain tax payments made by them or deducted on their behalf through Form 26AS. The digitized information is downloaded to the National Computer Center of the Income Tax Department for further processing.

Details on Challan Correction Mechanism available in pdf format at Income Tax Website ChallanCorrectionMechanism(pdf)

Related Articles :

- Income Tax for Beginner, Income Tax For Beginner – Part II

- Advance Tax:Details-What, How, Why

- Challan 280: Payment of Income Tax

- Paying Income Tax Online: Challan 280, Paying Income Tax Offline: Challan 280

- Filling ITR-1 : Bank Details, Exempt Income, TDS Details

- Viewing Form 26AS on TRACES

Disclaimer : This is an information based website, meant for providing assistance to it’s readers. We do not hold any responsibility for mis-information or mis-communication. If you find any mistakes please let us know we shall rectify it.

Did you ever make mistake in filling Challan 280? Did you meet the Assessing Officer? Please share your experience it will be beneficial to many people.

i have mentioned wrong pan no (i.e. my client (diseased person pan no instead of his wife’s PAN NO.) while paying advance tax in June 21 how to correct it.

You will have to file ITR and claim it back!

Hi,

In IT Self Assessment Tax Payment Challan No. 280, I filled up all details correctly including PAN, Name and other details and paid via bank. But, on separate receipt slip as issued from bank (not the counterfoil),the Name is in abbreviation, pan no. is correct.

Previously my Name in PAN Card was in abbreviation but in my new updated Pan, it is in full name as written on my challan by me. The bank official said the short name appeared on its own on entering the PAN, and not the full name. All my Income tax documents and 26AS all are generated with full name.

Will there be any problem, since PAN number is same.?

please respond.

Hi,

While making payment of Self Assessment Tax for the AY 2019-20, I wrongly mentioned the AY 2018-19 in ITNS 280, Also the wrong code (400) was selected in minor head. It needs to be 300 as Self Assessment Tax. My ITR for AY 2018-19 has been approved now. How can I correct it ? is there a way to cancel this transaction and get refund or can be rectified as suggested in next financial year. Kindly guide and suggest.

Thanks

Neeraj

Paid self-assessment tax in wrong Assessment Year i.e. instead of AY 2018-19, I have paid in AY 2017-18. Submitted a request letter to AO. Generally how long does it take to correct the mistake. In meantime, can I send my ITR to Central Processing Unti in Bangalore?

Hi Sir,

Actually i forgot to add some components while calculating income tax and i paid say Rs 2000 by booking challan 280 of Rs. 2000 through online SBI . I have not yet completed the process of filing ITR.

Now i realized i missed some amount under 80CCD and i can see that I should have paid tax of Rs. 1500 .

What should I do in this case to get cancel my challan (which is done through online SBI) or is there any alternative.

Please help.

Thank you .

Please make another payment and add those details in ITR.

Don’t cancel the other challan.

I have paid my self assessed tax for FY 2017-18{AY 2018-19} through challanNo 280 under minor head 300 on 05.03.18.The clerk to whom I gave the payment said that system did not allow to receive self assessed tax for AY 2018-19 under minor head 300 and he corrected the AY as 2017-18 in the challan. Would the amount paid be adjusted against current FY 2017-18(AY 2018-19)?The payment was for FY 2017-18(AY 2018-19). Please intimate whether any corrective measures to be taken by me.

For FY 2017-18 or AY 2018-19 you can pay advance tax and not self assessment tax.

Self-assessment tax: This tax is paid in the assessment year before filing the I-T returns. If during the calculation of your tax liability, you realise that some tax is still due after taking into account the TDS and advance tax, then you pay self-assessment tax. For AY 2018-19 it will start from 1 Apr 2018.

Please visit the bank change the minor head from 3000 (Self Assessment Tax) to 100(Advance Tax) if you want it for FY 2017-18 or AY 2018-19.

Hello Sir,

I made a mistake while paying TDS online on sale of priperty. I entered the amount under “Fees” instead of “Income Tax”. How can i get this corrected on the TDS challan?

Thanks

SIR, I HAVE RECEIVED INTIMATION U/S 143(1) OF THE INCOME TAX ACT, 1961 THROUGH CENTRALIZED PROCESSING CENTER, BENGALURU SHOWING NET AMOUNT PAYABLE (Sl. No. 52) IS RS. 750/-. THIS IS THE INTEREST AMOUNT WHICH I EARNED FROM BANKS AND DISCLOSED BY ME. I HAVE ALREADY PAID MYSELF THIS AMOUNT OF RS.750/- WHILE FILLING ONLINE TAX UNDER WRONG HEADS ie MAJOR HEAD 0024 and MINOR HEAD 300. NOW HOW CAN I RECTIFY THIS MISTAKE AND TRANSFER THE SAME AMOUNT OF RS.750/- UNDER MAJOR HEAD 0021 and MINOR HEAD 400.

