Let’s understand how you can sell or redeem mutual fund units. How to redeem mutual fund units? online or offline? What is the amount one gets on redeeming the mutual fund units Redeeming Mutual Funds Units in SIP or Lump Sum, How will you get your money or redemption proceeds? When will you get the redemption amount? Instant Redemption

Table of Contents

Overview of Selling or Redeeming Mutual Fund units

Before investors redeem any investment one should evaluate whether this is solely a sentiment driven urge based on market conditions, or is a goal-based investment strategy. If you are selling your Mutual Fund units based on the market you may regret in the future. Selling mutual fund units should be part of a strategy linked to specific goals then.

- Redemption of mutual funds unit happens on a business day.

- Unlike the units of a close-ended scheme, open-ended schemes can be redeemed anytime. Schemes like Equity Linked Savings Scheme (ELSS) cannot be redeemed up to 3 years from the date of investment.

- For SIPs, time is calculated from each time you buy units and not from the date of purchase of the first SIP.

- It is not necessary to sell all the units.

- On redeeming mutual fund scheme units the return earned is linked to the day’s net asset value (NAV). So amount you will get is the number of units you sell multiplied with that day’s NAV of that particular scheme.

- Exit loads usually apply only until a certain holding period has been achieved in a particular mutual fund scheme. Generally, equity schemes have exit load for longer durations

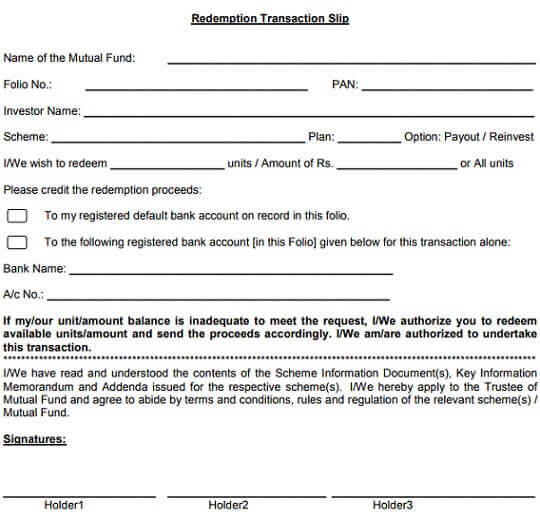

- To redeem mutual fund you need to know following which you can find on your account statement, shown in the image below.

- The fund name

- Your folio number

- The number of units you hold/ wish to redeem or the amount you want to get.

- You can redeem Mutual Fund online or offline by submitting a redemption request form. Even if you have purchased units through a mutual fund agent or a third party platform you can sell it online by visiting the mutual fund website or registrar and share transfer agent’s (RTA) website/office.

- Redemption proceeds for liquid or debt-oriented units are paid within one or two working days. Many Mutual funds are offering instant redemption.

- For equity mutual funds, the amount is paid back to investors within 3-4 working days.

- Keep your communication details such as the mobile number and email address updated. Updates and status of your redemption request would be sent to the mobile number and the email address that the fund house has been supplied

- The returns investors earn from mutual fund investments attract capital gains tax. This taxation actually depends on how long the investment was held. Long term investments attract lower capital gains tax than short term ones.

How to redeem mutual fund units?

If you wish to redeem units of a mutual fund scheme, you have to do on any business day. Unlike stocks and ETFs, mutual funds trade only once per day, after the markets close.

Cut off time: Depending on what time you submit your application, you will be allotted the appropriate day’s NAV. And this could be the NAV of the same day, previous day or the next day. There are separate rules for liquid funds and equity or debt funds. Most platforms specify the cut off timing for the order to be executed the same day which is typically around 2 pm.

Offline: You need to fill in a transaction slip.which you can download from the fund house website or detach from the end of your account statement. The redemption application can be submitted at any of the fund house official points of acceptance of transactions, across the country. A transaction slip to redeem mutual funds units is shown in the image below.

The redemption request forms can be found online or at the mutual-fund house’s office.

If you want to redeem funds from more than one fund house, it is better to head to the registrar and share transfer agent’s (RTA) office – CAMS, Karvy Computershare.Not all fund houses are serviced by a single registrar, and hence, it is in your interest to find out which is the RTA for your fund house. Your mutual fund communication letters are the quickest place to find the RTA. A phone call to the RTAs or the fund houses’ office would be the next best option.

Many fund houses also allow online redemption through their websites. If you have invested through an on line portal, you could use their online facility as well. Video below shows how to redeem Mutual Funds unit online.

With the advent of technology, today online redemptions are also possible. If you have activated your online mutual fund account, then the redemptions can be done online.

For those who haven’t activated the online account with your fund house, many offer immediate access for existing investors using details such as Folio number, PAN and email address. Once you gain access to the online account, then you just need to select the scheme from which you need to withdraw and the number of units you wish to sell.

Today there are mobile applications that help you withdraw with just a tap on your phone. Select fund houses offer SMS and Whatsapp redemption request facility too. For redemptions across fund houses, you can use mobile apps offered by Registrars and Transfer Agents such as myCAMS, KTrack offered by Karvy Computershare.

For redemptions across fund houses, you can use mobile apps offered by Registrars and Transfer Agents such as myCAMS, KTrack offered by Karvy Computershare.

