This article talks about how to fill Salary details from one employer only by an individual in Income Tax Return, ITR1 and ITR2. Individuals who were earlier asked to provide only the taxable amount of salary in ITR1 are now required to provide the break-up of their salary such as allowances, not taxable, perquisites etc in ITR1 for FY 2017-18. There is no change for filling Salary Details in ITR2 from last year.

The last date to find ITR for income earned between 1 Apr 2018 to 31 Mar 2019 i.e FY 2018-19 or AY 2019-20 is 31 Jul 2019. Then one can file till 31 Mar 2020 but with a penalty.

AADHAAR CARD is Compulsory FOR TAX FILING

Table of Contents

Before Filing Salary Details in ITR for AY 2019-20

Salary details to be filled in for FY 2018-19 or AY 2019-20 is simpler than last year AY 2018-19. Filling Allowances not exempt in FY 2017-18 or AY 2018-19 was not direct. One just needs to get the details from Form 16 and Form 12BA. Exempt Allowances like HRA, LTA are now in Salary Details section.

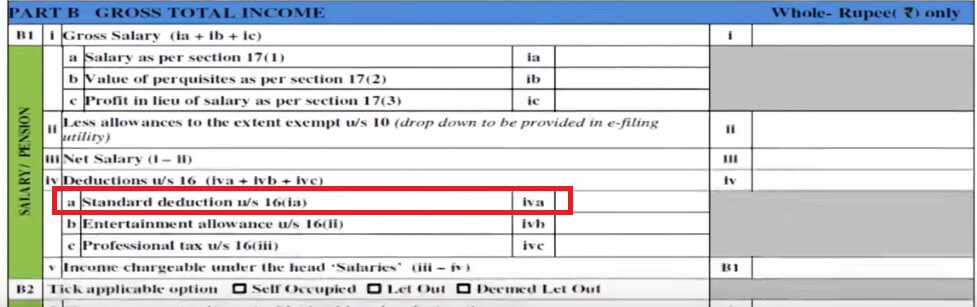

Income tax return ITR for salaried in FY 2017-18 required taxpayers to provide full details of their salary income i.e the break-up of their salary such as taxable allowances, allowances not taxable. Note that Salary consists of BASIC SALARY + TAXABLE ALLOWANCES + EXEMPT ALLOWANCES+ Values of Perquisites+ profits in lieu of salary+Deductions u/s 16 as shown in the table below.

Changes for FY 2018-19 that you have to be aware of are which we have covered in detail in our article ITR for FY 2018-19 or AY 2019-20: Changes, How to file

- For Salaried and Pensioners Standard Deduction of Rs 40,000 is available,

- New Section 80TTB for senior citizens for interest on FD etc and

- Long Term Capital Gain (LTCG) on equity

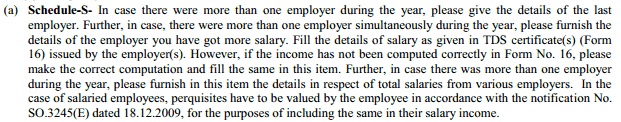

Instructions to fill the Salary details from Income Tax Department in ITR1 is shown in the picture below. So if you have more than 1 Form 16 for this year, you need to calculations as explained in our article How to Fill ITR when you have multiple Form 16

Documents needed before filling Salary Details

To fill the salary details in ITR one needs

- Form 16 issued by the employer. Form 16 is the proof given by an employer to all its employees with the complete details of income (salary), the amount deducted as income tax (TDS) for each month and the total tax payment.

- Form 12BA: Form 12BA is a statement showing particulars of perquisites, other fringe benefits or amenities and profits in lieu of salary. Perquisites are benefits provided by the employers in addition to the normal salary at a free of cost or concession rates such as Free Meals, Gifts, vouchers etc, Interest-free or concessional loans, RSU or ESPP by the employer. Details about Form 12BA can be found here and about perquisites here.

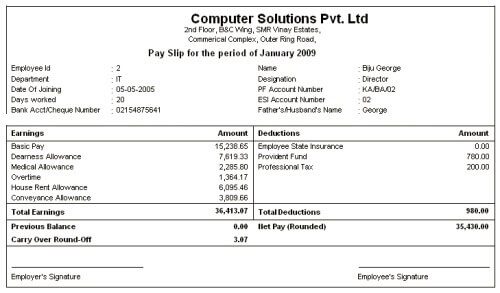

Pay Slip to find Basic Salary.

Note:

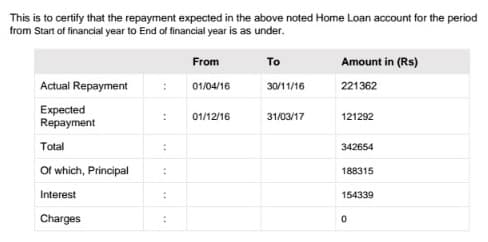

- If you have not been able to claim the exemptions (HRA allowance), deductions (as in 80C, 80D), the certificate showing the principal and interest breakup on loan on house property please keep information handy as you can claim these deductions while filing your Income Tax Return. One is required to submit details of the home loan to employer based on Home loan certificate from the bank. Our article Submitting Home Loan Interest Proof to the Employer with PAN of Lender covers it in detail.

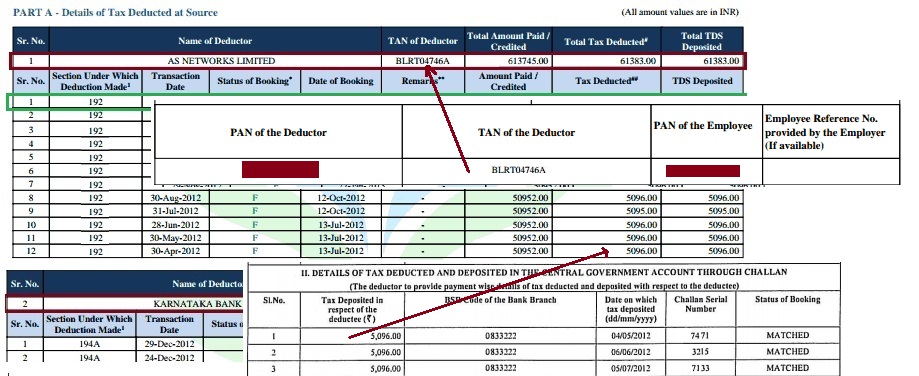

- Before filing Please Verify that TDS mentioned in Form 16 matches TDS information in part A of Form 26AS. as shown in the image below Salary details are in Part A of Form 26AS. Excerpt of Form 26AS is shown below(It shows for the year 2012-13. You should check for FY 2018-19 or AY 2019-20) Our article What to Verify in Form 26AS? explains how to view the Form 26AS, what exactly to verify in Form 26AS with the Form 16, Form 16A issued and Advance Tax, Self Assessment Tax paid.

Match Form 16/Form16A entries with PartA of Form 26AS

Our article Understanding Form 16: Part I,Understanding Form 16: Chapter VI-A Deductions, Understanding Form 16 – Part 3 explains it in detail.

How to Fill Salary Details in ITR1, ITR2 etc

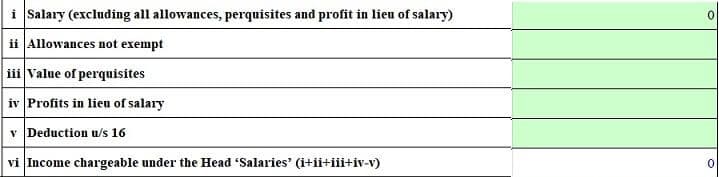

Income tax return ITR1 for FY 2018-19 requires taxpayers to provide full details of their salary income. Individuals can now fill information from Form 16 and Form 12BA.

