Let’s say you want to urgently transfer money to your friend on a Sunday or a public holiday? You can’t use NEFT/RTGS as banks are closed.Using IMPS,Immediate Payment Service, we can easily transfer money to a person or merchant 365 days, 24×7!This article talks about IMPS or Immediate Payment Service. What is IMPS? Comparison of IMPS with NEFT and RTGS, How to transfer money through IMPS using internet, How to transfer money through IMPS using mobile, How to transfer money through IMPS through SMS, how to pay merchant. It also shows list of banks which provide IMPS service and how they support IMPS, using Internet, mobile,SMS .

Table of Contents

What is IMPS?

Immediate Payment Service (IMPS) is an instant inter-bank money transfer service. Funds can be transferred in a jiffy and effortlessly using internet. This service is available 24×7 throughout the year even on Sundays and public holidays.

Advantages of IMPS

- Instant Money Transfer: Money can be instantly transferred to a person using account number or mobile number depending on the details available. Sending and receiving of payment is immediate, unlike NEFT.

- Easy to transfer: The steps to avail IMPS are easy and user-friendly. They require basic details like Name of the beneficiary, account number + IFSC code or MMID + mobile number and the amount.

- Available 24×7: IMPS can be availed 365 days 24×7 even after the banking hours and the ultimate benefit is that one can transfer on Sundays and on public holidays too.

- Fees is less: The fee for transferring money is small.

- Various avenues available: Money can be transferred with net banking, mobile banking, SMS, ATM as per our convenience.

- No internet connection required: In case of emergency when no internet connection is available IMPS can be availed via SMS easily. You will require the same details as required for mobile, internet IMPS.

- Secure authenticated transactions: IMPS transaction is a secure transaction as banks have authenticated them with various factors like mobile number authentication, mPin and MMID numbers.

- Transfer by NRI customers: NRI customers can also transfer money to India using IMPS.

How to transfer money through IMPS?

Transfer money through IMPS Using account number and IFSC code

In this category, instant transfers are done to account holders holding accounts in the same or different bank using their account number and branch IFSC code.Transfer using IFSC can be done through internet banking or through mobile banking that is using of app on the handset.

- You need to first login using your details

- If the person you want to transfer money to is already added as a beneficiary, then you can proceed ahead with the transfer. If not, you need to register him/her as a beneficiary. To register a person as beneficiary select the option “Add Beneficiary”. Add his account number correctly, his branch IFSC code. IF you are unaware of his IFSC code, it is easily available on the internet. You might get an OTP to confirm the registration of a beneficiary. If you are using mobile banking, no OTP will be generated. T

- Select the person you want to transfer money to, enter the amount and remarks if any.

- Confirm and verify the details

- The money is now transferred and the accounts will be immediately debited/credited.

- You will receive SMS confirmation along with transaction number for any future reference.

Can IMPS amount be transferred to the wrong account?

The beneficiary details required for sending money are the mobile number and MMID or Account number and IFSC code. The transaction will get declined in case any one of these two numbers is erroneous and the transaction will get reversed instantly. If funds are credited to the Incorrect/unintended beneficiary, then the customer is requested to coordinate with the beneficiary bank for the refund.

Comparing IMPS with NEFT, RTGS, UPI

NEFT, RTGS and IMPS allow you to send money from one bank account to another. NEFT and RTGS are also options for transferring money online using internet or mobile banking. But the service is not available on holidays and beyond a certain time range. IMPS has leverage over both the services as it offers instant transfer from your mobile, desktop or an ATM branch. Our article Third Party Fund Transfer : NEFT,RTGS discusses NEFT and RTGS in detail.

NEFT

Through NEFT, the money gets transferred during the bank’s working hours. Since the fund transfer happens in batches, there can be a delay in money transfer. NEFT operates in hourly batches, there are twelve settlements between 8am to 7pm on weekdays (Monday through Friday) and six settlements between 8am to 1pm on Saturdays. So, when you initiate the transaction, depending on the next settlement batch, the money will be transferred. According to the Reserve Bank of India (RBI) website, there is no maximum limit for NEFT money transfer.

RTGS happens in real time and gross basis and is meant for high-value transactions, minimum Rs.2 lakh. The transfer usually happens within 30 minutes from the time of initiation depending on the service window of RTGS. The service windows for RTGS at banks are processed continuously throughout RTGS business hours—8am to 8pm on weekdays and 8am to 3.30pm on Saturdays.

