As per the tax law, most of the taxpayers have to file their returns electronically. You can file your income tax returns using the following Options. In this article we shall explore the various filing options.

- Do it yourself, file through Income Tax Department website https://incometaxindiaefiling.gov.in/

- Filing through a professional (Chartered Accountant/Tax Return Preparer (TRP)/Certified Financial Planner)

- Using an online e filing Service provider like Cleartax.in, MyITreturn.com, Taxspanner.com,Taxsmile.com

Table of Contents

Compare Ways of Income Tax Return Filing

My suggestion is no matter how you file your returns please understand what you are filling in, ask questions why is this so? Start by reviewing your Form 16 and ITR filed. I am not from the financial background but over the years I have learnt and shared my learnings.

Another suggestion Please do not postpone filing your returns till last week.

Select the Correct Assessment Year, Match Income and TDS with Form 26AS, You should have 0 tax due before filing ITR etc, Please check our article Mistakes while Filing ITR and CheckList before submitting ITR for more details.

| Income Tax efiling Websites | Professionals: CA, Tax Lawyers | Income Tax Websites: ClearTax, etc |

|

|

|

Steps to File Returns through Income Tax Department website

Steps to file the return by downloading the form and then uploading it

- You can only File ITR1/ITR4 online while logged in to Income Tax Website.

- For all others, one need to Download the applicable ITR Utility Excel or Java utility

- Fill the Form, Pay any due as Self Assessment Tax

- Generate XML and save it on the desktop

- Login to the portal. If you are first timer you need to Register on e-Filing website using your PAN Online

- Go to e-File – Income Tax Return – Upload Return

- Everify the return or Send ITR-V

Our article E-Filing of Income Tax Return explains the process in detail.

Steps to file your lTR-1/ITR4 online

- Register on e-Filing website using your PAN

- LOGIN to the portal.

- GO TO e-File – Income Tax Return – Prepare and Submit

Advantages and Disadvantages of using incometaxindiaefiling.gov.in

- Filing online tax returns through the Indian government website is free of cost.

- No guidance is provided while filing the returns nor post-filing.

- One should also have required software installed on his computer, for example, Microsoft Excel for excel or a proper version of Java to use Java utility.

- One should have basic technical skills such as knowledge of Excel or Java or use the internet for ITR1/ITR4.

- The utility provided by Income Tax Department contains sections which are full of tax jargons. A person must know tax laws, to fill in the form. One tends to fill up the information to the best of his/her knowledge. However the sections not being intuitive or simple, you may skip some questions which can impact your tax calculation. Ex Interest on FD, 80TTA

- Data of your Income, TDS etc reside on the computer where you have downloaded the utility provided by the Income Tax Department. Confidentiality of your data depends upon the security measure taken by you.

- Due to heavy rush, at times, Income Tax Department e-filing server gets slow, especially between July 20-31, resulting in a delay in e-filing of returns

If you are doing tax return filing yourself, please note that here you take full responsibility of what you enter and submit in your return to income tax department. So, at a later date, you cannot say that you calculated a certain deduction wrongly because of mistake and you don’t know IT provisions – in that case, you cannot expect any mercy from IT department and they will slap a hefty penalty treating as concealment of income.

A friend of mine didn’t know the difference between FY and AY so he filed for the wrong AY. He realised his mistake, filed the ITR for appropriate AY. As he did not send the ITR-V so he thought he has corrected his mistake till he got a notice from the Income tax department for the return processed for earlier year. I don’t want to scare you, filling income tax form is no rocket science but is not a cake walk either.

Filing through a Tax professional (CA/ CFP/ Tax Return Preparer (TRP))

For those who either are not very tech savvy and need a face to face contact with a professional the options are Chartered Account(CA), Tax Return Preparers (TRPs), Certified Financial Planner(CFP)

Chartered Accountant (CA): A CA is an expert in the areas of taxation, both personal as well as corporate. He can help you plan your taxes well. He is well versed with the latest tax laws. He is knowledgeable about accounting concepts, making balance sheets, reading the financials of a company.

Certified Financial Planner(CFP): provide a holistic view of all aspects of financial planning like Risk Analysis & Insurance Planning, Retirement Planning and Employee Benefits, Investment Planning, tax planning and Estate planning. One can consider the certified financial planner to be like the general practitioner MBBS.

Tax Return Preparer Scheme seeks to assist small and marginal taxpayers in preparing and filing their tax returns. Tax Return Preparers (TRPs) are professionally trained individuals by Income Tax Department who can come to your doorstep and assist you in filing your income tax return. This scheme is basically launched to help small and marginal tax payers. It was conceptualized by the Income Tax Department (ITD) and launched in 2006-07. TRPs will receive 3% of the tax paid on the returns prepared & filed for every new assessee in the 1st year (subject to a maximum of Rs. 1000), 2% in the second year and 1% in the third year and Rs. 250 for the returns prepared & filed for the old assessees.