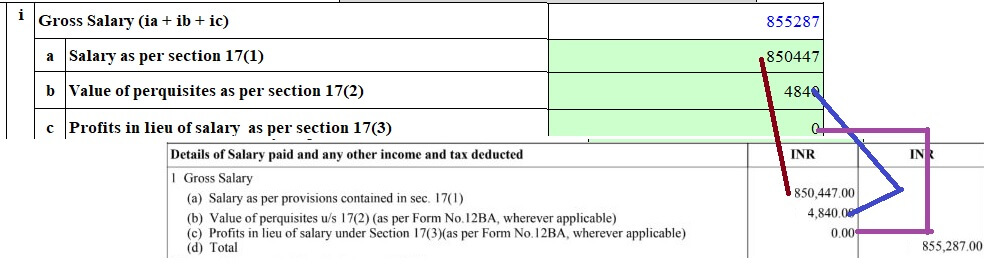

In ITR1 one needs to fill Schedule (or section) S, Income from Salary is shown below. All the details can be found in Form 16 and form 12BA for perquisites. Fill in details as shown below.

- Fill in row a Salary as per section 17(1) in Schedule S from (a) Salary as per section 17(2) in Form 16. In the image shown below, it is 8,50,447

- Fill in row b Value of Perquisites as per Section 17(2) from (b) Value of perquisites under section 17(2)(as per Form No:12BA, wherever applicable) in Form 16. In the image shown below, it is 4840

- Fill in row c Profits in Lieu of Salary as per Section 17(3) from (c) Profits in lieu of salary under section 17(3) (as per Form No:12BA, wherever applicable). In the image shown below, it is 0.

Fill in Exempt Allowances in ITR1, ITR2 etc

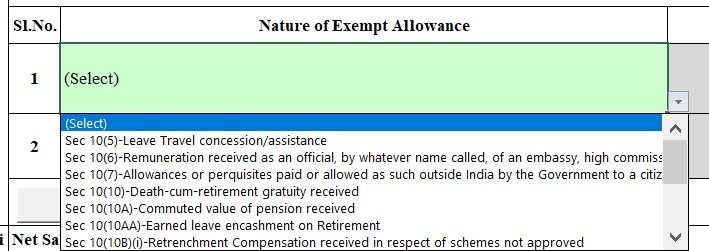

Select the drop-down and choose the Exempt Allowances mentioned in your Form 16. Other than HRA which you can claim while filing ITR if you missed providing details to your employer, Common Exempt allowances are given below. For List of benefits available to Salaried Persons and sections, you can check the Income Tax webpage here. Please claim those exempt allowances which appear in your Form 16. You can claim HRA while filing ITR. You CANNOT claim LTA while filing ITR.

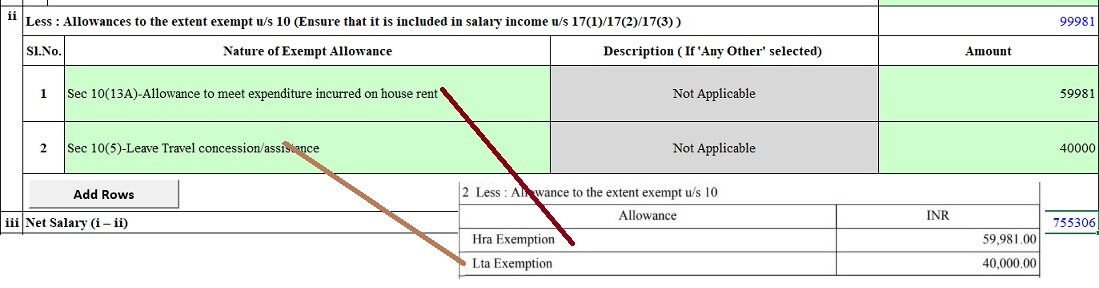

The image below shows the ITR with Exempt Allowances filled from Form 16.

- Section 10(5) Leave Travel Concession LTC or LTA: An employee can claim exemption under section 10(5) in respect of Leave Travel Concession.

The exemption under section 10(5) is available to all employees (i.e. Indian as well as foreign citizens).

The exemption is available in respect of the value of any travel concession or assistance received or due to the employee from his employer (including former employer) for himself and his family members in connection with his proceeding on leave to any place in India. - Section 10(13a) –HRA Exemption: HRA is partially exempted. An allowance granted to a person by his employer to meet expenditure incurred on payment of rent in respect of residential accommodation occupied by him is exempt from tax to the extent of least of the following :House Rent Allowance actually received by the assessee

Excess of rent paid less 10% of salary* due to him

An amount equal to 50% of salary due to assessee - Section 17(2) Medical Reimbursement and Conveyance Allowance: Has been removed. It is now covered under Standard DeductionEarlier one could submit bills for medical expenses to the employer and claim reimbursement. From FY 2018-19 this has been removed. Medical allowance and medical reimbursement are two different things.

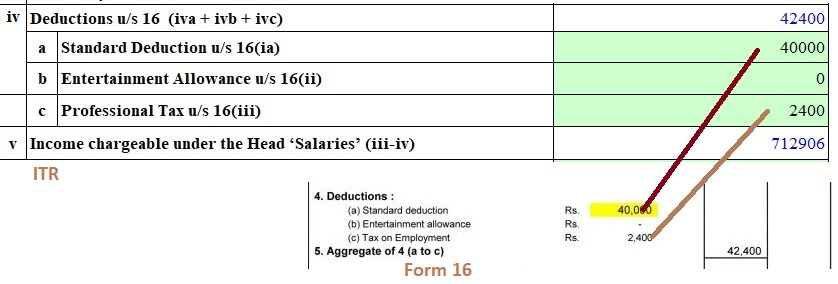

- Fill in row numbered v Deduction u/s 16 in Schedule S a from 4 in Form 16. It includes Allowances such as Entertainment Allowance and Tax on Employment. In above example, it is 2400.

Fill Deductions in ITR

The standard deduction is essentially a flat amount subtracted from the salary income before calculation of taxable income. The maximum amount of standard deduction that can be claimed by a salaried individual/pensioner is Rs 40,000 for the financial year 2018-19, as shown in the image below (It was increased to 50,000 Rs for FY 2019-20 announced in the budget 2019 which is applicable from 1 Apr 2019)

Understanding Salary

Money that is received under Employer-Employee relationship is called as Salary. If one is a freelancer or are hired by an organization on contract basis, their income would not be treated as salary income.( In such case your income would be treated as income from business and profession). The salary consists of following parts

Basic Salary: This is the core of salary, and many other components may be calculated based on this amount. It usually depends on one’s grade within the company’s salary structure. It is a fixed part of one’s compensation structure.

Allowance: It is the amount received by an individual paid by his/her employer in addition to salary to meet some service requirements such as Dearness Allowance(DA), House Rent Allowance (HRA), Leave Travel Assistance(LTA) , Lunch Allowance, Conveyance Allowance , Children’s Education Allowance, City compensatory Allowance etc. Allowance can be fully taxable, partly or non taxable.

