If you pay less tax than what you are supposed to while filing income tax return then while assessing the Income Tax Return ,you might be asked to pay the outstanding demand. Income Tax Department sends the intimation under Section 143(1) asking for outstanding demand along with the calculations as to why Income tax department thinks you need to pay more tax. You can go through the calculations and pay the outstanding tax if you agree or you can reject the Outstanding demand. This article talks in detail about how to pay or reject the Outstanding Income Tax that one receives under section 143(1).

What is Assessment of the Income Tax Return?

Every taxpayer has to furnish the details of his income to the Income-tax Department by filing up his return of income. Once the return of income is filed up by the taxpayer, the next step is the processing of the return of income by the Income Tax Department for its correctness. The process of examining the return of income by the Income Tax department is called as Assessment.

Under the Income-tax Law, there are four major assessments as given below:

- Assessment under section 143(1), i.e., Summary assessment without calling the assessee.

- Assessment under section 143(3), i.e., Scrutiny assessment.

- Assessment under section 144, i.e., Best judgment assessment.

- Assessment under section 147, i.e., Income escaping assessment.

Our articlesAfter e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1) and Income Tax Notice :Sections,What to check,How to reply discusses various types of Assessments in detail.

Who processes the electronically filed returns?

Electronically filed Income tax returns are processed by Central Processing Center,CPC at Bengaluru. The Infosys team set up an IT-CPC,a centralized processing center for all IT-related processes where all the filed returns were directed validated, scanned, digitized, processed, and printed.The CPC was set up in February, 2009 and Infosys Technologies Ltd was appointed for a period of 5 years as the technology partner and was paid Rs 250 crore for the five-year contract. In Dec 2014 contract for the Centralized Processing Centre (CPC) of the Income Tax (I-T) Department at Bangalore to Infosys was extended by two years up to September 2017.

Earlier all the Income tax returns were assessed by Assessing officers. Now only some cases are referred to Assessing officers.

What is Intimation under the section 143(1)?

Three types of notices are sent under section 143 (1)

- Intimation where the notice is to be simply considered as final assessment of your returns when the return filed by you matches his computation. Nothing is to be done on part of the taxpayer. Keep it with your income tax papers.

- Processing under section 143 (1) would make you eligible for a refund. If you are getting Refund, wait for the transfer into your account.

- Notice of demand where the officer’s computation shows shortfall in your income tax payment for the said financial year.If there is a tax demand then this intimation becomes Notice of Demand under section 156. The notice says “In case of Demand, this intimation may be treated as Notice of demand u/s 156 of the Income Tax Act, 1956. Accordingly, you are requested to pay the entire Demand within 30 days of receipt of this intimation”

Assessment under section 143(1) can be made within a period of one year from the end of the financial year in which the return of income is filed.

Till what Outstanding tax demand we can ignore?

If Outstanding tax demand is less than Rs 100 (or refund is less than Rs 100) then one can need not pay the outstanding demand. In case of refund one will not get the refund if refund amount is less than Rs 100. It will be adjusted in future ITRs.

Table of Contents

How to reply to notice received under section 143(1)?

Ascertain the nature of Income Tax Demand: First and for most thing, you have to ascertain the reason for raising demand. You will get the information from Intimation received u/s 143(1) of Income tax Act.

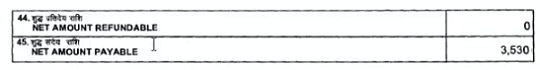

If you have outstanding tax demand at the end of the notice you would see the Net Amount Payable as shown in image below

- Understand the motive of serving the notice.

- Check the given details of notice, i.e., your name, address, PAN, etc.

- Check the validity of the notice as well as the duration within which you have to respond

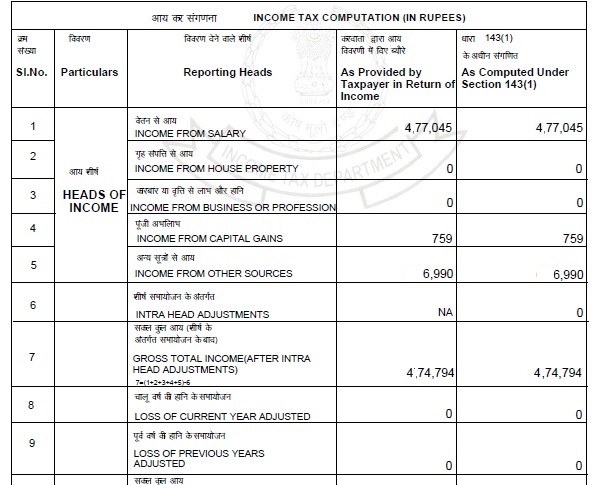

- Check calculations. It would be explained in two columns yours and how Income Tax Calculated it, as shown in image below from our article Understanding Income Tax Notice under section 143(1)

