“I have paid my taxes, then why should I file my Income Tax returns?” Young readers ask us this question. This a perception among many people, most of them, salaried that as TDS has been deducted filing of returns is not important, because after all, the government’s main objective is to ensure that it’s getting the tax due to it. But your job does not end at paying taxes, filing returns is equally important. It is our constitutional obligation to file tax returns. Let’s look at why it is important to file Income Tax return, why you should file Income tax returns on time, disadvantages of filing returns after the due date.

Table of Contents

When is it mandatory to file Income Tax Return?

The income tax return is a prescribed form through which the particulars of income earned by a person (individual, company, HUF etc.) in a financial year and taxes paid on such income is communicated to the Income-tax department at a specified time.

An Individual taxpayer is required to furnish his or her return of income if the person’s gross taxable income ie, total income under all five heads of income before claiming exemptions, exceeds the basic exemption limit for the relevant assessment year. It is essential to file returns when your total gross income exceeds the basic exemption limit even if taxes due are NIL as per Income Tax section Section 139(1). Basic Exemption limit for FY 2018-19 or AY 2019-20 is Rs 2,50,000 (for those less than 60 years) Rs 3,00,000(for those between 60 to 80 years) and Rs 5,00,000(for those above 80 years)

To file an Income Tax Return is an obligation placed on every citizen of India by the Government. (this is true in other parts of the world too). Non-filing of Income Tax Return attracts interest, penalty, prosecution and scrutiny from the Income Tax Department. You will end up getting a notice from the income tax department if your income is above the exemption limit and you haven’t filed ITR, as shown in the image below.

- Your gross total income (before allowing any deductions under section 80C to 80U) exceeds Rs 2.5 lakhs in FY 2018-19. This limit is Rs 3 lakh for senior citizens (aged above 60 but less than 80) or Rs 5 lakhs for super senior citizens (aged above 80).

- If you have a refund due, as more taxes have been deducted, you need to file your Income Tax Return, to claim this refund.

- It is mandatory to file your Income Tax Return, if you have any Foreign Assets, even though you may not have any taxable income. Any resident individual who holds beneficial interest in any asset situated outside India (including financial interest in any entity outside India) or who has signing authority in a foreign bank account is also required to file ITR, irrespective of his gross total income

- You want to carry forward a loss under a head of income

From assessment year 2020-21, a few more categories of people will need to mandatorily file ITR, as per Budget 2019 irrespective of their income level.

- Those who withdraw more than ₹1 crore from their current bank account in a year,

- or pay an electricity bill of ₹1 lakh or more, or

- pay more than ₹2 lakh for foreign travel during the current financial year will also be required to file their ITR in 2020-21

Failure to file Income Tax Return at the end of the relevant financial year attracts a penalty even though tax payable is Nil,

- It is proof of your financial life.

- Income Tax Return is essential for making any investment and goes to prove that you have a valid source of income to make such investment.

- When you file Income Tax Return, you create your Financial Record with the Tax department. This financial history is needed when you avail any kind of loan (home, personal, vehicle loan) or when you apply for VISA, etc.

For Govt it is accounting that all taxes due from you have been collected.

This is also an opportunity for the taxpayer to look at his income, taxes paid and his financial life. To do an audit.

What happens if you don’t file your ITR? or If you miss the due date of filing of ITR

If you have missed filing ITR on the due date, you can file your ITR with the penalty. As per the new law, Late Filing Fees u/s 234F will be levied. The Late filing fee

- is a penalty of Rs 5,000 will be levied if the return is filed after the due date but before December 31 of that year and

- Rs 10,000 post-December 31 to Mar 31.

However, if your income is not more than Rs 5 lakh, the maximum penalty levied will be Rs 1,000.

If there is some tax due then you would have to pay interest on the tax due under section 234A/234B/234C

Before FY 2018-19/AY 2019-20 If you don’t file your returns, you might be fined and penalised. One had to pay interest if the return is not filed before the end of the assessment year. If the return is not filed even after the end of the assessment year, the penalty may also be levied.