I paid my tax amount but missed adding cess to that amount. How can i correct this.

Did you pay the full tax amount with cess but did not show the break up? Then no worry.

Else pay self-assessment tax, show it in ITR, revise your return and submit again.

Related articles for you:

Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

How to Revise Income Tax Return (ITR)

I have paid but not filed my return .. do u mean i can pay again just the remaining cess amount using the same form and generate a second challan and mention both challans in my return?

Yes you are absolutely right

I really got into this article. I found it very interesting and loaded with unique points of interest. I like to digest material that makes me think. ThanksThank you for writing this great content.

Hello Sir,

I made a big mistake during the process of tax payment.

Instead of using the challan No- 280, I have payed my taxes under Challan 286.

I have also mailed Assessing Officer, but have not received any response from his end.

Could you please help me out and suggest the necessary steps to rectify the mistake.

-Thanks and Regards,

Garima Jalota

Hmm.. how much is the amount?

Is it reflecting in your Form 26AS?

Challan 286 is INCOME DECLARATION SCHEME,2016 CHALLAN so one has to careful.

Please consult a Chartered account or a tax lawyer to be on safe side.

while making payment of tax via challan 280, i wrongly entered cess amount in surcharge column, is there any way to tackle this problem. Please revert me as soon as possible

If the total amount is correct it does not matter. Income Tax Department looks at the total amount paid

I have paid Self Assessment Tax for FY 15-16 but by mistake i wright HUF pan card no behalf of Individual. so what i do now for correct this mistake

Sir my name is arjun. I was working in a Ca office as a trainee. yesterday I was made a mistake I was paid a self assessment tax amount of one of our clients but unfortunately that was wrong which was higher than the actual amount . so how to get refund from it department . and please tell me the procedure and period is taking for getting the refund

Sir my name is arjun. I was working in a Ca office as a trainee yesterday I was made a mistake I was paid a tax amount of one of our clients but unfortunately that was wrong which was higher than the actual amount . so how to get refund from it department . and please tell me the procedure and period is taking for getting the refund

Hi,

I first filed ITR myself which displayed 40000 rupees to be refunded by tax department. I filed and e-verified it. Later my CA told that i filled wrongly and he again filled a revised return in which I had to deposit 25000 rupees as self assessment tax to IT department. I filled challan 280 and deposited 25000 rupees and e-verified the revised return; but the next day I recieved 40000 ruppes tax refund from IT department from my previously filled ITR .

Can you tell me what can I do now? Will I get a notice from IT departement? Can I ask for refund of 25000 rupees which I deposited through challan 280?

Please help me.

Thanks

Deep

HI ,

I made a tax payment through ITN281 challan on my company TAN .Which is I need to pay through ITN280 Challan with PAN number.How can i rectify this.

Thanks,

Hari krishna

HI ,

I made a tax payment through ITN281 challan on my bank TAN .Which is I need to pay through ITN280 Challan with PAN number.How can i rectify this please?

Thanks

Hi

I paid Challan 280 for Self Assessment tax. I have mistakenly entered more amount in Cess which should have been entered in basic tax. However total amount is same which was due. What can i do to correct it?

As long as total amount is correct It does not matter.

Thank you for your quick response.

hello sir

we are paid vat amount from 01.01.2016 to 31.03.2016 but we are mansion period in challan 01.01.2017 to 31.03.2017 wrongly. how to correct it

hello sir

i have paid sales tax amount for the period of 01.01.2016 to 31.03.2016 but i have mansion in challan period from 01.01.2017 to 31.03.2017. how to correct it

These are stupid people want to harras common public. And they can’t do anything with a parallel economy of non-tax payers in India. What a shame !!!

Why can’t these officers apply the common sense . There is no online solution available. You have to visit them. Shame Shame Shame…

I am visiting there for last 6 months, filed RTI, and submitted huge number applications personally/speed post/online but no one is there to listen they just enjoy it.

my ITR is not yet clear, CA was asking me to pay 5000/- because some part of it would go to these people.

it seems unless I pay to CA service charge, they will not do anything.

IT dept has not processed my previous years returns and sending notice to file this year ITR, how will I manage my so many criminal cases along with the office work, my ITRs will not get clear if my previous ITRs are not closed

Let them do their job and you should do yours. The penalty for not doing your job is higher.

So Please fill in your ITR for AY 2016-17.

If my ITR is not clear can they put me in Jail?

I filed RTI to know why they are not processing my ITR, but till now my RTI has is just being transferred from one place to another, one’s From Gurgaon to Calcutta, and from Calcutta to Noida and from Noida one office to another, every month I get a letter saying my RTI is transferred to another office as the office it was transferred earlier was not right office. and I think it is perfectly fine as per the law of RTI that if your RTI does not reach in the right office they can transfer it to other office after taking one month time.