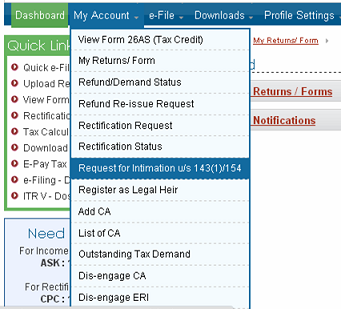

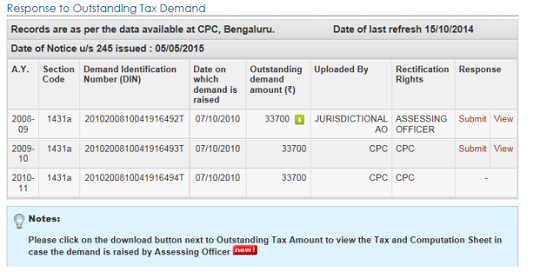

If you have not received intimation u/s 143(1) you can visit Income Tax E-Filing Website and request for re-sending of Intimation u/s 143(1) / u/s 154 .

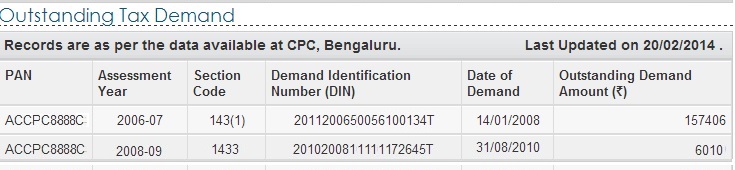

How to check Outstanding demand details on Income Tax website

You can check Outstanding demand and details by Logging in to the Income tax website and Click on My Account and then Outstanding Tax Demand as explained in Notice for Adjusting Refund Against Outstanding Tax Demand, Section 245. details displayed are: Assessment Year, Section Code, Demand Notification Number, Date on which demand is raised, Outstanding Demand amount

Outstanding Tax Demand

- How do I know about the reason for such demand when I don’t have the notice for the same?

- Log in to income tax e-filing portal Income tax efiling website.

- On the top Navigation Blue Bar go to My Account Section

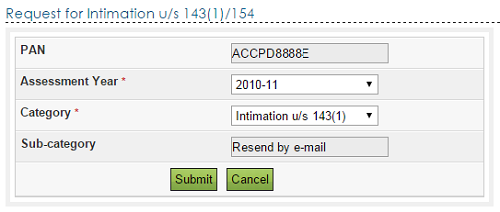

- From on My Account Section,drop down menu, select Request for Intimation u/s 143(1)/154 as shown below

- Select the appropriate Assessment Year from the drop down .(For the financial year 2009-10 the Assessment Year will be 2010-11)

- Now Select the Category– Intimation u/s 143(1). The other category is Rectification u/s 154.

- Sub-category will automatically become Resend by e-mail. It would be sent to your email id on income e-filing portal. You can update your e-mail id through Profile settings section on top blue navigation bar .

- Now enter the captch code and submit the request.

- You will receive a confirmation mail from CPC the same day and the intimation with in 5-6 days of your submitting the request in your registered e-mail id.

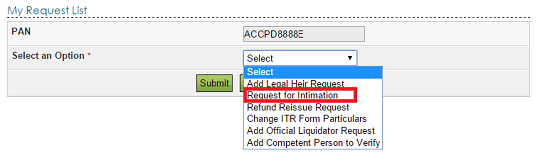

- If you do not receive the intimation with in 5-6 days you can track the status of request by logging on to your e-filing account and clicking on the My Request List Tab on the top blue navigation bar of your account. A screen will appear,shown in image below. Select the type of request and Submit. Status of your request will show .

How to respond to Income Tax Outstanding Demand Notice?

If you have received an Income Tax Demand then you have two choices, one to accept and Pay the demand , other choice is to reject the demand. It is based on the Income Tax tutorial Response to Outstanding Tax Demand (pdf format)

Step 1 Login to www.incometaxindiaefiling.gov.in with user ID, password, date of birth.

