If you want to pay the LIC premium online, view your LIC policy schedule, know the bonus, loan and claim status of your LIC policies, revival premium quote if you have missed paying the premium on time online. LIC policyholders can avail the services by registering their LIC policy and policy details with the LIC’s website. LIC’s e-Services is LIC’s initiative to provide you with on-demand service within a few clicks! You can now have many of the functionalities that were available only at a branch office, online at your fingertips. LIC website is free of cost and is available from Feb 2016 ! This article talks about LIC eServices website, why you should register at LIC eServices, How to register at LIC eServices? What are services available onlie at LIC?

Table of Contents

Why should your register at LIC Website?

Lets look at the advantages of registering your LIC policy online

- Your can authorize and make premium payments 24×7, 365 days . In case you forget to pay a premium and it’s the due-date you need not worry about going to the LIC office as it can be easily paid online. You can also schedule the day and month on which you want the account to be debited thus you need not keep a track of the premium due date every time.

- You will save time and money as we physically need not visit the branch. You can avoid expenses of postage/courier in sending the remittance to LIC

- You can also view your premium dues and all the policy details of every policy you own in a very organized manner in your account. You can also enroll and purchase new policies at a lower cost.

- You can avail various services like: Online Payment, Policy Status, Loan Status, Claim Status, Nominee and Assignment status, Benefit illustration, Revival Quotations, Registration of complaint, Policy and proposal images, Policy conditions, premium history.

FAQ on LIC eServices

But I have a physical Insurance policy and I am happy with my agent?

Earlier Insurance policies were issued in physical mode only, whether a policyholder submits a proposal in physical form or online. The policyholder was required to go to the Insurer’s office or use services of agents for their policy servicing needs, ex pay premium. The entire process was cumbersome, time consuming and involving incidental expenses. Since all the policies were issued in physical form and not usually collated at a single location, the matter got even more complicated on untimely demise of the policyholder. The dependent normally had hard time in identifying all the insurance policies and making claims with various insurance companies.

So IRDA,Insurance Regulatory and Development Authority of India, governing body of insurance proposed, electronic Insurance Account (eIA), to have policies in electronic format and held with an ‘Insurance Repository’ ,similar to stocks which are held in Demat account. The access to all the policies is then available at a click of a button. The Insurance Repository System not only provides policyholders a facility to keep insurance policies in electronic form but also enables them to undertake changes, modifications and revisions in the insurance policies with speed and accuracy. In addition, the Repository acts as a ‘single stop shop’ for policy servicing. Our article What is Electronic Insurance Account or eIA? explains it in detail. In March 2015, IRDA came out with guideline every insurance company must provide policies in demat form by themself or through collaboration with other repository services. LIC e Services is a step in that direction.

How to register at LIC Website?

Didn’t LIC have its customer portal?

Yes, it did. Around Nov 2005 Life Insurance Corporation of India launched two portals, one each for customers and agents. But now LIC has decided to streamline the customer service operations and take it to the next level. So if you have registered your LIC policy(s) then you don’t have to do anything.

Who can register for LIC e-Services?

Every existing policyholder of LIC of India can register for LIC e-services at no cost. In LIC e-Services one can only register for all the policies taken on his/her name or the minor children. As soon as the children become major, separate user-id needs to be created for them to avail e-services for the policies on their lives.

Policy in name of your spouse(wife or husband) cannot be registered in the same account. One has to register these policies separately. Say for example Mr Aditya Roy wants to enroll for an LIC policy of his wife Riya Roy. He needs to create a separate account/ID for her. He cannot use his registered ID for the same purpose.

Note: You can pay LIC premium online using Netbanking, a credit card without Registering yourself . You can go to Online services and click on Pay Premium Online where you will be asked if you want to pay direct or through the Customer Portal. You can click on Direct,

How to register at LIC e-Services Website?