Perquisite: Is any benefit or amenity granted or provided free of cost or at concessional rate such asRent free unfurnished house, Rent free furnished house, Motor car facility, Reimbursement of Gas, Electricity & Water, Club facility, Domestic Servant Facility, Interest Subsidy on Loan , Reimbursement of medical bills, Reimbursement of Hospital bills, Reimbursement of telephone bills, Benefits derived by employee stock option, and so on. Form 12

How tax affect the various components of salary

| Component of Salary(per annum or p.a) | Amount | Tax | Taxable Amount | Exempt |

| Basic Salary | 480,000 | Full amount is taxable | 480,000 | 0 |

| Dearness Allowance | 48,000 | Depends on company policy. Mostly fully taxable. | 48,000 | 0 |

| House Rent Allowance | 96,000 | Applicable if living in a rented house. Minimum of three amounts (Note:Calculation shown below) | 52,800 | 43200 |

| Conveyance Allowance | 22,200 | Conveyance allowance of Rs 9,600 per annum is exempted from tax. If salary component is more than 9,600, the remaining part is taxable.In this case:22,200-19,200=3000 Starting FY 2015-16, this limit has been increased to Rs.19,200 per annum. | 3000 | 19,200 |

| Entertainment Allowance | 12,000 | Depends on company policy. Mostly fully taxable. | 12,000 | 0 |

| Overtime Allowance | 12,000 | Fully taxable | 12,000 | 0 |

| Medical Reimbursements | 15,000 | If substantiated with bills, are exempt to a limit of Rs 15,000 annually | 0 | 0 |

| Gross Salary | 6,75,000 | Gross Taxable Salary | 6,07,200 |

Related Articles :

- E-Filing of Income Tax Return, E-filing : Excel File of Income Tax Return, Which ITR Form to Fill?

- Fill Excel ITR form : Personal Information,Filing Status

- Fill Excel ITR1 Form : Income, TDS, Advance Tax

- Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

- Paying Income Tax : Challan 280

- How to fill ITR1 for Income from Salary,House Property,TDS

- Income Tax Notice for Inconsistency in Salary Income and Form 26AS

- Mistakes while Filing ITR and CheckList before submitting ITR

- Which ITR Form to Fill?

Disclaimer: Please use the article the for informational purpose only.

Hope this article helped you to fill in the salary details using Form 16 and Form 12BA. if you want something missing do let us know. If it helped you then please leave a comment. It would mean a lot to us. If you found this article helpful, please share the link on Facebook/Twitter.

Sir

I have received arrears from 1999 to 2011 recently in which my DA is negative but when i fill that amount in ITR 2 it shows invalid amount

Thanks this blog has really helped me alot. This really helps and tells a process that is required to fill up an Income tax return.

Thanks a lot for sharing this.

MAINE PERQUSIST AUR ALLOWENCES EXMPT INCOME NATURE OF INCOME ME NAHI DALA AUR FILE KIYA TO KUCH PROBLEM HOGA KYA

As long as you have paid all taxes due it is OK.

You might get a notice and would be given a time limit to reply.

So you have 2 options

1. revise return and fill in details

2. Wait for the notice which may or may not come. And in that case you will have to revise the return.

Its your call.

Hi,

Thanks for such an informative article. So far as per your responses above what I understood is that to fill 27.d Of ITR-1 Exempt Income(For Reporting purpose only) for FY 2017-18

1.Conveyance Allowance: 19200 –> Section 10(14)(ii)

2.Education Allowance: 1200 –> Section 10(14)(ii)

3.Medical Reimbursements(Reimbursements on bill submission):15000 –>Any Other with Description as Exempted under section 17(2)

How to fill following items in 27.d Of ITR-1 Exempt Income(For Reporting purpose only) for FY 2017-18

4.Books And Periodical (Reimbursements on bill submission):12000 –> ???

5.Meal Passes(Sodexo):23000 –>??

6.Misc Allowance:20000 –??

Thanks in advance.

How have they shown in your Form 16?

Are they showing up as perquisites?

Can you send the snapshot of that to bemoneyaware@gmail.com

All these are shown under point 2 (Less :Allowance to the extent exempt u/s 10) of form 16.

Thanks

Hi,

Your article was very informative. I have one query. I need to know where to fill the medical allowance

exemption u/s 10 in ITR1 for FY 2017-18? Form16 details mentioned below for your reference.

Less :Allowance to the extent exempt u/s 10

Allowance Rs.

House Rent Allowance 161,308.00

Medical Allowance 15,000.00

Transport Allowance 19,200.00

Total: 195,508.00

Thanks in advance.

Hi Sir,

Very informative article.

I have one query:

I have been provided form 16 with following details of exemption u/s 10. I need to know where do I need to fill Medical allowance exemption of 15000 Rs. There is no option to fill it in the ITR1 under exempt income for reporting purpose section.

2. Less :Allowance to the extent exempt u/s 10

Allowance Rs.

House Rent Allowance 161,308.00

Medical Allowance 15,000.00

Transport Allowance 19,200.00

Total: 195,508.00

Thanks,

Vishal

If you have Medical Reimbursement then to show it in ITR as exempt income show it with Nature of Income as Any Other with Description as Exempted under section 17(2) as shown in the image here. Please claim this only if it appears in your Form 16.

Thanks for clarifying. I am confused because it is appearing in my form 16 as Medical Allowance u/s 10 but medical allowance/reimbursement should be u/s 17(2). So still I can put it in exempt income u/s 17(2) ?

Below three allowance is appearing u/s 10 in my Form16.

Less :Allowance to the extent exempt u/s 10

Allowance Rs.

House Rent Allowance 161,308.00

Medical Allowance 15,000.00

Transport Allowance 19,200.00

Total: 195,508.00

I know it sucks.

But that is the only workaround we can suggest.

Why Form 16 shows Medical Allowance under section(10) we are digging into and will update you.

Thanks a lot..

Very informative article. Thanks for sharing.

I need one clarification. In the section “How to Fill Salary Details in ITR2”, you have given the image showing allowances not exempt as zero. Will this also be not the same as ITR1 calculation?

Allowances, not exempt=SALARY AS PER PROVISION CONTAINED IN SEC 17 (1)* – EXEMPT ALLOWANCES – BASIC Salary.

Good catch Sir. Thanks a lot.

Have updated the article with the correct image.

Thanks! One more doubt creeped in after this correction. The conveyance allowance 19200 is declared under sec 10(14) in ITR1, but in ITR2 it’s declared under sec 10(10cc). Any specific reason? Which one is correct section to declare conveyance allowances?

Transport allowance has to be claimed under section 10(14) in any ITR.

Transport Allowance is a type of allowance offered to employees of a company to compensate for their travel from residence to and from respective workplace location.

For AY 2018-19 Conveyance allowance is given an exemption of up to Rs.19,200 per annum or Rs.1,600 per month. The sections under which this exemption is applicable are Section 10(14)(ii) of Income Tax Act and Rule 2BB of Income Tax Rules.

in ITR2 it has to be shown as Others

and Nature of Income as 10(14)(ii)

10(CC) is Tax on Perquisites Paid by the Employer [Section 10(10CC)]

Sir, My Employer unable to provide me Form 16 before the deadline, I filled my ITR without Form 16 information from the employer, after some time, I received Form 16 from my employer. Now how can I reimburse my TDS deducted from salary?

I don’t want to revise otherwise I have penalized.

Fantastic article. Thank you for the effort.

Thanks for encouraging words.

Thank you for commenting.

Sir,

I am trying to file ITR with ITR 1. I have one house property let out with a home loan taken during 2016-17.

I have entered the rent received, taxes paid and interest paid to bank.

After subtracting rent received and tax paid with 30% std deduction from the interest paid, the total loss is about 205,000. So the utility fills -200,000 as the loss automatically.

The remaining 5,000 i am claiming under sec 80EE s I am eligible for that. Hence no loss to carry forward.

When I submit the xml, its throwing below error.

“The sum of individual values under the head of house property cannot be different from the income chargeable under the head house property”

It basically means the automatic loss of -200,000 (filled by the utility) under income chargeable under the head house property does not match with the sum of the columns which comes to -205,000.

What do we do here?

Its not allowing me to file the ITR.

Hi, I am also facing the same issue. In my case, the total is less than Rs 800 from 2 lakh. Even if i increase the rent to match the calculation of 2 lakh, i still cant submit the form online. Any suggestions?