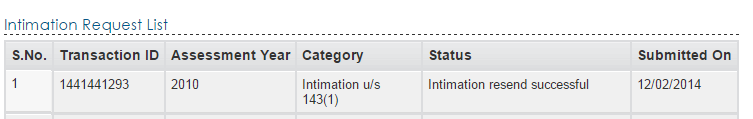

Step 2 Click on E-file and go to Respond to Outstanding Tax Demand . The following details are now displayed :Assessment Year, Section Code,Demand Notification Number,Date on which demand is raised, Outstanding Demand amount, Uploaded by,Rectification rights, Response, Submit and View

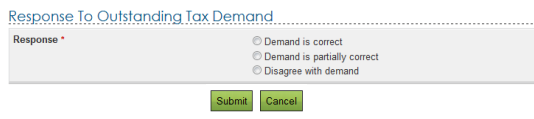

To submit the response click on Submit and select one of the following option : Demand is Correct, Demand is Partially Correct and Disagree with Demand

How to proceed if you agree and want to pay Outstanding Tax Demand?

If you select Demand is correct, then a pop up is displayed as “If you confirm „Demand is correct‟ then you cannot „Disagree with the demand‟. Click on Submit if this is ok with you.

A success message shall be splashed on your screen.

- If any refund is due, the outstanding amount along with interest will be adjusted against the refund due.

- In any other case you must repay the demand immediately.

Click on E-Pay Tax to pay the taxes online. This will take you to Tax Information Network (TIN) website.

- Select Challan 280 for paying your Income Tax Due. Our Article Paying Income Tax Online, epayment: Challan 280 explains with pictures in detail.

- Choose appropriate Assessment Year . Please be careful in filling the Assessment Year.

- For individuals making tax payments, select (0021) INCOME-TAX (OTHER THAN COMPANIES) under tax applicable

- Fill in your PAN and Assessment Year correctly.

- Fill in the address, phone number and email address

- Fill in the Bank Name and Captcha Code

- Under Type of payment section Select 400:Tax on Regular Assessment . Other options are (100) ADVANCE TAX : For regular advance tax payments or 300 SELF ASSESSMENT TAX if you are paying taxes after the financial year has ended.

- You will be redirected to the Net banking page. Please check the information entered here. You can enter the total income tax to be paid in the income tax field. You can leave surcharge, education cess, interest and penalty blank. You can check your intimation to get the details like Interest Payable,Surcharge.

- Get the BSR code and challan number

What to do after paying the outstanding tax demand?

You check the status of your tax payment by viewing Form 26AS and Select the specific Assessment Year. Go to Part C – Details of Tax Paid. There should be an entry with the details of your Outstanding Income Tax Demand payment.

Whom to inform after making payment of Tax against a demand notice?

In case the demand notice is from CPC Bangalore no further communication will be required. Demand will automatically be adjusted with the tax payments made. You can check the status of demand by logging in to Income Tax e-filing portal after few days of making payment. Go to “Outstanding Tax Demand” and check the status. If your payment is received by the IT department then you may find no records.

If the notice of demand is served upon you by the Jurisdictional Assessing Officer, you must write request to the Assessing Officer to delete the demand mentioning therein the details of tax payments made by you and attaching therewith the copy of tax payment Challan.

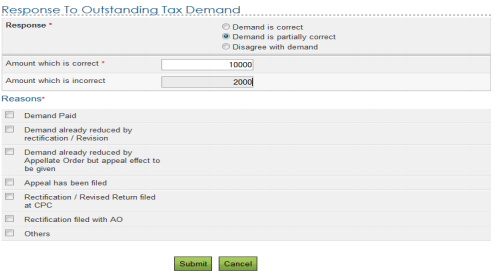

How to proceed if you feel Demand is partially correct?

If you think Demand is partially correct, then two amount fields will be available and also fill in one or more reasons as to why the demand is incorrect, as shown in image below.

- Amount which is correct – Enter the amount which is incorrect. If the amount entered here is equal to the demand amount, then one pop is displayed “Since the amount entered is equal to outstanding demand amount, please select the option “Demand is correct”

- Amount which is incorrect: Amount is auto filled which is the difference between the outstanding amount and Amount which is correct.

- Fill in the reasons as to why demand is incorrect

- Based on the reason selected, one needs to provide additional information as per the below table.

- Demand has already been paid : Provide the CIN (Challan Identification Number). Also mention BSR Code, date of payment, serial number of challan and amount. You can also add your comments under ‘remarks’. Or if CIN is not available mention that demand has been paid by challan has no CIN. And mention date of payment, amount, and remarks (your comments) if any.

- Demand has already been reduced by rectification/revision : Provide date of order, demand amount, details of AO who has rectified. And then upload rectification/appeal effect order passed by AO.

- Demand has already been reduced by Appellate order but appeal effect has to be given by the department : Provide, date of order, appellate order passed by (details of CIT(A) etc). Reference number of order.

- Appeal has been filed : Stay petition has been filed or stay has been granted by or installment has been granted by . Also provide date of filing of appeal, appeal pending with (details of CIT(A) etc) Stay petition filed with (details of office). If stay has been granted, you have to also upload the copy of Stay Order.