What is Income?

Usually, Income is associated with salary. But as per Income tax Department Income has a broader meaning. It is broadly defined as the increase in the amount of wealth associated with a person, family, company, trust etc during a fixed period of time. So the regular income from salary or income from the business or profession is considered as income. But also income from the sale of a house, rented house, interest from investments in Fixed Deposits or Mutual Funds(Debt, Equity) or Stocks is also considered as income. Income is classified into various categories such as:

1. Income from Salary

2. Income from House Property

3. Income from Profits and Gains of Business or Profession

4. Income from Capital Gains

5. Income from other Sources

The aggregate income under all these heads is termed as Gross Total Income.

What is the difference between Gross total income and Taxable income?

Gross Total Income is the sum of all the income earned. It is always calculated before applying any deductions from Section 80CCC to 80U. Total Income is the Gross Total Income reduced by amount permissible as deduction under Sections 80CCC to 80U.

Let’s say, your gross total Income from all types of Income is Rs. 3,00,000. You have saved taxes by investing Rs. 20,000 in EPF, 35,000 in LIC premium for claiming deduction under Section 80C. Your Taxable Income is Rs. 2,45,000 (Rs.3,00,000 – Rs. 55,000). This is below the exemption limit. However, even in this situation, you are required to file your Income Tax Return as your gross total Income exceeds the basic exemption limit of Rs. 2,50,000. (assuming you are not a senior citizen).

Is it necessary to file ITR if one has PAN?

It is mandatory to have a PAN card to file an ITR.

But if you have been allotted a PAN, it is not mandatory to file an income tax return if your income is less than the basic exemption limit. But you can file an Income tax Return called Nil Return. The nil income tax return is filed to show the Income Tax Department that you fall below the taxable income and therefore did not pay taxes during the year. Mostly. people file Nil Returns for record purposes for visa processing or for getting loans.

In FY 2017-18, about 67 million returns were filed, which is about 18% of the total PAN allotted. Till 31 March 2018, about 379 million Permanent Account Numbers (PAN) were allotted to various entities. Out of these, 369 million or 97.46% PANs were allotted to individuals

What Reasons do people give for not filing returns?

When it comes to filing of income tax return, some of common views that

- My employer has already deducted tax on my salary income hence I don’t need to file my income tax returns!

- I work hard & hardly find time. Why waste time on filing income tax returns.

- The deadline for filing tax returns is far away, why bother now!

- I have anyway missed the deadline for filing tax returns (July 31), so now it does not matter whether I file the returns or not!

How does the I-T department select cases where penalties are imposed?

An I-T officer may detect non-compliance such as not filing returns within the deadline, or not disclosing the full income. He issues a show-cause notice to the taxpayer, and if he is not satisfied with the explanation, may issue a penalty order under the relevant section of the Income Tax Act

How many years of backdated returns can you file?

The last date for filing of ITR for FY 2017-18/Ay 2018-19 was 31 Mar 2019. You now cannot file a return for FY 2017-18 or AY 2018-19 or for earlier years. What can you do? You may receive a notice from the Income Tax Department with penalty charges for not filing ITR. The alternatives and the risk for not filing the ITR vary from individual to individual depending on their tax due. You should pay off your income tax liability as soon as possible rather than waiting for the Income Tax Notice. You can also apply for Condonation of Delay in Filing ITR Section 119(2)(b) within 6 years of from the end of the assessment year for which income tax return has to be filed. Our article Missed Filing ITR: Check Tax Liability,File Condonation of Delay, discusses it in detail.

The return filed after the due date is called Belated Return. After that it becomes time-barred, that is, cannot be filed.

Before FY 2017-18, an individual could file ITR Only one year from the end of the relevant assessment year (or 2 years from the end of Financial Year).