IMPS: With IMPS the money gets transferred instantly. This service is available 24×7. When you initiate a fund transfer via IMPS, the initiator bank sends a message to IMPS, which debits the money and sends it to the receiving account. All this happens within 5-10 seconds. The maximum that you can send is Rs.2 lakh.

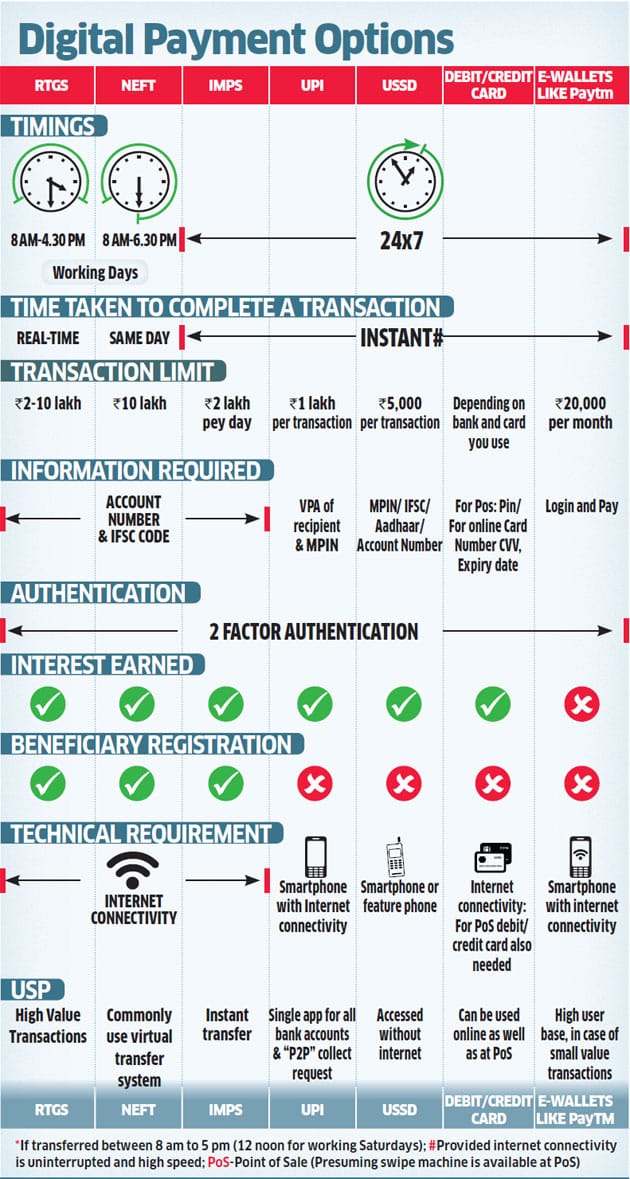

The following image shows the comparison between the various digital options

IMPS Using MMID and mobile number

What is MMID?

Mobile Money Identifier (MMID) is a 7 digit code issued by a participating bank to their Mobile Banking registered customers for availing IMPS service as a beneficiary. Every account will have a unique MMID. MMID is like your mobile account number. Whenever you want to receive money, you need to share my MMID with the sender. It is safe to share your MMID with everyone

- IMPS with MMID is where a person can transfer money using just the MMID & mobile number of the beneficiary. No other details like account number, IFSC code are required.

- Both sender and receiver of money should have MMID number and should have their mobile numbers registered with the bank.

- Transfer using MMID can be done with mobile banking and internet banking. MMID can be easily generated by sending a SMS.