- Rectification/ Revised Return has been filed at CPC : Provide Filing Type, E-filed acknowledgement number, Remarks (comments, if any of the tax payer), Upload challan copy,Upload TDS Certificate,Upload letter requesting rectification copy,Upload Indemnity Bond

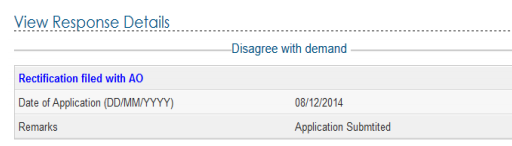

- Rectification has been filed with Assessing Officer :Mention the date of application and remarks (comments, if any of the tax payer).

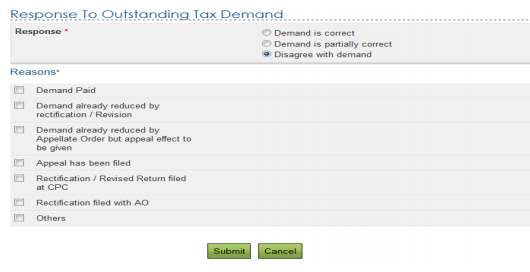

How to proceed if you disagree with Outstanding Tax Demand?

If you Disagree with the Demand then you must furnish the details of your disagreement along with reasons. The details/reasons are the same as the mentioned above under ‘demand is partially correct’.

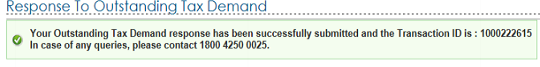

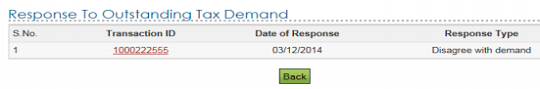

After submitting a response the success screen would be displayed with the transaction ID as shown in image below.

One can click on View link under Response column to view the response submitted. The following details are displayed: S. No. Transaction ID – A hyper link, Date of Response, Response Type

One can click on Transaction ID to know the details of response submitted.

- Demand position gets updated every day

- If demand is shown to be uploaded by AO in the above table, rectification right is with Assessing Officer, please contact your jurisdictional Assessing Officer for the same.

- For the demand against which there is No Submit response option available such demand is already confirmed by the Assessing Officer. Kindly contact your

Jurisdictional Assessing officer.

I hope this post is useful and informative. We have personally not paid the Outstanding Tax demand, so if you find anything missing or incorrect please do let us know. Have you received Income Tax demand notice? How did you deal with it? Did you pay the taxes online or offline? Please share your comments.

I received a demand notice of 2460/- by the IT department. Demand says ‘Challan not available for AY’ .

I had submitted my ITR on 23rd Dec along with the challan details for the 2460/-. However it looks like before the challan got updated in TIN, the ITR was processed.

I checked the TIN site it is showing the challan is updated in TIN on 24th Dec for AY 2020-2021. The demand was also raised on 24th Dec.

I have sent Disagree the Demand and put in my challan details I had put while filing the ITR in the Demand Paid area.

Let me know if this is the correct approach and if I need to do anything else.

Your approach is correct.

You don’t need to do anything else

Hello sir / madam,

I am Venkatesh, When I logged into the income tax portal in March-2020 I noticed there is a outstanding tax demand of Rs. 3,750/- U/s 143(1)a for AY-2009-10.

I have not received any notice from IT dept in 2010. Now it is more than 10 years. Can I respond to their notice now as it is reflecting in portal. I had submitted all the investment proofs to my employer in 2009. But the missed by my employer, hence there is a outstanding tax demand. I request you to kindly advice me how to address this? or shall I leave as it is as it is more than 10 years. Please guide. Thanking you.

I got a notice from CPC Bangalore sec 143(1) for tax demand ay19-20

I deposit TDs by challan

In challan name and pan is incorrect

The demand related to above challan

How can I respond to CPC for adjust the demand intimation

Did you agree to the demand by logging on to the Income tax website

1 Login to http://www.incometaxindiaefiling.gov.in with user ID, password, date of birth.

Step 2 Click on E-file and go to Respond to Outstanding Tax Demand. The following details are now displayed :Assessment Year, Section Code,Demand Notification Number,Date on which demand is raised, Outstanding Demand amount, Uploaded by,Rectification rights, Response, Submit and View

To submit the response click on Submit and select one of the following option : Demand is Correct, Demand is Partially Correct and Disagree with Demand

In case the demand notice is from CPC Bangalore no further communication will be required. Demand will automatically be adjusted with the tax payments made. You can check the status of demand by logging in to Income Tax e-filing portal after few days of making payment. Go to “Outstanding Tax Demand” and check the status. If your payment is received by the IT department then you may find no records.