What are disadvantages of filing Belated Returns ie Returns after the due date?

Pay Penalty: If the return is filed beyond due date but before December 31, then fees payable will be Rs. 5,000 whereas in other cases it will be Rs. 10,000.

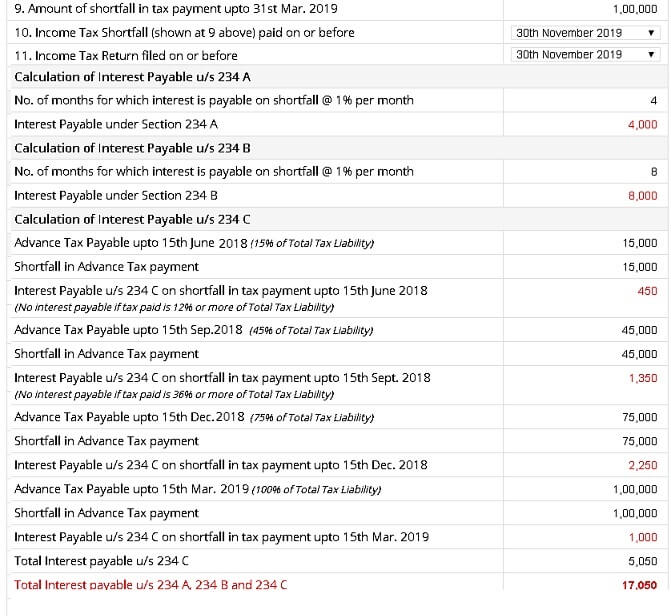

Pay Interest: When you still owe taxes to the government. For example: if you have income from other sources if you have worked in more than one company, etc. You will be liable to pay a penalty of 1% interest on the balance tax payable, under section 234A will be payable. The image below shows the example of how much interest is charged if one owes 1 lakh of rupees and does not pay Advance Tax on time.

Cannot carry forward of losses: You cannot carry forward business or capital losses for set off against future profits and gains. Thus, you would lose the benefit of setting off of these losses against the income of next year. However, the loss from house property does not have this limitation and can be carried forward even if the return is filed late. Further, certain deposits to reduce the capital gains liability are generally required to be made before the due date.

Reduced time for revising your income tax returns: Under the changed rules, you only have time till March 2020 to make the change (for ITRs for AY 2019-20).

Delay in the processing of returns: Once the return is filed and e-verified, the CPC(Central Processing Centre, Bangalore), of the Income Tax Department processes the income tax return. It is only then that the tax liability or refund of a taxpayer is determined. If you have any tax refund then you can file the return even after the deadline without any issue. The only disadvantage will be that your return may be processed late, which may delay the refund process.

Our article Section 234A,234B,234C : Interest Penalty for not paying Expected IncomeTax on Time explains the concepts of 234A, 234B and 234C.

Where in ITR do you file the date of filing?

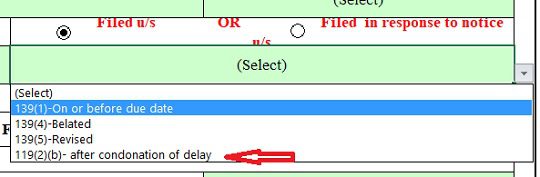

In ITR Return filed under section says when you are filing the return. It depends on whether you are filing for first time in the assessment year before or after the due date or whether you are revising your return or you have been served notice by Income Tax Department and you are filing returns in reply to that. Due Date for filing of returns for individuals is 31-Jul of the Assessment Year, for ex for AY 2019-20 it is 31-Jul-2019.