Redeem Mutual Fund Units Online

What is the amount one gets on redeeming the mutual fund units?

It is easy to calculate the approximate value of your investments. It can be done by multiplying the number of units you hold on the day with that day’s NAV of that particular scheme.However the same could be subject to:

i) Exit load, if any, of the scheme: Exit loads usually apply only until a certain holding period has been achieved in a particular mutual fund scheme. Generally equity schemes have exit load for longer durations – for the obvious reason that equities are meant for long term investments – compared to debt schemes and liquid schemes. In a way this serves the purpose of discouraging quick withdrawal from investments. Generally most equity-oriented mutual fund schemes have an exit load of 1% if redeemed before a year from purchase. There are some schemes, such as the liquid or ultra short-term funds, which do not have an exit load. So, if you hold an equity mutual fund and you wish to redeem before a year, an exit load will be deducted from the NAV which is applied for your redemption per unit.

ii) Applicable NAV the NAV that depends on the day and time when that you submit your redemption request. For example, if you submit your redemption before the cut-off time on a business day as defined in the scheme information document, you are entitled to the NAV of the same day.

iii) Securities Transaction Tax (STT) as applicable to equity oriented schemes.

Redeeming Mutual Funds Units bought in Lump Sum

Example of Lump Sum Redemption of Mutual Fund Units: Suppose, you are selling today 500 units of a mutual fund scheme you had purchased four months ago. The scheme charges an exit load of 1 per cent if you redeem the units before one year.

- Let us assume the NAV is Rs 100. You will get Rs 99 per unit [Rs 100 – Rs 1 (1 per cent of 100)] on redemption. T

- The total amount which you will get will be Rs 49,500 (Rs 99 X 500 units). That means you have paid an exit load of Rs 500 (Rs 1 per unit).

- That means you have paid an exit load of Rs 500 (Rs 1 per unit).

Redeeming Mutual Funds Units in SIP

For SIPs, one year is considered each time you buy units and not from the date of purchase of the first SIP. For calculation of capital gains and to determine applicability of load, the principle of FIFO (First-In-First-Out) is followed. This means when you sell your units, you sell your oldest units first.

Example of Redemption of Mutual Fund Units in SIP

Assume that you have invested via SIP in a mutual fund scheme from January to June, 2017. You sold the scheme on 10 thMarch, 2018 at a NAV of Rs 110. The scheme charges an exit load of 1 percent if the units are withdrawn before a year. How much exit load would you pay? (See the table below)

Number of units more than one year old: 55 (Purchased in Jan-Mar, 2017) – Exit Load not applicable

Number of units less than one year old: 60 (Purchased in Apr-Jun, 2017) – Exit load applicable

Exit load payable: Rs 110 NAV X 0.01 (One per cent of NAV at redemption) X 60 units (Units redeemed in less than 1 year) =Rs 66

Amount you get on redemption of 115 units: Rs 12,584 [(Rs 110 NAV X 115 units) – (Rs 66 Exit load applicable)]

| SIP Date | Num of Units Purchased | Exit Load when sold on 10 Mar 2018 |

| 5 Jan | 20 | NA |

| 5 Feb | 18 | NA |

| 5 Mar | 17 | NA |

| 5 Apr | 19 | 1% |

| 5 May | 21 | 1% |

| 5 Jun | 20 | 1% |

| Total | 115 | 1% |

When will you get the redemption amount?

Redemption proceeds for liquid or debt-oriented units are paid within one or two working days. For equity mutual funds, the amount is paid back to investors within 3 working days.

How will you get your money or redemption proceeds?

The redemption proceeds are paid to the investor’s bank account provided the investor has provided the bank’s IFSC code and the bank and branch is enabled for RTGS NEFT. If the fund house, does not have complete bank details, cheques are sent to the investor.

Instant redemption in mutual fund schemes

Fund houses are using technology to provide instant redemption. This is mostly for liquid funds. The idea is that your liquid fund should work like your savings account. A few fund houses have launched instant redemption for some specific schemes. For example, Reliance Mutual Fund and DSP BlackRock Mutual Fund offer a facility of immediate redemption from select schemes (Reliance Money Manager Fund and DSP BlackRock Money Manager Fund). You can invest through a mobile app (for the Reliance scheme) or online through the fund house website by registering and linking your bank account. There is no charge or exit load on redemption, which can be done at any time through the same platform. When you want to redeem, the money gets credited to your registered bank account within a few minutes. Investors can withdraw up to 95% of the amount in their account subject to an upper limit of Rs2 lakh per day.

The real differentiator is that now you can even redeem at night and money gets credited immediately for the schemes under this facility. While DSP Blackrock has provided this facility through its website and intends to expand it for third-party distributors as well, Reliance has a provision for some outside distributor platforms.

Related Articles:

All about Mutual Funds : Basics, Choosing, Paperwork, Direct Investing

- Mutual Funds: Registrar and Transfer Agent : CAMS, Karvy

- Get started with Mutual Fund investing: KYC, Platform

- How to Choose Mutual Fund

- Systematic Transfer Plan or STP in MF: What is STP,How to invest

- Redeeming Mutual Funds : Check Exit Load,Taxes

Hi,

Could you please replace the RuPay logo used in the article with the corrected version?