Hi,

I paid tax first time last year 15-16, I paid bank interest under Major head 0024 and minor head 300 . I want to change major head 24 to 21 . what i have to do now ? I send 4-5 mail to assessing officer . did got any reply. how to approve them. how to file complete. or any other process is there.

Try visiting the AO.

We don’t know of any other process

I am in outsite city for job not possible to go . is there any process file complaints.

I made the same mistake. and have written mail to my AO but no response.

probably they will not respond on mail, they may like to have you there so that they can tell you how it should be done.

otherwise there is no reason it cant be done on line

If only common sense was so common.

Even if you go yourself, they just take the papers and give acknowledgement.

Govt is trying to hasten the process but would take time

though I have send him application(given in this thread) by e-mail, and at the same time I will post it by speed post, but not sure if it will resolve the problem.

I paid the self assessment taxes using wrong chalan(282 with major head 024 instead of 280 and major head 021), please let me know anybody face the same issue and how did he dealt with it, I have already submitted a request for change in major head to my Assessing Officer but he is not doing anything, I raised online RTI but no impact till now (for last fifteen days), I have raised multiple Grievances on Income tax website, but no favorable response, I don’t know what to do next, any suggestion? if some one has faced this issue. if major head is not corrected my ITR will not get clear.

Sad to hear about your efforts to get the challan corrected. RTI also didn’t work? You have another 15 days. Hopefully you should get some answer.

Best wishes.

I shall check with our CA and find out if there is another way.

itne tarah ke taxes dene ke baad bhi income tax dept ek chhoti se mistake ke lie torture kar raha hai, lagta hai mistake nahi crime kia hai

Bikool sahin pakende hain aap.

what did your CA say?

They send me a income tax notice under 210.

Section 210: It is obligatory for every person to pay advance tax according to his/her estimate without any notice from the A.O. However, the A.O is also empowered to issue a notice to any person liable to pay advance tax under Sec.210,directing him to pay tax. This notice can be sent latest by the last day of the February of the previous year.

This means that you had an additional due tax of Rs 10,000 and you had to pay Advance tax. You have to see your income for the year and checkout how much tax was due. You can use help of a CA. Same draft letter for intimation under section 210 can be found here.

how to respond if i dont have any income this year

Can you please confirm if I want to pay advance tax,

I should use only

chalan-280

major head 0021

minor head 100

I hope if I pay like this it will not cause any mismatch while filing return for the interest from FD

I got a response for my RTI with screen shot showing that they have done it, but it is not yet reflected in 26AS, and Now my ITR status changed to “Rectification rights transferred to AST” I don’t know what should I do now, will it be processed by itself or I need to go there and push it through my AO

I have a question…

the reason people make this mistake is

major head 0024 is described as “0024-Interest Tax”

when people pay taxes on the interest they earn from saving/FD/TD,

they try to put the tax in right category, and because we are paying taxes on interest so the most appropriate category looks like “0024-Interest Tax”

my Question is what type of tax actually this major head (0024) is for?

I started a petition for this chalan correction should be available on to tax payer, if you agree with me please sign petition, so that income tax dept should get message that we are suffering and they should provide some online solution to it.

you can find my petition on change dot org

While you mail AO, also CC it to higher authorities like CBDT, CPC Bangalore, Ministry of finance (Head) as IT is part of Finance Ministry, or so since it may create a form of compliance for AO.

I don’t think AO is going to reply anyway since they have zero commitment to people, sad reality of our country and officers. Still just for increasing chances of answers.

Hi,

while paying self assessment tax for AY 14-15, by mistake i choose wrong major head and challan number as well. based on above thread, i need to contact AO officer.

so is it okay if we send email to them with the detail information or post all the documents or do we need to go in person to correct. which is recommended way to solve the issue ??

You are talking about AY 2014-15 so its better if you go atleast once and talk to AO. Then you can ask him how to follow up.

Do keep us updated

Dear Sir,

Advance tax paid for AY 2016-17 on 15-12-2015 around 9 p.m.

Date mentioned on challan is 16-12-2015.

How to get it corrected?

If advance tax is not paid by due date then Under Section 234B interest at another one per cent per month is payable for Default in Payment of Advance Tax, that is, if 90 per cent of the tax is not paid before the end of the financial year in which income is received.

We don’t think you would have a problem because of delay by a day in payment.

We shall try to dig up more and get back to you.

I have paid advance tax by e-payment by internet banking in Rs.80 Lakhs instated of Rs. 8.00 Lakhs for 2nd quarter dec’2015.

How can i rectification in challan in amount.

please assist me.

My bank has deposited the tax in wrong minor head. Bank has deposited the money in advance tax head instead of regular assessment. Due to this my assessment year also became wrong. tax deposited date is 05.10.15.please help me.