HI

I also have the same issue..Any Solutions ?

Can you send details at bemoneyaware@gmail.com so that we can try it and pinpoint the problem?

Send the Interest income, Rent details and snapshot of the ITR for House property that you have filled.

Can you send details at bemoneyaware@gmail.com so that we can try it and pinpoint the problem?

Send the Interest income, Rent details and snapshot of the ITR that you have filled.

We tried it both online and using latest Excel utility and we did not face any problem.

When are you getting the problem?

Video does not have sound after 04:30. Please reupload

Thanks for Info.

Uploaded the new video.

Hi,

Thanks for he info. I have 3 questions if you can answer:

1. Where to fill medical allowance amounting to 15000 and education allowance amounting to 2400 (100/child/month) in ITR2.

2. in your example for filling conveyance allowance , you have used Sec 10(14)- amount received towards expenditure for ITR1 and Section 10(10CCC) in ITR2. isnt that wrong. ITR2 also has option of section 10(14) in other allowances section.

3. Can we combine conveyance and education allowance (19200+2400) and fill 21600 in section 10(14).

Thanks

Corrected in the image. Thanks for informing.

We had corrected in Video but missed in the article.

Yes you can combine conveyance and education allowance under section 10(14) in ITR2

Hi,

Could you please help also in guiding where to fill medical bill reimbursement amounting to 15000 in ITR2

Thanks

Nitin

Does the medical bill reimbursement amount come up in Form 16?

IF yes, can you send the snapshot of Form 16 to bemoneyaware@gmail.com

It is not shown exactly in form 16. Form 16 consists of deductions under section 10 and it consists of total amount of all the deductions. There is no details in form 16 of what components it consists of but as per my salary slips, the total amount is total of (medical reimbursement/LTA/Conveyance allowance/Children Education allowance/HRA).

Shown as below

2. Less: Allowance to the extent exempt u/s 10 — 2,55,750.00

I worked in India till Dec’2016 as salary employee. In jan i moved to Bahrain Gulf (with another employer in Bahrain Itself). I got salary in foreign currency itself in foreign a/c.

Please let me know should i pay any income tax on salary income earned in foreign (FTP Jan to March’17) . Further there is no personal income tax in Bahrain. It is tax free salary.

If yes, then which ITR to be prepared & which head income to be shown.

I AM A SALARIED PERSON. I RECEIVE MY SALARY IN CASH AMOUNTED TO RS 25000 PER MONTH. MY EMPLOYER DO NOT KEEP RECORD AND DO NOT DEDUCT TDS ON THIS AMOUNT. HE DOES NOT HAVE TAN NO. HE HAS NOT ISSUE FORM 16 AT ALL.

WHICH ITR SHOULD I FILE FOR F Y 214-15?

CONTACT 8793939479

As your income is above 2.5 lakh you should have to file your income tax. But your employer has to deduct TDS also.

Are you planning to file ITR for all past years starting with FY 2014-15?

remember these are belated returns so cannot be revised.

If you do not have any tax liability or if you have a refund, then there will be no penalty or interest on late filing of return. However if you have a tax liability, you will have to pay the normal interest (under Section 234A of the Income Tax Act) at 1% of the tax liability for each month, or part thereof for delay in filing the return. If you are liable to pay advance tax as per the Income Tax Act, you will have to pay the interest on default in payment of advance tax under Section 234B and the interest on deferment of advance tax under Section 234C.

Hello Sir,

I am a salaried person with income of 5L pa. Further My deductions of TA and Tax on employment is more than 5000. Do I need to fill ITR2 form or ITR1 will be ok?

Further where can I write the Housing Loan Interest in online form. Should I mention in negative in “Income from House Property”

Thanks

I have LTCL of Rs. -100,000 in current AY, how do i set-off in coming years? For e.g., in Next AY if I gain LTCG of Rs. 70,000, then how to carry forward the balance of Rs. -30,000 and under which section do I mention this in CFL? Should I mention only this Rs. -30,000 or should I mention Initial LTCL of Rs. -100,000 and LTCG of Rs. 70,000; and then this balance of Rs. -30,000. It would be helpful, if you reply with ITR2 snapshot by entering these values.

I have actually discovered a web site that has the most affordable rates on name brand flashlights. This website says it has quickly shipping in a protected online order atmosphere. If you are searching for flashlights for outdoor camping or emergency situations this is a site you should check out.

I’m a psu bank employee. My form 16 includes tax paid by me as well as my employer on behalf of me on perks in form 12ba. How to show tax paid by employer in my itr1

sir,

i m salaried person working in government sector , company paid to me 10000/- per month as a flying kit maintenance allowance(uniform maintenance) which comes under the income tax section 10(14).Company cut the TDS on the above money . sir how to file return for refund plz suggest me if any documents required for that at the time of filing return and after that.

regards,

suraj

sir,

i m salaried person working in government sector , company paid to me 10000/- per month as a flying kit maintenance allowance(uniform maintenance) which comes under the income tax section 10(14).Company cut the TDS on the above money . sir how to file return for refund plz suggest me if any documents required for that at the time of filing return and after that.

dear sir,

i m salaried employee. i am going to file first time itr. at time of documents submission in company i have submitted all thing to save tds but when i received form 16 i saw that my tax has deducted for financial year 15-16.

i have submitted a certificate for permanent disability of my father for 50000/- exemption but this was not appearing in form-16/TDS.

please guide me how to get deducted tax.

Regards,

Yogesh

Please verify with your company why they did not include permanent disability of your father?

If they have missed you can claim it while filing ITR for exemptions undex Section 80DD or 80DDB.

Deduction under section 80DD of the income tax act is allowed to Resident Individuals or HUFs for a dependant

-who is differently abled and

– is wholly dependent on the individual (or HUF) for support & maintainance.

Below are the conditions you must meet to avail this deduction –

Deduction is allowed for a dependant of the tax payer and not the tax payer himself.

The taxpayer is not allowed this deduction if the dependant has claimed a deduction under section 80U for himself/herself.

Dependant in case of an individual taxpayer means spouse, children, parents, brothers & sisters of the taxpayer. In case of an HUF means a member of the HUF.

The taxpayer has incurred expenses for medical treatment (including nursing), training & rehabilitation of the differently abled dependant or the tax payer may have deposited in a scheme of LIC or another insurer for maintenance of the dependant

Disability of the dependant is not less than 40%.

Disability is as defined under section 2(i) of the Persons of Disabilities Act, 1995

When the above conditions are met amount of deduction allowed is –

Rs 75,000 where disability is more than 40% and less than 80%

Rs 1,25,000 where disability is more than 80%

These deductions are allowed irrespective of your actual expenditure.

Details on Section 80DDB

This deduction is in respect of medical treatment of a specified disease or ailment as prescribed by the Board.

80DDB deductions are also available to individuals or HUFs and are available for expenditure incurred in respect of assessee himself or his dependent spouse, children, parents, brothers/sisters.

In order to get 80DDB deduction the assessee has to submit a certificate in the prescribed form from a neurologist, oncologist, urologist, haemotologist, immunologist or such other specialist as prescribed working in a government hospital.

My employer has not mentioned following allowances in section 10 of form 16.