I did not file return in ay 11-12 and now income tax department is demanding that, i can see tax deduction 26as but its not filled, could you please let me know how to respond it dep.

I got intimation 143(1) with outstanding tax demand for a tax credit mismatch that claimed tax credit amount not present in 26AS. However same amount is reflected in 26AS correctly and it was even present earlier also when I filled ITR. Also I checked everything was correctly filled in ITR. I responded to tax outstanding demand with option “Disagree with Demand” mentioning details and also filled a rectification. How many days should I wait for further response from CPC?

There is no fixed time in which you would get a response from CPC.

I received demand notice for section 144. AO made demand of my full loan amount which I responded with option Disagree with demand. Rectification by column shows AO and Uploaded by shows Juridictional AO, but AO says she can not do anything even though I responded as disagree, I have to pay 20% to bring the stay on demand and make appeal at CIT. She agrees my case will be in my favor but 20% is also huge amount for me pay. From reading here I understand she still has rights to rectify the demand but she is not willing to do it. Please advice

Submitted response to 143(1) and did ‘disagree with demand’ with reason. How can i come to know that this is accepted and no further action required from my side?

If 143 1 a CPC query came in March 31 ,2018 and assess disagree now again query came in Sept for same query and assessee agree and ready to pay tax with file g revised return then what will be consequences

They will accept the revised return and tax!

After login my PAN I came to know that I have three outstanding tax demands for AY 2011-2012,2012-2013,and 2013-2014.When they calculate tax demand they consider my salary only but not consider my TDS as recorded in my from16. If they consider my TDS, there will not be any additional tax demand.Please suggest me what will be my action.

It’s best you approach a tax consultant.

One needs to understand the problem of why TDS was not considered.

You can go through this process.

https://www.incometaxindiaefiling.gov.in/eFiling/Portal/StaticPDF/Response_OTD.pdf

I recieved hard copy of 1431A demand notice for AY 2011-12, Actually I worked in 2 companies From 1st Apr 2010 to 2nd Apr 2010 in my first company them from 5Apr 2010 to 31 Mar2010 in second company both company tax details are available in 26 AS form. During return filing I forget to add my first company income by Mistake and filed based on second company form 16. I don’t have any tax liability all is submitted and showing in 16 AS. Let me know how to correct it now.

can you scan and send the pictures of the notice.

We can suggest you correct steps based on what the notice says.

But as the notice is genuine you should reply to it within the stipulated time as suggested in notice.

I received intimation under section 143(1) for AY 2016-17, for tax credit mismatch. The mismatch was rectified by filing revised return and paying Self assessment Tax.

The portal is showing outstanding tax demand. What should I do next ?

I had received a outstanding demand notice on 21/06/2017 for the AY:2016-17 from CPC

and since i had already paid the tax so i had submitted the response as ” Disagree with demand” on 04/07/2017. but still no reply received from CPC for clearance of demand

Hi, I have paid for my demand notice raise. Now have received demand notice 220(2) to pay interest. Do I need to pay it immediately or will it be adjusted in future returns. Will there be any interest levied on 220(2) demand

respected sir, my assessment is completed under section 143(3) and my taxable income after assessment is comes below rs 1 cr. but assessing officer levies surcharge on additions made by him (case is for A.Y. 15-16 ). I want to know whether the levy of surcharge is correct or incorrect? and the relevent section of income tax act in regard to this.

That is shocking.

For AY 2015-16 surcharge is 10% above 1 crore.

You can check the act at Income Tax website.

sir,

I WRONGLY SUBMIT ” DEMAND IS CORRECT ”

WHAT IS THE PROCESS OF OUT STANDING DEMAND REFLECTING ?????

PLS REPLAY

If assessees selects “Demand is correct”, then a pop up is displayed as “If you confirm ‘Demand is correct’ then you cannot ‘Disagree with the demand’.

I have wrongly clicked yes even though I disagree with demand u/s 154 what to do for now??

I have received a 143(1) intimation. In the two columns (As Provided by Taxpayer in Return of Income) and (As Computed Under Section 143(1)), all the amounts are the same – either “0” or matching amounts. In about three or four columns, the column for the amount provided by me is “N/A”, while the one opposite, computed under 143(1) is “0”. At the end, from numbers 49 to 53, which are “Total outstanding demand and interest payable under sec220(2) to the extent adjusted with refund amount”, “Net Amount Refundable”, “Net Amount Payable” – all show “0”. Refund Sequence No., and Demand Identification No. are both empty. So does this mean that this is just a preliminary intimation, and I don’t have to take any action? Please answer as I am worried.