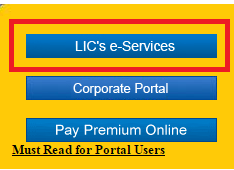

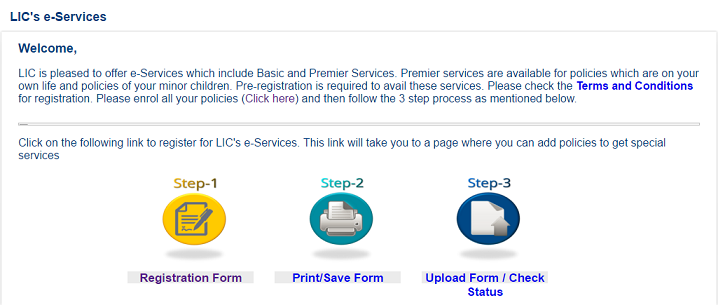

Registering on LIC portal is a one time, simple and easy process. Go to www.licindia.in and then click on LIC’s e-services on the page as shown in the image below

You will see two blocks one for Registered User and one for New User as shown in the image below

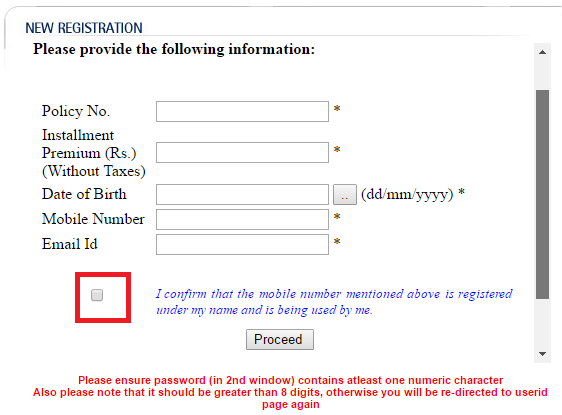

Click on New User, it takes to the screen shown in image below. All fields showing * are mandatory which are basically all the fields

- Take any one of your LIC policy and provide Policy Number, Installment Premium, Date of Birth as in the policy document.

- Provide Mobile Number and Email Id

- Click on the checkbox against I confirm that the mobile number mentioned above is registered under my name and is being used by me.

- Click on Proceed

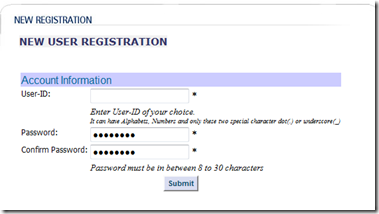

Select User-name and password in accordance with the terms and conditions mentioned on the website. These would be used to Login later. You will enroll all your LIC policies after logging in.

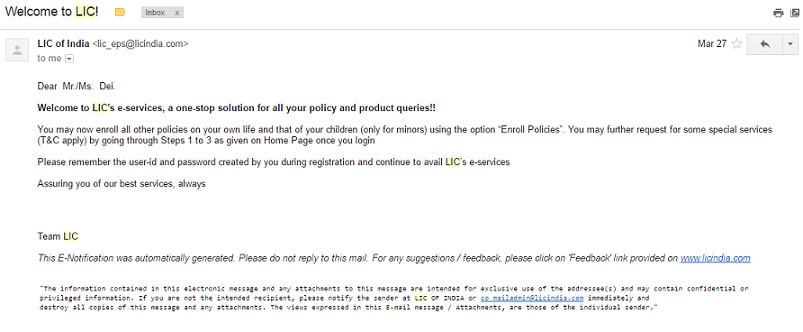

You will get a welcome mail on your registered E-mail ID, as shown in image below.

Login to LIC Website

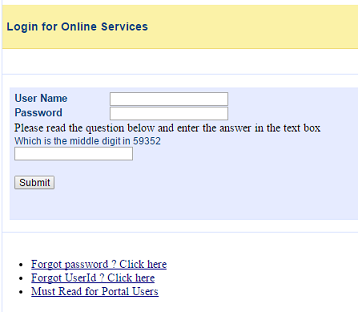

Go to www.licindia.in and then click on LIC’s e-services on the page. Click on Registered User. The screen that comes is shown in the image below.

Enter your User Name, Password, solve a simple mathematical question

Click on Submit.

After Login to LIC India E-Services

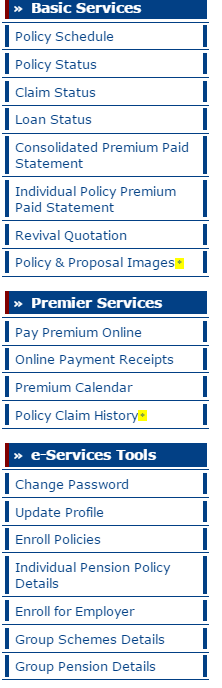

After Login you will see a list of services, Basic Services, Premier Services, eServices tool as shown in the image below and a screen asking you to Register Policy as explained later. Premier services, those marked by yellow star ex: Policy and Proposal Images, Policy Claim History are available only if you Register the policy. For rest of services just Enrolling policy is OK.