For more details one can read Duties and Obligations of TRPs If you want to avail services of TRP then locate the TRP by visiting http://www.trpscheme.com/locate-trps.aspx and selecting your state, city or pin code(it’s below the map). You will get the TRP available in your area with his/her TRP ID and Mobile No.

Example of where consulting a professional helped

I had salaried income, and I filed ITR1 using the form 16.

Then came one financial year where I switched my job and I had two Form 16. Even though I found it a bit complicated, I could still manage myself. But my calculation showed that I had to pay a few thousand as tax. That’s when I thought of consulting a chartered accountant.

When he did the calculations, I didn’t have to pay extra tax. Instead, I got a refund of around Rs. 8,000 as my new employer didn’t consider the rent I paid during previous employment.

I wouldn’t have known this had I not consulted a professional.

Sometimes refund is due to some exemptions(HRA) not covered in Form 16 or some legal deductions that I could make use of. Had it been me on my own who knows nothing much about the financial stuffs, I would have lost a lot of money.

Our article How to Fill ITR when you have Multiple Form 16 explains the process in detail.

Advantages and Disadvantages of using Tax Professionals

- Since the burden of preparation and filing is taken over by the Professional, so you are not required to have any tax knowledge.

- However since the Professional would prepare your return by asking relevant questions and document provided by you, the accuracy depends upon the quality and relevance of questions asked by the Professional and data provided by you.

- To the Tax Professionals, you only provide the raw data. You are not aware of why such information has been asked and what is its implication on tax calculation.

- Tax Professional would prepare your return, based on his workload and hence there is always a wait period. If you go Tax Professional near the end of filing period you might get a hurried job.

- Fees charged by Tax Professionals varies and also depends upon the amount of income and type of income earned.

- Tax Professionals provide full post-filing support, but at an additional cost

- At Tax Professional, the confidentiality of your data depends upon the care and precaution taken by the Tax Professional

- Some of these Tax professionals just ask for Form 16 and PAN number so simple things like Interest earned on Saving Bank account or interest earned on PPF account get ignored. These need to be filled in ITR.

- Some of these Tax Professionals file online return on behalf of the client, providing their own email id and password. The client then has no way to track emails from the Income tax department.

Using online Tax efiling Websites: Cleartax,Taxsmile, Taxspanner,Taxshax,myITReturn

There are websites, like Cleartax, Taxsmile, Taxspanner etc, who file the returns. These websites are registered with the Income Tax department as an e-return intermediary. They provide you with a simple platform for inputting the details, which automatically fills the Income Tax department’s ITR form. For this benefit, they charge a fee.

Being an online tax preparation and filing portal can be accessed at any time, anywhere.

- They cover every aspect of return filing by asking intuitive and simple questions. Information of law has been taken into consideration while framing the intuitive question so that the user does not miss any part of his income and expenditure. There is no mention of complicated sections or tax jargons. Hence it is easy to understand the question and provide relevant data.

- Some of them also provide Chartered Accountant assisted filing.

- You must check that the portal encrypts the saved and transmitted data and is protected from hackers.

- You get emails from the Income tax department.

- All your data gets stored with such sites.

- You must check that the portal encrypts the saved and transmitted data and is protected from hackers.

How should you choose a tax-filing portal? The first step is to check whether the portal provides the form that you want. While most offer ITR 1 and ITR 2, few have the others. The next step is to see if the portal accounts for all the sections.