As explained in our article Understanding Income Tax Notice under section 143(1)

If net amount refundable/net amount demand is less than Rs 100 or no difference, you can treat Intimation under section 143(1) as completion of income tax returns assessment under Income Tax Act.

Congrats your ITR is done for the year.

Thanks a lot! 🙂

Helpful, no very helpful site. Thanks.

Thanks for encouraging words

PASSED WRONG DEMAND. TELL ME THE PROCESS OF CORRECTION OF NOTICE DEMAND.

i have filed our income tax returns a.y. 2008-2009 with offline.

but a.o. has raised demand i have already filed correct returns. tds amount not show in returns so my question is how can update tds amount in income tax site.

I had taxable income and paid tds and ask for refund under 80c which was 15954 but income tax department ask me pay 3170 more tax. What is this mean? I paid prepaid tax and instead of refund I have to pay tax?help me on this

Hi,

I Have refund Ay 2016-17 and this refund adjusted outstanding demand AY 2012-13.

after adjusting refund , i filed rectification return with A O ( 25-10-2016) and clear the Outstanding Demand. can i claim refund AY 2016-17?

plz help me

We have received 143 (1) notice from CPC regarding the excess tax to be paid.We paid the demand amount through Bank by remitting 280 challan. The same was reflecting in the 26 AS of the relevant year.The Income tax website still showing the demand of so and Rupees to be paid.Now where I have to give response to nullify the demand.

Did you follow the process of Agreeing with the demand as explained in article.

Else please do so.

Also check that Form 26AS shows amount paid in relevant Assessment Year

Hi

I had efiled for AY 2016-17 but I got intimation letter u/s 143 computation and under that u/s 89 as Rs. 5400/- , which was shown by me, not taken by them. So in that case what should I do? Now they r demanding Rs. 5400/-. Should I agree or should I not?

You have to understand the reason why Rs 5400 were not taken by Income tax department.

Unless you can explain it to Income Tax Dept. with proof it would be a demand against you and you would also have to pay interest on it.

You can contact a good CA/Tax Lawyer.

Sir

I got intimation u.s.154 of additional tax to pay, but my 26AS certificate shows that tax already paid by employer then what should I do

After paying the outstanding demand. Can we get any revert from CPC that the same is received and no debts are there ?

If yes then how many days it generally takes for reverting.

If no then how can we know that no outstanding demand is there.

the demand notice was for Ay 2010-11. I wrote to Jurisdictional ITO and the ITO has reduced the amount payable vide her order dated 29 july 2016. I have entered this fact in efiling portal with a copy of ITO’s orders. I also paid the said amount online on 31st July 2016 and this is reflected in 26AS. even after ten days of ITO’s orders and a week after payment of rectified amount the demand notice in efiling portal remains still the old amount. Normally how long will it take the Income tax department (CPC or the ITO) to remove the notice from the portal.

You would need to enter compliances suitably, Can we help you? COmeonline for chat at http://www.itrtoday.com anytime from 9 AM to 9 PM

Hi ,

This is regarding an Outstanding Tax Demand raised by AO for AY 2004-05.

I had responded “Demand is Correct” & paid the said amount 2 weeks back . However , the same amount is still there . What should I do regarding this ? Should I wait ? Please advice.

Hi Sir,

I have also received a demand pertaining to AY 2008-09 (as per comments many persons have got this demand and that is the same year when CPC contract was alloted to Infosys).

Coming to the demand, it mentions that I have not paid any tax during that AY, while I have Form-26AS showing that all taxes have been paid. I have a demand of Rs 55K (43K tax + other penalties). I do not have Form-16 pertaining to that year (only 26AS and acknowledged copy of filed returns in Bangalore)

CPC is not helping and asking me to contact the AO. While the demand itself has been uploaded by CPC, the Rectification rights are with AO. Now the problem is I am currently in Delhi and my AO is in Rajasthan, so I do not know how to go about it. My CA has asked for transfer of AO to Delhi, but 8 months have passed and still AO has not been changed.

Please suggest a way forward. Should I necessarily have to visit the IT office in Rajasthan for clearing this demand?

Thanks

Hi,

I got the demand for AY 2009-2010, and for 1.65 Lakh. I have done the ITR Filing, then may be forgot to send the Acknowledgement to CPC/ it did not reach CPC.

Now what should i do ?

Do i need to file returns again for AY 2009-2010 ?

I am not able to do filing for AY 2009-2010 online.

What happened if someone got a notice of Income Tax demand of 5 lacs and penalty under sec 148 if he simply ignored it 3 months back.

Sir please please look for the notice and see if you have to meet assessing officer.

very good and deep information on clearing income tax demands.