That’s sad to hear.

As it has been more than 7 days and there has to be change in Assessment Year and Minor Head you now need to approach the Assessing officer.

After the window period available to banks for challan correction, the assessee can make a request for correction to his or her assessing officer, who is authorized under the departmental OLTAS application to make such correction in challan data in bonafide cases, to enable credit of the taxes paid, to the concerned assessee.

Format of application to bank for challan correction to be requested by the taxpayer

To

The Branch Manager,

…………………………. (Address of Branch)

Taxpayer Details :

Taxpayer Name :

Taxpayer Address :

Taxpayer TAN/PAN :

Name of Authorized Signatory :

(in case of non-individual taxpayer)

Sub : Request for Correction in Challan No: 280/281/282/283 [Strike out which ever is not applicable]

Sir/Madam,

I request you to make corrections in the challan data as per following details :

Challan Details:

BSR Code Challan Tender Date (Cash/Cheque Deposit Date) Challan Sl. No.

Sl. No. Fields in which correction required Please Tick Original Details Modified Details

1. TAN/PAN (10 digit)

2. Assessment Year (YYYY)

3. Major Head code (4 digit)

4. Minor Head code (3 digit)

5. Nature of Payment (3 digit)

6. Total Amount (13 digit)

Note: Please tick against the relevant fields where changes are required.

Tax payer/Authorized Signatory Date

Note:

1. Attach copy of original challan counterfoil.

2. In case of correction to challan 280, 282, 283 attach copy of PAN card.

3. In case of a non-individual tax payer, attach the original authorization with seal of the non-individual tax-payer.

4. The request form for correction is to be submitted in duplicate to the bank branch.

5. A separate request form is to be submitted for each challan.

While paying the tax through challan 280 i selected wrong assessment year. It is mentioned that to approach “assessing officer”. How to find out the address of the assessing officer? Is there any link available for this?

Kindly clarify. Thanks in advance.

To know your Assessing Officer , (which is an optional field to fill in our ITR forms also) Go to incometaxindiaefiling.gov.in/e-Filing/Services/KnowYourJurisdictionLink.html and enter your PAN number. Our article How to find Jurisdictional Assessing Officer : Income Tax explains it in detailTo know your assessing office

Sir how did you rectify this mistake of selecting the wrong assessment year

And how long did it take to rectify this error??

Please let me know

i have mentioned wrong pan no (i.e. my huf pan no instead of my personal

pan no) while paying advance tax in march 2015 how to correct it.

Approach your assessing officer.

how much time restriction for wrongly asstt. year entered in itns 280 be rectified.

I paid self assessment tax online. I was supposed to pay some additional tax and interest of it. But while filling the challan, I entered entire amount (tax due + interest) under basic tax. Should I correct the challan or just leave it as is? What will be the implications if I don’t correct it?

As long as you have paid the full amount, no need to worry.

IT looks at the full amount.

So pat your back for doing your duty on time

I made payment for amount that was actually exempt (PPF & divided interest) through challan 280. Though i submitted the revised ITR-1. Do I need to do anything for the challan as well.

Hi,

While making online payment of Self Assessment Tax through bank, Assessment year was WRONGLY taken as 2014-15. The said challan is in respect of financial year 2015-16.

So how to change the assesment year.

Can you help please?

Thanks,

Shalu

For rectifications in challans paid through online mode (internet challan), taxpayer has to contact their concerned Assessing Officer (AO) of the Income Tax Department (ITD)

Hi,

In IT Self Assessment Tax Payment Challan No. 280, I filled up all details correctly including PAN, Name and other details and paid via bank. But, on separate receipt slip as issued from bank (not the counterfoil),the Name is in abbreviation, pan no. is correct.

Previously my Name in PAN Card was in abbreviation but in my new updated Pan, it is in full name as written on my challan by me. The bank official said the short name appeared on its own on entering the PAN, and not the full name. All my Income tax documents and 26AS all are generated with full name.

Will there be any problem, since PAN number is same.?

please respond.

We don’t think so as PAN is the same.

Check your Form 26AS and see if Self Assessment Tax is reflected there.

I have paid Self Assessment Tax for FY 14-15 (AY 15-16), but when the receipt was generated, it was showing Tax on Regular Assessment. I dont know whether it was my error or not.

Subsequently I have filed my ITR and also got it verified online through Adhaar Card OTP.

How to get the tax paid accounted under the correct head of Self Assessment Tax. Whether there will be any problem for the returns already filed online and e-verified

Hi,

While efiling my return for 2015-16, I found that I have tax oustanding of 14770. I made the e-payment by selecting Callan 280 and option 400 tax on regular assessment. Now, I got to know that I should have selected 300 self assessment tax.

I am not sure if I need to correct it and what impact it will have on my tax credit to for 26AS.

Can you please help?

Thanks,

Ajay