1. Education allowance

2. LTA

3. Leave Encashment

but these are mentioned in annexure to form 16. Can I file the ITR after subtracting these allowance from the “income chargeable under the head salaries (3-5)…

Dear Sir/Madam,

This Financial year I am going to file my ITR for the first time

My form 16 shows income chargeable under head salaries Rs.399,515.00. It does not include HRA exemption, I can claim Rs. 56,400 in HRA

I am going to fill ITR form 1 ,Can I directly show “income from salary/pension” in form Rs. 399515-56400=343115??If not then please suggest how I can claim HRA

Thanks in advanced

Regards

Rahul Chanouria

Delhi

If your HRA has not been accounted in Form 16, you can still claim it by calculating HRA As the HRA was not claimed, taxable income would be more hence employer would have deducted tax on it. Now when you claim it in ITR you tax liability would get reduced (and in cases where you have paid more tax than due you might get refund also) Our article How to Claim Deductions Not Accounted by the Employer explains it in detail.

Dear Sir/Madam,

Today I was looking for information to decide the ITR form to file.

My income is only from interest on deposits & bonds. I was under impression that I must file ITR-1. But on Internet I found that ITR-1 can not be filed if exempt income is more than Rs. 5000/- & ITR-2A

can be filed only if I have Salary Income. So, I am confused which form to file? Kindly correct me if my understanding is wrong.

I started filling Form ITR-2A. But it seems filling details in Schedule OS 1d are mandatory even if income from the heads is 0. In fact none of the heads in 1d (5BB,115A(i,ii etc) are applicable to me but Calculate Tax does not allow to leave 1d(1,2,3,4,5) empty & I have to select heads forcibly & randomly with Income 0. This does not look proper to me. Kindly suggest.

Can you send me a link which provides detailed information about filling or leaving different Schedules & their sub sections.

Kindly reply ASAP.

Thanking you. Best regards, RAKESH

You can only file ITR-1 if the exemptions you claim under Section 10 are less than or equal to Rs. 5,000.

You should file ITR-2 if your maximum exempted income exceeds Rs. 5,000. Certain incomes are exempt under Section 10 of the Income Tax Act. Allowances which may be exempt to a certain extent include:

HRA

Transport Allowance

LTA etc.

Gratuity, leave encashment and pension may be exempt under Section 10 of the Act.

As you are not an employee you have no exempt income under section 10.

So you can file ITR1. Mention Income form Salary as 0

Dear Sir,

Thank you for your quick reply.

I forgot to mention that I have Interest Income from Tax Free Bonds too so even though there is a income from these but it is tax exempted which must also be shown in ITR (kindly confirm this). But, ITR-1 does not have a schedule EI which is for this purpose I guess so either ITR-2 or ITR-2A must be filled? As I do not have income from Capital Gain, so most appropriate form me will be ITR-2A.More over, I can hide unwanted Schedules (like OS) with the help of

Home sheet of ITR-2A sheet.

Kindly comment.

Best regards. RAKESH

Hello experts..

I am going to file my father return for FY 15-16, he got retired in FY 15-16 and he has received grauity leave encashment and commutede pension which is exempt, now my question is which ITR Form should i use ??…and how to show the above exempted income in ITR

Good to know that you are handling your father ITR.

Short ans: Taxable under what head:- Gratuity received by an employee on his retirement is taxable under the head “Salary” and gratuity received by the legal heir is taxable under the head” Income from Other Sources”. If you want to Show it explicitly you need to fill ITR2 and show it under Other allowance. Please note the Income that has to be mentioned in salary is 1a mentioned in Form 16 – all alllowances mentioned in Form 16.

Please check YouTube video for detail.

Tax treatment of gratuity :- For the purpose of exemption of gratuity under sec.10 (10) the employees are divided under three categories:

Any death cum retirement gratuity received by Central and State Govt. employees, Defense employees and employees in Local authority shall be exempt.

Any gratuity received by persons covered under the Payment of Gratuity Act, 1972 shall be exempt subject to following limits:-

For every completed year of service or part thereof, gratuity shall be paid at the rate of fifteen days wages based on the rate of wages last drawn by the concerned employee.

The amount of gratuity as calculated above shall not exceed Rs. 10,00,000/-

In case of any other employee, gratuity received shall be exempt, subject to the following exemptions

Exemption shall be limited to half month salary (based on last 10 months average) for each completed year of service or Rs. 10 Lakhs whichever is less.

Where the gratuity was received in any one or more earlier previous years also and any exemption was allowed for the same, then the exemption to be allowed during the year gets reduced to the extent of exemption already allowed, the overall limit being Rs. 10 Lakhs.

As per Board’s letter F.No. 194/6/73-IT(A-1) Dated 19.06.73 exemption in respect of gratuity is permissible even in cases of termination of employment due to resignation. The taxable portion of gratuity will qualify for relief u/s 89(1).

Gratuity payment to a widow or other legal heirs of any employee who dies in active service shall be exempt from income tax subject to provisions mentioned above Circular No. 573 dated 21.08.90).

The ceiling of Rs. 10 lakh applies to the aggregate of gratuity received from one or more employers in the same or different years.

I retired on 31.01.2016. I received some dues like leave encasement,GPF,Gratuity,and commutation etc,which is u/s 10. Please help me to know, In which ITR should I mention those all dues?

Warm regards,

Pratap Palan

Sir these come under Income from Salary so some part of Gratuity, leave encashment is exempt income.

You can enter all the exempt income in ITR1 as Exempt Income

or

you can fill ITR if you want to show the break up

Gratuity exemption should be entered in the allowances field, which are exempt under section 10.

Thank you very much, Sir…..

I have received lic maturity rs 1 lac which is fullybtax free. there is no coloum of sec 10(10)D to show this exempted amount in new itr1. so where I should mention this to get tax benefit. I am pensioner and if I include this amount, I am liable to pay tax, but actually I am not. please guide where to show. amount received on maturity of lic policies.

The maturity proceeds received by you are exempt under Section 10(10D) and should be shown under exempt income.

So in ITR1 show it as Exempt Income along with any other exempt income that you may have

The ITR-2 Form is the Income Tax Return form for Individuals and HUFs who do not have any income from Business or Profession. How do I fill out my ITR-2 Form?

I undertook domestic travel with family in the FY2014-15. But I could not intimate the employer about the same, to get the exemption on LTA (I have not claimed LTA exemption before). Is it possible to claim this LTA exemption through my IT return for FY 2014_15 (the same way as HRA exemption can be claimed while filing IT return). Can LTA exemption be claimed in my IT return.

Thanks,

Ritg

If one is getting Tax exemption under section 10(26), does he need to file Income Tax return? If so then which form shall be applicable for this situation?

Not sure.

From what we have read:

An employee is eligible for Section 10(26) exemption if he or she meets both the following conditions:

· Employee belongs to a community eligible for this exemption

· Employee is employed in any of the North East states of India

So An eligible employee residing in the specified region is exempt from Tax Deducted at Source (TDS) on any income earned while employed in that region.

But if your income is above basic exemption limit, have interest from FD or saving bank account you should be required to file ITR. It is a financial record, helps in getting loans and visa.

Depending on the type of income you should file corresponding ITR. What are others that you know doing?

That was for last year. This year there is no such restriction. U can fill ITR1 if it’s your income is from salary, income from other sources and house property

Hello Experts,

I am going to file my father’s IT Return for the FY2014-15 and he got retired in this FY.My confusion is that Should I file form ITR-1(sahaj) or ITR-2A because I have read somewhere that if the income exempt is greater than Rs5000 then we need to file ITR-2A i.e. other than form ITR-1. So,please guide me which form should I file as he got commutted pension & other retirement benefits which are exempt from income tax.

Thanks in advance

I had form 16 from two companies. Second company has not considered HRA , conveyance allowance reimbursement and notice pay reimbursement as non taxable. They are included in form 16. How to claim HRA , Conveyance and notice pay reimbursement while filing income tax return. and what form to fill.

Hi,

when filing ITR-2, i entered option 2, “Allowance exempt under section 10”, should this not be deducted from the “Income chargeable under the head salaries (1 + 3 + 4 + 5 + 6)”?

can someone explain why 2 is not deducted from income chargeable under the head salaries? if it is not deducted it will not be same as my employer gave form 16 and in the income tax return?