How to transfer money through IMPS using MMID and mobile number

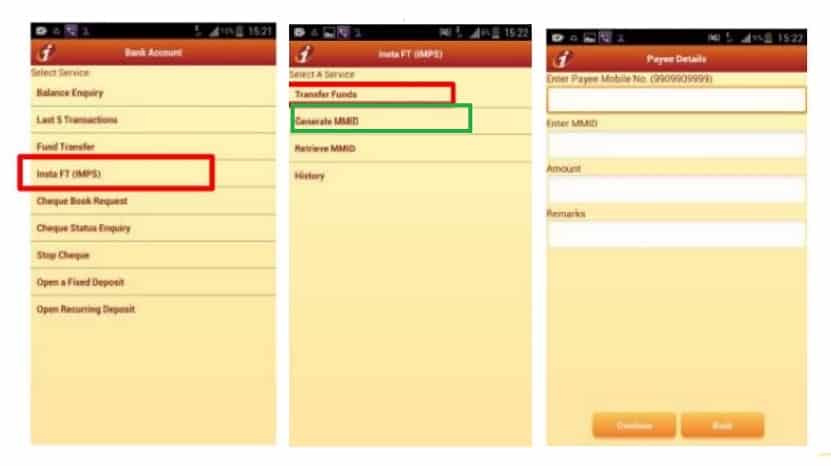

- Login with your details to internet or the mobile App.

- Select fund transfer and then IMPS.

- Enter beneficiary’s mobile number & MMID number.

- Enter the amount.

- You will have to enter your OTP or mPin to authenticate the trasaction.

- The money is now transferred and the accounts will be immediately debited/credited.

- You will receive SMS confirmation along with transaction number for any future reference.

The following video shows how to transfer money through IMPS using MMID and mobile number.

IMPS Using ATM transfer

A person can go to the nearest ATM and send money to other person by entering the beneficiary’s debit card number. The money is transferred to the beneficiary instantly and he can withdraw the amount from another ATM. The limit is Rs 5,000 a day and Rs 25,000 a month.Currently, only six banks, Union Bank of India, Canara Bank, Lakshmi Vilas Bank, Andhra Bank, IndusInd Bank, Punjab National Bank offer this service and another six to seven are under the process of setting this up. Another way to transfer funds from ATM to ATM is by using IMPS. In this scenario:

- You need to enter your ATM pin.

- Select Fund transfer and then select IMPS.

- ATM will fetch your registered mobile number on the screen

- You will need the beneficiary’s mobile number and their MMID numbers to validate the transaction.

- Enter the amount for fund transfer

- Confirm the IMPS Fund transfer details

- Upon confirmation amount is transferred to the beneficiary on a real time basis

Both remitter and beneficiary get notifications for the transaction on their mobile.

IMPS using SMS

IMPS can also be availed without internet connection in case of emergency scenarios. You can also register yourself, add beneficiary, make payment through IMPS by sending a single SMS. Details for the same can be availed on the website of individual banks. Generally the SMS to be sent to the number given by the bank.

IMPS <Beneficiary Mobile No><Beneficiary MMID><Amount><MPIN>

For example for Central Bank

Type IMPS <Benef_Mob_ No> <Benef_MMID> <MPIN> Send to 9967533228

Banks which support IMPS

All the banks support IMPS. You can look at the latest list of all the banks and their IMPS details at NPCI website , which channels like Internet, Mobile, SMS, Merchant Payment.

Related Articles:

- Cheque: Clearing Process, CTS 2010

- Post Office :Internet Banking, Mobile Apps and Core Banking Solution

- NACH: What is NACH? NACH OTM,How NACH will replace ECS

- Third Party Fund Transfer : NEFT,RTGS

- Number of ATM Transactions

- What is Mobile Banking

- Saving Bank Account:Do you know how interest is calculated and more

- Interest on Saving Bank Account : Tax, 80TTA

There were times when we used to wait for hours in a long queue to transfer money from a physical branch account. Today it takes seconds to transfer money. NEFT and RTGS are also options for transferring money online using internet or mobile banking. But the service is not available on holidays and beyond a certain time range. You can choose NEFT, RTGS or IMPS depending on the circumstance, time, day and amount of transaction. Have you tried any of the online fund transfer services? Which one do you prefer?

Hi,

Thanks for sharing in details about NEFT, RTGS and IMPS.

This is an amazing article and loved it. I am looking forward more to this.

We can provide IMPS – Money Transfer Services for lowest price.

Check this URL: https://www.espay.in/domestic-money-transfer/

Thanks Again!

Imps pin ching

Sorry, could not understand your comment.

Could you explain it?

Thank you for sharing this details, Enjoy faster and hassle free transferring remittance from Axis Forex Online .

Axisforexonline

/”>axisforexonline

Thanks for elaborating in details about NEFT, RTGS and IMPS.

Here one may wonder as why IMPS with so many inherent advantages is not as popular as others methods for transfer of fund !