Now online feature has also come on income tax http://taxbaniya.com/2014/12/20/clear-income-tax-demands/

i am doing part time accountancy work and one of my client wrongly deducted tds of Rs. 40,000 in the FY 15-16 u/s 92B. Now can i take benifit of this tds on my professional income. My total professional income is 8,50,000 in which i have net profit of Rs. 4,65,000.

I have received intimation under section 143 (1)demanding outstanding Tax for Assessment YeaRr2016-17. I have received amount of arrears on salary in the FY 2015-16 and employer has paid the TDS on the same. However, I forgot to mention in form 10 (E)while filing the return. Now, there is no question of agreeing the additional demand and I just want to regularize my ITR

1. What is to be done? How to proceed further?

2. Shall I fill form 10 (E)online?

3. After filing 10 (E), is IT return to be revised online?

I have received intimation under section 143 (1)demanding outstanding Tax for Assessment YeaRr2016-17. I have received amount of arrears on salary in the FY 2015-16 and employer has paid the TDS on the same. However, I forgot to mention in form 10 (E)while filing the return. Now, there is no question of agreeing the additional demand and I just want to regularize my ITR

1. What is to be done? How to proceed further?

2. Shall I fill form 10 (E)online?

3. After filing 10 (E), is IT return to be revised online?

I got a demand notice to pay outstanding for AY 2009-10 2010-11 and 2011-12. But as per my knowledege there is no such outstanding bills from my side. I have already paid tax in the given FY. Also i have proof i.e receiving orders. I am working in indian railways and i dnt have any other source of income apart from salary, hence i filled itr based on form 16. How should i proceed here please help.

What does the notice say..you have to understand that. Is the Form 26AS not matching what you have claimed as tax etc?

Was there some cash transactions?

th e amount of tax has been deducted from my salary by DDO but the deducted amount is not appearing in form 26AS due to wrongly quoted my PAN No.I have requested the DDO to do correction in TDS report but till date correction has not been done despite of submitting the case in concerned CA.

My Tax portal is showing demand of 80 k… i could see in 26AS that my both companies in that year has deducted the tax correctly, but i observed that in demand tax department has only taken my first company tax into consideration… and asking me to pay demand that is exactly equals to tax deducted by second employer in 26AS + interest.

How shall i disagree this demand …which option shall i choose

Disagree with Demand as the TDS from second employer is not taken care of .

i had switched my job during FY 2011-12. But my form 26-AS shows only the TDS details of first employer. And I got an Outstanding Tax Demand notification u/s 1431(a). How should i respond if i disagree with the demand? I had not e-filed for that FY.

And as per 26-AS, taxable salary is the total gross salary minus 80C deductions. The HRA, professional tax and transport exemptions were not subtracted.

my Demand is last updated and now shows u/s 143(1)B

what does it mean?

I paid tax of around 84K and my total demand was 72 K

now demand updated to 42 K and shows u/s 143(1)b

and it shows my rectification rights are transferred to AST.

For 2008 to 2009 year , income tax filed wrong and got letter from tax department like have to pay around 1 lac , but as per my income it’s wrong and other income sources wrongly enter same amount of Sal ..what to do now

Limited information so can’t help. Please don’t panic. Check in detail why Income Tax department is asking you for details.

Reply to notice in time.

I got the demand for 2011-12.That demand is wrong because when I was filing returns I paid the money and submitted.I updated in the income tax site as demand is incorrect and I provided all the details like Chalan and BSR code.I posted this information and I didn’t get any confirmation.So far I waited for 11 months and went to office and submitted written statement.But I don’t see any information after 5 months. Can you tell me how to remove this demand from my PAN.Do you have any email id to send email

I have got a demand notice for the assessment year 2007 – 08 and there is no details in it. If I have to go through as per you, request for intimation u/s 143(1) / 154 the assessment year starts only from 2009-10 due to which I am not able to request for details . How do I get the details ?

What does the notice say, to meet the assessing officer?

Check the site and see if they have uploaded details for the notice

Else Visit your assessing officer and try to get details.

As the Deductor of TDS is not responding to my communications, if I want to make the Outstanding Tax demand payment what are the necessary steps to do that? Can I do that ? Or do I need professional help?

If I make the payment, will there be any more disputes/ pay any more amount in future for this AY?

Who is deductor of TDS? if its for property he would be getting similar notice?

Did Deductor of TDS give you any form?

Is it reflected in your Form 26AS?

The deductor is my previous employer/company. They paid me the salary minus the TDS in the year 2010. I filed my IT return for AY & claimed my TDS.