You have a point

For Salary (Excluding all exempt/non-exempt allowances,perquisites & profit in lieu of salary in ITR2 one should fill in 1(a) Salary as per provisions contained in section 17 – exempted allowances in 2.

It has been clarified that the standard deduction on family pension is admissible to the extent of 1/3rd of family pension or Rs 15,000, whichever is less. My query is that the deduction of Rs 15,000(in my case it’s 15000) have to be done in which column or head of ITR-1 income tax return form or we have to self deduct this 15000 amount from family pension and enter the remaining amount of family pension in [Income from other sources] column/head of ITR-1.

AS in case of Interest Income from banks. We have to show this interest income in Income from other sources Column/head of ITR-1. In case if interest income from bank is 18000 then we have to show 18000 in column [Income from other Sources]. and deduction of interest of 10000(in this case) comes in column 5q i.e 80TTA.

Similarly, i want to know that the deduction of Rs 15,000 (in case of family pension) have to be done in which column or head of ITR-1 form or we have to self deduct this 15000 amount from family pension.

Deduct 15000 from the total family pension drawn and show it as income from other sources in ITR1

My last organisation has put my encashed leaves under taxable income. As I know, leaves encashed are exempted under section 10 a. But ITR 1 form has np place to mention deductions under section 10 a. How should I claim it?

I have some medical bills which my company didn’t accept as they accept investment proofs, medical and LTA bills till 15th Jan.

Now I have some income from interest also and I have calculated my tax liability and also paid self assessment tax considering these medical bills as non taxable as my total medical bills are less than Rs. 15000/-.

My question is while filing ITR1, where should I show this amount?

I can’t change my Form16.

rom what we know you cannot claim medical reimbursement amount upto limit of 15,000.

Typically companies pay out unclaimed amount as salary in Mar.

Has company not paid you the amount corresponding to medical bills along with Mar salary?

You can claim Medical insurance premium under 80D during filing of returns.

You also cannot claim LTA.

My company is paying me Rs. 1250/ as medical reimbursement every month in my salary but they deduct tax on it. They accept bills till 15th Jan, so whatever bills I submitted till that date they exempt that amount while calculating tax.

Now I have some more medical bills for which I don’t want to claim medical reimbursement but only want to exempt that amount from tax.

Is there any way to do so?

Please check your payslip. Remaining amount would have been paid to you in month of Mar.

They paid me Rs. 1250/- as medical reimbursement every month, but after deducting tax.

They don’t consider any bills or investment proofs after 15th Jan.

My question is whether my medical bills dated after 15th Jan are taxable or exempted?

If exempted how can I show this in my form ITR1?

After Jan you company does not accept the bills and pays remaining amount as taxable income.

Medical bills are only accepted by company and CANNOT be claimed in ITR

My gross salary is Rs. 283,093. HRA + Conveyance = Rs. 50,210. Tax on employment is Rs. 2400. Now when I pre-fill ITR2 (I have capital gains etc.), it shows Rs. 283,093 under “TDS” tab as per form16 issued by the employer. Shouldn’t it be Rs. 283,093 minus HRA etc.

After that, under Schedule S, what I have to fill in 1. Salary ? Rs. 283,093 or Rs. 283,093 – HRA – Conveyance? I have filled row 2. allowances exempt = Rs. 50,210 and row 6 = Rs. 2400.

We have come across this problem recently from many of our readers who are prefilling their ITRS.

We were going through various Form 16s and realised that salary mentioned in Form 26AS is gross salary and not the taxable salary.

So the Income tax dept would use 283,093 as the salary and not salary in Pt 6 in Form 16 after deductions.

You should first contact your payroll or finance department and get clarification.

Can you check part A of the Form 16 where all deductions and TDS are mentioned.

If it’s ok with you can you share the name of your company either in blog or by sending mail to bemoneyaware@gmail.com.

Capgemini India Private Limited.

Also if I fill the salary under schedule S as Rs. 283,093 minus HRA etc. a popup comes after I click save that says the salary is less than 90% of the salary mentioned in the TDS tab. What’s this?

Part A mentions Rs. 283,093 as “amount paid” and Rs. 0 under “amount of tax deposited”.

Please verify the values with Form 26AS. We have written an article on it The amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS1

I am going to submit IT return for the Assessment Year 2015-16. I have collections of medical bills of amount more than 20k, which was received from pharmacy/hospital. Could you please tell me, under which component i have to add in e-filling & max amount for exemption.

how get tax exemption for the medical allowance component(in salary slip). Also i havenot submitted my bills to the employer.

From what we know you cannot claim medical reimbursement amount upto limit of 15,000.

Typically companies pay out unclaimed amount as salary in Mar.

Has company not paid you the amount corresponding to medical bills along with Mar salary?

You can claim Medical insurance premium under 80D during filing of returns.

Hi Team,

I am filling itr 1 online, in my form 16 there is deduction u/s 10 as conveyance rs. 9200 & other is Tax on employment.

Request you to kindly confirm in which field I have to mention the above 2 deductions.

Sir in ITR1 you fill in the salary mentioned in Pt 6 of Form 16

Hello,

I am a senior citizen aged 61 years. Therefore, income upto Rs 3,00,000 should be exempted from tax. Please tell me how I can avail this income tax rebate. Where can I mention this (senior citizen category) in ITR-1 to claim this rebate?

Thanks and regards.

Maam when you enter your Date of Birth then automatically the software(excel or java) will take care of exemption limit. You don’t need to mention anywhere Senior citizen.

This is exemption. When you enter your income details,tax details and Calculate Tax the exemption would be automatically taken care of.

If you still have questions do let us know, we can point you to appropriate video.

For my father aged 74 years, Tax calculator is matching the computation as Form 16.

Whereas in e-flie ITR1, tax computation do not match Form 16.

Date of Birth is correctly filled up.

Please advise.

I am filing ITR1 and filling the same salary mentioned in Form16(Income chargeable under the head “Salaries(3-5)). But on submitting, I am getting error “the amount of salary disclosed in “Income details/Part BTI” is less than 90% of Salary reported in Schedule TDS1″.

Please guide.

Thanks

Hi.

I do have the same problem.Can we proceed with “Ok”. Did you get solution on this?

Thank you.

Hi,

I too have the same problem.Please suggest.Thank you.

Can you send details of the Income and TDS(full amount) if possible to bemoneyaware@gmail.com

We tried reproducing it but could not do so,

Can you send details of the Income and TDS(full amount) if possible to bemoneyaware@gmail.com

We tried reproducing it but could not do so, so any help from you would help other readers

This happens usually when one prefills from Form 26AS

We have written article The amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS to explain the issue.

This is a warning message

so that you can check your salary Income shown in Income from salary head and Salary paid details shown in TDS schedule ,

Which income details are you filling in ITR? Pt 6 in Form 16 in ITR1 and for ITR2 it is details as mentioned in image above.

Please also verify Form 26AS

I am adding row 6 (income chargeable under head) from form 16 to enter amount in Income Details tab and Sch TDS 1 section is auto filled. Here amount ofcourse is higher because this does not have exemption from HRA etc. I am still getting same error while submitting. Should I cross that error and submit further ? Why am I getting this ?

Please help

Exactly…I’m also facing this same issue…Admin can we modify the Sch. TDS(1)- Income Under Salary field? But this is getting loaded from 26AS directly?

This happens usually when one prefills from Form 26AS

We have written article The amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS to explain the issue.

Please give us your feedback on if our understanding of issue is correct

This seems like common problem. When we fill salary from the head “Salary” (#6 of form-16 which came after deduction of Sec 10) and the software is taking reference of the Salary as TDS1 which is ultimately creating the difference.