- 139(1): On or before the due date: section

- 139(4): Belated After the due date under section 139(1) but before the expiry of one year from the end of relevant assessment year: section

- 139(5): Revised

- 119(2)(b): Afer condonation of delay. Condonation of delay request can be filed within 6 years from the end of the assessment year for which income tax return has to be filed. But it is better you file ASAP. Once you file the condonation request, you can track the status through the e-filing portal. After the request is accepted you file the ITR under section 119(2)(b)- after condonation of delay

Related Articles:

- After filing Income Tax Return

- Income Tax for Beginner, Income Tax For Beginner – Part II

- Which ITR Form to Fill?

- E-filing : Excel File of Income Tax Return

- Fill Excel ITR1 Form : Income, TDS, Advance Tax

Income tax authorities allow you to self assess your income and accordingly pay taxes. Many people tend to believe that his/her income tax return is a drop in the ocean for the income tax authorities and hence do not file returns or do not declaring full income. Deliberately hiding your income from the income tax authorities, to reduce your tax liability, amounts to tax evasion. Some examples of tax evasion include, not declaring interest received on bank fixed deposits or accepting income in cash. We recommend you to file your returns on time, before due date. For as they say A stitch is time saves nine or precaution is always better than cure. Do you file your returns on time?

Dear Sir, I am retired Govt. Employee in the year May 2011 after attaining the age of 60 years. I did not disclose my terminal benefit so far. Subsequently I never filed my returns being below Gross total income ( pension per year). Due to increase in DA my Gross total Income for the year 2014- 15 is increased beyond 2, 50,000/-. As I do not having saving under 80 C etc. what I have to do for filing the ITR 1 for the 2014-15/ AY 2015-16. However the Gross total Income ( pension ) for the year 2015-16 by 31.03.2016 is below Rs. 3,00,000/-. Please suggest me the action to be taken by advising the same same to my E mail ID. Do not keep my question and answer/reply (to me) open to all.Thanking you.

Since May 2006 I am a 48yrs old housewife with zero income & I am dependent on my husband, prior to that I was working as a class-1 Govt officer in an PSU (U/T),Till this time all my tax files were updated. This year onwards I am looking for employment or starting my independent small business.Recently I Read your article, which was extremely well crafted in a most simplified manner loaded with high info contents.Now my concern area for future is- Will my unemployed period be treated as Pause period by tax authorities or based on your writeup will I be charged penalty/fine for not filling tax returns for the unemployed period. Please advise the way forward ? Many thanks

I missed filing my IT return for FY 2013-14 (AY 2014-15) as I worked in two different organisations. Now when I try to file my IT return using different portals (myITreturn.com, clearTax.com, incometaxindiaefiling.gov.in), the “Tax to be paid” differs from site to site.

I’m confused where to file my returns. Kindly help me out.

GTI: 425155

Total Deductions: 44851 (80C- 20851 , 80GG- 24000)

Total Taxable Income: 380304

Tax paid – 15530

Balance Tax Payable:

1090 (myITreturn)

1080 (clearTax)

3000 (incometaxindia)

Also I have filed IT return for AY 2015-16 (FY 2014-15) for which I haven’t submitted the House rental agreement yet. When and where should I produce the proofs, as I have already submitted e-filing?

Hi Prakash,

There must be some reason for tax payable coming different on different website. Primarily I can say it is either a data entry issue or a calculation issue. Or everything is correct and it is a 234A interest coming out.

We can certainly help you out if it is still a pending issue to you. As the deadline for FY 2013-14 is coming near. Please send us a mail on myitreturn[at]skorydov[dot]com for support and we will get you through it accurately.

My brother is a doctor. He got stipend 25,000/- p.m. from may 2010 to april,2013 with tax reduced as TDS every year. But he has not collected any TDS slip from college (thus no record of salary received and TDS). From april,2013 onward he is getting salary of about 1 lac/month and TDS is deducted every time. His PAN card was issued in Aug,2013. He has not filed ITR yet.

Now my question is how to file ITR ? Can it be filled online? As PAN card was issued after college, do he need to file ITR only after Aug, 2013 ? I have heard that Stipend is not counted as salary.