Now (in 2016), I see “Outstanding Tax Demand Notice u/s 245” in my http://www.incometaxindiaefiling.gov.in account, after I got e-mail(s) “Intimation under sec 143(1)” and another e-mail “Intimation of Suo Motto Rectification proposal by CPC Bangalore”. After clarifying with Form 26AS, it seems, the deductor (company) of TDS has rectified his TDS return thereby not giving me the credit of the TDS deducted for AY 2011-12.

Therefore, please answer :

1. Is it possible that, the company can take back the TDS after so many years? Why would they do that ? Is this legal ?

2. Is the Outstanding Tax Demand payment mandatory ?

3. If I do not make the payment (now), what are the future implications ?

4. As mentioned earlier, the Deductor of TDS is not responding to my communications and the amount being moderate, I’m ready to pay to the IT Dept. Now, if I make the payment, will there be any more disputes/ pay any more amount in future?

5. What is the safest method to make the payment – Offline or Online ?

6. Most importantly, after I make the tax payment, do I need to take any sort of action after that ?

Would really appreciate if you could answer my queries.

Regards,

Shiv Das

Do you have form 16 for AY 2011-12 which mentions TDS deducted?

We have forwarded your queries to our CA and will update soon.

Yes, they had given me Form 16 A (TDS certificate). Now, I assume, they have rectified their TDS return and haven’t deposited the tax to Govt. Therefore, it is not mentioned in the Form 26 AS, and hence the income tax department has raises a demand.

Request you to please answer my queries from the previous comment.

Regards,

Shiv Das

Checked with CA , akshaymaheta.ca@gmail.com. his reply is as follows

1) Company can’t change details of TDS once it’s been deposited and return also been filed. It’s not at all legal as respective TDS against respective pan no.is what company bound to deposit . So in nutshell they can’t do and if they are doing then it’s not at all valid. Meanwhile you can check whether your pan no has not been changed from previous one used in that company.

2) outstanding tax demand is not mandatory; if you have valid challans details and Tds details you can disagree the same.

3) if you are not making any payment now…and not able to prove that demand is wrong then.. If in future any refund exist against return of income filed by you; will be directly adjust against such demand and no intimation will be given at that time.

4) You can approach your assessing officer before paying such amount. Submit physical copy of return along with fo16/16A where deductor must have mentioned Tds deducted and deposited details .which will help you out to prove that deductor had deposited Tds against your pan no and same is reversed now. AF AO gets satisfied then he will ask company to prove the same.

If above things not work then u can pay and no other demand will be asked from department. You will get 143(1) confirming payment and reconciliation of declared income and taxes.

But first approach to Assessing officer for clarity and to avoid same consequences in future.

5) Both are safest method. As you feel convenient you can choose

6) once you make payment you can again go to that tab of demand and apply dis agree to demand again and you will be asked to enter challan details if amount already paid. Mention paid challan details in respective field and submit you response. Thats all.

Dear Sir,

I paid self assessment tax for wrong assessment year, the mistake I could realise on receipt of intimation u/s 143(1) from CPC.

How should I proceed to close the issue?

regards,

Sir, While responding to outstanding demand under option rectification/revision filed at CPC, in addition to putting e-filing acknowledgement number, I have to upload 4 things.

1. Challan copy

2. TDS certificate

3. Letter requesting rectification copy

4. Indemnity Bond

I have the TDS certification and challan numbers for tax remitted. Kindly advise on what is meant by “Letter requesting rectification copy” ?

sir,

we have a incometax demand Rs.13000 for AY 2013-14.

if we wnt pay that demand

is there any interst payable thereon?

if Yes, from which date we have to calculate?

pls help me…..Thanks

Yes u can pay demand but int u/s 234 B and 234 C to be calculated till the date of payment of tax.

For further in depth details mail me your data on “jshah6124@gmail.com”

How to get a copy of the initial Tax demand notice if misplaced.

That notice must have contained the reson for the Demand.

Knowing that will help greatly in responding correctly.

U can get it through online efilling website

Dear Sir,

I have received a notice from IT department regarding some financial transactions u/s TDS -194A for AY 13-14, I have never submitted my ITR and in these transaction I have suffered loss, so how should I reply to IT department…

See this notice is calling of information and filing of return for AY 2013-14.

What you have been asked for is, there may be some fixed deposit lying in your account or in your name on which TDS u/s 194 A would have been deducted.

Since right now everything is pan no.based, department would like to ask other details in addition to FD interest. You have been asked to file return because government will think like layman that , What this person is hiding and why he is not filing income tax return in-spite of having such interest income or any other income which he may be having but not declaring.

So, go to compliance sheet and fill details like investment made out of accumulated saving and return is not filed because of no taxable income.

And it is advisable to file Income tax return if gross taxable income cross besic exemption limit.

So, file Return with proper information and submit compliance with due care.

Hope it helps.