Can we modify Salary Part in TDS1 accordingly after deducting Sec 10 ammount as it seems like the root cause of the warning message.

This happens usually when one prefills from Form 26AS

We have written article The amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS to explain the issue.

Please give us your feedback on if our understanding of issue is correct

ma’m..i am doing M.D. from lok nayak hospital,delhi. from last yr i started getting stipend 70,000 per month..so this year i have to file ITR 1st time..i am getting HRA 9000 per month which is included in my stipend..and on this HRA i have given incometax.. but i am living outside on rent..and paying rent of 7500 per month..so please guide me that which from i have to use for ITR filling online and in that form can i get tax rebate on Rent which i m paying from last 12 mnths..thanks

I have inserted extra rows under salary by clicking on ‘add salaries’ in oversight. How can that be deleted ? Thank you

Hi kriti,

Thanks for sharing this information. Its very good.

I have a query here.

In Schedule S , The Allowance under section 10 (point 2) shall be subtraced while calculating the Income Under Head Salaries(Point 7). But it is not happening in ITR2 form.

Point 7 = Point 1 + Point 3 + point 4 + point 5 – Point 6

Only Professional Tax is substracted?

Can you please help me in understanding How the Allowance under section 10( point 2) is reduced from total taxabale income?

Thanks

gargi

Explanation of exempt Allowances are given below. Our article Tax Exempt Allowances in Salary Schedule S in ITR2 explains it in detail.

Travel concession/assistance received is under section 10(5). It basically refers to Leave Travel allowance or LTA which is an allowance you get from your employer when you are on leave from work and you along with your family actually travel domestically i.e. within India.

Tax is paid by the employer on non-monetary perquisites (sec 10(10CC)) . Perquisite is a benefit received by an employee in excess of his salary. Perquisite can be provided both by way of a monetary payment or a non-monetary payment/benefit. Payments which can be called non-monetary payments are car facility, chauffeur salary paid directly, benefit on account of interest-free loans, rent-free accommodation, furniture provided to employees, soft furnishings and so on.

Allowances to meet expenditure incurred on house rent under section 10(13A). House Rent Allowance or HRA is given by the employer to the employee to meet the expenses of rent of the accommodation which the employee has taken for his residential purpose. House Rent Allowance so paid by the employer to his employee is taxable under head Income from Salaries

Hi,

I want to know which ITR i have to file as i am salaried person and also having monthly income from Bus travel agency (not reg.) but on the business income my TDS has been deducted.

So in my 26AS shown 2 deductor detail who deposit TDS.

So pls help me in this.

Hi,

I am a retired central government employee . I am receiving pension from State Bank of India( PSU Bank). But this pension is not taxed. I have income from properties that I have rented out. Hence, I am looking to file IT 2 form My questions:

1. The TAN number of my employer is not available with me. How to address this, as it a mandatory field for income under ‘Salary’

2.There is also no tax deducted at source. I am currentlly outside india for a couple of months and hence cannot ask my bank for a Form 16 either. Can I still goto any of the efiling websites and file tax returns under ‘Other Income’ as it is sometimes done for family pensions

PS: I am the pension holder and my case is NOT a family pension case

Thanks much in advance

regards

Lalitha

Sir, as a pensioner of Indian Air Force, I am drawing pension from SBI in which I do not have any FD Account. I requested the bank to issue me Form 16 for total pension drawn during the financial year. Bank has issued me Form 16 without its TAN since no tax has been deducted for pension. Then where to show the income from pension in ITR 1? It does not accepts in TDS1 part without TAN with zero tax deducted. Kindly advise.

I don’t think You need to file ITR if there is no tax deducted from your income.

Thanks for your articles ;

i joined a broking firm in dec 2007 and worked there till oct 2011 ;i joined another company in november 2011 but didnt transfer my p.f.. I withdrew the pf amt in JAN 2015.

1)As i have not continued for more than 5 yrs in prevoius company but i had done a withdrawl in jan 2015 will i have to pay tax.

2) Is there any limit.?

Thanks

In view of receiving of less than Rs. 2 lakhs of family pension per year, the employer did not submit Form 16.

But I have good amount of FDs and for which I earned interests which shows in the 26AS.

Now question is whether mentioning of TAN no. of employer who is paying Family pension in the ITR1 for pension amount is mandatory?

Employer will not submit Form 16 as it is not taxable under head Salaries but under Income form other sources. So TAN is not required.

Long ans is given below

We have assumed that you receive regular monthly family pension from the employer of your spouse on account of his death. The said pension income shall be taxable in your hands as “income from other sources”. You could claim a deduction of one-third per cent of such pension income or Rs.15,000, whichever is lower.

Any family pension received by any member of the family of an individual who has been in service of the Central or state government and has been awarded specified gallantry awards is exempt from tax. Similarly, any family pension received by the widow or children or nominated heirs of a member of the armed forces (including para-military forces) of the union, where the death of such member has occurred in the course of operational duties, subject to some prescribed conditions, is exempt from tax.

If the family pension received by you does not fall in the above excluded category, then the net pension income shall be taxable in your hands as per your tax slab rate, depending on your other taxable income.

My company has not paid medical allowance for the year 2014 – 15 & hence do not appear in my form-16. Now I have applied for medical allowance & getting it for 2014-15 as well as 2015-16. I do have medical receipts for both the years 15000 each.

Can I know whether still I can add medical allowance for the year 2014-15 while efiling & avoid tax.

If not I will get 15000 tax free for 2015-16 & have to pay tax for the reimbursement of 15000 for 2014-15.

As both will appear in 2015-16 form -16.

Has company not paid you the amount corresponding to medical bills in Mar salary?

Typically companies pay out unclaimed amount as salary in Mar.

We are not sure of it Sir.

Hello experts,

I’ve 2 employers in FY14-15. i have received two form 16.

The first employer has not given me any HRA exemption, (I have all the receipts/agreement copy).

Since there is no separate column in ITR1, how to go about it. Please advice.

Our article HRA Exemption,Calculation,Tax and Income Tax Return shows shows how to claim HRA in ITR

Our article How to Fill ITR when you have multiple Form 16 explains it in detail

I have switched my job in the financial year, How should I file income tax using two different form 16.

Our article How to Fill ITR when you have multiple Form 16 explains it detail.

my gross income is 508107/= after deducting the tour and travel allowance, my HRA is 5500*12=66000, my basic salary is 19625 PM , then please guide how to file the ITR online and the HRA will be shown in which section for the tax rebate.

Sir,

Our article

HRA and Income Tax return explains how HRA is shown in the ITR.

You can try filing through free website cleartax etc , they will be able to guide you.

Are you filling for AY 2014-15?

This video on youtube(60 mins) is also helpful

Form ITR2 has a schedule for spouse’s income. If the income is from interest there will be TDS deduction. There is no schedule for spouse’s TDS. How to account for it?

There is no way to account for her income as TDS will be in her name and would be tied to her PAN number.

As she has no income she should sumbit Form 15G to the bank for not deducting TDS.

Our article Investing in name of Wife explains in detail.

Loan money : If you want to buy a house in your wife’s name but don’t want the rent to be taxed as your income, you can loan her the money. In exchange, she can give you her jewellery. For example, if you transfer a house worth Rs 10 lakh to your wife and she transfers her jewellery for the same amount in your favour, then the rental income from that house would not be taxable to you.

Have you paid all tax due on FD. Please remember that tax on interest of FD is as per the income slab. Our article Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund explains it in detail.

Where to mention Loan money from spouse in ITR… Don’t want to mention as gifted to wife…

Can we mention in ITR LOAN from SPOUSE as INTEREST FREE LOAN…?