Can he file ITR online from Aug,2013 i.e. after issue of PAN card?

Your brother have to file IT return.TDS deducted will be reflected in Form 26 AS.your brother need not get any slip from his employer…mail me @chiduvalliappan@gmail.com

No he doesnt has to as stipend doesnt amounts to income so he is not liable to pay income tax.

Aw, this was a very nice post. Finding the time and actual

effort tto produce a topp notch article… but what can I say… I hesitate a whole

lot and never seem to get anything done.

Thanks Shanon. The trick is to begin then things will fall in place

Aw, this was a very nice post. Finding the time and actual

effort tto produce a topp notch article… but what can I say… I hesitate a whole

lot and never seem to get anything done.

Thanks Shanon. The trick is to begin then things will fall in place

Hi sir

Iam salaried person so had filed income tax return on that salary base

In financial year 2014-15 ia had also use to do a intraday trading in share and some case delivery trade of maximum weak periods from that particular year trading I had capital loss

I had forgot that trading to show or disclose in in my return file of financial year 2014-15 and at present I can’t do revise return file of 2014-15

So in that case can I get panalty or what is provision of penalty on that matter

Or you have any guidance on that matter so I can correct my mistake

Hi,

Nice post. Nowadays tax filing on proper time is become necessary for completion of visa process for some counties and also it’s need to apply a loan form bank or any financial organizations.

Thanks Anu we appreciate the encouragement.

Hi,

Nice post. Nowadays tax filing on proper time is become necessary for completion of visa process for some counties and also it’s need to apply a loan form bank or any financial organizations.

Thanks Anu we appreciate the encouragement.

Hi Kirti,

My query is regarding filing tax returns.

My mother is a house-wife and her income comes from Bank FD interest and Post office monthly income plan.

Her total income for the year is just less than 2.5 L and she fills Form 15 H to avoid TDS deduction by banks

as she is a senior citizen.

Is she required to file IT returns even though her tax liability is nil ?

She has never filed IT returns even though she has a PAN card.

From next year her tax liability will be nil even if her income is 4.5 L if she invests 1,50,000 for claiming deduction under 80CC,C.

Her tax slab starts from 3 L + 1.5 L investments will make her income upto 4.5 L as non-taxable. Is that correct ?

If I transfer funds to her bank account from my salary (tax gets deducted form my salary at source), can she make FD in her name and

claim the interest income as hers. This way her interest income will increase, she will get more interest on Senior citizen FD than what I will get and

also will have no tax liability tax till 4.5 L (if she invests in 1.5 L in tax saving FDs). Is this legal in terms of IT rules ?

In this case, does she have to file IT returns ?

Thanks,

Gagan

Income Tax Liability starts at Total Gross Income. If her total Gross income is more than exemption limit then she needs to file returns.

Gift from adult children is not her income. Her income is still interest from FDs.

If she invests in Tax saving FDs her money is tied up so one needs to find appropriate tax saving avenue

or you can plan her FDs so that she does not cross her exemption limit. It’s 3 lakh for FY 2013-14(AY 2014-15)

Many people gift money to parents and let parents earn FD at higher interest rate. That is allowed by IT.

Hi Kirti,

My query is regarding filing tax returns.

My mother is a house-wife and her income comes from Bank FD interest and Post office monthly income plan.

Her total income for the year is just less than 2.5 L and she fills Form 15 H to avoid TDS deduction by banks

as she is a senior citizen.

Is she required to file IT returns even though her tax liability is nil ?

She has never filed IT returns even though she has a PAN card.

From next year her tax liability will be nil even if her income is 4.5 L if she invests 1,50,000 for claiming deduction under 80CC,C.

Her tax slab starts from 3 L + 1.5 L investments will make her income upto 4.5 L as non-taxable. Is that correct ?