How to register a policy at LIC website

If you buy a new LIC policy and you are already registered.

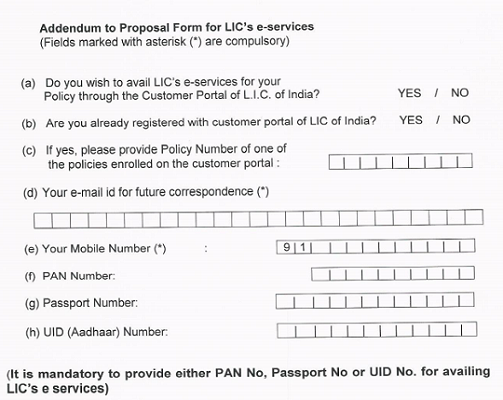

If you are buying a new LIC policy and you have already registered on LIC Portal, then your policy will be registered for LIC e-Services. All you have to mention one of your policy number which is already enrolled on LIC portal and give your consent for LIC e-Service in proposal form or addendum provided by LIC, as shown in image below.

YouTube Video for LIC Website registration

This video shows how to register new user online at LIC website

How to check LIC policy details Via Phone/SMS?

If you do not have access to the Internet or just want to check your LIC policy details over the phone, you can call their customer care and they shall assist you with all your queries.

- LIC helpline number: 1251( From BSNL/ MTNL/Mobile phone users should prefix the STD number of their city.)

- LIC toll-free numbers 1800-33-4433 or 1800-22-4077

How to check LIC policy details Via SMS?

For Individual Policy Enquiry SMS, Type: ASKLIC <POLICY NO> PREMIUM/REVIVAL/BONUS/LOAN/NOM and send to 56767877 or 9664996649.

- Premium- Installment premium under policy

- Revival-If policy lapsed, revival amount payable

- Bonus- Amount of bonus vested

- Loan- Amount available as Loan

- NOM- Details of Nomination

Example: My policy number is 1234567890 and my policy as lapsed as I failed to pay my premium. I would like to know what will be the revival amount. So, the SMS sent would be

ASKLIC 1234567890 REVIVAL AND SEND TO 56767877.

Remember if you use SMS method you will have to pay for SMS and it will provide limited information. It is better to login which is FREE OF COST!

Doesn’t LIC have a mobile App?

LIC of India has a mobile application called as LICMobile and is currently available for the Android platform only through Google Play Store. It provides all information about LIC products & portal services are at your fingertips. Options for viewing Products of LIC, Premium calculation, Check Policy Details, Apply for Policy and get LIC Branch contact information. But Feedback on Playstore is not that great.

- What is Electronic Insurance Account or eIA

- LIC Jeevan Shikhar Insurance Policy

- Mixing Insurance with Investment

- Checklist for buying Life Insurance Policy

- Insurance : Surrender or Make policy paid up or Continue

Have you registered for LIC eServices? Would you recommend someone to register for LIC e-services? Does going online makes sense?

I have registered with the LIC customer portal. Now I need to enroll my policy with employer for tax exemption. But while trying to do that I am getting an error message that I have not yet registered in the Customer portal. What should I do now?

You have to register your policy at LIC portal as explained in the article

Why do you want to enrol your policy with the employer, you just have to provide LIC payment receipt to the employer to claim your tax exemption.

This Old Way Now You Try New Way I am Giving A link And Visit—> https://www.jamadar.in/2019/12/pay-lic-premium-online.html

While creating new customer id, I have wrongly entered my email id. What to do now?

Were you successful in creating the Customer Id?

login to LIC portal

2.click on profile management

3. click on update profile (as shown in the image below)

4. click on contact details

5. change your email id, mobile number.

6. then click on save.

OTP Not generating while registering for premier services

Which browser are you using?

What is the error message you are getting?

Wait for sometime and try again

I want to pay premium online but it is not accepting my policy number. It says invalid policy number. Please advise

Know how to update registered email id of LIC login portal.

https://licofindia2017blog.wordpress.com/2017/08/29/how-to-update-registered-email-id-of-lic-online-login/

I uploaded my docs and scanned with signed form for Premier services, I did not get any response yet from LIC for premier e-Services to activate.

I want to register but it is not accepting my e mail address what should I do

I want loan status