Hi Kirti,

My health insurance company is asking me to pay 2 years premium since they are giving additional discount. I want to avail of the scheme, can you please tell me whether I have to show the 2 year premium as Deduction for one year i.e 2013-2014 or will the premium amount be spread over 2 financial years i.e 2013-2014 and 2014-2015.

Thanks,

Gagan

Hi Gagan

Deduction of insurance premium paid will be allowed in the year in which it is paid

therefore you cannot defer the deduction and you have to take deduction is 2013-2014

Now question is is discount offered more than the tax saved? For example

On total income of 6,00,000 income tax liability is 51500, by paying Rs 10,000 as health insurance premium

your taxable income becomes 590000(6,00,000 -10000) tax liability is 49440 you save 2060

which is actually 20.6% of 10,000

If you would be in 30% slab by paying premium of 10,000 you would have saved 3090 (30.9% of 10,000)

Person in 10% slab saves 1030 (10.3% of Insurance premium)

So what have you decided?

Hi Kirti,

My health insurance company is asking me to pay 2 years premium since they are giving additional discount. I want to avail of the scheme, can you please tell me whether I have to show the 2 year premium as Deduction for one year i.e 2013-2014 or will the premium amount be spread over 2 financial years i.e 2013-2014 and 2014-2015.

Thanks,

Gagan

Hi Gagan

Deduction of insurance premium paid will be allowed in the year in which it is paid

therefore you cannot defer the deduction and you have to take deduction is 2013-2014

Now question is is discount offered more than the tax saved? For example

On total income of 6,00,000 income tax liability is 51500, by paying Rs 10,000 as health insurance premium

your taxable income becomes 590000(6,00,000 -10000) tax liability is 49440 you save 2060

which is actually 20.6% of 10,000

If you would be in 30% slab by paying premium of 10,000 you would have saved 3090 (30.9% of 10,000)

Person in 10% slab saves 1030 (10.3% of Insurance premium)

So what have you decided?

thanks for earlier suggestion

again while e filing for financial yr 12-13 -i found that tds submitted by deductor(DDO) is for one quarter.but form 16 given to me shows whole amount.when asked my office acountant he told me it will be updated shortly.

now should i file return with same form 16 details given to me by DDo -in which interest being clubbed for late tax and tax payable showing in e filing

OR wait till my accountant files revised tds (BY DEDUCTOR)

Don’t wait file your returns. Follow up with the accountant. If you have Form 16 that’s sufficient proof as of now.

Hopefully by the time your return is processed it will be reflected in Form 26AS.

If not now CBDT allows the Assessing Officers to verify and authenticate the correct value for the mismatched TDS. The instruction provides absolute liberty to them for issuing notice to the faulty deductors and compelling them to submit the statement of file correction as per the established procedure.

Best of Luck. File now. It’s last date today!

thanks for earlier suggestion

again while e filing for financial yr 12-13 -i found that tds submitted by deductor(DDO) is for one quarter.but form 16 given to me shows whole amount.when asked my office acountant he told me it will be updated shortly.

now should i file return with same form 16 details given to me by DDo -in which interest being clubbed for late tax and tax payable showing in e filing

OR wait till my accountant files revised tds (BY DEDUCTOR)

Don’t wait file your returns. Follow up with the accountant. If you have Form 16 that’s sufficient proof as of now.

Hopefully by the time your return is processed it will be reflected in Form 26AS.

If not now CBDT allows the Assessing Officers to verify and authenticate the correct value for the mismatched TDS. The instruction provides absolute liberty to them for issuing notice to the faulty deductors and compelling them to submit the statement of file correction as per the established procedure.

Best of Luck. File now. It’s last date today!

Do we have to show interest received in PPF (although its exempt from tax) somewhere in ITR1 or ITR2?

Yes Neerav you do as interest in Exempt income. Discussed in Exempt Income and Income Tax Return

Do we have to show interest received in PPF (although its exempt from tax) somewhere in ITR1 or ITR2?

Yes Neerav you do as interest in Exempt income. Discussed in Exempt Income and Income Tax Return

Nice article. Around 500 Rs. deducted from my salary as income tax but it was due to late investment document submission. In that case shall I get that small amount return or not?

If after calculating your tax you find that your total tax payable is -ve i.e you have paid more tax than expected, Income tax department owes you a refund. So calculate your TOTAL Tax liability and fill your return asking for refund if refund is due!

Nice article. Around 500 Rs. deducted from my salary as income tax but it was due to late investment document submission. In that case shall I get that small amount return or not?

If after calculating your tax you find that your total tax payable is -ve i.e you have paid more tax than expected, Income tax department owes you a refund. So calculate your TOTAL Tax liability and fill your return asking for refund if refund is due!

hi..I would like if i can add anything if it is not mentioned in the form 16…like the transport allowance has not been mentioned in form 16…but i was told that minimum 9600 can be claimed..so can i add that inspite of not being mentioned in form 16

Yes you can. Conveyance allowance is exempt under section 10(14)/ Rule 2BB upto Rs. 800/- p.m. If the employer has not considered this while computing TDS, you may file return in form ITR -2 claiming the exemption under section 10 to take benefit of conveyance allowance.

Caclubindia Conveyance Allowance

You can call following numbers to verify (waiting time is a little long)

For Income tax related queries

ASK : 1800 180 1961

For Rectification and Refund

CPC : 1800 425 2229

e-Filing : 1800 4250 0025

hi..I would like if i can add anything if it is not mentioned in the form 16…like the transport allowance has not been mentioned in form 16…but i was told that minimum 9600 can be claimed..so can i add that inspite of not being mentioned in form 16

Yes you can. Conveyance allowance is exempt under section 10(14)/ Rule 2BB upto Rs. 800/- p.m. If the employer has not considered this while computing TDS, you may file return in form ITR -2 claiming the exemption under section 10 to take benefit of conveyance allowance.

Caclubindia Conveyance Allowance

You can call following numbers to verify (waiting time is a little long)

For Income tax related queries

ASK : 1800 180 1961

For Rectification and Refund

CPC : 1800 425 2229

e-Filing : 1800 4250 0025

You are doing a great service to people like me. This time a student of mine who is now a CA helped me out. But your blog has given me a lot of info which is very important.

I am not saying do it yourself, but you should know what information is being filled. It’s not rocket science

You are doing a great service to people like me. This time a student of mine who is now a CA helped me out. But your blog has given me a lot of info which is very important.

I am not saying do it yourself, but you should know what information is being filled. It’s not rocket science

Thank you! Superb info.

Just one question, Assuming one has already filed under ITR1 and now wants to file under ITR2, would mentioning it as “Revised” work?

You need to file revise return. A different form. And be very careful of the change for a change would be a probable case of stricter checking.

You can call following numbers to verify

For Income tax related queries

ASK : 1800 180 1961

For Rectification and Refund

CPC : 1800 425 2229

e-Filing : 1800 4250 0025

Similar query on Caclubindia Filed Wrong ITR Form

For e-Filing of Returns

Thank you! Superb info.

Just one question, Assuming one has already filed under ITR1 and now wants to file under ITR2, would mentioning it as “Revised” work?

You need to file revise return. A different form. And be very careful of the change for a change would be a probable case of stricter checking.

You can call following numbers to verify

For Income tax related queries

ASK : 1800 180 1961

For Rectification and Refund

CPC : 1800 425 2229

e-Filing : 1800 4250 0025

Similar query on Caclubindia Filed Wrong ITR Form

For e-Filing of Returns

Very informative article.

Thanks for sharing.

Keep it up.

Very informative article.

Thanks for sharing.

Keep it up.

in IT return where we show Professional tax paid