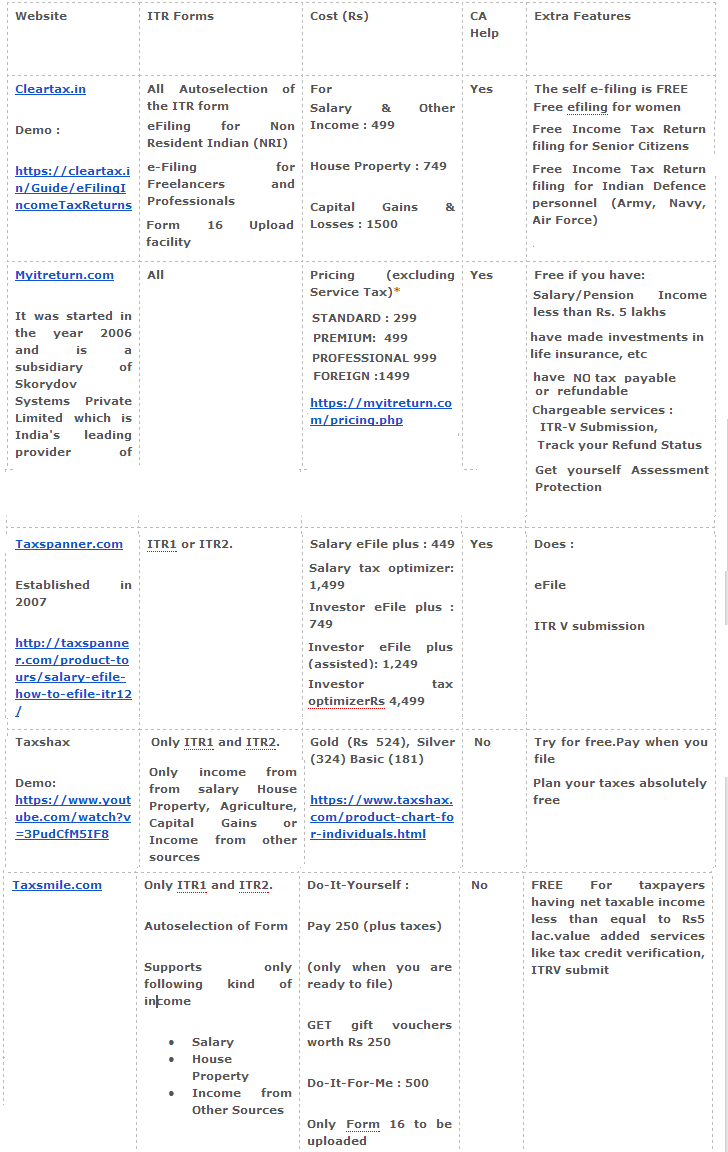

Table given below is the comparison of some of the online Income Tax efiling websites. Click on image to enlarge.

If you use online Tax efiling Service Provider which one do you use: ClearTax, myItReturn, Taxspanner, Taxsmile, Taxshax or some other.

Related articles:

- Understanding Form 16: Tax on income, Understanding Perquisites, Understanding Form 12BA

- Which ITR Form to Fill?

- Registering on Income Tax efiling Website,

- Fill Excel ITR form : Personal Information,Filing Status

- E-filing : Excel File of Income Tax Return

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

Filing income tax returns is not rocket science but it is not a cake walk or as easy as saying ABC. Like any other thing in life, it takes learning and patience. My suggestion is no matter how you file your returns please understand what you are filling in, ask questions why is this so? Start by reviewing your Form 16 and ITR filed. I am not from the financial background but over the years I have learnt and shared my learnings. Another suggestion Please do not postpone filing your returns till last week. How has been your experience with filing income tax return?

Extremely Nice data about the documenting wage government form online through site. There are heaps of online tax filings sites accessible in India. You can include these destinations in this article moreover.

Income Tax Return Filings

Very Nice information about the filing income tax return online through website. There are many efiling websites available in India. You can add these sites in this article also. One can view them at https://www.topteninsider.com/income-tax-efiling

This information is indeed very useful. But I would like to know that if one files the income tax return through a Chartered Accountant, then who is responsible for any omission or any kind of mistake. (Even after we provide all the information asked by a CA)

Interesting question. You are responsible for your ITR. It’s your income, your return.

Infact many CA don’t file as tax prep rarer but file as you. Many don’t give password to their clients too.

Filing through CA has advantage like you claim deductions, some tax saving advice and incase of tax queries you can authorise him to represent on your behalf.

But you cannot do away with your responsibility. Please maintain proper records and try to learn about basics of finance.

Very Nice Collection of informative information..

It is helpful for all blog reader or that person looking for such a information.

Thanks for sharing

Excellent blog which makes to get a good knowledge for people like me who do not know what is Income Tax. But it will be better to train interested people to file their returns by the IT department as is like TRP’s.

Well said. We have trying to spread awareness about income tax returns in our small way. We have seen many people are just interested in filling form not understanding the income tax.

We have open offer to give free training session on Income Tax in Bangalore but not many have opted for it.

Nice Blog you have post related for income tax i really appreciate your blog and thanks for sharing this information. Service Tax Acts Online

Nice Blog you have post related for income tax i really appreciate your blog and thanks for sharing this information. Service Tax Acts Online

Thanks for sharing this post, It help me to improve my knowledge in ITR Filing

Thanks for kind words Anu. Glad to know it helped you

Thanks for sharing this post, It help me to improve my knowledge in ITR Filing

Thanks for kind words Anu. Glad to know it helped you

Thank you. Very helpful.

Thank you. Very helpful.