If I transfer funds to her bank account from my salary (tax gets deducted form my salary at source), can she make FD in her name and

claim the interest income as hers. This way her interest income will increase, she will get more interest on Senior citizen FD than what I will get and

also will have no tax liability tax till 4.5 L (if she invests in 1.5 L in tax saving FDs). Is this legal in terms of IT rules ?

In this case, does she have to file IT returns ?

Thanks,

Gagan

Income Tax Liability starts at Total Gross Income. If her total Gross income is more than exemption limit then she needs to file returns.

Gift from adult children is not her income. Her income is still interest from FDs.

If she invests in Tax saving FDs her money is tied up so one needs to find appropriate tax saving avenue

or you can plan her FDs so that she does not cross her exemption limit. It’s 3 lakh for FY 2013-14(AY 2014-15)

Many people gift money to parents and let parents earn FD at higher interest rate. That is allowed by IT.

Hi Kirti,

My queries are related to Filing Tax returns.

1. My mother who is a house-wife has income from Bank FDs and post office deposits. She is a Senior citizen so she fills Form 15 H to avoid TDS deduction by Banks. Her total income for the year is less than 2.5 L so her tax liability is nil for the financial year. Is it mandatory for her to file Income tax returns ? She has not file returns before as well though she has a PAN card.

2. For the next financial year, can she invest 1.5 L for claiming deduction under 80 C, 80 CC. This way

Regards,

Gagan

If your mother taxable income is less than 2.5 lakh then she does not need to file IT returns.

Hi Kirti,

Thanks for the reply.

If my mother’s income is 4.5 L and she invests 1.5 L under 80C/CC. Then when you say taxable income, does it mean her taxable income is 2.5 L or 4.5 L ? (She is a senior citizen).

Also, do you have any article on the kind of savings we should do so that we have a good corpus to meet our normal requirements after the age of 60. My age is 33 years and I have no dependents except my parents. My parents have medical coverage from their ex-employer BHEL.

Thanks,

Regards,

Gagan

A Very good question and it made me look for information to verify.

For an individual and HUF, it is mandatory to file return of income if his/its gross total income (before claiming Chapter VI-A deduction) exceeds the maximum exemption limit.

So your mother’s gross total income is 4.5 lakh which is more than maximum exemption limit so she would have to file income tax return.

Found this article on money control which clarifies the same Filing I-T returns first time? What you need to know

But in 2011 it was said there will be no scrutiny for senior citizens. No random scrutiny of I-T returns for senior citizens

Gagan you need to save and invest.

We did a series of articles some of them are as follows

http://bemoneyaware.com/beginner-to-investing/

Beginner to Investing – Approaches, Plan, Psychology

These articles are organised at our webpage http://bemoneyaware.com/in-20s-30s-learn-money/investing/

Let us know how you found them

Hi Kirti,

Thanks for the information.

Since I am going to file IT Returns tomorrow, one last confirmation. Do I need to file ITR-I or ITR-2 ?

I ‘ve income from salary and bank FD interest. You articles suggests I need to fill ITR-2.

Regards,

Gagan

Hi Kirti,

My queries are related to Filing Tax returns.

1. My mother who is a house-wife has income from Bank FDs and post office deposits. She is a Senior citizen so she fills Form 15 H to avoid TDS deduction by Banks. Her total income for the year is less than 2.5 L so her tax liability is nil for the financial year. Is it mandatory for her to file Income tax returns ? She has not file returns before as well though she has a PAN card.

2. For the next financial year, can she invest 1.5 L for claiming deduction under 80 C, 80 CC. This way

Regards,

Gagan

If your mother taxable income is less than 2.5 lakh then she does not need to file IT returns.

Hi Kirti,

Thanks for the reply.

If my mother’s income is 4.5 L and she invests 1.5 L under 80C/CC. Then when you say taxable income, does it mean her taxable income is 2.5 L or 4.5 L ? (She is a senior citizen).

Also, do you have any article on the kind of savings we should do so that we have a good corpus to meet our normal requirements after the age of 60. My age is 33 years and I have no dependents except my parents. My parents have medical coverage from their ex-employer BHEL.

Thanks,

Regards,

Gagan

A Very good question and it made me look for information to verify.

For an individual and HUF, it is mandatory to file return of income if his/its gross total income (before claiming Chapter VI-A deduction) exceeds the maximum exemption limit.

So your mother’s gross total income is 4.5 lakh which is more than maximum exemption limit so she would have to file income tax return.

Found this article on money control which clarifies the same Filing I-T returns first time? What you need to know

But in 2011 it was said there will be no scrutiny for senior citizens. No random scrutiny of I-T returns for senior citizens

Gagan you need to save and invest.

We did a series of articles some of them are as follows

http://bemoneyaware.com/beginner-to-investing/

Beginner to Investing – Approaches, Plan, Psychology

These articles are organised at our webpage http://bemoneyaware.com/in-20s-30s-learn-money/investing/

Let us know how you found them

Hi Kirti,

Thanks for the information.

Since I am going to file IT Returns tomorrow, one last confirmation. Do I need to file ITR-I or ITR-2 ?

I ‘ve income from salary and bank FD interest. You articles suggests I need to fill ITR-2.

Regards,

Gagan

I have taken VRS in April 2013. Whether the terminal benefits exempted from tax are to be included in the income and exemptions claimed under relevant sections while efiling. Further 16A details are to be given quarter wise or one entry for the entire year be given in the ITR1?

I have taken VRS in April 2013. Whether the terminal benefits exempted from tax are to be included in the income and exemptions claimed under relevant sections while efiling. Further 16A details are to be given quarter wise or one entry for the entire year be given in the ITR1?

I want to start e-file my return from this year.But I have missed last two years where my income was more than NIL limit though no tax due.But am afraid that I will be penalized.What to do? forget last yeas and start from this year? Please Help

Was your income from salary or business? Did you do tax saving? Did you get notice from income tax department?

Let’s take one step at a time.

If your income is above exemption limit then Please do file the returns this time.

I want to start e-file my return from this year.But I have missed last two years where my income was more than NIL limit though no tax due.But am afraid that I will be penalized.What to do? forget last yeas and start from this year? Please Help

Was your income from salary or business? Did you do tax saving? Did you get notice from income tax department?

Let’s take one step at a time.

If your income is above exemption limit then Please do file the returns this time.

I agree, I hadn’t given this much of importance to filing the returns until my friend had a trouble with his UK visa last time. He wasn’t given the Visa since he had not filed for returns and that was quoted as a primary thing to do to ascertain citizenship in a country.

I wish they did a similar thing to voting as well 😉

Vinay Thanks for sharing your friend’s experience.

And Yes that’s a good idea.

Thanks for sharing this Vinay.

I agree, I hadn’t given this much of importance to filing the returns until my friend had a trouble with his UK visa last time. He wasn’t given the Visa since he had not filed for returns and that was quoted as a primary thing to do to ascertain citizenship in a country.

I wish they did a similar thing to voting as well 😉

Vinay Thanks for sharing your friend’s experience.

And Yes that’s a good idea.

Thanks for sharing this Vinay.

While I appreciate whole heartedly your immense service in this regard, I must say our tax system is very complicated. It’s so difficult to file the returns. I had to take recourse to professional CAs in the last two years.

Filling Tax return is not rocket science, yes it is not as easy as ABC. It is good to take help of professional CAs but don’t just rely on them.

Ask them, understand what they are filling. It’s your tax your responsibility.

While I appreciate whole heartedly your immense service in this regard, I must say our tax system is very complicated. It’s so difficult to file the returns. I had to take recourse to professional CAs in the last two years.

Filling Tax return is not rocket science, yes it is not as easy as ABC. It is good to take help of professional CAs but don’t just rely on them.

Ask them, understand what they are filling. It’s your tax your responsibility.